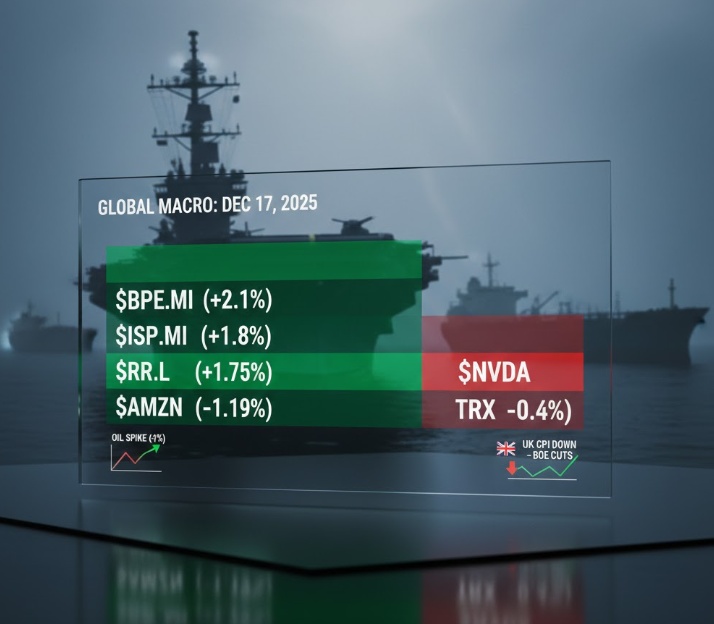

The military escalation between the USA, Israel and Iran is causing strong market movements worldwide. Investors are shifting out of cyclical sectors and into security, energy and defense.

_________________________

Bitcoin $BTC (-1,02 %) shows surprising stability

- 📈 In the meantime +8,1 %

- 💰 Just over 70,000 dollars

- Stabilization at around 69,000 dollars

Despite geopolitical risks, Bitcoin is apparently being used as a liquidity parking lot in the short term. At the same time, volatility remains high - further escalations could trigger new spikes.

_________________________

🛢 Oil prices up significantly

- Brent: + just under 6 %

- WTI: + a good 5 %

- In the meantime even +13 %

According to the report, the USA is currently no release from the strategic oil reserve. The market is still considered to be supplied, but the situation remains tense.

_________________________

🏦 Banks under pressure

The European banking index loses around 3,5 % - sharpest decline since April 2025.

Particularly affected:

- HSBC - $HSBA (-2,86 %)

- Barclays - $BARC (-4,17 %)

- Standard Chartered - $STAN (-5,21 %)

- Deutsche Bank - $DBK (-2,07 %)

- BNP Paribas - $BNP (-2,06 %)

- BBVA - $BBVA (-3,58 %)

- Commerzbank - $CBK (-4,02 %)

In the USA also weaker until the US opening:

- Bank of America - $BAC (+1,09 %)

- Citigroup - $C (+2,3 %)

Reason: Strong Middle East business of many institutions and general risk aversion of investors.

_________________________

✈️ Travel industry collapses

High oil prices and uncertainty weigh heavily on tourism stocks:

- TUI - $TUI1 (-7,46 %) (-11 %)

- Lufthansa - $LHA (-4,26 %) (-11 %)

Flights to the region are canceled, travel offers suspended. Investors fear rising costs and falling booking figures.

_________________________

💎 Luxury stocks clearly in the red

The European luxury index loses almost 4 %.

Strongly affected:

- Richemont - $CFR (-5,65 %)

- Swatch - $UHR (-6,16 %)

- LVMH - $MC (-3,08 %)

- Hermès - $RMS (-3,03 %)

- Kering - $KER (-3,88 %)

- Brunello Cucinelli - $BC (-4,04 %)

- Moncler - $MONC (-2,6 %)

- Ferragamo - $SFER (-3,35 %)

Background:

Luxury is heavily dependent on global travel. Capital flows out of cyclical stocks.

_________________________

🛡 Defense stocks as clear winners

Geopolitical tensions drive up defense stocks:

- BAE Systems - $BA. (+5,23 %)

- Lockheed Martin - $LMT (+4,06 %)

- RTX - $RTX (+7,13 %)

- Kratos - $KTOS (+6,66 %)

- Hensoldt - $HAG (+5,46 %)

- Leonardo - $LDO (+3,45 %)

- Renk - $R3NK (+3,35 %)

- Rheinmetall - $RHM (-1,11 %)

Partial price increases of 3-6 %.

The focus is particularly on missile defense systems and possible increases in defense budgets.

_________________________

🚢 Shipping companies benefit

Transport values increase due to detour (avoidance of Hormuz, Suez Canal & Bab al-Mandab):

- Maersk - $MAERSK A (+7,75 %)

- Hapag-Lloyd - $HLAG (+8,51 %)

- Torm - $TRMD A (+4,66 %)

- Frontline - $FRO (+4,84 %)

- Hoegh Autoliners $HAUTO (+3,73 %)

Reason: Shortage of transport capacity and speculation on rising freight rates.

_________________________

🥇 Gold in demand

- Gold price: +2,5 %

Profiteers in mining stocks:

- Evolution Mining - $EVN (+7,93 %)

- Northern Star - $NST (+4,94 %)

The sector has been showing relative strength for several days.

$4GLD (+1,86 %)

$GOLD

$GOLD (+1,74 %)

_________________________

📊 Market logic clearly recognizable

Winner:

🛡 Armaments

🚢 Shipping companies

🥇 Gold

₿ Bitcoin (short-term)

Losers:

🏦 Banks

✈️ Travel

💎 Luxury

_________________________

🔎 Conclusion

The market reaction follows the classic pattern of geopolitical crises:

- Risk is reduced

- Capital seeks security

- Energy prices rise

- Defense stocks benefit

The decisive factor remains whether the situation eases diplomatically - or escalates further.

_________________________

Source:

Reuters: Anleger greifen bei Bitcoin als "Fluchtvehikel" zu (Via TradingView)