$BNTX (+0,89 %)

$ON (-3,41 %)

$HIMS (-2,86 %)

$PLTR (-0,28 %)

$O (+1,17 %)

$8058 (+2,47 %)

$7974 (-1,6 %)

$BP. (+1,27 %)

$BOSS (-0,16 %)

$SWK (-2,03 %)

$SPOT (+1,54 %)

$N1CL34

$UBER (+0,61 %)

$CPRI (-1,03 %)

$SHOP (-4,47 %)

$RACE (+0,55 %)

$HOG (-1,44 %)

$HTZ (-1,08 %)

$PFIZER

$UPST (-6,94 %)

$ANET (+0,78 %)

$PINS (-3,96 %)

$TEM (-2,16 %)

$AMD (-1,65 %)

$SMCI (+0,73 %)

$RIVN (-2,19 %)

$BYND (+15,18 %)

$KTOS (-2,08 %)

$CPNG (+4,88 %)

$BMW (+0,76 %)

$NOVO B (-0,38 %)

$FRE (-0,43 %)

$ORSTED (-1,31 %)

$AG1 (-0,95 %)

$EVT (+1,34 %)

$CCO (+0,13 %)

$DOCN (+0,87 %)

$LMND (-6,68 %)

$SONO (-3,11 %)

$MCD (+1,05 %)

$HOOD (-3,35 %)

$QCOM (-2,14 %)

$FTNT (-0,74 %)

$FSLY (+1,2 %)

$HUBS (-0,43 %)

$ELF (+0,09 %)

$ARM (-1,65 %)

$SNAP (-1,92 %)

$DASH (-0,63 %)

$APP (-1,86 %)

$AMC (+0,77 %)

$ZIP (-4,36 %)

$FIG (-1,58 %)

$LCID (-5,31 %)

$DUOL

$UN0 (-0,14 %)

$CBK (-3,34 %)

$DEZ (+2,67 %)

$ZAL (-0,6 %)

$HEN (+0,46 %)

$MAERSK A (+1,22 %)

$HEI (-0,7 %)

$CON (-1,6 %)

$AZN (+2,59 %)

$ALB (-2,14 %)

$MRNA (-0,26 %)

$QBTS (-10,7 %)

$WBD (-2,66 %)

$LI (-1,65 %)

$RHM (-0,51 %)

$DDOG (-0,76 %)

$RL (-3,09 %)

$OPEN (-0,61 %)

$ABNB (-0,29 %)

$PTON (-2,16 %)

$MP (+0,1 %)

$TTD (-0,49 %)

$STNE (-0,11 %)

$SQ (-7,71 %)

$GRND (-5,12 %)

$IREN (-6,23 %)

$AFRM (-8,15 %)

$CRISP (-0,05 %)

$RUN (-32,12 %)

$7011 (+1,92 %)

$DTG (+0,83 %)

$HAG (-2,95 %)

$DKNG (-0,3 %)

$LAC (-1,96 %)

$KKR (-6,02 %)

$PETR3 (+0,89 %)

$CEG

$WEED (-0,42 %)

Mitsubishi

Price

Discussion sur 8058

Postes

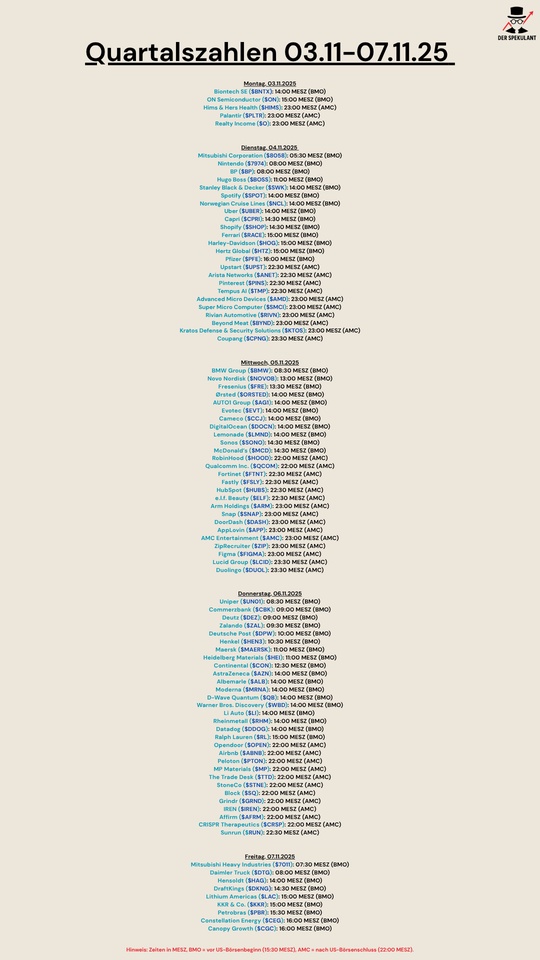

18Quartalszahlen 03.11.25-07.11.15

Warren Buffett focuses on Japan - 5 stocks in focus

In the Berkshire Hathaway portfolio $BRK.B (+0,3 %) Warren Buffett has the companies Mitsubishi $8058 (+2,47 %), Mitsui $8031 (+2,95 %), Itochu $8001 (+2,05 %), Marubeni $8002 (-0,29 %) and Sumitomo $8053 (+3,55 %).

The five companies are conglomerates. They do business in many different sectors: Industrial metals, oil and gas, food and agriculture, automotive supply chains, infrastructure, real estate, finance, industry, chemicals, media, digital technology, consumer goods and healthcare.

"We like their capital allocation as well as their management and attitude towards shareholders," said Buffett, explaining his decision to buy. "All five companies increase their dividends when appropriate, they buy back their own shares when it makes sense, and their top managers are far less aggressive in their remuneration programs than their US counterparts," the well-known investor continues.

However, the economic environment in Japan is anything but rosy at the moment: corporate profits were weak in the second quarter and suffered above all from the US tariffs.

The country's demographics also harbor risks for Japan investors. "Japan's structural problems are likely to remain unsolved because the ageing society has no strength for reform," warned Gunther Schnabl, Director of the Flossbach von Storch Research Institute in Cologne.

Buffett, known as the "Oracle of Omaha" after his US headquarters, has selected Japanese companies that diversify across different sectors and cycles, benefit from commodity trading and also pay high dividends. Commodities traditionally perform well in an internationally inflationary environment.

For investors, this means that bargain hunters can currently come across undervalued quality stocks in Japan whose diversified business segments are able to cope well with possible international risks.

Source text (excerpt): Handelsblatt, 28.09.25

Review of August 2025

📈 Performance:

S&P500: +1.51%

MSCI World: +1.76%

DAX: +2.59%

Dividend portfolio: +4.24%

My high and low performers in August were (top/flop 3):

🟢 $UNH (+1,44 %) UnitedHealth +16.78%

🟢 $ADM (+0,59 %) Archer Daniels Midland +12.33%

🟢 $8058 (+2,47 %) Mitsubishi Corp. +12.05%

🔴 $LLY (+0,95 %) Eli Lilly -5.99%

🔴 $MSFT (-0,13 %) Microsoft -7.51%

🔴 $CTAS (+0,62 %) Cintas -9.20%

Dividends:

August 2025: €129.54

August 2024: € 101.41

Change: +27.74% 🥒

Sales:

🟥 $7974 (-1,6 %) Nintendo (6 pcs.) +100%

Purchases:

🟩 $PG (+1,14 %) Procter & Gamble (4 pcs.)

Savings plans:

- ($CTAS (+0,62 %) ) Cintas (50€)

- ($MC (-1,61 %) ) LVMH (50€)

- ($MSFT (-0,13 %) ) Microsoft (25€)

What else has happened?

The tax assessment notice has arrived and the back payment has increased to 4100€. Funnily enough (typical for Germany), the advance payment is calculated on the basis of this year. As everything seems to run automatically, nobody checks whether this makes sense. In any case, the tax office assumes that I will have to pay the same amount again next year (or more) and tells me that I should pay €6500 in advance. Of course, I'm now asking for a recalculation. But that's a lot of work again, which could have been avoided if someone had just looked over it. Then they would have seen that this was a one-off. Well, what else do I expect these days.

The appointment at the garage has been arranged for the beginning of September. Let's see what else is in store for me.

I'm going on vacation at the end of September. That will be necessary again. My last vacation was last year around Christmas.

🥅 Goals for 2025:

Deposit of €10,000 and thus a deposit volume in the share portfolio of ~€73,000

Target achievement at the end of August 2025: 60.58%

How was your August?

If you liked the report and would like to read more, feel free to follow me,

If you're not interested, you can keep scrolling or use the block function.

Primetals, Mitsubishi, voestalpine and Rio Tinto build hydrogen-based iron production plant

Primetals Technologies, together with its partner Mitsubishi $8058 (+2,47 %)the steel manufacturer voestalpine $VOE (+0,35 %) and the mining group Rio Tinto $RIO (-0,21 %) signed a cooperation agreement for the construction of an industrial-scale prototype plant for hydrogen-based iron production in Linz, Austria.

The aim of the partners is to drive forward the development of fluidized bed and smelting technologies that could lead to net-zero CO2 emissions in iron production. The plant, which is scheduled to go into operation in mid-2027, will be the first time that a hydrogen-based direct reduction plant for fine ore will be integrated with a smelting plant producing pig iron briquettes, pig iron and pig iron.

The prototype plant will combine two core technologies of Primetals Technologies - hydrogen-based fine ore reduction (HYFOR) and the smelter. HYFOR is the first DR technology for processing iron ore fines without agglomeration and has been in pilot operation at the voestalpine Donawitz site since 2021. The smelter uses renewable energy to melt and further reduce the direct reduced iron (DRI), producing pig iron with potentially zero CO2 emissions.

"This project represents a significant step forward in future-proof ironmaking - for the first time we will implement a continuous production process with hydrogen-based direct reduction," said Alexander Fleischanderl, Chief Technology Officer and Head of Green Steel at Primetals.

"The combination of HYFOR and Smelter is a highly innovative development that has the potential to change the industry, similar to how the LD converter (BOF) has impacted steel production. We are very proud to have voestalpine, Rio Tinto and Mitsubishi as strong partners and together we are able to play a key role in shaping the future of ironmaking with net CO2 emissions."

The new plant will have a capacity of three tons of pig iron per hour.

Mitsubishi, a strategic partner in the development, will support the expansion of the technology through its ferrous raw materials business. "Mining and trading of ferrous raw materials has been one of our core businesses for many decades, and we intend to develop a new range of low-emission metals to support the decarbonization of the steel industry," said Kenichiro Tauchi, COO of the Group's ferrous raw materials business.

"HYFOR and Smelter are promising new technologies to accelerate the decarbonization of the steel industry, and Mitsubishi Corporation is pleased to participate as a strategic partner of Primetals Technologies in the development of these breakthrough technologies together with leading partners in the steel supply chain."

voestalpine sees the project as being in line with its greentec steel strategy. "With greentec steel, voestalpine has a clear step-by-step plan for CO2-neutral steel production," says voestalpine CEO Herbert Eibensteiner.

"As a first step, a green electric arc furnace will be put into operation at both the Linz and Donawitz sites from 2027. By 2029, we will reduce our CO2 emissions by up to 30% compared to 2019. This corresponds to almost 5% of Austria's total annual CO2 emissions and makes greentec steel the largest climate protection program in Austria. Our long-term strategy is to achieve climate-neutral steel production with green hydrogen. Together with Primetals Technologies and Rio Tinto, we are taking a completely new and promising path in research into hydrogen-based pig iron production."

Rio Tinto, one of the world's largest iron ore producers, will supply 70% of the iron ore feedstock for the plant, sourced from its Pilbara operations, the Iron Ore Company of Canada and the future Simandou operations.

"We are pleased to join a consortium that covers the entire iron and steelmaking value chain," said Thomas Apffel, General Manager for Steel Decarbonization at Rio Tinto. "By contributing our ironmaking expertise and iron ore from the Pilbara, Iron Ore Company of Canada and the future Simandou operations, we aim to drive the development and adoption of fluidized bed technology. This fines-based ironmaking solution is a compelling alternative to shaft furnace technology as it eliminates the need for pelletization, which can offer significant benefits to both steelmakers and mining companies. Rio Tinto welcomes the addition of further participants to the consortium and looks forward to supporting the widespread adoption of this innovative technology."

The project has been supported by several EU and Austrian government initiatives. These include the Austrian Federal Government's "Transformation of Industry" program managed by Kommunalkredit Public Consulting (KPC), the "Twin Transition" initiative managed by Austria Wirtschaftsservice (aws), the EU Coal and Steel Research Fund under the Clean Steel Partnership and the EU's Clean Hydrogen Partnership under the Hydrogen Valleys.

Timing is right 🕰️ (exceptionally)

For some time now $9984 (+0,52 %) on my watchlist for several reasons:

- Fair valuation 🤝

- Japan underrepresented in PF 🇯🇵

- Communications sector underrepresented in PF ☎️

For once, I managed the first strike with good market timing. The amount should grow over time via savings plans. There is a lot to gain for the company in the next few years 💯

I am unsure about following up on $8058 (+2,47 %)which I also consider to be very fairly valued...

Nissan and Honda consider merger

The Japanese car manufacturers Honda $7267 (+0,57 %) and Nissan $7201 (+1,3 %) are considering a merger, according to media reports.

The joint production capacities, sales channels and development departments could thus strengthen their own market position in the battle against Chinese manufacturers.

It is also possible that Mitsubishi $8058 (+2,47 %) may also become part of the new alliance.

No exact deal has yet been made.

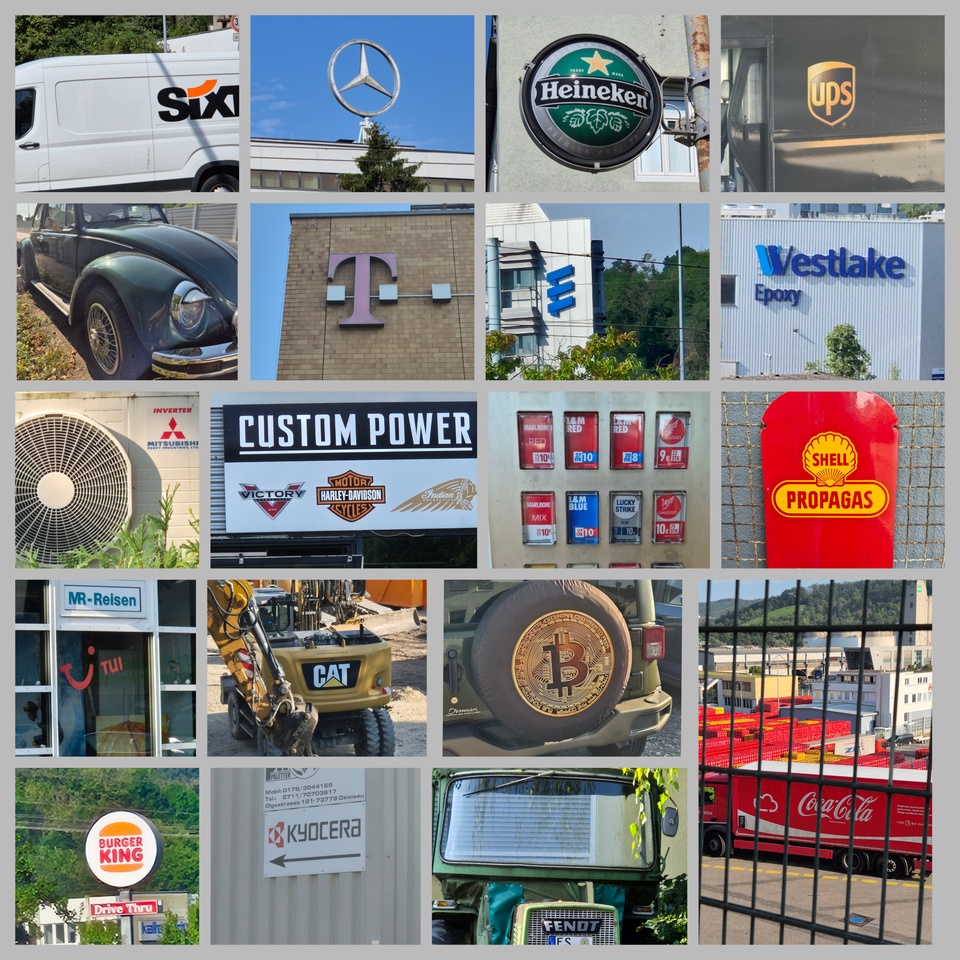

Share march, 30km route with 35 share companies

First day of vacation, 32°C and a 30km walk towards Stuttgart. I was able to find over 35 stock companies along the route.

Highlight, $BTC (-2,43 %) Bitcoin logo on the wheel arch of the Jeep.

In addition to the car brands, $MBG (-0,03 %)

$DTG (+0,83 %)

$VOW (+0,3 %)

$BMW (+0,76 %)

$VOLV B (+1,01 %)

$TSLA (-1,27 %)

$1211 (-0,1 %)

$P911 (-0,34 %)

$F (-1,06 %)

$8058 (+2,47 %) I was able to discover numerous other companies that were new to me.

New for me was $6971 (+1,6 %) Kyocera, a manufacturer of electronic devices from Japan and $WLK (+2,36 %) Westlake Chemical from the USA.

From Germany there were also $SIX2 (+0,5 %) Sixt $DTE (+3,41 %) Telekom $TUI1 (-1,69 %) Tui $AGCO (+0,04 %) (Fendt) $256940 Eberspächer (supplier to the automotive industry) $SIE (-0,47 %) Siemens $EBK (-0,45 %) ENBW $DHL (+0,7 %) Post and $ALV (-0,35 %) in the process.

Other companies:

$CAT (-1,73 %) Caterpillar $HEIA (+1,53 %) Heineken $HOG (-1,44 %) Harley Davidson $PM (+0,74 %) Philip Morris $NKE (-2,44 %) Nike $AAPL (-1,64 %) Apple $005930 Samsung $UPS (+0,33 %) UPS $SHEL (+1,53 %) Shell $V (+0,87 %) Visa $MA (+0,54 %) Mastercard $KER (-0,49 %) Kering

$KO (+1,04 %) Coca-Cola $QSR (+2,25 %) Restaurant Brands (Burger King)

$O (+1,17 %) Reality Income (leased to Decathlon)

Would you have recognized everything? It's interesting what you discover when you consciously look around.

Out of interest, please link if you post something similar 🫡 or use the #aktienmarsch

📈 Furious start to 2024 for the $XDJP 🇯🇵

The Nikkei 225 index rose by 13.5% in the first seven trading weeks of the current year and things are also looking very good for Japanese quality stocks in the near future (e.g. $6758 (+2,52 %)

$8058 (+2,47 %)

$9434 (+0,74 %) ) are looking very good.

Hier die ZusammenfassungWhy Japanese shares are particularly interesting at the moment

A number of positive factors such as robust GDP growth and investments in the semiconductor industry have already supported the index in the first two months. In addition, the hype surrounding artificial intelligence is also boosting the market there, while improved corporate governance and share buybacks are strengthening investor confidence. (1)

Despite a temporary dip in the Japanese economy in the second half of 2023, GDP growth should continue to surprise on the upside. More on this from paragraph 3 of the Artikels.

How can you participate now?

The SG Japan Quality Income Index (Fig. 1) would be one way to participate specifically in the performance of Japanese quality companies. It comprises 60 companies that have been selected on the basis of good financial ratios and their dividend strength, among other factors.

If Japanese dividend stocks were not perfect for reducing the US overrepresentation in the portfolio (as @PowerWordChill

it would do🌚) ?

More information on the index selection process:

https://www.ideas-magazin.de/2024/ausgabe-263/titelthema/

(1)Section "Corporate governance and other drivers"

(3) ibid. "Japanese economy with dip in the second half of 2023"

#finance 📊

This article is part of an advertising partnership with Societe Generale

but I've been looking for another individual stock for my savings plan for some time, preferably a dividend growth company of course. Unfortunately, I haven't found one yet.

I sold a few shares of my AMD derivatives after a gain of almost 50% and invested them in $8058 (+2,47 %) Mitsubishi (thus 2nd Japanese share).

Which dividend-free stocks do you recommend? I would like to get another derivative. I have Meta and AMD as derivatives (5 leverage).

Titres populaires

Meilleurs créateurs cette semaine