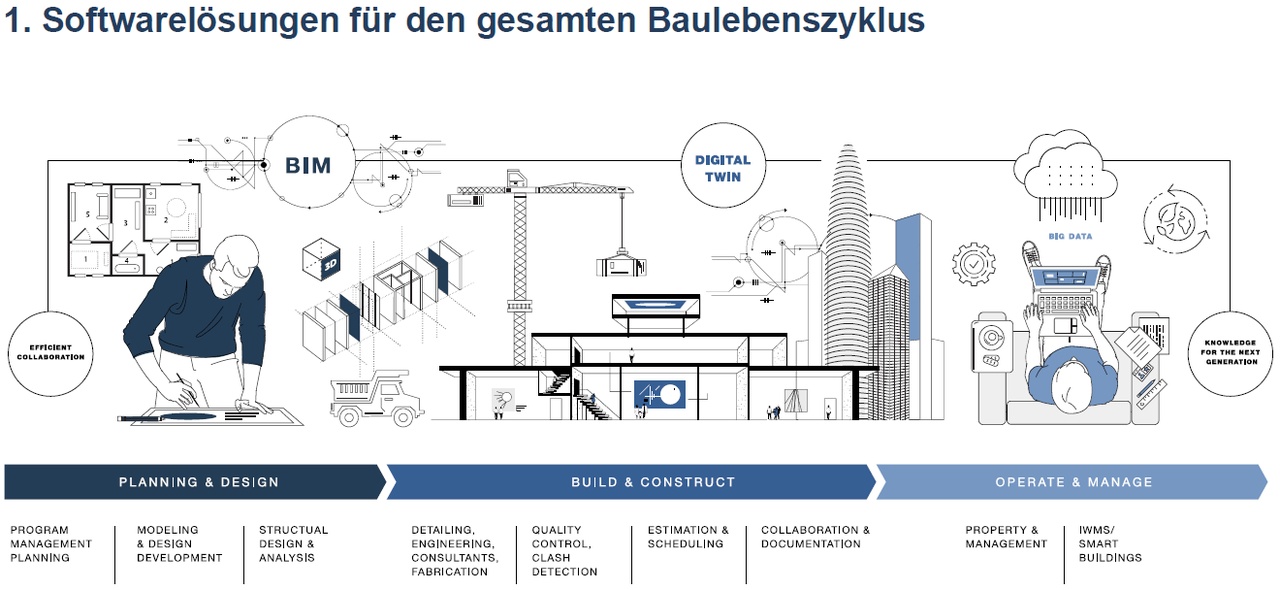

The construction industry is a fascinating area for us investors. It is one of the least digitized sectors in the world. This is precisely where Nemetschek $NEM (-2,58 %) comes in. As a private investor, I look for companies that solve a real problem and become almost indispensable in the process. Nemetschek is one such candidate: their software covers the entire life cycle of a building - from the initial design to demolition.

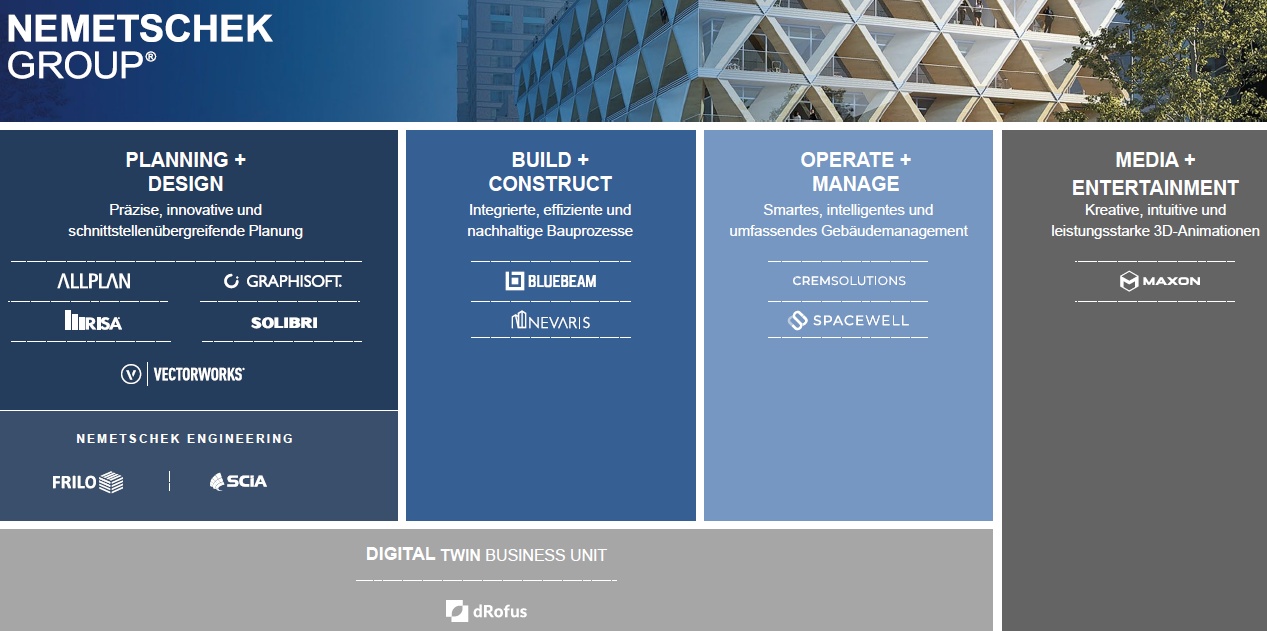

What sets Nemetschek apart from many of its US competitors is its holding structure. Instead of squeezing everything into a single software package, they allow their brands such as Graphisoft, Allplan and Bluebeam to operate as independent companies.

At the heart of this is the Design segment, which contributed an impressive 46% of total sales in 2025. Here, architects use tools such as Archicad for building information modeling (BIM) to plan buildings digitally in advance.

In the Build segment, things get practical. This involves the digitalization of the construction site itself. With the massive takeover of GoCanvas in 2024, Nemetschek has ignited a turbo here to close the gap between the planners in the office and the craftsmen on site.

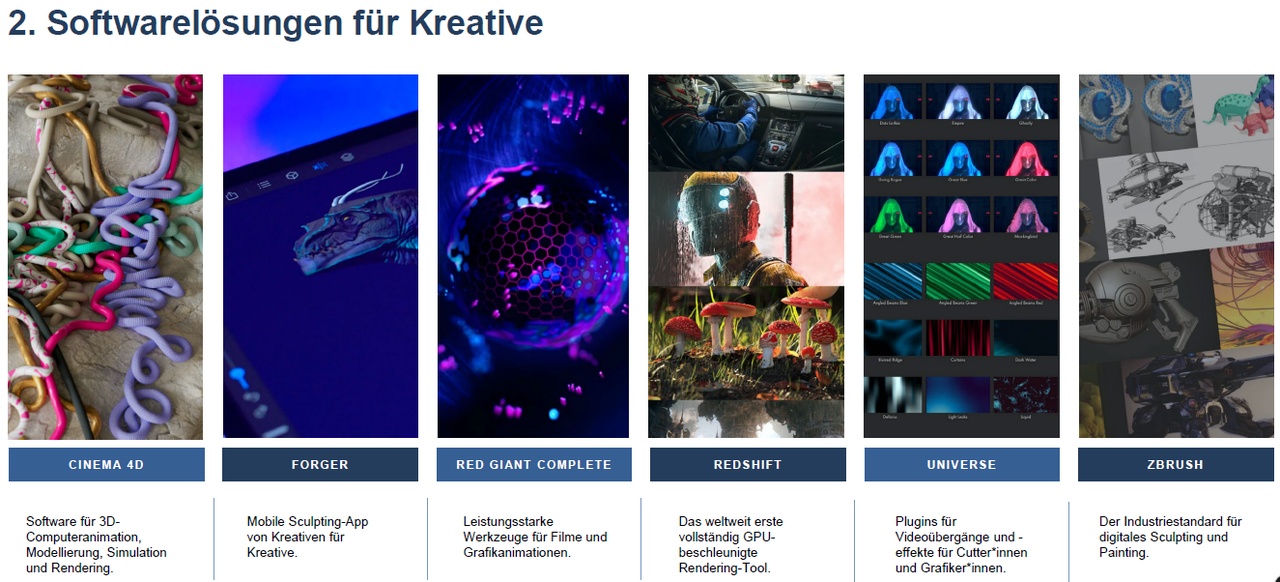

Added to this are the Manage segment, which deals with the efficient operation of buildings, and Media, in which the Maxon brand creates photorealistic visualizations with Cinema 4D. This diversity makes the model very resilient in my eyes.

But who is in charge?

There is a clear vision and a strong family behind the company. Control is firmly in the hands of the founding family.

Professor Georg Nemetschek holds around 38.9% through his foundations, the Nemetschek Foundation a further 4%, his sons 5.4% and he himself directly holds 2.7%. This means that over 50% of the shares are in firm hands, while the free float is 49%. This is a double-edged sword for us shareholders. It offers enormous stability for long-term decisions, but limits the influence of external investors.

Yves Padrines, who recently extended his contract until the end of 2028, is in charge of the operating business as CEO. He has massively trimmed the Group towards the subscription model (SaaS). He is supported by CFO Louise Öfverström and newcomer Usman Shuja, who heads the important Build division as CDO. I see the fact that the contracts of the core team have been extended on a long-term basis as a very positive signal for continuity.

Why Nemetschek is so hard to beat!

Why don't customers simply switch to Autodesk or Bentley? Because the switching costs are extremely high. If an architecture firm has set up all its processes on Archicad or Vectorworks, switching costs not only software licenses, but months of retraining and loss of productivity. This is a "sticky" business, which is reflected in extremely high customer loyalty.

Another ace up our sleeve is the "OPEN BIM" strategy. While others try to lock customers into their closed system, Nemetschek relies on open standards #ai. This makes them a favorite in large, complex projects where different companies with different software need to work together.

The bare figures

In financial terms, Nemetschek reached a real milestone in 2025: the revenue mark of one billion euros was broken for the first time. Specifically, revenue rose to EUR 1,191.2 million, which corresponds to a currency-adjusted increase of a whopping 22.6% compared to the previous year's EUR 995.6 million.

What is particularly impressive for me as an investor is that the proportion of recurring sales is 92%. This is almost like an insurance policy for future income. Despite the high investments and the acquisition of GoCanvas, the EBITDA margin is a strong 31.2%. So Nemetschek is managing to grow profitably while completely converting their business model to subscriptions.

Where are the dangers?

No analysis without warnings. Firstly, the valuation. Nemetschek is almost always expensive. A P/E ratio of 40 to 50 is an announcement. Nothing can go wrong operationally, otherwise the share price will quickly plummet, as we saw at the beginning of 2026 when it temporarily fell below €73.

Secondly: the US competition. Autodesk is a giant with much deeper pockets. Thirdly, the M&A risk. Nemetschek is growing strongly through acquisitions. If they make a mistake with a billion-euro takeover like GoCanvas or if the integration doesn't work out, it could wreak havoc on margins.

My verdict

If you have a time horizon of 5 to 10 years: Yes. The company is not a "gamble", but a quality stock. Experts expect that net profit could more than triple to over 11 billion euros by 2032.

If profits triple, the share definitely has the potential to multiply, even if the valuation (the P/E ratio) should fall somewhat. Personally, I see Nemetschek as one of the strongest tech stocks in Europe. In my view, the recent price setback at the beginning of 2026 was more a correction of the overvaluation than a problem with the business model. If you can pick up the share at prices of around €70 to €80, you are buying into a highly profitable company with a deep moat. It is a marathon investment in the digitalization of the world we live in.

Edit: for those who want to read more https://blog.aktien.guide/nemetschek-aktienanalyse