Rheinmetall: EU Commission approves takeover of Lürssen naval division | INDUSTRIEMAGAZIN https://share.google/XlxHcpHdJQeyPiP3t

Rheinmetall

Price

Discussion sur RHM

Postes

297EU Commission approves NVL takeover

Part 9 - Fiscal policy, debt and markets

The state as a market player

When debt is problematic - and when it enables growth. Classification beyond simple debt ratios

Reading time: approx. 5-6 minutes

Fiscal policy is not a side issue for the markets in 2026. It is a valuation factor. Budget deficits, special funds, defense budgets, industrial policy - all of these have a direct impact on yields, valuation multiples and sector rotations. If you only look at debt ratios, you miss the point. The decisive factor is the ratio of growth to interest rates - in short: g to r.

g stands for the nominal growth of an economy, i.e. real growth plus inflation. r stands for the average effective interest rate at which a state refinances itself. The sustainability of debt depends largely on how these two variables relate to each other.

The key correlation is as follows: as long as the nominal growth of an economy is higher than the average financing rate of its debt, the debt ratio stabilizes or decreases relative to GDP - even in the case of moderate primary deficits. Formally: If g > r, time works for the debtor. If r > g, time works against him.

Why is this the case? Government debt is measured in relation to economic output. If GDP grows faster than interest costs, the economy "grows" relatively into debt. The ratio falls or remains sustainable. If the ratio reverses, interest expenditure increases relatively more than the economy's income. This creates fiscal pressure.

This logic is not new. It can already be found in classical debt arithmetic and has often been linked to the inequality formula r > g from the work of Thomas Piketty in more recent discussions. It is important to classify it correctly: there, r > g describes the relationship between return on capital and growth in the context of wealth concentration. The mechanics are similar for public finances, but the focus is different - it is about debt sustainability. The mathematical core is related, but the economic application is different.

Applied to 2026, this means that in a world of structurally higher interest rates, the difference between g and r will become the decisive macro lever.

The German government debt ratio is currently around 63-65% of GDP. Internationally, this is moderate. However, the decisive factor is momentum. Nominal growth has recently been roughly in the region of 2-4 %, depending on the quarter. At the same time, new issue yields for ten-year German government bonds are in the range of around 2.5-3 %. Germany is therefore in a borderline zone. g and r are close to each other. A clear growth advantage no longer exists automatically as in the zero interest rate regime.

This makes the quality of fiscal spending crucial. If additional debt has a primarily consumptive effect, the ratio rises faster than economic output. If, on the other hand, it flows into infrastructure, digitalization or defence capacities, it potentially increases trend growth - i.e. g - and shifts the equation in favour of sustainability.

Rising defense budgets have a direct impact on $RHM (-0,17 %) (Rheinmetall AG). Infrastructure and industrial projects increase the order base at $SIE (+1,82 %) (Siemens AG). Grid investments stabilize regulated cash flows at $EOAN (-0,64 %) (E.ON SE) and $RWE (+0,8 %) (RWE AG). Digital modernization strengthens providers such as $SAP (+1,12 %) (SAP SE) or security providers such as $YSN (+0,51 %) (secunet Security Networks AG). These are concrete fiscal transmission channels in sales, cash flow and margins.

But every additional issue also has an impact on the bond market. Higher supply can cause yields to rise. Higher yields increase discount rates - particularly relevant for long-dated growth cash flows. Fiscal policy therefore generates two forces: profit impetus through demand and valuation pressure through higher capital costs. Which one prevails depends on the market framework.

In the US, the government debt ratio is significantly higher - roughly in the range of 115-125% of GDP. At the same time, nominal growth is more robust than in Europe. As long as nominal growth is in the range of around 4-6% and long-term Treasury yields are below or only slightly above this level, the debt dynamic remains manageable. It becomes critical when interest expenditure rises faster than the nominal income of the economy.

Industrial policy programs have a direct impact on individual sectors. Semiconductor investments stabilize investment cycles at $INTC (-1,11 %) (Intel Corporation) and $NVDA (+1 %) (NVIDIA Corporation). Defense spending supports $LMT (-1,36 %) (Lockheed Martin) and $NOC (-2,23 %) (Northrop Grumman). Infrastructure programs have an impact on $CAT (-0,15 %) (Caterpillar Inc.). Tax incentives in the energy sector stabilize cash flows at $NEE (+0,49 %) (NextEra Energy). Fiscal policy becomes a sector-specific source of income.

The historical US post-war example illustrates the dynamics. After the Second World War, the debt ratio was over 100 %. It fell significantly in the following decades. Strong nominal growth played a central role. At the same time, financial repression, regulated capital markets and phases of unexpected inflation had a debt-reducing effect because they reduced real interest burdens. g was greater than r for a longer period of time - partly also influenced by politics.

Conversely, the European sovereign debt crisis showed what happens when r > g and confidence wanes. Rising risk premiums increased interest costs, growth stagnated and the debt ratio turned negative.

For investors, this means that debt is not a moral judgment, but a mathematical and institutional issue. The decisive factors are growth, interest rates and confidence. If you only look at the debt ratio, you ignore the dynamics behind it.

In 2026, it is precisely these dynamics that will be decisive. In an environment without a zero interest rate buffer, fiscal policy is no longer an automatic growth lever. It can enable growth - if it is used productively and g is stable above r. However, it can also generate valuation pressure if r rises above g in structural terms.

The state is therefore one of the largest allocators of capital in the world. Its budget decisions act like an additional investment fund in the trillions. If you want to understand markets, you have to read this dynamic in the valuation framework - not in isolated percentages.

The next part will conclude the series: Part 10 - Why key figures fail without a valuation framework. There I will bring the entire series together with the key figures series - and show why classification is more important than mathematical precision.

put your money where your mouth is, Rheinmetall 25 Mio Trade

This is exactly what the Rheinmetall CEO did.

In December 2020, Armin Papperger bought around 13,000 shares at €78.24 - i.e. for just over €1 million. Back then, hardly anyone was talking about the armaments boom. The "turnaround" had not yet been proclaimed. It was a classic conviction investment.

At the later all-time high of around € 2,008 per share, the package would have been worth € 13,000 × € 2,008 = around € 26.1 million. → Book profit of around € 25 million or almost +2,400 % return.

A machine like the Panther. $RHM (-0,17 %)

🚀 Munich start-up tests first European hypersonic rocket - technological breakthrough or military game changer?

Introduction

A young German-British company has taken a remarkable step: For the first time first time a prototype of a hypersonic rocket has been successfully successfully tested for Europe. And after just nine months of construction 😳 This test marks an important milestone in an area that has so far been dominated almost exclusively by major powers such as Russia, the USA and China.

_________________________

⚡️ 1st European hypersonic test flight successful 🚀

On February 3, 2026, the Munich-based startup Hypersonica launched its HS1 prototype from the Norwegian spaceport Andøya. According to the company:

- The rocket reached hypersonic speeds of over Mach 6 (more than 7,400 km/h).

- It covered a distance of around 300 kilometers.

- The prototype did not carry a warhead - it was purely for flight testing.

- A production-ready version is to be developed by 2029.

Hypersonica has thus achieved an unprecedented success for a privately financed European armaments and aviation project in the hypersonic sector.

_________________________

🧪 2. why hypersonic missiles are relevant

Hypersonic missiles fly extremely fast (faster than Mach 5) and are traditionally difficult to intercept. This gives them:

- ⇨ strategic importance in the field of modern defense systems,

- ⇨ high importance for future military technologies,

- ⇨ Influence on the geopolitical balance of power.

Only a few countries still possess such technology - Russia and the USA have already developed or deployed their own systems. Europe has so far lacked a comparable, sovereign solution.

_________________________

🇪🇺 3. Europe wants to become more technologically independent

The background to the project is not only technical ambition, but also geopolitical strategy:

- Europe is to become more technologically independent from the USA and other major powers.

- Public debates show that security policy and defense technology are seen as part of sovereignty.

- Hypersonica's success could strengthen Europe's role in defense and space technology.

Hypersonica was only founded in 2023, is based in Munich and has a subsidiary in London. The CEO and co-founders emphasize that the technology has long been neglected and that faster development cycles are needed.

_________________________

🧠 4. technical & strategic challenges

Hypersonic missiles are not only fast, but also complex:

- The engine is not the central problem, but

- combining high speed with precise control and stable maneuverability.

- Mach speeds generate enormous thermal loads that require special protection and materials.

Hypersonica wants to address these challenges and carry out further tests and developments in the coming years.

_________________________

👍 5. significance for industry & research

Successful testing is not only a technological step, but can also

- Boost investment in European aerospace

- Boost research networks between universities, start-ups and defense agencies

- Strengthen Europe's presence in a globally strategic technology

Competition and comparison: To date, the USA, Russia and China have also been working on their own hypersonic systems, which have significantly greater ranges. Europe's approach, however, is a fast, private development path, similar to the influence of companies like SpaceX on space development as a whole.

_________________________

$LMT (-1,36 %)

$RYTT34

$BA (-0,81 %)

$GD (-0,45 %)

$LHX (-1,96 %)

$KTOS (-9,24 %)

$SAF (+1,93 %)

$RHM (-0,17 %)

$AM (+2,34 %)

$SAAB B (-0,74 %)

There’s blood out in the street📉

Market volatility is intense.

As a beginner investor, it’s challenging to watch all the gains since August being wiped out.

How do you manage this psychologically?

$IREN (-6,41 %)

$AVAV (-6,13 %)

$ONDS (-11,34 %)

$VST (-0,75 %)

$AMD (-1,53 %)

$RHM (-0,17 %)

$OMDA (-2,33 %)

$DCTH (+2,47 %)

$AMZN (+2,51 %)

$RKLB (-6,56 %)

$INOD (-1,3 %)

Long term means you dont really care^^

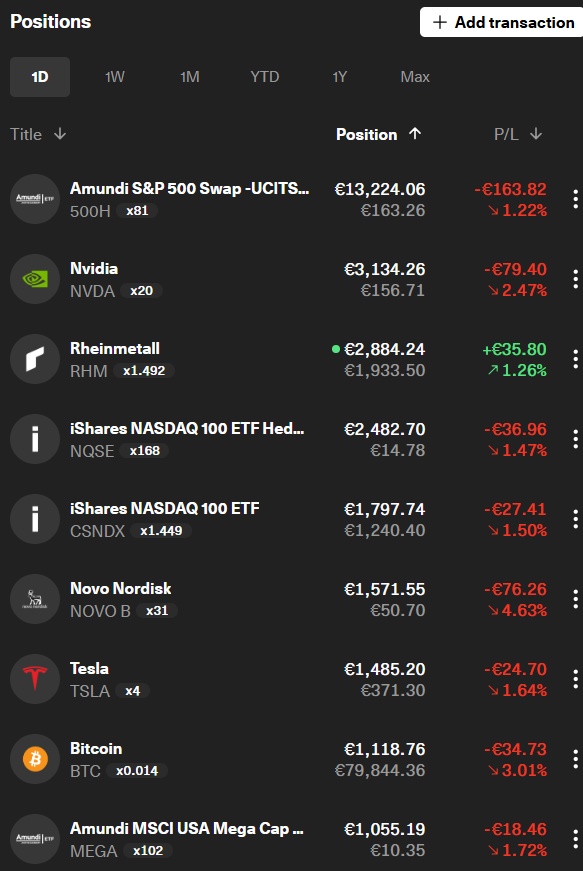

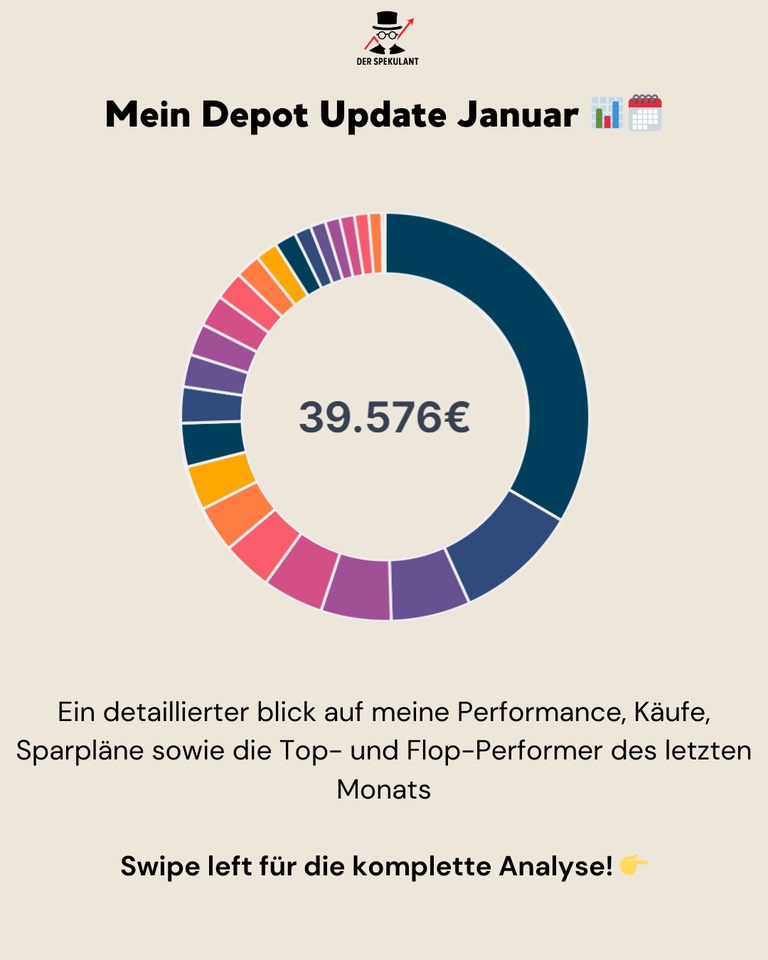

📊 My portfolio update January 2026

January was a challenging but generally constructive month.

A strong start to the year was followed by a significant tech correction in the middle of the month, triggered by risk-off flows, interest rate sensitivity and caution after the first US earnings.

Despite this volatility, I closed the month clearly in the plus the month:

👉 Monthly performance: +2.5 %

👉 Portfolio value: € 39,576

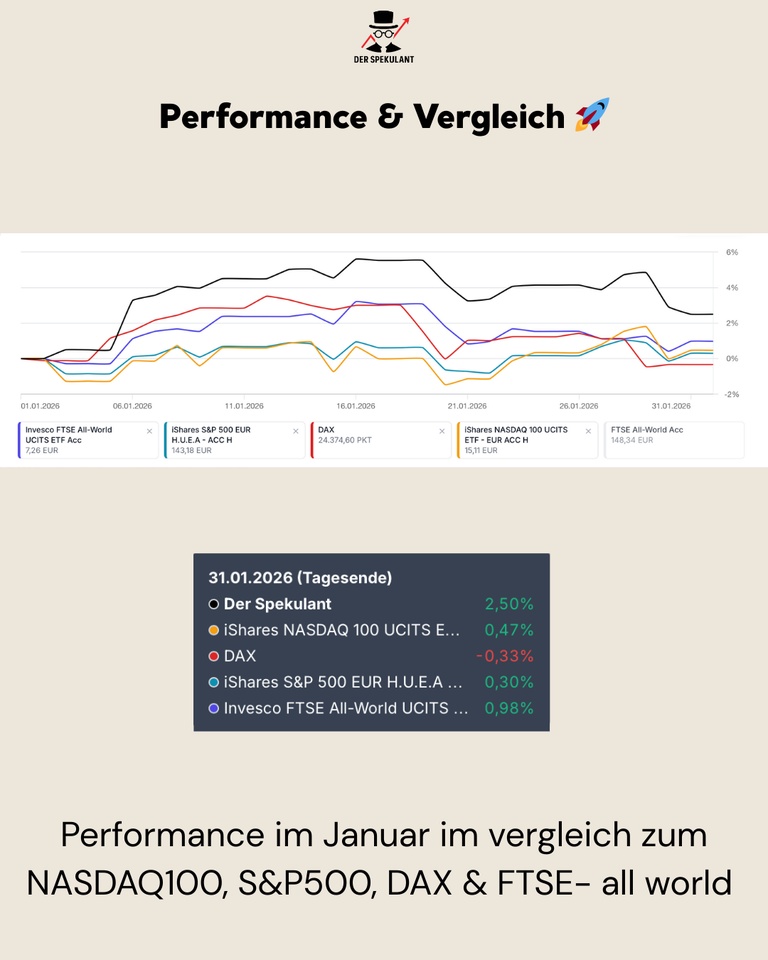

1st performance & comparison 🚀

January was characterized by sectoral rotation:

Software & high-beta corrected significantly, while selected cyclicals, commodities and special situations remained stable.

Performance in comparison (31.01.2026):

- My securities account:

+2,50 %

- NASDAQ 100: +0.47 %

- S&P 500: +0.30 %

- DAX: -0.33 %

- FTSE All-World: +0.98 %

👉 The outperformance is not the result not from broad tech exposurebut from targeted themes, anti-cyclical positions and active allocation.

2. purchases, sales & allocation 💶

The focus in January was clearly on Risk management and cash management:

Acquisitions: Siemens ($SIE (+1,82 %)) (twice) - Partial reinvestment of realized gains. Euro Overnight Rate Swap ETF ($XEON (+0,01 %))- targeted liquidity build-up

Sales: Partial sale Rheinmetall ($RHM (-0,17 %))after an extreme run (+735% since entry)

👉 Currently Cash / cash equivalents at ~4 % of the portfolio - deliberately increased in an environment of increasing uncertainty.

3rd top mover in January 🟢

January was clearly dominated by special situations and cyclical themes carried.

The strongest performer was IREN m($IREN (-6,41 %)), which rose by +40,8 % benefited massively from the recovery in the mining sector. Another strong performer was the VanEck Uranium & Nuclear ETF ($NUKL (+1,82 %))with +21,7 %driven by structural demand, supply shortages and geopolitical reassessment.

American Lithium placed +19,1 % and showed a technical countermovement after months of weakness. Alibaba ($BABA (+0 %)) was convincing with +15,9 %supported by valuation levels, margin stabilization and the first signs of regulatory easing.

Also Novo Nordisk ($NOVO B (-2,32 %)) (+15,4 %) also benefited from sustained demand in the GLP-1 segment, while Rheinmetall despite a partial sale again +14,1 % and confirmed its role as a structural profiteer.

4th flop mover in January 🔴

The weaker side of the portfolio was clearly in the high-multiple-tech segment segment.

Cloudflare ($NET (-7,53 %)) lost -11,2 % in the wake of a massive revaluation of AI and infrastructure software. Ferrari ($RACE (-0,43 %)) (-10,9 %) and Snowflake ($SNOW (-3,7 %)) (-10,3 %) suffered from profit-taking and higher expectations after strong previous quarters.

Also CrowdStrike ($CRWD (-7,77 %)) (-6,6 %) and Datadog ($DDOG (-4,15 %)) (-6,4 %) were under pressure, although there was little change in operational quality. Berkshire Hathaway ($BRK.B (+0,06 %)) rounded off the list of losers with -6,1 % burdened by interest rate and insurance discussions.

👉 Important: These are primarily valuation and sentiment moves. valuation and sentiment movesnot fundamental breaks.

5. conclusion 💡

January was not an easy month, but a good start to the year:

- Outperformance against all relevant indices

- Profits realized, cash increased

- Volatility consciously accepted instead of blindly smoothed out

The environment remains challenging:

Interest rates, Fed expectations, political uncertainties and earnings will continue to shape the markets in February.

The focus therefore remains clearly on quality, liquidity and selective opportunities.

❓ Question for the community

Which stock surprised you the most in January - positively or negatively?

👇 Write it in the comments!

+ 3

BAE Systems now the chance?

We all know that the arms hype has been going very well since the Ukraine attack. In my research I have seen that $BA. (+0,02 %) compared to $RHM (-0,17 %) has actually not gone so well.

$$BA. (+0,02 %) Sits on a very high cash flow and the order books are well filled, furthermore you have recurring revenue through maintenance contracts. What a very stable business.

They pay a small dividend of about 1.7% as the company is in the UK the withholding tax is a nice thing. They also have regular and strong buybacks.

I realize that armaments are not everyone's cup of tea, but they are an $BA. (+0,02 %) an established player that has lagged behind the competition and I would imagine that they still have some potential.

Oh and after the 20% in January there has now been a good correction.

What is your opinion?

Possible profiteers ?!

If there is a military escalation or a direct attack by the US in Iran (or in the Middle East in general), three sectors tend to react most strongly: armaments (defense), energy (oil/gas) and safe havens (gold/precious metals).

1. defense industry (defense & aerospace)

This sector benefits directly from the expectation of government orders for ammunition, missile systems, drones and logistics. The focus here is on US companies, but European stocks also often move up.

ETF option (broad diversification):

iShares US Aerospace & Defense ETF (focus on US defense):

VanEck Defense UCITS ETF.

VanEck Defense ETF: WKN: A3D9M1 / ISIN: IE000YYE6WK5

2. energy sector (oil & gas)

Iraq is a major oil producer. A conflict in this region immediately fuels fears of supply shortages or blockades (e.g. Strait of Hormuz). The oil price (Brent/WTI) usually rises sharply, which increases the margins of the major oil companies (Big Oil).

Certificates on the oil price:

If you want to bet directly on the commodity price (Brent Crude Oil), you often use ETCs (Exchange Traded Commodities).

WisdomTree Brent Crude Oil: WKN: A1N49P/M/N / ISIN: JE00B78CGV99

3. safe havens (gold & dollar)

In times of military uncertainty, capital flees from risky investments (such as tech stocks) into so-called "safe havens".

Gold: Considered the number 1 crisis currency.

US dollar: Often appreciates as it is considered the most stable currency, which in turn burdens export-oriented US companies, but can benefit dollar holders.

Important risk warnings

"Sell the news": Markets often price in conflicts before the first shot is fired. As soon as the attack actually takes place, it can paradoxically happen that prices (e.g. oil, gold, silver)

prices (e.g. oil, gold, silver) fall because the uncertainty has disappeared ("sell on good news, buy on bad news" - or vice versa).

Overall market reaction: While armaments and oil rise, broad indices such as the DAX or the S&P 500 often fall initially, as transportation costs rise (bad for airlines such as Lufthansa) and consumer sentiment falls.

Political intervention: If the oil price is too high, the USA often intervenes in strategic oil reserves, which can quickly reduce the price pressure on energy stocks.

Rheinmetall plans Starlink alternative

Hello my dears,

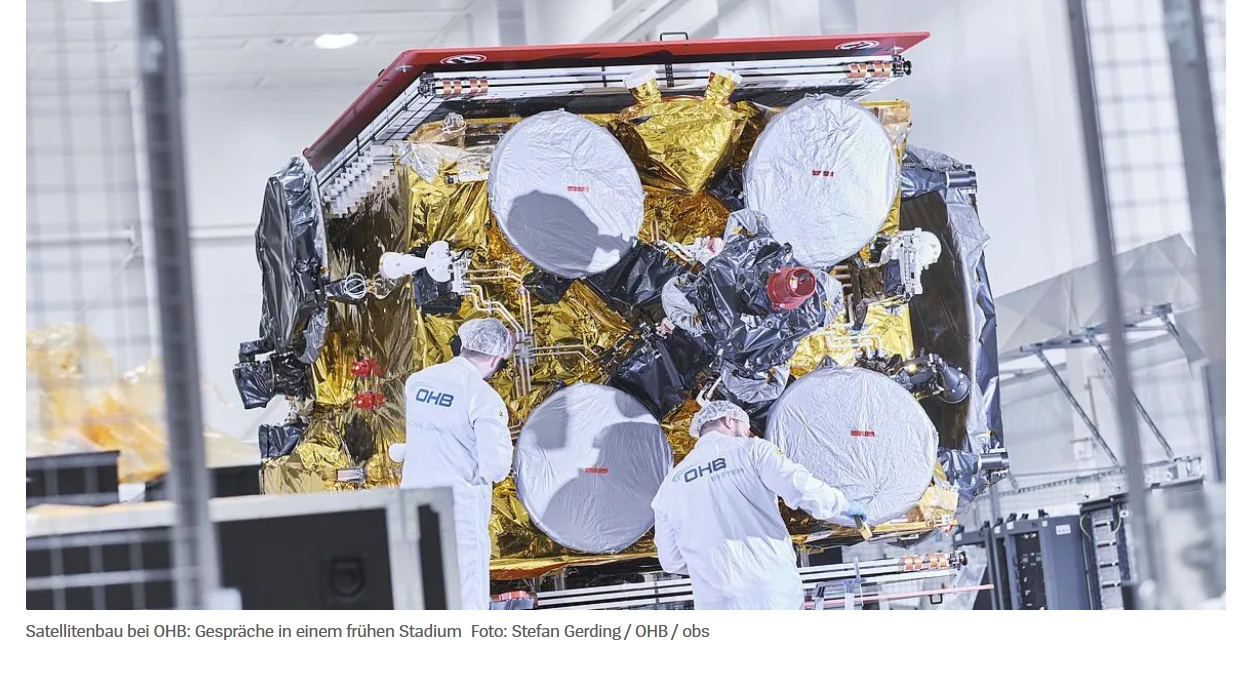

I have already introduced OHB to you, but unfortunately I have not invested myself. Did any of you invest after my presentation?

According to insiders, the defense group Rheinmetall is in negotiations with the space and technology group OHB for a Starlink competitor.

26.01.2026 at 09:39

The armaments group Rheinmetall and Bremen-based space and technology group OHB are discussing plans for the joint construction of a satellite system comparable to Starlink for the Bundeswehr. The two companies are in talks about the project, a person familiar with the matter said on Monday, confirming reports in the "Financial Times" and the "Handelsblatt" newspaper.

The talks are at an early stage, according to the FT. However, Rheinmetall and OHB wanted to jointly bid for the establishment of a Elon Musks Starlink comparable communication system for the German Armed Forces. The contract could be worth around ten billion euros. Rheinmetall did not comment on the information. No comment was initially available from OHB.

The Düsseldorf-based company sees the satellite business as a market of the future. Eight to ten billion euros in sales are to come from the digitalization business, which also includes satellites, the Group announced. The Düsseldorf-based company is already working with the Finnish satellite manufacturer Iceye in this area. (Reuters)

Aufrüstung im Weltall: Rheinmetall will mit OHB deutsches Starlink bauen - DER SPIEGEL

Internetabschaltung im Iran betrifft auch Starlink-Verbindungen – DiePresse.com

Titres populaires

Meilleurs créateurs cette semaine