The new year got off to a slow start for me. The turn of the year somehow passed me by this time. It wasn't until mid-January that I felt I had arrived in the new year.

But then things got moving: During the first of two hikes through wintry Saxon Switzerland, it occurred to me that there was still something on my to-do list. I just wanted to start making videos again. Whether reels, shorts or entire YouTube videos. That was on my list. And as I climbed the Lilienstein at 8 a.m. on a cold January Saturday, I simply picked up my cell phone and shared my thoughts. But one thing was not enough. During my tours over snow and icy paths and ascents from the Schrammsteine to the Bastei, there were more shots. I finally left my comfort zone again and started the next project on my list. I simply started imperfectly instead of continuing to put off perfection.

Everything continued to run automatically in the background, thanks to automation and savings plans. This time with a small strategic adjustment. Additional funds were not invested, but held back for the taxation of the advance lump sum. The tax-free amounts were just enough, so there will be plenty of additional investments next month.

And now enough preamble, time for a look back.

DISCLAIMER/RISK WARNING

Please remember that this article is for entertainment purposes only. At no point is it a buy or sell recommendation or professional legal, tax or investment advice. Don't just copy anything I do. I am merely describing what is happening in my portfolios, but in no way guarantee that it is up-to-date, correct or complete.

Investing in the capital market is always associated with risks such as loss of invested capital, price fluctuations, liquidation risks or market risks. In accordance with the current guidelines of ESMA and BaFin, I expressly point out that this review serves exclusively to document my personal investment strategy and does not constitute investment advice within the meaning of Section 2 (8) WpIG. The securities presented by me are expressly not to be understood as investment advicebut are merely components of my personal portfolio at the time of reporting.

Overall performance

We all know and appreciate the magic of automation in our portfolios. Except for one thing, the entire news cycle passed me by in January. I'll come back to that at the end.

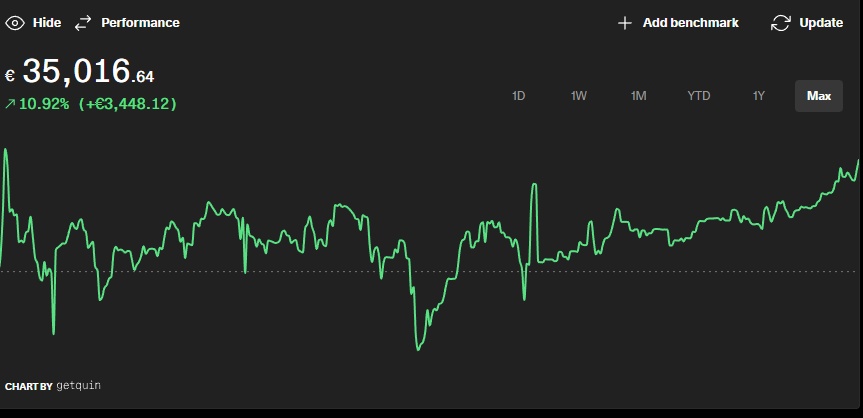

My key performance indicators for my overall portfolio at a glance:

- TTWROR (month under review): +1.64% (previous month: -0.46%)

- TTWROR (since inception): +84,34%

- IZF (month under review): +21.13% (previous month: -5.23%)

- IZF (since inception): +11,50%

- Delta: +1,461.07€

- Absolute change: +€2,572.29

Performance & Volume

My class leader $AVGO (-4,87 %) continues to decline as a proportion of the portfolio volume and, as in the previous month $NFLX (+2,45 %) with it. The latter even drops out of my top 5 largest individual positions. However, the tide is turning for the giant $GOOGL (-1,74 %) . But this is not a recommendation to you! It's just what happened to me. The other positions in my top 5 ($WMT (-0,82 %) , $BAC (-0,14 %) and $FAST (+1,63 %) are also not to be begged and continue to improve, also in terms of performance.

The five red lanterns naturally go to the same weakening candidates (in terms of performance). However, the minus points are finally getting smaller, particularly noticeable in the case of $NOVO B (-0,81 %) . And also with $TGT (-1,16 %) .

Largest individual share positions by volume in the overall portfolio:

Share (%) of the total portfolio (and associated securities account):

$AVGO (-4,87 %) 2.56% (main share portfolio)

$WMT (-0,82 %) 1.93% (main share portfolio)

$GOOGL (-1,74 %) 1.55% (main share portfolio)

$FAST (+1,63 %) 1.52% (main share portfolio)

$BAC (-0,14 %) 1.45% (main share portfolio)

Smallest individual share positions by volume in the overall portfolio:

Share (%) of the total portfolio (and associated securities account):

$NOVO B (-0,81 %) 0.45% (main share portfolio)

$BATS (-0,56 %) 0.56% (main share portfolio)

$GIS (+1,49 %) 0.56% (crypto follow-on deposit)

$MDLZ (+0 %) 0.60% (main share portfolio)

$CPB (+1,88 %) 0.61% (main share portfolio)

Top-performing individual stocks

Shares with performance since initial purchase (%) (and the respective portfolio):

$AVGO (-4,87 %) : +294% (main share portfolio)

$GOOGL (-1,74 %) +129% (main share portfolio)

$WMT (-0,82 %) : +104% (main share portfolio)

$NFLX (+2,45 %) : +77% (main share portfolio)

$BAC (-0,14 %) +75% (main share portfolio)

Flop performer individual stocks

Shares with performance since initial purchase (%) (and the respective portfolio):

$GIS (+1,49 %) : -35% (main stock portfolio)

$NKE (+0,8 %) -34% (main share portfolio)

$CPB (+1,88 %) : -30% (main share portfolio)

$TGT (-1,16 %) -26% (main share portfolio)

$NOVO B (-0,81 %) : -13% (main share portfolio)

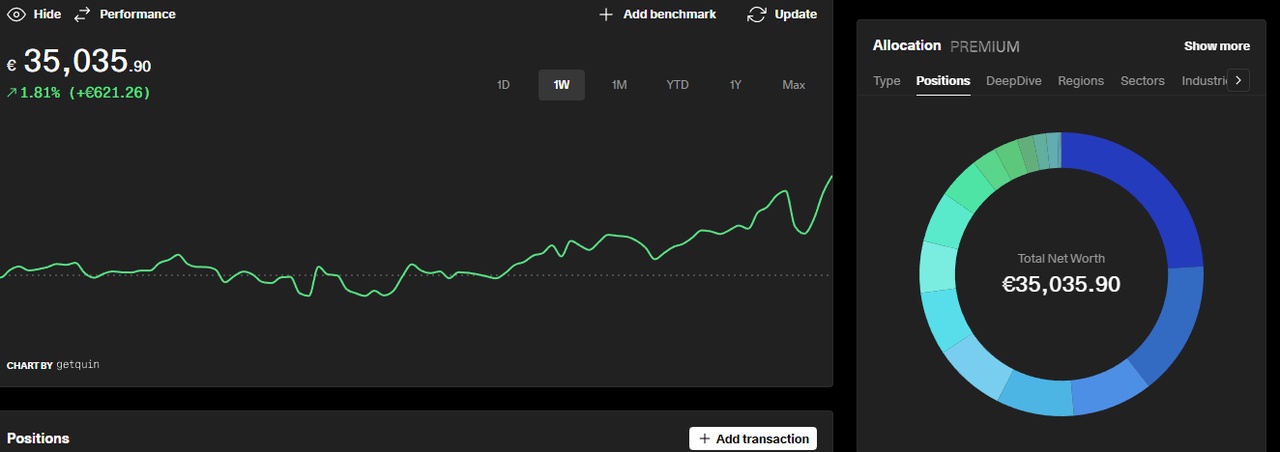

Asset allocation

Equities and ETFs currently determine my asset allocation.

ETFs: 41.9%

Equities: 58.1%

Investments and additional purchases

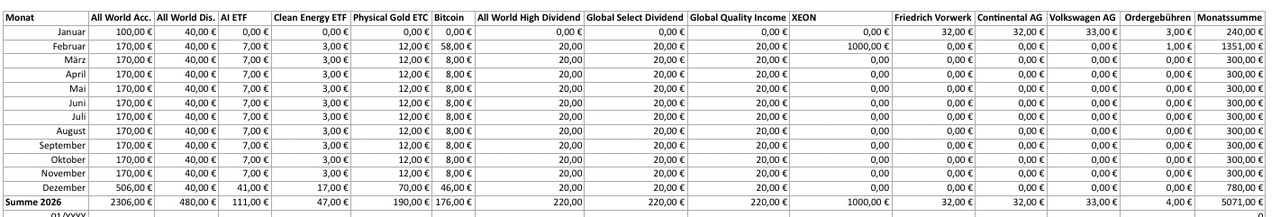

I have invested the following sums in savings plans:

Planned savings plan amount from the fixed net salary: €1,040

Planned savings plan amount from the fixed net salary, incl. reinvested dividends according to plan size: € 1,060

Savings ratio of the savings plans to the fixed net salary: 50.07%

In addition, there were the following additional investments from returns, refunds, cashback, etc. as one-off savings plans/repurchases:

Subsequent purchases/one-off savings plans as cashback annuities from refunds: € 0.00

Subsequent purchases/one-off savings plans as cashback annuities from bonuses: € 0.00

Subsequent purchases from other surpluses: € 0.00

Automatically reinvested dividends by the broker: €3.54 (function is only activated for an old custody account, as I otherwise prefer to control the reinvestment myself)

In the month under review, only the fixed savings plans were executed.

Number of unscheduled additional purchases: 0

Passive income from dividends

I received € 172.72 in dividends (€ 98.60 in the same month last year). This corresponds to a change of +75.15% compared to the same month last year. The reason for the strong increase, in addition to normal dividend growth, is that the distributions from my three large Vanguard ETFs slipped over the turn of the year, which makes January look unusually strong. Adjusted for this effect, growth is in line with expectations.

Number of dividend payments: 24

Number of payment days: 12 days

Average dividend per payment: €7.20

average dividend per payday: € 14.39

The top three payers in the month under review were:

$VWRL (-0,39 %)

$VHYL (-0,13 %)

$ISPA (-0,34 %)

My passive income from dividends (and some interest) mathematically covered 17.32% of my expenses in the month under review. For a rather weak month with medium-high expenses by my standards (due to the first annual bills), this is acceptable.

Performance comparison: portfolio vs. benchmarks

A comparison of my portfolio with two important ETFs shows the TTWROR in the current month (and since the beginning):

My portfolio: +1.64% (since I started: +84.34%)

$VWRL (-0,39 %) +1.52% (since my start: 66.12%)

$VUSA (-0,93 %) -0.26% (since my start: 63.76%)

After underperforming the ETFs last month, the tide has turned for the first month of the new year. 🤗

Key risk figures

Here are my key risk figures for the month under review:

Maximum drawdown:

since inception: 17.17%

Month under review: 2.06%

Maximum drawdown duration:

since inception:702 days

Month under review: 16+ days

Volatility:

since inception: 28.29%

Month under review: 2.28%

Sharpe Ratio:

since inception: 0.42

in the month under review: 9.26

Semi-volatility:

since inception: 21.01

Month under review: 1.36

The maximum drawdown of 702 days since the beginning is still reminiscent of the tough phase of 2022-2023 before the recovery began. In January itself, the decline was minimal at 2.06%, so a quiet start to the year, showing that no major dislocations were imminent.

My Sharpe ratio shot up to 9.26 in the month under review. This is an upward outlier that reflects the positive performance with low volatility. Since the beginning, it has been a solid 0.42. This means that for every unit of risk, I am achieving just under half a unit of return above the risk-free interest rate. Volatility was extremely low in January at 2.28%, compared with 28.29% since the beginning. Semi-volatility was even as low as 1.36%. This means that although the portfolio fluctuates, the actual risk of loss remains low.

What remains? The confirmation of my strategy: think long-term, keep calm, invest automatically. So January got off to a solid and uneventful start. Just the way I like it!

Outlook

As already explained, I will make provisions for the taxation of the advance lump sum in the markets in the second half of February. This will be accompanied by any expected refunds. If you want to know what, be sure to check back next time. 😊

I'll also bring AI as an off-topic topic.

Gemini 3 is simply amazing. I've already used it to create in-depth research on any topic and use it to create podcasts and information material. NotebookLM is now also on the list of tools I'm going to explore. That's the forward momentum in me, to keep my finger on the pulse and get the most out of the new possibilities.

This time I won't end my review with a personal point, but with an event that has not passed me by.

I actually keep politics and world events out of my social media and internet presence, unless they affect our finances, economy or portfolios. What is happening in Iran is absolutely shocking for me. It is inconceivable that the people there, who are fighting for the same rights that we take for granted, are being cut down en masse like cattle by an inhuman regime and its criminal henchmen

Of course you could say: What's it to us? But if we take a look at our country, we realize that such circumstances can also threaten us if we do not stand up for our free, democratic and liberal values and show the clear edge to everything that stands against them. Our women in particular have fought for rights that must be defended. We men also have a duty to defend these achievements. We must understand that all of us who were born and grew up here in the Western world, from Europe to North America to Australia, New Zealand and Japan, have won the ovarian lottery. Not only in terms of poverty and wealth, but also in terms of human rights and freedoms. And that is precisely why there have been and continue to be posts on my Instagram channel that address and share the situation in Iran. Because they are cut off from the outside world and continue to be brutally oppressed, tortured and executed, it is important to give people their own voice and make them visible.

The courageous people who risk everything in the fight for freedom, who have been injured and the countless people who have been murdered, are the greatest heroes this world has seen in recent times.

I wish the people of Iran, who are now risking everything, that they will finally drive out this criminal Islamic regime and its disgusting henchmen and find their way to peace, freedom and self-determination. I wish them all the best and all the happiness in the world. 🍀

Thank you for reading. And now off to an icy February! ❄️

👉 You can also see my portfolio review for January on Instagram from 08.02.2026 (and budget review from 09.02.2026).

📲 In addition to the portfolio and budget review, there are currently three posts a week: @frugalfreisein. Instagram reels and YouTube shorts currently appear irregularly under channels of the same name; the same applies to videos.

!!! Please pay close attention to the spelling of my alias. Unfortunately, there are too many fake and phishing accounts on social media. I have already been "copied" several times. !!!

👉 How do you personally feel the stock market year has started? (No investment advice!)