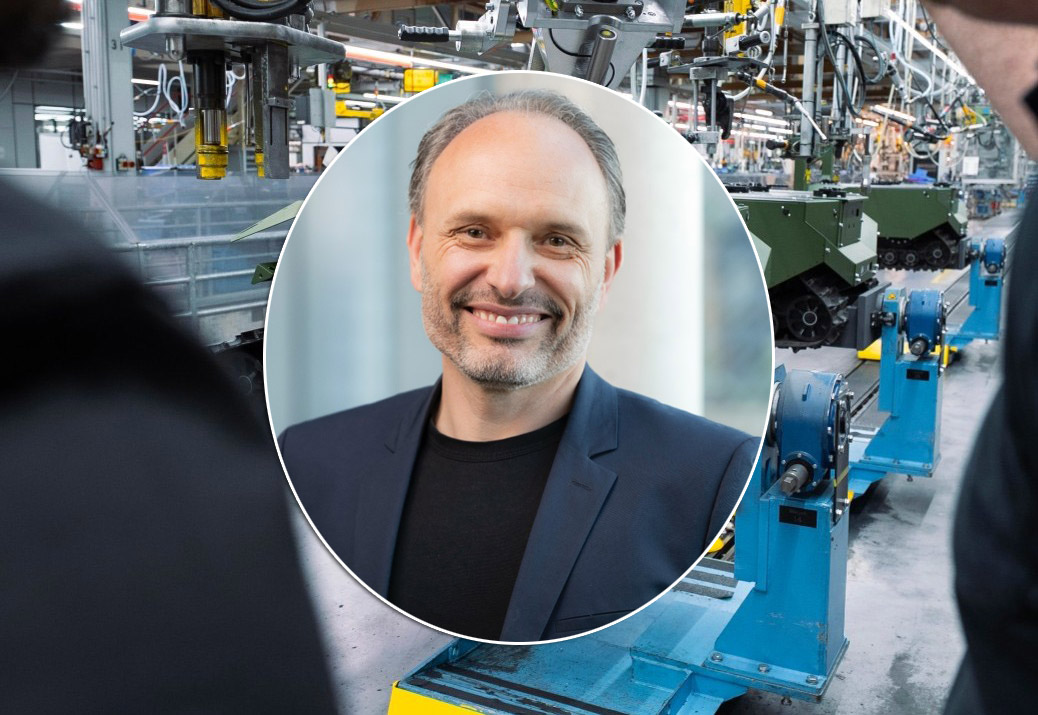

https://www.hartpunkt.de/deutz-entwickelt-neuen-800kw-panzermotor/

DEUTZ

Price

Discussion sur DEZ

Postes

48Yesterday's restructuring ⚙️

The following small positions were reversed:

$VOW (-3,38 %) (3)

$DEZ (-4,01 %) (25)

Newly included:

$FTNT (-1,14 %) (10)

Increased:

I wanted to tidy up my portfolio a bit, as these small positions were just bobbing around and I hadn't really thought through both investments.

I also wanted to take up a cybersecurity position.

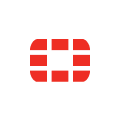

Swingtrade

$DEZ (-4,01 %) Hi, have Deutz with 100% price gain in the portfolio and wonder if now would be time for a swing trade... who sings here and can share their experiences 😀

In the long term, I already wanted to have Deutz in my portfolio

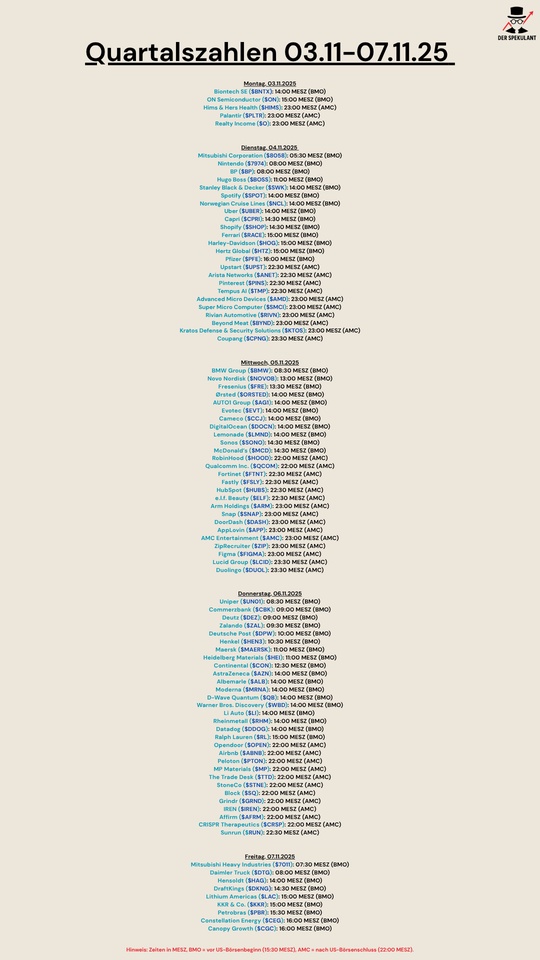

Quartalszahlen 03.11.25-07.11.15

$BNTX (-0,4 %)

$ON (-6,58 %)

$HIMS (-1,1 %)

$PLTR (+2,91 %)

$O (+0,36 %)

$8058 (-1,8 %)

$7974 (-0,89 %)

$BP. (+2,63 %)

$BOSS (-0,67 %)

$SWK (-2,78 %)

$SPOT (+2,85 %)

$N1CL34

$UBER (-0,62 %)

$CPRI (-4,04 %)

$SHOP (-3,23 %)

$RACE (-1,86 %)

$HOG (+0,61 %)

$HTZ (-3,52 %)

$PFIZER

$UPST (-3,13 %)

$ANET (-4,24 %)

$PINS (+1,78 %)

$TEM (-1,1 %)

$AMD (-3,16 %)

$SMCI (-2,7 %)

$RIVN (+2,15 %)

$BYND (+0 %)

$KTOS (+2,28 %)

$CPNG (-1,78 %)

$BMW (-2,17 %)

$NOVO B (-0,55 %)

$FRE (+0,25 %)

$ORSTED (-2,5 %)

$AG1 (-1,73 %)

$EVT (-1,25 %)

$CCO (-4,28 %)

$DOCN (+0,26 %)

$LMND (-0,17 %)

$SONO (-6,11 %)

$MCD (+0,3 %)

$HOOD (-4,81 %)

$QCOM (-1,01 %)

$FTNT (-1,14 %)

$FSLY (-1,93 %)

$HUBS (+1,76 %)

$ELF (+0,2 %)

$ARM (-4,91 %)

$SNAP (-3,26 %)

$DASH (-2,74 %)

$APP (-1,53 %)

$AMC (-7,04 %)

$ZIP (+10,7 %)

$FIG (-4,6 %)

$LCID (-0,59 %)

$DUOL

$UN0 (-0,29 %)

$CBK (-2,79 %)

$DEZ (-4,01 %)

$ZAL (-0,42 %)

$HEN (-0,96 %)

$MAERSK A (+1,35 %)

$HEI (-3,17 %)

$CON (-4,4 %)

$AZN (-2,23 %)

$ALB (-1,84 %)

$MRNA (-2,04 %)

$QBTS (-0,78 %)

$WBD (-0,21 %)

$LI (+1,2 %)

$RHM (+1,13 %)

$DDOG (+2,85 %)

$RL (-4,22 %)

$OPEN (-3,38 %)

$ABNB (-1,55 %)

$PTON (-0,62 %)

$MP (-5,64 %)

$TTD (-2,17 %)

$STNE (-0,59 %)

$SQ (-1,74 %)

$GRND (+0,5 %)

$IREN (-7,48 %)

$AFRM (-1,48 %)

$CRISP (+0,44 %)

$RUN (-3,45 %)

$7011 (-1,52 %)

$DTG (-1,94 %)

$HAG (+0,71 %)

$DKNG (-1,05 %)

$LAC (-1,26 %)

$KKR (-4,41 %)

$PETR3 (+4,2 %)

$CEG

$WEED (+0,38 %)

Dax under pressure - US stock markets expected to suffer losses

The German stock market was weak on Tuesday. Pressure was exerted on the indices not least by weak US stock markets, following the absence of trading in the USA on Monday due to Labor Day. The Dax slipped more sharply below the psychologically important 24,000-point mark, which has come back into focus since last week.

"Recently, buyers have always entered the market at the 24,000-point threshold," commented portfolio manager Thomas Altmann from QC Partners. "However, it is quite conceivable that this buying threshold will gradually shift downwards."

At lunchtime, the leading German index was down 1.1 percent at 23,784 points. The MDax fell below 30,000 points. Most recently, the index of medium-sized companies lost 1.8 percent to 29,914 points.

With regard to the USA, the main focus is on the reaction of the US stock markets after an appeals court denied President Donald Trump the authority to impose far-reaching tariffs on imported products on Friday, citing an emergency law.

"In Asian trade, the continuing uncertainty about the economic impact of the US punitive tariffs was used for profit-taking," said market expert Andreas Lipkow. In view of the power struggle taking place behind the scenes around the US Federal Reserve, there are currently many questions and the upcoming meeting in September is the subject of much discussion.

"An interest rate cut is far from a foregone conclusion." The upcoming economic data from the US, such as the labor market report on Friday, is therefore likely to play an important role. "Many new risk clusters are currently forming, which could still cause considerable fluctuations on the financial markets."

Among the individual stocks in the Dax, the FMC-Aktie ($FMC (-2,19 %) ) brought up the rear, losing 4.9 percent. A sell recommendation from the major Swiss bank UBS weighed on the stock. Analyst Graham Doyle referred to structural risks with regard to business development in the USA and the danger of falling consensus estimates for the operating result.

Siemens ($SIE (-0,81 %) ) fell by 2.8 percent. They suffered from a downgrade to "market perform" by Bernstein Research. Analyst Nicholas Green justified his move with the strong share price gains in recent years. Commerzbank ($CBK (-2,79 %) ) , downgraded to "Equal-weight" by Morgan Stanley, lost 2.4 percent. At the current valuation level, analyst Alvaro Serrano wrote that further progress in the Frankfurt-based company's business plan is needed first.

In the SDax the share price of SMA Solar ($S92 (-1,79 %) ) fell by 28 percent. The manufacturer of inverters for photovoltaic systems lowered its forecast for the current year and now expects an operating loss. The restructuring efforts that have already been initiated are to be intensified further.

The fact that the motor manufacturer Deutz ($DEZ (-4,01 %) ) is expanding its still small business in the defense market with the planned acquisition of the Sobek Group. The share gained 6.0 percent at the top of the index. The Sobek Group is a drive specialist for drones.

Beginner portfolio expansion 🧐

🆕I've been on the stock market and GetQuin for almost 2 months now. Like everyone else, I've had to take a lot of hits in the meantime, especially when it comes to my tech positions. Nevertheless, the build-up of my portfolio is not complete and I still have €7000 cash reserve left.

Taking a closer look at my investments, the following markets are currently covered:

🇺🇸USA Tech: $NVDA (-2,56 %) , $GOOGL (-0,74 %)

🇩🇪DE Infrastructure/Sustainability: $VOS (-6,02 %)

$2GB (-4,1 %)

$DEZ (-4,01 %)

🇨🇳China Consumer goods/tech:$1810 (+3,26 %)

+ Core ETF+ Satelite $VWCE (-0,86 %) + $WSML (-2,4 %)

📉I am currently already invested with just under €7000. Now, given the current market phase, I would like to invest a further €6000 to complete my portfolio.

🛒Another €3150 will initially flow into the core ETF to build a stable base. In addition, just under 700€ should go into defensive stocks such as perhaps$ULVR (-0,98 %) or$PEP (-1,76 %) should be bought.

☝🏼Wie does that sound good to you?

❓Now the question arises as to what I can do with the remaining available capital. Pharma would be one idea, but I have to be honest and admit that I only have a semi-understanding of the companies and their products. 🫠

👀Of course, I would like to invest my money in a future-oriented way, in stocks that offer good development potential and could also be valued favorably at the moment. 🔮

😵💫Als However, as a complete beginner, I find it difficult to recognize such stocks, as there are simply too many ways to get rid of your money.

Which sectors, shares or ETFs would you consider?

Have a nice Sunday everyone! ☀️

Highest entry price wanted!

The dust has settled, the hangover has slowly worn off...

Under the motto "Anyone can post profits", I would be interested to know who has the highest entry price for hype stocks such as $HIMS (-1,1 %)

$4X0 (-0,58 %) or $DEZ (-4,01 %) has shot!

I'll start: Deutz in at €7.50.

Sale

After the lucky hand with Steyr Motors $4X0 (-0,58 %) (+300€) now also $DEZ (-4,01 %) sold with a plus of 200€.

The portfolio is now slowly focusing on more defensive options.

To this end, the proceeds and freed-up capital were used today to $KO (+0,05 %) was bought today.

Titres populaires

Meilleurs créateurs cette semaine