Amundi Q3 2024 $AMUN (+0,57%)

Financial performance:

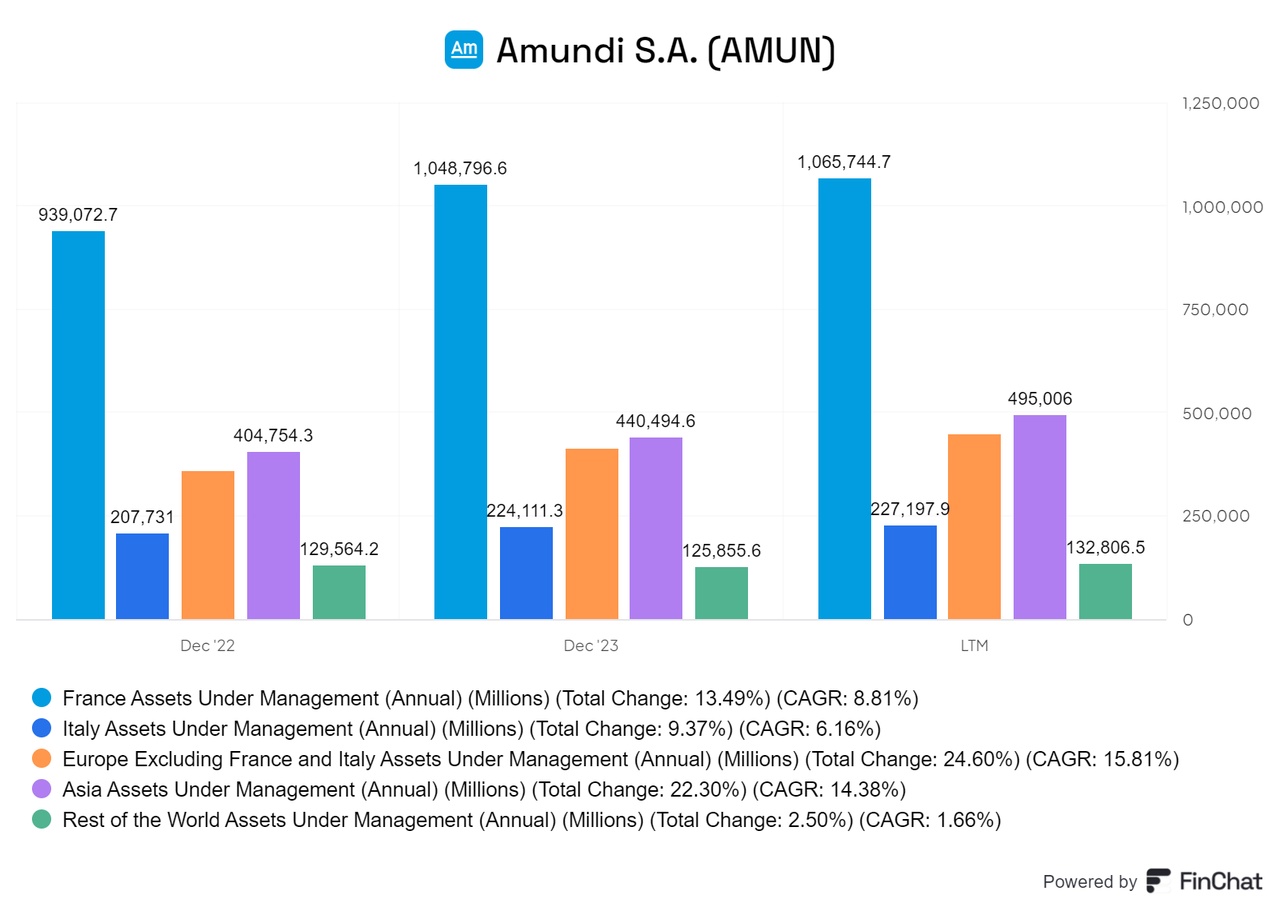

Amundi recorded an impressive financial performance in the third quarter of 2024 with an adjusted net result of EUR 337 million, an increase of 16.1% year-on-year. For the first nine months of the year, adjusted net income amounted to EUR 1,005 million, an increase of 10.4% compared to the same period in 2023. In addition, the company achieved a record level of assets under management (AuM) of 2.2 trillion euros, an increase of 11.1% year-on-year.

Balance sheet overview:

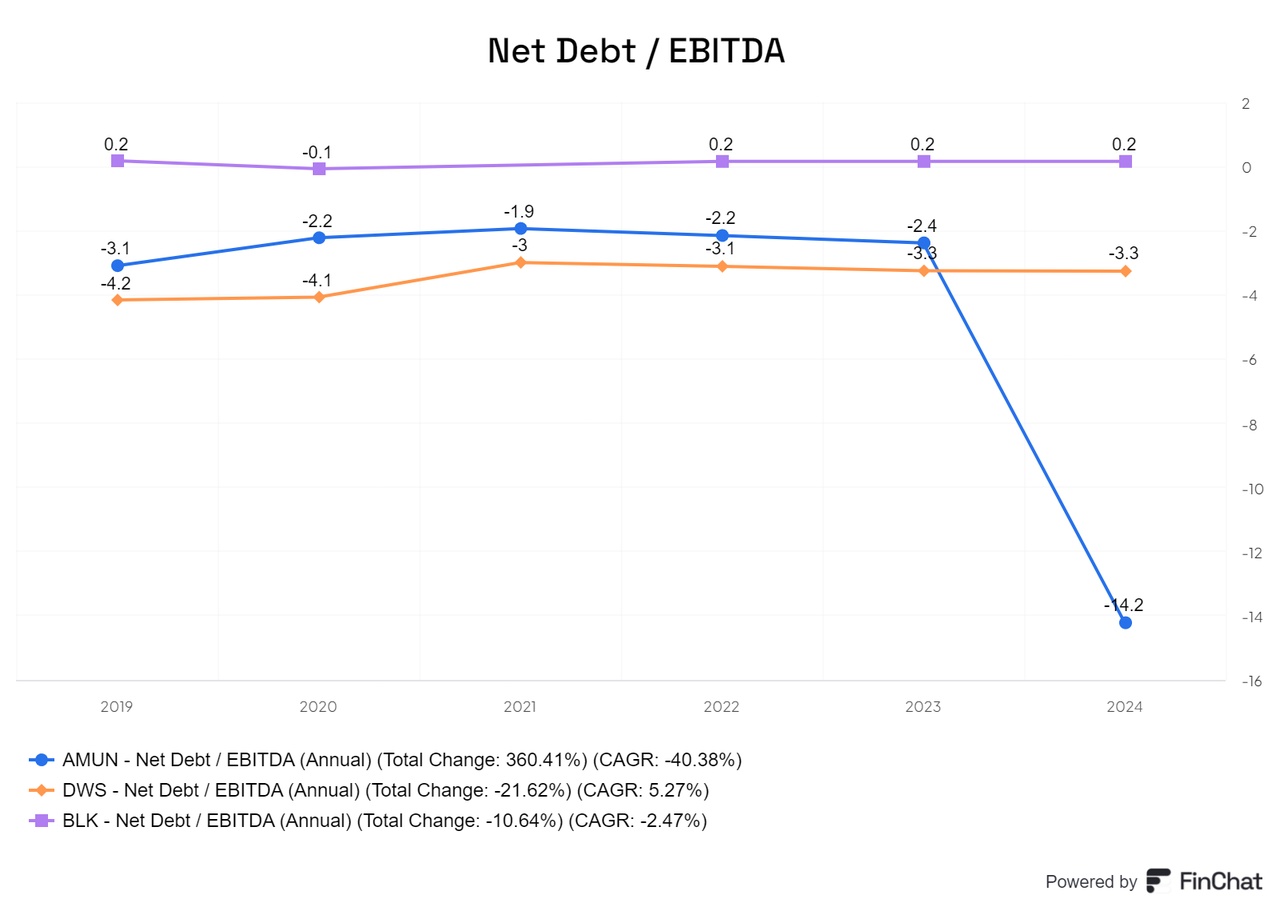

The acquisition of Alpha Associates resulted in goodwill of EUR 290 million and an intangible asset of EUR 50 million representing client contracts, which will be amortized on a straight-line basis until the end of 2030.

Notes to the income statement:

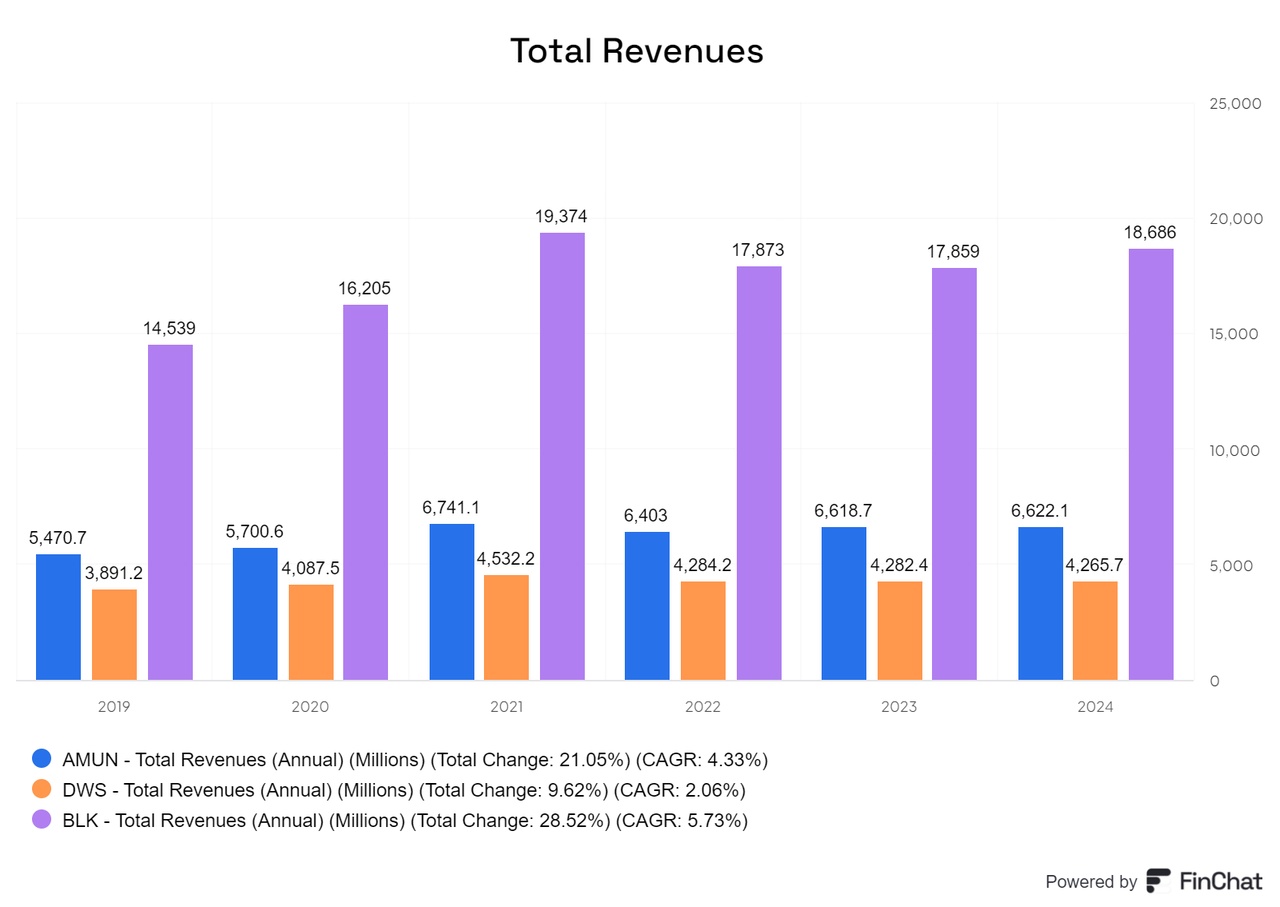

The adjusted net result for the first nine months of 2024 amounted to EUR 2,573 million, an increase of 7.3% compared to the previous year. Management fees rose by 6.6% to 2,364 million euros, while performance fees fell slightly by 2.0% to 88 million euros. Operating costs remained well controlled and rose by 5.9% to 1,356 million euros, resulting in a positive "Jaws effect".

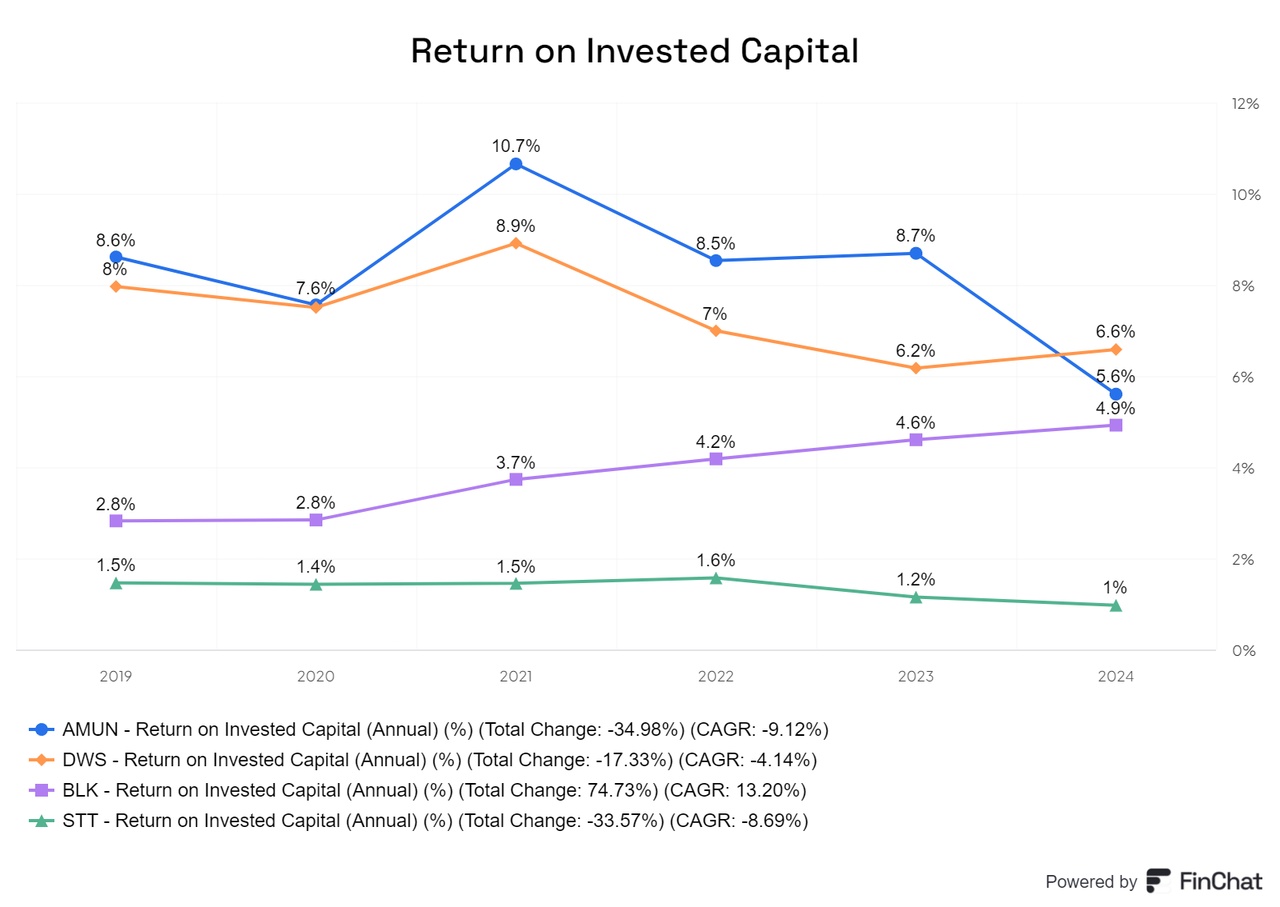

Key figures and profitability metrics:

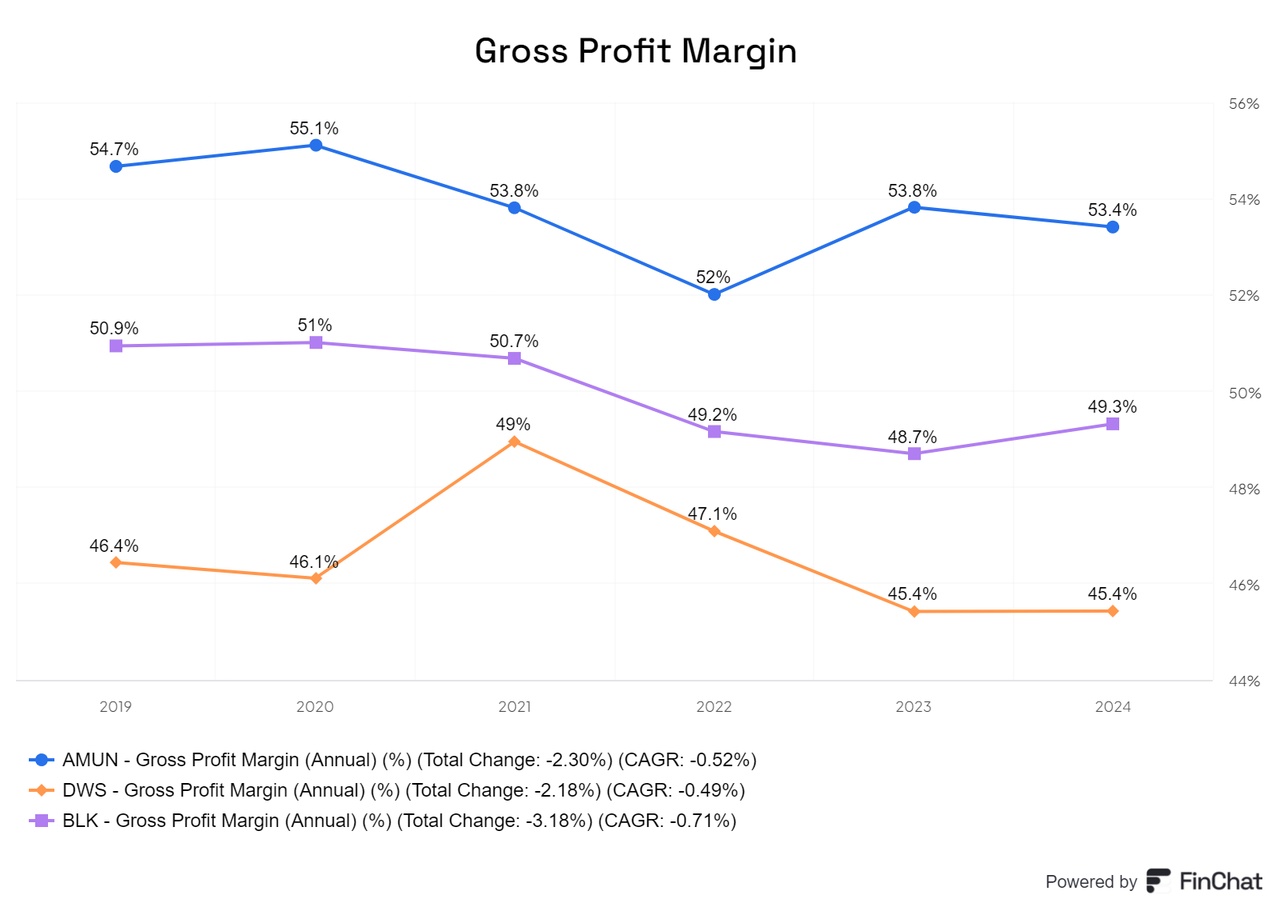

The adjusted cost/income ratio improved to 52.7% in the first half of 2024, compared to 53.4% in the same period last year. Adjusted earnings per share for the third quarter of 2024 amounted to EUR 1.65, an increase of 16.0% compared to the previous year.

Segment information:

Retail: Net inflows of EUR 6.3 billion in the third quarter of 2024, particularly from third-party sales partners.

Institutional and public clients: Net outflows of EUR 9.3 billion were recorded here in the third quarter of 2024, albeit with positive inflows from MLT assets.

Asia: Strong performance with net inflows of EUR 7 billion in the third quarter of 2024.

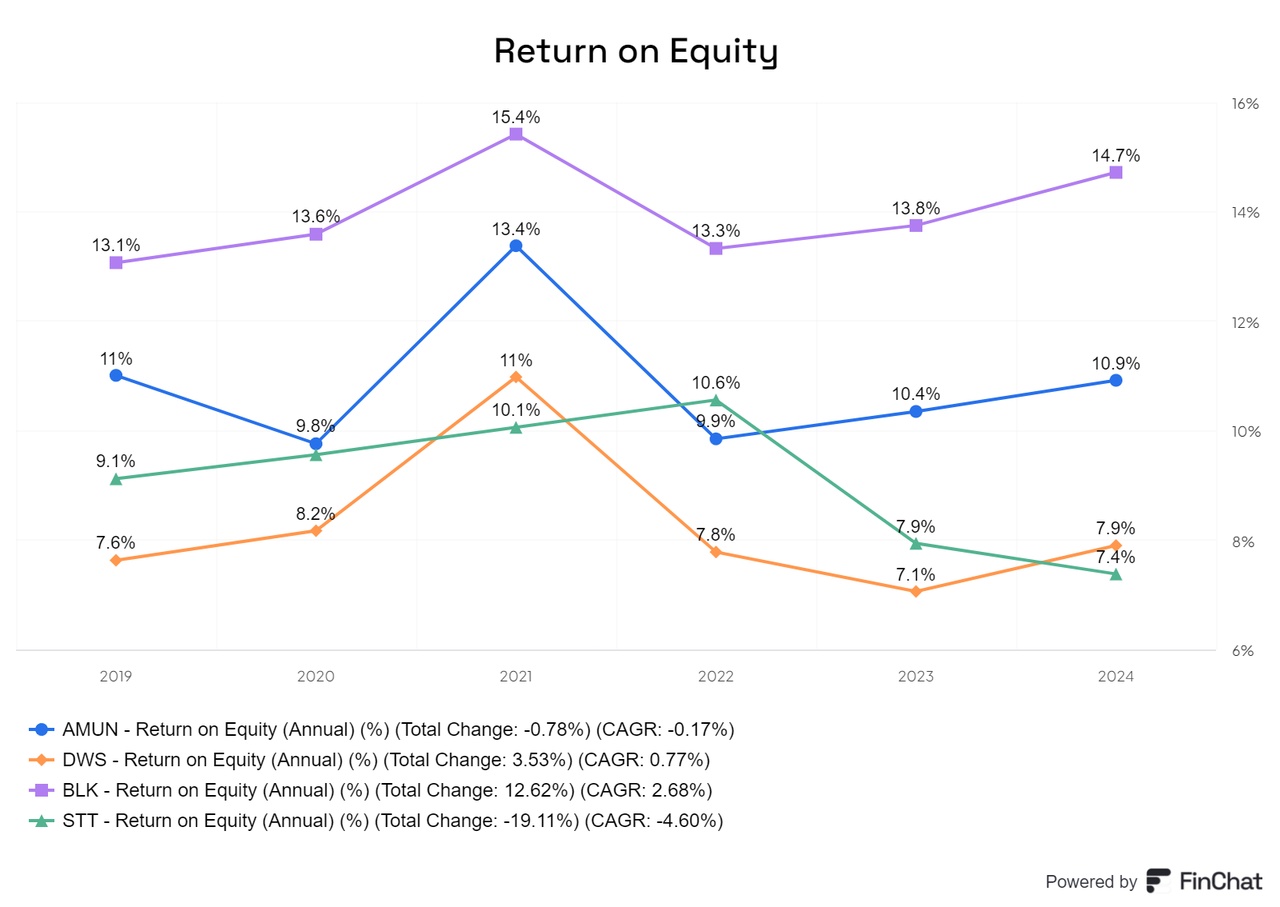

Competitive position:

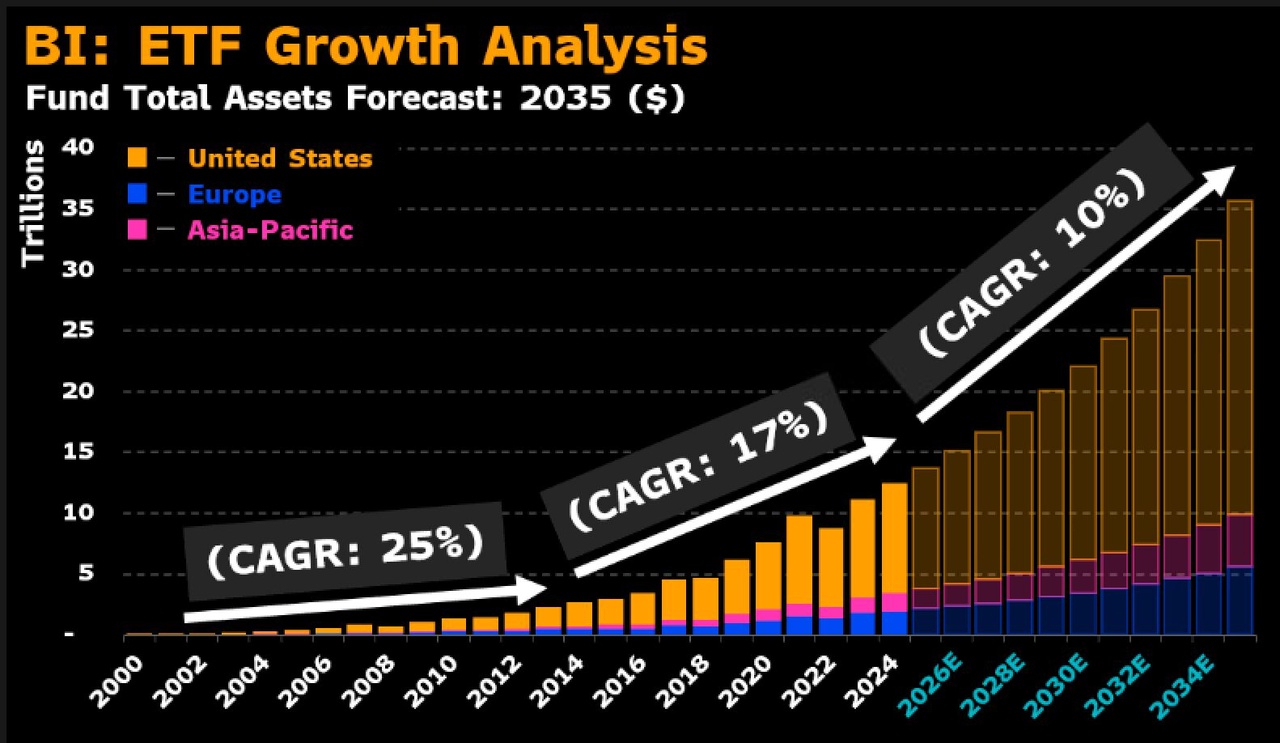

Amundi's strategic focus on ETFs, third-party distribution and Asian markets has strengthened the company's competitive position. Amundi is now the second largest provider in Europe in terms of net inflows into ETFs.

Forecasts and management statement:

Management expressed confidence in the realization of the 2025 plan, with further growth expected in strategic areas such as technology and Asia. The partnership with Victory Capital is expected to strengthen Amundi's presence in the US and contribute to revenue growth.

Risks and opportunities:

Risks include market volatility and client risk aversion, which could have a negative impact on inflows and sales. Opportunities lie in the expansion of the ETF range, the use of technology and growth in the Asian markets.

Summary of results:

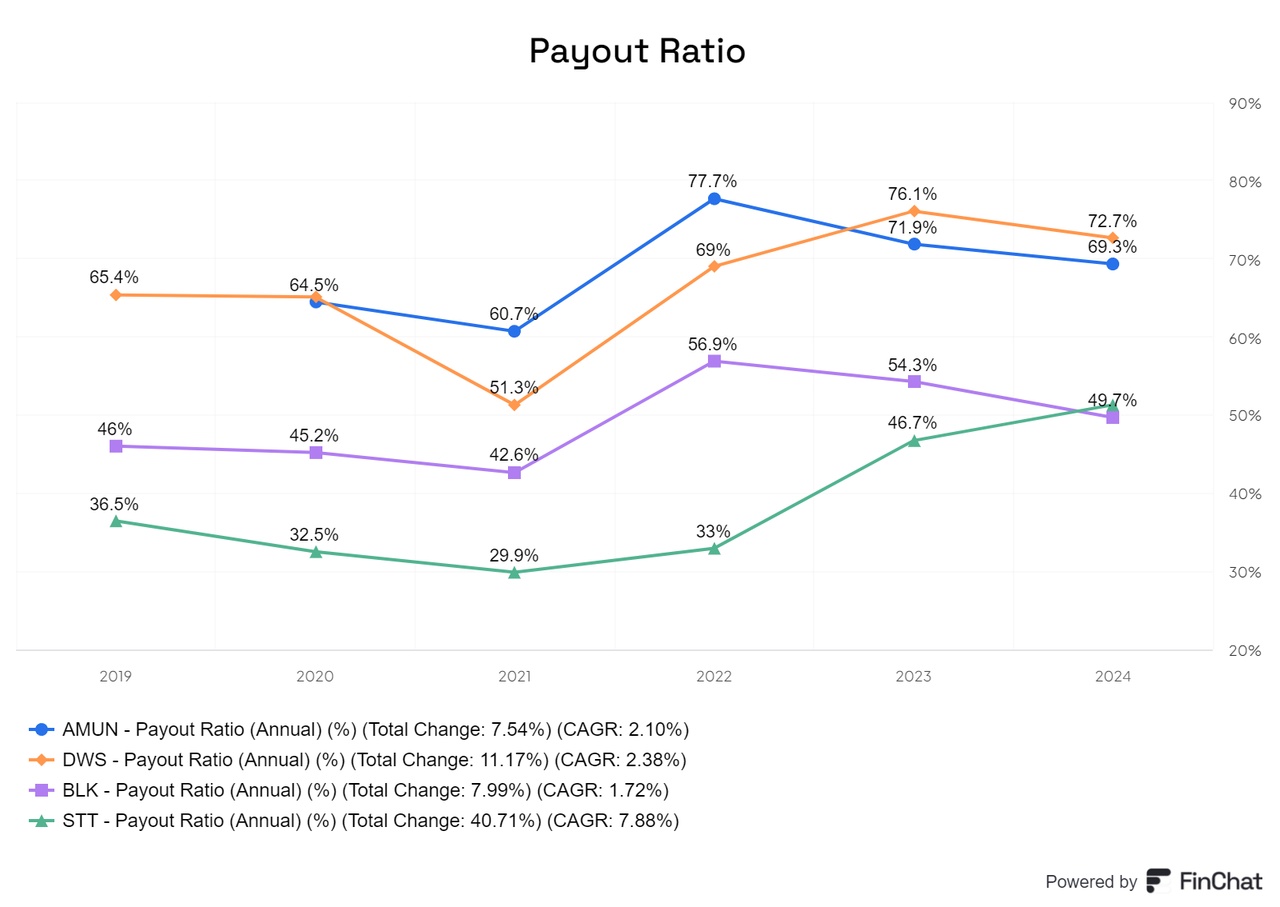

Amundi delivered a robust financial performance in Q3 2024 with significant growth in net income and assets under management. The strategic initiatives, particularly in ETFs and Asia, are delivering positive results. The acquisition of Alpha Associates and the upcoming partnership with Victory Capital are expected to further strengthen Amundi's market position and growth potential. The improved cost/income ratio and the positive "Jaws effect" underline the operational efficiency and position Amundi well for future growth.

Positive aspects:

Record assets: Amundi reached record assets under management of €2.2 trillion as of September 30, 2024, an increase of 11.1% year-on-year. This growth reflects the strong market performance and effective investment management strategies.

Strong growth in net income: Adjusted net income for the third quarter of 2024 amounted to EUR 337 million, an increase of 16.1% compared to the third quarter of 2023, driven by higher revenues and operational efficiencies resulting in a positive "Jaws effect".

Successful ETF strategy: Amundi's ETF assets under management exceeded EUR 250 billion, with net inflows of EUR 8 billion in the third quarter of 2024, positioning Amundi as the second largest provider in Europe in terms of net inflows into ETFs, demonstrating the success of its strategic focus on this area.

Positive inflows in Asia: The Asian market showed a strong performance with net inflows of EUR 7 billion in the third quarter of 2024. This development was supported by contributions from joint ventures and direct sales activities in countries such as Japan, Singapore and Hong Kong.

Improved cost-income ratio: The adjusted cost-income ratio improved to 52.9% in the third quarter of 2024, indicating increased operational efficiency and in line with the company's 2025 target.

Negative aspects:

Net outflows in the institutional segment: In the institutional clients and sovereign wealth funds segment, Amundi recorded net outflows of EUR 9.3 billion in Q3 2024, indicating difficulties in retaining institutional clients, despite positive inflows in MLT assets.

Decline in multi-asset and real assets: Multi-asset assets under management remained stable, while real and alternative assets declined by 8.3% year-on-year, indicating challenges in these asset classes.

Negative development in China: Amundi BOC WM in China recorded net outflows of EUR 0.7 billion in the third quarter of 2024, as maturing fixed deposits could not be offset by new subscriptions. This illustrates the difficulties in the Chinese market.

Effects of the exit from the low-wage insurance mandate: The exit from a low-wage insurance mandate led to significant outflows of EUR 11.6 billion and impacted total inflows in the quarter.

Pressure on performance fees: Although performance fees increased compared to Q3 2023, they decreased compared to Q2 2024 due to lower crystallization levels, indicating the volatility of this revenue stream.