At the start of my investment, I thought I would get shares that pay out a lot of dividends. At my age (32), that's a minor matter, but I'm still happy when dividends are paid out. The money from the sale was directly reinvested in $PG (-1.39%) and $PEP (-2.53%) . As soon as $HTGC (-2.84%) is in the plus, it will also leave the portfolio and the money will be reinvested.

- Markets

- Stocks

- Petrobras Brasileiro

- Forum Discussion

Petrobras Brasileiro

Price

Discussion about PETR3

Posts

100Podcast-Folge 126 "Buy High. Sell Low." 17 US Dividenden-Aktien 🗽🇺🇲💵

UnitedHealth 2,67% $UNH (-1.45%)

Chevron 4,11% $CVX (-1.74%)

Exxon Mobil 3,17% $XOM (-2.43%)

Lockheed Martin 2,37% $LMT (-0.06%)

Blackstone 2,87% $BXSL (-0.93%)

Diamondback Energy 2,64% $F1AN34

Constellation Energy 0,50% $CEG

Nike 2,6% $NKE (+2.05%)

Procter & Gamble 2,92% $PG (-1.39%)

PepsiCo 3,89% $PEP (-2.53%)

Petrobras 14,45% (Brasilien) $PETR3 (-0.02%)

Texas Instruments 2,96% $TXN (+0.19%)

IBM 2,20% $IBM (-2.04%)

Verizon 7,09% $VZ (+0.33%)

Merck 3,12% $MRK (+0.1%)

Coca Cola 2,9% $KO (+1.56%)

Amgen 2,92% $AMGN (+1.15%)

Spotify

https://open.spotify.com/episode/7hq0n56Srxggy46v7p9LsJ?si=9s_zmimuQeuBClpKMXVk5g

YouTube

https://openyoutu.be/VpoR3gPJg3U

Apple Podcast

https://podcasts.apple.com/de/podcast/126-siebzehn-us-dividenden-aktien/id1695869891?i=1000745737259

🌎📈 Mercosur agreement: Mega free trade - opportunities for the stock market & potential profiteers

After more than 25 years of negotiations, the EU and the South American economic alliance Mercosur (Brazil, Argentina, Paraguay, Uruguay) have concluded a historic free trade agreement. This creates one of the largest free trade zones in the world - with over 700 million people and a combined economic area worth around 22 trillion USD.

This agreement could trigger global economic and stock market effects - for companies, industries and investors.

_________________________

🛃🚢 What will happen to the Mercosur agreement?

- Tariffs on up to 91% of EU exports and 92% of Mercosur exports are to be gradually eliminated.

- The aim is to create a larger single market, better market access, simplified rules and more stable trading conditions between Europe and South America.

- Until now, high tariffs have applied to cars (approx. 35%), machinery (14-20%) and chemical products (up to 18%).

_________________________

📊 Possible effects on the stock market

📈 1. industries with strong exports benefit from higher demand

Europe can sell its products more easily in South America:

- 👩🏭 Cars & car parts

- 🏭 Mechanical engineering

- 🧪 Chemicals & pharmaceuticals

- 🪄 Electronics & high-tech

The elimination of customs duties and fewer trade barriers will increase the margins and competitiveness of these industries.

Possible examples of Frofiteurs:

- VW $VOW (+0.53%) BMW $BMW (+1.03%) Daimler $DTG (-2.32%)

- Siemens $SIE (+0.15%)

- BASF $BAS (+0.04%) Covestro $1COV (-0.13%)

- SAP $SAP (+0.11%) , ASML $ASML (+0.26%)

➡️ Expected share price impetus from higher export revenues and capped production costs.

_________________________

🍖 2. agricultural & food sector in focus

The agricultural business is also becoming more closely networked on both sides:

- Tariffs on wine, oil, cheese, dairy products and luxury foods are being reduced or gradually created.

- EU producers will gain greater market access in South America; conversely, South American agricultural exports (e.g. beef, sugar) will have better access to the EU.

Possible beneficiaries:

- Nestlé $NESN (-0.86%) Danone $BN (+0.32%)

- Heineken $HEIA (-0.73%) AB InBev $ABI (-0.16%)

- FrieslandCampina $FCEPL

⚠️ However, critics point out that price pressure on local farmers* also arises and environmental risks can increase, for example due to cheaper imports.

_________________________

🚗 3. raw materials & energy: medium to long-term effects

Mercosur countries export large quantities of raw materials:

- Soy, sugar, coffee, ethanol, grain

- Brazil is also a major supplier of crude oil and minerals

One of the aims of the agreement is more stable commodity trade with fewer tariffs, which can influence commodity prices and move the shares of commodity and energy companies.

Possible beneficiaries:

- Vale $VALE3 (-4.58%) Petrobras $PETR3 (-0.02%)

- Bunge $BG (-0.6%) , ADM $ADM (-1.52%)

_________________________

🏦 4. finance & services sector

The agreement also facilitates:

- Market access for financial services

- Opening of telecom and transportation markets

- Opening of public procurement to EU suppliers

➡️ This could strengthen banks, insurers and logistics companies that operate across borders.

Possible beneficiaries:

- Allianz $ALV (+0.26%) Deutsche Bank $DBK (+1.33%)

- DHL/Deutsche Post $DHL (+0.9%) Kuehne + Nagel $KNIN (+2.53%)

_________________________

🔄 Short-term market risks

Not everything is automatically positive:

- 🇪🇺 Agricultural protests in Europe show resistance to cheap imports.

- Political uncertainties remain - many parliaments need to ratify.

- Sectors with low competitiveness could come under price pressure.

_________________________

📌 Conclusion

The Mercosur agreement could be an issue with far-reaching effects:

✅ Strong export industry gains new sales markets

✅ Agricultural and luxury food sector gains sales opportunities

✅ Financial and service sector benefits from market expansion

✅ Raw material exporting countries in South America could become more integrated

⚠️ At the same time, there are risks for local producers and price distortions that could have a regional impact on share prices

_________________________

Question for you: What is your opinion on the agreement? And in which sectors or listed companies do you see the biggest winners in the long term?

_________________________

Sources:

- 💶📈 Wirtschaftliche Chancen für EU-Exporteure und Importeure durch Zollerleichterungen

- ⚙️🚗 Branchenanalysen mit Zollabbau-Effekten für Maschinen, Autos, Chemie etc.

- 🌾🥩 Agrar- und Rohstoff-Impakte durch neue Marktchancen und Quotenregelungen

When is the dividend paid?

$PETR3 (-0.02%) How long does it take before the dividend becomes visible in the securities account?

The payday should have been on 21.11.

Does anyone have any experience?

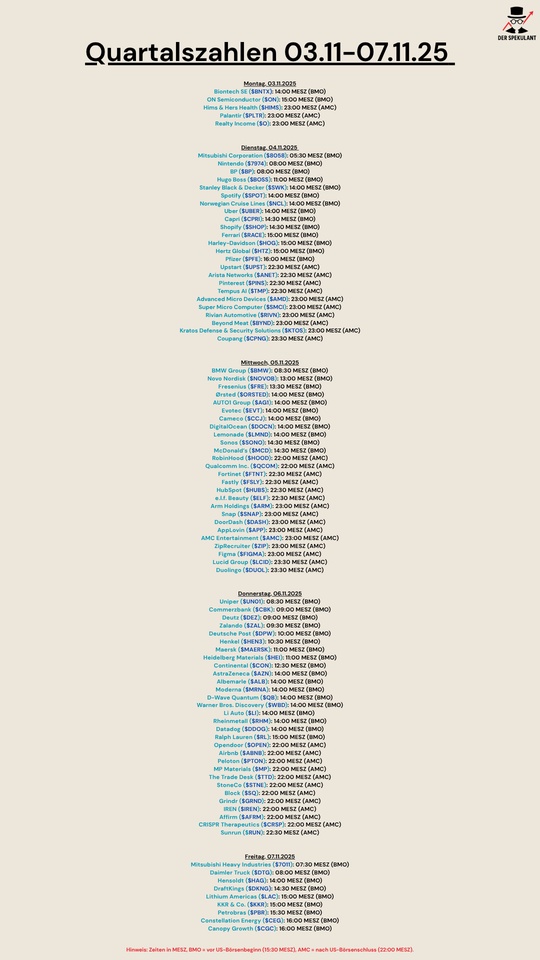

Quartalszahlen 03.11.25-07.11.15

$BNTX (+1.15%)

$ON (-1.46%)

$HIMS (-1.4%)

$PLTR (+2.52%)

$O (+1.27%)

$8058 (-0.59%)

$7974 (+0.93%)

$BP. (-1.54%)

$BOSS (+0.56%)

$SWK (-0.47%)

$SPOT (+0.74%)

$N1CL34

$UBER (+0.52%)

$CPRI (-0.39%)

$SHOP (+0.37%)

$RACE (+0.09%)

$HOG (-0.79%)

$HTZ (-2.57%)

$PFIZER

$UPST (+3.43%)

$ANET (-5.11%)

$PINS (-0.38%)

$TEM (+2.07%)

$AMD (-5.28%)

$SMCI (-0.66%)

$RIVN (-6.33%)

$BYND (-2.88%)

$KTOS (+3.84%)

$CPNG (+0.6%)

$BMW (+1.03%)

$NOVO B (+0.46%)

$FRE (+2.08%)

$ORSTED (+0.37%)

$AG1 (-0.53%)

$EVT (+0.3%)

$CCO (-0.49%)

$DOCN (-0.21%)

$LMND (+0.31%)

$SONO (+0.63%)

$MCD (-0.34%)

$HOOD (-1.67%)

$QCOM (+1.33%)

$FTNT (-5.64%)

$FSLY (-4.23%)

$HUBS (-0.41%)

$ELF (+7.13%)

$ARM (+2.74%)

$SNAP (-2.96%)

$DASH (+0%)

$APP (-4.15%)

$AMC (-2.08%)

$ZIP (+3.39%)

$FIG (+3.17%)

$LCID (-3.17%)

$DUOL

$UN0 (-0.21%)

$CBK (+1.94%)

$DEZ (-0.74%)

$ZAL (+2.4%)

$HEN (+0%)

$MAERSK A (+1.68%)

$HEI (+1.27%)

$CON (-0.76%)

$AZN (+1.87%)

$ALB (+2.32%)

$MRNA (+3.77%)

$QBTS (-7.36%)

$WBD (+2.32%)

$LI (+0%)

$RHM (-1.31%)

$DDOG (-2.21%)

$RL (+0.26%)

$OPEN (-3.14%)

$ABNB (+2.83%)

$PTON (-0.8%)

$MP (-3.02%)

$TTD (-2.04%)

$STNE (-2.62%)

$SQ (+1.46%)

$GRND (+2.93%)

$IREN (-2.87%)

$AFRM (+4.15%)

$CRISP (-0.94%)

$RUN (+0.93%)

$7011 (-4.25%)

$DTG (-2.32%)

$HAG (-1.79%)

$DKNG (+3.59%)

$LAC (-1.3%)

$KKR (+0.33%)

$PETR3 (-0.02%)

$CEG

$WEED (-0.48%)

Petrobras with strong Q2 2025 despite falling oil prices

Petrobras $PETR3 (-0.02%)

$PETR4 (-0.71%) delivered a robust performance in the second quarter of 2025, generating a net profit of USD 4.1 billion.

This was achieved despite a significant fall in the price of Brent crude oil from USD 75.7 to USD 60.7 per barrel.

The company's operational efficiency and strategic focus on exploration and production contributed to this resilience.

Petrobras' ability to maintain production levels and expand its presence in the natural gas market further underlines the company's competitive position in the industry.

《》Financial key figures《《

● Net profit: 4.1 billion US dollars

● EBITDA: 10.2 billion US dollars

● Operating cash flow: 7.5 billion US dollars

● Dividend payout: USD 8.7 billion (45% of free cash flow)

《》Outlook & forecast《《

Petrobras is sticking to its CapEx forecast of USD 18.5 bn for 2025 and is aiming to reach the upper end of its production forecast.

The company is aiming to increase production by 100,000 barrels per day, which could generate potential additional revenue of USD 2.5 billion at a price of USD 70 per barrel.

This strategic focus is intended to strengthen Petrobras' market position and promote future growth.

Dividend

$PETR3 (-0.02%) Hello,

I am a little unsure about the Petrobras dividend.

For me there has been a record date and a payday so far.

But unfortunately there was no payday!

According to getquin, the record date was 03.06 and the payment date 20.08.

The bank does not give any reasonable information and the Petrobras website is also inexplicable.

Is there something different about the terms in Brazil?

What is the problem?

Greetings

Duria

Lula wants to secure his future through oil production

The "law to simplify the environmental approval process" is known in Brazilian environmental circles as the "law of devastation". It was rushed through by the Chamber of Deputies in a night session before the congressional recess in mid-July.

President Luiz Inácio Lula da Silva has now vetoed parts of the law.

The reason for this withdrawal: Lula's left-wing government is afraid of offending the conservative Congress. More than two thirds of MPs had voted in favor of the law.

Environmentalists are up in arms against the law: they fear that simplified approval procedures will lead to greater climate risks and environmental damage, opening the door to one of Brazil's most controversial investment projects.

This is because Brazil also has high hopes for the oil deposits that are believed to be under the seabed of the Atlantic Ocean at the mouth of the Amazon off the north coast of Brazil. Neighboring Guyana is in the process of becoming one of the new global oil giants due to the oil produced there. From a geological point of view, there is much to suggest that the deposits extend into Brazil's sovereign territory.

The Organization of the Petroleum Exporting Countries (Opec) expects Brazil to increase its oil and gas production from the current 4.2 million to 5.8 million barrels per day by 2030. After the USA, this would make Brazil one of the countries that could increase its fossil fuel production the most over the next five years. Brazil currently ranks 8th among the world's largest oil producers; it could rise to 4th place by 2030.

However, the credibility of Brazil's climate policy is at stake with the potential oil production. Brazil has committed to significantly reducing its greenhouse gas emissions as part of the Paris Agreement. An expansion of oil production contradicts these goals.

Politically, however, it looks like the proponents will be successful. They have a strong lobby in Congress, in the cabinet, among the trade unions and in the federal states in the north of Brazil. President Lula is also in favor of the project: he would rather offer poor Brazilians jobs, education and health care financed by oil revenues than do without them in order to protect the environment. International environmental prizes do not win elections in Brazil, but social programs and electoral aid from the oil industry do.

With the decree for accelerated special procedures, a victory for the oil lobby seems likely. The majority of Congress is in favor of oil production. Elections are due next year. Lula can hardly afford to alienate his remaining allies in the north and north-east with an environmental policy with which he himself hardly identifies. A conservative successor would probably remove obstacles to oil production immediately.

$PBR (-0.78%)

$PETR3 (-0.02%)

$PETR4 (-0.71%)

Source: Text (excerpt) & image: Handelsblatt, 13.08.25

Petrobras increases oil and gas production by 8% in the second quarter

Petrobras $PETR3 (-0.02%)

$PETR4 (-0.71%) increased its oil, condensate (NGL) and natural gas production in Brazil by 8.1% year-on-year in the second quarter, reaching 2.879 million barrels of oil equivalent per day (boe/d). According to a production report published on Tuesday (29th), oil and NGL production totaled 2.320 million barrels per day, an increase of 7.6% compared to the second quarter of 2024. Natural gas production increased by 10% to 559,000 boe/d.

One of the highlights of the quarter was a 229.7% increase in diesel imports to 122,000 barrels per day. Petrobras explained in its report that the increase was due to the company's preparations for a period of higher demand.

Meanwhile, oil exports rose by six percent to 690,000 barrels per day in the quarter. Oil remains Brazil's most important export - and could be hit with a 50 percent tariff by the US from Friday, August 1. Petrobras said exports to the US accounted for eight percent of international oil sales, while China took the lion's share at 54 percent.

According to Petrobras, the increase in oil and gas production is mainly due to the gradual commissioning of the Almirante Tamandaré and Maria Quitéria floating production, storage and offloading facilities. The production increases were also supported by the achievement of peak production at the FPSO Alexandre de Gusmão. All three platforms operate in the pre-salt layer of the Santos basin.

The company also brought 14 new production wells on stream in the second quarter - seven in the Campos Basin and seven in the Santos Basin. "On the other hand, there were also higher production losses in the second quarter due to shutdowns and maintenance work, as well as a natural decline," Petrobras said. Refinery capacity utilization reached 91% in the second quarter, an increase of one percentage point compared to the first quarter and unchanged from the previous year.

Sales of refined products in Brazil increased by 0.8% year-on-year to 1.714 million barrels per day in the second quarter. Gasoline sales increased by 3.1% compared to the same period last year and by 1.5% compared to the first quarter, driven by increased overall demand for gasoline and a shift from ethanol to gasoline, particularly in flex-fuel vehicles.

Petrobras reported a 0.6% decline in diesel sales in Brazil in the second quarter compared to the same period last year and a 1.8% decline compared to the previous quarter. The company attributed the decline to increased imports from third countries - primarily from Russia - and lower demand from the agricultural sector.

Source: valorinternational.globo.com

BRL 3 billion in Petrobras bonds!

📢 **Petrobras launches new "green" bonds - BRL 3 billion [approx. 464 million euros] collected**

📅 *Rio de Janeiro, June 25, 2025*

Petrobras has completed the bookbuilding process for the 8th issue of so-called **Debêntures Incentivadas** - **non-convertible, unsecured corporate bonds** for a total of BRL **3 billion**, divided into **three series**.

📆 **Settlement is scheduled for June 26, 2025**.

🧾 The issue falls under Brazilian Law 12.431, which provides tax incentives for investments in infrastructure - which means **cheaper financing for Petrobras**, **tax benefits for Brazilian investors**.

---

🔍 **What does this mean from the perspective of ChatGPT & Dirk?**

✅ Petrobras is cleverly using the current favorable interest rate environment in Brazil to secure long-term capital.

✅ No dilution for shareholders, as **no conversion into shares is possible**.

✅ The state promotes these bonds because the money is earmarked for infrastructure - good for image and ESG score.

⚠️ It remains to be seen whether and how this will affect the dividend policy in the medium term. However, Petrobras has recently made it clear that as long as the cash flow is flowing, shareholders should not go away empty-handed. This bond strengthens the balance sheet for the time being.

💬 Dirk says: *"Better to issue bonds than to be made a political pawn again. He who pays, commands - Petrobras should avoid that. "*

---

#Petrobras #bonds #Brazil #dividend #infrastructure #shares #cashflow #ESG #Getquin #ChatGPTAndDirk

Trending Securities

Top creators this week