iShares Core MSCI World ETF

Price

Discussion sur IWDA

Postes

965What really makes a successful investor?

$LXS (-18,72 %)

$DBXD (-0,81 %)

$IWDA (-1,16 %)

$CSNDX (-1,55 %)

$CSPX (-1,24 %)

Eight percent reality, fifty percent hysteria? The psychology behind price jumps and how investors can deal with them correctly.

Volatility: normality instead of risk?

Hardly a day goes by without some share in the DAX environment recording a significant price swing. This could look like this, for example: A Quartalsberichtminimally misses expectations - minus ten percent. An outlook sounds a touch more optimistic than feared - up eight percent.

But a look at the long-term figures reveals this daily excitement for what it usually is: Irrationality.

Because the bottom line is that the DAX over the past 25 years - including Dividenden - around eight percent per year. Eight percent. Not 20, not 30, eight.

And since the Index is ultimately nothing more than a basket of its constituent companies, this inevitably means that the share prices of these companies have also risen by an average of around eight percent per year over the long term.

Expectations, forecasts, whispered estimates

Anyone who realizes this should find the daily Volatilität seem absurd. If the "fair" value of a company grows by eight percent annually over the long term, how rational can it be that the share price of most Aktienfluctuate by 50% during the year?

Or plummet by eight to ten percent or shoot up after the publication of individual quarterly figures - even though the long-term earning power has often hardly changed?

Of course: information must be priced in. Profits, margins, outlooks, risks - all this is part of the valuation. But in reality, companies Märkte rarely react to facts, but to expectations upon expectations.

In addition, there is a structural problem of modern capital markets: the time horizon has shrunk. It is now only about whether the share price will rise tomorrow - and no longer about where a company will be in a few years' time.

Algorithms, ETFs, short-term funds and a media news cycle that declares every decimal place a "game changer" amplify minimal signals into drastic price movements.

Drama vs. reality

If the daily price fluctuations were taken seriously, the economic reality of DAX companies would have to change radically on a permanent basis. But it doesn't. Mechanical engineering companies, chemical groups or insurers are not suddenly worth ten percent less just because one quarter was a little weaker. Nor are they fundamentally ten percent better overnight because an analyst raises his forecast slightly.

The long-term return of the DAX shows how little remains of all the drama. Eight percent per year - calm, steady, unspectacular. The daily swings are the noise around this trend, nothing more.

And that is exactly what investors should understand. Don't let yourself go crazy if share XY comes under pressure again. In most cases, there is little or hardly anything behind it.

From depression to euphoria - a lesson

Industries and sectors fall out of favor and come under pressure. A few months later, they are back in vogue.

In 2022, for example, we experienced a major tech depression. Meta, NetflixGoogle and many more were on the hit list, only to go on to soar to incredible heights.

Today, everything labeled "AI loser" or "software" is on the brink. In retrospect, the current sell-off in many of these stocks is probably just as incomprehensible as the fact that Meta collapsed to below USD 100 in 2022 from today's perspective.

Those who understand this separation between price and value experience volatility in a completely different way. Price fluctuations lose their horror because they are no longer perceived as a threat, but as the normal state of an irrational market. The Börse is not a precise measuring instrument, but a barometer of sentiment - and sentiment fluctuates more than fundamental data

Lanxess share: Chart from 10/02/2026, price: EUR 20.91 - symbol: LXS | source: TWS

Lanxess, for example, is trading up 7.6% today at EUR 20.91. The only relevant news I could find on the company was an upgrade by Goldman Sachsfrom sell to neutral and an accompanying price target increase from 10 to 23 euros.

What could better illustrate all the short-term madness than this Rating? It fits like a glove. Yesterday Lanxess was only worth EUR 10, today it is worth EUR 23.

New factories must have sprung up overnight.

Source

When it comes to capital market investments as a retirement provision, vola is anything but irrelevant. With maxDD of 73%, as with the Dax, the safe withdrawal rate drops to 2-3%pa. That comes close to a savings account.

Anyone who dismisses vola as market noise has never experienced a 73% drawdown. The psychological strain is enormous if the entire pension provision is invested there. And the risk of selling in panic is also very high.

Finally, the irrationalities you mentioned follow certain rules. You can use them to get more than 8%pa with less than 73% mDD. Momentum investing is the key word. 😬

Investment decision

Hi everyone,

I'm currently facing a question that everyone probably likes to ask themselves, but I have around €10,000 to invest and I'm not sure where to put it at the moment.

I am saving both the $TDIV (-0,25 %) as well as the $VHYL (-0,37 %) as a dividend earner but also the $IWDA (-1,16 %) as my core

My general goal is to have a good mix of dividend stocks ($KO, $SBMO (-0,13 %) etc) and growth/tech stocks ($GOOGL (-0,59 %) ). Overall, I want to continue this trend and therefore ask you for recommendations

ETF recommendation: simply put everything in an All-World

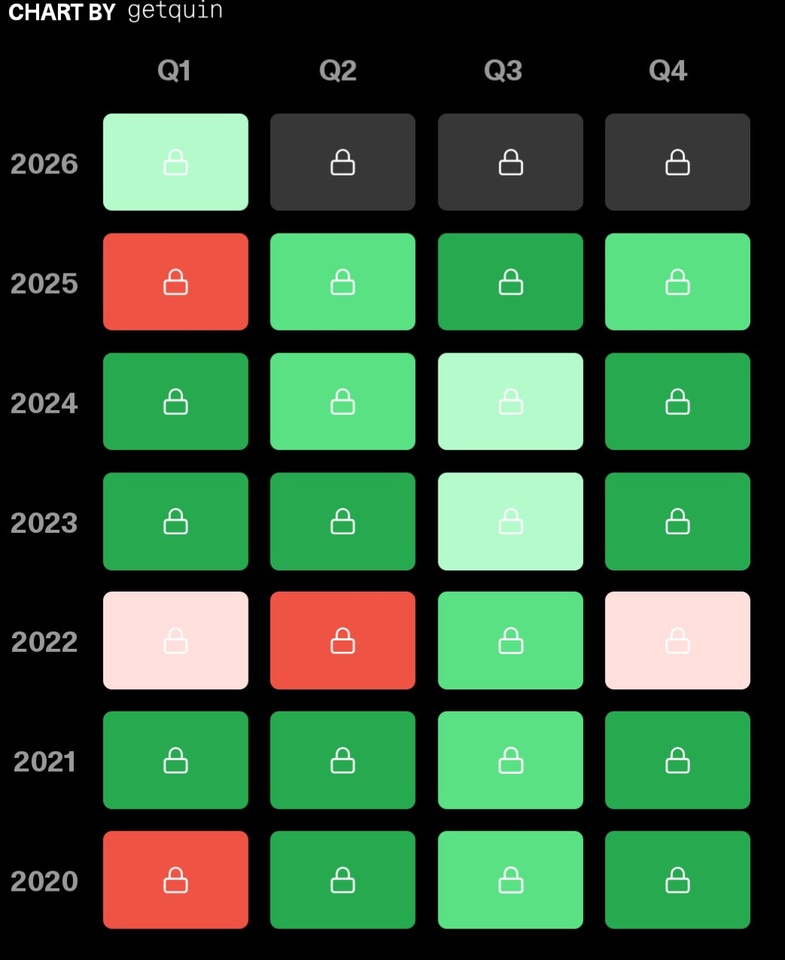

January performance is respectable but...

Nevertheless, I have decided to minimize the risk in my portfolio for the first time.

What did I do?

Stocks that I am not (or no longer!) 100% convinced of were removed from the portfolio and shifted into ETFs.

Thank goodness with a manageable loss.

ETF share increased and higher monthly savings, because I'm now an apprentice and earn more.

Savings as follows:

$COPX (-3,02 %) is saved with 600€

$IWDA (-1,16 %) with 400€

$XEMD (-2,21 %) with 250€

250€ overnight money

In 3 months, my Volksbank membership in the amount of € 4800 will be terminated. This will then be used to buy shares again.

Until then, my securities account will remain: $IREN (-7,48 %) , $RKLB (+0,84 %) , $QBTS (-0,78 %)

So: more safety, lower risk= better sleep, less headache

The crash is coming - or is it? An attempt to classify the overall market at the beginning of 2026

Reading time: approx. 6 minutes

At first glance, the current stock market seems contradictory. On the one hand, many indices are trading close to or at all-time highs, but on the other, there is no feeling of widespread euphoria. There is no widespread speculation, no classic "everything is rising" phase. Instead, we are seeing a market that is expensive, but at the same time selective, more rational than previous high phases and strongly characterized by expected values.

If you start with the naked valuation, the picture is clear. The US equity market, represented by the $CSPX (-1,24 %) (S&P 500), is clearly trading above its long-term norms. The forward P/E ratio of the index is currently around 21 to 22, while the 10-year average is closer to 18 to 19. This corresponds to a valuation premium of around 10 to 15 percent. However, this figure alone is only of limited significance, as it is heavily dependent on the current earnings situation and the respective estimates.

It is therefore worth looking at long-term smoothed valuation measures, above all the Shiller CAPE. This ratio compares the current index level with the inflation-adjusted average of corporate profits over the past ten years. The aim is to smooth out cyclical exaggerations in individual years and obtain a more stable picture of the structural valuation.

The Shiller CAPE of the S&P 500 is currently in the range of around 38 to 40. The long-term median is around 16, the long-term average around 17. This means that the market is trading at more than twice the level of a historically normal valuation situation. Comparable levels have only been reached in a few phases in the past, such as at the turn of the millennium or in individual exceptional situations thereafter.

A regional comparison helps to classify this figure. Japan is currently trading at a CAPE of roughly 28, while Europe is more in the region of around 20, which means that these markets are not cheap either, but are valued much less ambitiously than the USA. This underlines the fact that the high valuation level is not a global phenomenon, but is strongly US-centric - and is in turn particularly characterized by a few heavyweights.

The correct interpretation of this signal is crucial. The Shiller CAPE is not a timing instrument. It says nothing about when a market will fall or rise. Its strength lies exclusively in the classification of the long-term expected value. Historically, it has been shown that the higher the CAPE at the time of entry, the lower the average returns over the following seven to ten years. High CAPE values did not necessarily lead to losses, but almost always to below-average results compared to more favorable entry phases.

Today's market fits exactly into this pattern. The high CAPE does not signal an imminent correction, but an environment in which future earnings must come more from profit growth, cash flows and distributions. The scope for further multiple expansion is limited. The market demands substance.

A second long-term valuation framework is the so-called Buffett indicator. It puts the total market capitalization of a stock market in relation to economic output, usually measured by gross domestic product. The basic idea behind this is simple: in the long term, corporate profits cannot grow faster than the underlying economy. If market capitalization diverges too far from GDP, the demands on future profits and returns on capital increase considerably.

For the USA, this indicator is currently over 200%. Historically, the long-term average has tended to be in the range of 70 to 100 percent. Again, this is not a short-term warning signal, but a structural one. Such a high value means that the market is making very optimistic assumptions about margins, returns on capital and earnings growth.

These assumptions have not been plucked out of the air. Two factors explain a large part of today's valuation levels: firstly, an interest rate environment that continues to imply low long-term real yields despite monetary policy tightening, and secondly, unusually high margin stability of large companies. Dominant platform models, high barriers to market entry and economies of scale ensure that many heavyweights consistently achieve higher operating margins than previous market generations. This justifies higher multiples - at least as long as these margins can be defended.

The Buffett indicator becomes particularly revealing when the concentration effect is taken into account - analogous to the forward P/E ratio and CAPE. The so-called "Mag 7" now make up around 30 to 32 percent of the total market capitalization of the S&P 500, but account for an even larger share of aggregated profits. If this group is approximately excluded from the Buffett indicator, the ratio of market capitalization to GDP is significantly reduced. Instead of a value of over 200 percent, the adjusted indicator would be roughly in the range of around 140 to 160 percent.

This value is also historically high, but is in a completely different order of magnitude. It does not signal a structural extreme, but an ambitious but explainable valuation. The extreme character of the aggregated Buffett indicator is therefore - just as with the Shiller CAPE - to a large extent a concentration phenomenon.

If this observation is combined with the other indicators, a consistent picture emerges. The forward P/E ratio of the $SPX is currently around 21 to 22, without the "Mag 7" it would be around 16 to 17 and therefore close to the long-term average. The Shiller CAPE is falling from around 38 to 40 to around 26 to 28 and the Buffett indicator is falling from over 200% to a historically high, but not extreme, level. Three different valuation approaches, constructed independently of each other, thus come to the same conclusion: the perceived overvaluation of the market as a whole is largely the result of a strong concentration on a few, highly valued heavyweights.

A look beyond the USA reinforces this impression. The global equity market, as represented by the $IWDA (-1,16 %) (MSCI World), is also trading above its historical averages, but to a lesser extent. Europe remains more moderately valued in comparison, which is reflected not only in the lower P/E ratio, but also in the lower CAPE.

What does this mean for the return outlook? Historical CAPE regressions provide at least a rough guide here. At a CAPE level of around 38 to 40, the average annual returns of the US market in the following ten years were typically in the range of around 2 to 4 percent. This is not an exact forecast value, but a corridor of expectations. It does not necessarily imply poor results, but significantly lower returns than in phases of low valuation. Markets with CAPE values of around 20, such as Europe, have historically tended to be in a range of around 4 to 6 percent.

Putting valuation, market phase and capital flows together, a clear picture emerges. The market is no longer in a build-up phase in which bad news is ignored. However, it is also not in a classic euphoria phase. It is a mature acceleration phase. Profits are available, capital is invested, but it is flowing selectively. Mistakes are being punished again, quality is being paid for, hope without cash flow is increasingly being questioned.

The consequence of this is a shift in the source of returns. The past few years have been strongly characterized by multiple expansion. At today's valuation level, returns come primarily from earnings growth, cash flow and dividends. This explains why business models with strong cash flows are still in demand, while insubstantial story stocks are becoming less attractive.

Perhaps this is the real insight of this market environment: it is not the market that is the problem, but the expectation of it. Those who expect the same returns today as in the past decade will inevitably be disappointed. On the other hand, those who accept that the market has become more mature, more selective and more demanding will continue to find approaches that work. Not everywhere. Not automatically. But where price, expectation and substance fit together again. This is precisely why it is currently less about market opinions - and more about clean decisions.

Are some stocks now also traded at the weekend?

Good morning and have a nice weekend.

I have noticed for some time that two of my positions

have price movements outside trading hours and also at the weekend.

I am of the opinion that this did not exist in 2025, at least not at the end of 2025.

There was no movement at night or at the weekend.

In contrast to

$IWDA (-1,16 %) and

they have no movement.

Is this new since 2026, or have I missed something?

Yours sincerely

Carsten

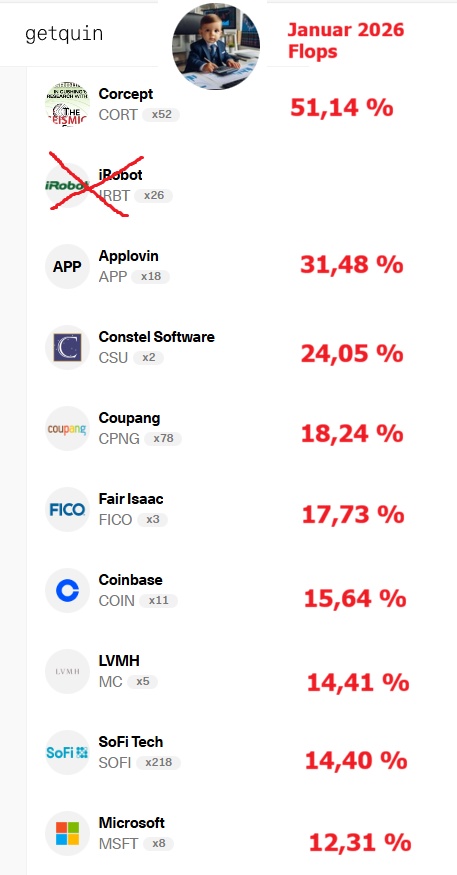

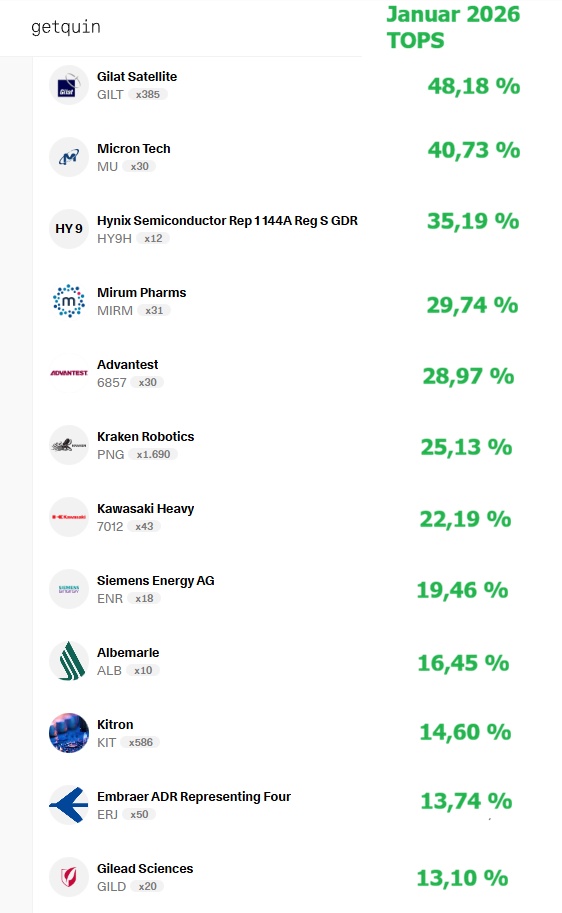

26 additional shares in the custody account 🚀

A wild January comes to a slightly green end

Hello my dears,

for all of you who are interested.

A short summary with the TOP and FLOP values.

Tenbagger 2024 +5.31 %

I Shares NASDAQ 100 ETF$CSNDX (-1,55 %) +0,10 %

I Shares S&P 500 ETF$CSPX (-1,24 %) +0,25 %

I Shares MSCI World $IWDA (-1,16 %) +0,87 %

Finally added some BTC

I’d been planning to buy some $BTC (-0,16 %) for a while, but went with $IWDA (-1,16 %) instead since it felt safer. Finally pulled the trigger. Wish I could’ve bought more, but I’m worried about liquidity next month…

Titres populaires

Meilleurs créateurs cette semaine