Sentence with X, probably nothing...

As the good Warren used to say, rule number 1 is:

Never lose money.

And rule number 2:

Never forget rule number 1

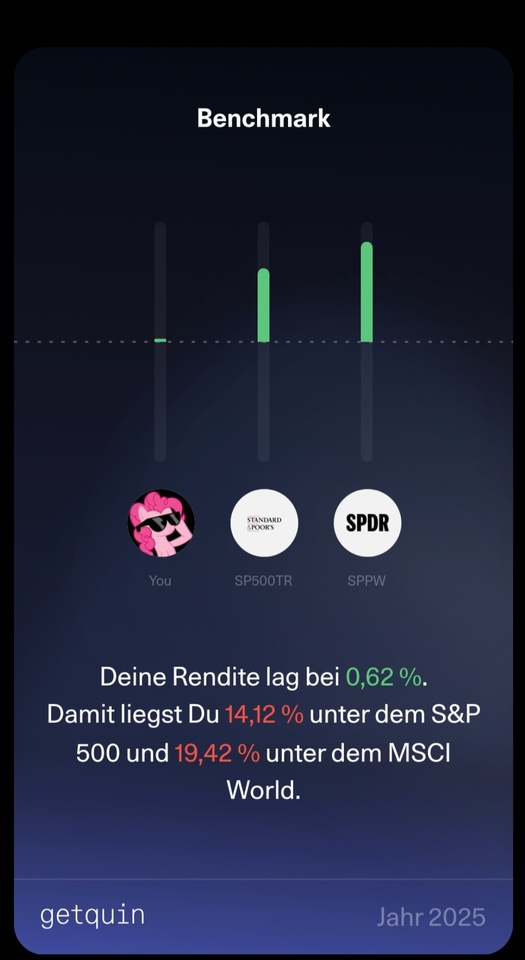

But the most important thing is that I was better than @DonkeyInvestor 😜

But joking aside, what was the problem?

Short and sweet, $BTC (-0,59 %) and $ETH (-0,52 %) are highly weighted in my portfolio.

I did make a few profits at the beginning of the year with $BTC (-0,59 %) and in the middle of the year with $ETH (-0,52 %) but obviously not enough. 😅

The fact that the overall portfolio has remained green is due to the fact that my multi-factor strategy on the equity side has beaten the market.

Emerging markets and value stocks have massively outperformed this year.

It is therefore not surprising that the ETF that has performed best is an EM value ETF $5MVL (+1,94 %)

Apart from factor funds, gold has also boosted the portfolio considerably,

although it is only part of the investment reserve. However, I'm starting to have too much of it, which is why I'm currently trying to have parts of my $EWG2 (+2,08 %) and sell it tax-free. (you have to do this in Austria)

Which is going more badly than right and Flatex and the Stuttgart Stock Exchange are currently passing the buck back and forth. (for 2 months) 😩

When the process is completed, I may write a report on my experiences.

What will change in 2026?

Nothing really, the portfolio will remain as it is, in rising prices $BTC (-0,59 %) and $ETH (-0,52 %) sold off further until my crypto allocation is just under 10%. (it is currently ~16%)

Should crypto continue to fall and fall below the targeted 10% allocation, I can imagine $BTC (-0,59 %) to buy more.

In the meantime, I will continue to $IQSA (+1,17 %) position further and wait for setbacks to take new positions in $GTIS (+0,1 %)

$DE000LS9UK98 (+0,52 %) and $C9DF (+0,87 %) build up or $U5W0 (+0,75 %) buy more. 😘

Oh yes, and the annual return of the MSCI World in EURO $IWDA (+0,57 %) is ~ 6.7% and not 20!

Dear getquin team. Please stop $AAPL (+1,51 %) to compare with 🍐.