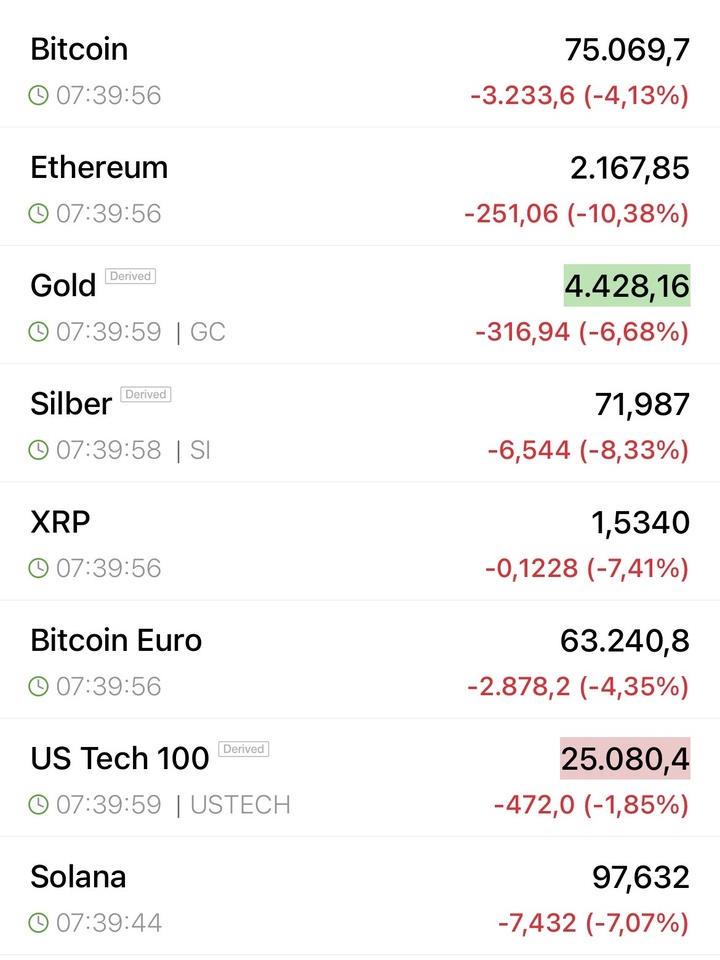

In recent days, markets around the world have experienced strong fluctuations: price slumps in precious metals such as gold (-7.5%) and silver (-14%) led to panic-like sell-offs in equities, cryptocurrencies and derivatives - particularly in Asia and then globally.

At the same time, supervisory authorities such as BaFin recently expressed concerns about rising risks on the financial markets, citing excessive risk appetite, political uncertainty and euphoria surrounding certain sectors (such as AI).

And even if corporate balance sheets remain solid overall, many investors are currently more focused on geopolitical risks, interest rate and political signals than on fundamentals.

In short, we are not seeing a sudden global "economy Armageddon", but a classic market exaggeration and correction process triggered by technical factors, sentimental overreactions and political uncertainties.

Why it's crashing right now: causes in detail

Several simultaneous drivers are typical for market phases like this:

1. increase in risk and volatility

Investors flee risk assets as soon as nervousness dominates. Panic selling then intensifies the downward pressure.

2. geopolitics and uncertainties

Political news (tariffs, geopolitical tensions, central bank decisions) is currently having a disproportionate impact on the markets.

3. high expectations vs. reality

Many tech and AI stocks had previously risen sharply. As soon as earnings and valuation levels fall short of expectations, sentiment quickly changes. This is not a crash signal, but a valuation reset.

4. sentiment momentum

Market participants have learned to think in terms of trends. When the masses sell, this drives prices down further in the short term - regardless of whether the fundamentals are weak or not.

This is not an apocalyptic revelation, but simply market dynamics.

Corrections are not a bug, they are a feature

There is no straight line upwards on the stock market, and the fact that prices fall is not a technological defect - it is part of the system. Corrections and even crash-like movements are part of the normal functioning of capital markets.

Historically, the biggest gains for investors have often come not in calm periods, but after periods of high volatility. Investors who only invest when everything looks great often miss out on the return drivers of the next few years.

Why such days should be encouraging

1. buy the dip is not a meme, it is a statistic.

In the past, investors who bought at lower prices often profited more than average because the average price was lowered and future recoveries have a stronger impact on the portfolio.

2. emotions are not a good investment mechanism.

Panic causes investors to sell when others are buying. And in the long term, the best returns have been achieved by those who bought and held on the dip - not those who got out on every bad day.

3. time in the market beats timing the market.

No one can predict exactly how deep a dip will go or when it will end. But those who stay invested for the long term and buy on dips tend to see better returns than those who try to time the perfect entry. This is simply because you have more time in the market where the returns are generated.

What really counts now

✔ Long-term thinking over short-term fear

✔ Keep positions or even expand them at a favorable price

✔ Really use diversification, don't just preach it

✔ Reduce emotions, increase plans

Crash-like days always feel bad. But they are not a disaster - they are opportunities to achieve returns that you would otherwise have missed.

If you take a long-term view and stay disciplined, such days are the friends of your returns, not their enemies.

$BTC (-0,92 %)

$MSFT (-0,3 %)

$SAP (+1,12 %)

$IREN (-6,41 %)

$MSTR (+1,9 %)

$ETH (-1,76 %)

$NVDA (+1 %)

$CSU (+7,38 %)

$4GLD (+1,46 %)

$SSLN (+6,91 %)

#börse

#aktien

#crash

#geopolitik