As every Sunday, the most important news from the past week, as well as the dates for the coming week.

Also as a video:

https://youtube.com/shorts/cpIdQFYiLeY?si=gaKXoxc1Q7c_VbNC

Sunday:

Due to industrial overcapacity, deflation is depressing prices in China. Prices there fell by an average of 0.7% compared to the same month last year. The reason for the decline was probably a high basis for comparison from the previous year, as well as government programs to boost consumption.

https://www.handelsblatt.com/finanzen/geldpolitik/deflation-verbraucherpreise-in-china-sinken-nach-13-jahren-erstmals-deutlich/100112409.html

Monday:

$HFG (-2,28 %) Hellofresh shocks the markets with a sales warning, down more than 10%. Analysts at JP Morgan continue to see the price target at 15 euros. This is because EBITDA is expected to rise again. Hellofresh is dispensing with expensive marketing campaigns, which hurts sales but may increase profits.

https://www.deraktionaer.de/artikel/aktien/hellofresh-schockt-mit-umsatzprognose-aktie-rauscht-nach-unten-20376335.html

Tuesday:

$VOW3 (-0,07 %) Volkswagen is struggling with a drop in sales and profits. Overall, 2.3% fewer vehicles were sold. Sales for 2024 increased minimally by one percent to 324.7 billion euros. Profit fell from 17.8 to 12.3 billion euros.

https://m.bild.de/geld/wirtschaft/zahlen-fuer-2024-volkswagen-gewinn-bricht-um-30-6-prozent-ein-67cfda107831137d2727f9c3

Wednesday:

$P911 (-0,83 %) Porsche earns significantly less. Similar to VW, profits are down by around 30%. The dividend is to remain stable. Turnover is also expected to stagnate in 2025.

https://www.handelsblatt.com/unternehmen/industrie/porsche-gewinn-sinkt-um-30-prozent-dividende-bleibt-stabil/100111337.html

Not only is Rheinmetall's share price rising $RHM (-0,42 %) Rheinmetall is rising, sales are also increasing significantly. Rheinmetall could grow by 34% in 2024. Growth of 25-30% is also expected for 2025. Rheinmetall achieved sales of just under 10 billion euros in 2024. The order backlog grew to 55 billion euros. The dividend is set to rise from 5.70 to 8.10 euros per share.

https://www.handelsblatt.com/unternehmen/industrie/rheinmetall-ruestungskonzern-steigert-umsatz-um-36-prozent-dividende-erhoeht/100112608.html

$TMV (-1,45 %) Teamviewer is celebrating its 20th anniversary, which means the tech company from Göppingen has been around longer than the average lifespan of a German company (around 12 years). Click here for a summary of the company's history:

https://www.finanzen.at/nachrichten/aktien/teamviewer-konzerngeschichte-deutschlands-unsichtbarer-tech-champion-mit-globaler-reichweite-1034321282

US inflation data comes in lower than expected, market bounces back. Compared to the same month last year, prices rose by 2.8%. An increase of 2.9% was expected.

https://finanzmarktwelt.de/inflation-us-verbraucherpreise-niedriger-jetzt-wird-bestimmt-alles-gut-342006/

Thursday:

The fashion group $BOSS (-1,21 %) Hugo Boss from Metzingen wants to increase its dividend to 1.40 euros per share. At 4.31 billion euros, turnover was three percent above the previous year's figure and higher than ever before. Declining sales in China were a particular burden on the Group. Profit therefore fell by 17% to 217 million euros. In the coming year, turnover is expected to stagnate, but profitability is set to increase.

https://fashionunited.de/nachrichten/business/trotz-umsatzrekord-jahresgewinn-von-hugo-boss-sinkt-um-17-prozent/2025031360615

Companies such as $DTG (+0,16 %) Daimler Truck fell significantly after Donald Trump announced that he would relax the emissions regulations for trucks. Daimler in particular has invested billions of dollars in recent years to make its trucks environmentally friendly.

https://www.finanzen.net/amp/trump-im-fokus-daimler-truck-aktie-verliert-aufgrund-von-ergebnissorgen-zweistellig-14313701

With the inflation rate in the USA already below expectations, producer prices are also below expectations. This is particularly interesting, as producer prices are a leading indicator for inflation in the future.

https://www.ariva.de/amp/usa-erzeugerpreise-steigen-weniger-als-erwartet-11567717

Friday:

As with $VOW3 (-0,07 %) VW, BMW's profits are also on the decline. BMW achieved a profit of 7.7 billion euros, 37% less than a year ago. Turnover fell by 8.2% to 142 billion euros. China is the main problem for BMW.

https://www.saarbruecker-zeitung.de/nachrichten/wirtschaft/gewinn-bei-bmw-sackt-ab-die-ganz-fetten-jahre-sind-vorbei_aid-125213969

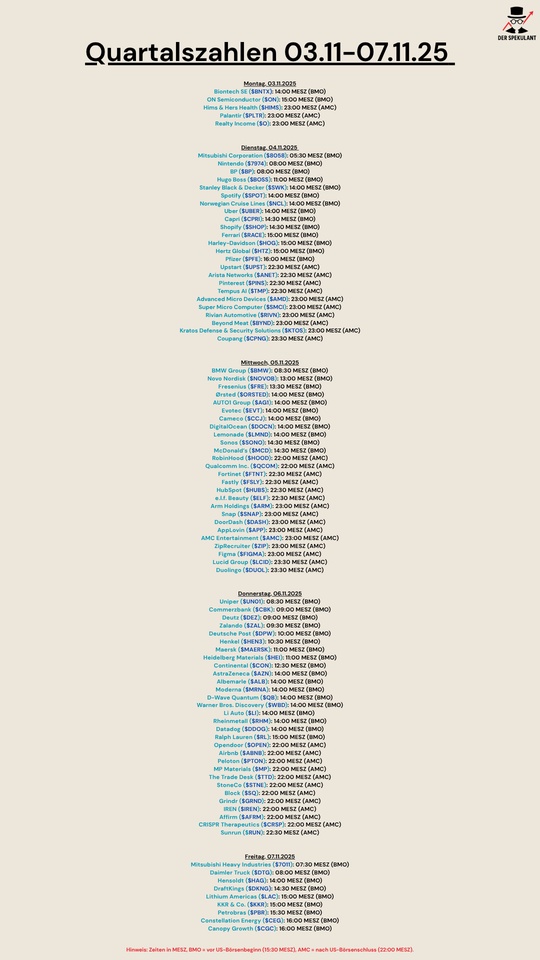

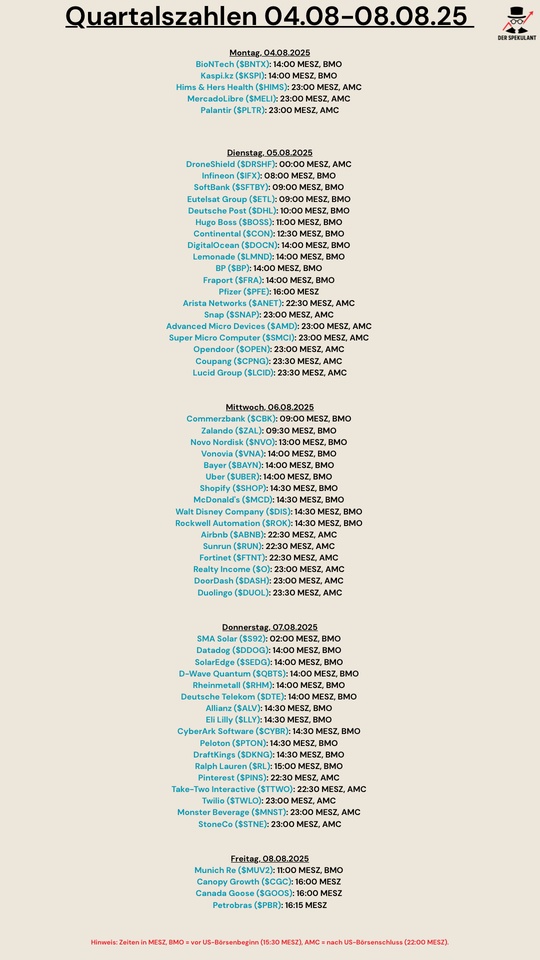

These are the most important dates for the coming week:

Wednesday: 04:00 Interest rate decision (Japan)

Wednesday: 19:00 Interest rate decision (USA)

Thursday: 12:00 Interest rate decision (BoE)

Can you think of any other dates? Write it in the comments 👇

#usa #interest #japan