$DPZ (-2,9 %)

$HIMS (+4,82 %)

$KTOS (-1,99 %)

$DOCN (-2,69 %)

$FME (-0,03 %)

$KDP (-2,93 %)

$AMT (-3,89 %)

$HD (-2,59 %)

$WDAY (+11,58 %)

$FSLR (-2,75 %)

$TEM (-1,94 %)

$O (-0,9 %)

$MELI (-9,08 %)

$HPQ (+7,03 %)

$LCID (+9,46 %)

$DRO (+10,35 %)

$HSBA (+6,76 %)

$FRE (+1,86 %)

$AG1 (-17,14 %)

$CRCL (+33,4 %)

$UTHR (+12,11 %)

$LDO (-2,67 %)

$IDR (+3,23 %)

$NTNX (+1,06 %)

$PARA (-3,09 %)

$NVDA (+2,02 %)

$TTD (+2,13 %)

$AI (+3,35 %)

$CRM (+4,59 %)

$SNPS (+2,38 %)

$SNOW (+5,5 %)

$PSTG (+8,76 %)

$ZIP (+1,12 %)

$ZM (-1,96 %)

$NU (-0,15 %)

$RR. (+1,7 %)

$MUV2 (+1 %)

$BIDU (-0,53 %)

$CELH

$DTE (+0,62 %)

$STLAM (-0,74 %)

$WBD (-0,26 %)

$HAG (+1,39 %)

$QBTS (+4,87 %)

$LKNCY (-2,48 %)

$BABA (-0,92 %)

$G24 (-0,96 %)

$HTZ (-2,32 %)

$PUM (-2,72 %)

$AIXA (-0,64 %)

$RUN (-2,11 %)

$INTU (+5,54 %)

$WULF (+2,86 %)

$MNST (-0,32 %)

$SQ (+1,37 %)

$ADSK (+1,64 %)

$MP (+1,52 %)

$RKLB (+1,27 %)

$SOUN

$SMR

$CRWV (+0,36 %)

$CPNG (-1,64 %)

$DUOL

HSBC

Price

Discussion sur HSBA

Postes

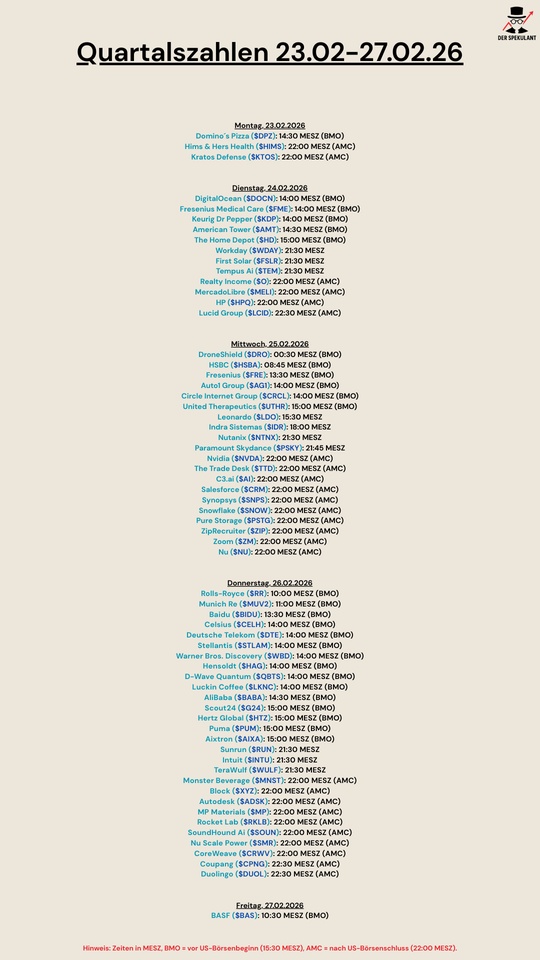

133Quartalszahlen 23.02-27.02.2026

UK Treasury selects HSBC Blockchain for digital government bond pilot project

The UK Treasury has decided to launch a trial program for digital government bonds, the country's first tokenized government bonds, using HSBC's Orion blockchain technology $HSBA (+6,76 %).

Officials see the trial as a way to modernize the government bond market by using blockchain technology to reduce costs and speed up settlement.

》How the pilot project for digital government bonds will work《

Under the pilot, the UK will issue a digital government bond instrument called DIGIT on HSBC's approved Orion platform. The UK will issue, distribute and settle the bond on a blockchain within a regulatory sandbox overseen by the Financial Conduct Authority.

The Treasury wants to test shorter settlement times than in the regular government bond market, where transactions are usually settled within one or two days. By tokenizing government bonds, officials hope to reduce operational risk, improve transparency for investors and simplify the transfer of bonds between market participants.

》Why the UK chose HSBC's Orion platform《

HSBC's Orion platform already supports the digital issuance of bonds for governments, central banks and large corporates around the world. According to HSBC, Orion has processed over $3.5 billion worth of digital bonds, including the European Investment Bank's first sterling digital bond and a $1.3 billion green bond for Hong Kong.

UK officials selected Orion as the technology foundation for DIGIT following a tender process that followed earlier public consultations on digital government bonds in 2023 and 2024. The decision aims to build on HSBC's previous work in tokenization while running the pilot in a controlled, permissioned environment that complies with UK debt management rules.

Chancellor of the Exchequer Rachel Reeves originally unveiled plans for a trial run of digital government bonds in a speech at Mansion House in 2024, with a two-year timeframe in mind for the launch. Since then, the UK has fallen behind countries such as Hong Kong and Luxembourg, which have already completed the sale of digital government bonds.

With the HSBC deal, the UK now joins the top markets exploring blockchain for public debt, and if the test project is successful, some analysts predict it will overtake other G7 countries. Market organizations welcome the test, but warn that lawmakers need to update legislation, tax laws and settlement procedures before digital government bonds become a normal issue.

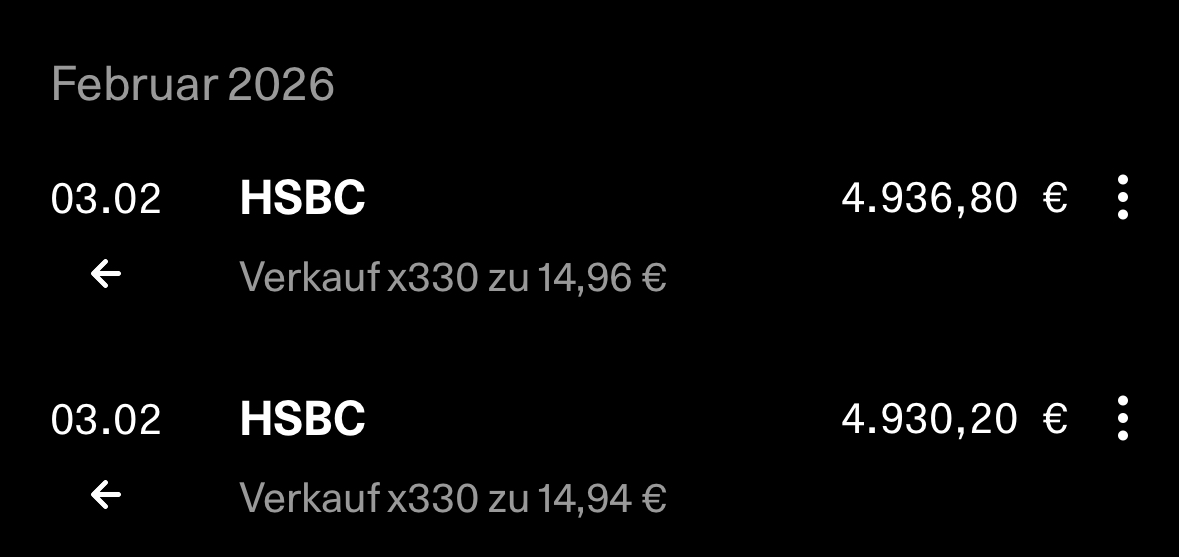

HSBC liquidates almost €10,000 position 😇

I got hold of the $HSBA (+6,76 %) Bank at over 7.3% dividend yield. Realized ~90% gross (without dividends) profit.

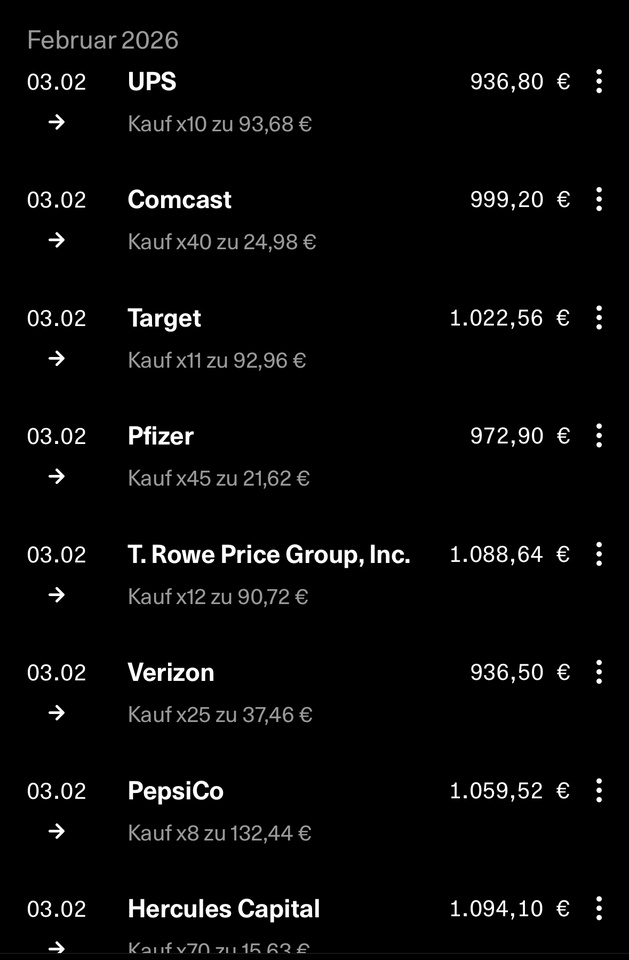

The proceeds were spread across my portfolio. Good Q's of my companies were published the other day. The HSBC proceeds are now in the shares.

Annual dividends were increased by more than €200. New balance: €6,950 (2026)☑️

HSBC UK and Sage simplify tax reporting for small businesses ahead of Making Tax Digital launch

As part of HSBC UK's comprehensive support for small businesses $HSBA (+6,76 %) the bank is launching a new tool to help business owners and sole traders prepare for the government's Making Tax Digital for Income Tax (MTD) changes coming into force in April.

Using Sage2's integrated technology, HSBC UK's My Business Finances allows eligible customers to manage their accounts and submit tax returns digitally directly from their HSBC UK business account, reducing the complexity that many small business owners are facing with the introduction of MTD.

A study by Sage $SGE (+2,47 %) shows that seven in ten (70%) sole traders are not prepared for Making Tax Digital. A third continue to record income and expenses using pen and paper, and two thirds rely on spreadsheets to prepare their tax returns.3

This partnership aims to bridge that gap ahead of MTD, providing practical support for clients to help them stay compliant, save time and stay in control of their finances as the tax system goes fully digital. Through My Business Finances, clients can manage their accounting and invoicing through their HSBC UK business account without having to switch between apps or platforms.

Tom Wood, Head of SME Business Banking at HSBC UK, said: "Small businesses are often incredibly ambitious but typically short on time. As a leading and trusted banking partner for SMEs, we're always looking for ways to help entrepreneurs work more efficiently so they can focus on growing their business.

Tax compliance can be both time consuming and costly - HSBC My Business Finances takes care of a company's invoicing, bookkeeping and tax compliance all in one place. This is particularly useful in light of the new tax reporting requirements in April."

Gordon Stuart, SVP, Fintech & Embedded Services, Sage, said: "Small businesses and sole traders want to focus on what they do best without having to deal with complex administrative tasks.

By integrating Sage's proven accounting and tax capabilities directly into HSBC UK's business account, we're making financial management effortless and accessible.

Our integrated accounting technology allows HSBC UK to deliver reliable accounting and tax functionality in a unified environment, within the tools business owners already use every day."

This is the latest in a series of support measures for small businesses banking with HSBC UK.

In July 2025, the bank introduced a monthly account fee for its Small Business Banking Account to complement free digital banking in the UK and free access to Business Specialists.

Dividends without withholding tax

About a handful of countries have no withholding tax at all or levy one so low that it is almost unnoticeable.

"These countries in which private investors in Germany are not subject to withholding tax include Ireland, Liechtenstein, Hong Kong and Singapore," says Stefanie Dyballa, Portfolio Manager at KSW Vermögensverwaltung in Nuremberg.

However, the Irish withholding tax is only low if the company is based in the country. Other countries with investor-friendly regulations are Bermuda, Brazil, Canada and Thailand.

However, the most important economy that leaves German shareholders untouched is the United Kingdom. "The UK has many attractive dividend payers to offer, especially in the energy and financial sectors," says the asset manager, naming the likes of $SHEL (+1,09 %) Shell, $BP. (-0,57 %) BP and $HSBA (+6,76 %) HSBC.

Hermann Ecker, authorized signatory and portfolio manager at Bayerische Vermögen in Bad Reichenhall, also immediately thinks of reliable dividend payers from the island, including $DGE (-13,7 %) Diageo, $RKT (-1,01 %) Reckitt Benckiser, $RIO (+3,25 %) Rio Tinto, $IMB (+1,37 %) Imperial Brands, $SGE (+2,47 %) Sage Group and $ULVR (-1,48 %) Unilever. The selection shows just how diverse the withholding tax-friendly UK capital market is.

However, it is worthwhile for investors to consider other companies in addition to the well-known names: Sometimes they offer even higher dividend yields. WELT has compiled a list of 19 shares that are listed in countries with zero or low taxes and have also shown a stable performance over the past twelve months.

The last criterion is intended to protect investors from falling into a value trap, i.e. investing in a company with an eroding business model. The British drinks group Diageo, for example, is regarded as a solid dividend payer, but its share price has fallen by a third over the past year. The Diageo dividend yield of just under five percent is little consolation.

By contrast, the British insurance giant $AV. (+1,32 %) Aviva. The London-based company has roots dating back to 1696 and is one of the leading providers of pensions and insurance in its core markets of the UK, Ireland and Canada. Thanks to a focus on cash generation, Aviva is considered a solid basic investment that currently offers its shareholders a dividend yield of around 5.5%, which is only reduced by the German capital gains tax plus solidarity surcharge.

The financial services provider Legal & General, founded in 1836, can also look back on a long tradition. $LGEN (+0,64 %) Legal & General can also look back on a long tradition. As a heavyweight in the areas of asset management and pension insurance, the London-based group has a comparatively cyclically resistant business model that benefits from long-term demographic trends. Shareholders receive a current yield of 8.5 percent, making Legal & General one of the highest-yielding stocks in the UK index. The same can be said of the $PHNX (+0,72 %) Phoenix Group, whose yield is an impressive 7.8 percent.

The mining group $RIO (+3,25 %) Rio Tinto. However, the company is benefiting from the global appetite for raw materials. Rio Tinto is one of the world's largest producers of iron ore, aluminum and copper. Investors are betting on the indispensable role of metals in the global energy transition. The dividend payout is four percent.

The yield is more than twice as high for the Brazilian competitor $VALE3 (+2,43 %) Vale. Founded in 1942, the Rio de Janeiro-based mining group is the largest nickel and iron ore producer in the world. Experience shows that the size of the dividend depends on the ups and downs of commodity prices. As these are currently pointing upwards, shareholders have a good chance of achieving a dividend yield of almost ten percent on their capital investment this year. There is no withholding tax.

More speculative are investments in Greek financial institutions such as $TELL (+0,47 %) National Bank of Greece. The bank was on the brink of collapse during the euro debt crisis and had to be rescued with state aid. However, business is now flourishing again. Thanks to this economic comeback and the adjusted balance sheet, shareholders of National Bank of Greece should be hoping for a dividend yield in the region of four to five percent.

Financial institutions are also among the most interesting investments in Asia. The city state of Singapore, which does not levy withholding tax and is considered one of the most stable financial centers in the world, is home to the $D05 (-0,51 %) DBS Group. Founded in 1968, the institution is considered one of the best banks in the world and has already been described as the "Fort Knox" of the Asian banking world. Investors appreciate the quarterly distribution, which amounts to four percent per year, and the conservative balance sheet management of the DBS Group.

The Oversea-Chinese Banking Corporation, founded in 1932, also offers a return of around four percent. $OVCHY Oversea-Chinese Banking Corporation, founded in 1932. It is the longest established bank in Singapore and offers a mix of banking, asset management and insurance, which speaks for diversified earnings. However, the Oversea-Chinese Banking Corporation is not quite as dynamic as the DBS Group.

The conglomerate $J36 (+1,9 %) Jardine Matheson has its roots in Hong Kong, but the shares are now listed in Bermuda. Founded in 1832, the company is a legend in Asian economic history with a broadly diversified portfolio ranging from real estate to retail. Little known: The financial services provider $IVZ (+1,89 %) Invesco, which stands for the most popular Nasdaq ETF QQQ. The investment company's shares have risen by almost half over the past twelve months and also offer a dividend yield of three percent.

If you want to invest specifically in Hong Kong, you can stick with the infrastructure group $1038 (-2,87 %) CK Infrastructure. Founded in 1996, the company belongs to the empire of tycoon Li Ka-shing. It invests globally in energy suppliers, waterworks and transportation infrastructure, which ensures stability. Investors receive a return of around four percent.

As far as the former British crown colony is concerned, Dyballa has other ideas: "Financial and telecommunications stocks listed in Hong Kong, such as the $3988 (-1,15 %) Bank of China and $941 China Mobile often offer stable and attractive dividends." And she also has a tip for Singapore: "Real estate stocks or REITs that are less well-known in this country also offer stable cash flows and high dividend yields," says the portfolio manager.

Source: Text (excerpt) WELT, 24.01.26

Privatization of Hang Seng Bank by HSBC nears completion

The planned privatization of Hang Seng Bank $11 by HSBC Holdings $HSBA (+6,76 %) has cleared a decisive hurdle today.

The High Court of Hong Kong approved the underlying takeover plan (scheme of arrangement) without any changes, paving the way for the delisting of the bank from the Hong Kong stock exchange.

The court also confirmed the capital reduction associated with the privatization plan at the same hearing, according to a joint announcement by HSBC Holdings, The Hongkong and Shanghai Banking Corporation Limited (HSBC Asia Pacific) and Hang Seng Bank.

The plan is expected to become final and effective on Monday, January 26, following the registration of the court order with the Hong Kong Companies Registry.

Hang Seng Bank has received approval from the Hong Kong Stock Exchange to delist its shares with effect from 4:00 p.m. on Tuesday, January 27, subject to the Plan becoming final and effective.

The privatization plan had already received shareholder approval at relevant meetings earlier this month, as referenced in a joint announcement on January 8.

The companies announced that most of the conditions for the privatization had been met. The remaining conditions relating to the registration of the court order and other administrative matters are also expected to be met.

HSBC Holdings, through its subsidiary HSBC Asia Pacific, already holds a majority stake in Hang Seng Bank, one of the most established financial institutions in Hong Kong.

The joint announcement noted that shareholders and potential investors should exercise caution when trading in securities of HSBC Holdings and Hang Seng Bank as the operation will only be implemented if all conditions are satisfied or waived by the specified deadline.

HSBC considers sale of insurance division in Singapore

HSBC Holdings Plc $HSBA (+6,76 %) is reportedly considering various options for its insurance business in Singapore, including a potential sale, as part of the ongoing Group reorganization under CEO Georges Elhedery.

Bloomberg News, citing people familiar with the matter who asked not to be named, reported that the banking giant is working with a financial adviser on a review of HSBC Life (Singapore) Pte.

The insurance division could be valued at more than 1 billion US dollars in a transaction.

Several insurers and investment firms have already expressed initial interest in the division, according to the report.

The review is still at an early stage and no final decision has been made on the future of the insurance business in Singapore.

This potential divestment is part of other business reorganizations HSBC has undertaken globally under Elhedery's leadership as the bank continues to evaluate its portfolio of businesses in various markets.

HSBC examines SRT transaction worth 2 billion euros

The bank HSBC Holdings $HSBA (+6,76 %) is reviewing the implementation of a Significant Risk Transfer (SRT) in relation to a portfolio of investment grade corporate loans worth €2 billion, according to an agency report.

The size of the SRT would correspond to around 10 percent of the reference portfolio, the Bloomberg news agency reported, citing people familiar with the matter. The final terms of the potential deal are still the subject of discussions with investors.

HSBC did not wish to comment on this when asked by Bloomberg.

SRTs are a structured finance transaction (securitization) that enables banks and lenders to transfer part of the credit risk of a loan or asset portfolio to third-party investors, for example by issuing debt instruments or through synthetic structures such as guarantees.

One of the most attractive aspects of SRT transactions is capital relief.

By outsourcing risks, banks reduce the capital they need to hold for certain assets and thus create space on their balance sheet for new business.

HSBC opens wealth management business in the United Arab Emirates

The London-based HSBC $HSBA (+6,76 %) is expanding further into the Middle East with the establishment of a new wealth management business in the United Arab Emirates.

According to a statement, HSBC is launching a wealth management business in the UAE, with James Grist appointed as managing director of the new company.

At launch, 10 onshore funds will be introduced.

"With our investment in establishing an onshore wealth management business, we aim to capitalize on the significant and long-term wealth opportunities in the UAE," commented Dinesh Sharma, the bank's regional head of international wealth and private banking for the Middle East and Turkey.

The latest expansion is part of HSBC's wider growth strategy in the Middle East, which includes the opening of its first wealth center in the region last year in Dubai.

Dividendenopi inside (Part 1 )..... Dividendenopi Rewind2025

A little later, but not too late, I'll also have my say at the end of the year, together with an insight into the goings-on of the Opi before @Tenbagger2024 , @SAUgut777 and some others get impatient, as you know, old people are a bit slower. I would also like to take this opportunity to thank and appreciate all those who contribute here on GQ with great analyses and strong contributions, critical comments and a wonderful exchange. I'm deliberately not naming any individuals now, otherwise I won't be able to finish. All of you together are great, whether you're a veteran or a newcomer. The community is alive and I am happy to be a part of it. Thanks also to @christian and the Getquin team, who make this possible by maintaining the platform, even if things sometimes don't run smoothly. The Bavarian says: Basst scho

The year 2025 was exciting and, from my point of view, successful in terms of my expectations. If you don't feel like evaluating a boring dividend strategy, don't want to read about overnight and fixed-term deposits, aren't interested in certificates and don't like the Sparkasse, you are welcome to leave here after Rewind 2025. Many thanks to everyone else for reading and, if necessary, commenting.

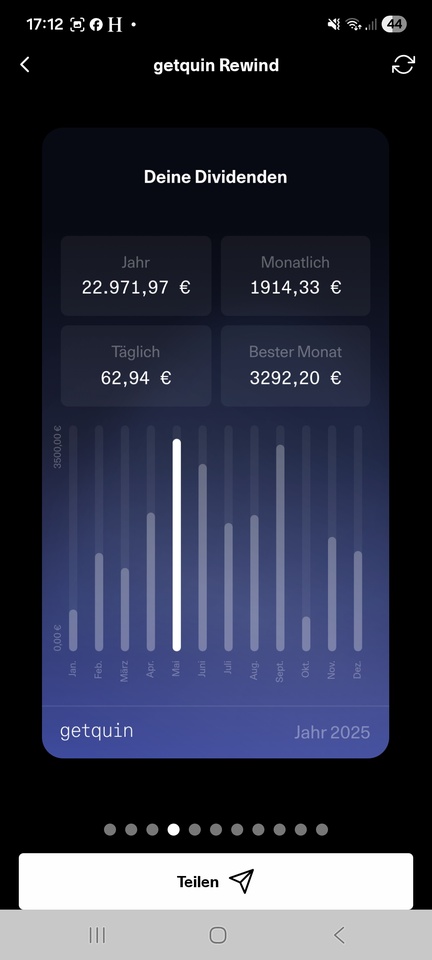

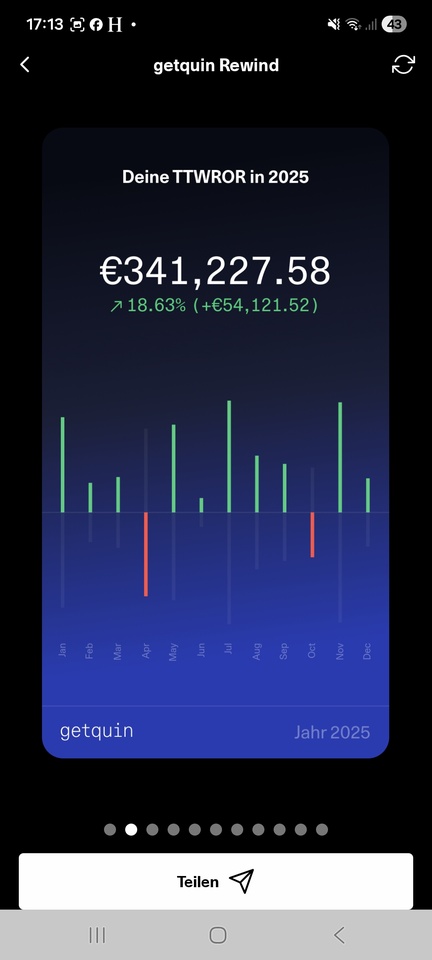

At least as far as the majority of shares are concerned, I am known to be invested in dividend stocks in order to generate the highest possible cash flow. I am now almost 62 years old and do not value excessive performance but would like to make a living from the income from my assets and decided to stop working at the beginning of the year when the company where I was employed was dissolved. I see myself as a buy and hold a while. Nothing lasts forever, especially with high-dividend shares. There are regular reallocations without getting into an operational frenzy. In 2025, for example $TRMD A (-0,04 %) and a large position $HAUTO (+7,91 %) had to leave the portfolio, the high dividend expectations were significantly reduced. The $QYLE (+0,36 %) has not recovered from April, $EQNR (-0,48 %) and $VICI (-0,72 %) led to the brink of capital loss despite respectable dividends and had to give way, as did $MUX (+0,4 %) with its inconsistencies. New additions were $NN (+0,43 %) , $PFE (-0,22 %) , $DTE (+0,62 %) and a first position at the end of the year $ARCC (+1,33 %) You can see the composition in my profile. I generally try to limit myself to +/- 20 positions and weight them according to purchase. A maximum of 20k per position is invested. This results in the calculation of my dividends and expected income. In its current composition, the portfolio shown here has a value of just over € 340,000 as at 31.12.2025 and has generated gross dividends of just under € 23,000 this year. This corresponds to a dividend yield of 6.73%

The time-weighted yield was 18.63% and therefore well above average, at least better than 67% of the getquin community. I wasn't able to beat the DAX, but at least I outperformed the S&P500 and beat the relevant MSCI World index by some distance. Even on a 5-year view I am on a par. Tobacco stocks did very well $BATS (+1,53 %) , $IMB (+1,37 %) and $MO (+0,52 %) , $HSBA (+6,76 %) , and $RIO (+3,25 %) and of course $965515 (+0,56 %) that I physically hold and the $EWG2 (+0,49 %) .

That's all there is to the part of my investments shown here in GQ. What follows is a piece of my life story and the first part inside Dividendenopi.

As I said, I now live off my assets. This amounts to just under € 1.2 million in all the forms of investment I hold. Is that enough for a carefree life? For me in any case. Because on top of that, I have a debt-free, owner-occupied property (a single-family home with a large garden in a quiet rural location near a city of 600,000 inhabitants) and a rented two-family home, appropriately enough, as a neighboring property. Partly financed, rent surplus after installment to the bank a good € 700 per month, flows completely into the maintenance reserve. Claims from BAV, life insurance, building society savings contracts will be added on top in the next few years, but are not taken into account here. There's even a savings account with €18,000..... half of which belongs to my wife and she doesn't want to close it.

My wife (still) works and has a decent income despite working part-time and has other liquid assets in the lower six-figure range. She does it herself, the stock market is the devil's work. Her story is not included here either.

So I / we are doing pretty well after all. It wasn't always like that, anyone who is or was self-employed knows that. But consistent financial planning is important, no matter what the situation, as is sticking to your savings rate. I started investing in real estate at the beginning of the 1990s and have been liquidating it over the last few years. In conjunction with my own wealth accumulation and an inheritance, I am now in a comfortable situation for me.

What do I do with the rest of the money outside the getquin portfolio? A good € 500,000 is (still) in call money and fixed-term deposit accounts. Interest rate hopping on call money and fixed-term deposits from 2 years ago yields around 3% on call money and over 4% on fixed-term deposits. The remaining capital is invested in certificates. Mainly in fixed-coupon express certificates with quarterly payout and partly in bonus certificates with CAP and barrier.

My investments currently generate a net monthly cash flow of € 4000, which is enough for me to live on. Plus € 800 ALG on top until the beginning of 2027.... But before the company closed, I only worked 16.5 hours a week. With my wife's income, that's a good €6500, which is bearable. You can certainly do more with your assets, depending on your needs. We live rather modestly, don't have any children and aren't the consumer type.

How am I invested outside of dividends, why certificates and which broker, where and how overnight and fixed-term deposits? I thought that would go beyond the scope of this article, so I'll come back to it in a second part. Thanks for your participation so far and see you soon

Significantly, you can see here that not having children is now the best provision for old age. Not an accusation, just an observation. 🤷♂️

Titres populaires

Meilleurs créateurs cette semaine