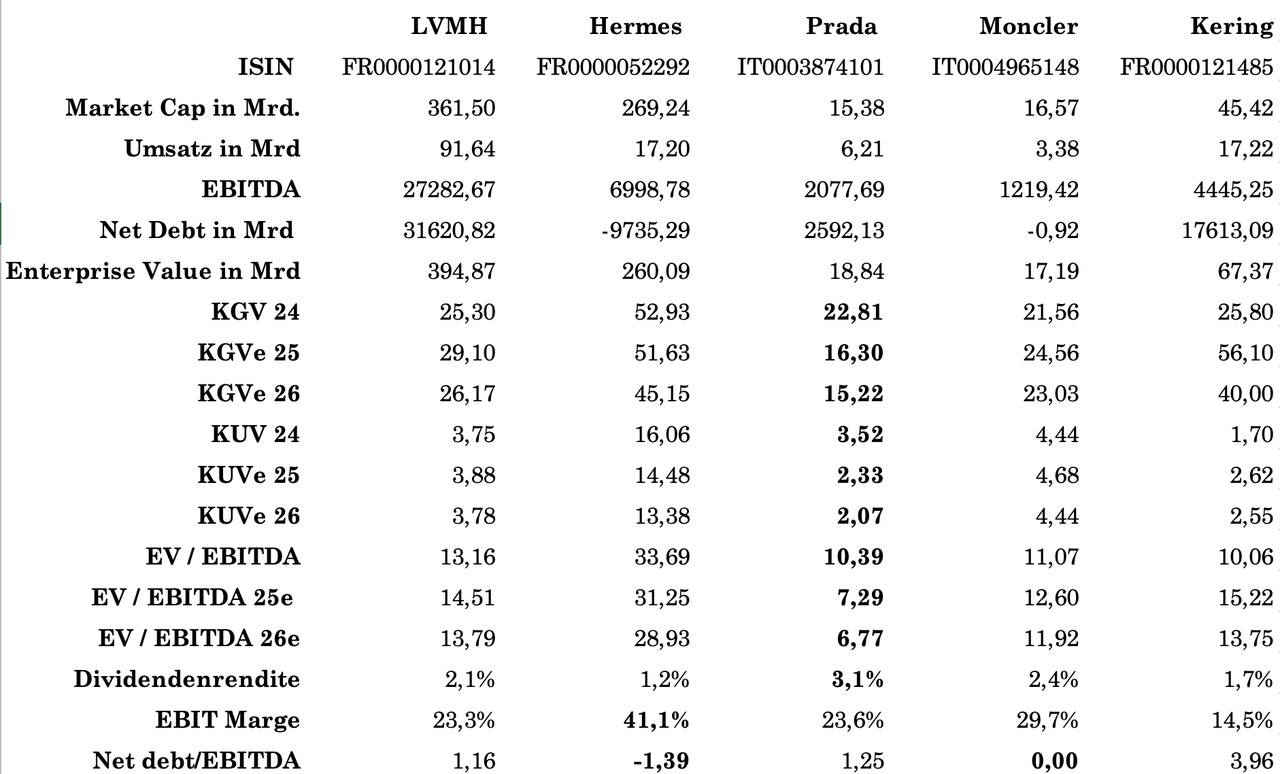

When you talk about quality companies with structural growth, it's hard to avoid LVMH. For me, the Group is basically something like an actively managed ETF in the global luxury segment - only with real entrepreneurial leadership and a remarkable dividend history.

What makes LVMH special is the breadth of its portfolio. We're not talking about a single fashion brand here, but a diversified empire of fashion, leather goods, watches, jewelry, perfume, cosmetics and spirits.

The portfolio includes, among others:

- Fendi

These brands have one thing in common: extreme pricing power. Anyone who believes that luxury is cyclical like normal retail is overlooking the crucial point - real luxury goods are status assets. And status rarely loses value, even if the economy fluctuates.

Structural growth instead of short-term hype

Prosperity in Asia continues to grow. The global upper-middle class is expanding. At the same time, luxury is becoming increasingly digital and global. LVMH is investing heavily in its own stores, brand staging and vertical integration - from production to the point of sale.

The result:

- High margins

- Strong cash flows

- Solid balance sheet

- Reliable dividend policy

And this in a business that has built up brand value over decades, which cannot simply be copied.

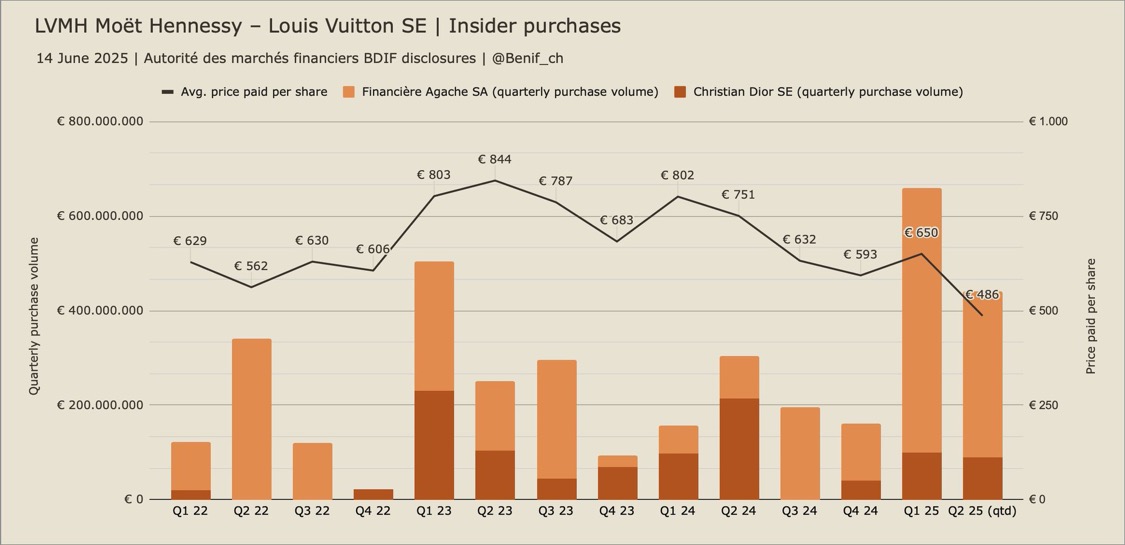

Dividend with substance

LVMH is not a high-yield stock, but the combination of growth and continuously rising dividends makes the share attractive in the long term. This is not a speculative story investment, but a global market leader with real substance.

Why I see it as a "luxury ETF"

Instead of valuing individual fashion brands or betting on trends, LVMH bundles numerous icons under one roof. Diversification within a premium segment - steered by a management that has proven for decades how to scale brands without diluting them.

For investors who:

- are looking for quality instead of a turnaround

- value global brand strength

- believe in rising prosperity

- like dividend growth

... LVMH is at least worth a closer look.

Not cheap, but quality has never been discounted.

$MC (-1.39%)

$LVMH

$LVMUY (-1.54%)

$CDI (-1.06%)

$RMS (+0.03%)

$1913 (-0.26%)

$MONC (-1.42%)