...remember exactly when I took this beautiful and motivating screenshot of my portfolio on May 31, 2024.

At that time, I had been investing in equities for exactly 12 months and, after the first 1-2 months of dreaming big about penny stocks 🫣 and after some training, I had defined my new personal strategy and goals, but more importantly, I had also consistently implemented them since then.

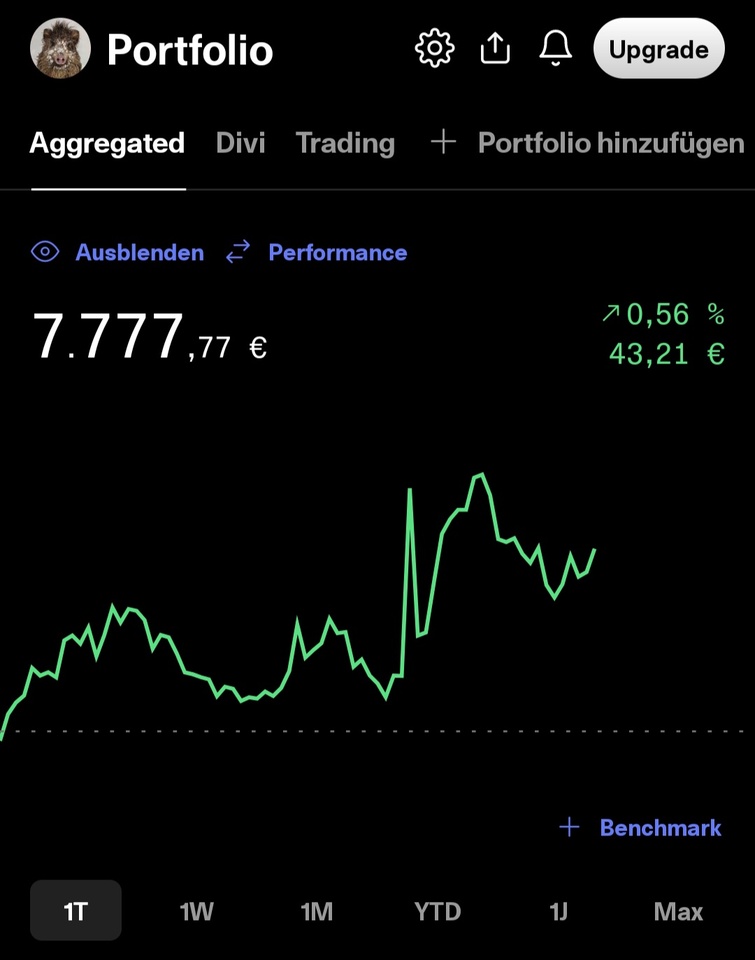

I then reached the first milestone I had set myself with a portfolio value of €10,000 on time in 08/2024 and also the second milestone, dividend >= €500, on time at the end of 2024.

Since then, my new chosen milestones 3 and 4 have been: portfolio value €20,000 by 08/2025 and dividends >= €1000 by 12/2025.

Since Friday, milestone 3 has even been reached almost 2 months earlier than planned...

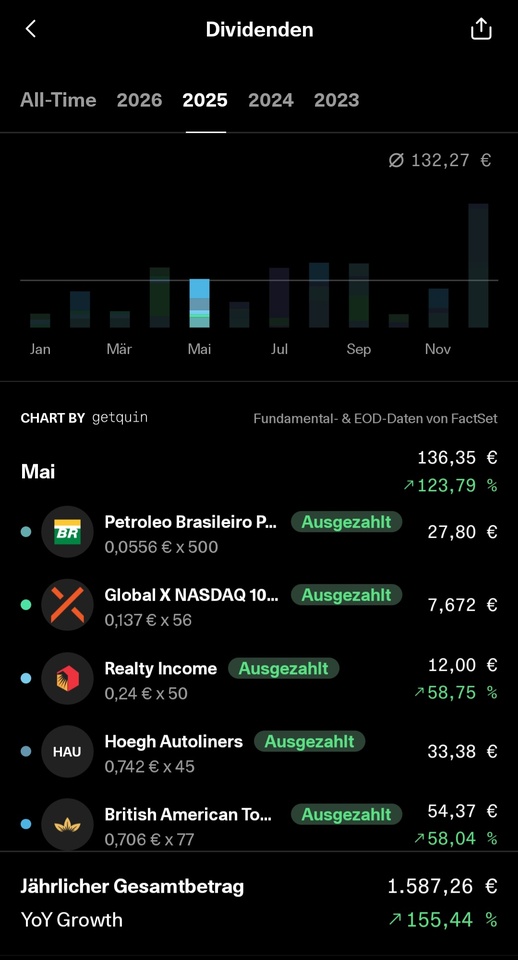

...and milestone 4 is also in sight early on with ~€500 in dividends received so far and ~€1000 still to be expected and is probably only a matter of time 🤗

If the question now arises that these are only gross dividends, I would like to point out that of €136.35 in May dividends, €125.90 remained net and that's how it actually looks in relation to each dividend month.

I generally have very little withholding tax to pay and the two ETFs also have a 30% tax exemption, so the €1000 FSA becomes a little more net of gross in percentage terms. In addition, with $VICI (+0.18%) I currently only have one pure US share in my portfolio and the remaining US share is in the two ETFs.

Another target for dividends, i.e. milestone 6, is >= €2000 for 2026, so the FSA would also be fully utilized after the marriage and not a single cent would be given away 😉

Even if May turned out a little poorer...

...new additions:

Stocked up:

Liquidated:

...everything is on target for the long term...

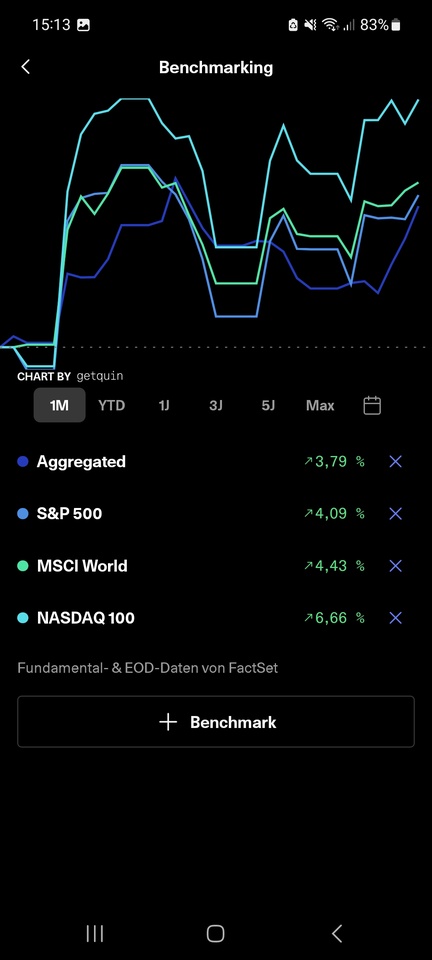

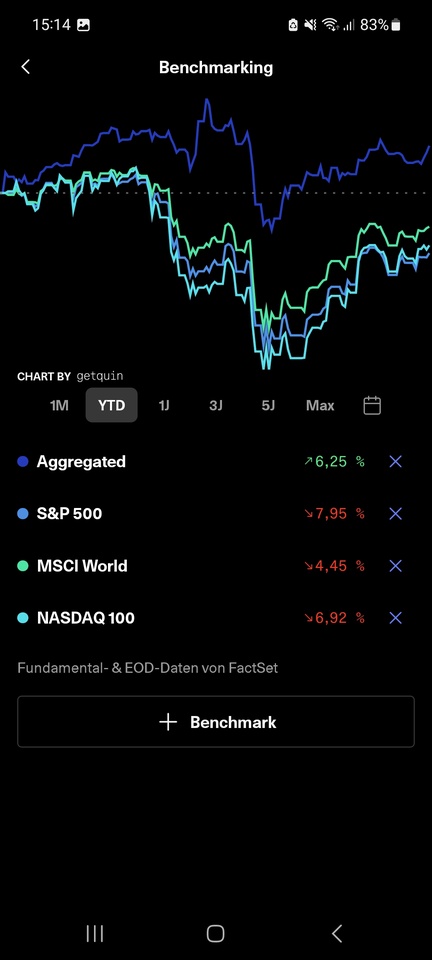

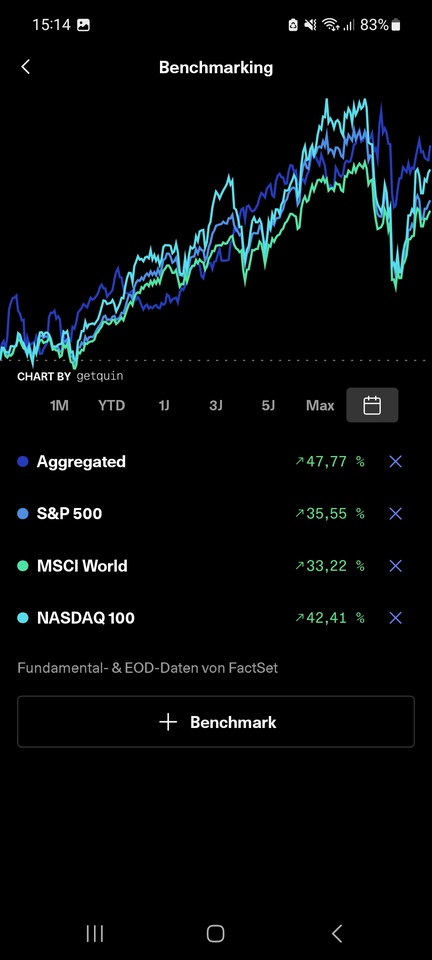

...even if we are only looking at a boring dividend and not a highflyer portfolio, it has been beating since the beginning (well 2 months of penny stocks deducted) for 2 years and I am quite satisfied with my performance since my strategy change 08/2023...

And so I will continue to stick to my current strategy and expand it within the scope of my possibilities.

The attentive reader will certainly have noticed that milestone 5 is still missing, but unlike 6, I won't set it until the end of the year and my target plan until then would be 25k+ and then we'll see...

...in the meantime, the last IHK exam (tax law) on the way to becoming a financial accountant is also coming up and who knows, maybe I can then increase my monthly savings rate of €550-700 a little more 🤷♂️

Anyway, until the next water level report, I wish us all a good hand on the path of at least 6 figures and stay true to your resolutions ✌🏻