$UCG (-1,78 %)

$MNDY (-2,57 %)

$KER (+2,46 %)

$BARC (-2,14 %)

$OSCR (-0,87 %)

$CVS (-0,04 %)

$SPOT (-1,19 %)

$DDOG (+0,85 %)

$BP. (+1,93 %)

$SPGI (-0,14 %)

$HAS (-0,99 %)

$KO (+0,29 %)

$JMIA (-3,28 %)

$MAR (-1,03 %)

$RACE (-0,38 %)

$UPST (-3,67 %)

$NET (-3,22 %)

$LYFT (-1,26 %)

$981

$NCH2 (+0,28 %)

$DSY (+0,49 %)

$1SXP (-0,2 %)

$HEIA (+0,6 %)

$ENR (+0,76 %)

$DOU (+1,03 %)

$OTLY (-3,45 %)

$TMUS (-0,09 %)

$SHOP (-2,72 %)

$KHC (-0,17 %)

$FSLY (-3,6 %)

$HUBS (-0,14 %)

$CSCO (-0,63 %)

$APP (-2,88 %)

$SIE (-1,06 %)

$RMS (-0,8 %)

$BATS (-1,23 %)

$MBG (-0,8 %)

$TKA (-0,07 %)

$VBK (+1,65 %)

$DB1 (+2,68 %)

$NBIS (-3,75 %)

$ALB (-0,65 %)

$BIRK (-1,84 %)

$ADYEN (+0,08 %)

$ANET (-1,89 %)

$PINS (-2,31 %)

$AMAT (-2,06 %)

$ABNB (-1 %)

$TWLO (-0,74 %)

$RIVN (-1,51 %)

$COIN (-2,85 %)

$TOM (+1,65 %)

$OR (-0,67 %)

$MRNA (-0,36 %)

$CCO (-1,47 %)

$DKNG (-0,62 %)

L'Oreal

Price

Debate sobre OR

Puestos

48Quarterly figures 09.02-13.02.26

Presentation

Hello everyone

I thought it was time for an introduction to me and my current portfolio.

Briefly about me, I'm Chris, 27 years old, work in IT and moved to Switzerland a good 7 months ago. I'm definitely very happy with my decision, even though it wasn't easy.

Apart from that, I love good food and am absolutely fascinated by cars and motor racing. I'm neglecting traveling a bit at the moment, but I also really enjoy it.

My dad laid the foundation stone of my depot when I was born. I saw it for the first time after my 18th birthday and was pretty excited. Unfortunately, I wasn't excited enough to continue with it. I then became more interested at the end of 2024, beginning of 2025 and so it was that I made my first transaction in April and $NVDA (-1,91 %) bought shares.

My approach is to build a highly focused portfolio of high-quality individual stocks. Around 10% of my portfolio is currently in $BTC (-2,39 %) , $ETH (-3,98 %) & $Sol are currently invested.

There are basically two reasons why I decided against a core-satellite structure.

A fee of CHF 50 + stamp duty has to be paid for each transaction and therefore a savings plan does not make sense in my opinion. My basic idea was to save in 3 different ETFs each month.

Furthermore, I find $BRK.B (-0,15 %) as a core position more attractive than an ETF, as they benefit from their capital strength especially in times of crisis and can make strategic acquisitions.

My next sales are as follows:

- Sale $BV0Z6G (+0,04 %)

25% partial sale of my $SHEL (+1,63 %) position

Once the sales are completed, my cash position will be around 20%. I currently have the following shares on my list that are eligible for purchase:

$RKLB (-0,43 %) I actually wanted to buy this stock in December, but couldn't because it is not traded at my bank.

It is quite possible that the portfolio performance is not quite right because I have linked the positions manually, as getquin does not offer a link to my bank.

Thanks also to those who post so many interesting articles on strategies and reviews of stocks here, such as @Tenbagger2024, @Multibagger, @Epi, @BamBamInvest & many many others! Thank you, thank you, thank you!

To anticipate the obvious question of why I don't transfer my custody account to another provider due to high fees and limited share availability:

- I work for a bank and therefore have compliance regulations that restrict me somewhat in that regard.

Please let me know what you think of my custody account. 😃

Have a nice Sunday evening!

Best regards

Chris

Is the former Nestlé division a pearl? 🫧

Nestlé sold Galderma in 2019 for around CHF 10 billion to a consortium of investors (including EQT, ADIA).

At the IPO in 2024, Galderma was valued at valued at CHF 14.5 billion

Hello my dears, Galderma has been on my watch for a few days now. $GALD (-0,56 %) has been on my watch. When I wanted to take a look at the presentation for you today. I realized how much fantasy and excitement there is in the share. And shortly afterwards, while researching, I discovered that Loreal has also recognized this potential. $OR (-0,67 %) has also recognized this potential.

And that the share would become an interesting takeover candidate.

But even without this takeover fantasy, I think Galderma is an exciting growth stock.

Ladies and gentlemen, what is your opinion here?

All

and

@Multibagger

@Dividendenopi

@All-in-or-nothing

@TradingHase

@Klein-Anleger

@Hobby-Investor

My dears,

before there is now a shitstorm now. With comments like "What are we supposed to do with a report from 2024? ".

I have added the report again because it describes the fresh IPO and the potential of the share quite well.

I hope you are gracious with me 🙈.

@Iwamoto Unfortunately, this has made it a little longer and different from my usual ideas.

Galderma receives approval for Nemluvio in Canada

Galderma has now also received approval for its promising drug Nemluvio (nemolizumab) in Canada.

12.01.2026 14:39

The dermatology company announced on Monday that the product can now be used to treat patients suffering from atopic dermatitis or prurigo nodularis.

Atopic dermatitis is a synonym for neurodermatitis - a disease in which the skin flakes and itches severely. Prurigo nodularis, on the other hand, is a rare skin disease with itchy skin nodules that usually occur on the limbs.

The product was approved in the EU for this indication almost a year ago.

(AWP)

L'Oréal raises fresh capital for Galderma

from Redaktion LZ

Thursday, January 08, 2026

L'Oréal is once again tapping the capital market and placing another billion-euro bond. The Group intends to use the money to increase its stake in the pharmaceutical company Galderma.

Galderma worth buying despite high valuation

Good momentum, potential price drivers and takeover fantasies with downside protection allow FuW to overlook the high valuation of the dermatology specialist.

Published: 09.01.2026, 12:36

In a nutshell:

- Galderma shares have gained over 60% in 2025, making them one of the top performers.

- FuW now rates them a "buy" despite the high valuation premium.

- Good momentum, potential price drivers and takeover fantasies allow for further price gains.

Since the IPO in March 2024, Galderma shares have almost only known one direction: upwards. They were also among the high-flyers on the Swiss stock exchange last year with a price increase of over 60%. Only Trump's tariff threats caused a temporary setback in the spring.

In March 2025, after a good run, FuW rated Galderma as a "hold" due to its impressive valuation - in retrospect, this was too cautious a decision.

Everything is running like clockwork

The market launch of the drug Nemluvio, which is used to treat the skin diseases atopic dermatitis and prurigo nodularis, is going better than expected, prompting analysts to raise their estimates for the drug's peak sales. In addition, Galderma consistently exceeded expectations last year and raised its full-year guidance in July and October.

Looking ahead to the annual report, which the company will publish on March 5, no overly negative surprises are to be expected. For 2025, it is forecasting sales growth of 17 to 17.7% and a core EBITDA margin of 23.1 to 23.3% at constant currencies.

The analysts at Jefferies expect sales and margins to reach the upper end of the target range. JPMorgan is also expecting figures in line with expectations for the fourth quarter, but points out that the outlook for the current year is likely to be conservative.

Industry-leading growth is likely to continue in the medium term. Analysts expect average annual sales growth of over 15% from 2024 to 2029. Profits are likely to increase disproportionately. The fundamental drivers for Galderma's business remain intact: the ageing population, increasing prosperity and the universal desire for beauty and a youthful appearance.

FuW changes its recommendation to "Buy"

The only flaw remains the high valuation. Based on the forward price/earnings ratio, the shares are trading at a valuation premium of over 80% compared to peer companies, according to Bloomberg. "The shares already anticipate a lot of upside," says Christoph Wirtz, buy-side analyst at Bank Rothschild & Co Wealth Management.

The average price target of the analysts listed on Bloomberg is close to the current price at CHF 170. However, a look back shows that the price targets have been raised continuously - by an average of CHF 54 since the end of July alone. It is quite possible that the estimates will rise further, especially if Nemluvio exceeds expectations.

Some analysts do not yet see the end of the line. UBS, Jefferies and JPMorgan, for example, have a target price of CHF 190, which implies an upside potential of around 16%.

Possible price drivers in sight

"The shares are currently trading mainly on the prospects of Nemluvio," says Wirtz. According to his calculations, the drug will contribute around half of profits in future.

"If Nemluvio becomes bigger than currently assumed, this would have a significant impact on Galderma's valuation," says Wirtz. While the company's aesthetics and skincare business is easy for investors to predict, the commercial success of Nemluvio is difficult to assess.

According to a UBS report, the consensus estimate for Nemluvio's peak sales is currently $3 billion to $4 billion. Galderma has not yet revised its original forecast of more than $2 billion.

The company is developing the drug for further applications. Phase II results for chronic itching of unknown cause should be available at the end of the year. Jefferies expects this indication to generate peak sales of USD 1 billion.

Another potential share price driver is the wrinkle treatment Relfydess, which is already available in many countries. Galderma plans to resubmit an application for approval in the USA at the beginning of 2026. In the first attempt, it was rejected due to deficiencies in connection with the chemical, manufacturing and control processes. A possible US approval and market launch could follow at the end of 2026.

Takeover fantasy available

Another positive development is that the French beauty group L'Oréal announced in December that it would increase its stake in Galderma from 10% to 20% and examine further joint research projects.

It is acquiring the additional shares from the existing shareholders, a consortium led by the Swedish private equity company EQT, at an undisclosed premium. This will make L'Oréal the largest shareholder in Galderma, while the proportion of existing shareholders, who want to exit anyway, will fall - without larger blocks of shares coming onto the open market and weighing on the share price.

In the press release, L'Oréal writes that it does not intend to increase its stake any further. Some analysts, including those from Jefferies and ZKB, nevertheless do not rule out a takeover - but only at a later date.

Wirtz also believes that a takeover by L'Oréal is possible. He would not take L'Oréal's rejection of a further expansion of its stake at face value. "It would have been unwise for L'Oréal to signal its interest in increasing its stake in the future, as the price would then have shot up."

Protection against a fall in the share price

"With the 20% stake, L'Oréal presumably wants to sound out the possibilities for cooperation first. After this test run, the management will decide whether a purchase makes sense." According to Wirtz, L'Oréal would probably sell its prescription drugs division to a pharmaceutical company in the event of a takeover.

According to Wirtz, L'Oréal's commitment also offers a degree of downside protection. "As investors know that L'Oréal may continue to add to its shares in the event of a price setback, the shares are unlikely to lose much."

Wirtz also points to the age of CEO Flemming Ørnskov. For the soon-to-be 68-year-old, a takeover would probably be a crowning career achievement. Ørnskov previously led the Irish pharmaceutical company Shire to success and sold it to the Japanese pharmaceutical group Takeda for USD 62 billion in 2019.

Galderma trotz hoher Bewertung kaufenswert

And that makes the IPO so interesting:

- Galderma is more than just the household name Daylong, for which the company is known in Switzerland. The company is one of the leading manufacturers of so-called cosmetic injectables, i.e. fillers used to smooth wrinkles, and neurotoxins, better known under the brand name Botox. The Galderma filler Restylane and the Galderma Botox Dysport are the number two in their respective markets - behind Abbvie (formerly Allergan), the top dog from the USA. Abbvie is clearly ahead. The Americans generate sales of around 3 billion dollars with their bestseller Botox, Abbvie itself speaks of a market share of around 70 percent.

- Galderma adheres to the "less is more principle". The Group is highly concentrated, limiting itself to three business areas. Cosmetic injectables are the company's most important pillar, accounting for 52 percent of sales. The second important business segment is skin care products, above all the dermatological moisturizing creams Cetaphil and the anti-aging cream Alastin. The Group is also one of the leading suppliers of creams for the treatment of acne. Medical skin care products account for 18 percent of sales. "I was impressed by how focused the company is," says Stefan Schneider, analyst at Vontobel.

- The Lausanne-based company is not only doing well at the moment. Supplies should also be ensured. Great hopes are pinned on a product called Relabotulinumtoxin A. This is an innovative product for the treatment of moderate frown lines and crow's feet. The product will be available in liquid form, eliminating the need for dermatologists to mix it with water. Analysts believe that the product will achieve peak sales of 1 billion dollars. However, the company will have to go through the books again for Relabotulinumtoxin A after the US Food and Drug Administration (FDA) criticized shortcomings in the production process in October.

Galderma machte 2023 einem Umsatz von 4,1 Milliarden DollarThe EBITDA margin was 23.1 percent. Management is targeting growth in the low to mid single-digit range for the coming years. One thing is clear: the company is operating in a booming market, with Galderma addressing a market potential of around 90 billion dollars across all categories. All indicators are pointing upwards. Societies in Europe and the USA, but also in emerging countries such as Brazil, are getting older and older, and the demand for products that blur the signs of ageing is increasing. The beauty ideal of eternally firm skin is universal, and more and more men are also interested in the products.- One of Galderma's major advantages is that it can conduct a large part of its business through the same sales channel, namely dermatologists. "This is very efficient and a major advantage, as there are also alternative providers for neurotoxic proteins such as Dysport," says analyst Stefan Schneider. Like Abbvie, the company goes to great lengths to train dermatologists in the use of its products.

- In the area of therapeutic products, Galderma is currently experiencing patent expirations for acne creams. But here, too, it looks as if supplies will be replenished. It concerns Nemozilumab, a drug for the treatment of neurodermatitis and a disease called prurigo nodularis, which leads to nodular skin changes that mainly occur on the legs, arms, back and stomach. The market potential is enormous; many asthmatics also suffer from neurodermatitis. At the same time, competition is tough. The top dog here is the French pharmaceutical company Sanofi, whose drug Dupixent is one of the most successful new launches in the entire industry in recent years.

- Galderma is led by experienced pharmaceutical managers. Group CEO Flemming Ørnskov led the British-Irish pharmaceutical company Shire to success and sold it to the Japanese company Takeda before joining Galderma in 2019. And finally, there is also the illustrious family tree with Nestlé and the French cosmetics group L'Oréal. Even if the episode of Galderma as a business unit in Vevey was not crowned with success.

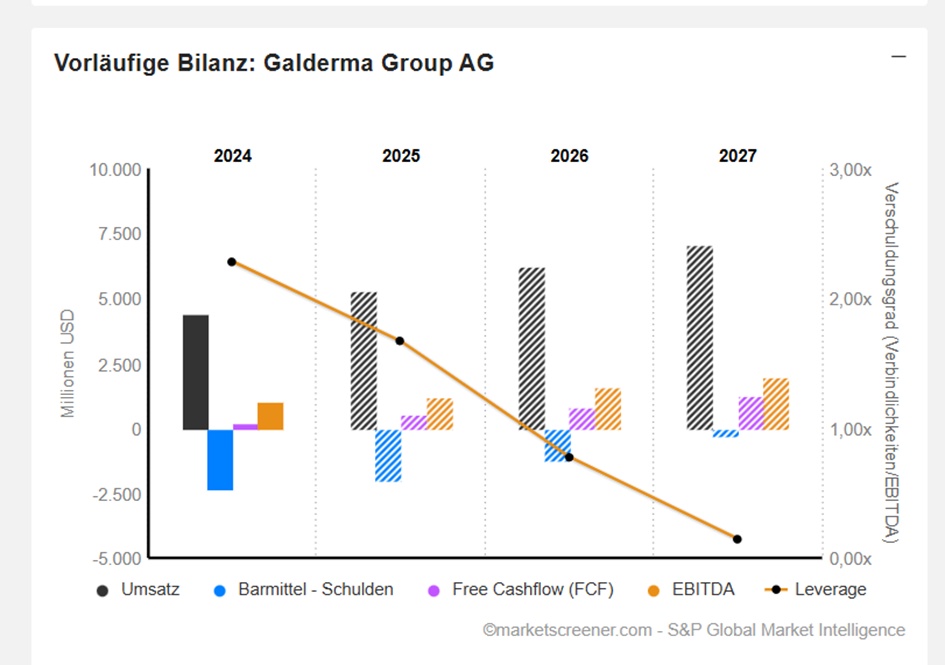

Spin-off from Nestlé

In 2019, the Swiss food company Nestlé sold Galderma to a consortium led by the Swedish private equity firm EQT for CHF 10.2 billion. With the successful IPO, the company will now get rid of half of the debt of around 5 billion dollars that it had accumulated under the aegis of EQT. The interest burden is likely to fall significantly, partly because the company will receive better conditions thanks to the lower debt.

And after the two Basel-based pharmaceutical groups Roche and Novartis, the Basel-based pharmaceutical supplier Lonza, the Geneva-based ophthalmology group Alcon and the Basel-based generics manufacturer Sandoz - whose inclusion in the SMI is likely to take place this year - the Swiss SMI may now have another SMI group in the healthcare group.

22.03.2024 - 11:38 am

Erfolgsreicher Start – was den Börsengang von Galderma so spannend macht | Handelszeitung

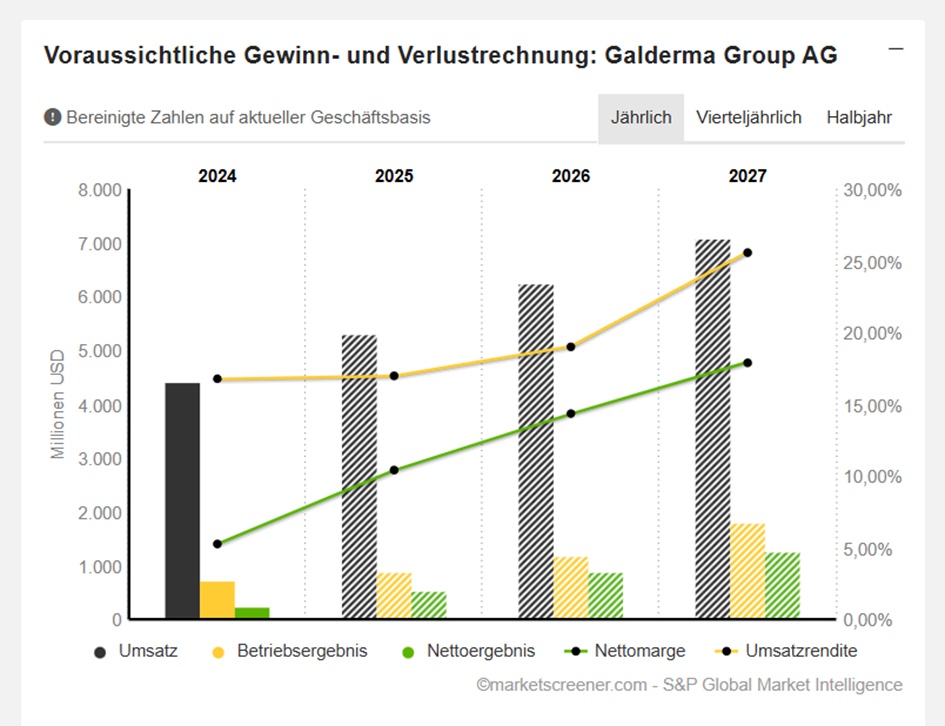

USD in millions2USD

Estimates

Year Turnover Change

2024 4'410

2025 5'297 20,1 %

2026 6'240 17,82 %

2027 7'094 13,69 %

Year EBIT Change

2024 738

2025 898 21,68 %

2026 1'187 32,18 %

2027 1'816 52,99 %

Year Net result Change

2024 231

2025 550 138,08 %

2026 893.3 62,43 %

2027 1'272 42,37 %

Year Net debt CAPEX

2024 2'356 275

2025 2'011 180.1

2026 1'225 203.7

2027 295 226.7

Year EBIT margin ROE

2024 16.73 % 3.51 %

2025 16.95 % 7.79 %

2026 19.02 % 11.17 %

2027 25.6 % 13.61 %

Year Earnings per share Change

2024 0.9734

2025 2.079 113,55 %

2026 3.582 72,33 %

2027 5.116 42,81 %

Number of shares (in thousands) 237,406

Date of publication 05.03.25

Market value 48,927

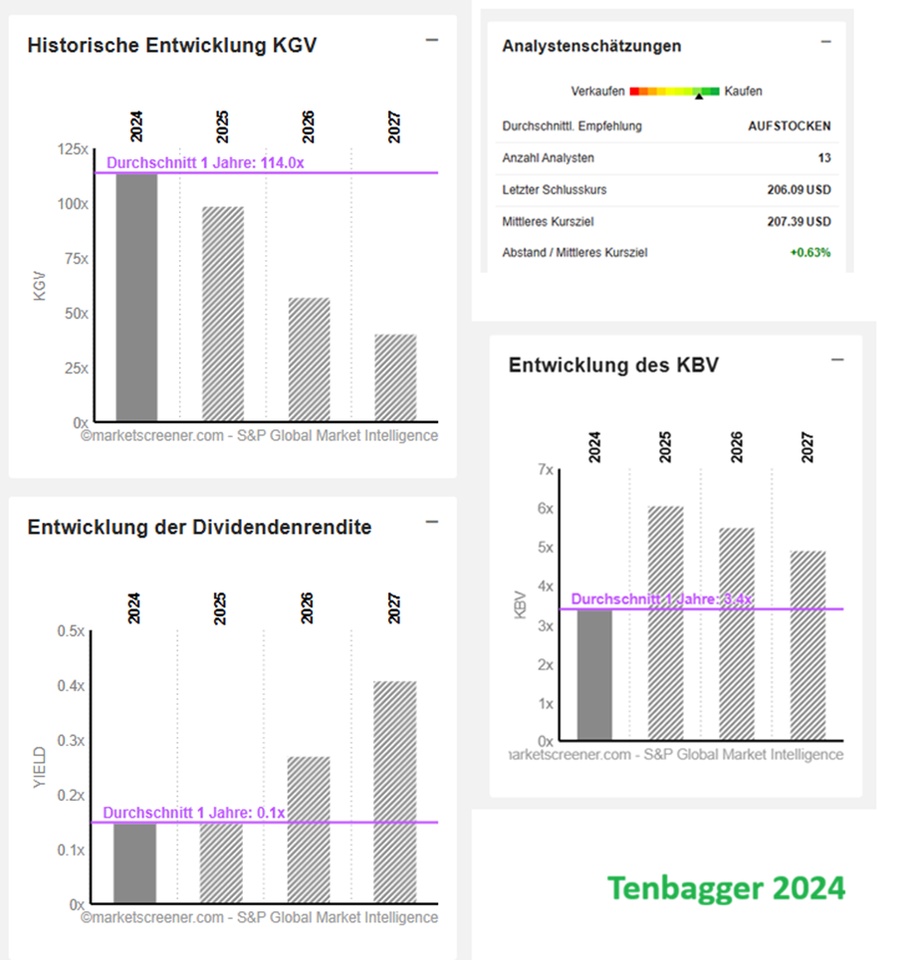

Year P/E ratio PEG

2024 114x

2025 99.1x 6.06x

2026 57.5x 0.8x

2027 40.3x 0.9x

+ 1

L’Oréal: consistencia que compensa

L’Oréal lleva años moviéndose con esa disciplina que no necesita grandes titulares para demostrar solidez. Su fuerza nace de un modelo operativo que domina tres pilares: innovación continua, marketing global extremadamente eficaz y la capacidad de fijar precios incluso en entornos tensos. La compañía ha convertido esa fórmula en un estándar del sector cosmético, y mantenerla durante décadas no es casualidad.

Cuando tomé posición en ella, la tesis se apoyaba en la previsibilidad de su crecimiento orgánico y la estabilidad de sus márgenes, respaldados por una diversificación que pocas empresas del sector pueden igualar. Desde entonces, la acción ha ido avanzando con el ritmo que caracteriza a los negocios maduros y bien gestionados: sin estridencias, pero con una progresión que tiende a premiar la paciencia del inversor.

En este tiempo, L’Oréal ha seguido reforzando su mix de ventas, impulsando categorías premium y apoyándose en una distribución omnicanal cada vez más pulida. Ese enfoque ha permitido sostener un perfil financiero muy equilibrado: márgenes robustos, generación de caja sólida y un retorno sobre el capital que sigue siendo referencia en la industria. Es un tipo de calidad que suele parecer cara… hasta que el mercado vuelve a apoyarla.

Con esa evolución, el objetivo de salida alrededor de los 405 € empieza a sentirse coherente. No es una cifra maximalista, sino un nivel razonable para asegurar una rentabilidad acumulada desde la entrada, en una empresa cuyo crecimiento compuesto —aunque moderado— se mantiene constante. Aun así, surge esa duda que acompaña a las compañías de calidad: ejecutar el plan o dejar espacio para que el negocio siga abriendo valor a largo plazo.

Es la tensión habitual. Por un lado, cristalizar beneficios tras un recorrido ordenado; por otro, el riesgo de vender justo antes de que la acción encadene otro tramo ascendente, algo que L’Oréal ha demostrado capaz de hacer más de una vez. En cualquier caso, la posición ha cumplido su función: ofrecer estabilidad, apreciación sostenida y la tranquilidad de estar invertido en un líder mundial cuya disciplina estratégica rara vez decepciona.

5 undervalued quality stocks

Handelsblatt searched the Dax, Stoxx 50 and Dow Jones for so-called quality stocks that are undervalued - i.e. whose price level is lower than the long-term average.

In order to be selected as a quality stock, the companies must have consistently fulfilled five conditions over the past five years:

- Rising or at least stable earnings before interest and taxes (EBIT),

- high liquid funds from the core business (operating cash flow) to cover ongoing costs at all times,

- low to moderate net debt in relation to equity; well below 100 percent,

- Rising dividends year after year,

- lower valuation than the company's own ten-year average - calculated from the ratio of consolidated earnings to market capitalization.

The sharp rise in share prices in recent years means that only five out of a total of 120 companies listed on the Dow, Stoxx and Dax fulfill all five conditions. Only one stock from the leading German index is included.

Visa $V (-0,49 %): The moat stock is available with a six percent valuation discount

Current dividend yield: 0.8%

Several million merchants worldwide accept payments in supermarkets, when shopping online or when traveling abroad. More than half of the group's revenues remain as profit, making Visa one of the most profitable companies worldwide and at the same time a typical moat share.

Higher prices and thus inflation have a positive effect, as they mean higher revenues for Visa because the credit card fees are linked to the merchant's turnover as a percentage.

L'Oréal $OR (-0,67 %): Ten percent valuation discount and the Group is growing faster than the market

Current dividend yield: 1.9%

When the world's largest cosmetics manufacturer reported sales growth of 4.2 percent in the past quarter, the share was one of the biggest losers of the day. Analysts had expected more. The share is trading 20 percent below its record high.

According to analysts' average forecasts, L'Oréal should earn 6.7 billion euros before interest and taxes in the current full year. That would be more than ever before and almost twice as much as five years ago. In the same period, the dividend per share rose from 3.85 euros to seven euros.

With a P/E ratio of 27.4 based on the earnings forecast for the next four quarters, the share is valued ten percent lower than its ten-year average.

Procter & Gamble $PG (-0,04 %): The dividend is safe and always rising

Current dividend yield: 2.9%

Branded products such as Ariel, Pampers, Braun and Gillette provide the American consumer goods manufacturer with reliably rising earnings. Over the past five years, earnings before interest and taxes have risen by 23%.

However, this year has shown that even such defensive shares are not resistant to price losses. Procter & Gamble is currently trading just under 20 percent below the record high it reached twelve months ago.

There are two reasons for this: the preference of many investors for more speculative technology shares, but also higher financial burdens for many consumers due to the rising cost of living. As a result, more consumers preferred cheaper own brands from retailers such as Walmart in the USA or Edeka and Rewe in Germany.

In the long history of the stock market, such price setbacks have almost always proved to be good opportunities to enter the market. The share is currently valued at a P/E ratio of 20.8 based on the earnings forecast for the next four quarters. This is seven percent below the average of the past ten years - after P&G had been valued above the historical average in recent years.

The strongest argument is probably the profit distributions. The Group has paid dividends every year since 1890. Since the end of the 1950s, Procter & Gamble has increased its dividend every year. Around 50 percent of profits go to shareholders.

This leaves enough of a buffer to increase the dividend even in years with slightly falling profits. Over the past five years, the dividend has risen by around one euro to 3.75 euros per share.

German Stock Exchange $DB1 (+2,68 %): Not only the stock market business drives profits

Current dividend yield: 1.8%

The Frankfurt stock exchange operator is set for its seventh record profit year in a row in 2025. In the third quarter, net revenue, pre-tax profits and earnings per share continued to rise as usual. Nevertheless, the share, which has risen sharply in recent years, has come under pressure in recent months: down 25% since the beginning of May.

Deutsche Börse is currently negotiating the purchase of the fund management platform Allfunds for 5.3 billion euros. Allfunds offers fund managers and distributors a platform for trading, data analysis and compliance systems.

The result of so much consistency is reliable dividends: The dividend has risen for nine years in a row, and the tenth increase is due next spring.

In view of the recent share price losses - coupled with rising consolidated profits - the share is no longer overvalued after a long time. With a P/E ratio of 18.7 based on the expected profits in the next four quarters, the share is valued three percent lower than its ten-year average.

Novo-Nordisk $NOVO B (-0,69 %): Highest valuation discount and highly speculative

Current dividend yield: 3.8%

The most speculative share among the stocks portrayed here is Novo Nordisk. With the presentation of its third-quarter results, the Danish pharmaceutical group once again lowered its sales and earnings targets. In addition, the management, under its new CEO since August, Maziar Mike Doustdar, cut its investment plans.

The company had grown strongly with the sales injection Wegovy, which had made Novo Nordisk the most valuable stock market group in Europe for a time, before competitors, above all the US group Eli Lilly $LLY (+0,01 %)successfully competed with similar products. Mass redundancies at Novo Nordisk were the result.

Despite all the setbacks, the pharmaceutical company is still increasing its profits - but at a slower rate. In the current year, analysts are forecasting average earnings before interest and taxes of the equivalent of 14.1 billion euros, compared to 13.5 billion euros in the previous year.

Since last summer's record high, the share price has fallen by 70 percent. This constellation - rising profits, collapsing share price - makes the once very highly valued share with a P/E ratio of 12.9 suddenly inexpensive. The ten-year average is almost twice as high with a P/E ratio of 23.4. No other quality share is currently trading at such a high valuation discount.

Novo Nordisk recently achieved positive results in tests with the drug Amycretin in diabetes patients. According to the company, these patients reduced their weight considerably and were also able to significantly lower their blood sugar levels.

This was Novo Nordisk's core business before the hype surrounding weight loss injections began. Over the past 30 years, the number of diabetics worldwide has quadrupled to around half a billion. According to the market research institute Mordor Intelligence, the Group has a 45 to 50 percent share of insulin products, making it the undisputed global market leader.

Source text (excerpt) & image, Handelsblatt 01.12.25

Crisis favorites: Smoke signals & lipstick - Psychology of consumption

The so-called lipstick effect describes the phenomenon that consumers do not completely forego luxury during recessions, but buy smaller luxury items when large purchases are no longer available.

(The chart below compares the performance of ULTA Beauty and the S&P 500 since March 13, 2020, when the nationwide COVID-19 lockdowns began).

(https://de.tradingview.com/chart/Wl3dkBka)

The term was coined by Juliet Schor back in 1998.

"They are looking for affordable luxury, the thrill of buying in an expensive department store, indulging in a fantasy of beauty and sexiness, buying 'hope in a bottle. Cosmetics are an escape from an otherwise drab everyday existence".

He gained notoriety when Estée Lauder boss Leonard Lauder realized after the 2001 attacks that his company was selling an unusually high number of lipsticks.

Without further ado, Lauder considered lipstick to be a counter-indicator to the economic situation.

Today, the effect is widely extended to consumer goods beyond cosmetics:

Small goods instead of expensive prestige items gain in popularity during crises.

1.

What is the lipstick effect?

In essence, the lipstick effect means

When budgets shrink, consumers cut back on expensive purchases - but indulge in a little sin.

"Consumers will still tend to buy small luxury items even during an economic downturn".

Or:

If you can't afford a car, you might buy the new luxury lipstick instead of nothing at all.

(https://fastercapital.com/startup-topic/People-Will-Actually-Buy.html)

After 9/11, the demand for lipstick shot up by around 11%.

Later, during the 2008 financial crisis $EL (-1,58 %) again reported rising cosmetics revenues, while other sectors suffered.

The lipstick effect is not constant; extreme situations such as deep snow or store closures due to the pandemic can weaken it.

However, in normal downturns, studies show that it works quite reliably as a consumption indicator.

2.

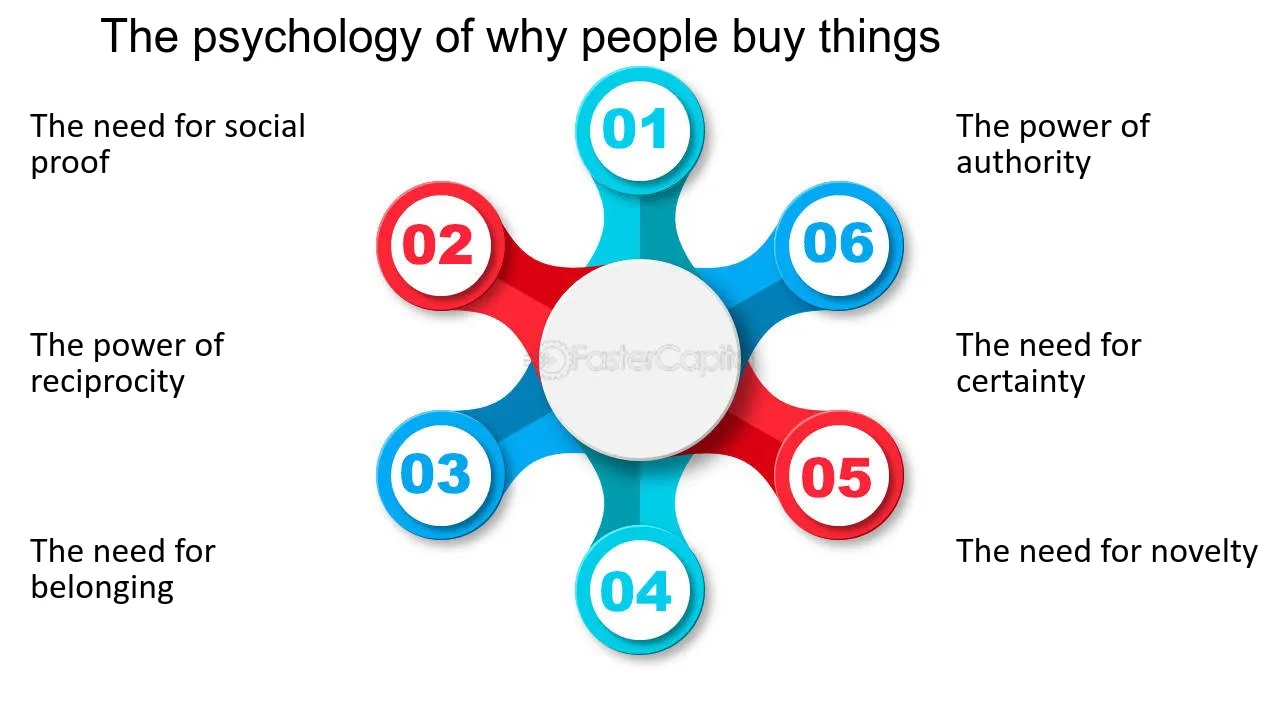

Psychological drivers

(https://www.falstaff.com/de/news/im-rausch-der-hormone)

Why do people reach for chocolate rather than expensive theater tickets in uncertain times?

Psychology is behind the lipstick effect.

Even when money is tight, people want to treat themselves to something good - a sweet consolation or a new make-up.

Consuming lipstick or ice cream can lift your mood and give you the feeling that you are doing something positive.

In a recession, women show an increased interest in beauty and attractiveness products, especially when they feel a high motivation to increase their attractiveness or to attract a partner.

This supports the lipstick effect hypothesis:

Even in times of crisis, people do not forgo small luxury items - especially those that boost self-esteem or attractiveness.

The study explains this in terms of evolutionary psychology:

- In uncertain times, perceived financial security decreases.

- People (especially women in this study) therefore invest more in their appearance to send signals of attractiveness that potentially symbolize access to stable social and economic resources.

3.

Economic impact: Crisis-winning industries

In many downturns, certain sectors have benefited disproportionately. Traditionally, cosmetics providers have flourished - lipstick, mascara etc. are seen as an "affordable luxury".

For example $OR (-0,67 %) reported increases in sales and profits for the crisis year 2008 despite the global contraction.

This effect explains why cosmetics shares are often considered stable. Tobacco and alcohol companies are also often robust:

Habitual goods such as cigarettes or beer are considered "addictive" goods - even in bad times, demand remains relatively stable. (Historically, cigarettes were even used as a means of bartering for war).

Fast food chains such as McDonald's do well because people want cheap food when everything is more expensive.

Gambling providers can also boom when dreams become more important than sober calculation.

Streaming services/online entertainment are typical: while physical contact is declining, the need for internet entertainment is increasing (Netflix, for example, grew strongly during coronavirus). Investopedia specifically names "fast-casual restaurants and multiplex cinemas" as winners of the crisis.

- Cosmetics

($OR (-0,67 %)

, $EL (-1,58 %))

Sales continue to rise in 2008 despite the crisis. The global cosmetics market amounted to around USD 504 billion in 2022 (growth +15% compared to 2021) - a sign of the continued importance of beauty care.

- Tobacco/alcohol

($BATS (-1,23 %), $PM (+0,02 %), $MO (+0,3 %), $DGE (+1,37 %))

Habitual drinkers and smokers rarely cut back further, tend to consume the same thing or switch to cheaper brands. Tobacco, for example, was an expensive means of exchange during the war.

- Fast food & entertainment

($MCD (-0,07 %), $NFLX (+8,37 %), $AMC (+0,62 %)

)

Affordable indulgences and distractions are in demand. Reports from the corona crisis document, for example, that Amazon recorded a +70% jump in e-commerce sales in the beauty and care sector during the lockdown compared to pre-crisis levels - an indication that consumers were busy ordering small luxury items online.

4.

Historical examples of crises

Concrete history makes the effect tangible: Already after 9/11 in 2001 $EL (-1,58 %) reported unusually high lipstick sales - Leonard Lauder even spoke of a "counter-indicator" to the recession.

The picture continued in 2008/09:$OR (-0,67 %) and other cosmetics companies fared better than the market as a whole (they were able to expand their sales), while luxury goods shrank.

Corona pandemic (2020) again brought examples: Although the economy slumped in the first half of the year, online trade in beauty products boomed,

Amazon recorded a +70% increase in beauty/care products in e-commerce in spring 2020 compared to the pre-crisis period and Sephora ($MC (-1,38 %)) reported a +30 % increase in online sales compared to 2019.

The effect was even evident in 2022/23: according to market researchers, around a third of make-up customers in the UK bought products as a "reward", with spending on lipstick there increasing by around 12.3% in 2023 (despite the tight cost of living).

In China, the lipstick effect was conspicuously absent in 2022, as a study by the China Institute made clear. (https://cidw.de)

"Despite government efforts to promote moviegoing with subsidies and discounts, consumers remain cautious, especially in tier 1 cities. The "lipstick effect", according to which small expenditures increase in times of crisis, did not materialize in China. In December, the China Film Administration launched a subsidy program."

5.

Stock markets in times of crisis

How did investors react to the lipstick effect? Some consumer stocks are considered defensive securities. Thus $OR (-0,67 %) 2008 continued to show a profit - a prime example of stability. Estée Lauder experienced a small price jump in 2001 as investors bet on the strong demand for beauty products.

Tobacco stocks ($BATS (-1,23 %) , $MO (+0,3 %), $PM (+0,02 %)) and food companies ($NESN (+0,54 %) ) were also regarded as pullback stocks:

Their cash flows suffer comparatively little as underlying demand continues.

McDonald's ($MCD (-0,07 %)) was largely able to compensate for its 2008 share price slump by 2010, and the share price also recovered quickly after the coronavirus slump in 2020.

Netflix ($NFLX (+8,37 %)): Its price briefly doubled with the lockdown dividend, after which the situation normalized.

6.

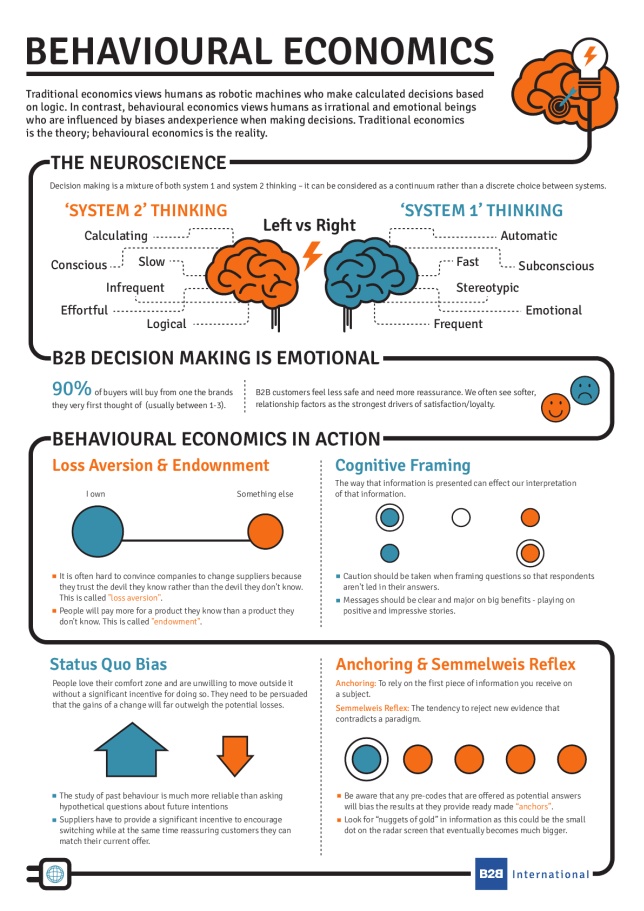

Behavioral economic classification

The lipstick effect fits well into the picture of loss aversion and prospect theory: investors and consumers avoid large losses (e.g. cash tied up in a car) and value small gains relatively highly.

(https://hub.hslu.ch/business-psychology/prospect-theory)

In this sense, an inexpensive luxury item minimizes the feeling of "having done without".

Social influences also have an effect: If you see friends treating themselves to something despite the crisis, you are more likely to justify it for yourself.

Behavioral economics thus explains why people satisfy their unpaid desire for a little happiness during a crisis - often reflexively, emotionally and depending on the context.

(https://www.b2binternational.com/publications/what-is-behavioural-economics)

In both world wars, cigarettes were more a part of survival than chocolate - as a tranquillizer in the trenches and a tangible bartering commodity.

Hitler had smoking banned in many places during the Second World War, but tobacco was still available at the front. Chocolate became scarce in 1939: US soldiers were served sweets in their rations, officially to boost morale. Other goods such as coffee, ice cream and video games have similar stories - in the USA, for example, the chocolate business boomed briefly after the world wars as a nostalgic feel-good store.

What was good as a small consolation in war is considered a luxury in peace.

Sources:

https://www.sueddeutsche.de/panorama/lippenstift-mode-geschichte-1.5360041

https://fastercapital.com/startup-topic/People-Will-Actually-Buy.html

https://fastercapital.com/content/The-Lipstick-Effect-and-its-impact-on-consumer-behavior.html

https://pmc.ncbi.nlm.nih.gov/articles/PMC9636953/#:~:text=consumers%20to%20spend%20more%20on,1

+ 4

In contrast to the rest of the market, they held up quite well on Freedom Day... :)

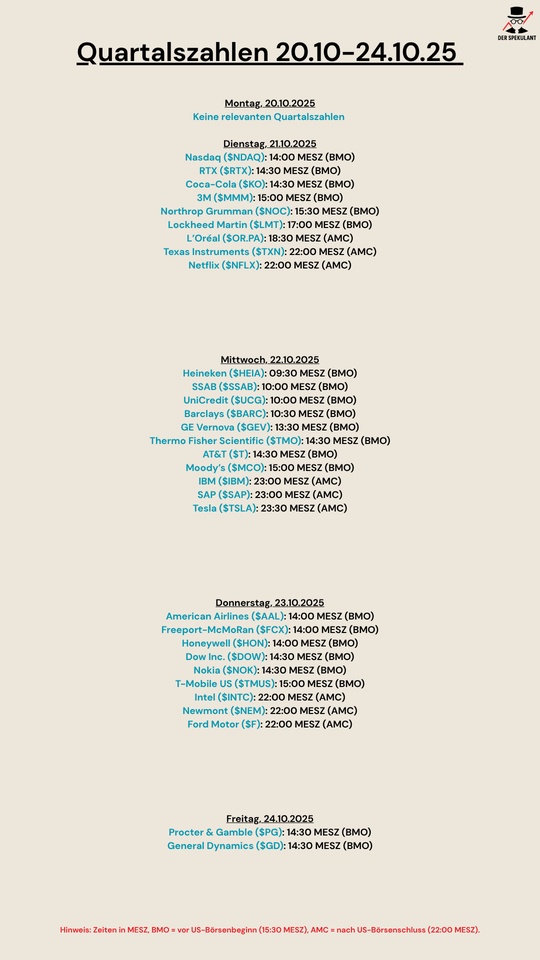

Quartalsberichte 21.10-24.10.25

$NDAQ (-1,22 %)

$RTX (+0,88 %)

$KO (+0,29 %)

$MMM (-1,27 %)

$NOC (+0,28 %)

$LMTB34

$OR (-0,67 %)

$TXN (-0,57 %)

$NFLX (+8,37 %)

$HEIA (+0,6 %)

$SAAB B (+0,24 %)

$UCG (-1,78 %)

$BARC (-2,14 %)

$GEV (-1,49 %)

$TMO (-0,73 %)

$T (+0,78 %)

$MCO (-0,62 %)

$IBM (-0,74 %)

$SAP (-1,73 %)

$TSLA (-0,89 %)

$AAL (-2,41 %)

$FCX (-0,01 %)

$HON (+0,13 %)

$DOW (-1,97 %)

$NOKIA (+0,47 %)

$TMUS (-0,09 %)

$INTC (-1,33 %)

$NEM (+0,89 %)

$F (-0,76 %)

$PG (-0,04 %)

$GD (+0,1 %)

Elf Beauty Q1'26 Earnings Highlights

- Revenue: $353.7M (Est. $353.5M) UP +9% YoY✅

- Adj EPS: $0.89 (Est. $0.84) ✅

- Market Share: +210bps; 26th consecutive quarter of gains

H1 FY26:

- Net Sales Growth: >9% YoY

- Adjusted EBITDA Margin: ~20% (vs. ~23% in H1 FY25)

Strategic Updates:

- Acquired Hailey Bieber's brand rhode for $800M (closed Aug 5)

- Raised prices by ~$1 across categories to offset tariff costs

- Reduced China-based production to <75% from ~100% in 2019

Other Metrics:

- Adj EBITDA: $87.1M; UP +12% YoY

- Adj EBITDA Margin: 25%

- Adj Net Income: $51.3M

- Gross Margin: 69%; DOWN -215bps YoY

Liquidity:

- Cash: $170M

- Long-Term Debt: $256.7M

CEO Commentary – Tarang Amin:

🟡 “Our strong Q1 results are a continuation of the consistent, category-leading growth we’ve delivered over the past 26 quarters.”

🟡 “We remain excited by the significant whitespace we see ahead as we strive to make the best of beauty accessible for all.”

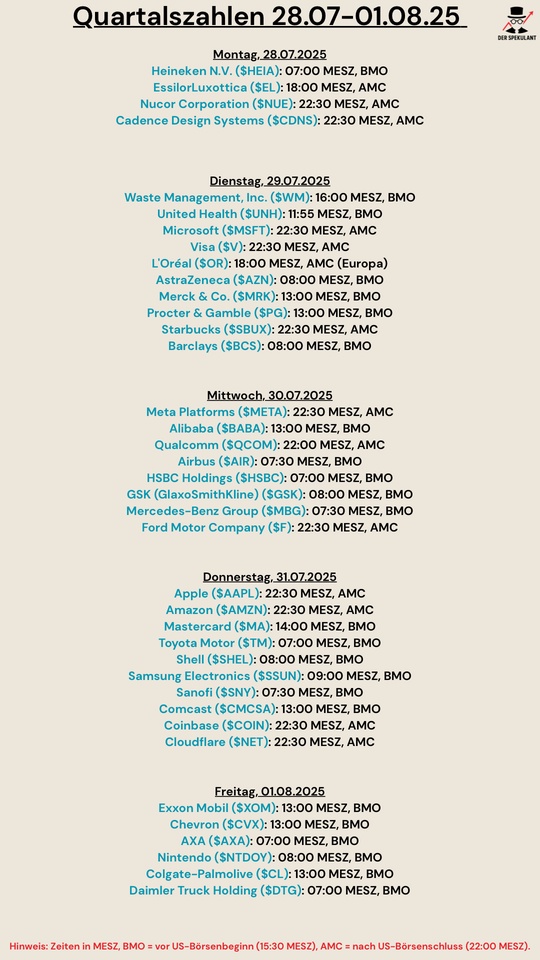

Quarterly figures 28.07-01.08

$HEIA (+0,6 %)

$EL (-5,65 %)

$NUE (-0,73 %)

$CDNS (-1,63 %)

$WM (+0,62 %)

$MSFT (-0,31 %)

$V (-0,49 %)

$OR (-0,67 %)

$AZN (+1,13 %)

$MRK (+0,2 %)

$PG (-0,04 %)

$SBUX (-1,22 %)

$BCS (-2,33 %)

$META (-0,87 %)

$BABA (-2,08 %)

$QCOM (-0,47 %)

$AIR (-1,18 %)

$HSBC (-1,25 %)

$GSK (+0,18 %)

$MBG (-0,8 %)

$F (-0,76 %)

$AAPL (-0,43 %)

$AMZN (-0,35 %)

$MA (-0,69 %)

$7203 (+0,55 %)

$SHEL (+1,63 %)

$005930

$SNY (-0,49 %)

$CMCSA (+0,11 %)

$COIN (-2,85 %)

$NET (-3,22 %)

$XOM (+1,79 %)

$CVX (+1,31 %)

$CS (+0,76 %)

$NTDOY (-0,41 %)

$CL (-0,11 %)

$DTG (+0,22 %)

$UNH (-0,62 %)

Valores en tendencia

Principales creadores de la semana