Genmab$GMAB (+0,79%) is perhaps one of the most exciting biotech bets I currently have in my portfolio. Take a look at the story and then do your own research.

Genmab is close to the so-called sweet spot to cleverly move up the pharma value chain - from licensor to producer.

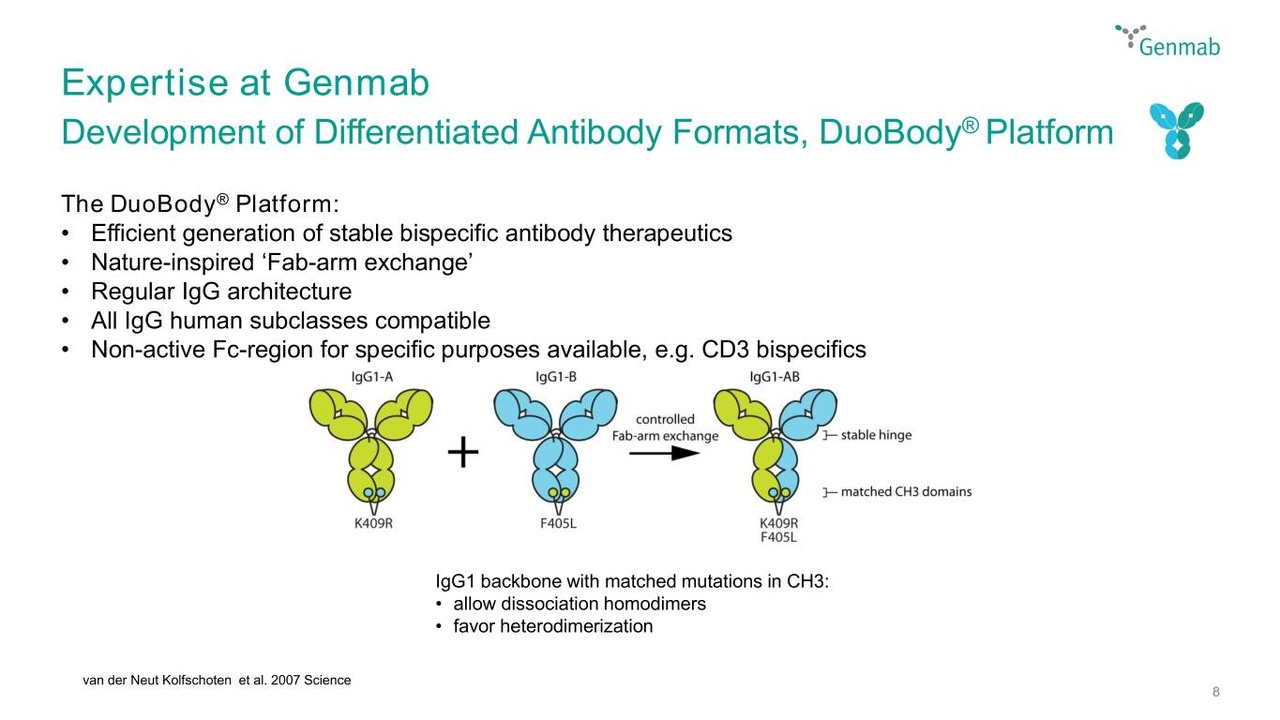

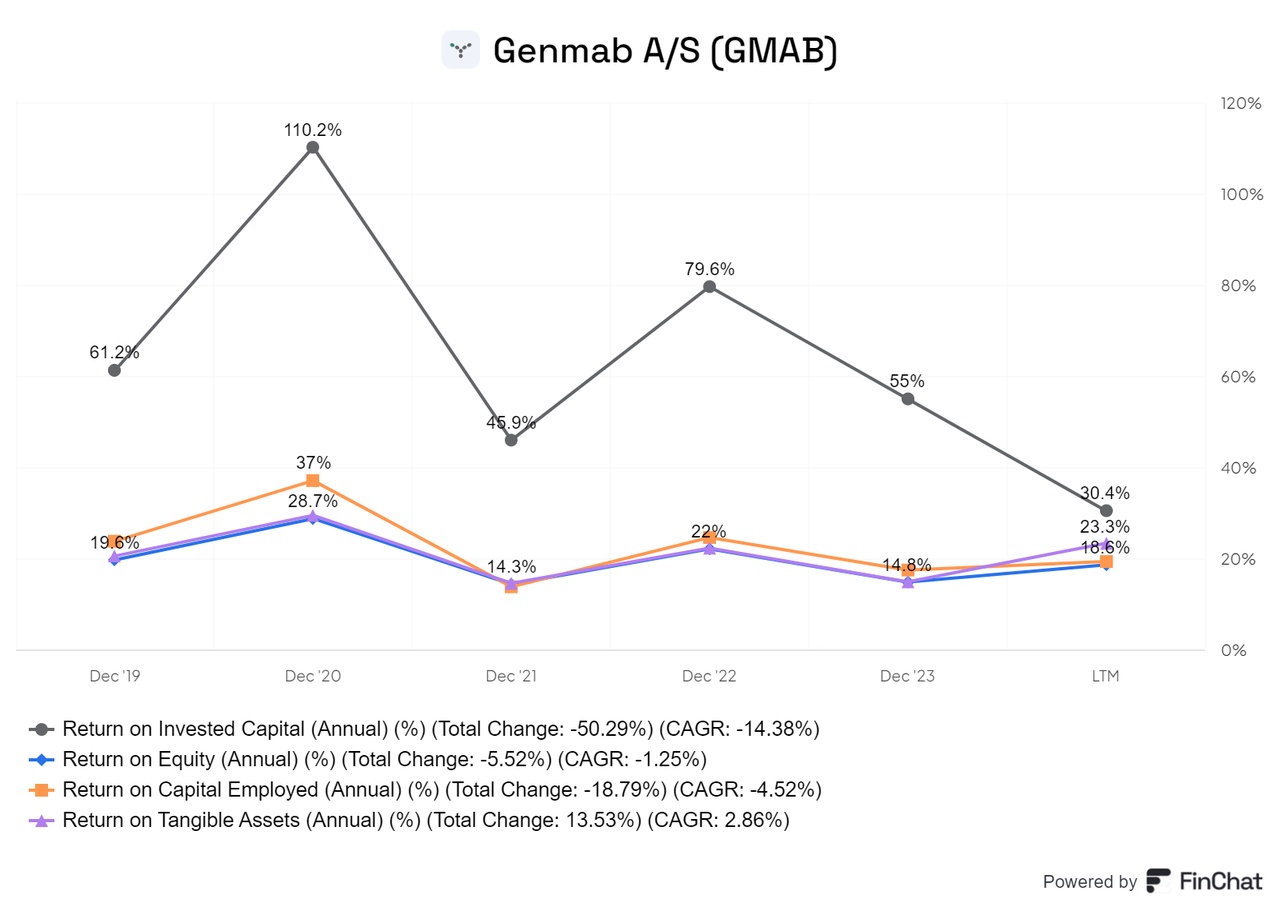

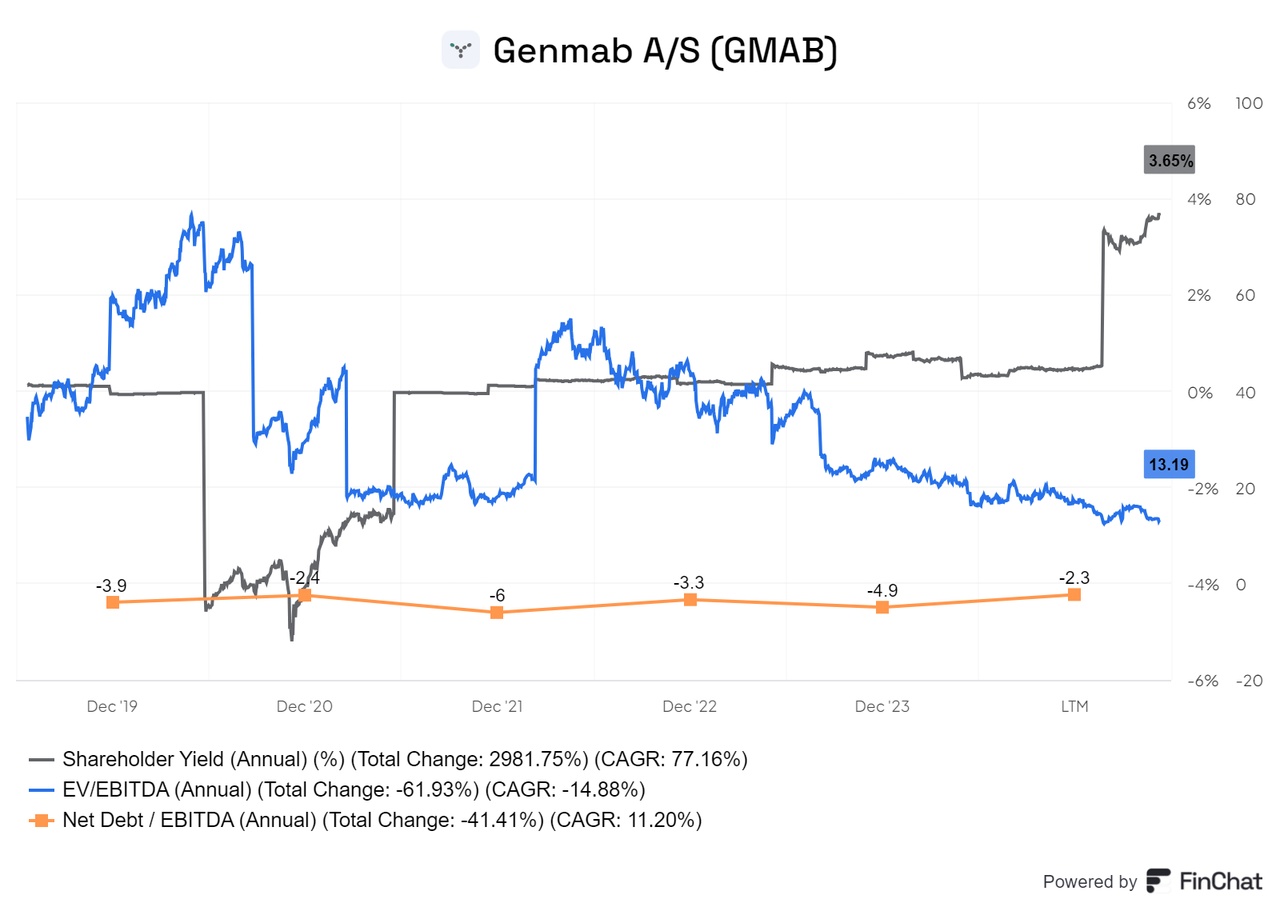

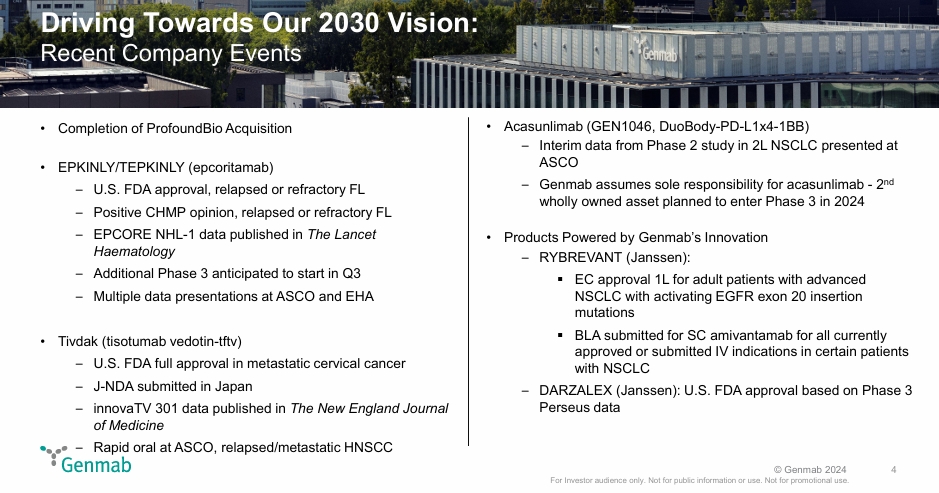

After the spin-off and the IPO, Genmab has earned an enormous amount of money in recent years through its antibody patents in cancer medicine. These patents (search for Genmab Duo-Body and Hexa-Body) are currently the so-called gold standard. Big pharma players such as AbbVie, Novartis and above all Johnson & Johnson (search for the blockbuster Darzalex) are diligently transferring billions in royalties. Genmab has thus developed into a cash monster. As the patents for the blockbusters such as Darzalex expire in 2030, the money will become a little less.

Genmab is currently taking the big step from licensor to producer of its own drugs. In other words, they are not just collecting royalties, but keeping the whole cake - of course, they then also have the entire risk of development and distribution in-house. Genmab is undergoing a crazy transformation through targeted M&A deals and the recruitment of absolute top managers.

The whole thing is not unexpected and has been planned in a very structured way. In the first transition, deals other than just license royalties have already been agreed - for example, a 50/50 arrangement was agreed with Abbvie. The foundations for the company's own sales structures have already been laid.

The USD 8 billion deal to purchase Merus in December 2025 is now likely to be the game changer. Together with the ProfoundBio acquisition (ADC technology), Genmab has made a clear statement. With Merus, they have not only acquired huge expertise in antibodies, but also the cancer drug petosemtamab (for head and neck tumors, already in phase 3!). This is exactly the piece of the puzzle that was missing.... A potential multi-billion dollar blockbuster, 100% owned by Genmab, which they will soon be unleashing on the world.

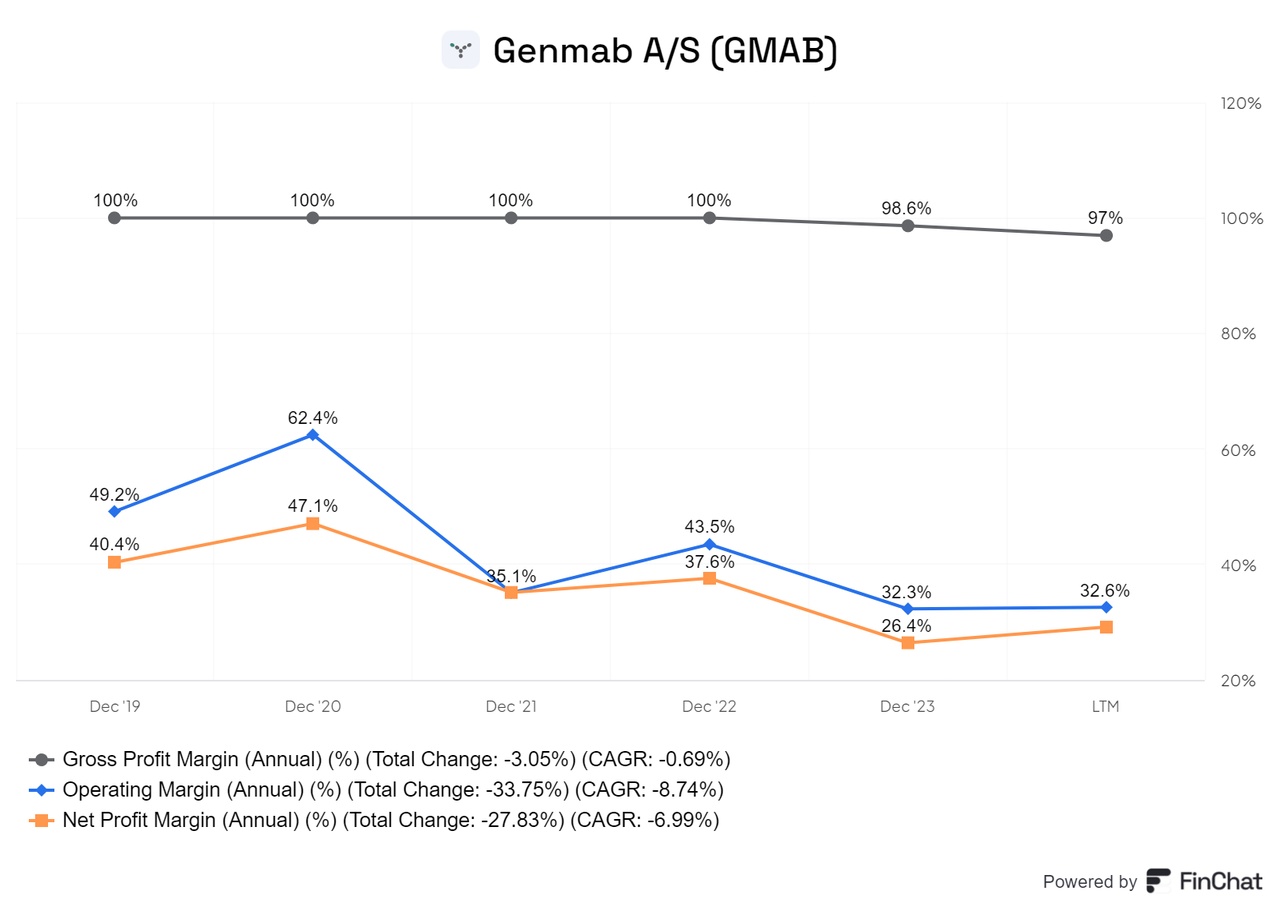

This transformation is not an easy road and costs tons of money. A global sales army is not being built up for nothing, and in a few years' time the patent cliff will be waiting at Darzalex. Until then, the new engine must be running. But if the management continues on this smart path and uses the billions from the past to make itself independent of Big Pharma, Genmab will catapult itself into a completely new league.

As I mentioned, I already have the share in my portfolio, but this year I will be making targeted additional purchases every quarter 🤑 🤞🏼

The homepage gives a good insight into the company:

https://www.genmab.com/antibody-science/antibody-technology-platforms

Article about the Merus acquisition :

https://www.financierworldwide.com/genmab-agrees-8bn-merus-deal