estimated reading time: 4 minutes

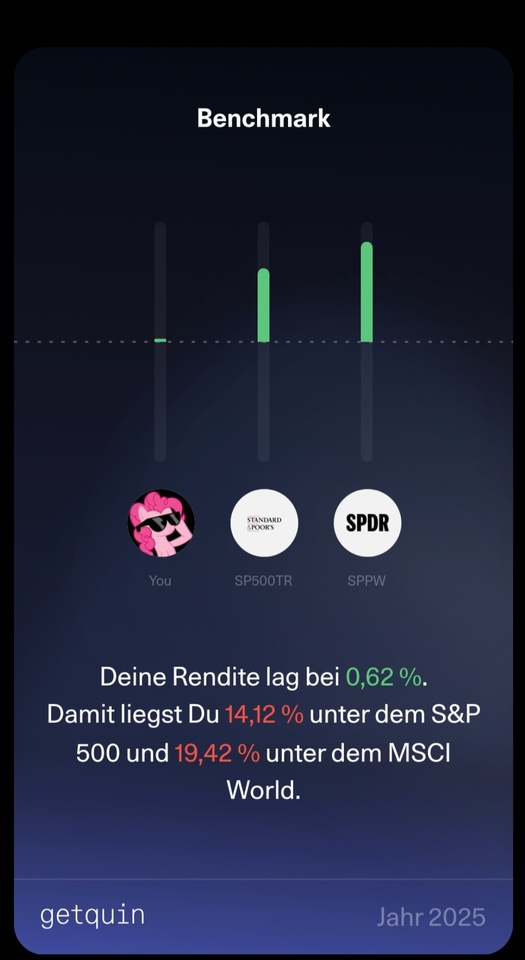

Twenty years ago, the new market crash wiped out my first stock market money and my ego. I swore off the stock market, but my pension certificate showed me that ducking out has an expiry date.

So the first attempts to start again followed. Here on Getquin, I have learned from positive critical voices from e.g. @DonkeyInvestor and @Epi that there is more to it than "just picking something". Since my last post 6 months ago, this was followed by extreme late-night brooding, Excel monsters, AI research, reading Kommer and countless "new agains".

I have tried to read up on modern optimization models such as Mean-Variance, Black-Litterman and Fama-French etc. and implement them in the best possible way.

The result was this portfolio!

As thoroughly tested as you can in a private garage, and coupled with the insight that we only have to leave the uncontrollable to chance.

And one thing first. I am convinced of this and will not change it.

I just want to share my thoughts and ideas about the direction with you. It's difficult to really explain every detail here, I'm sure I could do it better in a conversation, but that's not possible here. I can assure you that the selection and combination definitely makes sense - at least for me and the construct. Among other things, it was important to me to be able to control individual regions separately. I think I have achieved that.

Global (30%)

- SPDR MSCI All Country World, $SPYY (+0,91 %)

- L&G Global Equity UCITS ETF, $LGGG (+0,78 %)

- iShares Edge MSCI World Momentum, $IS3R (+1 %)

- Xtrackers MSCI World Value, $XDEV (+0,55 %)

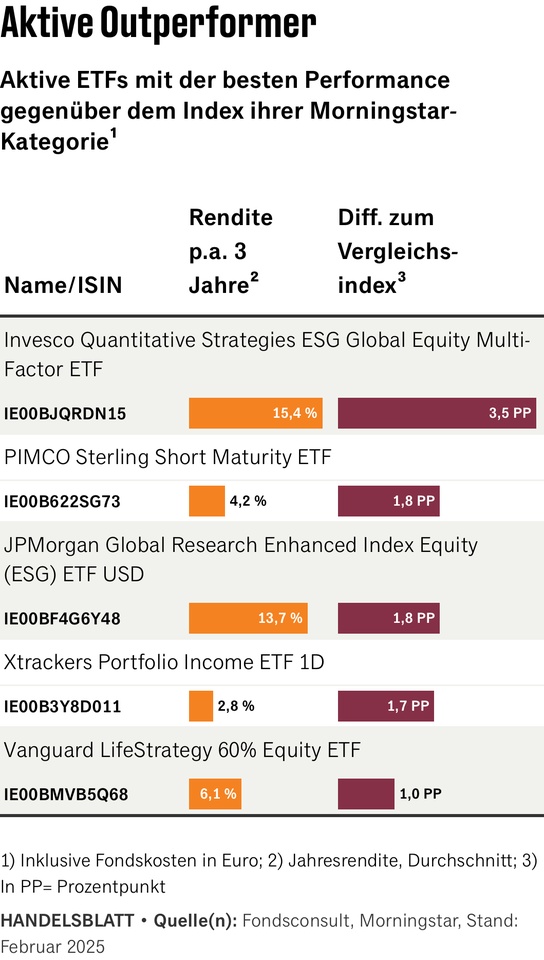

- Invesco Global Active ESG Equity, $IQSA (+1,17 %)

- VanEck World Equal Weight Screened, $TSWE (+1,14 %)

- VanEck Morningstar Developed Markets Dividend Leaders, $TDIV (+0,23 %)

USA (31.5%)

- L&G US Equity, $LGUG (+0,59 %)

- iShares MSCI USA Mid-Cap Equal Weight, $IUSF (+0,19 %)

- JPMorgan BetaBuilders US Small Cap Equity, $BBCS (-0,07 %)

- SPDR MSCI USA Small Cap Value Weighted, $ZPRV (+0,01 %)

Europe (17.5%)

- HSBC EURO STOXX 50, $H50A (+1,23 %)

- L&G Europe ex-UK Quality Dividends Equal Weight, $LDEG (+1,04 %)

- SPDR MSCI Europe Small Cap Value Weighted, $ZPRX (+0,53 %)

Emerging markets (19%)

- iShares Edge MSCI Emerging Markets Value Factor, $5MVL (+1,94 %)

- UBS LFS MSCI Emerging Markets ETF, $EMMUSA (+1,76 %)

- L&G Emerging Markets Quality Dividends Equal Weight, $LDME (+1,13 %)

- SPDR MSCI Emerging Markets Small Cap, $SPYX (+1,28 %)

Japan (2%)

- L&G Japan Equity UCITS ETF, $LGJG (-0,02 %)

Ø TER = 0.25%

In summary, this gives the following breakdown

Regional breakdown

- USA (North America) ~ 48%

- Asia ~ 22%

- Europe ~ 22%

- UK ~ 3.6%

- Japan ~ 4.4%

Market capitalization

- Large Cap ~ 52%

- Mid Cap ~ 26%

- Small Cap ~ 22%

The portfolio deliberately allocates its capital to the regions and - where possible - to all capitalization classes. The world building blocks provide the global beta; value, momentum and quality satellites add factor premiums. In the USA, a complete large/mid/small stack provides a pronounced size bias, while Europe receives a value bias via quality and small value ETFs. The emerging layer combines large-cap value stocks, quality leaders and a small-cap module - a diversification anchor beyond the developed markets.

Due to the almost equal weighting of the 18 positions, the Herfindahl index of ETF weights falls to ~633; indirectly, the portfolio contains several thousand individual stocks. The weighted TER is ≈ 0.25 % p. a., spreads below 0.1 %. This means that, compared to a $GERD (+0,86 %) a favorable multifactor portfolio myself.

The factor tilts (value 42 %, size 35 %, quality/div ≈ 12 %, momentum ≈ 8 %) increase the expected volatility moderately to 18-20 % p.a.; however, historical data on small and value indices indicate 1-2 percentage points additional return over long horizons. Large caps remain present at around 52 %, mid caps at 26 % and small caps at 22 % support the size premium .

With my "multi-factor all-cap portfolio", I combine global market coverage with five proven premiums, without cost or concentration ballast. Of course, I will have to endure additional fluctuations, but I believe that I have created a robust source of returns over the long term.

I have tried to consider everything and leave nothing to chance, except the uncontrollable.

Anyone who has made it this far. Thanks for reading.

I'm looking forward to your feedback.

PS:

YES, I have Bitcoin😉 and also two themed ETFs. They just stay like that.

- ARK AI & Robotics ETF, $AAKI (-1 %)

- HanETF Future of Defense ETF, $ASWC (-0,67 %)

- ETC GROUP CORE BITCOIN, $BTC1 (+1 %)

---

no investment advice; DYOR

Thanks also to @VPT , @Mister_ultra , @Ph1l1pp , @ShrimpTheGimp , @MoneyISnotREAL , @Staatsmann and @Smudeo for commenting and providing approaches.