A comprehensive introduction to $CDR (+0,62%) - the Polish games company CD Projekt RED - perhaps also interesting for those who have not yet had any contact with the gaming industry.

Disclaimer: I am a co-owner of the company. This is not investment advice. Rather, I invite you to give your opinion on the company and the analysis. For me, this is the first written company analysis of this scope. More will be published in the future. I am therefore looking forward to your feedback.

Here is the short version and key statements:

- $CDR (+0,62%) is a Polish games company, which became known in particular for the games Witcher III and Cyberpunk 2077.

- Market value: PLN 11.44 billion; P/E ratio: x14.6; P/E ratio: x27.5; EPS: PLN 4.164, very low debt ratio, high net liquidity.

- Many game releases are expected in the next few years, which in my opinion are not priced into the share price.

I. The gaming market in general

Gaming has long since ceased to be a niche hobby reserved for socially distant nerds and has become a daily companion for billions of people [1], including me. With the rapidly growing number of players, the market for video games is also growing. Sales are expected to grow by 45% by 2027.[2] These figures should be treated with caution. The fact is that "gaming" is becoming increasingly socially acceptable and acceptance and sales potential are growing steadily. For this reason, more and more established companies are taking an interest in this market. $AMZN (+1,02%) develops games, especially for cloud gaming. $MSFT (-0,51%) has been involved for a long time and has become a gaming giant, particularly through the incorporation of Minecraft and the takeover of Activision Blizzard. It also$NFLX (-1,19%) also offers games and $DIS (+0,19%) now wants to invest 1.5 billion in Epic Games, the creators of Fortnite, for example.

II Introduction to the company

→ History

Nevertheless, the gaming market has so far been dominated by smaller players who have been adding value to their names with excellent games for years. One of these companies is CD Projekt Red.

Still a game distributor in the 90s, CD Projekt RED was officially founded in 2002 and developed its first game, "The Witcher". The two CEOs have raised the company since 1994 and are also both the largest shareholders. They are characterized by open, transparent and direct communication.

"The Witcher" is based on the books by Andrzej Sapkowski, which were already very well known in Poland. The game and its two sequels helped to make the stories of the witcher Geralt of Riva internationally known.[3] Witcher III in particular brought outstanding success and fame, with over 50 million copies sold, making it one of the most successful games in the world.[4]

→ The cyberpunk disaster

Cyberpunk 2077 was released in December 2020. An estimated 13 million licenses were sold at release. The most successful release of a game ever.[5] However, the game for the PC was in an unfinished state, as evidenced by many bugs, i.e. errors in the programming. The version for PS4 and X-Box was disastrous, downright unplayable, so that $6758 (-0,04%) (Sony) stopped offering the game for sale for several months.

Unfortunately, it has become relatively normal for games to have a few bugs (errors) on release, which are then quickly fixed in a so-called hotfix. Cyberpunk, however, had a new quality in its bugs, which contradicted the generally very good image of the company. The result was a lot of negative publicity, bug compilations and a huge shitstorm. In addition to the many bugs, there were complaints that many of the announced game elements were not implemented.

A short personal interjection: A few of my friends played Cyberpunk on PC at the time and were very satisfied. Of course there were bugs, but they didn't really bother them. The gaming experience was still uniquely exhilarating.

Remarkable is the decision of the company management to devote considerable human and financial resources over the next 3 years to completing the game in the quality it deserves. CD Projekt RED didn't just limit itself to fixing the bugs, but also intervened extensively in the game after the fact in order to live up to expectations. Whether they have succeeded is a matter of opinion. The game ratings on Steam [6] (probably the most meaningful) and playtest clearly underline that the restoration was a complete success. As of October 2023, the game has now sold 25 million copies[5].

The work was completed with a DLC, an additional downloadable content that traditionally expands the game with its own story, perhaps even a game world, and is purchased separately.

CD Projekt RED is known for its outstanding Witcher III game expansions, which often have the quality of a fully-fledged game in their own right. The Cyberpunk DLC, Phantom Liberty, also follows in this tradition. Within a very short time of the expansion's release on 26.09.2023, 5 million copies had already been sold[7].

→ Cooperation with Netflix

The first season of The Witcher was released on Netflix in 2019. The game has benefited greatly indirectly. Sales and average player numbers rose sharply after 2019. This trend was supported by the pandemic.

For completeness, it should be mentioned that the 4th season of the series will be released soon. The main actor, Henry Cavill, who himself is known as a passionate player of Witcher III, left the production amid criticism of the falsification of the book and game template and poor character portrayal.

The animated series "Edgerunners", set in the cyberpunk universe, has also been available on Netflix since September 2022. The company benefits directly from license fees, but especially indirectly from the series' excellent reputation. The game was not forgotten thanks to the series and reached a large audience. This led to a renewed (small) hype around the game, this time under much better conditions, as the game was in a better condition.

→ Outlook for the coming years

Back in October 2022, CD Projekt RED provided an insight into which games can be expected in the future, without giving specific dates. It was also announced that the in-house engine (key software for game development) will be discontinued and the Unreal Engine 5 from Epic Games will be used instead.

Three new games from the "Witcher universe" were announced, codenamed Polaris 1-3.

At the same time, the successful Witcher title is to undergo a "remake". This means that the 2007 game will be brought up to date with the latest technology (especially the graphical possibilities) and new, smaller game expansions will also be possible. The company is cooperating with Studio Fool's Theory, a renowned game studio for RPGs.

In cooperation with the development studio "The Molasses Flood", another game (Project Sirius) is being produced in the Witcher universe, which should be attractive to a broad market and will not necessarily have any overlap with the previous games and Polaris.

A new game in the cyberpunk universe is expected under the name "Orion".

Finally, a completely new brand is also being worked on, which will be integrated alongside Witcher and Cyberpunk.

In total, 5 new, in-house AAA games are planned, a remake and a previously unknown project in cooperation with another studio.

The completion of Cyberpunk has been completed. More than 400 people have been working on the new Witcher game Polaris 1 since fall 2023. 500 will be working on it in 2024.

III What makes the company so special?

CD Projekt Red is known for its style of storytelling, atmospheric game world and sophisticated character profiles. This creates an intense immersion. The characters are deep and versatile. The game world reacts to you and does not remain a mere backdrop. Stories are told that you won't forget for the rest of your life. A living book, a playable movie.

Comprehensive updates and extensive DLCs improve the gaming experience. The company also supports "modding", i.e. third parties can develop their own software for the game and offer it as a program. Players now have the opportunity to make subjective improvements to the game from a never-ending number of modification options. Some mods improve the graphics, while others offer more freedom in character design or gameplay. There are no limits. This allows a long-lasting player base to be maintained, with self-replicating content and updates. This also explains why Witcher III experienced a new renaissance in June 2019, four years after its release, with sales figures increasing by 150% by May 2023.

The company thinks long-term. The development time of a completely new game can take over 10 years. The management has actively decided to develop Cyberpunk as an extremely technically demanding game in order to be able to keep up visually in 5 years' time. In particular, dubbing in Asian languages is intended to further develop the huge market that has so far been rather untouched by Western games companies. Takeover rumors are consistently ruled out. The switch to the Unreal Engine, probably the most advanced game engine currently available, is also evidence of long-term planning.

IV. Key figures

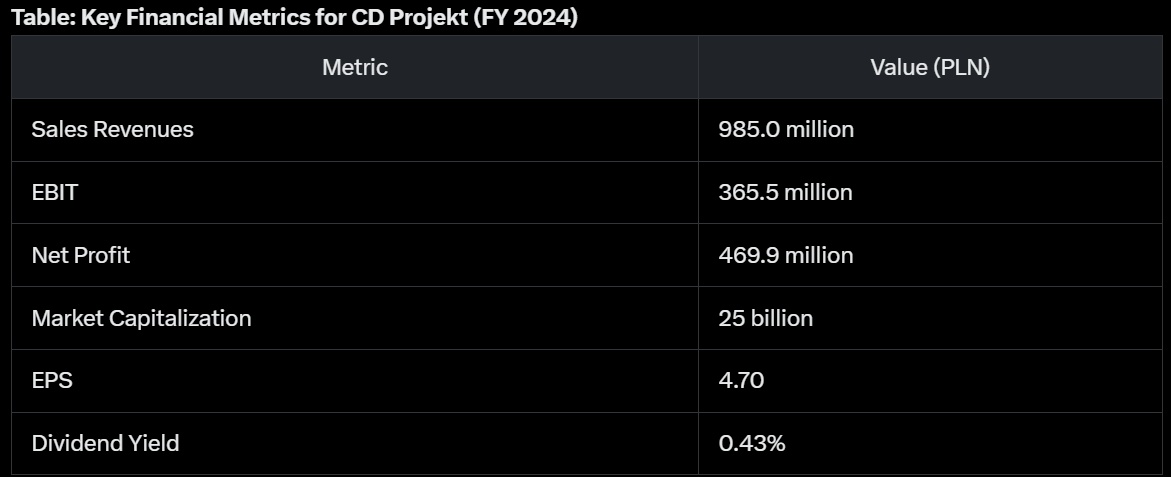

Now to the essentials. The figures are from MarketScreener [8] and are given in PLN; we will limit ourselves to a small selection of figures.

Current share price: 114.6

Market value: 11.44 billion

Sales forecast 2023: 782 million (KUV: x14.6)

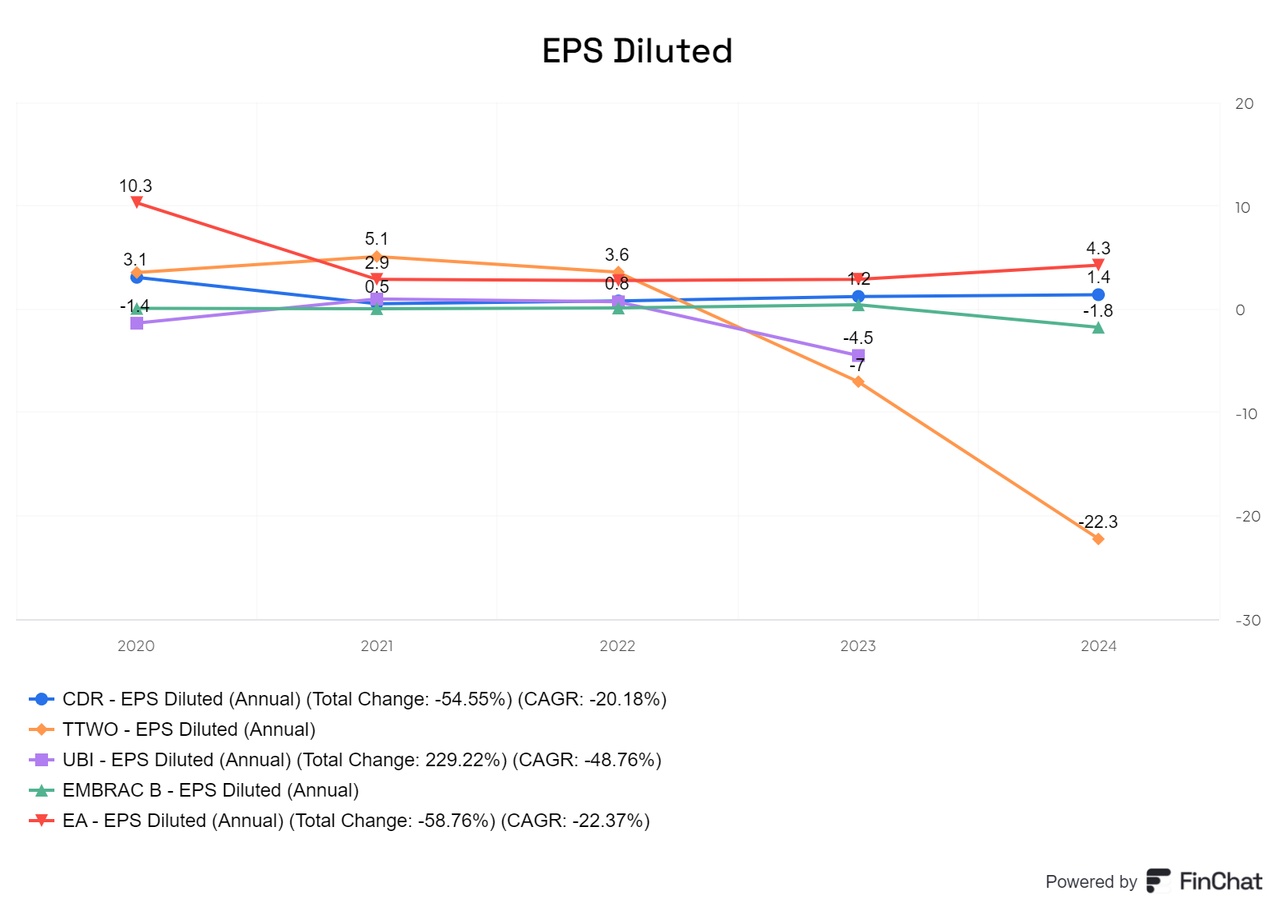

Profit expectation 2023: 423m (P/E x 27.5; net margin: 36.23%, profitability since 2015)

EPS: 4.164

Free cash flow: 295 million

Net liquidity: 1.022 bn (with a negligible debt ratio from current liabilities)

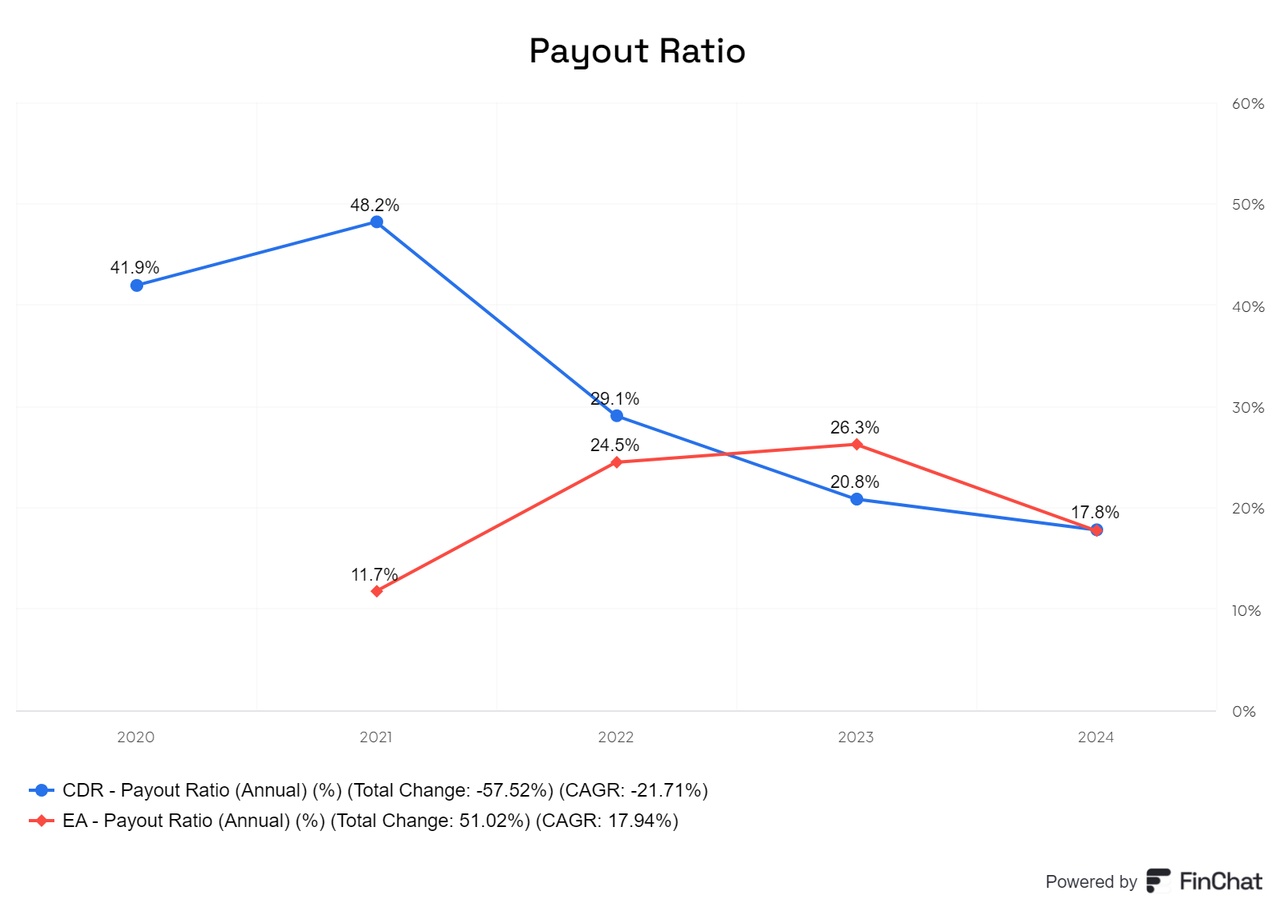

The dividend per share amounted to PLN 5 in 2020 and 2021, but was canceled for 2022 and will probably amount to PLN 0.9950 in 2023. You see, negligible for now.

These figures are not very meaningful. The figures have a high variance, as they are determined in particular by the Cyberpunk release and Disaster. In this respect, annual periods must be analyzed. A DCF valuation is also difficult under these conditions. If you are still interested, I recommend AlphaSpread [9] to take a closer look at a DCF valuation or other figures. I could not recognize a red flag.

V. Relevant assumptions

Any analysis is only as good as the assumptions on which it is based.

Personally, I am convinced that CD Projekt Red has learned from the Cyberpunk disaster and that the many updates and DLC have restored the company's reputation. If this assumption turns out to be wrong, i.e. a new game is released in an equally disastrous state, my investment case will be destroyed. My conviction is based on the company's transparent communication and admission of its own mistakes. Here is an interesting article on how Cyberpunk has changed the company. [10] The first test was the release of the Cyberpunk DLC. I am very pleased to see what an excellent state the content-rich game extension is in.

The future development of the Witcher Netflix series will only have a minor impact on the success of future Witcher games. Of course, the brand as a whole benefits from a good series. But the brand exists even without good cross-promo. What's more, the Witcher universe is already familiar to most Netflix users. The quality of the games speaks for itself, as does the company's regained reputation. In addition, a new book in the series is expected in the very near future. This cannot harm the game universe.

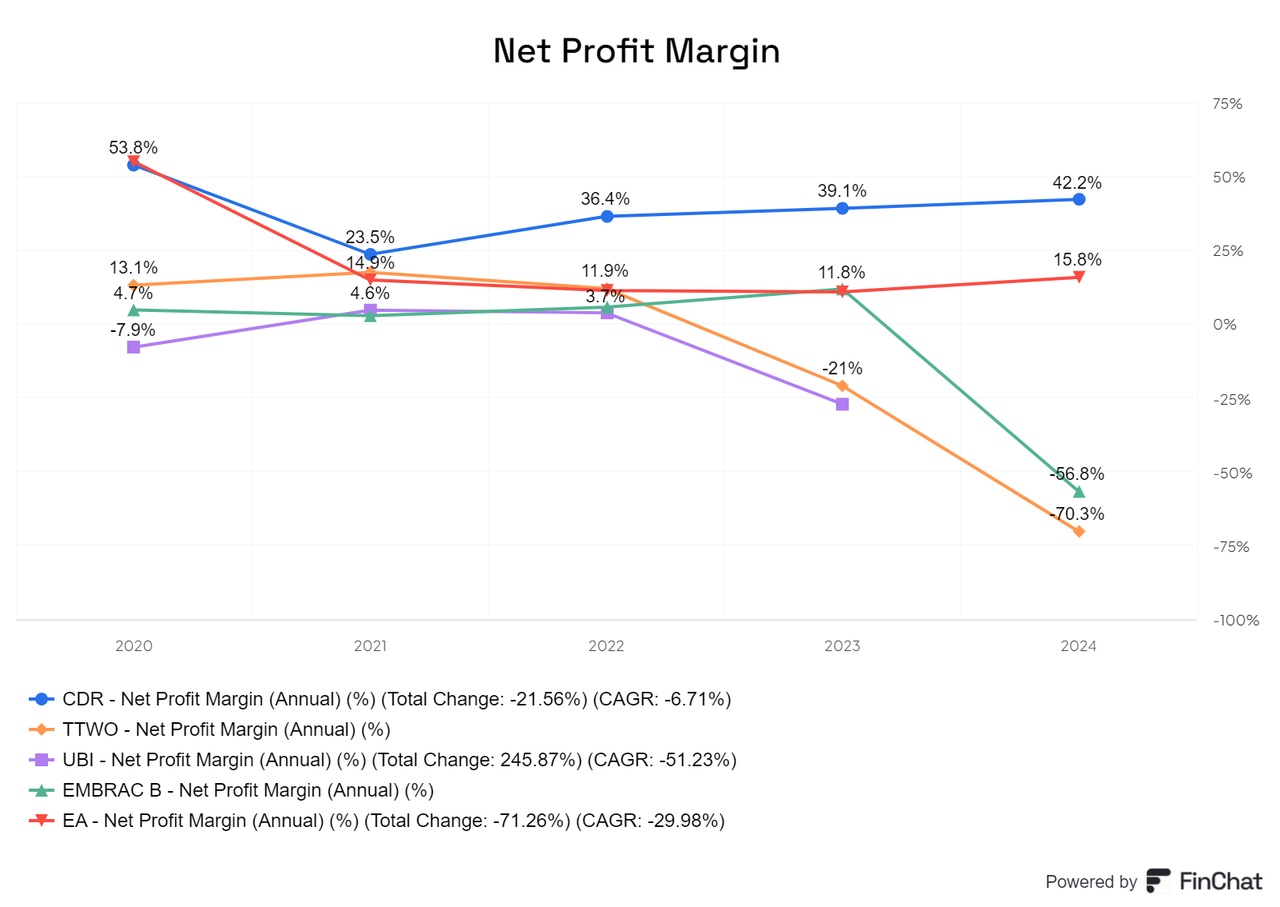

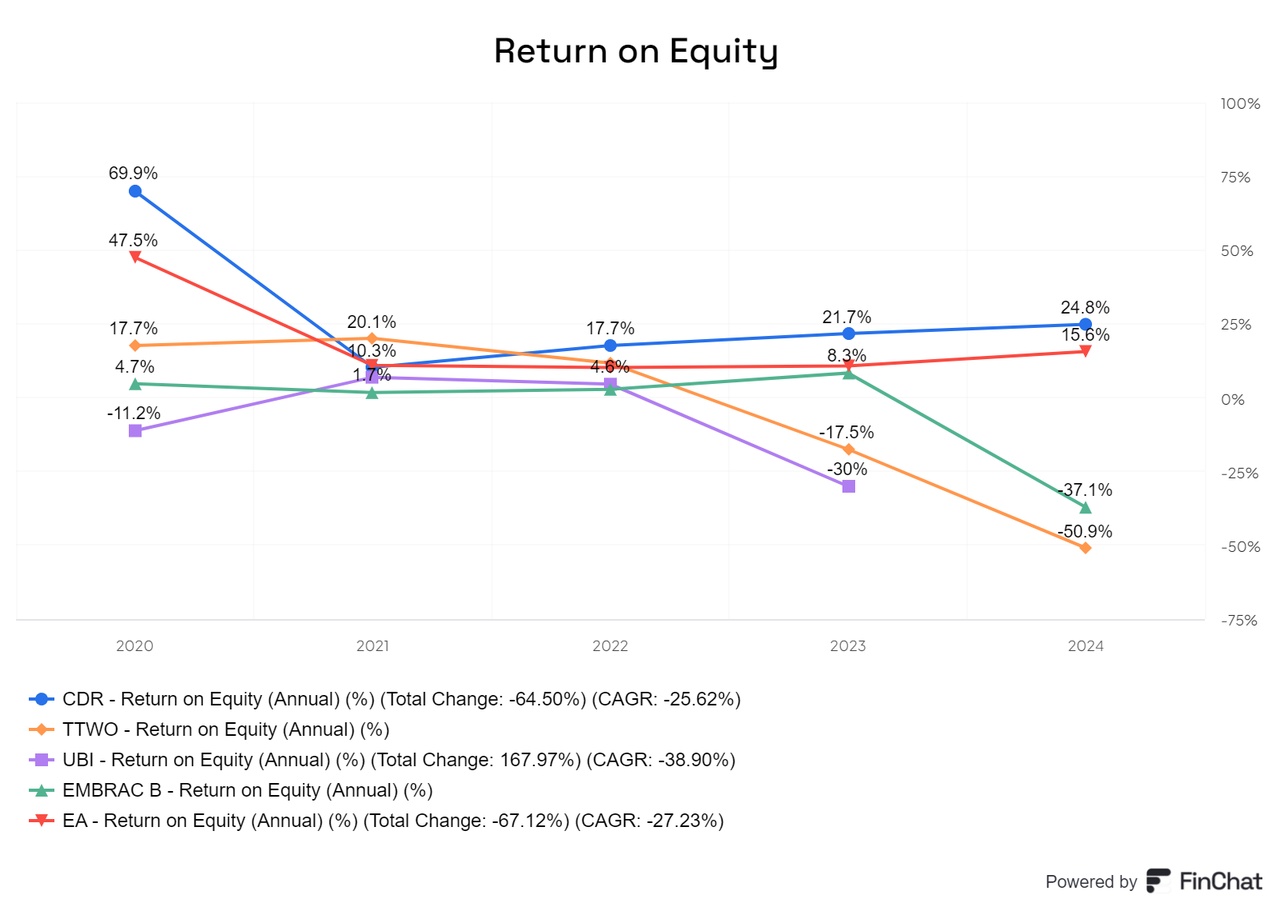

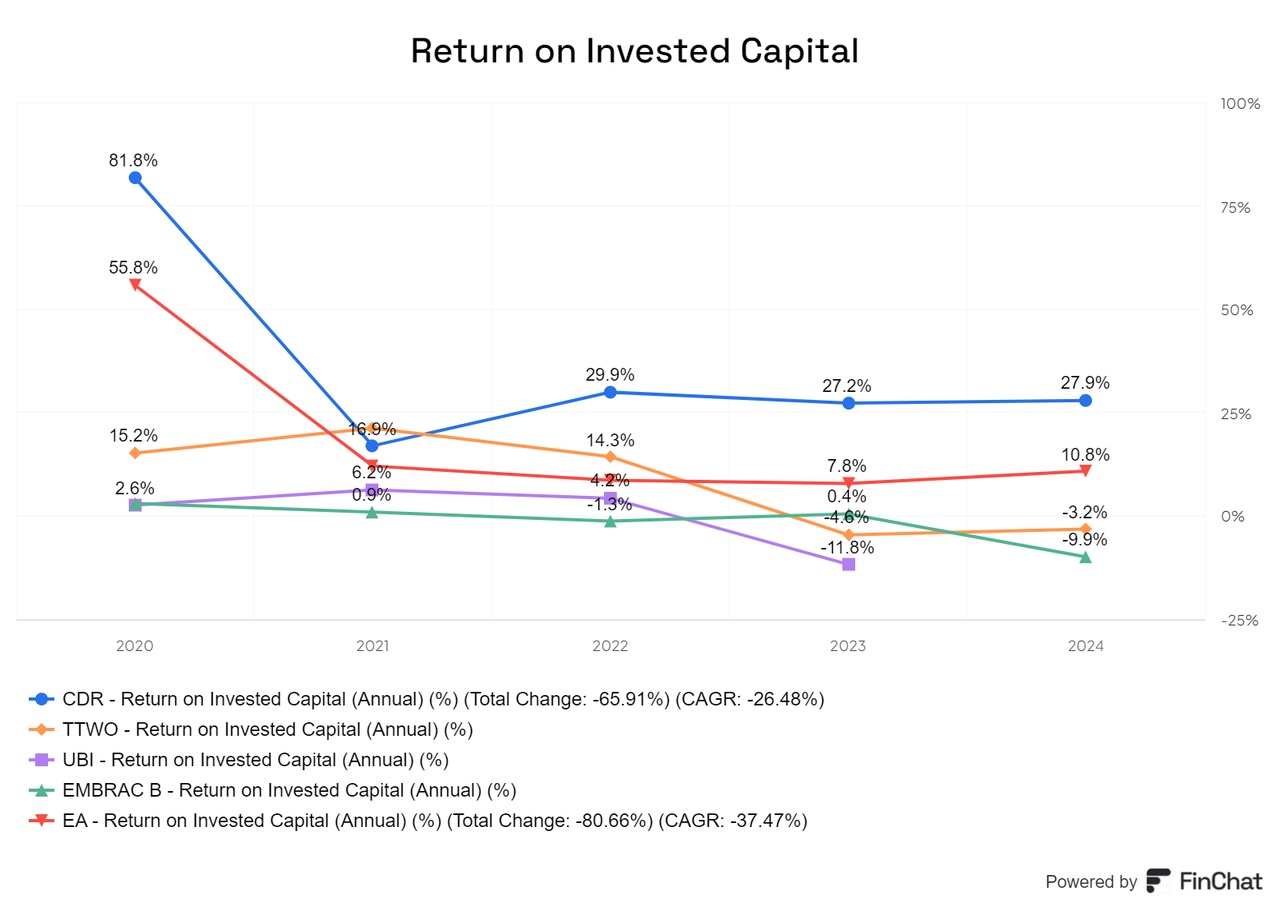

The future games can follow in the footsteps of their predecessors. Here I have deliberately decided to deviate from my convictions and paint a pessimistic picture. I have based my sales and revenue dynamics on the years 2020-2023 and calculated them individually for each main game. No increase in sales per game, ignoring the fact that Cyberpunk and Witcher III will continue to sell and factoring in time- and capital-intensive bug fixes. I treat the Witcher remake and Project Sirius as a very small revenue driver, only about 30% as profitable as the main games. In other words, a worst-case scenario. I have also reduced the net margin to 25% (10-25% less than previous years) for my assumption to account for a possible discount from using the new engine.

I assume that a game will be released annually from 2026. A postponement of one year is possible, but irrelevant for my investment case, as there is already enough net liquidity to operate for a few years without debt.

VI Analysis

→ Potential

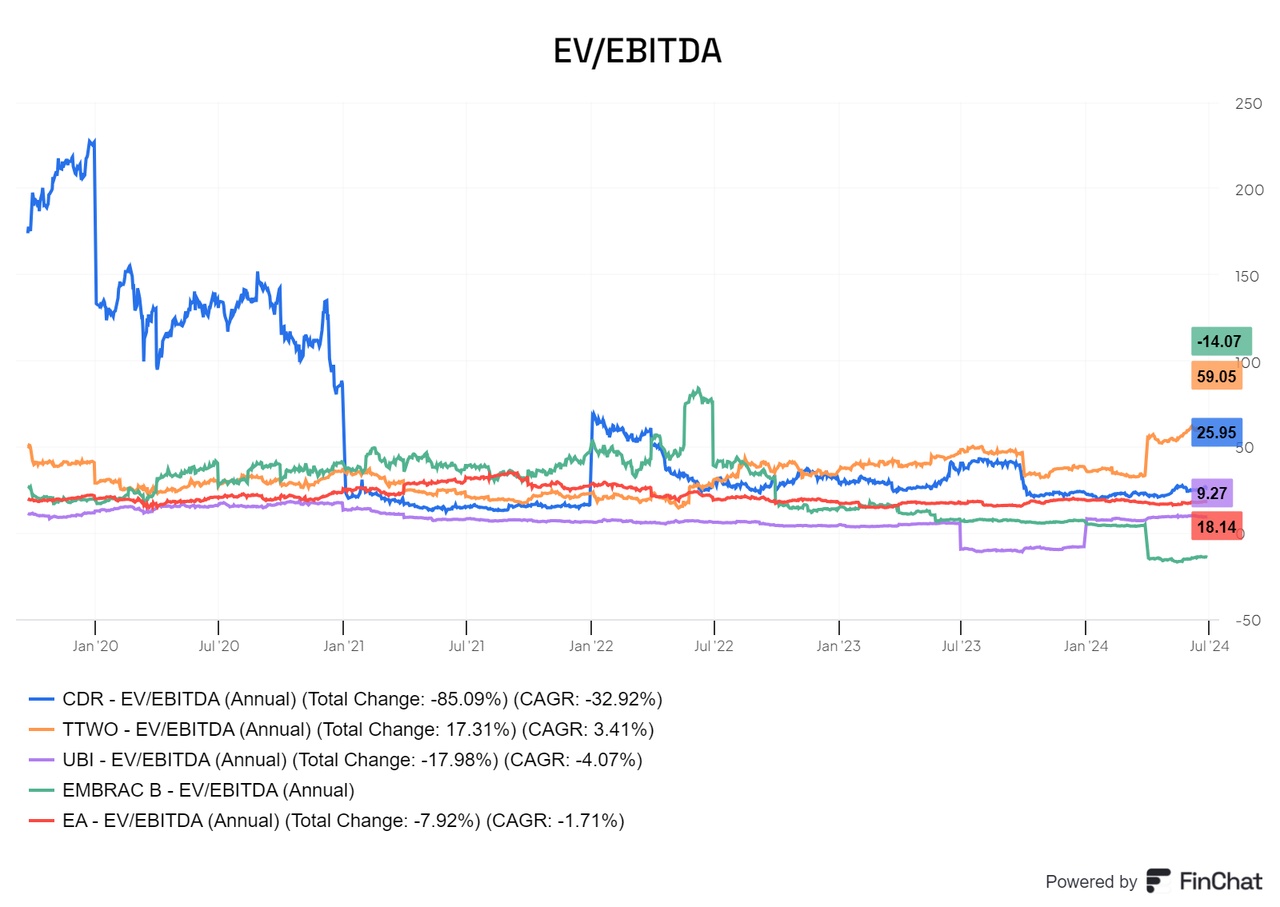

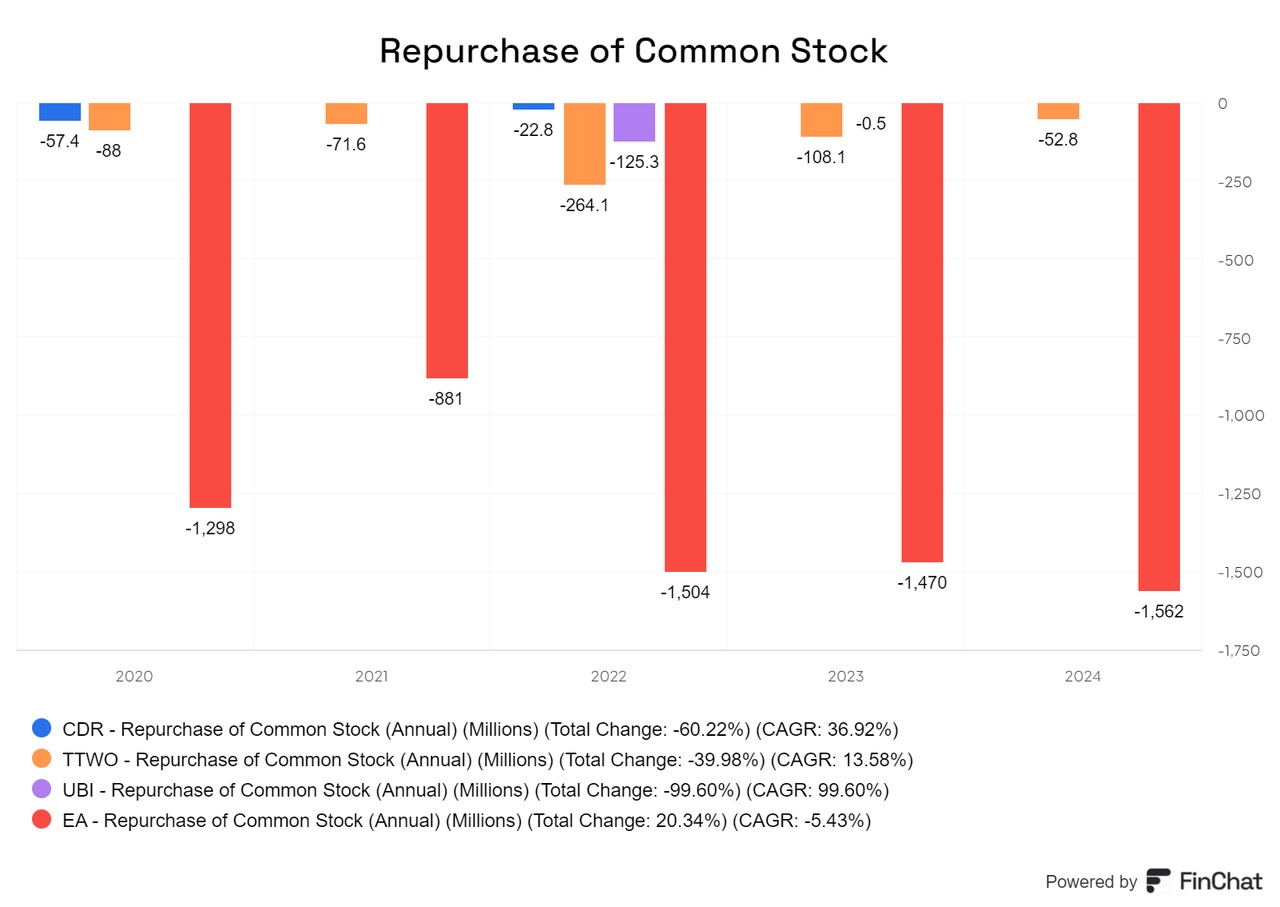

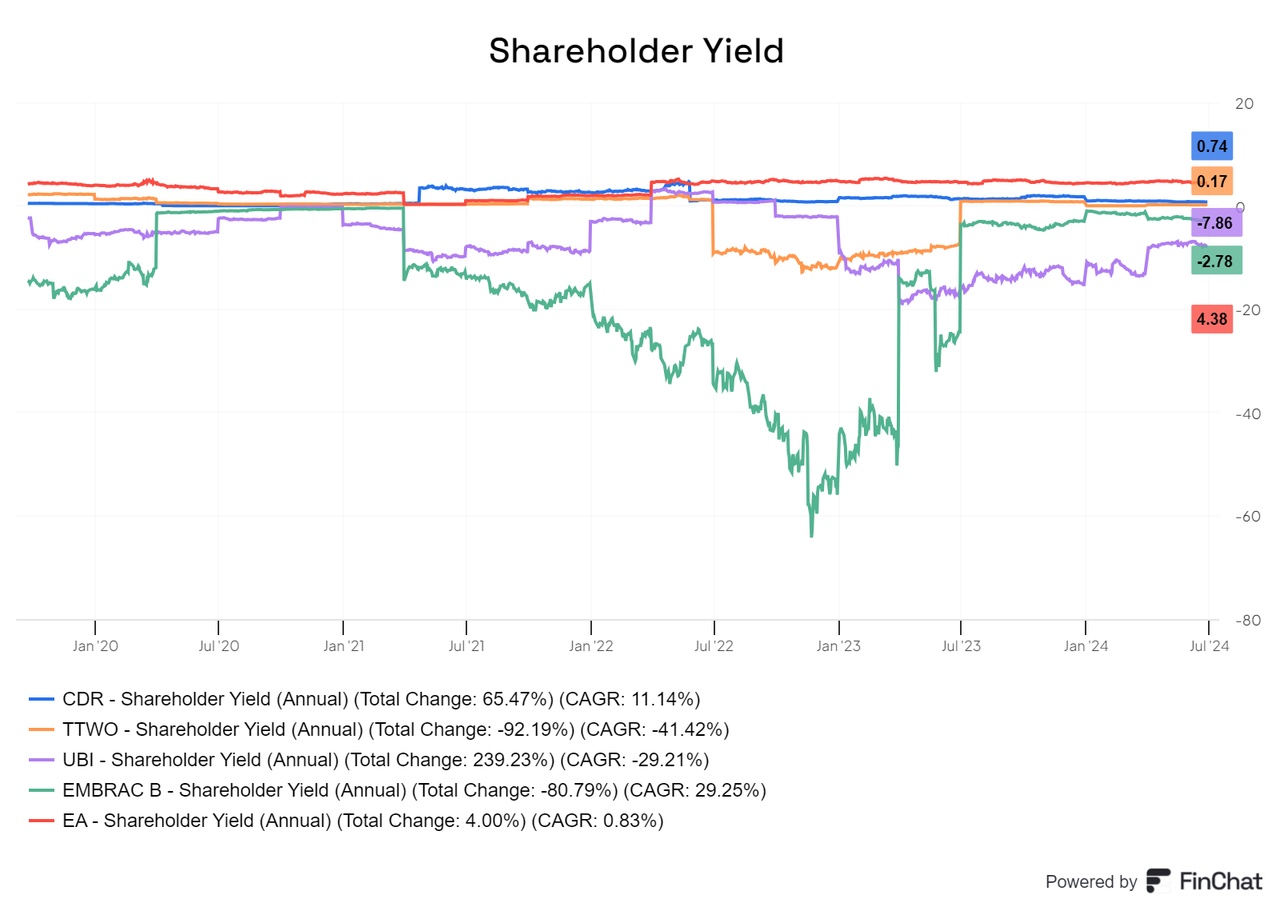

Taking the current market value into account, the P/E ratio in 2031 would be around 2 and the P/E ratio 7.2. As I said, this is a conservative calculation. If you compare these figures with $TTWO (-2,08%) or $UBI (-4,01%) companies with a similar income structure and size, this results in a massive undervaluation. A steady decline in sales is to be expected in 2024 and 2025. After that, however, a new era will begin for the company. The possibility that CD Projekt Red will present us with a large number of high-quality games until 2031 is not priced in. The opportunity exists for a sustained low entry level. I can also well imagine that the dividend will be increased again from 2026 as profits rise, as was the case in 2019 and 2020 before the Cyberpunk release.

Anyone who has actually read this far will receive a special piece of additional information that I believe is not yet taken into account in other analyses. CD Projekt RED has announced an AGM vote on an "incentive program" for staff and management.[11] A large part of the incentives consists of subscription rights for shares if a profit target of 2023-2026 is achieved. Accordingly, a profit of PLN 2,000 million must be made within these 4 years in order to trigger the option. This figure significantly exceeds previous analyst estimates.

I also took a look at the average player numbers for Cyberpunk and Witcher III and tried to correlate them with sales. The correlation is weak, but indicates that the sales of Cyberpunk as a Collector's Edition and the separate DLC for Q4 are underestimated. The figures will be published on 28.03.

→ Risk

The company has yet to prove that it can manage many game developments simultaneously. The current focus is clearly on Polaris I. Smaller projects are constantly being evaluated and the workforce adapted to their importance. The quarterly reports are recommended here, as they clearly show who is currently working on what. [12]

It will be a long time, at least 2 years, before a new game can be expected. Until then, the share price will probably react hypersensitively to any positive or negative news. I think a price rally will follow from the moment new information is released, such as a trailer. This was also the case in August 2018 after the trailer for Cyberpunk, which caused the share price to rise by 35% in just a few days. Until then, the chart will probably continue to move sideways. PLN 80, PLN 100 and PLN 120 initially appear to be strong barriers.

The lead quest designer of Witcher III has left CD Projekt and founded his own games company with other ex-employees. This is not unusual in the industry and also for CD Projekt. What is unusual is that CD Projekt RED often works together with these new companies. In this respect, these departures are probably open to interpretation.

There have also often been negative reports about crunch times, i.e. the time immediately before the release of a game, when it is de facto assumed that staff will work overtime. Unfortunately, this is not unusual for games companies. At least we keep hearing that CD Projekt RED stands out positively in this environment thanks to its typical accommodating approach (compensation programs, vacation compensation, etc.).

The analysts' estimates are negative. According to my research, there has been caution so far, as no concrete information on the new games is available.

My assumptions may be misguided. This is where I see the main risk. That's why I'm asking you. Which assumption do you disagree with? Have I overlooked something? What would you attach more importance to when analyzing the company?

Thank you very much for your time, I wish you successful investing!

Sources:

[1] https://explodingtopics.com/blog/number-of-gamers

[2] https://www.statista.com/outlook/dmo/digital-media/video-games/worldwide#revenue

[3] https://www.cdprojekt.com/en/capital-group/history/

[4] https://www.forbes.com/sites/paultassi/2023/05/30/the-witcher-3-has-become-the-9th-or-3rd-best-selling-game-in-history/

[5] https://www.statista.com/statistics/1305749/cyberpunk-2077-sales-worldwide/#:~:text=Cyberpunk%202077%20cumulative%20units%20sold%20worldwide%202023&text=It%20is%20estimated%20that%20the,most%20successful%20game%20launches%20ever.

[6] https://store.steampowered.com/app/1091500/Cyberpunk_2077/

[7] https://www.forbes.com/sites/paultassi/2024/01/05/cyberpunk-2077-phantom-liberty-reveals-big-sales-and-high-attach-rates/?sh=75c7f9512c67

[8] https://de.marketscreener.com/kurs/aktie/CD-PROJEKT-S-A-9933587/

[9] https://www.alphaspread.com/security/otc/otgly/solvency

[10] https://www.youtube.com/watch?v=kBnPNwv6C0E

[11] https://www.cdprojekt.com/en/wp-content/uploads-en/2024/01/egm-guide-february-2024.pdf S. 7

[12] https://www.cdprojekt.com/en/investors/