$RYA (+2,59 %)

$UNH (+0,38 %)

$GM (+0,23 %)

$RTX (-0,04 %)

$UPS (+0,1 %)

$UNP (+0,35 %)

$NOC (+1,14 %)

$BA (+0,37 %)

$MC (+1,03 %)

$TXN (-0,59 %)

$STX (-0,66 %)

$SSAB A (+0,6 %)

$ASML (+0,73 %)

$GEV (+0,89 %)

$SBUX (+0,57 %)

$T (+0,35 %)

$GD (+0,02 %)

$MSCI (+0,54 %)

$META (-0,48 %)

$NOW (+1,05 %)

$IBM (+0,51 %)

$LRCX (+1,04 %)

$TSLA (-0,11 %)

$MSFT (+0,28 %)

$000660

$005930

$SAP (-1,67 %)

$ABBN (+1,03 %)

$DBK (+0,73 %)

$ROG (+0,03 %)

$DOW (+0 %)

$NDAQ (+0,35 %)

$LMT (-0,2 %)

$CAT (-0,31 %)

$TMO (+0,26 %)

$HON (-0,82 %)

$MA (+0,02 %)

$BX (+1,04 %)

$WM (+0,2 %)

$WDC (+1,01 %)

$SNDK

$V (+0,16 %)

$AAPL (-0,07 %)

$SOFI (+1,85 %)

$CL (+0,19 %)

$AXP (+0,47 %)

$XOM (+1,34 %)

$CVX (+0,56 %)

Roche Holdings

Price

Debate sobre ROG

Puestos

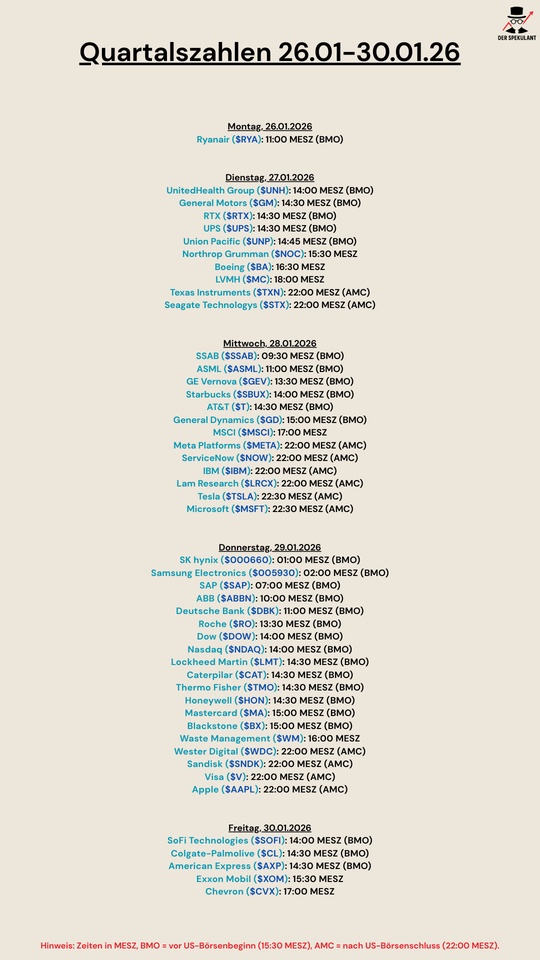

53Quartalszahlen 26.01-30.01.2026

Podcast episode 125 "Buy High. Sell Low." 20 European dividend stocks

Novo Nordisk 3.0% $NOVO B (-0,58 %) NVO

LVMH 2.0% $LVMH

Pernod Ricard 6.35% $RI (-0,32 %)

Imperial Brands 5.5% $IMB (-3,14 %)

BAT 6.2% $BATS (-0,7 %)

Sunrise Communications 8.00%

Nestle 4.05% $NESN (+0,57 %)

Roche 2.85% $ROG (+0,03 %)

Novartis 3.07% $NOVN (+0,79 %)

Shell 4.07% $SHEL (-0,14 %)

German Post 3.86% $DHL (-0,37 %)

Swisscom 3.75% $SCMN (-0,13 %)

German Telekom 3.52% $DTE (+2,25 %)

Strabag 2.72% $STR (+6,59 %)

Vonovia 4.82% $VNA (+1,52 %)

BASF 5.01% $BAS (+0,02 %)

Puma 2.8% $PUMA

Hannover Re 3.62% $HNR1 (-0,28 %)

Munich Re 3.8% $MUV2 (-0,09 %)

Allianz 4.00% $ALV (+1,05 %)

BP 5.76% $BP. (+1,6 %)

Spotify

https://open.spotify.com/episode/1zt05UZlehInr81iaZMdY5?si=e676f0a812014943

YouTube

Appple Podcast

Review of 2025 and outlook for 2026

Another strong year with a lot of profit. After a return of around 40% in 2024, I was able to achieve another strong return of 26% in 2025. I was able to realize a large part of the profit with my two Tenbagger shares $RGTI (+0,18 %) and $PLTR (-1,23 %) but the rest also performed quite well.

Due to the high gains in the two individual stocks, the weighting in my portfolio shifted massively and I took this as an opportunity to really tidy things up.

Portfolio realignment 2026

I would like to share the strategy I am pursuing with you. I have not yet reached the desired weighting, but I am slowly getting closer again.

The strategy is based on 3 different pillars and looks as follows:

CORE: ALL WORLD AND SWITZERLAND(40%)

The core consists of the broadly diversified world ETF $VWRL (+0,15 %) (approx. 30%) and with approx. 10% $CHSPI (+0,41 %) as an overweight of the home market

GROWTH AND QUALITY (35%)

The second part consists of some quality stocks with solid growth or dividends such as $SREN (-0,33 %)

$ROG (+0,03 %)

$BION (-1,2 %)

$MSFT (+0,28 %)

$SIE (-6,01 %) and the two trend tech ETFs $SMH (-0,26 %)

$XAIX (-0,22 %)

TENBAGGER SATS (20%)

Here I look for promising companies that have the potential to multiply and invest small amounts (currently max. CHF 1000). This is of course a high-risk investment, but I try to outperform with these stocks. By selling some of my tenbaggers, I was able to add new candidates to my portfolio.

These are all my potential price rockets:

$PLTR (-1,23 %) : my first Tenbagger. Here I have already realized around ten times my investment through partial sales. The rest will remain in the long term.

$RGTI (+0,18 %) : my second Tenbagger. I have realized approx. 8.5 times the stake through partial sales. The remainder is also left lying around.

$TER (-0,55 %) Chip testing, benefits massively from the AI chip boom.

$CELH Fitness energy drinks with strong growth and expansion into the mass market.

$CRSP (+0 %) Gene editing with huge health potential.

$MIPS (-4,57 %) : Safety systems for helmets. The technology is licensed to numerous helmet manufacturers in the sports and industrial sectors.

$RKLB (+1,32 %) : Rocket launches and satellites and established SpaceX chaser.

$JOBY Pioneer in urban mobility with air cabs and vertical take-offs.

$NU (+0,1 %) Digital neobank with enormous scaling potential in underserved markets such as Brazil, Mexico, etc.

$RBRK (+1,09 %) Cybersecurity

$IONQ (+1,74 %) Quantum computing. Highly speculative moonshot potential for computing power beyond classical computers.

I also hold approx. 5% in Bitcoin

Loss pots 🍯

I have a question for the community, maybe some of you here are a bit more familiar with a few tax issues that are bothering me.

I transferred my custody account from Onvistabank to ING in 2025. As there were sanctioned securities in my Onvistadepot, the custody account still exists and the 2025 loss pot was not transferred to ING. If I have now realized gains at ING in 2025, can I request a loss declaration from Onvista and claim this on my tax return for 2025?

On Thursday, I have withdrawn from the values $WCH (-0,75 %) and $AFX (-3,46 %) at a loss, these losses were also shown in the loss pot at ING. Now, on Friday, I sold my $ROG (+0,03 %) with profit on Friday, but I paid the full rate of capital gains tax on the profits and the loss pot remained unchanged.

Does anyone have any experience with this? In my opinion, this should be offset directly.

I know this is a very dry topic, but I would be grateful for any feedback 😁

Morningstar Best Stocks to own 2026

$ (+0,21 %)TYL (+0,21 %)

$GE (+0,19 %)

$GD (+0,02 %)

$CHRW (+0 %)

$ROL (+0,41 %)

$TW (+0,26 %)

$CSGP (+0,67 %)

$RKT (-0,47 %)

$CLX (+0 %)

$ROST (+0,24 %)

$FAST (+1,22 %)

$CSCO (+0,34 %)

$YUMC (-1,67 %)

$KOF (-0,26 %)

$ORLY (+0,22 %)

$KO (-0,44 %)

$RY (+0,11 %)

$MDLZ (+0,38 %)

$IMBBY (-2,64 %)

$A (-0,31 %)

$IDXX (+0,25 %)

$SONY (+0,26 %)

$MSCI (+0,54 %)

$SYY (+0,2 %)

$VLTO WI (+0,12 %)

$DPZ (+0,16 %)

$IDEX (+0,64 %)

$VRSN (+0,24 %)

$COST (+0,53 %)

$ITT (+0,59 %)

$SHW (+0,23 %)

$EPD

$SIE (-6,01 %)

$CP (-0,35 %)

$CTAS (+0,21 %)

$ROG (+0,03 %)

$BK (+0,25 %)

$CNR (-0,32 %)

$PM (-0,32 %)

$TSM (+1,46 %)

$ITW (+0,2 %)

$APD (+0,64 %)

$PG (+0,73 %)

$AAPL (-0,07 %)

$BAC (-0,75 %)

$CPB (+1,25 %)

$VRSK (+0,36 %)

$HSY (-0,13 %)

$GWRE (-0,09 %)

$HII (+0,26 %)

$GSK (+1,2 %)

$SBUX (+0,57 %)

$ALLE (-0,66 %)

$INTU (+0,54 %)

$MSI (+0,19 %)

$GWW (+0,26 %)

$UNP (+0,35 %)

$WCN (+0,13 %)

$WM (+0,2 %)

$NOC (+1,14 %)

$CAT (-0,31 %)

$PAYX (+0,19 %)

$ADP (+0,88 %)

$MCO (+1 %)

$SPGI (+1,36 %)

$NDSN (+0,18 %)

$WMT (+0,27 %)

$OTIS (-0,48 %)

$CL (+0,19 %)

Best Companies to Own: Methodology

The companies on this list are covered by Morningstar Research Services’ equity analysts and have shares available to US investors. This means that Morningstar equity analysts have calculated fair value estimates for the shares of the companies that trade on US exchanges. As a result, most of the companies on this list are based in the US.

Within that coverage list, the best companies meet the following criteria:

- Wide Economic Moat. The Morningstar Economic Moat Rating summarizes the length of a company’s competitive advantages. An economic moat is a structural feature allowing a firm to generate excess profits over a long period. If Morningstar Research Services believes that excess returns will persist for 20 years or more, that company earns a wide moat rating.

- Standard or Exemplary Capital Allocation.The stock’s Morningstar Capital Allocation Rating is an assessment of the quality of management’s capital allocation, with particular emphasis on the firm’s balance sheet, investments, and shareholder distributions. Capital allocation is judged from an equity shareholder’s perspective, considering companies’ investment strategy and valuation, balance-sheet management, and dividend and share buyback policies on a forward-looking basis. A company can receive an Exemplary, Standard, or Poor Capital Allocation Rating.

- Low or Medium Fair Value Uncertainty. The fair value Morningstar Uncertainty Ratingrepresents the predictability of a company’s future cash flows and, therefore, the level of certainty in the fair value estimate of that company. The Uncertainty Rating for a company can be Low, Medium, High, Very High, or Extreme. It captures a range of likely potential intrinsic values for a company based on the characteristics of the business underlying the stock, including such things as operating and financial leverage, sales sensitivity to the economy, product concentration, and other factors. The more predictable cash flows, the smaller the range of potential intrinsic values, the lower the uncertainty.

What Gives a Company an Economic Moat?

Companies with moats have one or more of the following characteristics:

- Network Effect. Lots of people are using the service, which then makes the service more valuable to the people who use it.

- Intangible Assets. Patents, brands, regulatory licenses, and other intangible assets can prevent competitors from duplicating a company’s products or allow the company to charge a significant price premium.

- Cost Advantage. Firms with a structural cost advantage can either undercut competitors on price while earning similar margins or charge market-level prices while earning relatively high margins.

- Switching Costs. When it would be too expensive or troublesome to stop using a company’s products, the company often has pricing power.

- Efficient Scale. When a niche market is effectively served by one or a small handful of companies, there is no room or incentive for potential competitors to enter the market.

To maintain analysts’ independence, Morningstar Research Services does not publicly rate its parent company Morningstar Inc. Therefore, Morningstar, Inc. is not on the list of the best companies available to US investors.

https://www.morningstar.com/stocks/best-companies-own-2026-edition

Roche continues strong sales growth momentum of 7% (CER) in the first nine months of 2025; full-year earnings outlook raised

- Group sales grew by 7% at constant exchange rates (CER; 2% in CHF) in the first nine months, driven by high demand for our innovative medicines and diagnostics.

- Pharmaceuticals Division sales rose by 9% (4% in CHF) due to continued high growth in sales of medicines for the treatment of severe diseases; Phesgo (breast cancer), Xolair (food allergies), Hemlibra (haemophilia A), Vabysmo (serious eye diseases) and Ocrevus (multiple sclerosis) were the top growth drivers.

- Diagnostics Division sales increased by 1% (-4% in CHF) as demand for pathology solutions and molecular diagnostics more than offset the impact of healthcare pricing reforms in China.

Outlook for 2025 earnings raised

Roche $ROG (+0,03 %) expects an increase in Group sales in the mid single digit range (CER). Core earnings per share are targeted to develop in the high single to low double digit range (CER). Roche expects to further increase its dividend in Swiss francs.

https://www.roche.com/investors/updates/inv-update-2025-10-23

CHMP recommends EU approval of Roche’s Lunsumio for people with relapsed or refractory follicular lymphoma

CHMP recommends EU approval of Roche’s subcutaneous formulation of Lunsumio for people with relapsed or refractory follicular lymphoma

Lunsumio provides high and long-lasting response rates, with approximately two-thirds of patients with a complete response in remission after four years1- Subcutaneous Lunsumio has potential to substantially reduce treatment administration time with an approximately one minute injection, compared with 2-4 hours IV infusion

- If approved, Lunsumio would be the first treatment available for people with follicular lymphoma after two or more lines of systemic therapy, which is both fixed-duration and subcutaneously administered

Goodbye SMH - Portfolio update with +58% TTWROR

Today I said goodbye to $SMH (-0,26 %) today. Despite the volatility, the entry in April was worthwhile and brought a nice profit of +40%, and that with an ETF! It wasn't a long-time play anyway, as it was a sector ETF.

Part of it went into the $QDEV (+0,11 %) together with my DCA, and later I will also get $TDIV (+0,05 %) get another share.

This means that companies such as $AMD (-0,01 %) , $MU (-0,96 %) , $INTC (-1,01 %) and others are completely out of my portfolio, 0% exposure.

My US share is now <60% and tech at 38%. The top 10 stocks make up less than 30% of the total weighting. This makes me almost as unconcentrated as the $IWDA (+0,23 %) and better diversified than the $CSPX (+0,32 %) .

New portfolio key figures:

P/E 30.0 (<30) 🟡

Forward P/E 21.6 (<25) 🟢

P/Β 13.0 (<5) 🔴

D/E 0.8 (<2) 🟢

EV/FCF 28 (<25) 🟡

ROE (5-Jahres-Durchschnitt) 50% (>15%) 🟢

EPS growth for the next 5 years 23% (>7%) 🟢

Sales growth (5-year average) 15% (>5%) 🟢

With this high ROE, I am also ok with a high P/E.

Top 10 positions now:

Alphabet $GOOG (-0,16 %)

NVIDIA $NVDA (+0,32 %)

Broadcom $AVGO (+0,17 %)

Microsoft $MSFT (+0,28 %)

Meta $META (-0,48 %)

Apple $AAPL (-0,07 %)

Roche $ROG (+0,03 %)

Taiwan Semiconductor $TSM (+1,46 %)

Mastercard $MA (+0,02 %)

Visa $V (+0,16 %)

Can you also write other key figures, such as the average correlation of the shares?

Roche’s Board of Directors proposes exchange of Genussscheine for participation certificates

Roche’s Board of Directors proposes exchange of Genussscheine for participation certificates (Partizipationsscheine)

Participation certificates (Partizipationsscheine) with a nominal value of CHF 0.001 each will replace the non-voting equity securities (Genussscheine).- Reduction of the nominal value of the bearer shares (Inhaberaktien) from CHF 1 to CHF 0.001 in line with the nominal value of the new participation certificates.

- Participation certificates are economically equivalent to Genussscheine and will be listed on the SIX Swiss Exchange.

- Discontinuation of printed dividend vouchers and a further transition to intermediated securities, in line with efficient and modern market practices.

- The exchange of Genussscheine for participation certificates and the reduction as well as the repayment of the nominal value of the bearer shares will be submitted to the shareholders for approval at the 2026 Annual General Meeting

Valores en tendencia

Principales creadores de la semana