Investment philosophy, "diversification" and dividends

Hi all, as this is my first slightly larger post I would generally appreciate some constructive feedback.

First something About Me

I'll be 22 in a month and I've been active in the stock market for about 2 years now. After a lot of back and forth, I can almost say that I have tried every strategy - but I never really felt comfortable. One learns from mistakes, and I have made many of them.

But what I have also done is to spend countless hours, days and weeks with books, videos, shareholder letters and internet research. I was particularly fascinated by the investment approaches of Terry Smith and the way of Joseph Carlson on Youtube.

My goal quickly became clear, I don't want to have thousands of companies in my portfolio that I don't know, understand or fully support. So an ETF focus was off the table.

Thereupon I built my own investment philosophy, which I would like to present to you in the following.

If you want to know more about me and my goals, there might be another article with a portfolio presentation soon :-)

First I would like to explain to you why I do not believe in diversification hold:

A quote from Warren Buffet is well known: "Diversification is protection against ignorance. It makes little sense if you know what you are doing."

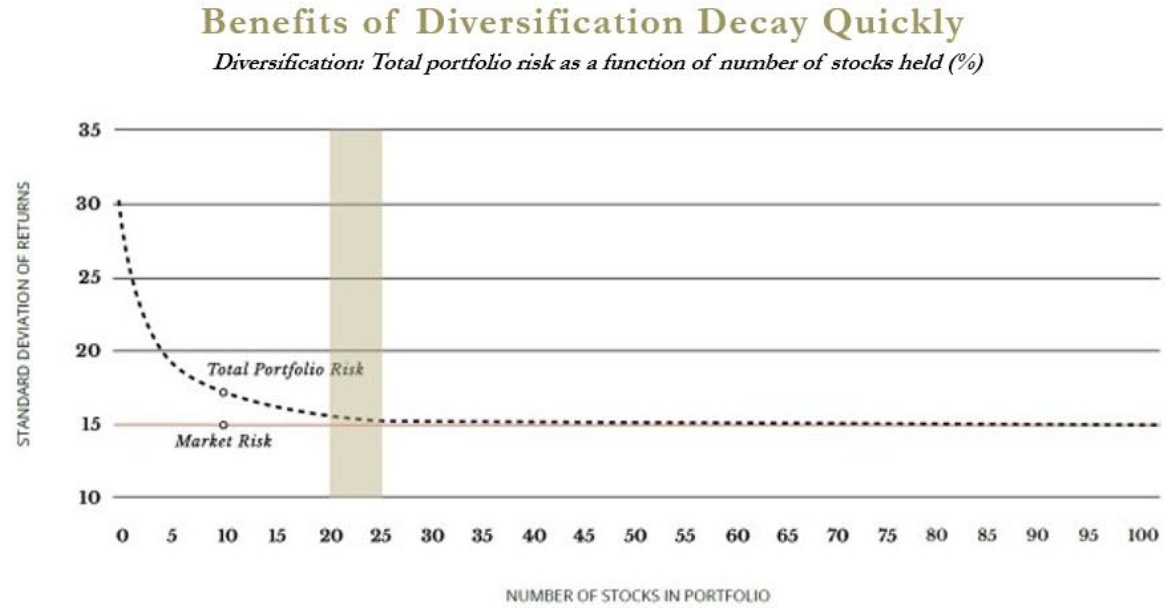

However, a quote from one of the world's best investors alone is unlikely to convince everyone. Studies also support Buffet's view. The advantages of diversification decrease very fast and the gap between market risk and total portfolio becomes minimal from a portfolio size of 20-25 companies - 25 companies give you all the advantages of diversification, more positions only worsen your performance and overview. (Figure 1)

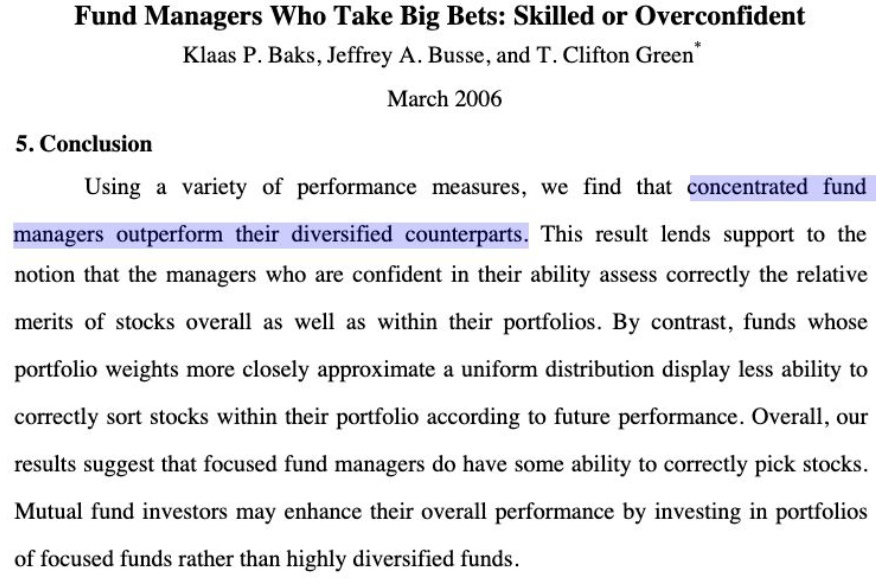

Because concentration delivers better performance. Fund managers who concentrate their knowledge in a few companies deliver better results than more diversified managers. (Figure 2)

Investment philosophy

I want to outperform the market, so I look for the best companies. What makes good companies?

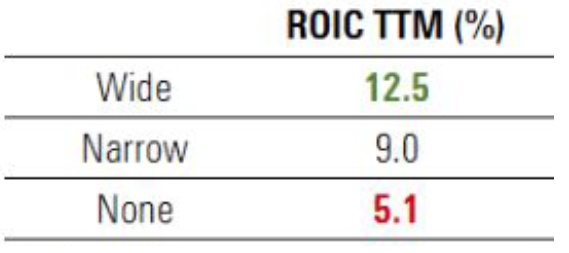

Companies with competitive advantages (moats) outperform the market (Figure 3), and they do so because they have high returns on capital. My first metric for evaluating quality of a company and with a high value in my company analysis is ROIC (Return on Capital Invested). I look for companies with at least 10% ROIC. (Figure 4) Furthermore I want high ROCE (Return on capital employed) and high ROA (Return on Assets) figures.

This directly eliminates some companies and also whole sectors, namely exactly those in which it is not worth to invest anyway. Why is this so?

There are sectors that historically outperform the market (Software, Consumer, Healthcare) - on which my focus is -, and sectors that consistently underperform and are not considered in my investment approach (Banking, Energy, Insurance, Mining, Utilities, Airlines) - just compare the sectors with the main index ;-)

Consumer goods, healthcare and software companies perform better because they generate sustained profits, so they remain profitable even during economic downturns. This allows for consistently high returns on capital.

Next, a look at the margin here I would like to see high Gross Margins >60%, which are also a good indicator of a competitive advantage, and a high Profit Margin, which is an indicator of the efficiency of a company's value creation. However, the most important margin for assessing profitability is the FCF margin.

A company's focus should be maximally on Free Cash Flow, we should invest in companies that are as profitable as possible. In the long run, the share price follows the Fcf/Share.

Beyond that I don't want any debt, any company with Debt/EBITDA > 3 flies right out, preferably anything less than 2.

In terms of growth, I look for stable and good EPS and revenue growth, but FCF growth has the highest priority.

The higher the better, the more important the key performance indicators are.

My minimum benchmarks for the most important metrics:

- ROIC > 15%, ROCE > 15-0%

- Gross Margin > 60%

- Profit Margin > 20%

- FCF Margin > 20%

- Debt / EBITDA < 3, preferably < 1

- FCF 5Y CAGR > 10-15%

(Not all of my companies always meet every metric, but I have built my own score where a minimum score must be met and by score I set the "Conviction" to a company).

Buy & Hold and long-term investing outperforms

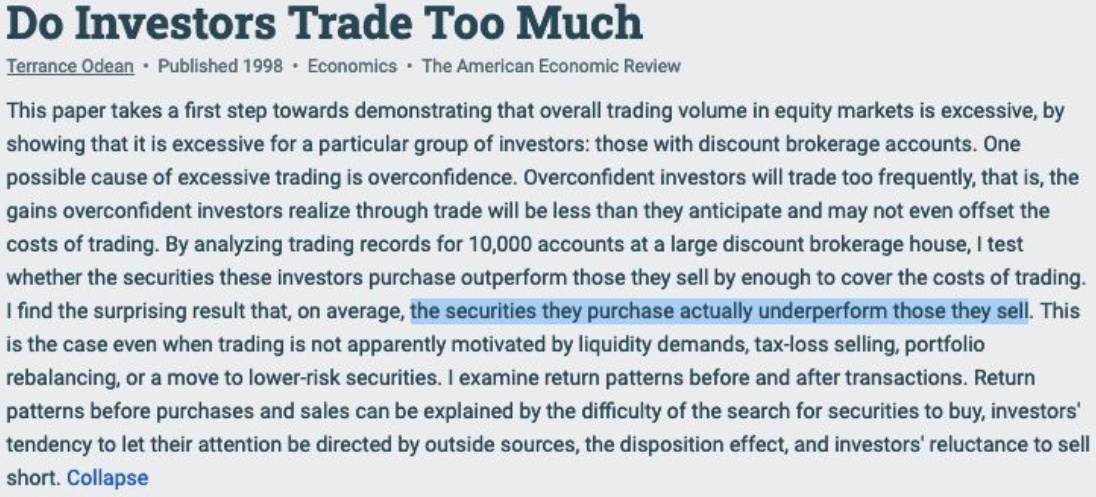

As long as a company continues to reinvest its capital at high returns there is no reason to sell. (Figure 5)

What about dividends?

Some of my companies pay a dividend, others don't - I don't put much emphasis on dividends, and will definitely not put bad companies in my portfolio just to get a payout in a given month ;) Dividends should be minimized if capital can be reinvested at high rates of return. At my young age and with a long term investment horizon the focus should be on yield, in old age I will also shift to dividends ;)

The most important thing to conclude: Invest in profitable companies that you UNDERSTAND

A few final tips:

- Don't chase trends, they fade away

- Do not be blinded by dividends

- Don't care about macroeconomics, invest in companies - not cycles

- Market timing is impossible

- Look for established companies, not one-hit wonders

- BUY GOOD COMPANIES - DON'T OVERPAY - DO NOTHING (Terry Smith)

My current investable universe:

$ADBE (-0,71 %)

$NVO (-0,56 %)

$CUV (-1,87 %)

$CDNS (-0,89 %)

$ASML (-1,13 %)

$VRTX (-0,01 %)

$V (-0,69 %)

$MA (-1,1 %)

$MSFT (-0,8 %)

$QLYS (-1,21 %)

$MKTX (-1,02 %)

$KLAC (-1,44 %)

$GOOGL (-0,81 %)

$REG1V (-0,59 %)

$TNE (-5,08 %)

$ENX (-0,55 %)

$EW (-0,9 %)

$VRSN (-0,51 %)

$FICO (-0,89 %)

$FTNT (-1,21 %)

$NEM (-0,37 %)

$MONC (+0,05 %)

$CSU (+0,91 %)

$6861 (+0,57 %)

$ENGH (-0,94 %)

$MC (-0,82 %)

$AAPL (-1,02 %)

$6857 (-2,24 %)

$7741 (-0,12 %)

$PAYX (-0,59 %)

$MTD (-0,88 %)

$TXN (-0,99 %)

$OR (-0,93 %)

$ZTS (-0,69 %) (Companies I watch, in my portfolio I have only 8 of them).

That's it from me for now. Please leave me some feedback and share the post if you like it :-)

What would you like to hear from me next? More about free cash flow? Portfolio presentation? Company presentation? My slightly different valuation approach, far away from P/E?

Some of the illustrations are from a slightly smaller fund ("Long Equity Investing" on Twitter - can only recommend you) or from Terry Smith's Shareholder Letter.

No investment advice