Top Movers

$DE (-0,58 %) +20%

$CNQ (+0 %) +17%

$CNR (-1,35 %) +17%

$8002 (-0,66 %) +17%

$CSL (-0,09 %) +17%

Top Loosers

$HIMS (+4,19 %) -44%

$NOVO B (+4,77 %) -32%

$3350 (+5,75 %) -30%

$MELI (+3,16 %) -18%

$BX (+2,86 %) -17%

Postes

10Top Movers

$DE (-0,58 %) +20%

$CNQ (+0 %) +17%

$CNR (-1,35 %) +17%

$8002 (-0,66 %) +17%

$CSL (-0,09 %) +17%

Top Loosers

$HIMS (+4,19 %) -44%

$NOVO B (+4,77 %) -32%

$3350 (+5,75 %) -30%

$MELI (+3,16 %) -18%

$BX (+2,86 %) -17%

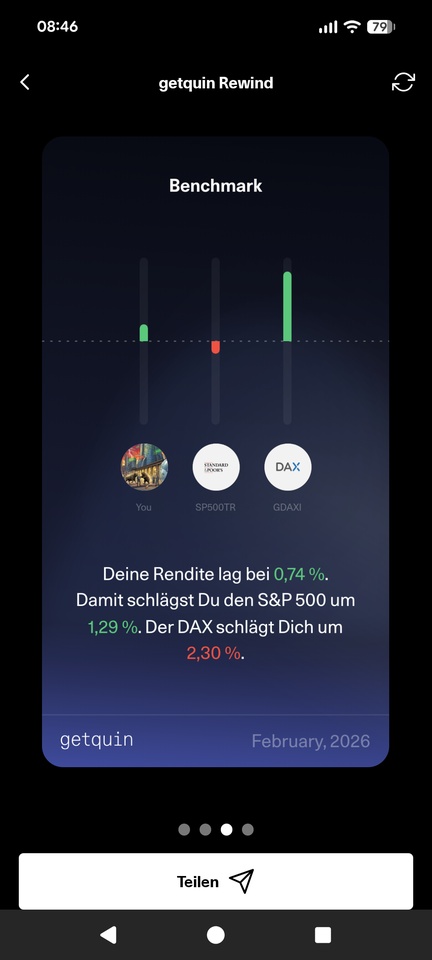

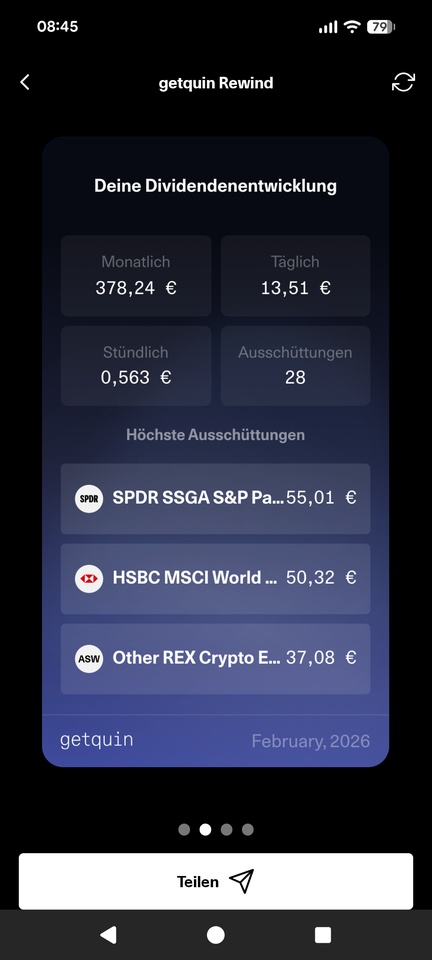

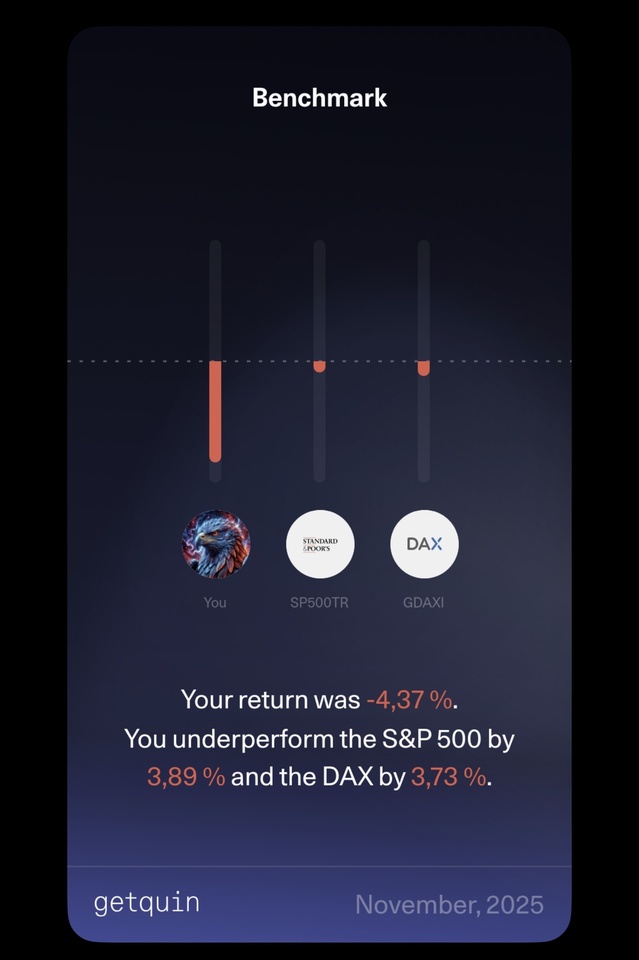

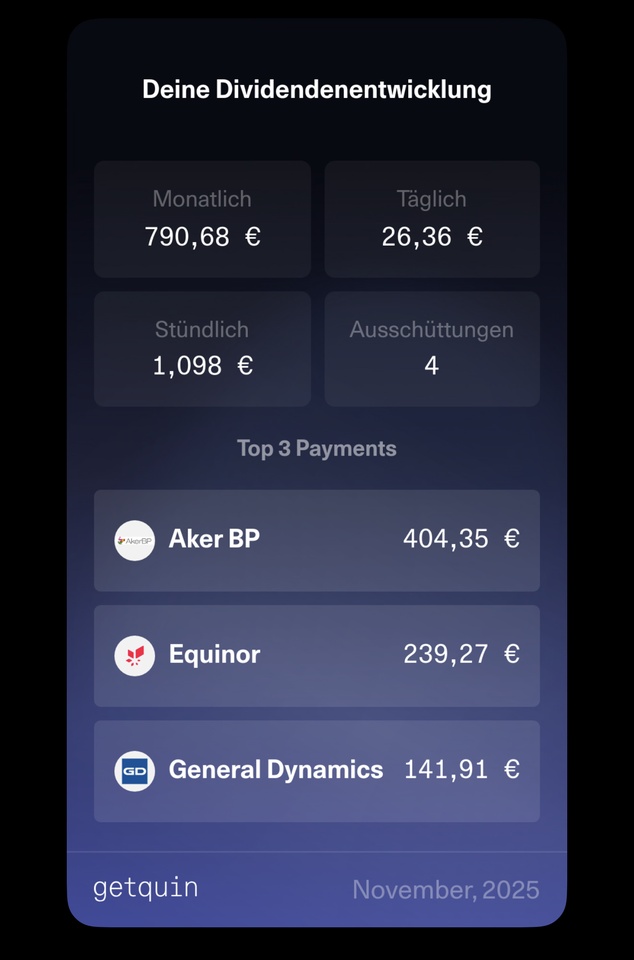

Bitcoin has caused a significant correction in the portfolio, which is nothing unusual given the high weighting.

In November, there were more purchases in the energy sector ($EQNR (+0,69 %)

$AKRBP (-1,87 %)

$CNQ (+0 %) )

With $RHM (+3,49 %) I also took advantage of the sell-off and now hold 15 shares.

In addition to Bitcoin, my overall allocation is still overweight in the AI, defense and energy (oil/gas) sectors.

Cash is at ~16%, with a downward trend.

That's it already!

Have a relaxed Tuesday evening 🍻

The world's hunger for energy is increasing and, according to the latest estimates, "peak oil" is further in the future than previously thought.

High geopolitical risks, artificially limited supply and robust demand = (in my opinion) a structurally bullish oil outlook.

Today I would like to introduce you to 3 stocks from the "hated" 🛢️Öl and natural gas sector.

Stock 1:

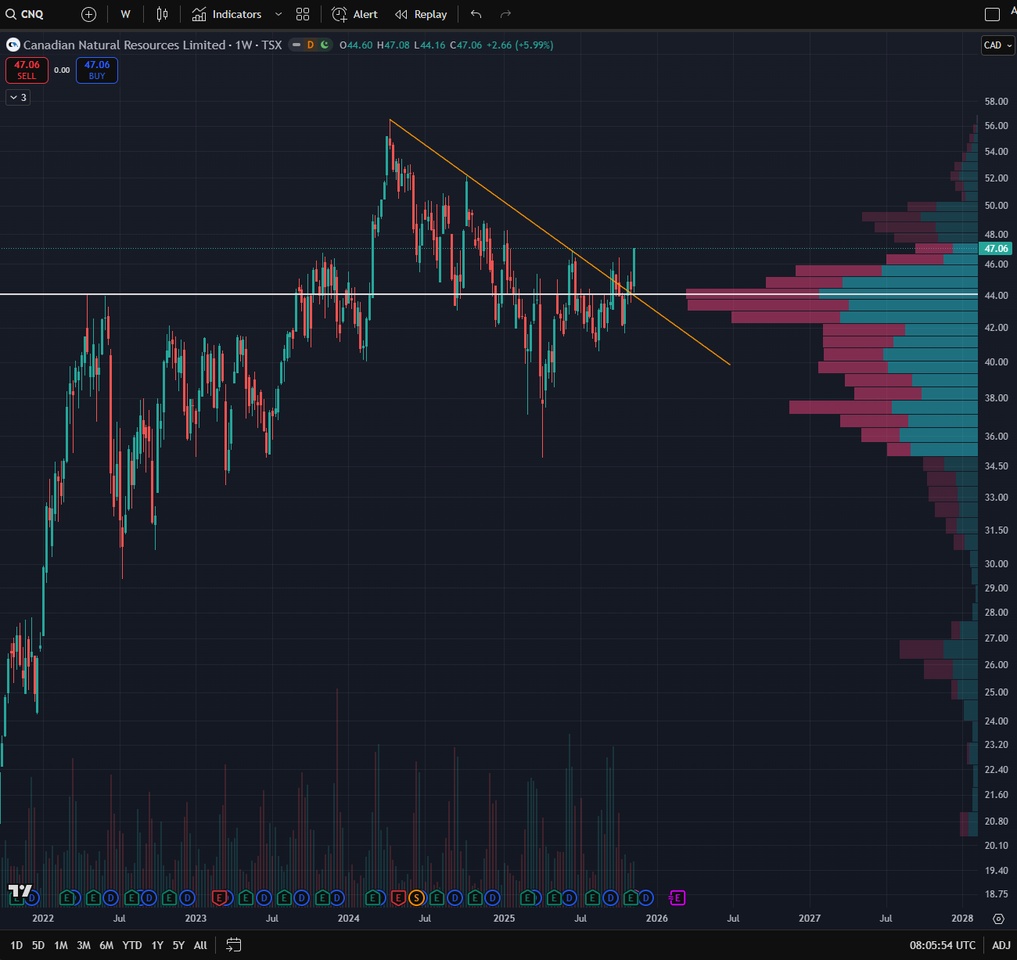

Canadian Natural Resources $CNQ (+0 %)

📍Overview of the company:

Canadian Natural Resources is a leading Canadian energy company primarily engaged in the production and processing of crude oil and natural gas.

Its business model includes the mining of bitumen oil sands and their processing into synthetic crude oil, conventional oil and NGL production as well as major natural gas production in Western Canada and selected offshore locations.

Geostrategically, CNQ benefits from a relatively stable regulatory environment in Canada and owns long-term, long-life production assets.

Analysts value the stock at a fair value of around $54-55, which suggests a moderate upside potential of close to +15-20% from the current price of around $47, assuming commodity prices and operating conditions remain stable.

💰Dividend yield (TTM): 5.187%

📈Notes on the chart:

What I like here is that $CNQ (+0 %) has clearly broken the weekly downtrend to the upside.

The price is also above the volume POC, which should now form a support.

I am already invested and plan to buy on setbacks.

Share 2:

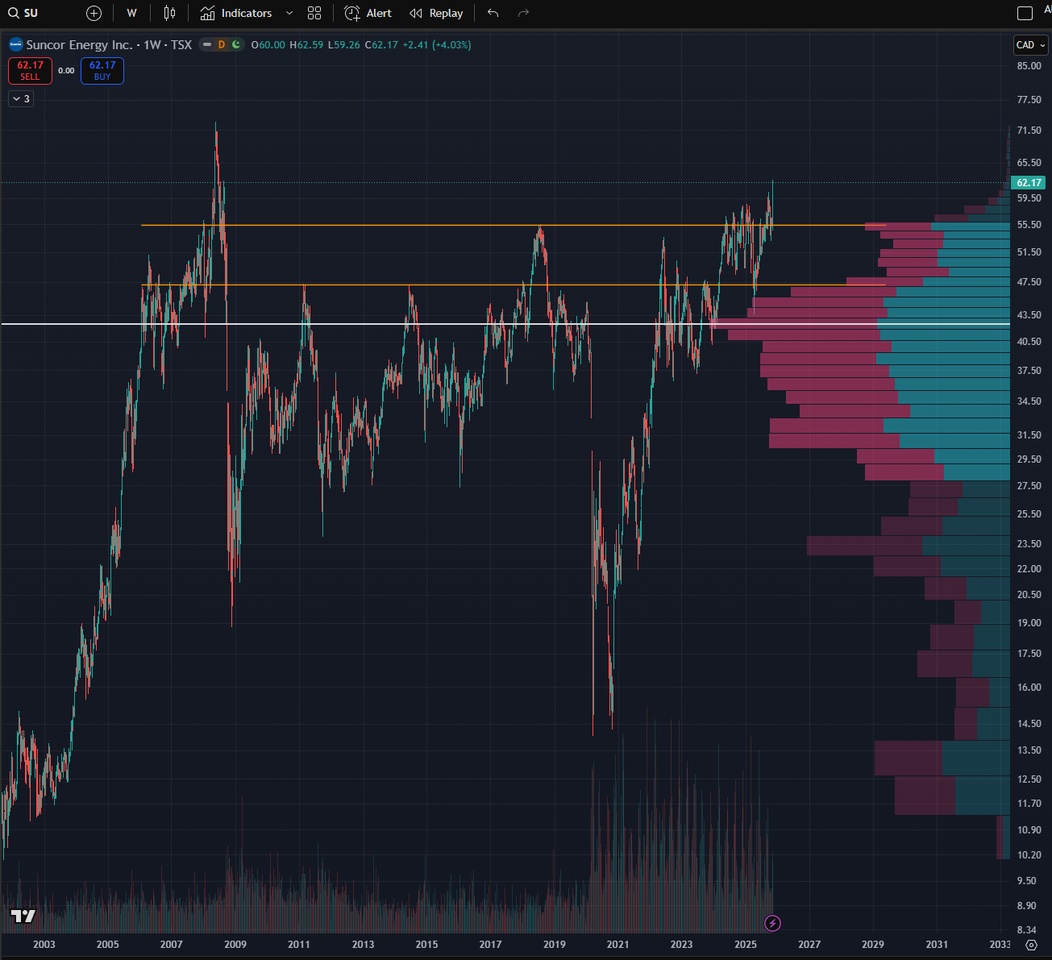

Suncor Energy $SU (-0,34 %)

📍Overview of the company:

Suncor Energy is one of Canada's largest integrated energy companies, making its money primarily from oil sands production, processing into synthetic crude oil, and downstream operations such as refineries and a large Canadian service station network.

Thanks to its strong presence in the politically stable regions of Alberta and Ontario, Suncor is considered to have a relatively secure geostrategic position, as Canada is one of the most reliable oil supply countries and oil sand reserves can be extracted over an extremely long period of time.

Risks arise primarily from North American regulation and ESG pressure, rather than from geopolitical conflicts.

Analysts currently generally see the fair value of SU shares at around C$70-75, while the price on the TSX chart is around C$62 - this results in a moderate expected upside potential in the low double-digit percentage range, depending on oil prices and operating performance.

💰Dividend yield (TTM): 3.816%

📈Notes on the chart:

$SU (-0,34 %) had a long sideways phase in which the price first consolidated at the ~C$47.2 resistance and for the entire past year at around ~C$55.

Now it looks as if the price has broken out of this range to the upside.

The next price target is the ATH from May 2008 (~C$73).

Here, too, I am already invested and continue to buy.

Share 3:

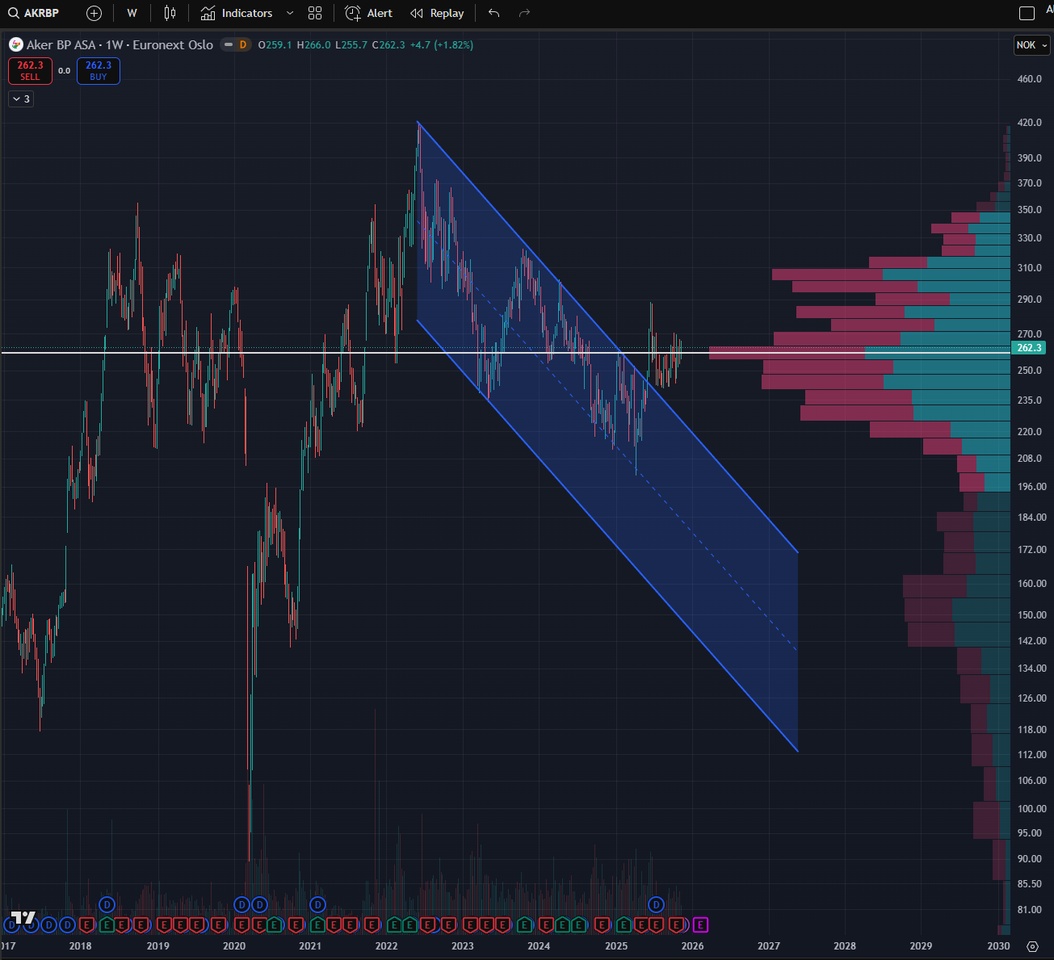

Aker BP ASA $AKRBP (-1,87 %)

📍Overview of the company:

Aker BP ASA is one of the largest independent oil and gas producers in Norway and makes its money mainly through the production of crude oil and natural gas on the Norwegian Continental Shelf.

The company operates several large fields such as Johan Sverdrup, Skarv, Valhall and Alvheim and is characterized by low production costs and high operational efficiency.

Geostrategically, Aker BP is considered very secure, as Norway is politically stable, has reliable regulation and the North Sea assets are not dependent on conflict zones - a clear advantage over many global producers.

Analysts are largely positive on Aker BP; consensus estimates see a fair value slightly above the current price level, supported by robust cash flows, high dividends and expected production increases.

Overall, Aker BP is seen as a high-quality, geostrategically stable oil stock whose valuation depends primarily on the long-term oil price.

💰Dividend yield (TTM): 10.05%

📈Notes on the chart:

Aker BP has successfully broken out of the downtrend since 2022 and is currently consolidating just above the long-term volume POC.

I am invested and will continue to buy if possible.

💬 Closing words

As of today, I am invested in the energy sector with 8.2% of my portfolio.

In addition to the stocks presented, I am also invested in $CVX (-1,52 %) , $EQNR (+0,69 %) , $OXY (-0,13 %) , $TTE (-0,83 %)

Do you have an "insider tip" from the energy sector that you would like to share? 🤔

In order to expand my share of the energy sector in Europe, I made my first purchase today. $TTE (-0,83 %) bought today.

This means that the share of the energy sector in my portfolio is now just under 7%.

The last purchases were:

I was about to expand one of my 3 largest positions $NOVO B (+4,77 %)

$JD (-1,14 %)

$CNQ (+0 %) but in the end I put in a little more gold .

I think it can have more potential with bags at maximums $DNG (+0 %)

I don't see it clearly I sell with losses$UNH (+0,88 %) ... with the fall of oil I will rotate to pretolers with low PERs and focus on dividends $FANG (+0,03 %)

$REP (-3,25 %)

$CNQ (+0 %)

$XOM (-1,26 %)

$CVX (-1,52 %) If things get ugly even with a recession, I think it can protect oil🫤🛢️

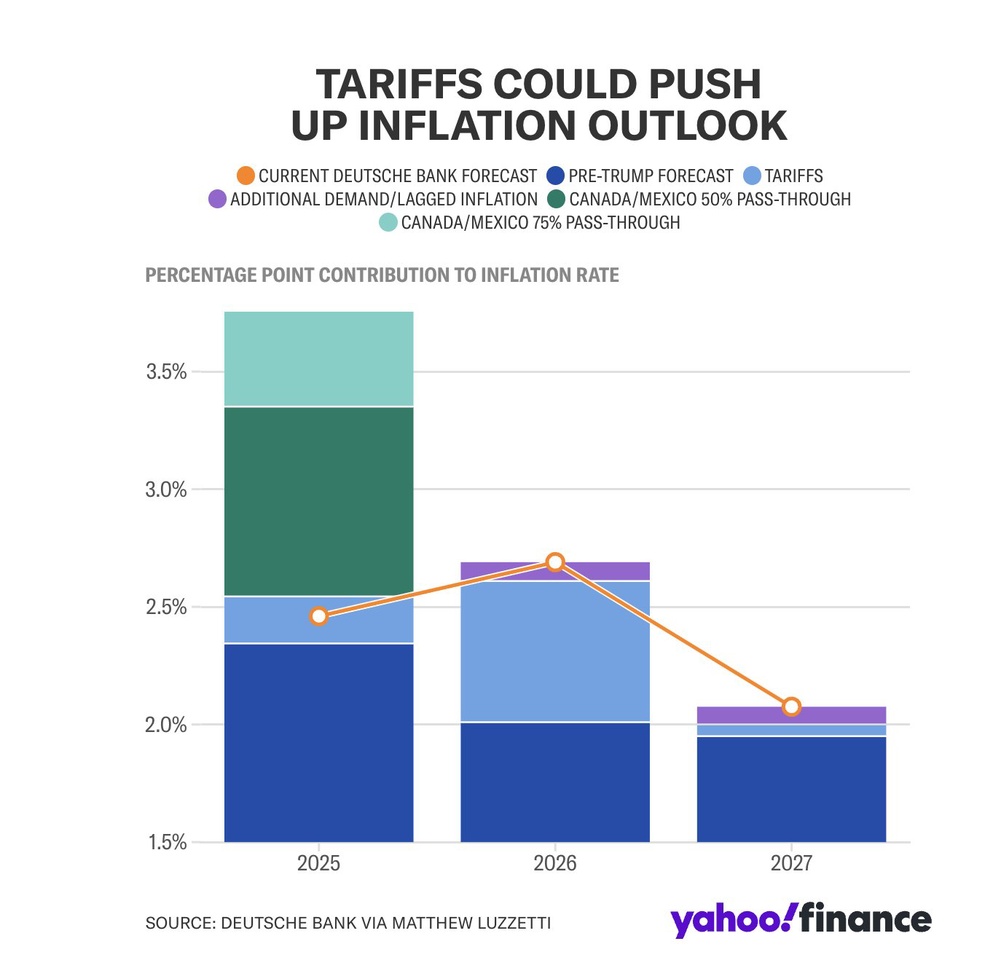

After I wrote in the first post about the consequences of the announced and effective tariffs of the USA... there are now some concrete answers from the affected countries, especially from Canada.

It's hard to keep up with all the news 👀

In this post, I go into more detail about the possible consequences for the EU, especially for the automotive sector.

"1st post from this morning" can be read again here: https://getqu.in/oj1JRH/

Trump's new tariffs: Recap

Since February 1, 2025, the US government and Donald Trump have imposed new import tariffs on Mexico, Canada and China:

Canada: A tough counterattack

However, this last step in particular would be a double-edged sword, as Canada is heavily dependent on energy cooperation with the USA.

Now it's getting concrete:

Canada's Prime Minister Justin Trudeau announced at a press conference in the evening Canadian time that tariffs of 25 percent will also be introduced on US goods from Tuesday next week 🔄 [2].

The tariffs planned by Canada are intended for US goods with a total value of 155 billion dollars.

The Canadian government is also considering measures in other areas, such as trade in critical minerals.

Further effects on companies:

Particularly affected: (automotive, energy, raw materials, agriculture)

German car manufacturers used Canada as a production and export location

Canadian oil and gas producers sell large quantities to the US, higher tariffs could make exports less attractive and squeeze profits.

Fertilizer producers are heavily dependent on US exports, higher costs and a competitive disadvantage compared to US competitors represent a potential risk.

Mexico: The USA punishes its most important trading partner

Counter-tariffs possible: President Claudia Sheinbaum has announced corresponding measures and instructed her Secretary of Commerce to implement a plan that considers counter-tariffs [2]. - We can be curious.

Mexico's dependence on the USA:

Trump uses tariffs as political leverage:

Impact on European companies: (again the car manufacturers 👀)

China: a further burden for an ailing economy

Consequences for China:

Indirect effects on Europe:

Chinese manufacturers such as BYD $1211 (+1,32 %) could be forced to develop alternative markets and push even harder into Europe.

Furthermore:

Is the EU facing the same fate?

Trump has already indicated that the EU must also fear tariffs.

Possible measures:

Possible reaction of the EU:

Conclusion: Trade war 2.0?

Trump is once again focusing on confrontation and using tariffs as economic and political leverage. The countries affected are fighting back, which increases the risk of a global trade war.

The consequences are far-reaching:

USA: Higher prices for consumers, relocation of production to the domestic market possible.

China: Further economic pressure, stronger focus on Europe as a sales market.

Mexico & Canada: Massive burden on the economy & industry, relocation of production conceivable.

Europe: German car manufacturers under pressure, possible US tariffs on European products.

I'm in the mood... Thanks for reading, I've had enough now! 🤝

__________

Main sources:

[1] https://www.tagesschau.de/ausland/amerika/usa-trump-strafzoelle-100.html

[2] https://de.finance.yahoo.com/nachrichten/roundup-kanada-mexiko-china-kontern-083517258.html

$CNQ (+0 %) Thanks to TR I was a bit surprised, as today-47% daily performance.

But now comes the note: "Please note...stock split, error in performance calculation"

Wanted to share my portfolio with you. Been investing since May 2020. 25 years old, full-time job and I buy and sell cars from time to time. Have a mix of growth stocks and dividend stocks. This year I will invest more outside the US to reduce the US share a bit. I will mainly $D6H (+0,21 %)

$YSN (+5,47 %) buy more. New additions will be: $WKL (-0,55 %)

$1913 (+0,28 %)

$CNQ (+0 %) After all the purchases have been made, I will increase all positions below 1k.

Meilleurs créateurs cette semaine