I am trying to organize my portfolio more clearly and combine several ETFs/funds with the same investment focus, as long as taxes are not too high when I sell them. I now have the pure MSCI World ETF $LWCR (-0,24%) and at the same time the MSCI World ETF of roughly the same size with Momentum $XDEM (+0,17%) . Which of the two would you liquidate? The momentum idea is good, but if you only change stocks every 6 months, the momentum may be long gone in between and you are betting on stocks on the decline. Thank you for your help!

Xtrackers MSCI World Momentum ETF

Price

Discussão sobre XDEM

Postos

22Portfolio feedback

Hello everyone,

I would like to get your feedback on my portfolio strategy. Here are the key data:

Age: 20 years old

Investment horizon: Very long (several decades)

Strategy: First investment then invest via savings plan + B&H

1. the planned portfolio

I am planning the following allocation for my portfolio. Important: The 20% in the dividend ETF will only flow until my exemption order has been fully utilized by the distributions. After that, fresh money will only flow into the other two positions.

- 55% Vanguard FTSE All-World (basis) $VWCE (-0,09%)

25% Xtrackers MSCI World Momentum

$XDEM (+0,17%)

20% VanEck Developed Markets Div Lead

$TDIV (-0,18%)

2. current situation

I took advantage of the "dip" in April and am already invested (mix of ETFs and individual stocks). I am currently considering how I should adjust or structure my portfolio, as the individual stocks have performed extremely well:

- Nvidia: +60%

- Alphabet: +90%

- Others: Amazon, Meta, United Health (all up).

My questions for you:

What do you generally think of my ETF selection and weighting (55/25/20)?

Would you swap one of the ETFs for another product?

Is there anything missing in the allocation (would you add another component, e.g. small caps)?

Individual shares: How would you deal with the winners? Realize profits and shift them into the ETFs, or simply let them run as "satellites", as I am still young?

Many thanks for your feedback!

In my opinion, these momentum ETFs are always "a bit late" and rebalance too slowly or too rarely. I would then perhaps split 60/20/20.

You can let shares run as long as you like them.

Adapt to market phases

With this sale, I have liquidated virtually my entire buy and hold portion (around 50% of my investments). On the one hand to free up some powder for less expensive courses, but mainly to shift most of it into more flexible strategies that can adapt better to changing market conditions. And, as a nice side effect, usually perform better. The aim is not to miss any further rises and still avoid drawdowns if one should occur soon. According to the theory at least 🫡

Going in and out market has been proven countless time to be a losing strategy, I don’t really understand why people still do this

Deposit of a 19 year old prospective bank clerk

Hello everyone,

After more than a year, it's time to present my portfolio again, as a lot has changed.

I am clearly pursuing a buy-and-hold strategy with quality stocks. As a core I currently have the $GGRP (-0,26%)and the $IWDA (-0,28%) . The $GGRP (-0,26%) will soon leave my portfolio and half of it will be reallocated to the $IWDA and the $XDEM (+0,17%) will be reallocated. This is simply because I think it's a good idea to have an ETF in my more growth-oriented portfolio that doesn't just have dividend payers in its line-up.

I find the $XDEM (+0,17%) in particular, as it focuses exclusively on stocks that have performed well recently. The fact that the excess return naturally drives up volatility somewhat is perfectly okay, as my investment horizon is at least 20 years.

Otherwise, another 57% of my portfolio consists of individual shares. My plan has actually always been a 50/50 ratio, but this has changed somewhat due to the strong equity returns. However, the ETF positions will soon be filled with around 600 euros of my training income. This should then level out a little better, as long as shares don't continue to rise enormously.

If you take a closer look at the shares, I think the strong focus on the classic ETF drivers such as $NVDA (+0,03%) , $MSFT (-1,12%) , $GOOG (+2,55%) and $AMZN (+1,25%) stand out. Of course, the ETFs in the portfolio increase the proportion of these stocks, but that is absolutely intentional. I remain very optimistic about the AI runners and see further growth and sufficient stability in the coming years.

I always find the following particularly noteworthy $EUZ (+0,27%) . It is the only German company in my portfolio. I am very confident in the long term and am excited to see how they will develop. Unfortunately, my $MC (+4,1%) position should also be mentioned. Well, bad luck and I didn't have the courage to sell when the downward trend was clear. But at least I can now offset the taxes from the $GGRP (-0,26%)-sale by selling the LVMH position and then buying it again immediately. As soon as the luxury segment improves again, I am sure that LVMH will be back at the top of the industry.

The bottom part of my portfolio currently consists of $MCD (-0,02%) and $MDLZ (-0,16%) among others. Due to the strong returns of the other shares, these two positions have become somewhat unimportant in my portfolio. At around 2% each, they have simply become too small for me, which is why I will be merging them. However, not again in a stable share with a dividend, but rather in a growth driver. I am currently watching $ANET (-4,93%) and am pretty convinced. The restructuring will probably soon lead to a EUR 4,000 position in Arista and free up another EUR 2,000 for the ETFs.

That should be all. If you have any questions, please feel free to ask, otherwise I'm very happy to receive your feedback :)

(A little info: The sum of the deposit comes from my grandfather's inheritance. The ETF shares I bought early on were bought by my father, as I was of course too young. Then I got involved with shares and was allowed to have more and more of a say. I currently make my own decisions about the portfolio)

Portfolio feedback for a Belgian guy !

Hey everyone! After seeing so many portfolio presentations, I decided to share mine today, following the advice of @DonkeyInvestor (link here)! 🚀

1. Investment horizon and goals

I am Belgian guy of 30 years old, already own an apartment, and have a mortgage to repay. I have been investing sporadically since I was 18, but I really started actively managing my investments in March 2024.

My main goal is to maximize my savings, with the flexibility to either buy a house in the future or allocate funds to another project. Because of this, my investment horizon is flexible but at least 5 years.

I then plan to keep investing long-term and see if this could help me achieve a certain level of financial independence. To be honest, in a rational (but admittedly a bit morbid) way, the inheritance I will receive one day could contribute to that goal—although I am not at all counting on it as a part of my strategy.

2. My strategy and how I intend to achieve my goals

A. Introduction

I already have an emergency fund covering six months of expenses, which gives me peace of mind and allows me to invest without short-term financial stress.

My job enables me to invest at save (for investment) €1,500 per month. Any bonus or additional income is either added to my investments, used to replenish my emergency fund, or allocated to vacations and other expenses.

Additionally, I have around €25,000 from selling mutual funds I purchased in my younger years. This gives me flexibility to pick individual stocks or invest in crypto when I see an opportunity.

B. Investment Strategy & Asset Allocation 🎯

I invest around €2,300 per month in a DCA approach in various ETFs. Then I invest in stock or crypto when I see an opportunity.

My goal is to build by end 2025 a portfolio with the following allocation:

- ~40% Individual Stocks (mainly large-cap growth & tech)

- ~7.5-10% Crypto (mainly Bitcoin, possibly some altcoins)

- The remaining ~50% in ETFs, diversified across different regions and themes

C. Diversification & Experimentation 🎢

Within my ETF allocation, I allow myself to include thematic or higher-risk ETFs instead of only focusing on broad market indices.

I fully understand that this approach is not the most straightforward or simplest way to invest (see point 3). However, at this stage, I want to "have fun" with investing, testing stock picking and specific ETFs. Over time, I will assess whether this was a good decision and adjust if necessary (see point 4).

D. Risk-Taking & Adaptability 🔄

Since I am still young, I am willing to take on more risk, fully aware that I could also lose money. As I gain experience and see the performance of my portfolio, I will adapt my strategy if needed (again point 4).

3. My choice for the stocks in my portfolio

A. ETFs

After experimenting with different allocations, I’ve decided to aim for the following ETF distribution by the end of 2025 (as a percentage of my total portfolio, so including stock and crypto):

- 25%$IWDA (-0,28%) → Broad exposure to developed markets.

- 5%$IEMA (+1,29%) → Exposure to emerging markets

- 5%$XDEM (+0,17%) → Performance

- 2-2.5% in $MEUD (+0,31%) & $XNAS (-0,32%) → European and Nasdaq exposure to complement my stock picks.

- 10% in Thematic ETFs → I enjoy sector-specific plays and have selec $RBOT (-0,38%) , $W1TB (-5,19%) , $LCOC (+6,49%) , $SMH (-0,42%), $DFEN (-0,83%) to get exposure to robotics, Cocoa (because why not), semiconductors, and aerospace/defense.

B. Stocks

Like most of you, I love tech 😄, so a significant part of my individual stock portfolio is centered around it. I generally invest €2,000 per stock, sometimes in one go, sometimes split across multiple entries.

- ✅ Tech Giants & AI

- $NVDA (+0,03%) (exception to my €2,000 rule)

- $AMZN (+1,25%), $GOOGL (+2,74%), $MSFT (-1,12%) – Their global impact is massive and they are solid, and I don’t see that changing anytime soon.

- $VST (-1,71%) – AI-driven energy demand is booming, and I chose Vistra Energy over other AI-linked power plays.

- ✅ European Exposure 🌍

- $ENR (-0,24%)

(Siemens Energy) – A standout performer this year in Europe, and AI is a key factor in its growth. - $NOVO B (-2,82%)

(Novo Nordisk) – The obesity epidemic is a growing concern (also in Europe), and Novo Nordisk is a leader in the space. - ✅ More Speculative Plays :

Palantir & Soundhound AI – Both are AI-related but carry higher risk. $PLTR (-1,99%) because of its massive presence in States' affairs. $SOUN is an even more speculative AI bet, but I believe in it for the voice aspects. - ✅ Employee Shares : $ENGI (-0,76%)

C. Crypto

I chose Bitcoin mainly due to its volatility and the potential for "easy profits". I initially invested in July and, seeing Trump getting closer to the White House, I decided to increase my position, anticipating potential market movements linked to his policies and the broader macroeconomic environment. For now, I’m sticking to Bitcoin but might explore XRP and other assets in the future.

4. Insight into how I plan to further expand your portfolio

Based on my calculations, I should reach €100,000 invested by late 2025 or early 2026. My plan is to keep investing consistently to get closer to the allocation I outlined earlier.

A. Expanding My Stock Portfolio 📈

I plan to maybe reinforce some existing positions but overall exploring new opportunities. Some stocks I’m considering include:

- Belgium: Syensqo, D’Ieteren

- France: Schneider Electric

- Banking sector: JP Morgan

- E-commerce & emerging markets: MercadoLibre

- Quantum computing: While highly speculative, I’m keeping an eye on this sector for the future. Since I already have exposure through Alphabet, I might consider IBM later on.

- Biotech & Medical Startups 🧬: I’ve been tempted by some early-stage medical stocks, but the extreme volatility and risk keep me hesitant. A single failed clinical trial can wipe out a stock forever, making this sector too unpredictable for me at the moment.

- I might also allow myself the occasional “easy trade”, but nothing certain yet.

- Finally, I could include new thematic ETF's.

B. Crypto

For Bitcoin, I keep things simple: I invest €100 whenever I see a dip (sometimes multiple times per day or week), staying patient and accumulating over time. I’m curious to hear your views on where Bitcoin is headed.

C. Reviewing My Strategy in Late 2025 🔍

- At the end of 2025, I’ll assess my portfolio, especially my thematic ETFs, by comparing them to the MSCI World. This will help me decide whether to stick with them or simplify my ETF strategy.

- I’ll also review my stock picks to see if any adjustments are needed.

- Given my horizon, I won’t make any rushed decisions.

D. Managing My Biggest Concern – US Exposure 🇺🇸

One of my main concerns is my heavy exposure to the US market, both through ETFs and stocks. However, given the current global economic landscape, it seems difficult to do otherwise while aiming for maximum returns.

For now, I’ll keep an eye on opportunities to diversify while ensuring that my investments remain aligned with my long-term strategy.

5. What I don’t want in my portfolio

I believe that investing inherently carries a level of amorality, especially when investing in broad-market ETFs that include a wide range of companies (but everyone has their own ethical perspective—let’s not start a debate on that! 😄).

That being said, I personally choose not to invest directly in companies involved in alcohol or tobacco. It’s a personal preference.

6. Conclusion 🎯

That’s it for this deep dive into my portfolio and a summary of my thoughts since May 2024, as well as since I started reading your posts in August.

Thanks for all the insightful discussions and shared knowledge—this is an amazing community, and I really appreciate the posts I read since August!

Have a great weekend and thanks you so much for reading so far!

Regards,

A Belgian investor

Presentation of portfolio logic - feedback welcome!

Hello dear community,

Recently my portfolio and its logic was presented in an article by Business Insider and analyzed by Konrad Kleinfeld from SPDR. There was some exciting feedback, but of course I would also like to activate your swarm intelligence and get your feedback 🙂

First of all: Although I am pursuing a core-satellite strategy, the "satellite" does not aim to outperform, but is simply for fun and offers room for investments that do not fit into the logic of the core. The satellite consists largely of ETFs (e.g. in commodities, real estate, private equity, REITs, etc.), but only accounts for <10% of the overall portfolio and is not included here.

My goal is broad diversification that goes beyond a pure market capitalization-based index as well as long-term returns.

In doing so, I rely on a rule-based approach and diversify along factors based on the selection criteria of the indices. As I deliberately do not want to make any sector or regional bets in the "core", but instead focus purely on the selection criteria of the indices, the relatively significant dividend block serves to reduce the US lump, as high-dividend companies are more frequently found in Europe.

Since the portfolio is quite granular, the portfolio overview function would be very confusing, so I hope it is easy to understand in text form:

1. MSCI World Block (40%):

$SPPW (-0,3%) MSCI World (10%)

$XDEM (+0,17%) MSCI World Momentum (10%)

$XDEQ (+0,11%) MSCI World Quality (10%)

$XDEV (-0,2%) MSCI World Value (5%)

$WSML (+0,35%) MSCI World Small Cap (5%)

Momentum, Quality and Size in the sense of the "normal", market-capitalized MSCI World are weighted slightly higher, as they have historically performed better and should logically perform better in a long-term positive market environment.

2. emerging markets block (20%):

$SPYM (+1,17%) MSCI Emerging Markets (6.67%)

$SPYX (+1,33%) MSCI Emerging Markets Small Cap (6.67%)

$5MVL (+1,43%) MSCI Emerging Markets Value (6.67%)

⚠ There are currently no ETFs on the MSCI EM Quality and MSCI EM Momentum indices that are available in UCITS form and tradable in Europe. Therefore, the logic of the EM block does not yet exactly reflect the structure of the World block. As soon as these ETFs are available, the block will be adjusted accordingly. Consequently, the "normal" MSCI EM as well as the value factor and small caps are currently equally weighted here.

3rd Dividend block (30%):

$VHYL (+0,15%) FTSE All-World High Dividend Yield (5%)

$TDIV (-0,18%) Developed Markets Dividend Leaders (10%)

$ISPA (+0,25%) Global Select Dividend 100 (10%)

$ZPRG (+0,42%) S&P Global Dividend Aristocrats (5%)

As mentioned, this block serves 1) to reduce the US lump, is also distributing and thus provides cash flow, which 2) is used for rebalancing at the end of the year (so I don't have to spend any additional capital on this, which has a psychological effect for me) and 3) the monthly distributions motivate me to continue investing intensively. In addition, 4) the tax-free allowance is utilized without having to actively sell shares in the other "blocks". The top 10 holdings of the individual ETFs differ greatly here despite the common denominator of "high yield". However, the financial sector is a large lump. The weighting here is derived from the high yield and diversification in the sense of complementing the other "blocks" (i.e. little tech and little US).

4. hedge bonds (10%):

$IBCI (+0,32%) Euro Inflation Linked Government Bond (10%)

My equity allocation is (roughly) based on the rule "120 minus age", so 10% is currently left for bonds. The purpose of a bond block in the portfolio is stabilization and further diversification. With shares, I give a company capital, i.e. I become a stakeholder in the company. Corporate bonds have the same logic, because here I am also giving capital to companies. That's why I opted for government bonds in the eurozone. TIPS have performed comparatively well here in the past and the logic of inflation-linked interest rates also appeals to me.

📈 Additional considerations:

1. i deliberately do without the "Low / Min Volatility" factor, as i assume a rising market in the long term and would like to participate more in the positive phases instead of reducing the vola.

2) I don't see overlaps between ETFs as a problem, but rather as a deliberate overweighting of companies that fulfill several criteria at the same time. Of course, many companies currently overlap in the classic MSCI World and the Quality and Momentum variants. However, the selection criteria are different and as soon as a company no longer meets the quality criteria, for example, it automatically drops out of the index and the weighting is reduced without me having to actively do anything about it.

3) I have actively decided not to invest in a multi-factor ETF because I want to have transparent control over the allocation of the individual factors and many of the factor ETFs available combine the selection criteria underlying the individual factors in such a way that the corresponding product would have performed well in the past, which of course represents a hindsight bias and does not necessarily correlate with future performance.

💡 To those of you who have read this far:

First of all, thank you for your time! The portfolio is intended to dynamically reflect a section of the market that could develop positively in a diversified manner based on the different selection criteria of the indices, without taking bets on specific sectors or regions. What do you think of the allocation and the strategy? Do you see any room for improvement or things you would do differently?

Thanks for reading, showing interest and thinking along. 😊

My Rewind 2024 - Getquin wrapped

Preface:

In the following, I would like to present how my portfolio has developed over the course of 2024.

This includes

1) my strategic orientation

2)Return on the portfolio.

The main topics are:

- Moving away from individual stocks

- Entry into gold and bitcoin

- Factor investing

Finally, I will give my own thoughts on how to proceed.

The main changes to my portfolio that have led

to my current strategy are presented below using a short timeline.

timeline:

My timeline

Beginning of 2024

At the beginning of the year, I pursued a 70/30 core satellite

strategy. The 70% ETF core again consisted of STOXX Europe.

MSCI World, Emerging Markets.

The 30% consisted of stocks such as: $CSIQ (-0,09%) , $O (+0,22%) ,$TSM (+1,06%)

$ADM (-1,54%)

$UMI (-2,75%)

$D05 (+0,53%)

$BMW (-0,38%)

$UKW (-2,27%)

$8031 (-0,74%)

$MUV2 (+0,54%)

February

Addition of gold to my portfolio. Target size 10%. Build-up in batches.

The remaining 70/30 strategy therefore only relates to the remaining

90%.

April-June:

Entry into Bitcoin via Trade Republic in several batches

at prices between 50k and 63k.

After exchange with @Epi to the fee schedule at Trade Republic

I sold them there in order to sell Bitcoin on a dedicated crypto exchange.

exchange.

June:

Thanks to @PowerWordChill I got to grips with factor investing. A Gerd Kommer book later, and after some internet research, I decided to

decided to transform my ETF strategy into a factor ETF strategy.

July-August 2024:

Sale of my shares. Concentration on the factor portfolio.

August - September 24:

Renewed build-up of Bitcoin with the aim of making Bitcoin a

a fixed component of the portfolio. Consideration is 5%-10%

of my portfolio.

The idea. Build up an initial position, then make regular

investments of €50 per week with the aim of growing to the target size

to grow to the target size. The rapid rise in October/November led me to

led me to leave it at €50 per week. And individual purchases in

larger tranches at an early stage with a portfolio size of 2.x%.

End of December 2024:

Position size of Bitcoin almost 5%.

I am not yet including Bitcoin in my gold/ETF quota. I'm still running it on the side.

I re-evaluated my factor weighting at the end of the year

and would like to fine-tune it a little. I will briefly present the result in the

following section.

In addition, I have decided to include a small

include a small proportion of real estate stocks. However, this will probably never

part of my strategy worth mentioning and contains - as of today - only

about 3% of my portfolio and only $O (+0,22%) ).

Overall breakdown of my portfolio:

As described above, I do not yet include Bitcoin in my overall strategy

part of my overall strategy so that rebalancing remains easier. This will

change when Bitcoin reaches its target size.

The rest is made up as follows:

ETFs:

$XDEM (+0,17%) 30.3% (MSCI World Momentum)

$XDEB (-0,43%) 10.1% (MSCI World Minimum Volatility)

$XDEV (-0,2%) 10.1% (MSCI World Value)

$ZPRV (-1%) 15% (MSCI USA Small Cap Value Weighted)

$ZPRX (+0%) 6.5% (MSCI Europe Small Cap Value Weighted)

$PEH (+1,25%) 4.5% (as a quality factor on emerging markets)

$5MVL (+1,43%) 4.5% (Edge MSCI EM Value)

$SPYX (+1,33%) 9% (MSCI EM Small Cap)

Gold

$EWG2 (+3,16%) 10% Gold ETC

Getquin Rewind and own data:

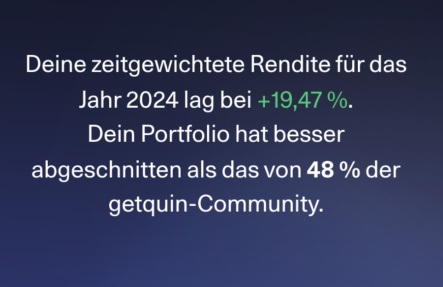

At the end of the post you will find my Getquin Rewind, as I was not able to embed the image in the text:

However, according to my own calculations, this cannot be correct.

My portfolio volume at the start of the year was around €103,500 with a return of €16,693. This would correspond to a total return of 19.2%. However, we are not yet talking about a time-weighted return, as my invested capital has roughly doubled over the course of the year. I therefore estimate my TTWROR to be higher.

My own thoughts and outlook:

I do not expect any major changes in strategy over the next few years. At some point, a strategy will have to be established. If necessary, I will make some adjustments to this strategy.

This includes the fact that I am dissatisfied with the costs of the emerging markets factor ETFs. So far, however, I intend to live with it. Should I

stumble across better products, I will consider switching. Especially as long as I stay within the tax allowance when switching.

I'll also have to decide how big my Bitcoin holding should ultimately be.

If you've been reading carefully, you'll notice that a lot of money has accumulated in the last year. Big profits, big investments. Due to personal circumstances, I will not maintain these rates in the same style, but will reduce them somewhat. I expect to be able to continue investing around 1.5-2k per month. This means that my financial goals are

with an expected return of 5% adjusted for inflation over many years.

I am half hoping for major setbacks in the near future and the associated favorable entries. However, in view of the impact that minor price jolts have had on society as a whole (thanks to populism), I don't really wish for them.

Do you have any suggestions, questions or comments? Is there anything that particularly interests you?

I am also happy to receive suggestions for improvement for future posts.

Best regards,

Your Smurf

PS: @DonkeyInvestor and me, that's love ❤. And now send me your coins! (So I can reward your next post appropriately).

PPS: I hope someone is interested.

Hello, my Birthday is today and im turning 18 years old. Now I have the independence and support of my parents to invest.

I'm an 18-year-old Brazilian just beginning my investing journey, and I'd like to share my investment strategy for feedback from more experienced investors. I recently moved to Saudi Arabia, where I’m awaiting my iqama (residency permit). My father has one, and he’s handling the application for mine. I live under my parents’ tax forum, and they currently handle any tax obligations. With 1,000 euros ready to invest, I’m excited to build a portfolio with a balanced approach to growth and risk, starting with ETFs and, over time, branching out to include individual stocks and crypto.

Initial Investment Strategy

My primary goal is to create a foundational portfolio entirely focused on ETFs until I reach a portfolio size of 5,000 euros. Here’s the breakdown of my initial plan:

1. 50% IWDA $IWDA (-0,28%) (iShares MSCI World ETF): I’m allocating half of my starting capital to the IWDA ETF to establish a core of diversified global exposure. The IWDA covers large- and mid-cap companies in developed markets, giving me solid coverage across sectors and geographies.

2. 25% $XDEM (+0,17%) MSCI World Momentum ETF: I’m dedicating a quarter of my portfolio to the MSCI World Momentum ETF. My goal here is to capitalize on stocks that are currently outperforming in the global market, with the understanding that momentum strategies can offer higher returns (though with greater volatility). I want this portion to add a growth element to my portfolio.

3. 25% $XDEQ (+0,11%) MSCI World Quality ETF: I’m putting the remaining quarter into the MSCI World Quality ETF to provide balance. The Quality ETF focuses on stable, financially strong companies with high returns on equity, low debt, and stable earnings growth. I see this as a stabilizing element to counterbalance the volatility of the Momentum ETF.

Monthly Contributions and Cash Reserve Strategy

My dad will be giving me $150 each month, and I plan to divide this as follows:

- $100 per month into the ETF portfolio: This consistent investment will go towards expanding my ETF positions and growing my portfolio gradually over time.

- $50 into a liquid cash interest account: I’ll use this account as a cash reserve that’s easily accessible, enabling me to buy into individual stocks when they appear undervalued or experience significant dips. This approach lets me take advantage of market corrections and buy solid assets at better prices, adding a tactical layer to my strategy.

Long-Term Portfolio Allocation Goals

Once I hit $5,000 in my ETF portfolio, I’ll shift focus to incorporate individual stocks, with the goal of making them around 45% of my total allocation. Here’s my intended breakdown for this part of the portfolio:

1. 25% “Strong” Companies: This portion would go to large, well-established companies that generate significant cash flow. I’m particularly interested in the Magnificent 7, as these tech giants have strong fundamentals and an impressive cash flow, even though they come with valuation risks. I see them as a solid foundation for long-term growth.

2. 25% Quality Dividend Growth Stocks: I want a portion of my stock allocation to focus on high-quality, dividend-paying stocks, particularly those that have been overlooked or undervalued. This segment is intended for income and stability, with the aim of reinvesting dividends to take advantage of compounding over time.

3. 25% Value Stocks: For this segment, I’ll look for undervalued stocks that have solid fundamentals but may be trading below their intrinsic value. This is a more opportunistic approach that lets me capitalize on underpriced assets for potential upside.

4. 25% High-Growth Stocks: Finally, I plan to reserve a portion for high-growth stocks with strong upside potential. This is the riskiest portion of my stock allocation, focusing on companies in fast-growing sectors or those with strong innovation prospects.

In addition, I plan to introduce crypto as a small allocation—around 5% of my overall portfolio—to capture any high-growth potential. I recognize the volatility and risk associated with crypto, so I’m keeping this exposure small and will prioritize established coins with strong fundamentals.

Risk Management and Future Adjustments

Given my age and a long investment horizon, I’m comfortable taking on higher risks in this early stage. I’m looking for growth opportunities and am willing to accept market volatility as part of the process. However, I recognize the importance of a gradual shift toward stability, and I plan to adjust my portfolio composition as I age and my financial needs evolve.

By the time I reach my mid-30s, I intend to focus more on financial security and risk management, gradually adding defensive assets to the mix. This could mean increasing allocations in dividend-paying stocks, bonds, or even safer ETF options that emphasize preservation of capital. I also plan to establish an emergency fund to cover at least six months of living expenses, providing financial peace of mind and further stabilizing my overall financial position but this will happen once I move out of my parents house.

Seeking Feedback

I’m excited to start investing and am eager to hear if this strategy aligns well with my goals and circumstances. I’d love any suggestions on specific ETFs, stocks, or crypto that might be worth considering, or advice on adjustments I could make to further diversify or optimize my plan. Thanks in advance for your insights!

Hello dear Getquin Community,

I would like to share my portfolio with you as an update.

You are welcome to give your opinion or suggestions for improvement.

Briefly about me:

I am 19 years old, live in Austria, work in an apprenticeship as a design engineer and have a monthly savings rate of 51.60% and 32.25% I invest, which is a total of €500 as an investment.

I started investing in mid-January 2024.

At my last update 6 months ago, my portfolio was still about 2.4k euros.

Deposits:

Etf - Depot (Flatex)

55/25/10/10

55% $XDEM (+0,17%)

25% $FVSJ (+2,3%)

10% $WSML (+0,35%)

10% $C6E (+0,41%)

Crypto - Depot (Bitpanda)

I know that my crypto positions are somewhat high and risky.

But I can cope well with this risk 🤣

Nevertheless, I have given up my altcoin position and don't hold that much of it and the only ones I have now are

I would rather look to invest in novo, asml, lvmh, especially in Europe (which also have good prices at the moment)

$XDEM (+0,17%) Momentum ETFs are fun when the momentum repeats. We are probably on the verge of a Momentum Change. I wonder if on the next rebalance the fund Will reajust enough for the new upcoming momentum, that is what Will make any decision to either keep using it or not. From what I have read, I fear there might be a 6 month lag on a proper readjustment, lets wait and see.

Títulos em alta

Principais criadores desta semana