Hello my dears,

Last year I always had one eye on the shares of Friedrich Vorwerk. $VH2 (-0,74%) with one eye. Sometimes it was too expensive for me, sometimes I forgot about it. In the end, I was looking for an investment in the holding company MBB. $MBB (+1,72%) But I completely missed the boat on both.

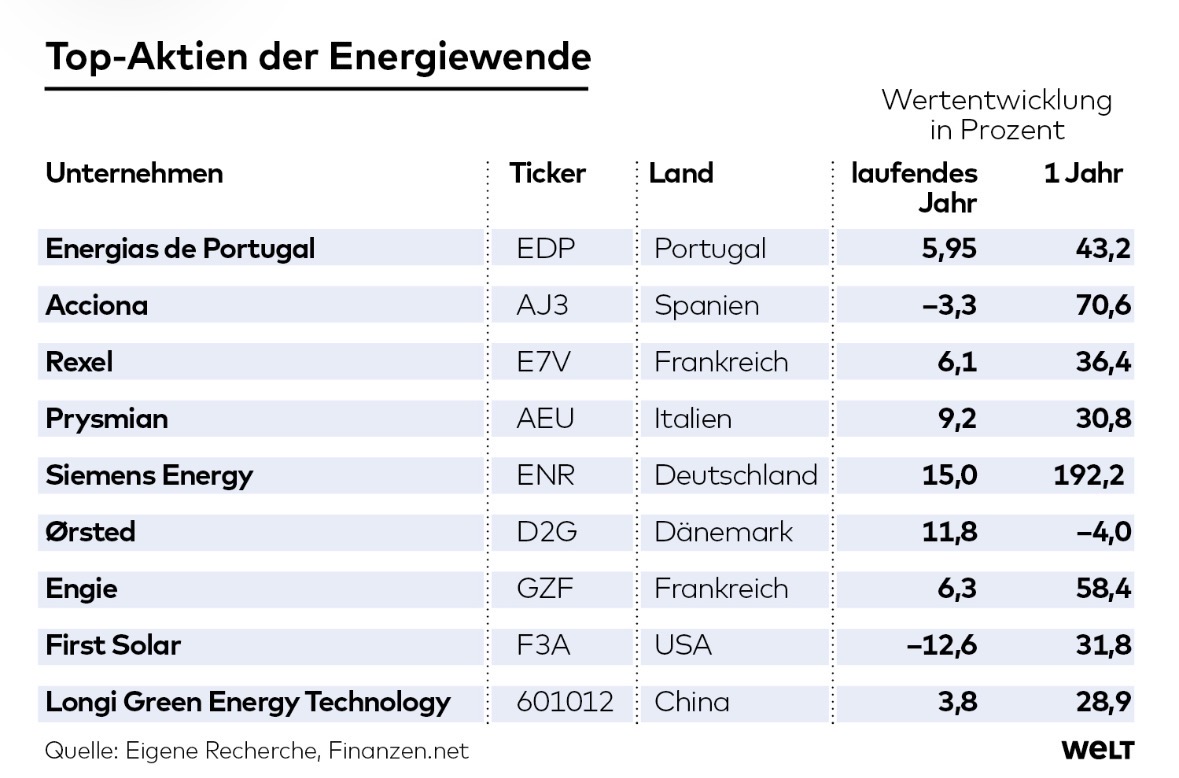

At Siemens Energy $ENR (-2,35%) I got involved by chance, perhaps we could call it luck.

Last week I was reminded of the ASTA Energy IPO, PFISTERER $PFSE (-1,26%) was brought back to my attention.

After the IPO in May, my opinion on Pfisterer was that the share must be an alternative to Friedrich Vorwerk and Siemens Energy. Both peer group shares were among the favorites. The topic of gigantic investments in the German electricity grid due to the energy transition and the age of AI was prominent on the stock market. After just over seven months, the Pfisterer share has risen well. I am very pleased with the development because the story has been discovered. A P/E ratio of 21 for 2027 is not too expensive for the growth.

Please share your opinion on PFISTERER in the comments.

Is the share now a buy for you after the decent correction on January 7?

(the share is currently hanging on to old lows, so if this is overcome I am positive). @TomTurboInvest

@Get_Rich_or_Die_Tryin ??

My dears, no light, no internet, no traffic - trains stopped, traffic lights went out. When there was a blackout in Spain and Portugal at the end of April last year, industry and more than 50 million people on the Iberian Peninsula were left without electricity. It took more than 12 hours for the electrical infrastructure to start working again to some extent.

Last year in Berlin, it wasn't just a few hours.

$PFSE (-1,26%)

Pfisterer: The secret winner of Siemens Energy's power grid boom?

One of the success stories of the last stock market year was the shares of Siemens Energy and the very successful IPO of Pfisterer . The two companies are linked, as Pfisterer is a supplier to Siemens Energy in the field of electricity grids. Siemens Energy is doing excellently in this area, as it received EUR 6.9 billion in orders in the last quarter and has an order backlog of EUR 42 billion. The segment is benefiting from new high-voltage direct current projects, among other things. Siemens Energy expects the positive trends in the energy sector to continue.

Demand for electricity in the USA is expected to grow by 2.2% to 2.4% this year and next. The two main drivers are AI data centers and the electrification of industry and transport. Consequently, investments must be made in the expansion of the electricity grids. Germany is also facing huge investments. The 2037/2045 grid development plan is likely to lead to investments of 250 billion euros, if not 450 billion euros. As a provider of the necessary infrastructure with a global presence, Pfisterer is a winner of the gigantic investments.

The PFISTERER Holding SE is a globally active technology company based in Winterbach, Germany. The company develops, produces and sells innovative products for connecting and insulating electrical conductors for interfaces in power grids. With 17 operating sites in 15 countries and production facilities in Germany, the Czech Republic and the USA, PFISTERER is well positioned for sustainable growth.

Business activities are divided into five segments: Components (COM), Medium Voltage Cable Accessories (MVA), Overhead Lines (OHL), High Voltage Cable Accessories (HVA) and High Voltage Direct Current Cable Accessories (HVD). These segments offer a broad portfolio of connections, cable accessories and insulation solutions for voltages from low to extra-high voltage, including innovative high-voltage direct current transmission systems.

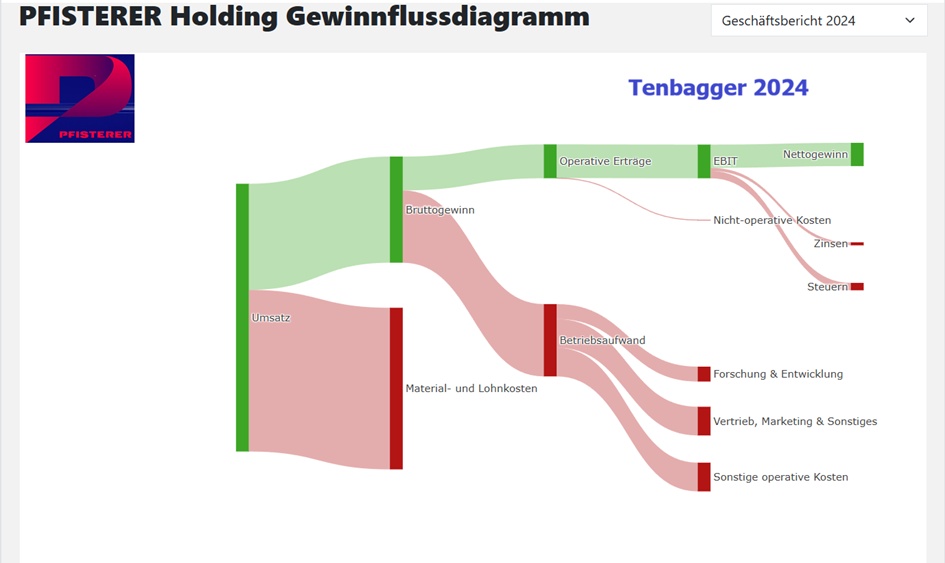

In the 2024 financial year, PFISTERER generated stable sales of EUR 383 million and a strong adjusted EBITDA of just under EUR 65 million. The company benefits from its technological expertise, global presence and diversified product portfolio, which is essential for the energy infrastructure of the future. The shares were placed as part of a public offering in Germany to finance further growth and expand the company's market position.

With a clear growth strategy, a solid financial base and an experienced management team, PFISTERER offers investors an attractive opportunity to participate in the energy transition and the modernization of the world's power grids.

Shareholders

Karl-Heinz Pfisterer 46.2 %

Dorothee Staengel 12.5 %

GS&P Kapitalanlagegesellschaft 0.5 %

Amplegest SAS 0.3779 %

Mandarine Gestion SA 0.3749 %

(I do not see the large funds invested here yet, which should perhaps mean potential for an investment) @Get_Rich_or_Die_Tryin ?

Projects

HVDC

OVERCOMING BOUNDARIES

Behind the four letters H, V, D and C lies an important driver of the energy infrastructure of the future. HVDC stands for High-Voltage Direct Current. The technology makes it possible to transport electricity over long distances with virtually no losses. It overcomes boundaries in both a figurative and a real sense. If we look into the future, we can see how HVDC connects countries and continents via supranational energy networks (so-called supergrids). We see how wind and solar power can be easily integrated into the grids in remote regions thanks to HVDC. And we will see a few more applications.

With PFISTERER's innovations in the field of HVDC cable accessories and the planned establishment of an in-house laboratory for product testing and development, PFISTERER is helping to ensure that this future technology can play to its strengths.

Manufacturing

INNOVATIVE PRODUCTS IN THE USA

The energy networks in the United States of America are in need of modernization. A number of extreme weather events have hit the country and its infrastructure hard in recent years. In order to support projects in the USA with innovative solutions, PFISTERER is setting up a site in Rochester in New York State. Its divisions: Production, sales, training center and cable assembly and testing.

Renewable energy

WITH TECHNOLOGY FOR FLOATING OFFSHORE WIND POWER

Offshore wind power is experiencing strong growth. And for good reason: floating offshore wind turbines can be used in deep waters with optimal wind conditions, opening up new areas for renewable energy.

With innovations for submarine cables and floating structures, PFISTERER is helping to bring this potential to full fruition.

SEANEX 145 kV

RELIABILITY FOR THE FUTURE

Offshore wind power is increasingly relying on higher voltage levels. They improve the efficiency of energy transmission, minimize transmission losses and increase the economic efficiency of large wind farms enormously.

This calls for technological upgrades to turbines, substations and cables. With SEANEX, PFISTERER has developed an innovative high-voltage connection system for offshore turbines up to 72.5 kV that has won over customers worldwide. We are currently working on the successor for voltage levels up to 145 kV.

Localization

IN SAUDI ARABIA

The economy in the Middle East is growing rapidly and with it the demand for energy. This calls for high levels of investment in the grid infrastructure - on two levels. It needs to be modernized on the one hand and expanded on the other in order to efficiently feed in renewable energies and ensure a reliable general energy supply. The combined solution is intelligent grids (smart grids) and regional interconnectors. Both increase grid stability and promote cross-border energy trading. Smart grids make use of modern communication technology and coordinate the different parts of the energy system, such as electricity generation and electricity consumption, while interconnectors link the electricity grids of two countries.

With the establishment of a new location in Saudi Arabia, including a sales and training center and a local production partner, PFISTERER is also contributing to the exciting development in the region.

Development of

THE FIRST PLUGGABLE UNIVERSAL SUBMARINE CABLE REPAIR JOINT UP TO 170 KV

PFISTERER is developing a universal repair joint for submarine cables up to 170 kV for the transmission system operator TenneT. Universal means: the one-size-fits-all solution will repair cable faults safely and quickly with minimal storage costs - completely independent of the structure or manufacturer of the respective cable.

(My dear @Klein-Anleger here we are in the oceans again, and at $PNG (+9,96%) )

A global distribution network - always close by

With a sales network that covers all continents, PFISTERER offers local expertise on a global scale. They rely on a direct presence in numerous countries, through their own factories, test laboratories and sales offices, which enables PFISTERER to meet their customers' requirements quickly and efficiently.

Where PFISTERER is not located itself, it works with long-standing, trustworthy distribution partners who have in-depth expertise and a strong network in their respective markets. They have been working with some of their partners for several decades. They know the specifics of the local market and are available to PFISTERER customers worldwide. This gives them a considerable competitive advantage.

Power generation solutions

Offshore wind

- PFISTERER connection technology can already be found in offshore wind farms all over the planet. Operators of offshore wind farms trust the solutions because they know they can rely on PFISTERER.

Onshore wind

- Using onshore wind to generate renewable energy to meet the growing energy demand of the future - this requires effective wind turbines. In the recent past, technological innovations have ensured that the efficiency of turbines has continuously increased and their costs have been reduced at the same time. PFISTERER technology ensures the safe and reliable integration of onshore wind power into power grids worldwide.

Solar

- The sun has the power needed for decarbonization. The importance of solar energy for the energy mix is constantly growing. Large-scale projects with enormous capacities are being built around the world. And thus a great need for efficient and reliable transportation of solar power. PFISTERER is meeting this demand with proven products for reliable energy transmission and distribution.

Conventional generation

- The transition to a renewable energy supply is taking place gradually. Until it is complete, conventional generation sources will remain an important part of the global energy mix. This also means that the associated infrastructure must remain up to date. PFISTERER supports conventional energy generation with reliable connection technologies for generators and substations.

Power transmission solutions

Underground cables

- The importance of underground cable systems in global power grids is growing. Urbanization, more frequent weather extremes and environmental and nature conservation goals make underground cables attractive. Increasing loads, resulting for example from the increasing use of volatile electricity from renewable energy sources, are increasing the demands on the systems. PFISTERER's solutions up to 550 kV ensure a reliable flow of electricity at sensitive interfaces.

Submarine cable

- In April 2025, the PFISTERER Group acquired the complete Akquisition von Power CSL bekanntgegebena leading specialist engineering company offering products and services for the connection of submarine cables for the global offshore industry.

Overhead lines

- Overhead lines transport electricity over long distances - and the increasing global demand means they have a lot of work to do. In order for them to do what they are supposed to do, advanced technologies and materials are needed for the efficient transmission of electricity.

- PFISTERER knows what is needed. And PFISTERER supplies it. They are a global partner for systems and components in overhead line projects - in the tropics and deserts with their extreme heat, in coastal regions and the northern latitudes with their ultra-low temperatures.

Substation

- Substations are central hubs in power grids - and therefore central to the energy supply. If operators want to ensure that transformers and gas-insulated switchgear are safe and economical, they should first make sure that their connection components and accessories work efficiently and reliably. PFISTERER technologies combine progressiveness and component diversity in a modular system - for a grid connection and system protection that operators can rely on.

Modular solutions

- Plug-in modular cable solutions are becoming increasingly attractive. They enable fast, flexible and safe installations in high and extra-high voltage grids. The advantages for energy suppliers, grid operators and OEMs are obvious: less downtime, easy maintenance, quick adaptation or expansion of systems - and therefore greater efficiency and future-proofing of the energy infrastructure. The largest selection of advanced plug-in technology components is available from PFISTERER.

Power distribution solutions

Distribution stations

- Substations in distribution grids are enablers and shapers of the future. They need to be robust and powerful because they are essential when energy sources are to be integrated into the grids. Or if smart grid technologies are to improve grid stability. Or when it comes to efficiently meeting the growing demand for energy in urban areas. PFISTERER offers innovative, reliable connection technologies for medium and low-voltage grids that harmonize with a wide range of cable types.

E-mobility

- Electrically powered vehicles will play a key role in the global mobility of the future. PFISTERER Technologie equips modern high-charger e-charging parks with advanced distribution technology. It can be described as advanced because it allows large amounts of electricity to be charged - at many columns simultaneously at full power. Its contact technology is also widely used in electric trains, for example for battery connections, air conditioning systems and carriage connections.

Industrial systems

- If industrial systems fail too often, their efficiency suffers. This happens, for example, when connection components for electrical drives and power supply systems are not precisely matched to the requirements of the system. Customized PFISTERER solutions reduce downtimes to a minimum.

Safety technology for distribution grids

- "Better safe than sorry" applies in particular to safety technology across all voltage levels. This is because safety technology is one of the most sensitive areas of energy supply. Operation should be correspondingly simple and unambiguous. And, of course, the same applies here in particular: Reliability is essential. PFISTERE's products - voltage detectors, earthing and short-circuiting devices, earthing and operating rods or continuous testing systems - fulfill these premises perfectly for every requirement.

The future

realize

In the (big) city and in the countryside, on the coast and on the high seas, in this country and elsewhere in the world - in numerous successful projects, innovative products and reliable services from PFISTERER have helped to make the energy infrastructure fit for the future. This is a selection of these projects.

"PFISTERER has shown that the company also offers ALSO MEETS THE HIGHEST REQUIREMENTS AS A PROVIDER OF COMPLETE SOLUTIONS."

Juan Carlos Sanchez, Canary Islands Project Director of Red Eléctrica de España (REE)

"AS THE WORLD MARKET LEADER IN THEIR FIELD, we have chosen PFISTERER

for the 220 kV EQUIPMENT FOR THE MORAY FIRTH WINDPARK."

Peter Cooke, Technical Development Director, Volkerinfra.

PFISTERER Referenzen

29.01.2026 at 09:01 am

EQS-News: PFISTERER eröffnet neues Trainingszentrum in Riad - Wichtiger Meilenstein in der Wachstumsstrategie (deutsch)

27.11.2025 at 13:16

EQS-News: Johannes Linden als CFO des Jahres 2025 ausgezeichnet (deutsch)

PFISTERER continues its growth trajectory in the first nine months of 2025 - Significant increase in earnings and incoming orders

PFISTERER PFISTERER setzt in den ersten neun Monaten 2025 den Wachstumskurs weiter fort – Ergebnis und Auftragseingang deutlich gesteigert

PFISTERER significantly increases sales and earnings in the first half of 2025

PFISTERER PFISTERER steigert Umsatz und Ergebnis im ersten Halbjahr 2025 deutlich

PFISTERER erhält Auszeichnung für herausragenden Börsengang des Jahres bei der IPO Night 2025

Wed, 29/10/2025

Current investor presentation

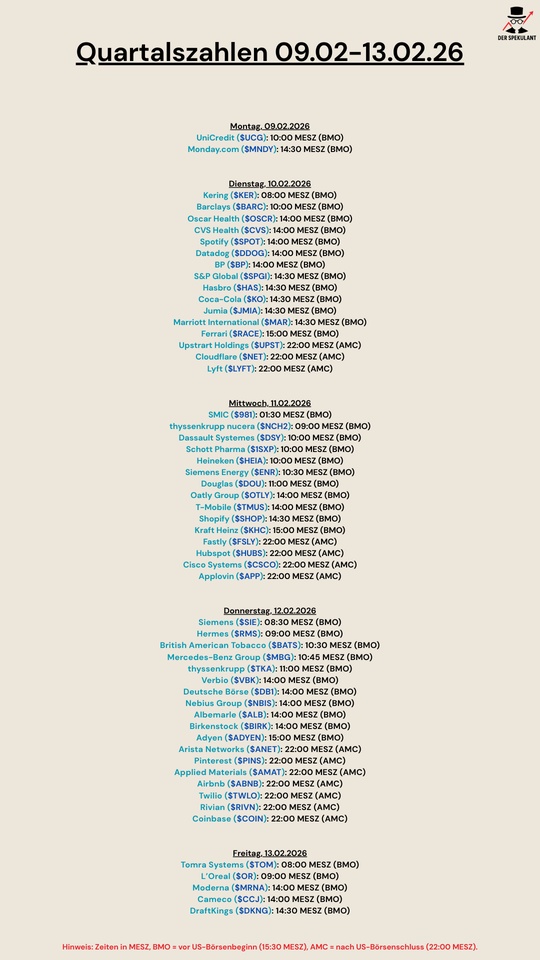

EUR in millions

Estimates

Year Turnover Change

2025 442,4

2026 500,6 13,16 %

2027 561,5 12,17 %

Year EBIT Change

2025 65,43

2026 73,17 11,83 %

2027 84,42 15,37 %

Year Net result Change

2024 32,18

2025 45,05 39,99 %

2026 52,81 17,21 %

2027 61,59 16,63 %

2028 26,98 %

Year Net debt CAPEX

2025 -13,7 41,5

2026 -4,6 50

2027 -7,75 50

Year Free cash flow Change

2025 -21,74

2026 -0,7667 +96,47 %

2027 26,11 +3505,64 % 🚀🚀

Year EBIT margin ROE

2025 14,79 % 34,8 %

2026 14,62 % 25,2 %

2027 15,03 % 24,5 %

Year Earnings per share Change

2025 2,21

2026 2,57 16,29 %

2027 2,92 13,62 %

Year Dividend Yield

2025 0,7633 1,04 %

2026 0,9033 1,24 %

2027 1,023 1,4 %

Year P/E ratio PEG

2025 28.4x 1.7x

2026 25x 1.8x

2027 21.5x 1.3x

2028 16.99x -0.17x

Market value 1,323

Number of shares (in thousands) 18,100

Performance

1 week +0.83 %

1 month -4.44 %

6 months +26.91 %

$PFSE (-1,26%)