Another strong year with a lot of profit. After a return of around 40% in 2024, I was able to achieve another strong return of 26% in 2025. I was able to realize a large part of the profit with my two Tenbagger shares $RGTI (+0,17%) and $PLTR (+2,91%) but the rest also performed quite well.

Due to the high gains in the two individual stocks, the weighting in my portfolio shifted massively and I took this as an opportunity to really tidy things up.

Portfolio realignment 2026

I would like to share the strategy I am pursuing with you. I have not yet reached the desired weighting, but I am slowly getting closer again.

The strategy is based on 3 different pillars and looks as follows:

CORE: ALL WORLD AND SWITZERLAND(40%)

The core consists of the broadly diversified world ETF $VWRL (-1,61%) (approx. 30%) and with approx. 10% $CHSPI (+0,05%) as an overweight of the home market

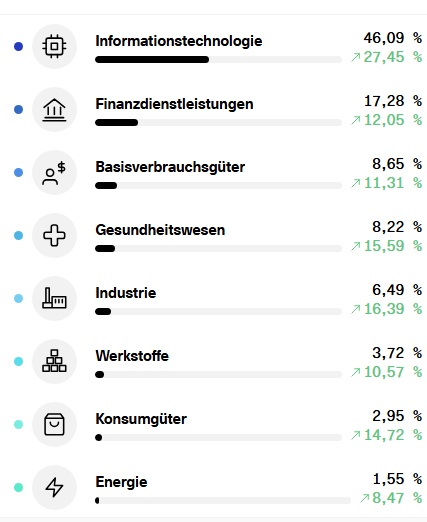

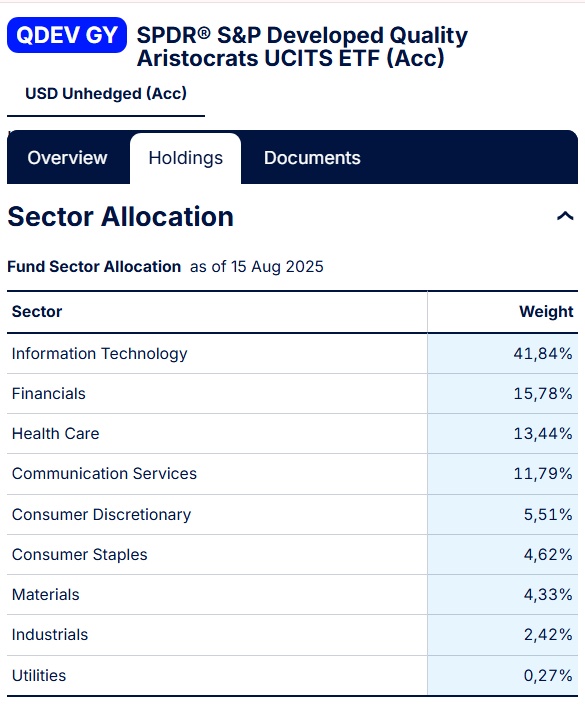

GROWTH AND QUALITY (35%)

The second part consists of some quality stocks with solid growth or dividends such as $SREN (-1,5%)

$ROG (-3,01%)

$BION (-1,48%)

$MSFT (-0,48%)

$SIE (-0,81%) and the two trend tech ETFs $SMH (-3,8%)

$XAIX (-1,13%)

TENBAGGER SATS (20%)

Here I look for promising companies that have the potential to multiply and invest small amounts (currently max. CHF 1000). This is of course a high-risk investment, but I try to outperform with these stocks. By selling some of my tenbaggers, I was able to add new candidates to my portfolio.

These are all my potential price rockets:

$PLTR (+2,91%) : my first Tenbagger. Here I have already realized around ten times my investment through partial sales. The rest will remain in the long term.

$RGTI (+0,17%) : my second Tenbagger. I have realized approx. 8.5 times the stake through partial sales. The remainder is also left lying around.

$TER (-10,17%) Chip testing, benefits massively from the AI chip boom.

$CELH Fitness energy drinks with strong growth and expansion into the mass market.

$CRSP (-2,82%) Gene editing with huge health potential.

$MIPS (+1,7%) : Safety systems for helmets. The technology is licensed to numerous helmet manufacturers in the sports and industrial sectors.

$RKLB (+0,84%) : Rocket launches and satellites and established SpaceX chaser.

$JOBY (-0,6%) Pioneer in urban mobility with air cabs and vertical take-offs.

$NU (-0,93%) Digital neobank with enormous scaling potential in underserved markets such as Brazil, Mexico, etc.

$RBRK (+2,7%) Cybersecurity

$IONQ (+0%) Quantum computing. Highly speculative moonshot potential for computing power beyond classical computers.

I also hold approx. 5% in Bitcoin