Hermès ($RMS (-0,05 %)) is not a classic fashion tradebut a structural bet on the top 0.1% of the world's population and their unwavering purchasing power.

Luxury is just the cover here. The real value comes from extreme scarcity, vertical integration and uncompromising pricing power.

Quality instead of quantity, craftsmanship instead of marketing, desirability instead of discount battles.

⚙️ What does Hermès do?

➡️ Leather goods & saddlery (core business):

The heart of the Group accounts for around 50% of sales. Hermès controls the entire chain - from its own tannery to the finished bag. → Excellence + heritage + highest margins.

➡️ Vertical integration:

Total control over the supply chain. Hermès owns its factories and trains its own craftsmen. No outsourcing, no compromises. → structural moat through operational self-sufficiency.

➡️ Artificial scarcity (unique selling point):

Demand for icons such as the Birkin or Kelly Bag permanently exceeds supply. Waiting lists of several years are not a bug, but a feature. → maximum value retention + guaranteed sales security.

➡️ Pricing power:

Hermès dictates the prices. The loyal core customer base (UHNWI) accepts increases far above the inflation rate without changing their purchasing behavior. → Highly scalable profit leverage.

➡️ Diversification:

Strong expansion into ready-to-wear, jewelry, home accessories and beauty. These divisions leverage brand prestige for additional growth. → Strategic expansion of the ecosystem.

👉 Hermès = The "indestructible" luxury infrastructure platform.

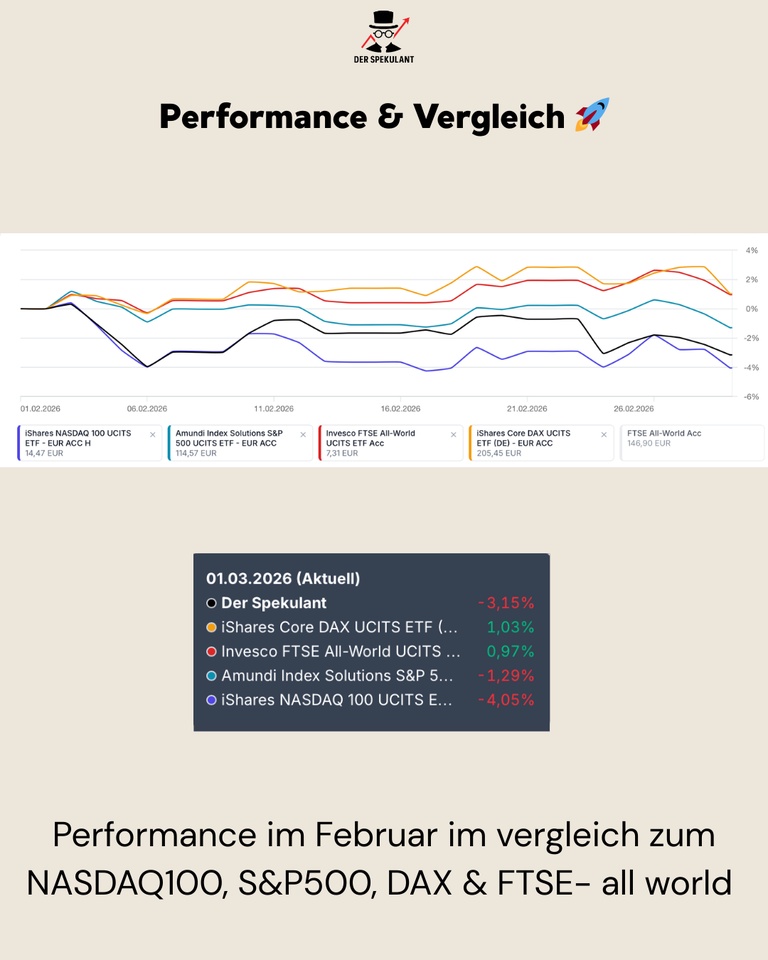

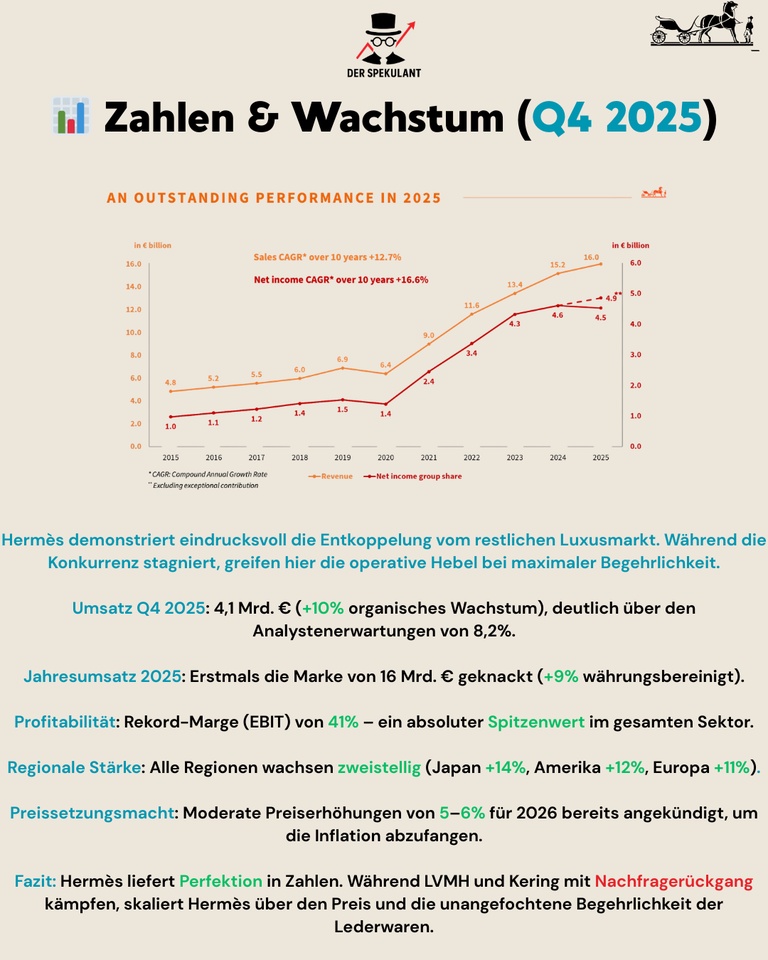

📊 Figures & growth (Q4 2025)

📈 Turnover Q4:

~€4.1 billion (+10% organic growth) → significant outperformance compared to analyst estimates (8.2%).

📊 Annual sales 2025:

Breaking the € 16 billion mark for the first time (+9% adjusted for currency effects).

📈 Profitability:

Record margin (EBIT) of 41% → an absolute peak value in the entire sector and beyond.

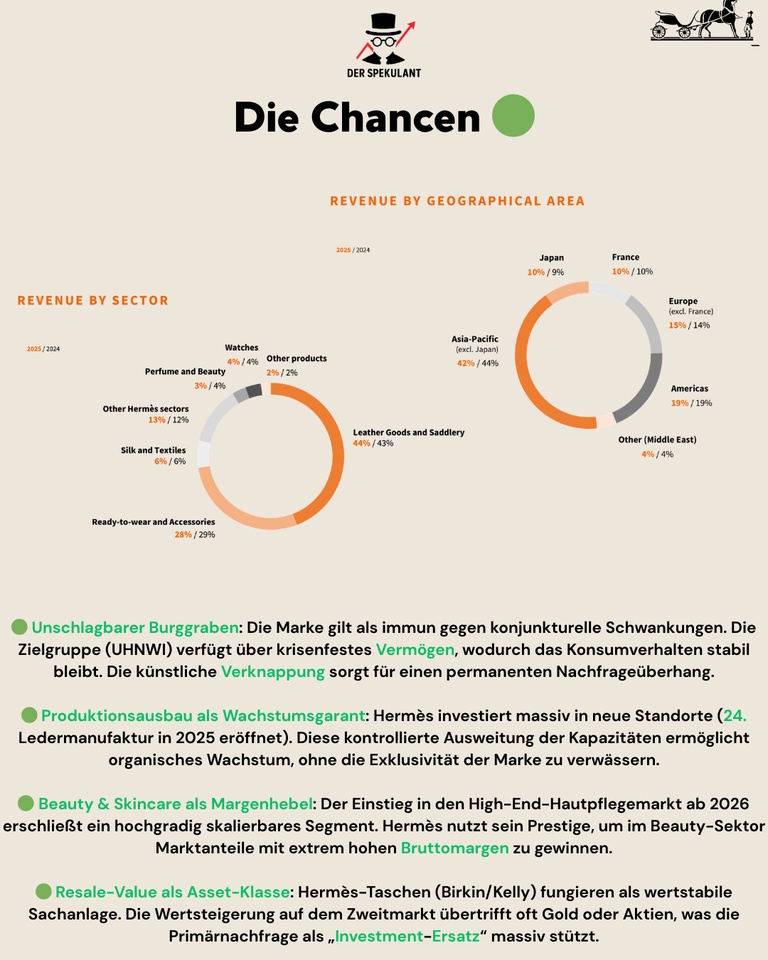

👥 Regional strength:

All regions show double-digit growth (Japan +14%, America +12%, Europe +11%). → Total resilience to local economic weaknesses (e.g. China).

💳 Pricing power:

Increases of 5-6% already announced for 2026. → Direct margin protection against inflationary costs.

Conclusion:

Hermès delivers "Perfection" in numbers. While competitors struggle, Hermès scales through price and unchallenged desirability.

🟢 The opportunities

🟢 Resilience of the target group:

The ultra-rich save last on luxury handbags. The business model is virtually immune to classic recession cycles.

🟢 Production expansion as a guarantee for growth:

Continuous opening of new leather factories (24th factory in 2025) meets the enormous demand in a controlled and organic manner.

🟢 Beauty & Skincare as a margin lever:

Entry into the high-end skincare market from 2026 offers new, highly scalable potential with extreme gross margins.

🟢 Resale value as an asset class:

Hermès bags are considered a more stable investment than gold. This massively supports primary market demand as an "investment substitute".

🔴 The risks

⚠️ Sports assessment:

With a P/E ratio of ~49 (February 2026), "perfection" is priced in. The share is not forgiving of operational mistakes.

⚠️ Currency headwinds:

As a global player, Hermès reacts sensitively to a strong euro, which can dampen nominal growth in the short term.

⚠️ Leather goods cluster risk:

50 % sales dependency on one segment. A change in trend for core models would be a structural risk.

⚠️ Geopolitical dependency:

Trade conflicts or luxury taxes in key markets (USA/China) could slow down momentum.

💡 Conclusion & outlook

Hermès is not a short-term fashion tradebut a structural bet on the global concentration of wealth.

🔹 Short term:

Sensitive to valuation levels, currency effects & market sentiment towards quality stocks.

🔹 Long-term:

ROI machine with a deep cultural moat, extreme pricing power and growing profitability on its own.

🎯 Investment case:

Leverage on artificial scarcity + pricing power + capacity expansion + ultra-luxury resilience → Structurally value-enhancing, operationally highly profitable, the gold standard for the portfolio in the long term.

💬 Community question:

👉 The ultimate "safe haven" with an unrivaled moat

or

👉 simply too expensive for an entry at this P/E ratio?

I am curious about your assessment 👇