$SPOT (-0,01 %)

Spotify has come under pressure and is back on the radar. Now things could get exciting again for anti-cyclical investors.

When anti-cyclical investing becomes a success story

It never ceases to amaze me how much time has passed since the last analysis of individual Aktien has passed since the last analysis. But during this time, the share was simply uninteresting for anti-cyclical investors.

However, there were times when it was completely different. From 2022 to 2024, I had written more than half a dozen Analysen written about Spotify. The share price then soared.

In fact, the share price has increased more than tenfold. It is a prime example of the success that is possible with anti-cyclical investments.

Of course, not every share works like this, but how many such bull's-eyes does an investor need? The most recent example is probably Micron.

However, Spotify has recently undergone another major correction, which could make things interesting again.

A whole range of growth drivers

The consumption of music is generally shifting away from physical data carriers to the internet.

The number of customers is therefore likely to continue to rise. The target is one billion monthly active users by 2030, compared to 713 million today.

At the same time, the subscription price will increase over time. There is also considerable growth in the advertising business.

A few quarters ago, this area hardly played a role, today it is a mainstay, but more on that later.

Spotify is now much more than just a music platform, even if the company is primarily perceived as such.

Podcasts and audio books are playing an increasingly important role. We have been aware of the sums earned in this area not only since Joe Rogan.

And of course Joe Rogan is just the tip of the iceberg. There are now countless, extremely successful podcasts on Spotify.

Worldwide, Spotify is probably in the top 3 of the largest podcast platforms in terms of listeners - in the USA it is number 1, ahead of Apple and Google.

We will see what market share can be secured in the audiobook sector in the future.

The figures speak for themselves

The bottom line is that Spotify has significantly increased its revenue from 7.88 to 15.67 billion euros over the past five years.

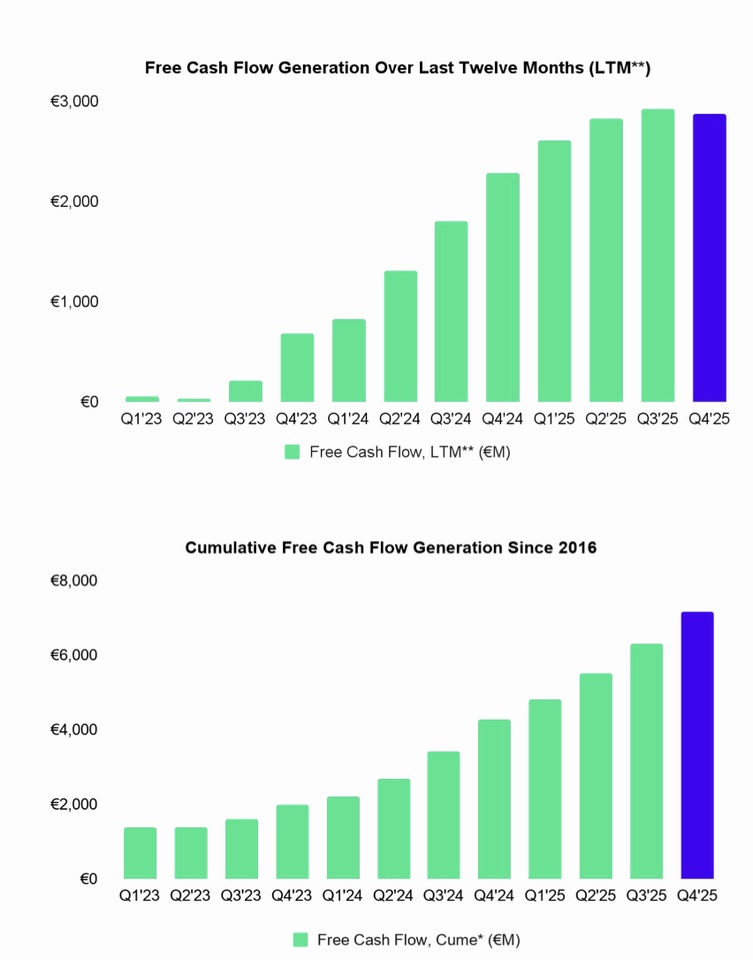

The free cash flow has been positive for many years, but this was simply ignored on the stock market as the reported profit up to and including 2023 was negative.

However, the tide has turned on this front too. In the 2024 financial year, earnings rose to USD 5.71 per share. This is likely to be followed by a 47% jump in earnings to USD 8.40 per share in the current financial year.

Spotify therefore has a P/E ratio of 60.4, which is not exactly low at first glance, but this estimate is put into perspective for two reasons.

In the 2026 financial year, earnings are expected to rise by 64% to USD 13.84 per share, which would reduce the P/E to 36.7.

In addition, free cash flow is still well above reported earnings. According to consensus estimates, free cash flow is expected to rise to USD 19 per share in financial year 2026, which would correspond to a multiple of 26.7.

Music streaming still a megatrend

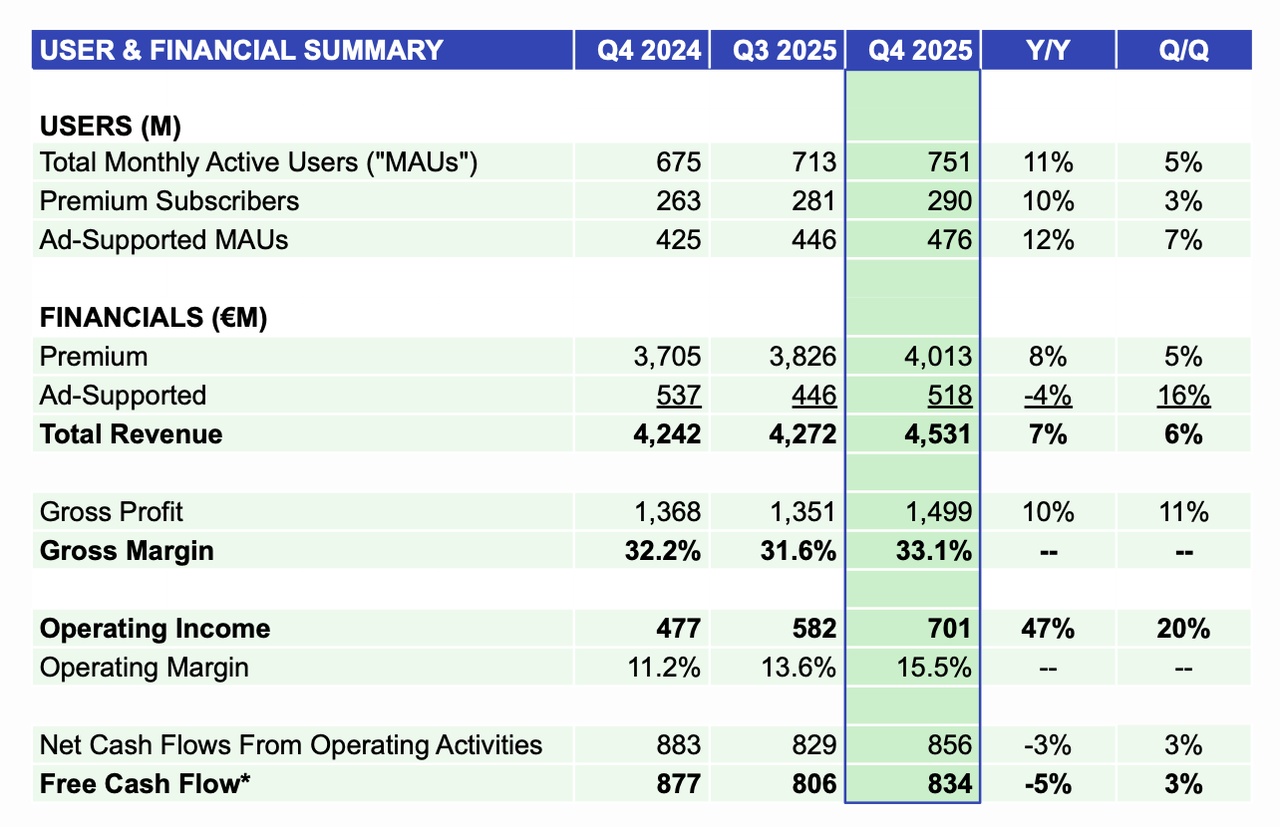

The latest quarterly figures show that this is realistic. In Q3, the number of monthly active users increased by 11% to 713 million.

The number of subscribers climbed by 12% to 281 million.

Revenue from the subscription business climbed by 9% to EUR 3.83 billion. However, the advertising business declined by 6% to EUR 446 million - as is usual in the industry, this segment is subject to major fluctuations.

Nevertheless, gross profit increased by 9% to EUR 1.35 billion. The operating result even climbed by 28% to 582 million euros.

At EUR 806 million, free cash flow was well above the reported result and increased by 13% over the year as a whole

Spotify share: Chart from 16.01.2026, price: USD 508.04 - symbol: SPOT | source: TWS

Spotify has returned to the important support level of USD 500. It will now be exciting here. If a bottom is formed, this could enable a recovery towards USD 550.

A procyclical buy signal with possible price targets of USD 600 and USD 640 - 650 would be issued above this level.

However, if Spotify falls below USD 500, further price losses towards USD 450 should be expected.