Here the title is $HAUTO (-0.47%) is very well presented. Immediately on my watchlist with price signals to enter.

- Markets

- Stocks

- Hoegh Autoliners

- Forum Discussion

Hoegh Autoliners

Price

Discussion about HAUTO

Posts

99Top performance! 👏

What is Hoegh Autoliners ASA?

Hoegh Autoliners ASA is a Norwegian shipping company with over 90 years of history. The focus is on the transport of vehicles, machinery and other rolling stock across the world's oceans using specialized RoRo (roll-on/roll-off) vessels. The shipping company has developed into one of the most important players in global vehicle and heavy goods transportation and has significantly expanded its fleet.

Why dividend hunters should take a look here

What particularly interests dividend investors is the dividend policy, and Höegh Autoliners is exceptional in this respect:

🟦 Quarterly dividend payment

The company pays dividends several times a year, usually quarterly in March, May, September and November.

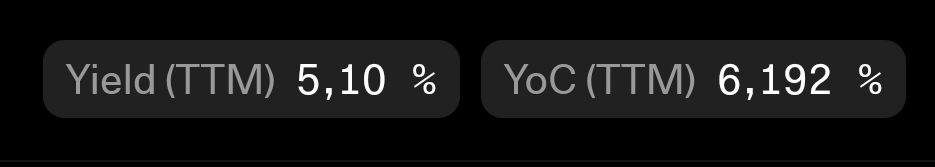

🟦 Very high dividend yield

The dividend yield is one of the highest on the market. Depending on the calculation period, it is clearly in the high double-digit range - around 19% to 25% compared to current share prices.

For example:

- An expected annual dividend of around € 1.95 per share corresponds to a dividend yield of almost 20% on the current share price.

- Historically, dividend yields of over 25 % to 30 % have even been observed when special payments are taken into account.

These are all yields that traditional dividend stocks in Europe or the USA can usually only dream of.

Total return ≠ dividend only

An often overlooked point about extremely high dividends is that they should not be viewed in isolation:

- Dividend yields of this level are partly the result of special distributions or share price declines that drive up the dividend percentage.

- The share has experienced strong price fluctuations in the past, and high dividends alone are no guarantee of long-term returns.

Nevertheless, quarterly distributions combined with an attractive valuation (low P/E ratio) are an interesting package for investors who prioritize current income.

Opportunities for dividend hunters

🟦 "Cash yield" instead of "price yield"

A large part of the dividend yield comes from actual cash distributions, not just theoretical calculations. This is a clear advantage for investors who want real income or rely on dividends for financial independence.

🟦 Quarterly payments instead of annual dividends

Many traditional dividend stocks only pay once a year. Four payments per year reduce reinvestment risks and improve cash flow.

🟦 Low valuation can mean further upside potential

A currently low P/E ratio (e.g. below 5) signals that the market is valuing the share very favorably. This can mean for dividend hunters:

➡️ High current distribution and potential for the share price to catch up.

Risks you should be aware of

As with any strong dividend stock, there are risks:

- Shipping industry volatility: fluctuating freight rates and global economic conditions impact earnings.

- Dividend fluctuations: Very high payments in one year can be lower the next if special payouts are not repeated.

- Share price risk: High dividend yields are often the result of falling share prices.

A dividend hunter should therefore see this share not just as an "interest payment", but as a company with operational risks and opportunities.

For whom is this share really interesting?

Ideal for:

- Investors who want stable and regular cash income

- Dividend income strategies with quarterly payments

- Investors with a medium to long-term horizon who can withstand fluctuations

Less suitable for:

- Investors who focus exclusively on price potential

- Risk-averse savers who prefer stable shares without sector cyclicality

Conclusion

The Hoegh Autoliners ASA share is a particularly exciting stock for yield and dividend hunters: it offers above-average current income, regular quarterly dividends and a business model with global reach in vehicle and heavy goods transportation. However, this attractiveness does not come without risk and volatility.

So if you prioritize "cash flow in the portfolio" over share price capitalization and are prepared to endure short-term fluctuations, this stock definitely belongs on your watchlist - because where else can you find similar dividend yields in established companies?

Of course, this is not a top analysis as you can see for yourselves. This is my personal opinion and I wanted to share it with you. Of course, it is not intended to encourage anyone to buy or sell. Everyone has to form their own opinion and start their own analysis.

$HAUTO (-0.47%)

$MAERSK A (+0.58%)

#dividende

#cashflow

#dividend

#transport

What is Hoegh Autoliners ASA?

Hoegh Autoliners ASA is a Norwegian shipping company with over 90 years of history. The focus is on the transport of vehicles, machinery and other rolling stock across the world's oceans using specialized RoRo (roll-on/roll-off) vessels. The shipping company has developed into one of the most important players in global vehicle and heavy goods transportation and has significantly expanded its fleet.

Why dividend hunters should take a look here

What particularly interests dividend investors is the dividend policy, and Höegh Autoliners is exceptional in this respect:

🟦 Quarterly dividend payment

The company pays dividends several times a year, usually quarterly in March, May, September and November.

🟦 Very high dividend yield

The dividend yield is one of the highest on the market. Depending on the calculation period, it is clearly in the high double-digit range - around 19% to 25% compared to current share prices.

For example:

- An expected annual dividend of around € 1.95 per share corresponds to a dividend yield of almost 20% on the current share price.

- Historically, dividend yields of over 25 % to 30 % have even been observed when special payments are taken into account.

These are all yields that traditional dividend stocks in Europe or the USA can usually only dream of.

Total return ≠ dividend only

An often overlooked point about extremely high dividends is that they should not be viewed in isolation:

- Dividend yields of this level are partly the result of special distributions or share price declines that drive up the dividend percentage.

- The share has experienced strong price fluctuations in the past, and high dividends alone are no guarantee of long-term returns.

Nevertheless, quarterly distributions combined with an attractive valuation (low P/E ratio) are an interesting package for investors who prioritize current income.

Opportunities for dividend hunters

🟦 "Cash yield" instead of "price yield"

A large part of the dividend yield comes from actual cash distributions, not just theoretical calculations. This is a clear advantage for investors who want real income or rely on dividends for financial independence.

🟦 Quarterly payments instead of annual dividends

Many traditional dividend stocks only pay once a year. Four payments per year reduce reinvestment risks and improve cash flow.

🟦 Low valuation can mean further upside potential

A currently low P/E ratio (e.g. below 5) signals that the market is valuing the share very favorably. This can mean for dividend hunters:

➡️ High current distribution and potential for the share price to catch up.

Risks you should be aware of

As with any strong dividend stock, there are risks:

- Shipping industry volatility: fluctuating freight rates and global economic conditions impact earnings.

- Dividend fluctuations: Very high payments in one year can be lower the next if special payouts are not repeated.

- Share price risk: High dividend yields are often the result of falling share prices.

A dividend hunter should therefore see this share not just as an "interest payment", but as a company with operational risks and opportunities.

For whom is this share really interesting?

Ideal for:

- Investors who want stable and regular cash income

- Dividend income strategies with quarterly payments

- Investors with a medium to long-term horizon who can withstand fluctuations

Less suitable for:

- Investors who focus exclusively on price potential

- Risk-averse savers who prefer stable shares without sector cyclicality

Conclusion

The Hoegh Autoliners ASA share is a particularly exciting stock for yield and dividend hunters: it offers above-average current income, regular quarterly dividends and a business model with global reach in vehicle and heavy goods transportation. However, this attractiveness does not come without risk and volatility.

So if you prioritize "cash flow in the portfolio" over share price capitalization and are prepared to endure short-term fluctuations, this stock definitely belongs on your watchlist - because where else can you find similar dividend yields in established companies?

Of course, this is not a top analysis as you can see for yourselves. This is my personal opinion and I wanted to share it with you. Of course, it is not intended to encourage anyone to buy or sell. Everyone has to form their own opinion and start their own analysis.

$HAUTO (-0.47%)

$MAERSK A (+0.58%)

#dividende

#cashflow

#dividend

#transport

Key information relating to the cash dividend to be paid by Höegh Autoliners ASA

Key information relating to the cash dividend to be paid by Höegh Autoliners ASA

25 February 2026

Oslo, 25 February 2026:

Reference is made to the announcement by the Oslo Stock Exchange today regarding the quarterly results and the resolution to distribute dividend in the amount of USD 99 million.

Dividend amount: USD 0.5190 per share Announced currency: USD.

Payment to shares registered with Euronext VPS will be distributed in NOK.

The NOK dividend amount is based on the daily exchange rate published by Norges Bank 24 February 2026 approximately at 1600 hrs CEST. The NOK amount is 4.9606 per share.

Last day including right: 27 February 2026 Ex-date: 2 March 2026 Record date: 3 March 2026 Payment date: 10 March 2026 Date of board resolution: 24 February 2026

This information is published in accordance with the requirements of the Continuing Obligations.

Ares Capital added to the portfolio

Somehow I think I'm rebuilding the depot from @Dividendenopi after.

$BATS (-0.28%) , $RIO (-0.45%) , $DTE (+3.08%) , $PFE (+1.48%) , $ARCC (-3.3%) - all identical.

Instead of $ALV (-0.68%) I have $MUV2 (+0.8%) , Instead of $HAUTO (-0.47%) I have $WAWI (+0.56%) . 🙂

I missed HSBC, I was too slow. The ETF position is different and @Dividendenopi there is even more "smoke" in the portfolio with other tobacco stocks...

Höegh Autoliners ASA - Trading Update January 2026

In January 2026, Höegh Autoliners transported$HAUTO (-0.47%) 1.3 million cubic meters of freight on a pro rata basis.

The transport volume in the last three months (November to January) amounted to 4.0 million cubic meters.

The pro rata gross freight rate in January 2026 was USD 92.2 per cbm (+0.5% compared to the average pro rata gross freight rate of the last three months of USD 91.7 per cbm).

The pro rata net freight price in January 2026 amounted to USD 77.7 per cbm (-1.3% compared to the average pro rata net freight price of the last three months of USD 78.8 per cbm).

The share of HH/BB in the pro rata transport volume in January was 22%.

In the last three months

the proportionate HH/BB share amounted to 22 %.

Andreas Enger, CEO of Höegh Autoliners, comments: "January delivered stable results in line with seasonal patterns, with weather-related delays continuing throughout the month."

Month in review January 2026

What a start to the new year - everything from high spirits to geopolitical tensions to a historic correction - and it seems to be continuing just as turbulently as it began...

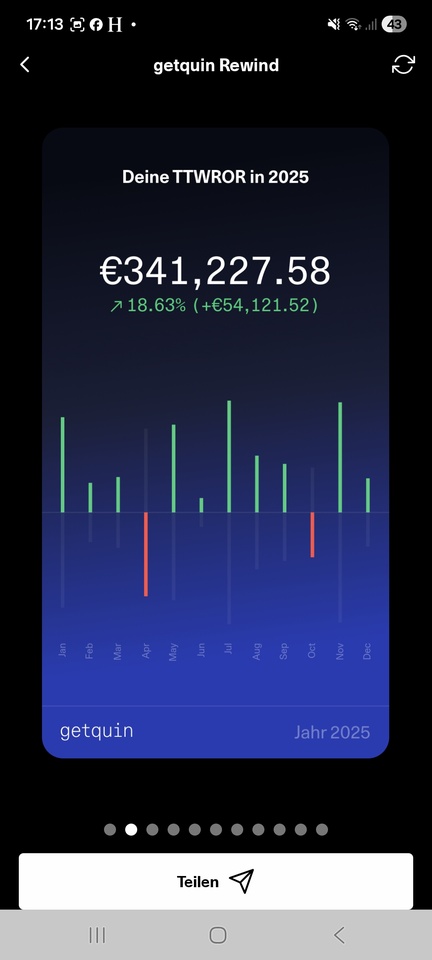

...but despite the events and the fact that there were only 2 small additional purchases last month, these circumstances don't really seem to bother my portfolio and so a new ATH was reached on the penultimate trading day and closed just below it on the last day.

I am quite satisfied with the 4.70% achieved under the circumstances and it shows me that my selection (.oO dividends do not hurt) is not so bad at all in order not to get under water even in such waters.

In the long term, my strategy continues to pay off positively and there is no reason for me to really change anything here...

...except that this year there will be a little more focus on growth in addition to dividends.

Which brings us directly to the next topic...

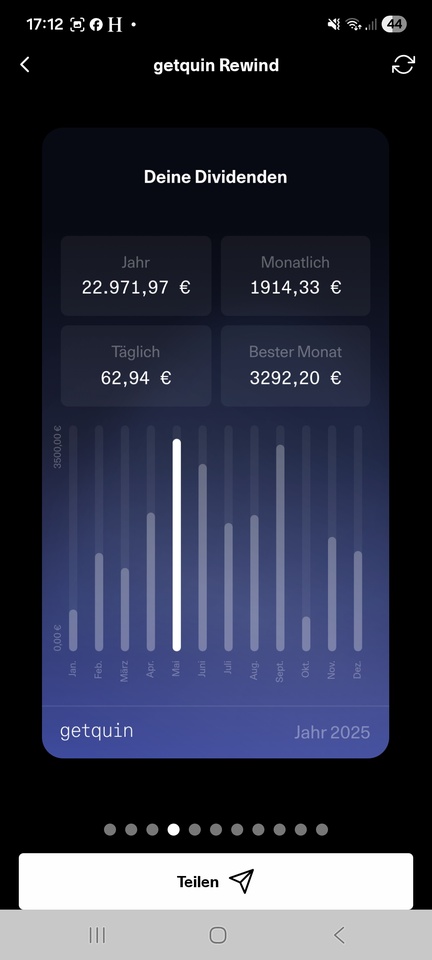

...after a good +3804.58% dividend growth in 2024, it was another +148.57% last year and, with the +40.37% forecast so far this year, should easily be enough to achieve my basic target of €2000 net dividend.

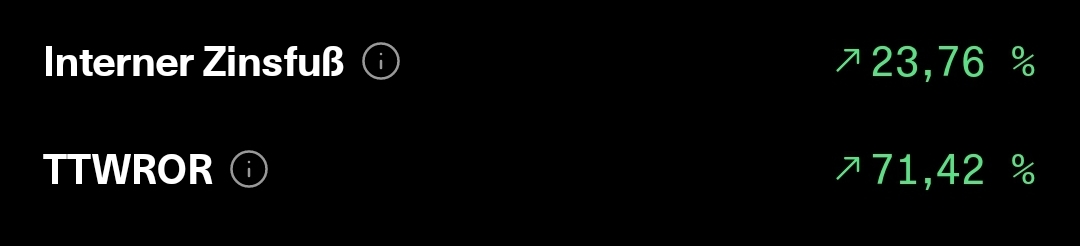

In my view, the overall rate of return is also suitable for the time being and will of course change somewhat over the course of the year...

...it is also fitting that January is a somewhat weaker dividend month, but still tastes good with a net dividend of € 104.16.

》Single stocks top 3《

$HAUTO (-0.47%) +11,28% (+35,55%)

$RIO (-0.45%) +10,28% (+41,03%)

$VAR (+0.84%) +9,50% (+10,20%)

》 Individual stocks Flop 3《

$YYYY (+0.07%) -7,96% (-4,27%)

$3750 (-1.48%) -2,58% (+46,54%)

$VICI (+1.03%) -0,84% (+17,41%)

》Additions/departures 《

none

》Increased《

$VICI (+1.03%) (10x)

$1211 (-0.39%) (10x)

Apart from that, there were 2 other pieces of positive news in my private life...firstly, the next check-up is still without findings and secondly, I now have confirmation from the pension provider that I can continue my further training as an accounting specialist (IHK) this year, which was interrupted by the operation. What's more, this will now be taken a little further and I'll also be taking the certification in DATEV and DATEV payroll accounting at the same time...can't hurt 🤫👍🏻

And so I wish us all continued good luck, a nice rest of the Sunday and maximum profits ✌🏻

+ 1

Höegh Autoliners ASA (HAUTO) - Trading Update December 2025

In December 2025, Höegh Autoliners transported $HAUTO (-0.47%)

1.4 million cubic meters of freight on a pro rata basis.

The transport volume in the last three months (October to December) amounted to 3.9 million cubic meters.

The pro rata gross freight rate* in December 2025 was USD 91.1 per cbm (+0.2% compared to the average pro rata gross freight rate of the last three months of USD 90.9 per cbm).

The pro rata net freight price* in December 2025 amounted to USD 78.1 per cbm (+0.1% compared to the average pro rata net freight price of the last three months of USD 78.0 per cbm).

The share of HH/BB in the pro rata transport volume in December was 22%. In the last three months, the proportionate HH/BB share amounted to 22%.

Andreas Enger, CEO of Höegh Autoliners, comments: "December ended the year with solid volumes and stable rates, despite seasonal weather disruptions and increasing trade imbalances in our network. The total impact of the US tariffs for the quarter is estimated at USD 5 million, however the EBITDA effect was offset by positive year-end freight revenue adjustments."

Höegh Autoliners joins the World Shipping Council

The World Shipping Council (WSC) announced that Höegh Autoliners $HAUTO (-0.47%) has joined as a member, further strengthening the Council's representation of the global liner shipping industry, including the vehicle transportation sector.

"We are pleased to welcome Höegh Autoliners to the World Shipping Council," said Joe Kramek, President and CEO of the WSC. "Car carriers are a central part of the liner shipping industry that moves global trade. Höegh Autoliners brings valuable expertise and perspective as we work with policymakers in the areas of safety, sustainability and effective global regulation."

"Over the years, Höegh Autoliners has invested decisively in an economically viable, cleaner future through our Aurora Class newbuilding project, positioning us as an industry leader in the next chapter of zero-emission ocean shipping. With changing trade patterns and an increasingly complex operating environment, the global liner shipping industry needs effective policies," said Andreas Enger, CEO of Höegh Autoliners.

"Joining the World Shipping Council reflects our commitment to working with industry peers and policy makers to shape practical global regulatory frameworks that promote both economic competitiveness and long-term sustainability, while strengthening the resilience of the supply chains we all depend on," he added.

Each year, two-thirds of the value of global trade is brought to markets by liner shipping. The WSC represents over 90% of global liner capacity and includes container, vehicle transportation and roll-on/roll-off services. Vehicle carriers, like container lines, provide regular, scheduled services that are essential to maintaining global supply chains and supporting international trade.

Through its member companies, WSC works with governments and international organizations to promote safe and environmentally responsible shipping.

Dividendenopi inside (Part 1 )..... Dividendenopi Rewind2025

A little later, but not too late, I'll also have my say at the end of the year, together with an insight into the goings-on of the Opi before @Tenbagger2024 , @SAUgut777 and some others get impatient, as you know, old people are a bit slower. I would also like to take this opportunity to thank and appreciate all those who contribute here on GQ with great analyses and strong contributions, critical comments and a wonderful exchange. I'm deliberately not naming any individuals now, otherwise I won't be able to finish. All of you together are great, whether you're a veteran or a newcomer. The community is alive and I am happy to be a part of it. Thanks also to @christian and the Getquin team, who make this possible by maintaining the platform, even if things sometimes don't run smoothly. The Bavarian says: Basst scho

The year 2025 was exciting and, from my point of view, successful in terms of my expectations. If you don't feel like evaluating a boring dividend strategy, don't want to read about overnight and fixed-term deposits, aren't interested in certificates and don't like the Sparkasse, you are welcome to leave here after Rewind 2025. Many thanks to everyone else for reading and, if necessary, commenting.

At least as far as the majority of shares are concerned, I am known to be invested in dividend stocks in order to generate the highest possible cash flow. I am now almost 62 years old and do not value excessive performance but would like to make a living from the income from my assets and decided to stop working at the beginning of the year when the company where I was employed was dissolved. I see myself as a buy and hold a while. Nothing lasts forever, especially with high-dividend shares. There are regular reallocations without getting into an operational frenzy. In 2025, for example $TRMD A (+2.05%) and a large position $HAUTO (-0.47%) had to leave the portfolio, the high dividend expectations were significantly reduced. The $QYLE (-0.7%) has not recovered from April, $EQNR (+2.96%) and $VICI (+1.03%) led to the brink of capital loss despite respectable dividends and had to give way, as did $MUX (-0.87%) with its inconsistencies. New additions were $NN (-2.68%) , $PFE (+1.48%) , $DTE (+3.08%) and a first position at the end of the year $ARCC (-3.3%) You can see the composition in my profile. I generally try to limit myself to +/- 20 positions and weight them according to purchase. A maximum of 20k per position is invested. This results in the calculation of my dividends and expected income. In its current composition, the portfolio shown here has a value of just over € 340,000 as at 31.12.2025 and has generated gross dividends of just under € 23,000 this year. This corresponds to a dividend yield of 6.73%

The time-weighted yield was 18.63% and therefore well above average, at least better than 67% of the getquin community. I wasn't able to beat the DAX, but at least I outperformed the S&P500 and beat the relevant MSCI World index by some distance. Even on a 5-year view I am on a par. Tobacco stocks did very well $BATS (-0.28%) , $IMB (+0.48%) and $MO (-0.54%) , $HSBA (-1.75%) , and $RIO (-0.45%) and of course $965515 (+1.72%) that I physically hold and the $EWG2 (+1.32%) .

That's all there is to the part of my investments shown here in GQ. What follows is a piece of my life story and the first part inside Dividendenopi.

As I said, I now live off my assets. This amounts to just under € 1.2 million in all the forms of investment I hold. Is that enough for a carefree life? For me in any case. Because on top of that, I have a debt-free, owner-occupied property (a single-family home with a large garden in a quiet rural location near a city of 600,000 inhabitants) and a rented two-family home, appropriately enough, as a neighboring property. Partly financed, rent surplus after installment to the bank a good € 700 per month, flows completely into the maintenance reserve. Claims from BAV, life insurance, building society savings contracts will be added on top in the next few years, but are not taken into account here. There's even a savings account with €18,000..... half of which belongs to my wife and she doesn't want to close it.

My wife (still) works and has a decent income despite working part-time and has other liquid assets in the lower six-figure range. She does it herself, the stock market is the devil's work. Her story is not included here either.

So I / we are doing pretty well after all. It wasn't always like that, anyone who is or was self-employed knows that. But consistent financial planning is important, no matter what the situation, as is sticking to your savings rate. I started investing in real estate at the beginning of the 1990s and have been liquidating it over the last few years. In conjunction with my own wealth accumulation and an inheritance, I am now in a comfortable situation for me.

What do I do with the rest of the money outside the getquin portfolio? A good € 500,000 is (still) in call money and fixed-term deposit accounts. Interest rate hopping on call money and fixed-term deposits from 2 years ago yields around 3% on call money and over 4% on fixed-term deposits. The remaining capital is invested in certificates. Mainly in fixed-coupon express certificates with quarterly payout and partly in bonus certificates with CAP and barrier.

My investments currently generate a net monthly cash flow of € 4000, which is enough for me to live on. Plus € 800 ALG on top until the beginning of 2027.... But before the company closed, I only worked 16.5 hours a week. With my wife's income, that's a good €6500, which is bearable. You can certainly do more with your assets, depending on your needs. We live rather modestly, don't have any children and aren't the consumer type.

How am I invested outside of dividends, why certificates and which broker, where and how overnight and fixed-term deposits? I thought that would go beyond the scope of this article, so I'll come back to it in a second part. Thanks for your participation so far and see you soon

Significantly, you can see here that not having children is now the best provision for old age. Not an accusation, just an observation. 🤷♂️

The year 2025 is drawing to a close...

...and so I would also like to look back in conclusion...

...after many personal ups and downs this year, everything turned out well after all.

In addition to the idea of getting married, as many people already know, I was torn out of life by cancer in the middle of the year. A long operation, since then a constant fight back to life, always at the limit, but at the end of the year the certainty that things will continue to improve and that I will remain free of cancer.

It's just a shame that the surgery was exactly 2 weeks before my final IHK exam (tax law) on the way to becoming a financial accountant, but postponed is not canceled and so I will tackle this project again in 2026.

But I would like to thank you again for the kind wishes for recovery and encouragement before and after the surgery, you are just meeegggaaa 🫶

But let's move on to the final figures for 2025:

The 28 was then also cracked on the last meters of this year and so overall I am almost in the middle of my 2nd forecast increase 💪🏻

Even if the path to the first 100k still seems a long one, it is the right path and, as we all know, that is the constantly growing goal.

In terms of dividends, I was also right on target and it's hard to believe that these also help to generate further sustainable growth 🤫😅

Now most people will be beating their hands over their heads and singing the performance song, but well, as you know, I approach things a little differently.

That's why I'm looking forward to breaking at least the 2k net dividend in 2026, despite my low volume 🥳

And despite this fact, I don't think the performance is bad at all 🤷🏻♂️🤗

》Top 5 of 14《

$3750 (-1.48%) +51,37% (+51,56%)

$HSBA (-1.75%) +35,01% (+39,07%)

$BATS (-0.28%) +34,53% (+91,90%)

$RIO (-0.45%) +20,55% (+28,69%)

$HAUTO (-0.47%) +15,83% (+26,19%)

》Flop 5 of 14《

$1211 (-0.39%) -11,51% (-11,49%)

$YYYY (+0.07%) -5,23% (+1,45%)

$ASWM (-1.76%) -2,36% (-2,36%)

$DTE (+3.08%) -1,70% (-1,70%)

$VAR (+0.84%) -0,80% (+2,65%)

All in all, the long-term view also looks quite reasonable in my opinion...

...so I will continue to stick to my targets and strategy in 2026.

And so there's really nothing left for me to do but thank the entire Getquin team @kundenservice @christian and the entire community...you are simply MEGA 🫶

Wishing everyone a happy new year and everything priceless for 2026 💫🥳

Let's just pick up together in 2026 where we left off in 2025 👋🏻

+ 2

Have you actually realized your wedding plans?

Trending Securities

Top creators this week