Top Movers

$DE (-0,58 %) +20%

$CNQ (+0 %) +17%

$CNR (-1,35 %) +17%

$8002 (-0,66 %) +17%

$CSL (-0,09 %) +17%

Top Loosers

$HIMS (+4,19 %) -44%

$NOVO B (+4,77 %) -32%

$3350 (+5,75 %) -30%

$MELI (+3,16 %) -18%

$BX (+2,86 %) -17%

Postes

11Top Movers

$DE (-0,58 %) +20%

$CNQ (+0 %) +17%

$CNR (-1,35 %) +17%

$8002 (-0,66 %) +17%

$CSL (-0,09 %) +17%

Top Loosers

$HIMS (+4,19 %) -44%

$NOVO B (+4,77 %) -32%

$3350 (+5,75 %) -30%

$MELI (+3,16 %) -18%

$BX (+2,86 %) -17%

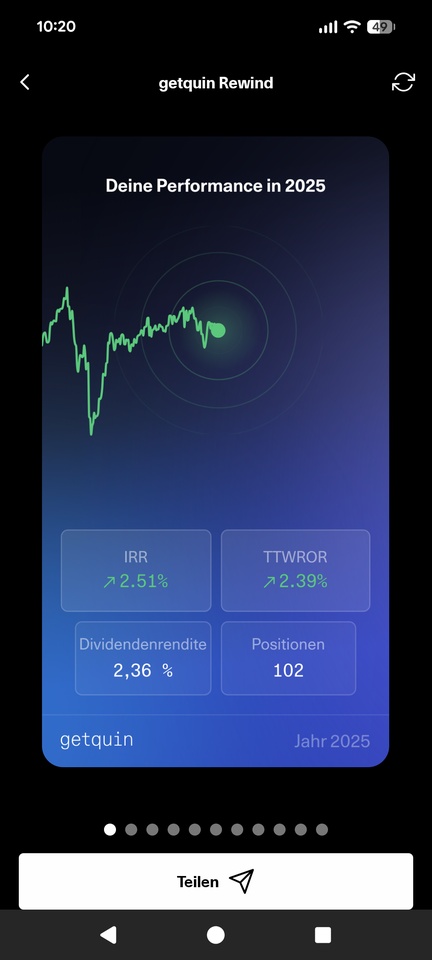

It was a good start to the year :)

Top Movers

$ASML (+2,71 %) + 34%

$JEDI (+2,88 %) +23%

$SLVY (+4,29 %) +22%

$8002 (-0,66 %) +17%

$KLAC (+2,26 %) +16%

Top Loosers

$HIMS (+4,19 %) -17%

$AOF (+0,8 %) -15%

$UNH (+0,88 %) -14%

$QCOM (+0,93 %) -12%

The BoJ's interest rate decision is due tomorrow. Anyone who remembers August 24 knows that this can also lead to increased volatility here and in the USA.

The consensus among market participants is that key interest rates will be raised from 0.25% to 0.75%. This may sound relaxed against the backdrop of European and US key interest rates, but it could have a direct impact on our portfolio.

Basically, I believe that the actual interest rate hike is already priced into both prices and carry trades and will therefore only lead to low volatility.

As always, the outlook for the continuation of interest rate policy is much more decisive. If a tighter interest rate policy with several rate hikes is announced next year, I actually expect losses of >10%, especially for Japanese stocks.

I will try to pick up Itochu $8001 (+3,85 %) during the day on Friday.

Bitcoin and dollar weakness hurt this year...

Top performers 2025

$KLAC (+2,26 %) +72%

$8002 (-0,66 %) +66%

$DG (-1,16 %) +57%

$ASML (+2,71 %) +37%

$HIMS (+4,19 %) +35%

$SLVY (+4,29 %) +35%

$AVGO (+2,03 %) +31%

$8031 (+0,81 %) +21%

$MUX (+2,69 %) +20%

$GLDI (+1,11 %) +18%

Low performer 2025

$3350 (+5,75 %) -69%

$ARE (+2,39 %) -54%

$ENPH (-1 %) -52%

$YMST -48%

$NOVO B (+4,77 %) -44%

$UNH (+0,88 %) -40%

$RICK (+3,08 %) -39%

$ZTS (-0,18 %) -30%

$AHH (+2,34 %) -29%

+ 1

In the Berkshire Hathaway portfolio $BRK.B (+1,16 %) Warren Buffett has the companies Mitsubishi $8058 (+1,74 %), Mitsui $8031 (+0,81 %), Itochu $8001 (+3,85 %), Marubeni $8002 (-0,66 %) and Sumitomo $8053 (+0,53 %).

The five companies are conglomerates. They do business in many different sectors: Industrial metals, oil and gas, food and agriculture, automotive supply chains, infrastructure, real estate, finance, industry, chemicals, media, digital technology, consumer goods and healthcare.

"We like their capital allocation as well as their management and attitude towards shareholders," said Buffett, explaining his decision to buy. "All five companies increase their dividends when appropriate, they buy back their own shares when it makes sense, and their top managers are far less aggressive in their remuneration programs than their US counterparts," the well-known investor continues.

However, the economic environment in Japan is anything but rosy at the moment: corporate profits were weak in the second quarter and suffered above all from the US tariffs.

The country's demographics also harbor risks for Japan investors. "Japan's structural problems are likely to remain unsolved because the ageing society has no strength for reform," warned Gunther Schnabl, Director of the Flossbach von Storch Research Institute in Cologne.

Buffett, known as the "Oracle of Omaha" after his US headquarters, has selected Japanese companies that diversify across different sectors and cycles, benefit from commodity trading and also pay high dividends. Commodities traditionally perform well in an internationally inflationary environment.

For investors, this means that bargain hunters can currently come across undervalued quality stocks in Japan whose diversified business segments are able to cope well with possible international risks.

Source text (excerpt): Handelsblatt, 28.09.25

Next week, the decision on a possible interest rate hike in Japan is due. Although the interest rate level in Japan is still very low, the last Japanese interest rate hike caused quite a stir and price losses.

Due to the development of wages and prices in Japan, the professionals are also expecting a rise in key interest rates

I am therefore reducing my Japan position in the portfolio from 5% to around 3.5% and Sumitomo is out. The following remain in the portfolio for the time being $8001 (+3,85 %) Itochu and $8002 (-0,66 %) Marubeni remain in the portfolio.

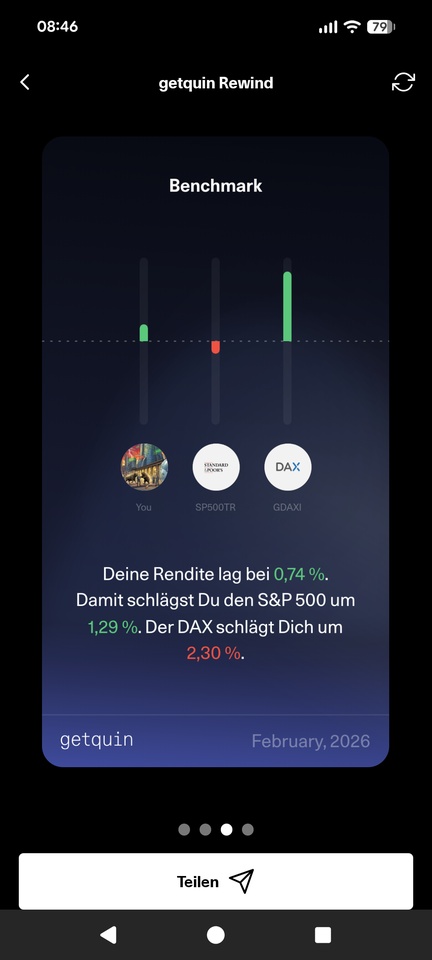

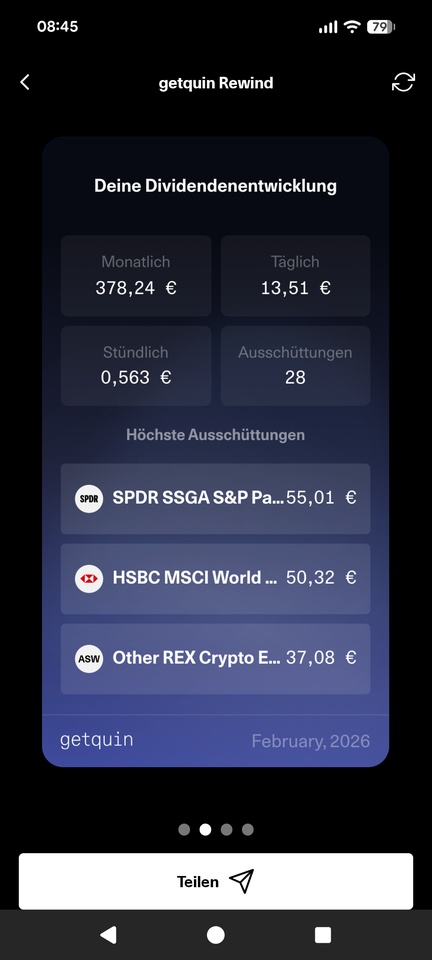

After reading along for quite a while now, I wanted to share my progress with you and perhaps get some feedback and a few opinions.

With the execution of the savings plans today, my main portfolio (I still have about 3/4 of the sum parked with BitPanda, but I think the interface sucks and therefore don't track it with GQ) has slipped over the 10k mark for the first time.

I'm very happy about that because it was quite a long way to get there. From various bad decisions ($PLUG (+11,64 %)

$SLI (+1,46 %) ) to consistently miserable entry points (during Corona AFTER the prices picked up again, Crypto in the middle of the last ATH,...) everything was actually there.

At the beginning of the year, I then decided to build up a dividend portfolio, had invested heavily in

$O (-1,2 %) and $BATS (+1,06 %) and immediately questioned everything again. In particular, what I actually wanted to achieve with the portfolio.

Looking at the performance of various World ETFs and the S&P500, I (hopefully) finally decided not to reinvent the wheel and stick to what works.

I then rebuilt my portfolio to its current state.

The two ETFs form the basis, supplemented by the $XDEM (+2,13 %)

Various individual stocks fly around it.

$UBER (+0,26 %) and $NU (+1,33 %) are the last remnants from the beginnings two and a half years ago. I bought the rest relatively recently. As my aim here is to beat my benchmark ((YTD Performance World ETF + YTD Performance S&P500)/2), I sit down once a month and enter everything in a spreadsheet. I look at the monthly performance, the annual performance and the YTD performance. If an individual share is below my benchmark for two out of three values, I put it under observation. If this remains the case for three months in a row, I sort it out. I am curious to see where the journey will take me. Currently on the hit list are $8002 (-0,66 %) and $MELI (+3,16 %)

I would be delighted to hear from anyone who is doing something similar and how things are going.

Finally, the framework in which I am traveling: I am 31 years old and moved from Kiel to Vienna last year, where I am currently working as an intern to finally finish my studies. My savings rate is currently 750€ per month (250€ crypto, 500€ individual stocks and ETF) and I save all the positions in my portfolio with a savings plan. The savings rate is quite new and has fluctuated a lot in the past.

Thanks to everyone who has read this far and thank you for your feedback and suggestions.

Have a nice evening. :)

No, not China!!! Japan 🇯🇵

My first Japan share 🇯🇵🇯🇵

Approx. 3.7% initial dividend yield

Payout at just under 30%

and a very good growth rate...

I think that could fit 😻

Always pay a nice dividend 🪹🪺🪺🪺🪺💴💵💶💷

Today with Marubeni $8002 (-0,66 %) my third Japan position in the portfolio.

Marubeni is a wonderfully boring broadly diversified trading and industrial conglomerate, which complements my long-term portfolio well.

The valuation is fair, but of course includes the usual conglomerate discount. The development of the balance sheet and P&L over the past years is just as continuously positive as the share performance and the dividend development (3% p.a. with strong div growth). Although the stock may be somewhat overbought, the MACD is positive, as is the SMA 20/50/200.

On the risk side, one must certainly mention the increased currency risk, among other things, also due to the current interest rate differentials, such as a possible upcoming interest rate hike by the Japanese central bank, which is likely to lead to turbulence on the Japanese stock markets.

With Itochu $8001 (+3,85 %) and Sumitomo $8053 (+0,53 %) Japan now has a 6% share in my portfolio, so that should be fine.

Meilleurs créateurs cette semaine