Societe Generale

Price

Discussione su GLE

Messaggi

13Quarterly figures 27.10-31.10.25

$KDP (-0,75%)

$7751 (-3,42%)

$NXPI (-1,3%)

$WM (-0,26%)

$CDNS (-0,76%)

$BN (-1,29%)

$SOFI (-2,42%)

$UNH (-0,86%)

$AMT (-0,65%)

$UPS (-0,25%)

$BNP (-1,5%)

$NVS (-1,23%)

$DB1 (+1,97%)

$MSCI (-0,69%)

$ENPH (-1,13%)

$BKNG (-0,57%)

$LOGN (-1,3%)

$V (-0,47%)

$MDLZ (-0,56%)

$PYPL (-0,35%)

$000660

$MBG (-1,13%)

$BAS (-1,38%)

$UBSG (-1,03%)

$SAN (-1,75%)

$CVS (-0,48%)

$OTLY (-1,4%)

$GSK (-0,44%)

$ETSY (-0,88%)

$CAT (-1,17%)

$KHC (-0,13%)

$ADYEN (-0,48%)

$ADS (-1,51%)

$AIR (-1,18%)

$SBUX (-0,61%)

$CMG (-0,03%)

$META (-0,7%)

$KLAC (-0,59%)

$MELI (-0,22%)

$WOLF (-1,1%)

$GOOGL (-1,12%)

$EQIX (-1,06%)

$MSFT (-0,85%)

$CVNA (-0,52%)

$EBAY (-0,7%)

$005930

$6752 (-5,87%)

$KOG (-0,23%)

$VOW3 (-1,39%)

$GLE (-1,53%)

$LHA (-1,86%)

$STLAM (-1,04%)

$SPGI (-0,2%)

$MA (-0,83%)

$PUM (-0,52%)

$AIXA (+0,48%)

$FSLR (-0,22%)

$AAPL (-0,57%)

$REDDIT (-2,42%)

$AMZN (-0,91%)

$NET (-0,26%)

$MSTR (-2,11%)

$GDDY (-0,33%)

$TWLO (-0,54%)

$COIN (-2,52%)

$066570

$CL (-0,33%)

$ABBV (-0,32%)

$XOM (+1,81%)

World Economic Forum 2025

January 20-24, 2025, Davos, Switzerland

The World Economic Forum (WEF) is an international organization founded by Klaus Schwab in Switzerland in 1971. It promotes cooperation between business, politics, science & civil society. The Annual Meeting takes place in Davos. The motto for this year:

"Cooperation in the age of intelligence"

The World Economic Forum 2025 is dedicated to a wide range of topics, including geopolitical tensions, economic growth and the transition to clean energy. At the same time, tech, AI, quantum computing & biotech also play an important role.

As always, there will be posts on all relevant topics from @HennRes & @Michael-official will be published. Under the #wef2025 you will be able to view all posts in chronological order.

Main topics:

- Rethinking growth: How can we tap into new sources of economic growth?

- How can companies respond to tech and geopolitical upheaval?

- What measures promote education, health & human capital?

- How can innovative partnerships & techs drive climate protection?

- How can cooperation be strengthened to overcome social divisions?

Participants from politics & business.

Over 350 government representatives, including 60 heads of state & government, 1600 people from the private sector, including 900 CEOs and over 170 people from NGOs, trade unions, academia and indigenous peoples are also present.

The key figures from politics are:

- 🇺🇸 Donald J. Trump(soon to be) President of the USA (via video link)

- 🇪🇺 Ursula von der Leyen, President of the European Commission

- 🇨🇳 Ding XuexiangVice Prime Minister of the People's Republic of China

- 🇦🇷 Javier MileiPresident of Argentina

- 🇩🇪 Olaf Scholz, Chancellor of Germany

- 🇿🇦 Cyril Ramaphosa, President of South Africa

- 🇪🇸 Pedro Sánchez, Prime Minister of Spain

- 🇨🇭 Karin Keller-Sutter, President of the Swiss Confederation 2025

- 🇺🇦 Volodymyr Zelenskyy, President of Ukraine

Executives from the private sector (who are expected/ not offical)

Technology sector

- 🇺🇸 $MSFT (-0,85%) (Microsoft) - Satya Nadella, CEO

- 🇺🇸 $AMZN (-0,91%) (Amazon) - Andy Jassy, CEO

- 🇺🇸 $IBM (-0,64%) (IBM) - Arvind Krishna, CEO

- 🇺🇸 $MSFT (-0,85%) (Microsoft) - Bill Gates, co-founder and head of the Bill and Melinda Gates Foundation

- 🌎 Cohere - Aidan Gomez, CEO

- 🌎 $META (-0,7%) (Meta) - Yann LeCun, AI scientist

- 🌎 OpenAI - Sam Altman, CEO

- 🇺🇸 $TSLA (-1,37%) (Tesla) - Elon Musk, CEO

Financial sector

- 🇪🇺 ECB - Christine Lagarde, President of the European Central Bank

- 🇫🇷 ECB - Francois Villeroy de Galhau, President of the French Central Bank

- 🇩🇪 German Bundesbank- Joachim Nagel, President

- 🇺🇸 $BLK (BlackRock) - Martin Lück, Chief Investment Strategist

- 🇳🇱 $ING (-2,07%) (ING) - Carsten Brzeski, Chief Economist at ING Germany

Banking sector

- 🇺🇸 $JPM (-0,68%) (JPMorgan Chase) - Jamie Dimon, CEO

- 🇨🇭 $UBSG (-1,03%) (UBS) - Sergio Ermotti, Group CEO

- 🇨🇭 $UBSG (-1,03%) (UBS) - Colm Kelleher, President

- 🇩🇪 $DBK (-1,23%) (Deutsche Bank) - Christian Sewing, CEO

- 🇺🇸 $GS (-0,54%) (Goldman Sachs) - David Solomon, Chairman and CEO

- 🇺🇸 $BAC (-0,63%) (Bank of America) - Brian Moynihan, CEO

- 🇺🇸 $C (-0,71%) (Citigroup) - Jane Fraser, CEO

- 🇬🇧 $HSBA (-0,98%) (HSBC) - Mark Tucker, Group Chairman

- 🇬🇧 $HSBA (-0,98%) (HSBC) - Michael Roberts, CEO of HSBC Bank

- 🇺🇸 $MS (-0,5%) (Morgan Stanley) - Ted Pick, CEO

- 🇬🇧 $BARC (-0,2%) (Barclays) - C.S. Venkatakrishnan, CEO

- 🇫🇷 $GLE (-1,53%) (Société Générale) - Slawomir Krupa, CEO

- 🇮🇹 $UCG (-1,53%) (UniCredit) - Andrea Orcel, CEO

- 🇦🇹 $BG (-1,38%) (BAWAG Group) - Anja E. M. W. Schreiber, CEO

- 🇦🇹 $EBS (-1,16%) (Erste Group) - Andreas Treichl, CEO

Industry sector

- 🇩🇪 $BAYN (-2,01%) (Bayer) - Bill Anderson, CEO

- 🇨🇭 $NESNE (Nestlé) - Mark Schneider, CEO

- 🇬🇧 $ULVR (-0,85%) (Unilever) - Hein Schumacher, CEO

- 🇨🇳 SHEIN - Donald Tang, Vice Chairman

- 🇮🇳 ADANIENT (Adani Enterprises) - Gautam Adani, Chairman

... and many more from the Tech, Banking, AI, Biotech, Pharma, Industrial, etc. sectors.

Zusammenfassung Earnings heute morgen:

$STLAM (-1,04%) | Stellantis Q3 2024 Earnings

Net Rev. €32.96B (est €35.94B)

Still Sees FY Adj. Oper Margin 5.5% To 7% (est 7.11%)

May Pursue Share Buyback Next Year: CFO

Backs FY Guidance

$$MAERSK A (-1,26%)

| AP Moeller Maersk Q3 2024 Earnings

Rev $15.76B ($15.12B)

EBITDA $4.80B (est $3.96B)

Ocean Rev. $11.11B (est $10.57B)

Loaded Freight Rate ($/FFE) $3,236 (est $2,850)

Still Sees FY Underlying EBITDA $11B To $11.5B

$TTE (+0,97%)

| TotalEnergies Q3 2024 Earnings

Adj EPS $1.74 (est $1.83)

Adj Net $4.07B (est $4.27B)

Adj. EBITDA $10.05B (est $10.42B)

Production 2.41M BOE/D (est 2.41M)

DACF $7.01B (est $7.5B)

$SHEL (+0,53%)

| Shell Q3 2024 Earnings

Adj EPS $0.96 (est $0.85)

Adj Profit $6.03B (est $5.39B)

Net Debt $35.3B (est $37.9B)

Oil & Gas Output 2.80M BOE/D)

Cash Flow From OPS $14.68B (est $12.08B)

Announces A Share Buyback Program Of $3.5B

$CARL A (-0,37%) | Carlsberg Q3 2024 Earnings

Rev. DKK20.48B (est DKK20.6B)

Organic Rev. +1.3% (est +2.57%)

Organic Volume Growth -0.2% (est +1.34%)

$STM (-1,39%) | STMicroelectronics Q3 24 Earnings:

- Net Rev $3.35B (est $3.24B)

- Sees FY Net Rev $13.27B, Saw $13.2B To $13.7B

- Sees Q4 Net Rev $3.32B (est 3.38B)

- Sees Q4 FY24, Q1 FY25 Rev Decline Above Seasonality

$ING (-2,07%) | ING Q3 24 Earnings:

- Net Income EU1.88B (est 1.69B)

- Net Interest Income EU3.69B (est EU3.83B)

- Loan-Loss Provision EU336M (est EU340.8M)

- Announces EU2.5B Shares Buy Back

$BNP (-1,5%) | BNP Paribas Q3 24 Earnings:

- Net Income EU2.87B (est EU2.89B)

- Rev EU11.94B (est EU11.98B)

- Loan-Loss Provision EU729M (est EU835.6M)

- FICC Sales & Trading Rev EU1.20B (est EU1.06B)

$GLE (-1,53%) | Societe Generale Q3 24 Earnings:

- Oper Expenses EU4.33B (est EU4.41B)

- Net Banking Income EU6.84B (est EU6.6B)

- Net Income EU1.37B (est EU1.27B)

- Equities Rev EU880M (est EU857.4M)

Podcast episode 60 "Buy High. Sell Low."

Banker interview part 2, job application, life, personal & private matters. Subscribe to the podcast, because part 3 is coming soon!

Spotify

https://open.spotify.com/episode/67iGQ3lcRqhxsQSXgsdHdY?si=pl4NBip0SK2HevoroljtQA

YouTube

Apple Podcast

$DBK (-1,23%)

$CBK (-0,53%)

$BNP (-1,5%)

$HSBC (-1,31%)

$HSBA (-0,98%)

$GLE (-1,53%)

$ACA (-1,21%)

$FUT

$MS (-0,5%)

$GS (-0,54%)

$C (-0,71%)

$WFC (-0,69%)

$SAN (-1,75%)

$BAC (-0,63%)

$USB (-1,21%)

$RBC (-0,8%)$NUBR33$BNS (-0,6%)$PBB (-0,49%)

#podcast

$SPOT (-0,79%)

$AAPL (-0,57%)

$GOOGL (-1,12%)

$GOOG (-1,07%)

#bank

#banken

#karriere

#geld

#job

💶 Amundi: Europe's financial architect - Does he build the most solid assets? 🏗️

Company profile

$AMUN (-1,22%) is one of Europe's leading asset managers and is headquartered in Paris. The company was formed in 2010 from the merger of the asset management segments of $ACA (-1,21%) and $GLE (-1,53%) and has been listed on the stock exchange since 2015. With assets under management of EUR 1.98 trillion (as at June 2024), Amundi is one of the world's largest players in asset management.

Historical development and business model

Since its foundation, Amundi has enjoyed continuous growth and offers a wide range of investment solutions for institutional and private investors. The portfolio ranges from actively and passively managed funds to ETFs and customized mandates. A particular focus is on the management of liquidity reserves and the development of specialized investment strategies for companies.

Core competencies and future prospects

Amundi's success is based on several core competencies:

- In-depth expertise across all asset classes and markets

- Leading position in European money market management

- Pioneering role in technological innovation, in particular through the ALTO investment platform

- Low-cost ETFs for investors

Looking to the future, the company is focusing on further growth, particularly in the areas of ETFs and sustainable investments.

Strategic initiatives

Amundi pursues various strategic initiatives to achieve its objectives:

- Increased expansion of the ETF business, with the aim of becoming the market leader in Europe

- Focus on sustainable investment strategies and the integration of ESG criteria

- Expansion into emerging markets, particularly in Asia

- Further development of digital platforms, such as the ALTO technology

Market position and competition

Amundi is the largest asset manager in Europe and among the top 10 worldwide. Its main competitors include global asset management giants such as BlackRock, Vanguard and Fidelity. In the European ETF market, Amundi ranks behind iShares ($BLK (-1,02%) ) and Xtrackers ($DWS (-1,35%) ).

Market potential

The global asset management market is growing steadily, particularly in the ETF and sustainable investment segments. Amundi is well positioned to benefit from these growth trends and further expand its market position.

Share performance

Since the IPO in 2015, the Amundi share has achieved a TR of 127%, 27% more than DWS in the same period.

Performance

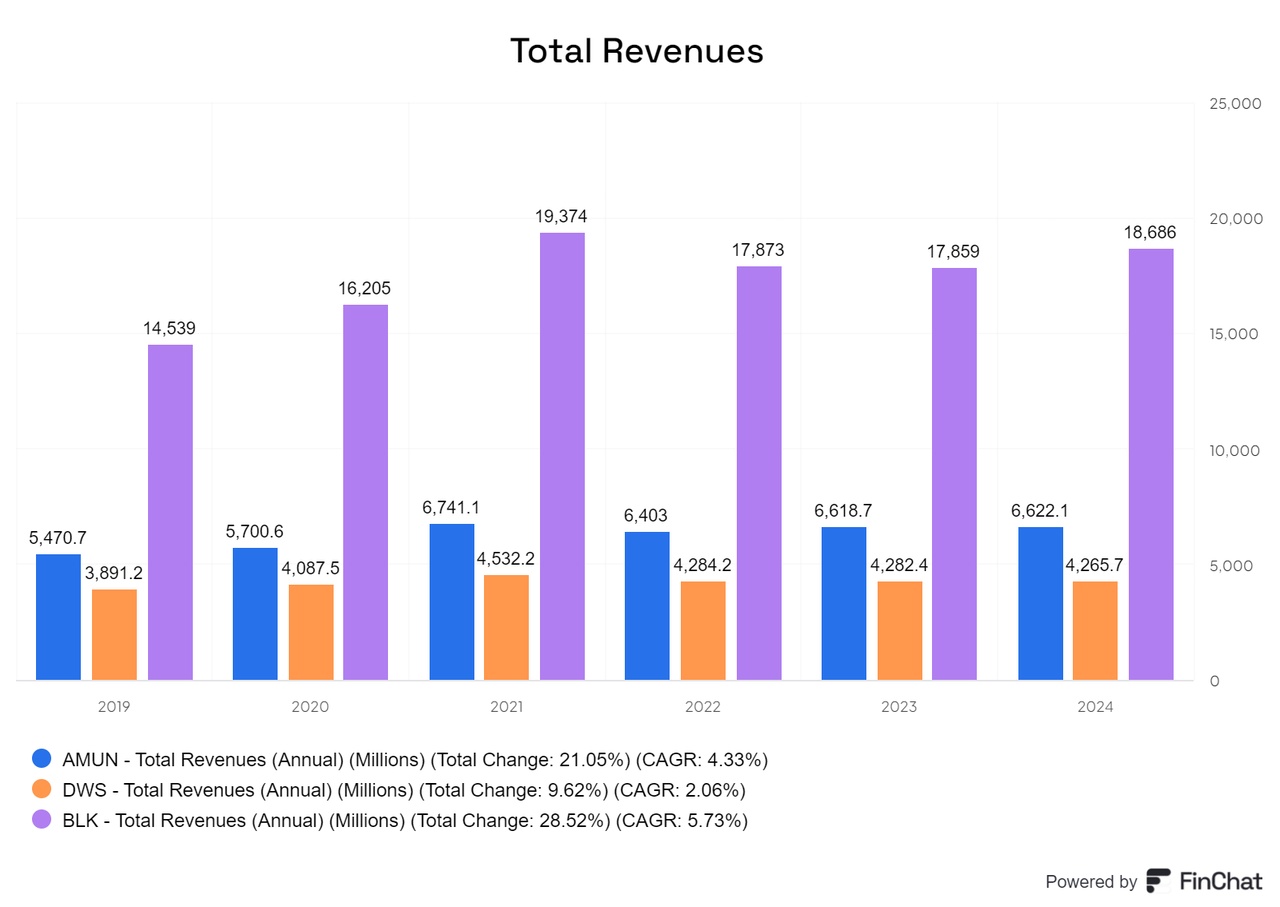

In terms of turnover, Amundi is significantly smaller than BlackRock, but larger than the German company DWS. BlackRock also has numerous other sources of income, such as from financial technology.

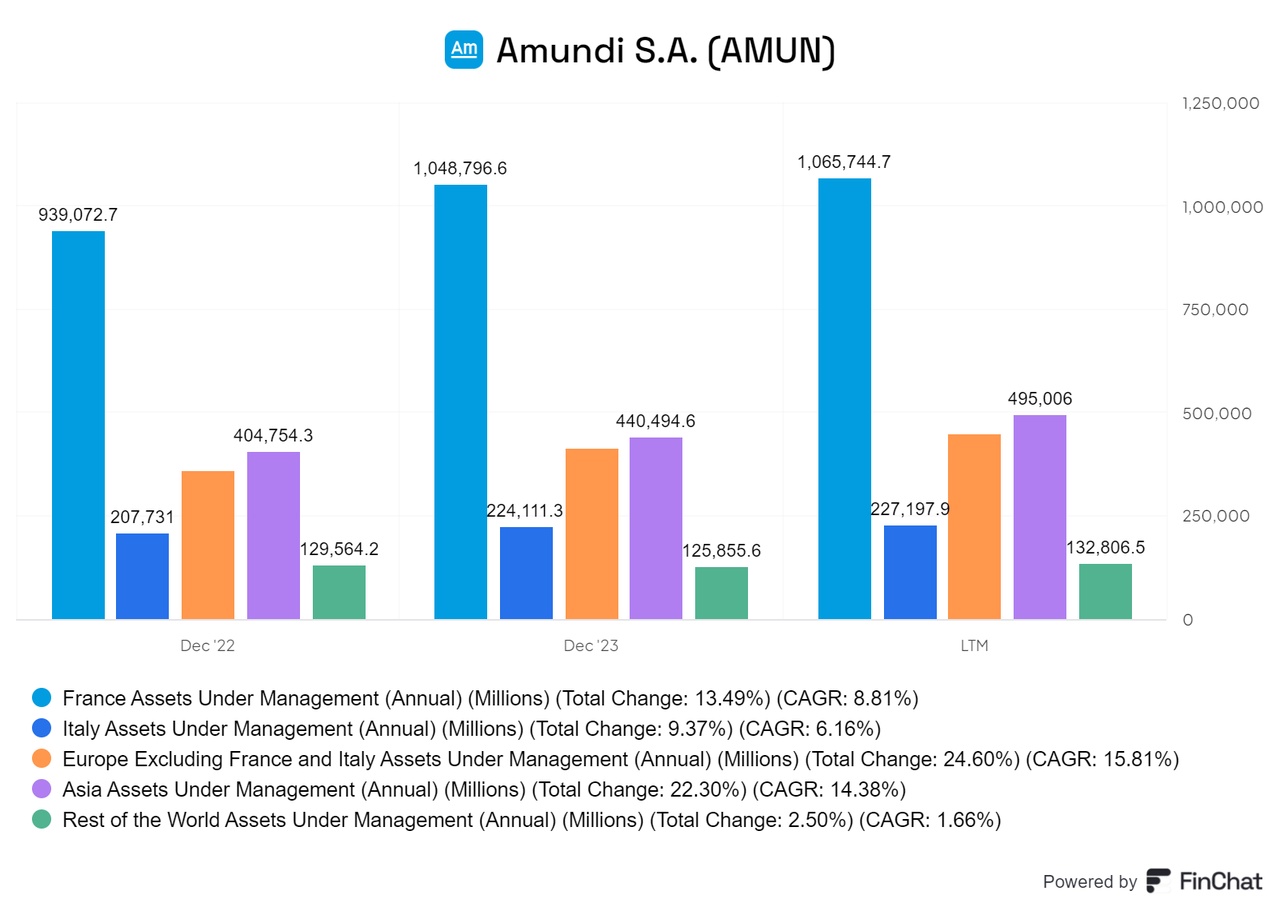

Looking at the assets under management (AUM), the dependence on Europe and Asia becomes clear, which at the same time underlines Amundi's strong positioning there. In contrast, Amundi's presence in the USA is small and its exposure in other regions is also limited. Amundi is therefore primarily a bet on Europe and Asia - two markets that still have relatively little capital in the asset management sector, but are showing an upward trend. There is also growing pressure to move towards more sustainable financial solutions, which positions Amundi well in these regions.

Amundi leads in sales growth and is expected to continue to benefit from the European trend as long as BlackRock does not introduce cheaper and even more offerings.

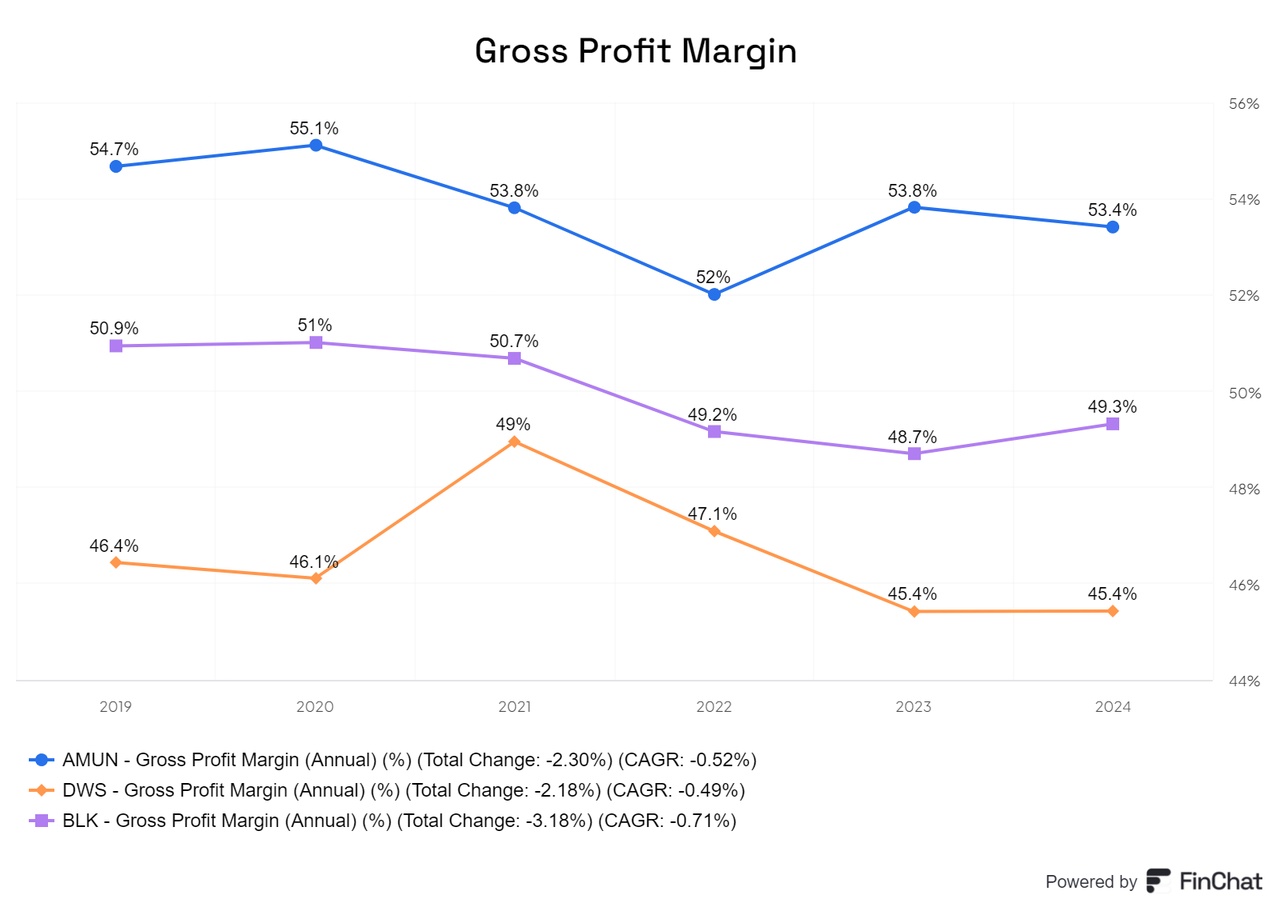

Amundi is also ahead in terms of gross profit margin.

However, its net profit margin is well behind BlackRock's, partly due to BlackRock's product mix.

In terms of earnings per share (EPS), BlackRock leads by a wide margin and was able to increase this significantly with an annual growth rate of almost 8%.

Free cash flow (FCF) is currently positive at all three companies. Amundi, on the other hand, was briefly negative in some cases, while State Street is a special case anyway.

The share-based remuneration essentially only affects BlackRock.

However, BlackRock buys back more shares and is therefore net negative. Amundi has also made purchases from time to time.

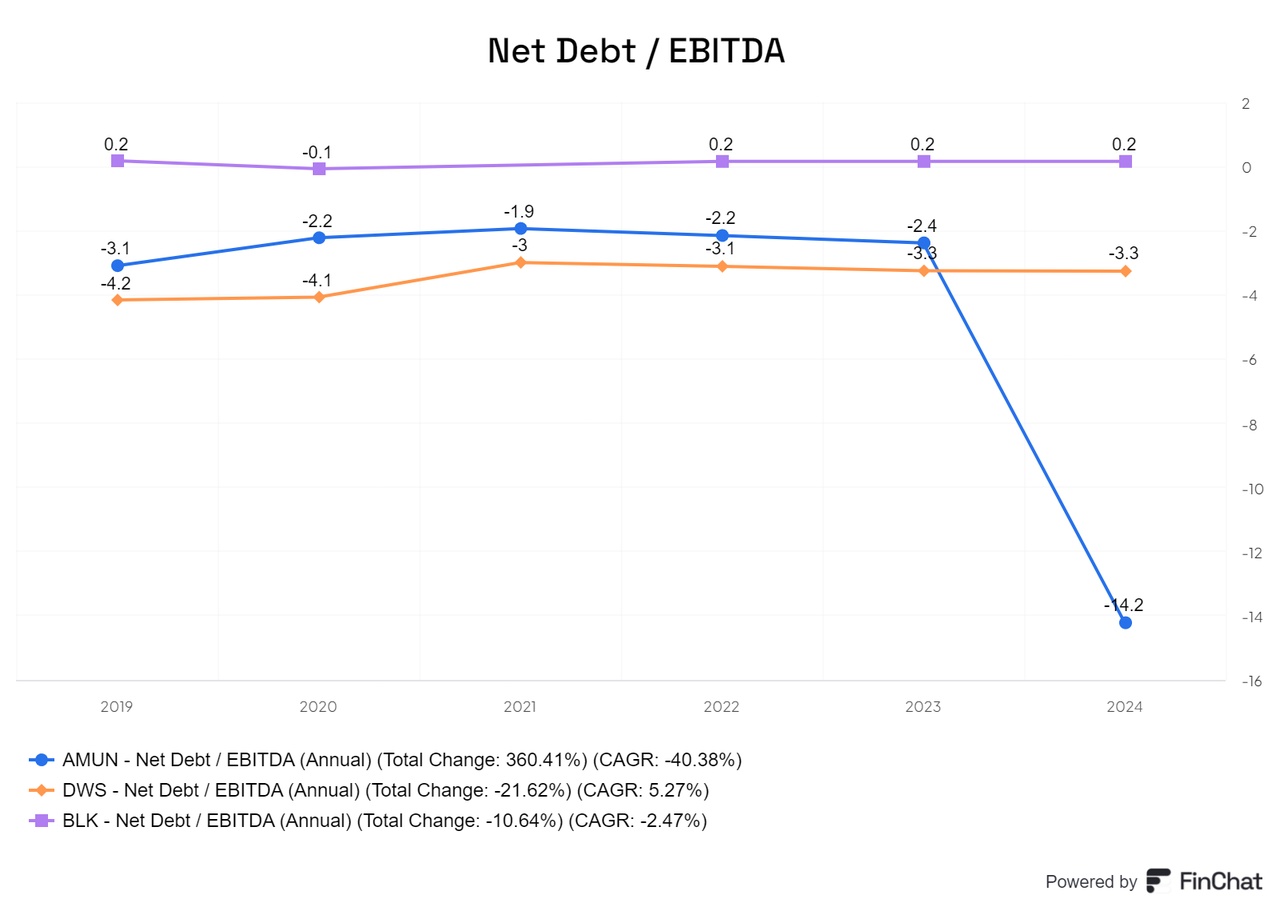

All companies are very well positioned in terms of the ratio of net debt to EBITDA.

Part 2:https://getqu.in/aiK2Y3/

+ 6

Podcast episode 54: Banker interview part 1: IB, WM, How do millionaires invest? Salary, career, studies, everyday life, networking

Subscribe to the podcast, because part 2 is coming soon!

Spotify

https://open.spotify.com/episode/4YsZurcJTxHC0ktE5y5f0J?si=NB6dHPnJRd2eGkSJLALbVQ

YouTube

Apple Podcast

#podcast

#spotify $GS (-0,54%)

$JPM (-0,68%)

$MS (-0,5%)

$DBK (-1,23%)

$CBK (-0,53%)

$BNP (-1,5%)

$GLE (-1,53%)

$HSBA (-0,98%)

$HSBC (-1,31%)

The Societe Generale ($GLE (-1,53%) ) forecasts that oil production ($IOIL00 (+3,19%) ) in the USA in the year 2024 is expected to grow more slowly than in the previous year. This estimate is based on the fact that the shale oil industrywhich has seen a sharp increase in production in recent years, is gradually maturing.

When an industry matures, this often means that the production rates production rates do not increase as quickly as before, as the best locations have already been "developed" and the remaining resources are more difficult and expensive to extract.

Furthermore, much of this expected production growth is already factored into the market expectations which means that investors are already prepared for this and prices may have reacted accordingly.

As a result, there could be limited upside potential for oil prices ($IOIL00 (+3,19%) ), as the expected increase in production is no longer surprising and may already have been priced in.

The Societe Generale ($GLE (-1,53%) ) plans to cut about 900 jobs in France this year, mainly in the areas of IT and support.

CEO Slawomir Krupa strives to cost reductions to increase profitability increase profitability. The exact number of job cuts will be between 900 and 1000 will be between 900 and 1000.

Krupa announced in September 2023 that it would reduce costs by 2026 by around 1.7 billion euros by 2026.

The $GLE (-1,53%) FORGE subsidiary was the first company in France to receive the highest crypto license!

The DASAP license now allows FORGE to offer services such as crypto custody, trading and sales. This shows that the company meets the highest security and compliance standards. Previously, other crypto companies had registered with the French market regulator, but only FORGE received the highest level of approval.

It's really cool to see Société Générale getting involved in the crypto space. They have already launched euro bonds and securities tokens on the blockchain. Just in April, they launched EUR CoinVertible - a stablecoin pegged to the euro for qualified institutional clients.

What do you guys think of this development? Do you think FORGE and Société Générale will succeed with their crypto strategy? What impact could these developments have on the crypto market?

Titoli di tendenza

I migliori creatori della settimana