New in:

Stocked up

And much more

.....

Sold

Posts

341. Business Model – Simple & Resilient

2. Durable Competitive Moat

3. Management Quality

4. Valuation – Significant Upside

5. Key Strengths

6. Risk Factors

Mitigation: Diversified product/geography mix, strong innovation moat, proven execution

✅ Conclusion: Attractive entry point in a high-barrier chronic care leader with durable moat, strong financials, and >50% upside potential.

Let me know your thoughts

First the new transaction.

$PEP (+0.95%) 2 further shares.

$COLO B (-0.89%) increased by 4 shares and also $KNIN (+1.26%) into the portfolio. In return $HLAG (+2.13%) out soon.

On the actual topic: After I reached my first $SOFI (-1%) my first 100% + share, the first 200% share was also reached today with Sofi🎉. Robinhood was close to the 200%, but didn't crack it. Considering that the euro/US dollar exchange rate is now clearly somewhere else, it's considerable either way.

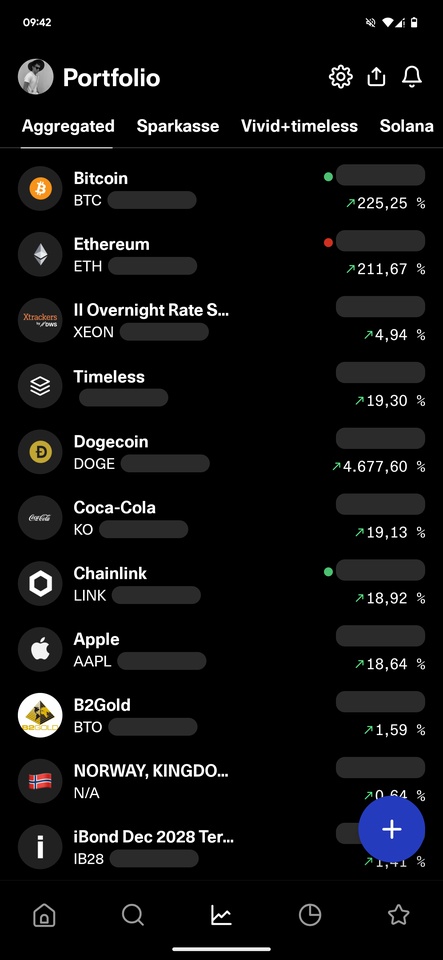

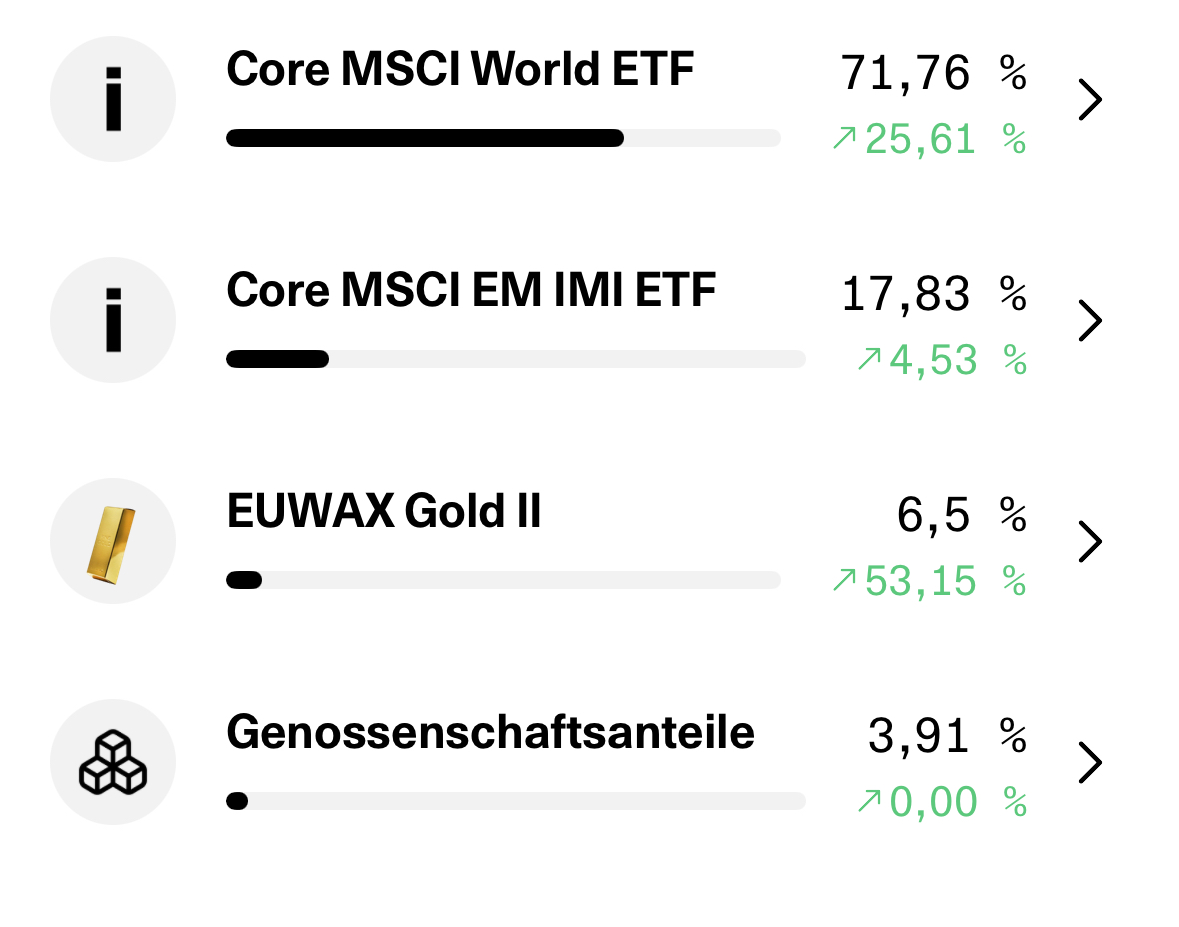

April was another exciting month - time for a little tour of my depot and everything around it:

📊 Performance & figures:

💻 Crypto & digital assets:

📈 Individual shares, ETFs & savings plans:

📊 Crowdcube investments:

🎴 Pokémon cards:

✉️ Application & work:

🏦 Interest & podcast:

🏠 Real estate:

🔮 Outlook for May:

And you? How was your April?

📌 If you don't like my investments - use the block function. 👍 If you celebrate my ideas - please feel free to follow! Thanks for reading - see you in May! 🙌

The semi-annual rebalancing of the SPDR S&P Developed Quality Aristocrats ETF ($QDEV (-0.22%) ) has just been completed, bringing notable changes to the composition of this quality-focused investment vehicle.

Outgoing Companies:

Incoming Companies:

This rebalancing aligns QDEV with evolving market conditions while maintaining its focus on quality companies with strong financial foundations. For investors seeking exposure to financially robust global corporations, these changes appear strategically sound, particularly with the inclusion of resilient tech giants and hospitality leaders positioned for growth.

Will this prove to be a winning choice? The fundamentals certainly suggest so.

@InvestmentPapa once again invites you to a challenge.

Despite a bumpy first quarter, the large positions remain in the green.

Today will be a nice quiet week of vacation.

Portfolio update: Equities: last week increase $COLO B (-0.89%) + savings plan on $CAKE (+2.94%) . Timeless: bought another share with a discount code. Pokemon: I was able to put together 10 packs from the cards I won and these have found their place in a children's facility.

Happy holidays to all and thank you @InvestmentPapa for this challenge. At the same time I nominate for this challenge @DonkeyInvestor

@DividendenWaschbaer and @TheRealRapha ❤️

The year is already going differently than planned. But hopefully we now have four relaxing days ahead of us to unwind with family and friends.

In any case, I'll be sitting on the terrace with a cold beer #grueneostern celebrate.

Despite the orange maniac in the States, the paranoid tsars in the East, the red capitalist in faraway Asia, rising egg prices... life goes on. Let's make the best of it. I'll keep my fingers crossed for you. Have fun with the golden egg hunt in your own depot.

HAPPY EASTERS, Dad.

The world's population is getting older and older, an irreversible demographic change with considerable economic consequences.

This article is intended to provide investment ideas and impetus. The stocks mentioned do not, of course, constitute investment advice, but merely serve as examples of potential beneficiaries of demographic change. Historical developments are no guarantee of future returns.

The main source is the short analysis "How to invest as the global population ages" by Goldman Sachs [1], which, however, does not name any specific stocks.

I have also added additional sources and charts.

__________

🌍 Demographic change: growth and ageing of the world's population

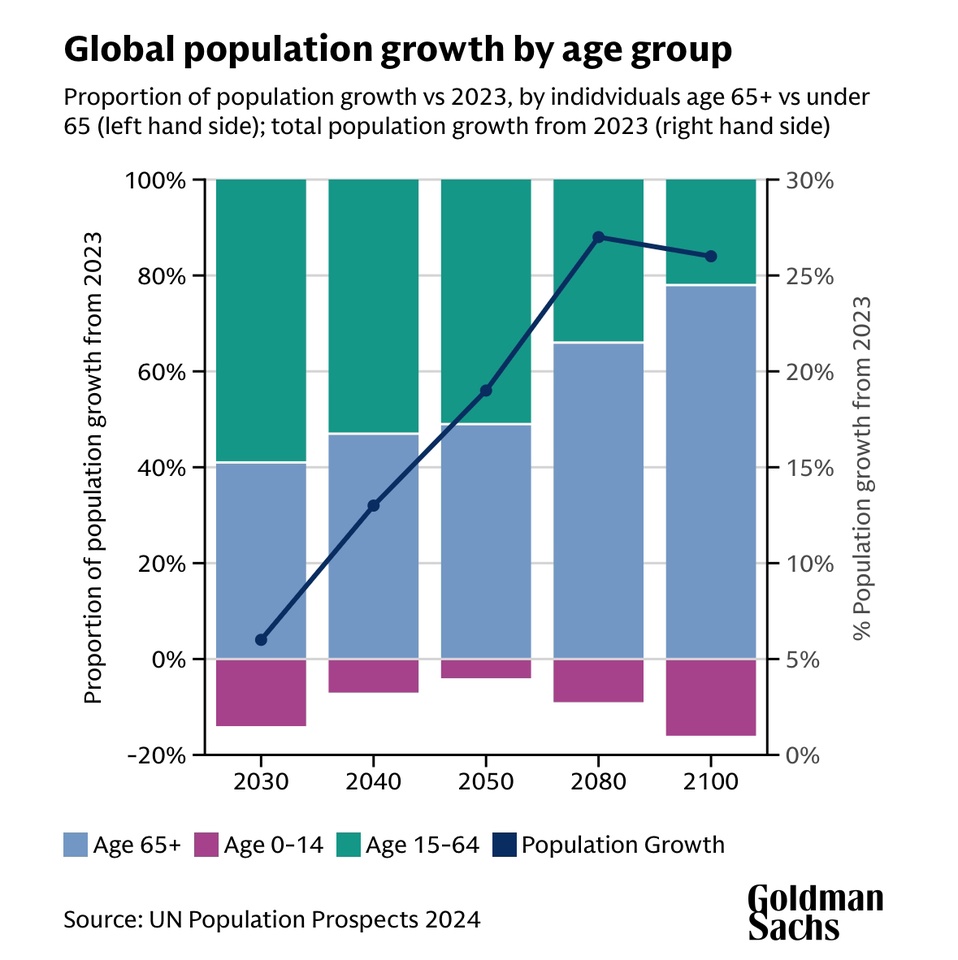

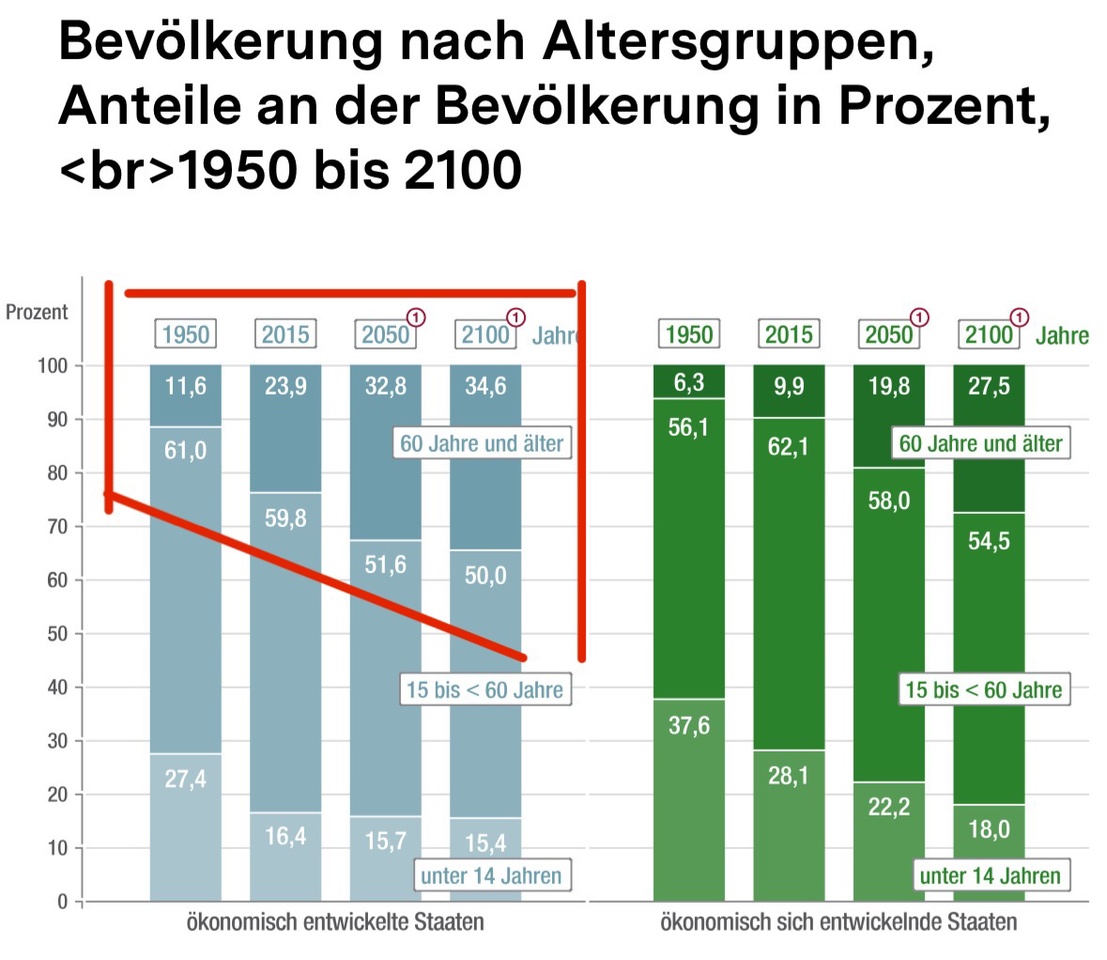

The world's population will grow to almost 10 billion people by 2050. But it is not just the number of people that is increasing, their age structure is also changing dramatically. [2]

Increase in the older population:

Source: [2]

Regional differences:

Europe & North America have the oldest populations & remain the most affected demographically.

Latin America, the Caribbean & Asia: The proportion of over-60s will more than double between 2015 and 2050, reaching around 25 %.

Africa remains the youngest region: in 2015, there were 21 countries worldwide with a birth rate of 5 children per woman, 19 of which were in Africa. However, it should be noted that current statistics from 2024 show that the birth rate per woman in Africa was already just 4.07 in 2023 and could fall to 2.79 by 2050. [3]

While industrialized countries are struggling with an ageing society, Africa remains the most dynamic and youngest region in the world. This development can also have an economic impact and open up new investment opportunities. [2]

Goldman Sachs also comments in the article with similar figures, according to which the global population is expected to increase by around 20% by 2050 and senior citizens will make up a disproportionate share. The number of people over the age of 65 is expected to double from 800 million to 1.6 billion during this period. [1]

In view of this demographic development, there are opportunities to benefit from precisely this trend. Opportunities lie in targeted investments in sectors that could benefit from the growing proportion of older people.

🚑 Healthcare: A growing market worth billions

Facts:

Possible profiteers:

Medical technology

Pharmaceuticals

🏡 Senior Living & Care: Bottlenecks in nursing homes worldwide

Facts:

The UK has a shortfall of over 30,000 senior units by 2028. [1]

In Germany, France and Italy there is a shortage of nursing home places due to the ageing population. [1]

In the US, only 2% of people over 65 live in nursing homes, leading to an increasing demand for home care and telemedicine. [1]

Potential beneficiaries:

Care providers

Homecare

Telemedicine

Anti-Aging

🚢 Leisure & consumption: The new "silver economy"

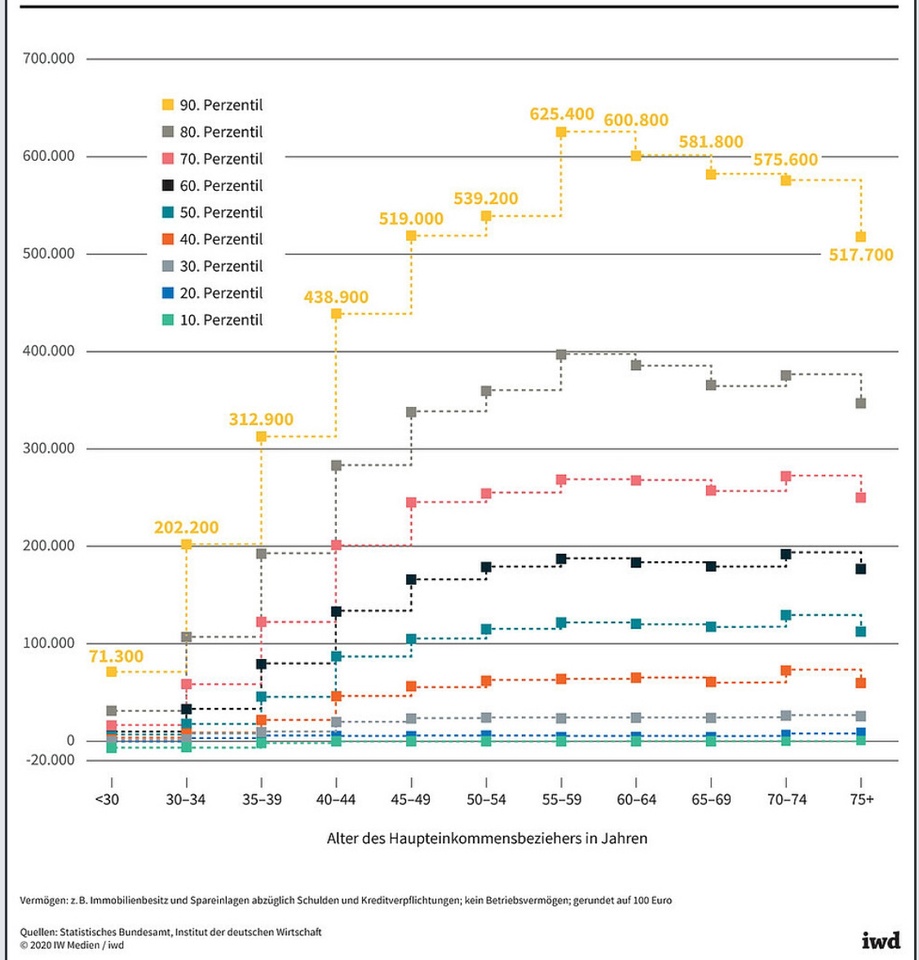

The following chart shows the distribution of wealth in Germany depending on the age of the main income earner. [4]

It is clear that older people tend to have higher wealth than younger age groups. This is reflected in the significantly higher values for the percentiles for age groups aged 50 and over. In particular, the groups aged between 50 and 74 have the highest assets.

The trends are also similar internationally:

This observation underlines the economic importance of the older generations and their central role in wealth distribution and consumer spending.

Possible beneficiaries:

Luxury

Cruise (Over 60s book a third of all cruises worldwide [1])

Motorhome manufacturers/ recreational vehicles (47% of motorhome users are over 55 years old, In the UK, two thirds of over 55s have a motorcycle license, which may indicate a growing market for motorcycles and accessories. [1])

🤖 Technology & automation: solution to the labor shortage

Facts:

The labor shortage caused by an aging society is becoming a global challenge. Automation, AI and robotics could help close the skills gap. [1]

Profiteers:

🧠 Conclusion:

Demographic change offers long-term investment opportunities. Early investment in the right sectors can benefit from rising spending on health, care, leisure and technology.

I myself am still looking for one or two individual investments and am a little annoyed that I didn't get into Hims & Hers earlier, although I have been on the verge of doing so several times. Apart from the luxury segment with LVMH, the portfolio also includes Siemens as a conglomerate in the field of automation.

Do you explicitly take demographic change into account in your investments, e.g. in the form of individual shares?

Which shares do you have in your portfolio or do you still see them as an opportunity?

Thanks for reading!

_________

Sources:

[1] https://www.goldmansachs.com/insights/articles/how-to-invest-as-the-global-population-ages

[2] https://www.bpb.de/kurz-knapp/zahlen-und-fakten/globalisierung/52811/demografischer-wandel/

[4]

https://www.iwd.de/artikel/mit-dem-alter-waechst-das-vermoegen-489710/

$NU (+1.13%) 10.1€ circa

$VER (-0.84%) 68,95€ circa

$COLO B (-0.89%) 106..... and thus the 4 Danish value.

Coloplast Q3 2024 $COLO B (-0.89%)

Financial Performance

Coloplast achieved a revenue increase of 10% to DKK 27,030 million in the financial year 2023/24, driven by organic growth of 8% and an additional increase of 4% from the acquisition of Kerecis. EBIT before exceptional items increased by 6% to DKK 7,286 million, with a slight decrease in the EBIT margin from 28% to 27% due to dilution effects from the Kerecis acquisition and exchange rate fluctuations.

Balance sheet summary

Total assets remained stable at DKK 48.073 million as at September 30, 2024. Equity increased by 4% to DKK 17,942 million, while net interest-bearing liabilities increased to DKK 21,841 million, mainly due to financing activities in connection with acquisitions.

Details of the income statement

Gross profit increased to DKK 18,269 million, with an improved gross margin of 68% compared to 67% in the previous year, supported by favorable input costs and the contribution from Kerecis. Operating costs increased by 16% to DKK 10,983 million, impacted by the Kerecis acquisition and one-off costs.

Cash flow overview

Free cash flow amounted to DKK 1,430 million, a significant improvement compared to the outflow of DKK 4,731 million in the previous year, despite a one-off tax payment in connection with the transfer of Atos Medical's intellectual property. Cash flows from operating activities amounted to DKK 2,766 million, a decrease compared to DKK 4,226 million due to higher tax payments.

Key figures and profitability ratios

ROIC after tax before exceptional items amounted to 15%, a decrease compared to 17% in the previous year, influenced by the acquisition of Kerecis. The debt ratio was 2.5x EBITDA.

Segment information

The Chronic Care division, including ostomy and incontinence care, recorded strong growth, with incontinence care increasing by 10%. Speech and respiratory care grew by 12 %, advanced wound care by 10 % and interventional urology by 7 %.

Competitive position

Coloplast continuously strengthens its market position through strategic acquisitions such as Kerecis, which are designed to promote long-term growth and profitability. The company uses its scalable infrastructure to further expand the growth potential of Kerecis.

Forecasts and management comments

For the financial year 2024/25, Coloplast expects organic growth of 8-9% and an EBIT margin before special items of around 28%. Management sees further growth potential in the Chronic Care division and continued contributions from Kerecis.

Risks and opportunities

Exchange rate fluctuations and integration costs due to acquisitions represent risks, while opportunities lie in the expansion of market share and the launch of new products such as the Luja™ catheter.

Summary of the results

Coloplast delivered a solid financial performance in financial year 2023/24 with strong sales growth, with strategic acquisitions further strengthening its competitive position. Despite challenges from exchange rate fluctuations and acquisition-related costs, the outlook for the coming financial year remains positive, with a focus on organic growth and efficiency improvements.

Positive aspects:

Negative aspects:

Companies that I find interesting but do not yet have in my portfolio and that have a 10-year average ROIC of over 10% and a 5-year average ROCE and ROIC of over 10%, $ANET, $MA (-1.15%) , $VRTX (+0.04%) , $RMS (-0.75%) , $PGHN (-4.29%) , $COLO B (-0.89%) , $ACN (-3.49%) , $MNST (-0.67%)

$FICO (-0.5%) , $MCO (+0.16%) , $KNIN (+1.26%) , $S&P Global, $ISRG (-0.03%)

$III (-0.25%) , $BKNG (-4.57%)

$HLAG (+2.13%) , $QCOM (-1.15%) , $CFR (+0.8%) and $IFX (-0.81%) . Already blatant companies

Top creators this week