Which are (so far) your best dividend stocks this year?

Most important for me, not overhyped, over-influenced.

Telekom

Energy/Infra

Consumer (Shop Action)

Postos

13For centuries, the North Sea has been regarded as a rough marginal sea. Now it is set to become the heart of Europe's energy supply. There are already 1600 wind turbines off the coasts, but this is just the beginning: electricity generation from offshore wind power is to be increased almost tenfold by 2050. This was decided by the energy ministers at the North Sea Summit in Hamburg on Monday.

The pact has the clear aim of dovetailing energy and industrial policy with increasingly important security interests. The ministers' plans go far beyond wind farms. The North Sea is to become a cross-border electricity hub that will make Europe less dependent on fossil fuel imports, stabilize electricity prices and give industry long-term planning security.

It is a course-setting move that is also being perceived on the financial markets. The long-term expansion plans are changing expectations for a sector that already celebrated a strong comeback last year. The industry is receiving an additional tailwind from the rapidly growing and ongoing energy requirements of digital technologies of the future, above all artificial intelligence, whose data centers require enormous amounts of reliable and affordable electricity. The sector is currently experiencing the perfect moment to become the new megatrend itself.

This should give investors hope, especially in combination with upcoming projects such as the North Sea Pact. After all, this involves up to 100 gigawatts of generation capacity being made available across borders. This would give both the wind energy and grid industries planning and investment security beyond 2030.

In return, the industry undertakes to reduce the costs of electricity generation by a total of 30 percent by 2040. In addition, around 9.5 billion euros are to be invested in new production capacities in Europe by 2030 and 91,000 additional jobs are to be created. According to "Wind Europe", a wind association, 32 million households can already be supplied with electricity from offshore wind energy today. With 300 gigawatts in 2050, this figure could grow to more than 330 million.

It is a new long-term perspective in the sector that should arouse the curiosity of private investors. It feeds the hope that the financial recovery in the sector reflects a lasting change in fundamentals - and that it will not fade away as quickly as it started. For example, UBS expects earnings growth in Europe this year. "The most attractive opportunities come from renewable energies and structural investments in Europe," says strategist Gerry Fowler.

Renewable energies are particularly in focus, supported by more than two trillion euros of investment in power grids and clean energy. Electrification companies are likely to benefit from supportive regulation and continued infrastructure spending.

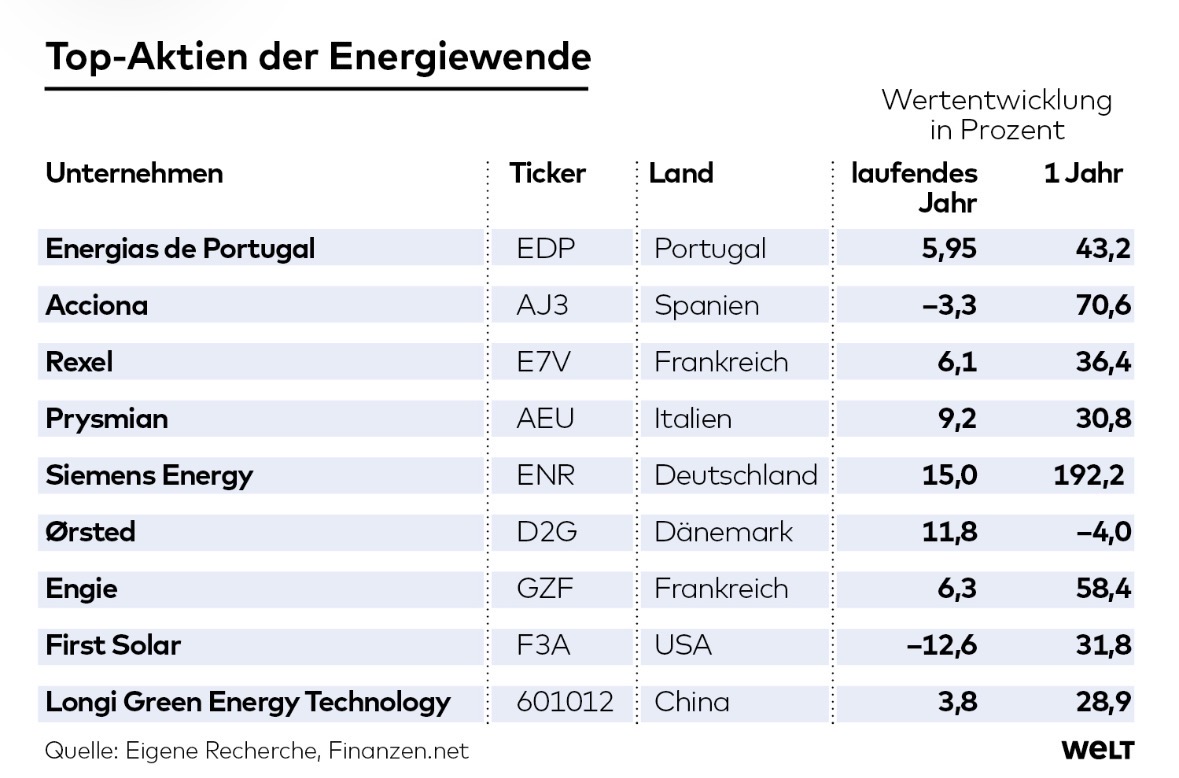

The strategist leads Energias de Portugal

$EDP (+0,57%) as an example. EDP is one of the largest energy suppliers in Europe. With a market value of 17.5 billion euros, the company is currently the most valuable Portuguese company. The shares are currently trading at 4.24 euros. That is an increase of 6 percent since the beginning of the year and an increase of 50 percent in the past year. And: according to analysts, EDP's potential has not yet been exhausted. Ten experts recommend buying the share. The average target price is around 4.6 euros, with some firms even expecting the share to rise to around 5.9 euros. The Group's dividend yield is 4.7 percent.

According to Gerry Fowler from UBS, the general conditions are currently creating new global champions in the areas of renewable energies, electrification, defense and infrastructure. He specifically highlighted European stocks such as Acciona

$ANA (-0,76%) and Rexel

$RXL (-1,21%) as companies that are turning local advantages into international growth. Another example is Prysmian $PRY (-1,25%). The Italian company is the world's largest and most successful manufacturer of energy and telecommunications cables. The shares are trading at 98.06 euros, up 9 percent since the beginning of the year.

While UBS is putting the green underdogs in the spotlight, other analysts continue to focus on big names such as Siemens Energy $ENR (+0,71%), Ørsted $ORSTED (-1,7%) and Engie (GDF Suez) $ENGI (+1,18%).

Also First Solar

$FSLR (+0,25%) analysts also believe that First Solar will achieve a turnaround after a weak start to the new year with a drop of 11 percent. With a market capitalization of around 26 billion US dollars, the solar giant production power plant for large-scale systems is a heavyweight. Analysts are expecting a sharp jump in profits.

Earnings per share are expected to rise from an estimated USD 14.61 last year to USD 23.30 this year. An increase of more than 56 percent. The drivers are the high order backlog and new production capacities, including a planned 3.7 gigawatt factory in the USA, with which the company intends to convert additional demand directly into revenue.

The analysts also see potential in Longi Green Energy Technology $601012. The Chinese company specializes in the manufacture and sale of photovoltaic panels and solar energy products. The company is not only active on the Asian market, but is also increasingly present on the global market.

Source text (excerpt) & graphic: WELT

Hi everyone! I’ve been building my portfolio and would love to get some honest opinions on my current allocation and diversification.

My strategy involves a mix of individual stocks and specialized ETFs. To get a better view of my actual risk, I’ve "looked through" my ETFs to see my true underlying exposure.

My Top 10 Holdings (by % weight):

Oracle $ORCL (-6,21%) – (Mix of direct stock + IT ETF)

Engie $ENGI (+1,18%) – (Direct stock)

Amazon $AMZN (-3,15%) – (Direct stock + S&P 500)

NVIDIA $NVDA (+0,59%) – (Spread across Semiconductor, $IUIT (-1,12%) , and S&P 500 $VUSA (-1,2%) ETFs)

Aegon $AGN (-1,52%) – (Direct stock)

Apple 7. Microsoft 8. Broadcom 9. ASML 10. AMD (because of the etfs)

The Strategy:

I have a significant tilt towards Semiconductors $SMH (-0,72%) and IT, but I try to balance the volatility with a Defense ETF $DFEN (-2,04%) , a European Banks ETF $EXX1 (-0,39%) , and some plays like Engie and Aegon.

I’d love your thoughts on:

Concentration: My top 3 holdings (Oracle, Engie, Amazon) represent a large chunk of the total. Is this too top-heavy, or do you like the conviction?

ETF Overlap: I’ve noticed that companies like NVIDIA and Broadcom appear in three different ETFs I own. Does this "hidden" concentration bother you, or is it just part of betting on winners?

Diversification: I’m currently light on Healthcare and Emerging Markets. Would you stick to this high-conviction tech/defense play or start branching out?

Looking forward to hearing your perspectives! 📈

#investing #portfolio #stocks #etf #tech #defense #getquin #diversification

Last weeks value stocks bought such as Deutsche Telekom ($$DTE (+1,84%) ) Ahold $AD (+2,55%) Heineken $HEIA (+0,92%) and Engie $ENGI (+1,18%) . ASML $ASML (-0,1%) and ASMI $ASM (+0,35%) trimmed and sold to bring my tech weighting to around 25%. Cost some redemenent this week, but a more stable portfolio.

The party in neighboring France was short-lived, Lecornu resigned and with him the Paris stock market sank, too bad being that France turns out to be a solid country in fundamentals, the latest data showed good growth in the country despite unstable politics, let's see how long this will last and by how much French stocks will fall, some opportunities may appear on the horizon, in France personally I am following $SAN (+1,51%) e $ENGI (+1,18%) , solid companies with good distribution, the former still undervalued according to fundamentals. I will have a chance to invest more cash in 10 days, in the meantime I am watching the developments in the transalpine market.

Just bought$ENGI (+1,18%) 32X and $POR (+2,03%) 56X to make my exposure a lot bigger in the utilities sector because this sector is also known for good stable dividends. currently 0.19% is almost nothing in this this sector.

The UBS recently carried out an extensive screening of the European equity market. There are a few stocks that were rated very positively by the analysts.

These include the French energy supply group Engie $ENGI (+1,18%) the Italian logistics and postal company Poste Italiane $PST (+0,56%) the British online real estate broker Rightmove

$RMV (-2,77%) and the French technology service provider SPIE $SPIE (-0,72%).

In addition, the Irish specialist insurer Beazley $BEZ (+0%) the Spanish energy group Iberdrola

$IBE (+0,76%) and the Swedish telecommunications company Telia

$TELIA (+1,26%) are on the list.

The chances of a positive development are good - according to "Welt". Reason:

In Europe, politicians are investing massive amounts of money in infrastructure and defense while promising reforms to stimulate the economy. Added to this are interest rate cuts by the European Central Bank (ECB) and bulging savings accounts, which could flow into consumption and investment if the mood improves.

And overall, it is all about long-term growth: government investments are planned for years to come and the ECB is likely to cut interest rates even further.

The combination of government stimulus, cheap financing and private capital is providing a tailwind on the markets. There are some European ETFs that have been performing very well since the beginning of the year.

At the forefront is the Global X Euro Infrastructure Development $BRIP (-0,71%) with a return of 23.1 percent.

Also strong is the Xtrackers Dax $DBXD. (-1,02%)

The ETF achieves 20.3 percent and costs just 0.09 percent per year.

Also exciting is the WisdomTree Europe Defensive $EUDF (-2,51%). With 18.9 percent since its launch in March, it has made a solid start and costs just 0.40 percent.

The classic among the European ETFs, the iShares Core Euro STOXX 50 $CSSX5E (-0,46%)is somewhat more defensive at 11.8 percent, but scores with minimal fees. Europe is therefore back on the ETF radar.

Source (excerpt) & image: "Welt", 17.07.2025

Hey everyone! After seeing so many portfolio presentations, I decided to share mine today, following the advice of @DonkeyInvestor (link here)! 🚀

1. Investment horizon and goals

I am Belgian guy of 30 years old, already own an apartment, and have a mortgage to repay. I have been investing sporadically since I was 18, but I really started actively managing my investments in March 2024.

My main goal is to maximize my savings, with the flexibility to either buy a house in the future or allocate funds to another project. Because of this, my investment horizon is flexible but at least 5 years.

I then plan to keep investing long-term and see if this could help me achieve a certain level of financial independence. To be honest, in a rational (but admittedly a bit morbid) way, the inheritance I will receive one day could contribute to that goal—although I am not at all counting on it as a part of my strategy.

2. My strategy and how I intend to achieve my goals

A. Introduction

I already have an emergency fund covering six months of expenses, which gives me peace of mind and allows me to invest without short-term financial stress.

My job enables me to invest at save (for investment) €1,500 per month. Any bonus or additional income is either added to my investments, used to replenish my emergency fund, or allocated to vacations and other expenses.

Additionally, I have around €25,000 from selling mutual funds I purchased in my younger years. This gives me flexibility to pick individual stocks or invest in crypto when I see an opportunity.

B. Investment Strategy & Asset Allocation 🎯

I invest around €2,300 per month in a DCA approach in various ETFs. Then I invest in stock or crypto when I see an opportunity.

My goal is to build by end 2025 a portfolio with the following allocation:

C. Diversification & Experimentation 🎢

Within my ETF allocation, I allow myself to include thematic or higher-risk ETFs instead of only focusing on broad market indices.

I fully understand that this approach is not the most straightforward or simplest way to invest (see point 3). However, at this stage, I want to "have fun" with investing, testing stock picking and specific ETFs. Over time, I will assess whether this was a good decision and adjust if necessary (see point 4).

D. Risk-Taking & Adaptability 🔄

Since I am still young, I am willing to take on more risk, fully aware that I could also lose money. As I gain experience and see the performance of my portfolio, I will adapt my strategy if needed (again point 4).

3. My choice for the stocks in my portfolio

A. ETFs

After experimenting with different allocations, I’ve decided to aim for the following ETF distribution by the end of 2025 (as a percentage of my total portfolio, so including stock and crypto):

B. Stocks

Like most of you, I love tech 😄, so a significant part of my individual stock portfolio is centered around it. I generally invest €2,000 per stock, sometimes in one go, sometimes split across multiple entries.

C. Crypto

I chose Bitcoin mainly due to its volatility and the potential for "easy profits". I initially invested in July and, seeing Trump getting closer to the White House, I decided to increase my position, anticipating potential market movements linked to his policies and the broader macroeconomic environment. For now, I’m sticking to Bitcoin but might explore XRP and other assets in the future.

4. Insight into how I plan to further expand your portfolio

Based on my calculations, I should reach €100,000 invested by late 2025 or early 2026. My plan is to keep investing consistently to get closer to the allocation I outlined earlier.

A. Expanding My Stock Portfolio 📈

I plan to maybe reinforce some existing positions but overall exploring new opportunities. Some stocks I’m considering include:

B. Crypto

For Bitcoin, I keep things simple: I invest €100 whenever I see a dip (sometimes multiple times per day or week), staying patient and accumulating over time. I’m curious to hear your views on where Bitcoin is headed.

C. Reviewing My Strategy in Late 2025 🔍

D. Managing My Biggest Concern – US Exposure 🇺🇸

One of my main concerns is my heavy exposure to the US market, both through ETFs and stocks. However, given the current global economic landscape, it seems difficult to do otherwise while aiming for maximum returns.

For now, I’ll keep an eye on opportunities to diversify while ensuring that my investments remain aligned with my long-term strategy.

5. What I don’t want in my portfolio

I believe that investing inherently carries a level of amorality, especially when investing in broad-market ETFs that include a wide range of companies (but everyone has their own ethical perspective—let’s not start a debate on that! 😄).

That being said, I personally choose not to invest directly in companies involved in alcohol or tobacco. It’s a personal preference.

6. Conclusion 🎯

That’s it for this deep dive into my portfolio and a summary of my thoughts since May 2024, as well as since I started reading your posts in August.

Thanks for all the insightful discussions and shared knowledge—this is an amazing community, and I really appreciate the posts I read since August!

Have a great weekend and thanks you so much for reading so far!

Regards,

A Belgian investor

Hello everyone,

Today I would like to introduce you to my portfolio. As you probably know, it's just too much fun to expand my portfolio with new stocks. There are now a few too many, but I still can't really part with my worst-performing stocks ($NVM (-2,65%) , $ENPH (-0,76%) , $WAC (-1,06%) ). I'm hoping that I'll be able to sell them in positive territory at some point, or am I on the wrong track and in your opinion should I sell at a loss and try to make up the loss with other stocks?

I have been investing since the end of 2022 and at 29 years old, I still have a long time to go. My strategy is to be as desertified as possible in sectors and to beat the market in the long term (just let me believe that it works :D), hence so many individual stocks. I want to hold these for many years (esp. $AMZN (-3,15%) , $GOOGL (-0,5%) , $QCOM (-2,21%) , $MSFT (-2,84%) , $V (-3,22%) , $MC (-0,49%) , $SALM (-5,19%) ) but I'm also not too keen to pocket the profits. Are there any stocks in my portfolio that you would view critically for the next few years and would be worth considering selling? Recession and all that...

Priority is on growth, which is reasonably safe, so only a few small caps - but a few bets have to be in there :) ($AIDX (-3,48%) , $NRX (-0,83%) , $ITM (-2,6%) , $F3C (+0,31%) , $MITK (-5,79%) ). But with rather small amounts, probably too small or what do you say?

At the same time, I would also like to claim a €900 allowance via dividends ( $BATS (+0,19%) , $ENB (+0,88%) , $BNPQY (+0,42%) , $STLAM (-1,94%) , $ENGI (+1,18%) , $RIO (-1,46%) ) and secure a trade or two.

Recently I have been investing 240€/m in the $XDWD (-1,13%) and between 200 - 500€/m in individual shares (depending on what is left). Actually, I want to increase the existing shares properly now, but somehow there are always nice entry options in solid companies like $0L2T (-2,59%) , $ZTS (-2,37%) , $ADM (-1,21%) , $PANW (-2,69%) , $ENR (+0,71%) . Help what to do? :D

And then there's also crypto $BTC (-4,44%)

$NEAR (-4,24%)

$ADA (-3,26%)

And Japan, they're doing well too $4063 (-0,43%) , $6501 (-0,37%) , $8001 (+0,62%)

Looking forward to your feedback and advice!

Portfolio Feedback 2.0

For fun, I share my portfolio due to the new feed view and also hope to be able to take a few "like-minded" people with me.

41 years old, married, 3 children, employed project manager, savings rate due to current circumstances and mortgage at 350€.

The portfolio consists of 3 (4) building blocks:

Core/Satellite (buy & hold strategy consisting of MSCI World, Microsoft $MSFT (-2,84%) , Cloudflare $NET (-9,27%) and Crowdstrike $CRWD (-9,88%) for the long-term investment period (in the best case until retirement) Share of the portfolio approx. 30% ETF / approx. 18% individual shares

2. crypto represented by $BTC (-4,44%) also buy & hold (investment period > 10 years). Share of the portfolio approx. 15%

3. momentum strategy (always the two stocks with the highest momentum) currently AMD $AMD (-2,1%) and MercadoLibre $MELI (-4,72%) (here a change is probably due again next month) Share of the portfolio approx. 30%. The long-term benchmark here is the S&P 500

4. employee shares ENGIE $ENGI (+1,18%) are rather negligible as they will most likely be sold at the end of the holding period. Share in the portfolio approx. 7%

The current weighting also corresponds approximately to the target weighting:. The position size per individual share should be at least 3-5%, hence the small number of positions. For some, the MSCI World share is probably still too low and the TECH exposure far too high. For me, however, this is exactly what I would like to replicate. I am only at the beginning of my journey and have already learned a few lessons, see past transactions, but I think I am on the right track, even if the road to my goal still seems endless.

Now I would like to have PRO & CONTRA from you :-)

Principais criadores desta semana