Steico

Price

Debate sobre ST5

Puestos

39What do you think of Steico?

$ST5 (+2,8 %) Do you think they will reach the €30 mark this year?

Dates week 4

As every Sunday, the most important news from the past week. As well as the most important dates for the coming week.

Also as a video:

https://youtube.com/shorts/6kS3uOc3Gyo?si=ylP3Ik3aaxt4tQ6Q

Monday:

The Dutch pension fund ABP sold all of its $TSLA (+1,5 %) Tesla shares. However, the reason for the sale is not Elon Musk's political statements. It was his remuneration model and the working conditions at Tesla. According to Tesla, Musk is entitled to a 56 billion dollar share package that Musk has been fighting over with American courts.

Tuesday:

$ST5 (+2,8 %) Steico exceeded expectations in terms of turnover 376.3 million euros instead of 375 million euros. However, profits were slightly lower than expected. Steico manufactures sustainable insulation materials.

https://www.ecoreporter.de/artikel/steico-mehr-umsatz-weniger-gewinn-aktie-legt-zu/

Producer prices in the USA are less hot than expected. Year-on-year, producer prices rose by 3.3%. However, analysts had expected an increase of 3.5%. Producer prices are regarded as a leading indicator for inflation.

https://www.ariva.de/news/usa-erzeugerpreise-steigen-weniger-als-erwartet-11501258

Wednesday:

The German economy remains in a permanent slump. According to initial estimates, GDP shrank by 0.2% in 2024. This means that GDP has shrunk for two consecutive years (2023: 0.3%). This was last seen in 2002 and 2003 and resulted in Agenda 2010. It is striking that comparable political players were in government in 2002 and 2003, as well as in 2023 and 2024.

New DAX record at 20,609 points. The reason for the rise is a decline in core inflation in the USA. This reduces the risk of a restrictive monetary policy by the Fed. Core inflation was expected to be 3.3 %, but was actually 3.2 %.

Thursday:

As the Swiss luxury group $CFR (+1,12 %) Richemont presents strong figures, the entire luxury goods sector takes off. Even $KER (-1,03 %) Kering and $MC (-0,23 %) LVMH were also able to make significant gains. The Christmas quarter went much better than expected.

Also $ZAL (+0,79 %) Zalando reported a strong final quarter and exceeded its profit targets in Q4. EBIT is likely to rise to 510 million euros, whereas a maximum of 480 million euros was originally forecast.

In his first days as President of the European manufacturers' association ACEA, Ola Källenius is campaigning against the CO2 sanctions imposed on car manufacturers. His argument is that we need a market-driven path to decarbonization and not one driven by EU sanctions.

Friday:

Trump is likely planning to make cryptocurrencies a national priority and wants to give crypto insiders a voice in the government to do so.

https://www.instagram.com/p/DE6ZsF6R-5v/?igsh=bjgyMGVhemZjMWZx

Industrial production in the US rises by a surprising 0.6% in December. Experts had only expected an increase of 0.2%. Mining and the production of utilities also increased.

These are the most important dates for the coming week:

Monday: 08:00 Producer prices (DE)

Tuesday: 14:30 Inflation data (Canada)

Thursday: 14:30 Unemployment figures (USA)

Can you think of any other dates? Write it in the comments 👇

Analyst updates, 29.10. 👇🏼

⬆️⬆️⬆️

- JEFFERIES raises the price target for SAP $SAP (-0,7 %) from EUR 230 to EUR 255. Buy.

- DEUTSCHE BANK RESEARCH raises the price target for DEUTSCHE TELEKOM $DTE (+0,76 %) from EUR 33 to EUR 39. Buy.

- ODDO BHF raises the target price for ALLIANZ

SE

$ALV (+0,19 %) from EUR 288 to EUR 324. Outperform. - ODDO BHF raises the price target for DWS

$DWS (+0,3 %) from EUR 38 to EUR 39. Neutral. - METZLER raises the price target for LUFTHANSA $LHA (+1,76 %) from EUR 5.70 to EUR 6.40. Hold.

- METZLER raises the price target for NEMETSCHEK

$NEM (+0,73 %) from EUR 89 to EUR 91. Hold. - METZLER raises the price target for FRIEDRICH

VORWERK $VH2 (+0,61 %) from EUR 29.20 to EUR 38. Buy. - GOLDMAN raises the price target for SYMRISE $SY1 (-3,49 %) from EUR 127 to EUR 131. Neutral.

⬇️⬇️⬇️

- BOFA lowers the price target for MUNICH

RE

$MUV2 (+0,89 %) from EUR 550 to EUR 535. Buy. - WARBURG RESEARCH lowers the price target for WACKER

CHEMICALS $WCH (+4,04 %) from EUR 136 to EUR 133. Buy. - WARBURG RESEARCH downgrades STEICO

$ST5 (+2,8 %) from Buy to Hold and lowers target price from EUR 42 to EUR 29. - METZLER lowers the price target for SALZGITTER $SZG (+1,68 %) from EUR 17 to EUR 15.50. Hold.

- DEUTSCHE BANK RESEARCH lowers the price target for SGL

CARBON $SGL (-0,06 %) from EUR 10.80 to EUR 10.60. Buy. - LBBW downgrades PHILIPS $PHIA (+1,52 %) from Buy to Hold and lowers target price from EUR 30 to EUR 26.

- GOLDMAN downgrades ABB

$ABBNY (+0,4 %) from Buy to Neutral. Target price CHF 52. - UBS lowers the price target for CARL ZEISS MEDITEC $AFX (+0,12 %) from EUR 71 to EUR 65. Neutral.

- JPMORGAN lowers the price target for STMICRO

$STMPA (+2,13 %) from EUR 42 to EUR 35. Overweight.

As every Sunday, the most important news from the past week, as well as the most important dates for the coming week.

Also as a video:

https://youtube.com/shorts/uWLmaUmA94I?si=Nvgan1ND1bTBDfNJ

Sunday:

Joe Biden resigns and names Kamala Harris as possible successor. Trump has already made a statement. We are curious to see what the markets will do tomorrow. The election campaign in the US seems to be starting all over again.

Monday:

The battery manufacturer $VAR1 Varta is restructuring at the expense of its shareholders. In addition, Porsche and Michael Tojner secure pre-emptive rights for the issue of new shares. As a result of the StaRUG proceedings, small shareholders at Varta in particular are left empty-handed.

https://www.handelsblatt.com/meinung/kommentare/varta-gau-fuer-kleinaktionaere/100054586.html

Tuesday:

$P911 (+0,68 %) Porsche corrects its forecast. Turnover is expected to be lower than planned and the margin is also likely to fall. This is probably due to flooding at a European supplier.

Also $ST5 (+2,8 %) Steico also fell significantly. Although turnover and profit increased, the share price fell. The reason is a cautious outlook.

Wednesday:

Profit at $TSLA (+1,5 %) Tesla falls for the second quarter in a row, Tesla has clearly missed expectations with its figures. Car sales fell by seven percent to 19.9 billion USD. Total sales increased slightly thanks to the strong storage business.

$RHM (+2,27 %) Rheinmetall doubled its profit and was even able to exceed expectations. The armaments group is benefiting from numerous orders from the German armed forces. Sales increased by 49% to 2.2 billion euros in the second quarter. Profit doubled to 271 million euros. Rheinmetall is undoubtedly one of the winners of the Ukraine war.

The Purchasing Managers' Index for Germany 🇩🇪 and the USA are disappointing. The value for Germany fell below 50, and the same applies to industry in the USA. The index thus signals a recession. In the USA, at least the service sector remains above the 50 mark.

https://finanzmarktwelt.de/einkaufsmangerindex-juli-316954/?amp

Thursday:

Yesterday, the building materials group $STO3 (-0,5 %) Sto reported disappointing figures. Earnings will probably be halved and the targets for 2024 and 2027 have been canceled.

There was also weak news from the automotive industry. $7201 (+0,86 %) Nissan's profit collapses by 99%. Opel parent company Stellantnis reports a 40% drop in profits.

Things are also going badly in the luxury goods industry. Gucci's sales shrank by 19%, putting pressure on the profits of its parent company $KER (-1,03 %) Kering.

Even consumer goods giant $NESN (-0,01 %) Nestlé disappointed with a lowered forecast. Turnover fell by 2.7%, partly due to currency effects.

Even in Poland 🇵🇱, which is otherwise economically spoiled, the supermarket chain $DNP (+0,66 %) Dino Polska has to report poor figures. Among other things, profits fell by 28% compared to the previous year.

The situation was different in the pharmaceutical sector. $SAN (-0,17 %) Sanofi exceeded analysts' expectations in terms of profit and was able to increase its turnover by 8 %. Also $AZN (+0,82 %) Astrazeneca also raised its annual targets. Sales increased by 15 %. However, profits fell slightly due to exchange rate effects.

Good economic data from the USA 🇺🇸. GDP growth in the second quarter was probably significantly stronger than expected (2.8 % annualized, expected: 2.0 %). In addition, inflation is unlikely to exceed expectations.

Friday:

$MBG (+0,92 %) Mercedes is able to slightly improve its return on sales again. In addition, there was no profit warning, which many had expected.

BASF $BAS (+1,55 %) BASF does not have to lower its forecast, but continues to struggle with rather weak figures. Sales fell by 7%, while adjusted profits of 2 billion euros in the second quarter were roughly at the previous year's level.

Inflation in Japan 🇯🇵 was above expectations. Real interest rate hikes may still have to be made there after all. However, even the price increases for core consumer prices in the capital Tokyo are barely above the BoJ's 2% target.

The German pharmaceutical group $MRK (+1,95 %) Merck also delivered strong figures and raised its forecast slightly. Instead of sales of 20.6 - 22.1 billion euros, the range was raised to 20.7 - 22.1 billion euros. Sales stagnated in the second quarter. The reason for the forecast increase is good figures for the cancer drug Xevinapant.

Most important dates in the coming week:

Tuesday: 14:00 Inflation data (Germany)

Wednesday: 05:00 Interest rate decision (BoJ)

Thursday: 13:00 Interest rate decision (BoE)

As every Sunday, the most important news from the past week, as well as the most important dates for the coming week.

Also as a video:

https://youtube.com/shorts/Tzvt-QWMEx0?si=s6XBg1idGvlqJmah

Monday:

Global military spending reaches a new record high. Global military spending amounted to 2.3 trillion euros in 2023. This is roughly equivalent to the GDP of France. At 859 billion euros, the USA spent around 37% of this. It is followed by China, Russia, India and Saudi Arabia. Germany follows in seventh place, just behind the UK. Ukraine follows in eighth place.

Despite the crisis in the construction industry, the sustainable insulation specialist $ST5 (+2,8 %) Steico can significantly increase its profit. In particular, profits rose significantly in the first quarter from 2.1 to 5.9 million euros. The main reason was falling purchase prices, which is also exciting in view of the upcoming ECB interest rate decision. We hold a very small position of 3 shares in Steico in our value portfolio. For the most part, we exited at prices well above EUR 60.

https://www.ecoreporter.de/artikel/steico-gewinn-im-ersten-quartal-wächst-deutlich/

Tuesday:

The Chinese are buying fewer and fewer iPhones and more and more smartphones from the Chinese manufacturer Huawei. $AAPL (-0,53 %) Apple's sales fell by 20% in China in the first quarter. Huawei's sales increased by 70 %. Apple is a victim of the rising tensions between the USA and China.

Wednesday:

$TSLA (+1,5 %) Tesla suffers first drop in sales since 2020 in Q1 2024. Sales fell by 9% to USD 21.3 billion. The announcement of more affordable models at the end of the year already generated enthusiasm.

The German government surprisingly raises its growth forecast; instead of 0.2%, GDP growth of 0.3% is now expected. Among other things, the ifo business climate index has already climbed for 3 months in a row.

Thursday:

Our value stock $KGX (+3,32 %) Kion starts the new quarter with solid figures. Turnover increased by 2.8%. Profitability increased, only the cash flow deteriorated slightly. In our view, it is also positive that incoming orders increased again compared to the same quarter last year.

Our value stock $HFG (+1,88 %) Hellofresh reports quarterly figures and is particularly impressive with its growth in the ready meals segment. Overall, sales rose by 3.8%, but the ready meals division grew by 56.2%. Hellofresh thus broke the 2.07 billion euro sales barrier in one quarter, the highest ever. The bottom line will initially be lower due to the start-up financing of the ready meals brand.

Consumer sentiment in Germany 🇩🇪verbessert continues to improve. In April, sentiment rose for the third time in a row. However, the value of the GfK barometer remains in negative territory at -24.2 points. This means that negative responses to the survey continue to predominate. However, the trend is positive.

Growth in the USA 🇺🇸 is lower than expected at 1.6% in Q1. The inflation rate is also higher than expected. These are bad signs. In theory, the Fed should be looking at inflation rather than economic growth. This means that a reduction in interest rates in the USA could be postponed further. The stock markets are falling sharply.

After $META (+0,25 %) Meta, the next tech company is now announcing a dividend payout. Alphabet will pay out 0.20 cents per share in future. The share price literally exploded after the announcement. The other figures are also convincing, with profits rising to 22 billion euros in one quarter.

Friday:

The Japanese 🇯🇵 central bank postpones the interest rate decision. As a result, the yen continues to fall. Last year, Germany became the world's third-largest economy despite zero growth, thanks to the weak yen.

Saturday:

The inflation rate in Germany is expected to have risen in April for the first time this year. Inflation was probably 2.3% in April, compared with 2.2% in March. The main reason for this is the renewed increase in VAT on gas and district heating.

These are the most important dates for the coming week:

Tuesday: 11:00 Inflation data (Eurozone)

Wednesday: 20:00 Interest rate decision (USA)

Friday: 14:30 Employment data (USA)

Purchase $ST5 (+2,8 %)

Expect a trend reversal here soon

The interest rate peak will soon be reached and the focus will continue to be on insulation materials and sustainable construction.

Only a matter of time until it goes up again significantly, similar to some real estate stocks that will now also soon pull up significantly.

Steico gets new owner The fact that a 51% block of shares is changing hands at Steico does not taste good. Founder and majority owner Udo Schramek is selling 51% of his shares to Kingspan. Around 10% will remain with Schramek, who will continue to serve as CEO and chairman of the board of directors. The Irish are proving good timing here, as the share has lost around 75% since its all-time high in the summer of 2021. As a supplier of ecological insulation materials, Steico has many growth drivers underpinned by megatrends up its sleeve. In addition, the product portfolio complements the existing construction solutions of Kingspan, which specializes in thermal insulation for buildings. The share (33.50 euros; DE000A0LR936) thus retains a free float of around 26.8%. After the recent profit warning, however, we remain outside Steico.

+++ Signs of life +++

(from the series: Investment Diary & Thoughts)

Knee surgery survived last week. 🩼

Whether good, is the other question... 😣 In the meantime got postoperative fever, knee still swollen, probably needs to be punctured again... and otherwise so?

I lie around the whole day, meow at my wife from time to time (which I feel sorry for again seconds later, because she certainly can't help it...) and then I think to myself:

Look again in your depot. But no, I don't feel like it. Health and all that. That comes first.

Now I fell so when planking on the sofa suddenly my own trains of thought to the topic invest. And the decision is made after 2 days:

I will make my investing even simpler and less complex.

What follows:

Nearly all BigBlueChips are sorted out and shifted into the MSCI World & MSCI EM. After all, they are represented there anyway, so why bother with them?

What remains for the pension is the MSCI World ($IWDA (+0,25 %) ) , MSCI EM ($EIMI (-0,28 %))and EUWAX GOLD II ($EWG2 (+1,23 %) ).

In addition, I focus on 5 (max. 7) individual stocks. According to the current status these include $ST5 (+2,8 %) (Steico SE), $NIBE B (+3,19 %) (NIBE "is love"); $YSN (+3,58 %) (Secunet); $UKW (+0,9 %) (Greencoat for ever - or what better comes); $COLO B (-0,3 %) (Coloplast) and $MRK (+1,95 %) (Merck KGaA).

Over the years, I have become less and less interested in more.

Investing remains important. But please make it as boring as possible.

The last weeks alone (preparation for surgery and now the aftercare) have shown me that I am not ready for this and especially not able to keep track of 15-20 values. Thus, the focus on investing as simple as possible and still preserve individual value opportunities for me has become more attractive again.

Maybe this will actually create opportunities for the activated trading of 1-2 values from the basic framework... if not, also not so wild. And yet I will be able to focus even better on these values.

Concentrating on a few individual values and a really large core (I'm also talking about more than 150k€ in the core here) is the true core-satellite strategy for me. That I had neglected this over the years somewhat, or expanded - normal. So now "back to the roots", or "back to simplicity".

Time is not money, but valuable in terms of family, free time and your own health.

And otherwise so?

Soon the physiotherapy will start. I have no idea how to cope at the moment, but that will come.

I still have the post on hold for the "Green Investment" and the resolution (win pronounced in the poll) of the winner of the getquin-Cap. Both of which I have not forgotten. As soon as I can sit reasonably, without problems, I will get back to writing.

To getquin I will certainly become more active again, I have time now. At least 8 weeks (with good progress) is a long time.

So, keep your head up, dad is doing it too....

Your KneePapa. 🦵

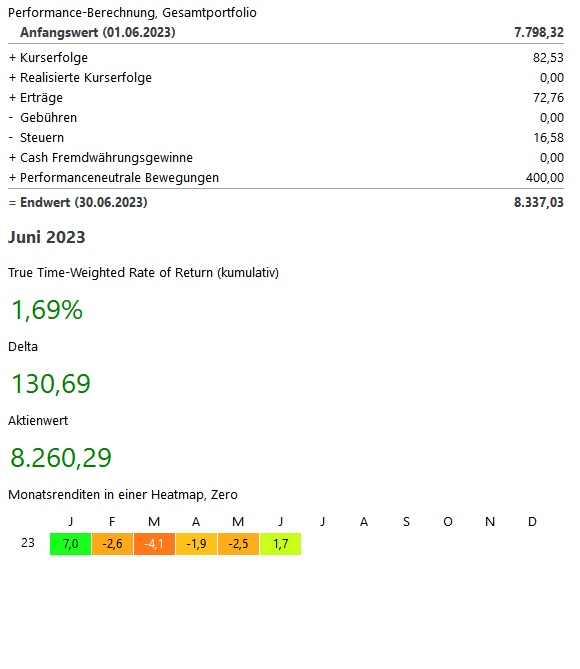

Depot Performance: June 2023 +1.69% 📈

Top share: Lakeland Industries $LAKE (+0,32 %) +29,20%📈

Flop share: Steico $ST5 (+2,8 %) -35,36%📉

Net dividends: 56.18€

As every Sunday, the most important news of the last week and dates of the coming week.

here the dates of the coming week as a video:

https://youtube.com/shorts/nasFIUyppOU?feature=share

Monday:

Several gradations at $ENR (+2,63 %):

Jeffries downgraded Siemens Energy from 'Buy' to 'Hold', with a price target cut from EUR25 to EUR16.50. Analyst Simon Toennessen expects two years of losses at Siemens Gamesa. The parent company could fathom higher costs at the subsidiary for years.

Deutsche Bank Research left the rating at 'Hold' but lowered the price target to EUR20 from EUR26. According to analyst Gael de-Bray, the valuation is attractive, but the uncertainty remains too high.

Citigroup downgraded the stock to 'Neutral' from 'Buy' while lowering the price target to EUR18 from EUR29. Analyst Vivek Midha believes that the company can no longer plan ahead after the profit warning.

DZ Bank also downgraded Siemens Energy from 'Buy' to 'Hold' and lowered the share price from EUR27 to EUR16. Analyst Alexander Hauenstein emphasized that currently too many questions remain unanswered.

https://goldesel.de/Artikel/abstufungen-und-verbrannte-erde-bei-siemens-energy

#Markowitz has died. Harry Markowitz was a crucial pioneer of #portfolio theory and Nobel laureate. He was instrumental in making correlation matter when considering portfolio risk. That is, a portfolio can be less risky despite having risky stocks if individual stocks have little correlation in performance. Among stocks from the same industry, for example, the correlation is often quite high, while other industries correlate less. Other asset classes even less. From a risk perspective, it can therefore also make sense to add gold or cryptos to the portfolio.

https://de.m.wikipedia.org/wiki/Harry_Markowitz

The #ifo business climate index has weakened further. The value fell to 88.5 points. Experts had expected 90.7 points. The ifo business climate index surveys executives and is used to derive the economic barometer.

70 % of the $GDAXI-companies expect AI to change their business model in the next few years. 90% of DAX companies plan to use AI applications.

Tuesday:

The USA's economic engine 🇺🇸 continues to hum. New orders for durable goods surprisingly increased. Month-on-month, orders rose by 1.9%; a decline of 0.9% had been expected.

https://m.ariva.de/amp/usa-auftrge-fr-langlebige-gter-legen-unerwartet-weiter-10767671

Wednesday:

$BAYN (-0,21 %) is facing a setback in its search for a successor to Xarelto. The Regeneron Group's application for approval of the eye drug Eylea initially failed at the U.S. regulatory agency. Bayer holds the marketing rights to Regeneron's drug.

https://goldesel.de/Artikel/bayer-rutscht-auf-neues-tief

De#bankenstrinesstest in the USA 🇺🇸 was positive. In the face of a severe economic downturn, the 23 banks tested were able to maintain a capital ratio of 10.1% on average. The aim was to remain above the minimum ratio of 4.5%.

Thursday:

EU consumer confidence 🇪🇺 improved somewhat, similar to the U.S. 🇺🇸.

Friday:

Morgan Stanley has upgraded its rating for $ST5 (+2,8 %) upgraded its rating from 'Equal-weight' to 'Overweight'. At the same time, the price target was reduced from EUR 53 to EUR 45. The share is currently trading below EUR 30. Analyst Manfredi Bizzarri believes that now is the right time to buy Steico. There would continue to be headwinds from the construction industry and competitors, but expectations are now probably at rock bottom. The company should soon start growing again, as Steico's niche is attractive in the long term.

https://goldesel.de/Artikel/zeit-fuer-den-einstieg-bei-dieser-aktie

Production at #china 🇨🇳 continued to decline. However, the stock markets in China still rose. The main reason was that Li Qiang (Premier) advocates policies that increase domestic demand.

The #inflation in the euro zone is falling more sharply than expected, to now 5.5% compared with the same month last year. In Germany, there was an increase from 6.1% to 6.4% compared with the previous month. However, one-off effects such as the EUR 9 ticket and the fuel price discount played a role here. Experts had expected an increase of 5.7% in Europe.

Key dates in the coming week:

Monday: 1:50 manufacturing index (Japan)

Tuesday: 8:00 Trade Balance (DE)

Wednesday: 20:00 FOMC Minutes (USA)

Thursday: 11:00 Retail Sales (EU)

Friday: 14:30 Labor Market Report (USA)

Valores en tendencia

Principales creadores de la semana