I have decided to add the German reinsurers to my portfolio. Do you prefer $HNR1 (-0,16 %) (or Talanx $TLX (+0,09 %) ) or $MUV2 (+0,16 %) ?

Talanx

Price

Debate sobre TLX

Puestos

18Talanx revises profit forecast to 2.3 billion euros

The insurance group Talanx is raising its profit forecast for 2025 following a record profit in the first half of the year. For analysts, this is not too much of a surprise.

Instead of more than 2.1 billion, net profit for the year as a whole is now expected to reach around 2.3 billion euros, the Group with the main brand HDI announced in Hanover on Thursday. In the first half of the year, the insurer absorbed immense losses caused by the forest fires in California. These were particularly costly for Hannover Re, the world's third-largest reinsurer, in which Talanx holds the majority of shares.

On balance, Talanx earned almost 1.4 billion euros - 26 percent more than a year earlier and more than analysts had expected on average. The primary insurance division, which includes insurers in Poland and Latin America in addition to HDI, recorded particularly strong growth. This time, the division even contributed 51 percent to the Group result. The rest of the profit came from reinsurance.

"Despite high major claims payments in the first quarter, we achieved a record half-year result and at the same time further strengthened our resilience," said CEO Torsten Leue. The destruction caused by the fires in Los Angeles at the beginning of the year cost the Group more than 624 million euros

Talanx ahead of the figures (tomorrow)

The Talanx Company

Talanx AG offers insurance and reinsurance products and services worldwide. The company offers life, personal accident, liability, motor, aviation, legal expenses, fire, burglary, water damage, glass, storm damage, household, homeowners, hail, livestock, engineering, general property, marine, business interruption, extended coverage, travel assistance, aviation and space liability, and other property and non-life insurance products. It also offers bancassurance products. Talanx sold goods and services worth € 25.58 billion in the last financial year. The company made a bottom-line profit of € 3.28 billion.

How the competition is doing

Talanx faces various competitors on the market. In contrast to Talanx shares, Allianz shares (Allianz shares) recently rose by 0.25 percent. Investors also bought Generali SpA shares (Generali SpA shares). The price of Generali SpA (Generali SpA share) climbed by 0.03 percent.

Talanx ahead of the figures (tomorrow)

The Talanx Company

Talanx AG offers insurance and reinsurance products and services worldwide. The company offers life, personal accident, liability, motor, aviation, legal expenses, fire, burglary, water damage, glass, storm damage, household, homeowners, hail, livestock, engineering, general property, marine, business interruption, extended coverage, travel assistance, aviation and space liability, and other property and non-life insurance products. It also offers bancassurance products. Talanx sold goods and services worth € 25.58 billion in the last financial year. The company made a bottom-line profit of € 3.28 billion.

How the competition is doing

Talanx faces various competitors on the market. In contrast to Talanx shares, Allianz shares (Allianz shares) recently rose by 0.25 percent. Investors also bought Generali SpA shares (Generali SpA shares). The price of Generali SpA (Generali SpA share) climbed by 0.03 percent.

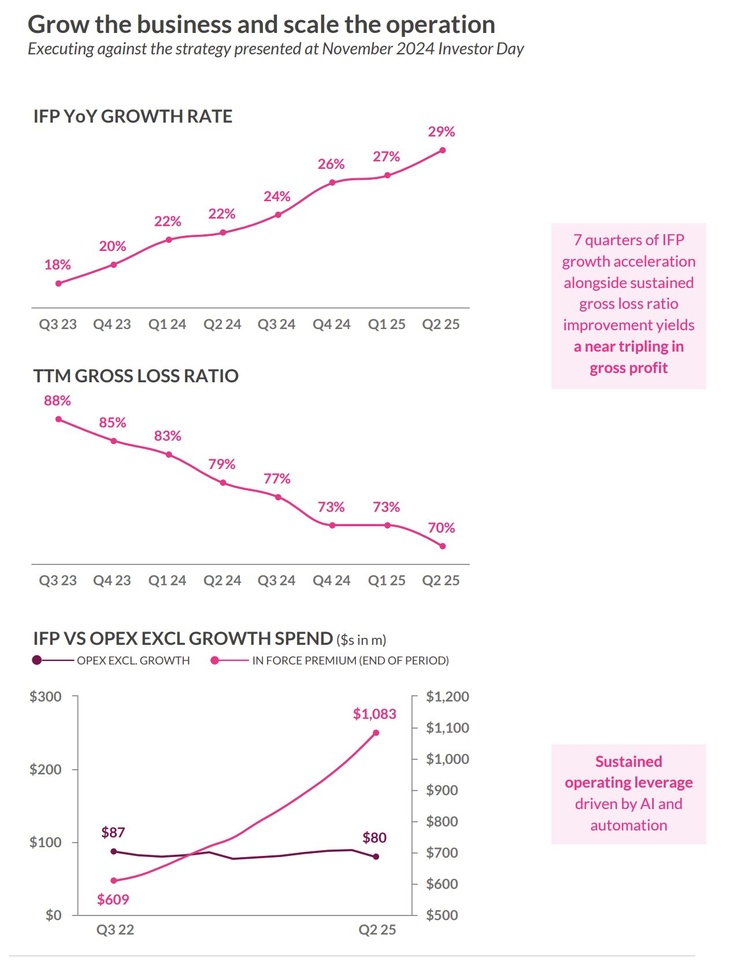

Lemonade Q2'25 result highlights 🚀👌

- Revenue: $164.1M (Est. $161.4M) ✅; UP +46% YoY

- EPS: -$0.60 (Est. -$0.80) ✅

- In-Force Premium: $840M; UP +22% YoY

Customer & Premium Metrics

- Premium per Customer: $394; UP +11% YoY

- Total Customers: 2.1M; UP +10% YoY

- Policies in Force: 2.13M

- Annual Dollar Retention (ADR): 87%

Other Q2 Metrics:

- Gross Profit: $41.3M; UP +91% YoY

- Adj EBITDA: -$30.4M

- Net Loss: $41.6M

- Gross Loss Ratio: 77% (vs. 94% YoY)

- Cash & Investments: $888M

- Net Cash Used in Operating Activities: -$29.8M

CEO comment:

🟡 "We achieved record sales and margin improvements. This is the strongest second quarter in Lemonade's history."

🟡 "We are on track to achieve our target of adjusted EBITDA profitability by mid-2026."

$BRO (-0,03 %)

$BRK.B (-0,22 %)

$BRK.A (-0,12 %)

$PGR (-0,03 %)

$ALV (-0,2 %)

$MUV2 (+0,16 %)

$CS (-0,01 %)

$HNR1 (-0,16 %)

$UNH (+0,85 %)

$ALL (-0,04 %)

$601318

$CB (-1,38 %)

$ZURN (+0,35 %)

$TLX (+0,09 %)

$HSX (+5,64 %)

Analyst updates, 03.01.25

⬆️⬆️⬆️

- Raymond James Upgrades Block Inc (SQ) to Outperform

Raymond James analyst John Davis upgraded Block Inc (NYSE: SQ) from Market Perform to Outperform with a price target of $115.00. $SQ (+0,36 %)

- HAUCK AUFHÄUSER IB upgrades KNORR-BREMSE from Sell to Hold and raises price target from EUR 63.60 to EUR 65. $KBX (-0,52 %)

- EXANE BNP upgrades UBS from Neutral to Outperform and raises price target from CHF 27 to CHF 35. $UBSG (+0,1 %)

- BERENBERG raises the price target for TALANX from EUR 91.10 to EUR 95.30. Buy. $TLX (+0,09 %)

- BERENBERG raises the price target for SNP from EUR 56 to EUR 61. Hold. $SHF (+1,26 %)

⬇️⬇️⬇️

- UBS lowers the price target for ADOBE SYSTEMS from USD 525 to USD 475. Neutral. $ADBE (-0,2 %)

- JEFFERIES lowers the price target for SCHOTT PHARMA from EUR 31.80 to EUR 26.34. Hold. $1SXP (-2,2 %)

Analyst updates, 05.12.

⬆️⬆️⬆️

- HSBC upgrades SIEMENS to Hold. Target price EUR 185. $SIE (+1,05 %)

- DEUTSCHE BANK RESEARCH raises the price target for MUNICH RE from EUR 450 to EUR 535. Hold. $MUV2 (+0,16 %)

- DEUTSCHE BANK RESEARCH raises the price target for HANNOVER RÜCK from EUR 255 to EUR 294. Buy. $HNR1 (-0,16 %)

- DEUTSCHE BANK RESEARCH raises the price target for TALANX from EUR 70 to EUR 76. Hold. $TLX (+0,09 %)

- JEFFERIES raises the price target for ORACLE from 190 USD to 220 USD. Buy. $ORCL (+0,88 %)

- HAUCK AUFHÄUSER IB raises the target price for MTU from EUR 264 to EUR 280. Sell. $MTX (+1,11 %)

- BARCLAYS upgrades AUTO1 from Equal-Weight to Overweight and raises target price from EUR 9 to EUR 19. $AG1 (-7,98 %)

- JPMORGAN raises the price target for HELLOFRESH from EUR 14 to EUR 16. Overweight. $HFG (+0,7 %)

- JPMORGAN raises the target price for DELIVERY HERO from EUR 42 to EUR 55. Overweight. $DHER (+0,66 %)

- JPMORGAN raises the price target for CTS EVENTIM from EUR 104 to EUR 112. Overweight. $EVD (-0,42 %)

- JPMORGAN raises the target price for SCOUT24 from EUR 92 to EUR 105. Overweight. $G24 (-0,57 %)

- JPMORGAN raises the target price for JUST EAT TAKEAWAY from GBP 16.02 to GBP 18.32. Overweight. $TKWY

- JPMORGAN upgrades DELIVEROO from Neutral to Overweight and raises target price from GBP 1.70 to GBP 1.92. $ROO

- JPMORGAN raises the price target for HEIDELBERG MATERIALS from EUR 150 to EUR 151. Overweight. $HEI (-4,43 %)

- JPMORGAN raises the price target for FRAPORT from EUR 49 to EUR 59. Neutral. $FRA (-0,76 %)

⬇️⬇️⬇️

- METZLER lowers the price target for HYPOPORT from EUR 220 to EUR 185. Sell. $HYQ (+0,06 %)

- ODDO BHF lowers the target price for SCHOTT PHARMA from EUR 38 to EUR 37. Outperform. $1SXP (-2,2 %)

- BARCLAYS lowers the target price for RIO TINTO from GBP 61 to GBP 60. Overweight. $RIO (+2,26 %)

- JPMORGAN downgrades STRÖER from Overweight to Neutral and lowers target price from EUR 79 to EUR 57. $SAX (+0,07 %)

⬆️⬆️⬆️

- BOFA raises the price target for WALMART from USD 95 to USD 105. Buy. $WMT (-0,22 %)

- JEFFERIES raises the price target for WALMART from USD 100 to USD 105. Buy. $WMT (-0,22 %)

- HAUCK AUFHÄUSER IB raises the target price for RHEINMETALL from EUR 680 to EUR 750. Buy. $RHM (-1,06 %)

- WARBURG RESEARCH raises the target price for RHEINMETALL from EUR 600 to EUR 700. Buy. $RHM (-1,06 %)

- JPMORGAN raises the price target for SALESFORCE from USD 310 to USD 340. Overweight. $CRM (+0,76 %)

- WARBURG RESEARCH raises the target price for LEG IMMOBILIEN from EUR 81.60 to EUR 90.50. Hold. $LEG (+1,2 %)

- DEUTSCHE BANK RESEARCH raises the price target for HEIDELBERG MATERIALS from EUR 116 to EUR 137. Buy. $HEI (-4,43 %)

- KEPLER CHEUVREUX raises the price target for GFT TECHNOLOGIES from EUR 31 to EUR 32. Buy. $GFT (+0,57 %)

- ODDO BHF raises the target price for TALANX from EUR 76 to EUR 78. Underperform. $TLX (+0,09 %)

- KEPLER CHEUVREUX raises the target price for THYSSENKRUPP from EUR 3.70 to EUR 3.80. Hold. $TKA (+0,19 %)

⬇️⬇️⬇️

- STIFEL lowers the price target for BAYER from EUR 36 to EUR 28. Hold. $BAYN (-0,24 %)

- LBBW downgrades ENI from Buy to Hold and lowers target price from EUR 16.70 to EUR 15. $ENI (+0,1 %)

- WARBURG RESEARCH lowers the target price for SFC ENERGY from EUR 29 to EUR 27. Buy. $F3C (+1,2 %)

- WARBURG RESEARCH lowers the target price for TECHNOTRANS from EUR 23 to EUR 21. Buy. $TTR1 (-0,91 %)

- DEUTSCHE BANK RESEARCH lowers the price target for CUREVAC from USD 3.90 to USD 2.50. Hold. $CVAC

- BERENBERG lowers the price target for ASTRAZENECA from GBP 150 to GBP 140. Buy. $AZN (-0,01 %)

Analyst updates, 15.11. 👇🏼

⬆️⬆️⬆️

- JEFFERIES raises the price target for ASML from EUR 760 to EUR 840. Buy. $ASML (+0,39 %)

- RBC raises the price target for TESLA from USD 249 to USD 313. Outperform. $TSLA (-0,12 %)

- JPMORGAN raises the price target for WALT DISNEY from USD 125 to USD 128. Overweight. $DIS (-0,19 %)

- JPMORGAN raises the price target for SIEMENS from EUR 215 to EUR 230. Overweight. $SIE (+1,05 %)

- BARCLAYS raises the target price for SIEMENS ENERGY from EUR 21 to EUR 35. Equal-Weight. $ENR (+2,56 %)

- LBBW raises the target price for EON from EUR 13.80 to EUR 13.90. Buy. $EOAN (+2,1 %)

- HAUCK AUFHÄUSER IB raises the target price for ADESSO from EUR 80 to EUR 85. Hold. $ADN1 (-2,32 %)

- DEUTSCHE BANK RESEARCH raises the target price for BURBERRY from GBP 7.40 to GBP 8.60. Hold. $BRBY (-1,4 %)

- BERENBERG raises the price target for TALANX from EUR 76.20 to EUR 91.10. Buy. $TLX (+0,09 %)

- BERENBERG raises the price target for HAPAG-LLOYD from EUR 163 to EUR 169. Hold. $HLAG (+0,88 %)

⬇️⬇️⬇️

- JPMORGAN lowers the price target for BAYER from EUR 34 to EUR 25. Neutral. $BAYN (-0,24 %)

- SANTANDER downgrades SHELL from Neutral to Outperform and lowers target price from GBP 30.50 to GBP 30. $SHEL (+0,74 %)

- WARBURG RESEARCH lowers the price target for SECUNET from EUR 216 to EUR 210. Buy. $YSN (-0,96 %)

- METZLER lowers the price target for SIXT-STÄMME from EUR 105 to EUR 95. Buy. $SIX2 (+0,12 %)

- ODDO BHF lowers the target price for MERCK KGAA from EUR 187 to EUR 176. Outperform. $MRK (-0,19 %)

- METZLER lowers the price target for SMA SOLAR from EUR 20 to EUR 16. Hold. $S92 (+2,05 %)

- DEUTSCHE BANK RESEARCH lowers the price target for GRENKE from EUR 28 to EUR 24. Buy. $GLJ (+0,77 %)

- BERENBERG lowers the target price for K+S from EUR 15.70 to EUR 14.70. Buy. $SDF (+1,11 %)

- BERENBERG lowers the price target for AUMANN from EUR 17 to EUR 14.50. Hold. $AAG (+1,5 %)

- BERENBERG lowers the price target for DERMAPHARM from EUR 58 to EUR 50. Buy. $DMP (-0,51 %)

- BARCLAYS lowers the price target for SYMRISE from EUR 123 to EUR 115. Equal-Weight. $SY1 (-0,81 %)

Summary Earnings, 14.11. 👇🏼

Siemens AG Q4 24 Earnings: $SIE (+1,05 %)

- Orders At 22.93Bln Euros (est 21.36 Bln Euros)

- Revenue Rising 1% To 20.81 Bln Euros (est 20.77 Bln Euros)

- Profit 3.12 Bln Euros (est 3.0 Bln Euros)

- Net Income Of 1.90 Bln Euros (est 1.80 Bln Euros)

Swiss Re Q3 24 Earnings: $SREN (+0,72 %)

- Net Income Of $2.2 Billion For The First Nine Months Of 2024

- 9m Return On Investments (ROI) Of 3.9%; Recurring Income Yield Of 4.0%

- Return On Equity (ROE) Of 13.4% For First Nine Months Of Year

- Still Expects To Achieve A Group Net Income Of More Than $3 Billion For 2024

- Currently Expects Losses Resulting From Hurricane Milton To Be Less Than $300 Mln, Which Will Impact Group Results In Q4 2024

E.ON SE 9M 24 Earnings: $EOAN (+2,1 %)

- Adj EBIT EU4.37B, -23% (Y/Y)

- Sales EU56.28B, -19% (Y/Y)

- Still Sees FY Adj EBITDA EU8.8B To EU9B, (est EU8.94B)

- Still Sees FY Adj Net EU2.8B To EU3B (est 2.92B)

Deutsche Telekom AG Q3 24 Earnings: $DTE (+0,63 %)

- Net Income EUR 2.957B (est EUR 2.396B)

- Adjusted EBITDA AL EU11.10B (est 11.05B)

- Rev EU28.50B (est 28.39B)

- Sees FY Adj EBITDA Al About EU43B

ASML is sticking to its long-term goals and plans to increase sales to between 44 and 60 billion euros by 2030, with a gross margin of 56 to 60 percent. Despite the current difficult market conditions, ASML CEO Christophe Fouquet sees promising long-term prospects for the semiconductor industry, especially due to the AI trend. $ASML (+0,39 %)

Talanx expects a record profit of over 1.9 billion euros for 2024 and a surplus of over 2.1 billion euros for 2025. The profit increase will be supported by primary insurance and new targets are to be presented at the Capital Markets Day on December 11. $TLX (+0,09 %)

Nagarro increased sales by 3.7 percent to 242.9 million euros in the third quarter and adjusted EBITDA by a good eight percent to 34.6 million euros. The company is adjusting its revenue forecast for 2024 to 960 million euros and expects an EBITDA margin of over 14 percent. $NA9 (-13,8 %)

Adesso recorded an increase in turnover of 15 percent to 330 million euros in the third quarter and a 37 percent rise in operating profit to 38.9 million euros. Jörg Schroeder will step down as Chief Financial Officer on April 30, 2025; his successor will be Michael Knopp from January 15, 2025. $ADN1 (-2,32 %)

Dermapharm increases turnover in the first nine months by just under three percent to 890.1 million euros, while adjusted EBITDA falls slightly to just over 240 million euros. However, consolidated net income rose to just under 93 million euros, and the Group CEO is optimistic for the final quarter. $DMP (-0,51 %)

Energiekontor sees itself on course for its annual targets after nine months with an expected pre-tax result of EUR 30 to 70 million, although the upper end of the range will not be reached due to the below-average wind year. Three projects with 79 MW have already been commissioned this year and several more projects are currently being marketed. $EKT (-0,73 %)

The financial services provider MLP increased revenue by twelve percent to EUR 746 million in the first nine months and EBIT by almost half to EUR 66 million. The company confirms its forecast for 2024 with EBIT of between EUR 85 and 95 million and expects EBIT of EUR 100 to 110 million in 2025. $MLP (-0,49 %)

GFT Technologies is again lowering its annual targets and now expects revenue growth of 10 percent to around EUR 865 million and adjusted EBIT of around EUR 77 million. Profit before taxes is expected to fall to around EUR 65 million, as the environment remains challenging and momentum in the coming months will be lower than expected. $GFT (+0,57 %)

ProSiebenSat.1 is lowering its forecast for the year due to weak TV advertising revenues and expects an adjusted operating result of less than EUR 575 million. The Group plans to sell Flaconi and Verivox in order to invest in Joyn, programs and debt reduction. $PSM (-0,06 %)

Wacker Neuson is again lowering its annual targets and now expects revenue of EUR 2.2 to 2.3 billion and an EBIT margin of 5.5 to 6.5 percent. In the third quarter, the company reports a drop in revenue of over 20 percent and a 61 percent fall in EBIT. $WAC (-0,83 %)

Cewe confirms its annual targets with sales of between 770 and 820 million euros and an EBIT of 77 to 87 million euros, with the upper half of the ranges being targeted. The company generates most of its profits in the Christmas quarter and posts a marginally positive EBIT in the summer quarter, despite increased marketing expenditure. $CWC (+0,1 %)

Merck KGaA reports a 1.8 percent increase in sales to 5.3 billion euros in the third quarter, while the adjusted operating result rises by 12 percent to over 1.6 billion euros. CEO Belén Garijo announces that sales for 2024 are expected to be in the lower half of the previous range. $MRK (-0,19 %)

Bilfinger records revenue growth of 15 percent to just under EUR 1.3 billion in the third quarter and increases operating profit by 35 percent to EUR 76 million, supported by good demand and the latest acquisition. The Executive Board confirms the adjusted annual targets with an increase in revenue to EUR 4.8 to 5.2 billion for 2024, also taking into account a savings program and special effects from the integration of Stork. $GBF (+1,42 %)

K+S is revising its production forecast for 2024 downwards due to high sickness rates and now expects an operating result (EBITDA) of around EUR 540 million. In the third quarter, the company reports a decline in sales and EBITDA, with profits exceeding analysts' expectations but remaining below consensus estimates for the full year. $SDF (+1,11 %)

German winning stocks of the past five years

+603% SUSS Microtec $SMHN (+1,06 %)

+411% Rheinmetall $RHM (-1,06 %)

+329% Redcare Pharmacy $RDC (-3,44 %)

+326% ATOSS Software $AOF (-0,19 %)

+262% PNE $PNE3 (+0 %)

+258% Mutares $MUX (+0,08 %)

+232% Energiekontor $EKT (-0,73 %)

+231% GFT Technologies $GFT (+0,57 %)

+230% Elmos Semiconductor $ELG (-1,13 %)

+229% Adtran Networks $ADV (+0,22 %)

+161% Commerzbank $CBK (+1,49 %)

+146% Krones $KRN (+0 %)

+131% Hella $HLE (+0,12 %)

+126% Munich Re $MUV2 (+0,16 %)

+125% Deutsche Bank $DBK (+0,6 %)

+111% VERBIO $VBK (+0,47 %)

+111% KSB (Vz) $KSB (+0 %)

+109% Infineon $IFX (-0,16 %)

+109% Siemens $SIE (+1,05 %)

+107% Talanx $TLX (+0,09 %)

+103% Encavis $ECV

+100% SFC Energy $SFC

+95% Nemetschek $NEM (-0,08 %)

+93% Aixtron $AIXA (-1,01 %)

+90% flatexDEGIRO $FTK (+0,34 %)

+84% SAP $SAP (-0,83 %)

Which ones do you have in your portfolio or on your watchlist?

I sold Infineon and Elmos too early.

Valores en tendencia

Principales creadores de la semana