I was able to leave the champagne in the fridge yesterday after LVMH $MC (-0,61 %) fell short of expectations in terms of profit and net income, losing up to -5% at times. The share recovered slightly later in trading. Things don't look so rosy today either. In the long term, however, I am not worried, even if the jump above €800 may take a little longer.

Let's start with the facts:

I have taken the time and trouble to read through the annual reports and listen to the earnings call:

Summary and classification from the published annual reports of LVMH "Presentation

2024

Annual Results" [1] and "Financial Domcuments" [2]. Page references in the source reference refer to the reports mentioned separately in [Source 1 & 2].

First of all, a brief overview of how the % figures in the annual report are to be understood, as this is important in my opinion.

📈 Percentage figures: "Published" vs. "Organic"

Two types of growth figures are given in the LVMH reports:

1 . Published development (Published)

- This figure shows the change in sales compared to the previous year in euros.

- It takes into account exchange rate fluctuations (e.g. a weak US dollar or yen) and changes in the scope of consolidation (e.g. due to acquisitions or sales of parts of the company).

- Example: A fall in the US dollar against the euro means that sales from the USA are worth less in euros, even if they have remained stable in the region. *(For a detailed explanation, please refer to the "Appendices" at the end of the post).

2 . Organic development (Organic)

- This figure shows the "real" growth of the core business.

- Exchange rate effects and changes in the company portfolio are deducted.

- It better reflects the extent to which the company has actually grown or declined in its markets.

Why the difference is important:

Published change gives a complete picture of external factors. Organic change, on the other hand, shows operational performance and is a better indicator of a company's long-term stability.

📊 Business figures 2024: overview

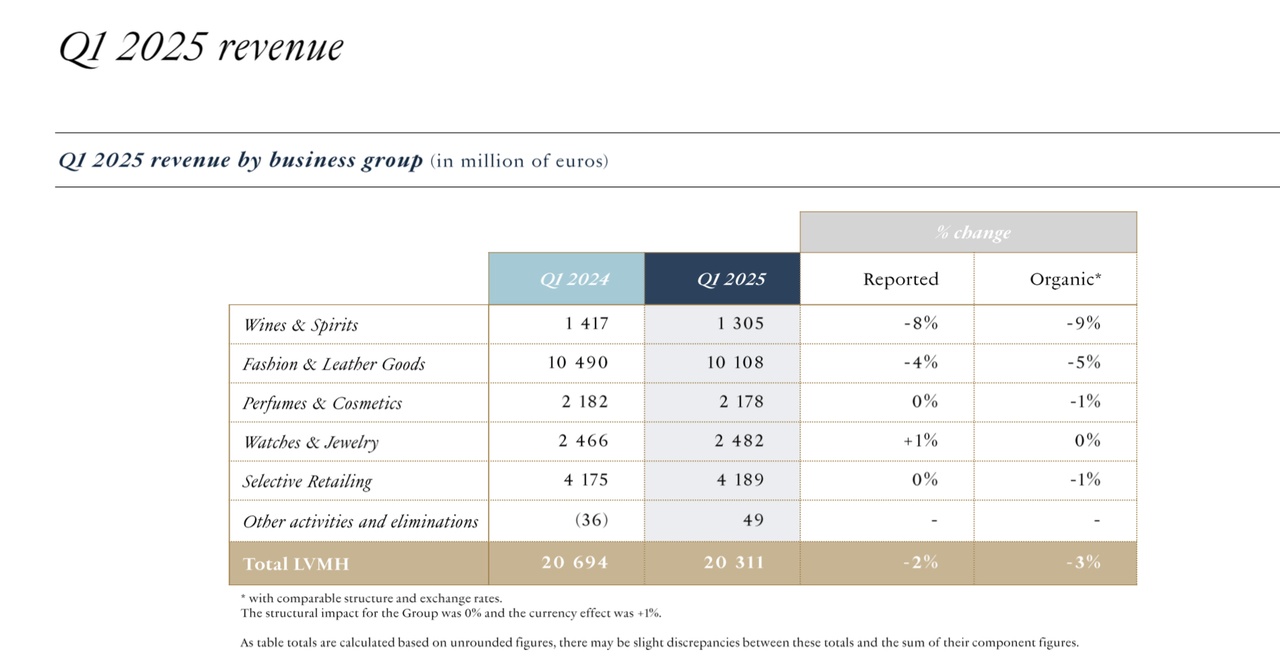

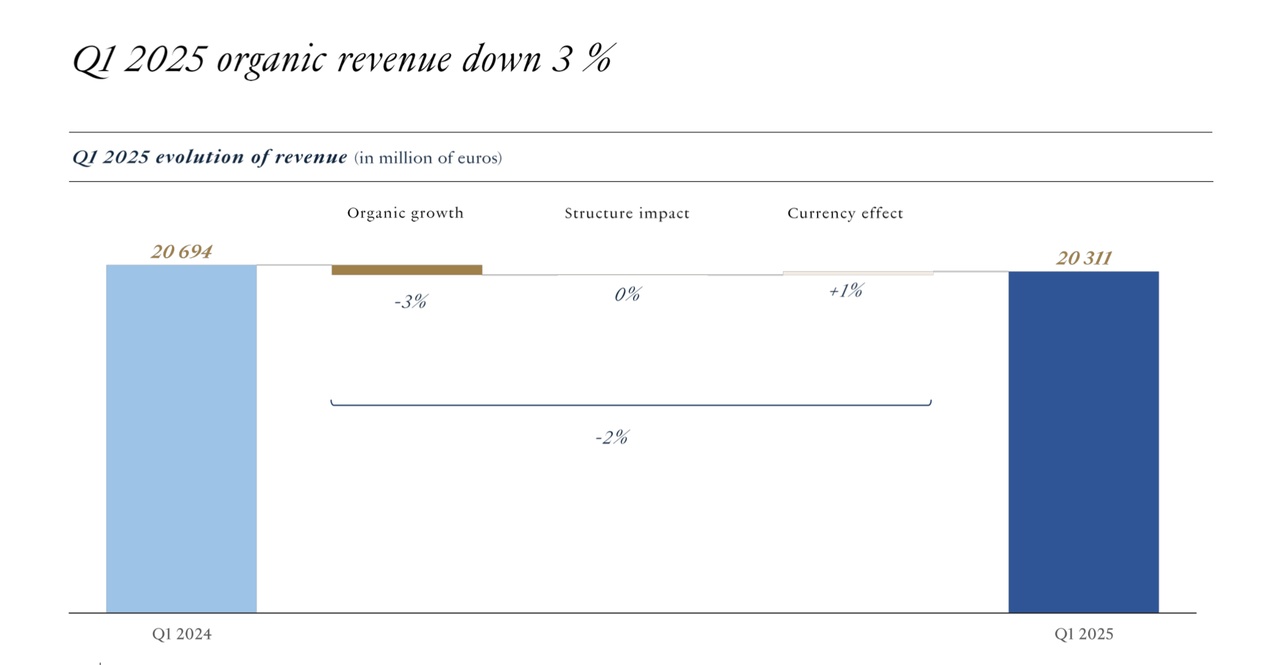

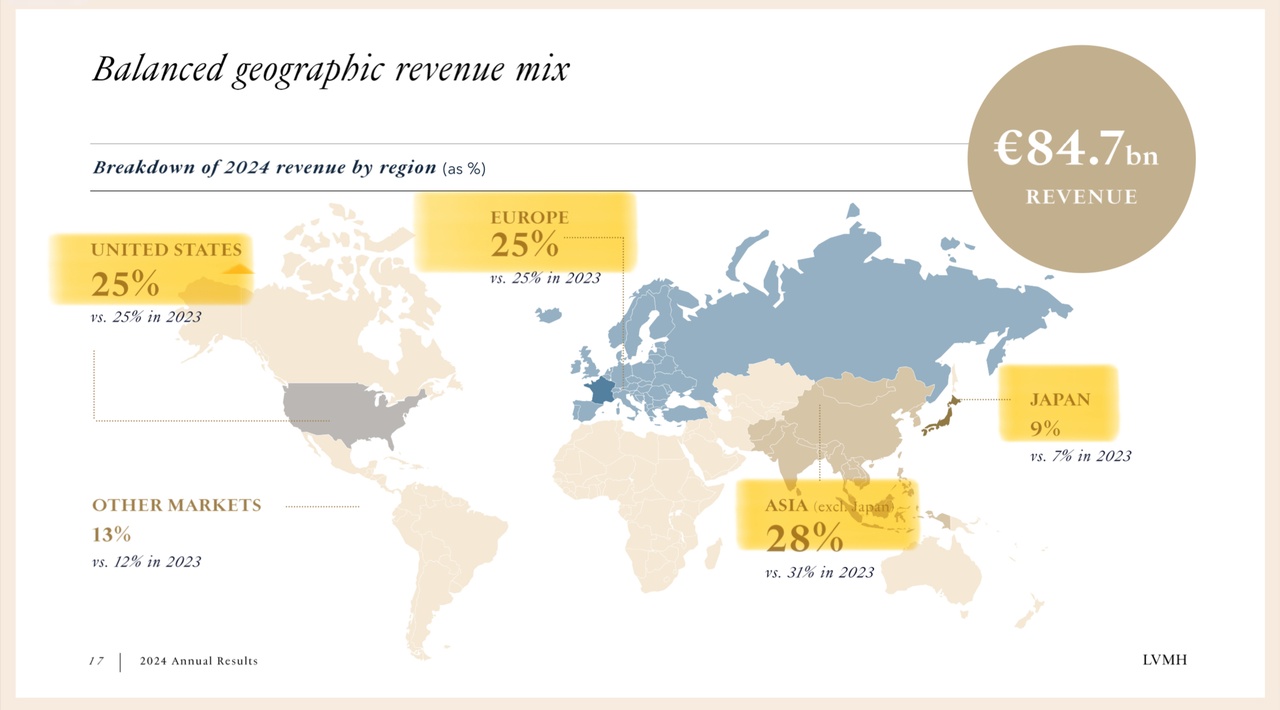

- Sales: EUR 84.7 billion (-2% published, +1% organic, exceeded expectations of EUR 84.3 billion) [2, p. 2; 3]

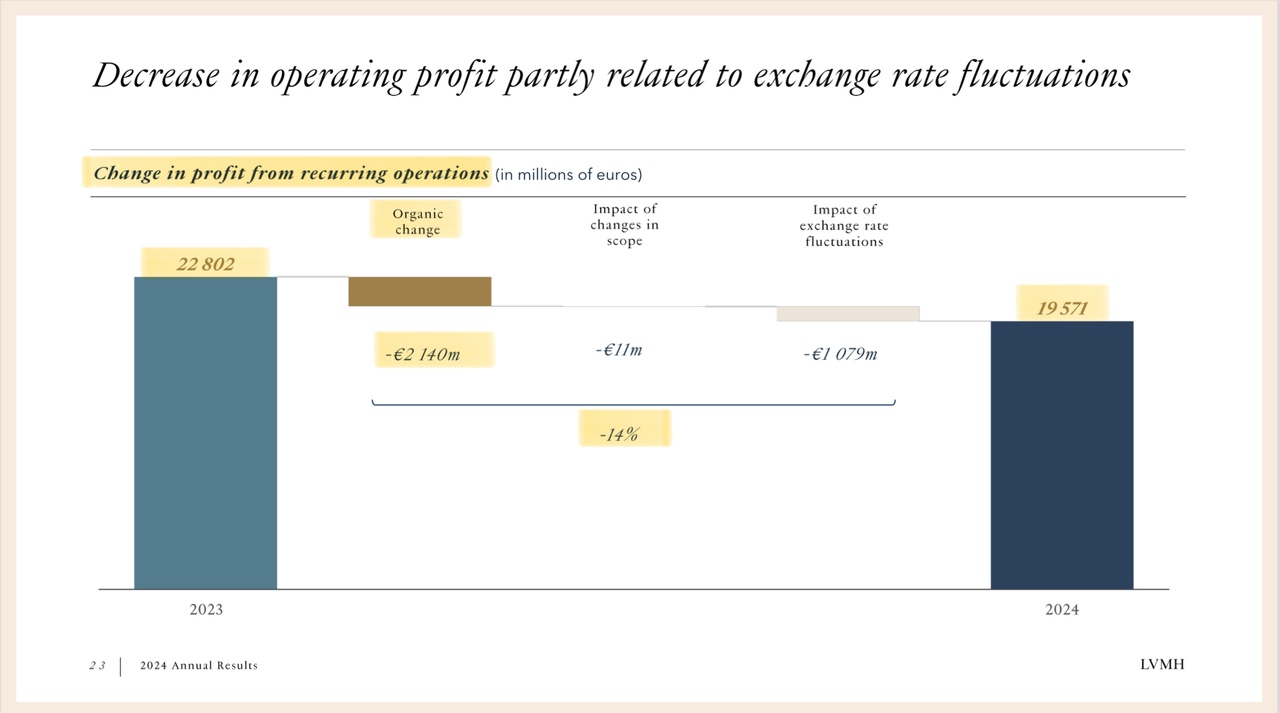

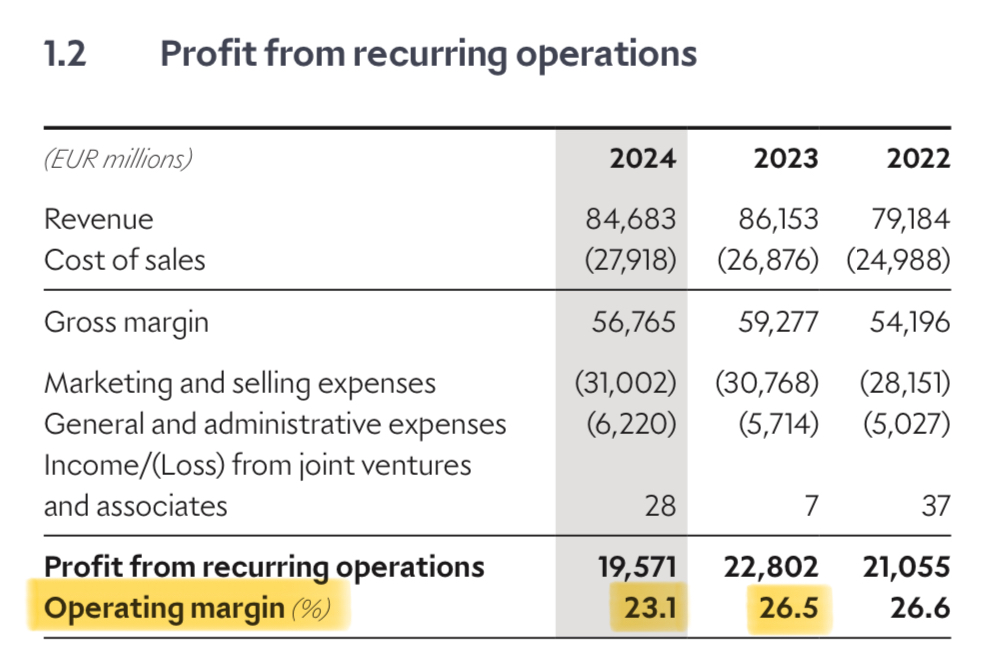

- Operating profit: EUR 19.6 billion (-14% published, -9% organic, below expectations of EUR 20.3 billion) [1, p. 23; 2, p. 7; 3]

- Net result: EUR 12.6 billion (-17% published, below expectations of EUR 13.7 billion) [1, p. 22] (More on increased marketing & administration costs later in the text)

- Operating margin: 23.1% (decline of 3.4 percentage points, but still strong compared to the industry) [2, p. 7]

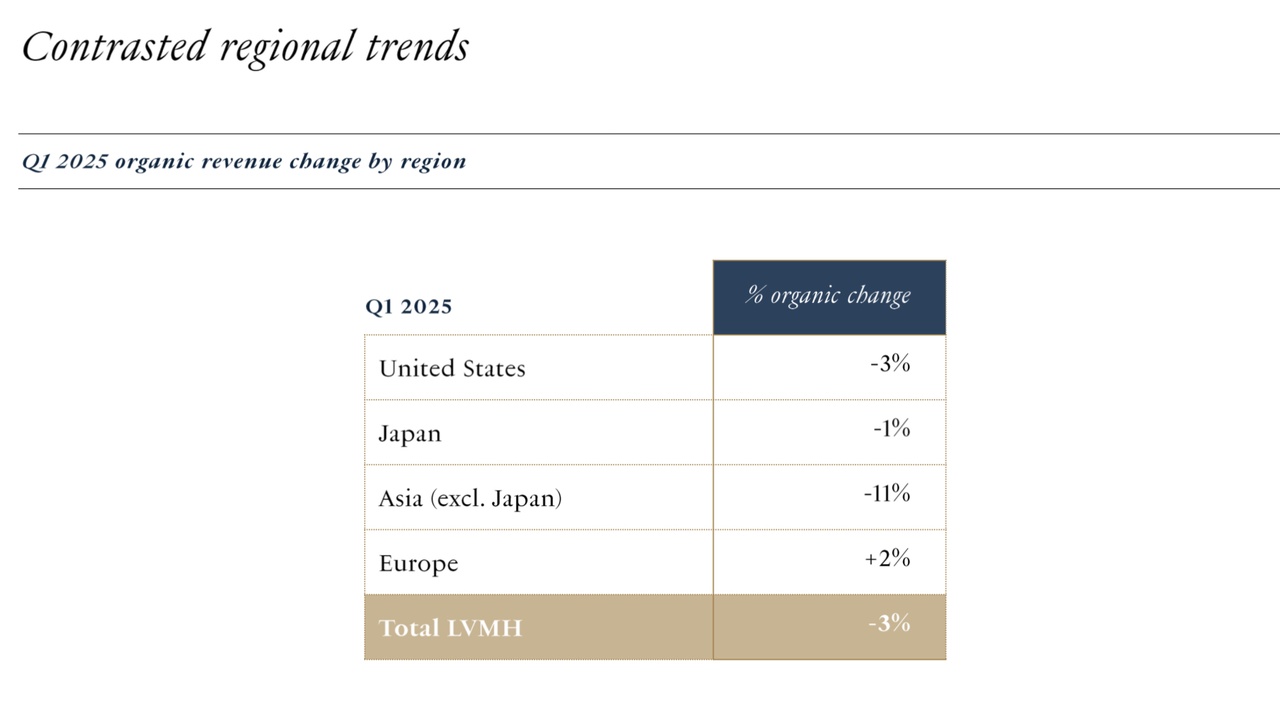

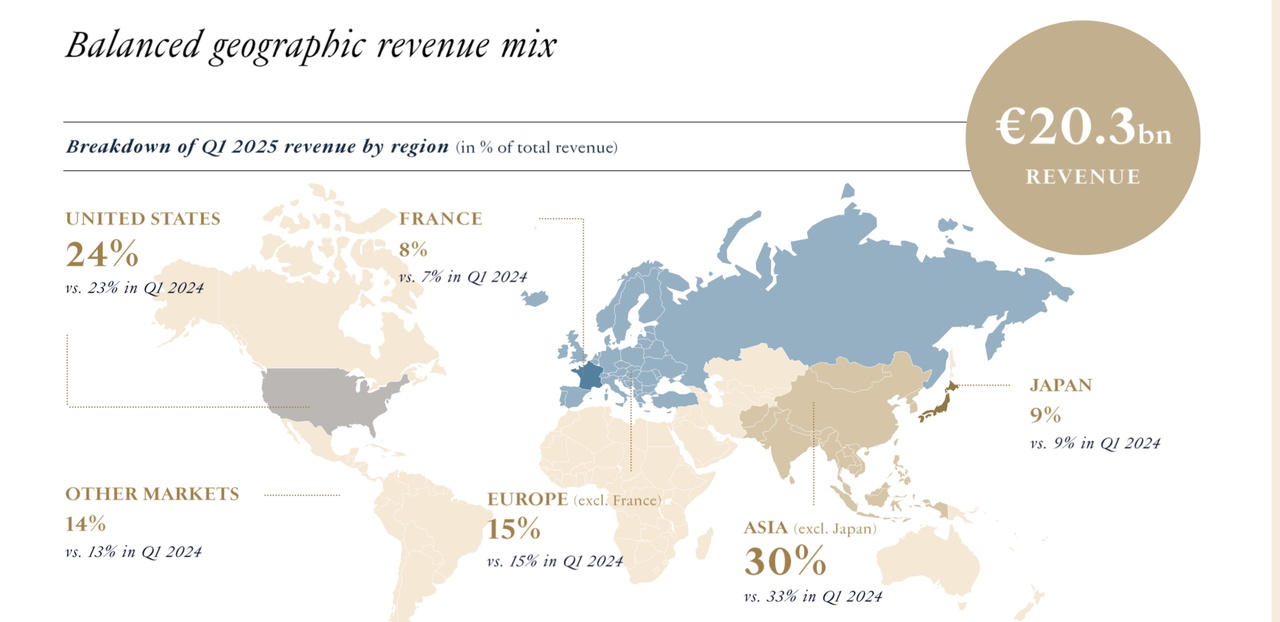

Regional performance: [1, p. 17-18]

- Japan: The strongest market with +28% organic sales growth, supported by a weak local currency and robust local demand.

- Europe and USA: Stable development of +2% and +3% organic sales growth respectively, despite uncertain consumer sentiment.

- Asia (excluding Japan): Decline of -10% organic, mainly due to weaker demand in China.

Main factors for profit decline explained: (Transcript Earnings Call, CFO: Jean-Jacques Guiony)

LVMH reports a 17% drop in profits to 12.5 billion euros compared to the record previous year. This is mainly due to several factors:

1 . Increase in costs:

- Operating costs increased by 2 %, which was higher than organic sales growth and led to a reduced operating margin.

2 . Currency and price fluctuations:

- Currency movements, mainly due to the US dollar and the absence of price increases contributed to the decline in gross margin, which fell by 180 basis points (-1.80%)

3 . losses in certain areas:

- Wine & Spirits: a decline of -36% due to lower volumes, prices and mix ratios, although costs were reduced.

- Duty Free Shoppers (DFS): Heavy losses, mainly due to weak Chinese tourism in Hong Kong and Macau.

- Non-recurring charges: Losses due to restructuring in Duty Free Shops (DFS), the withdrawal from brands such as Stella McCartney and Off-White, as well as expenses for irregular events, e.g. the Olympic Games and employee share plans.

4 . Higher expenses:

- Administrative expenses increased by 9% and investment in new stores and marketing costs were maintained or increased slightly (+1%), further impacting profit.

- Labor costs increased, but could not be offset by price increases (or should not be offset by price increases, according to the call).

- In addition, costs increased due to store openings already planned in 2021-2023, which increased the cost base.

Additional management decision:

- LVMH faced a difficult decision: to cut costs more drastically, but this would have sent the message that a "crisis" is structural in nature, i.e. longer-term and profound. This would have meant the company adopting a very cautious approach to spending and investment in order to prepare for a prolonged crisis.

- Instead, the management emphasizes that the "crisis" is only temporary and that it is important to remain flexible in order to adapt to changing circumstances. They did not want to take too drastic measures that could damage the company in the long term, especially in areas such as marketing and budget planning. These should not be cut too severely in order not to jeopardize future growth potential and competitiveness.

- Despite the decline in profits, LVMH was able to increase its cash flow by 3.4 billion euros, which led to a reduction in debt.

- In addition, a stable dividend of 13 euros per share was proposed in order to offer shareholders a constant return in difficult times.

Summarized so far: LVMH's profit decline resulted from an imbalance between cost increases and sales growth, as well as specific challenges in some business units.

👜 Products & segments: Highlights 2024

1 . Fashion & leather goods

- Sales reached EUR 41.1 billion (-3% published, -1% organic). Louis Vuitton shone with innovative collections, including Pharrell Williams' "The World is Yours" designs. Christian Dior combined tradition and modernity with its spring/summer 2025 collections, inspired by Amazons and Scottish history. A collaboration with artist Takashi Murakami and the opening of a flagship store on the Champs-Élysées are planned for 2025. (2, S. 11-12)

- Further store expansions in addition to the new flagship store on the Champs-Élysées are planned to further strengthen the global presence in Tokyo and Milan.

2 . Perfumes & Cosmetics

- In the Perfumes & Cosmetics segment, sales rose to EUR 8.4 billion (+2% published, +4% organic). Dior Sauvage continued to assert itself as the world's leading men's fragrance, supported by the launch of "Sauvage Eau Forte". Guerlain expanded its successful "Aqua Allegoria" range and focused on sustainable production, including regenerative agriculture for the flowers used in the fragrances. (2, S. 13-14)

3 . Wines & Spirits

- Sales in the Wines & Spirits segment fell to EUR 5.9 billion (-11% published, -8% organic), as weaker demand in China and the USA weighed on the business. Nevertheless, Moët Hennessy impressed with new products such as Dom Pérignon Vintage 2015 and other prestige cuvées. For 2025, LVMH plans to further expand the customer experience, including through innovative marketing initiatives such as the collaboration with Formula 1. (2, p. 10)

4 . Watches & Jewelry

- In the Watches & Jewelry division, LVMH generated sales of EUR 10.6 billion (-3% published, -2% organic). Tiffany & Co. opened its renovated "Landmark" flagship store in New York, while Bulgari set new standards with its "Aeterna" collection and the world's thinnest watch design. (S. 14-15)

5 . Selective Retailing (Sephora & DFS)

- In the Selective Retailing division, sales rose to EUR 18.3 billion (+2 % published, +6 % organic). Sephora recorded double-digit growth in North America and Europe and relied on innovative technologies such as AI tools to improve the customer experience. (2, S. 15-16)

🌎 Sustainability in case anyone is itching:

- Reduction of CO₂ emissions by 55% compared to 2019 (target for 2026 already exceeded).

- Biodiversity projects will be expanded to five million hectares by 2030 (2024: 3.8 million hectares)

- Focus on circular design: by the end of 2024, 31% of materials were already sourced from recycled sources (2, S. 4)

💰 Financial strength and key figures

Cash and debt

- Cash position: EUR 9.6 billion (+24% compared to 2023).

- Free cash flow: EUR 10.5 billion (+29% compared to 2023)

- Net financial debt: decrease to EUR 9.2 billion (-14% compared to 2023), resulting in a debt ratio of 13.3

- Available credit lines: EUR 10.8 billion, sufficient to cover current liabilities

Inventories

- The total value of inventories rose to EUR 23.7 billion, an increase of 3.1 %. This is primarily due to strategic stockpiling in the fashion and perfume sectors.

📈 Classification in the stock market environment

LVMH shares have been under pressure in recent months, despite strong fundamentals:

- Macroeconomic uncertainties: Interest rate hikes and a weaker buying mood for luxury goods are weighing on the sector.

- Declining figures in Asia: Weak sales in China are dampening market sentiment.

- Competitive pressure: Competitors such as Hermès $RMS (-0,54 %) are reporting stronger growth, which is increasing the pressure on LVMH.

LVMH has reported a 17% drop in profits, not a good sign at first glance. But when you look at the details, it becomes clear:

The problems are largely temporary.

- Macro factors: Currency movements (strong USD), higher costs and weaker demand in some segments, notably Wine & Spirits (-36%) and DFS (Travel Retail).

- No structural problem: Management has deliberately cut non-aggressive costs in order not to jeopardize long-term growth potential (e.g. marketing & expansion).

- Operating margin under pressure: Costs increased by 2%, while sales declined slightly (Published, organic +1 %)which led to a decline in the margin.

⚡ Why I remain optimistic in the long term:

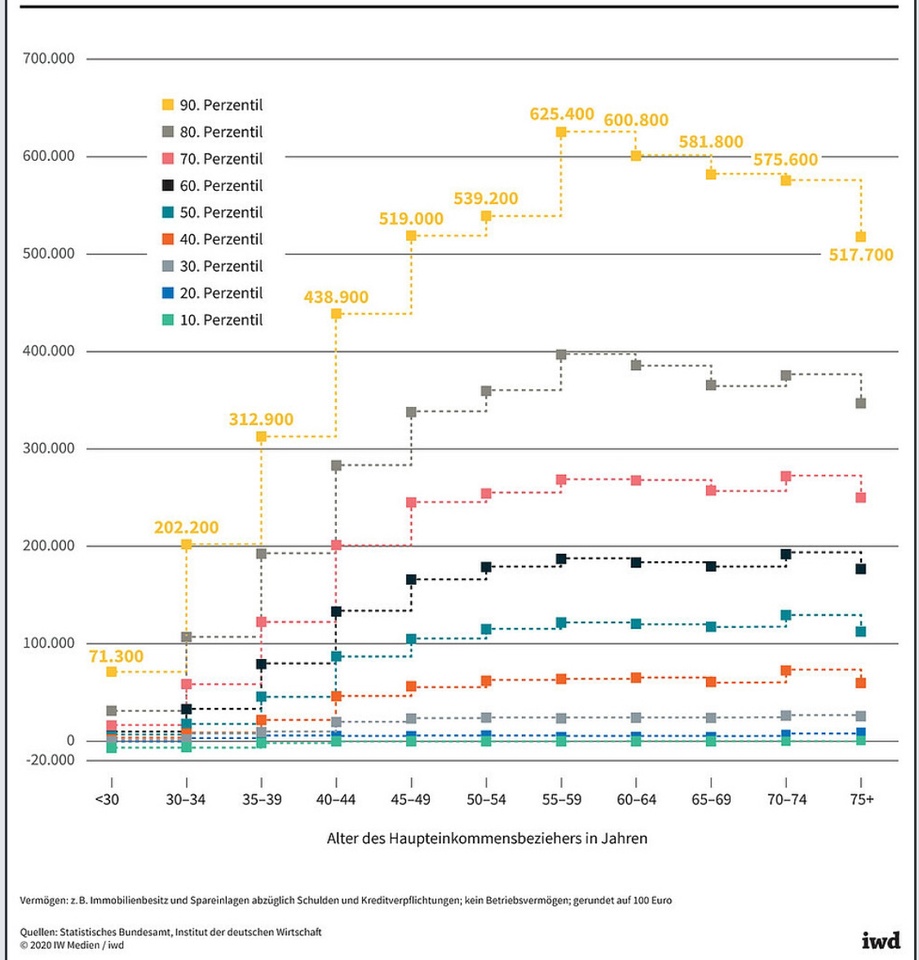

- Strong brands & pricing power: LVMH owns premium brands with high pricing power, once demand recovers, the company can expand margins again.

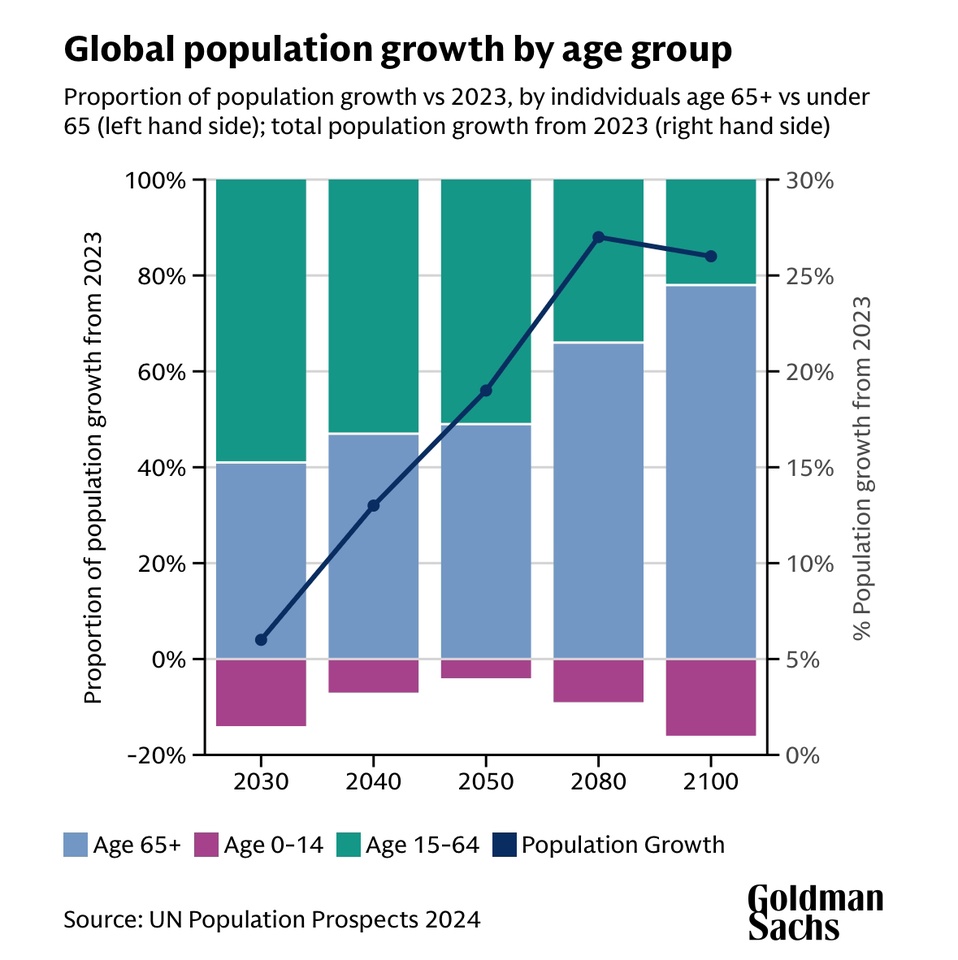

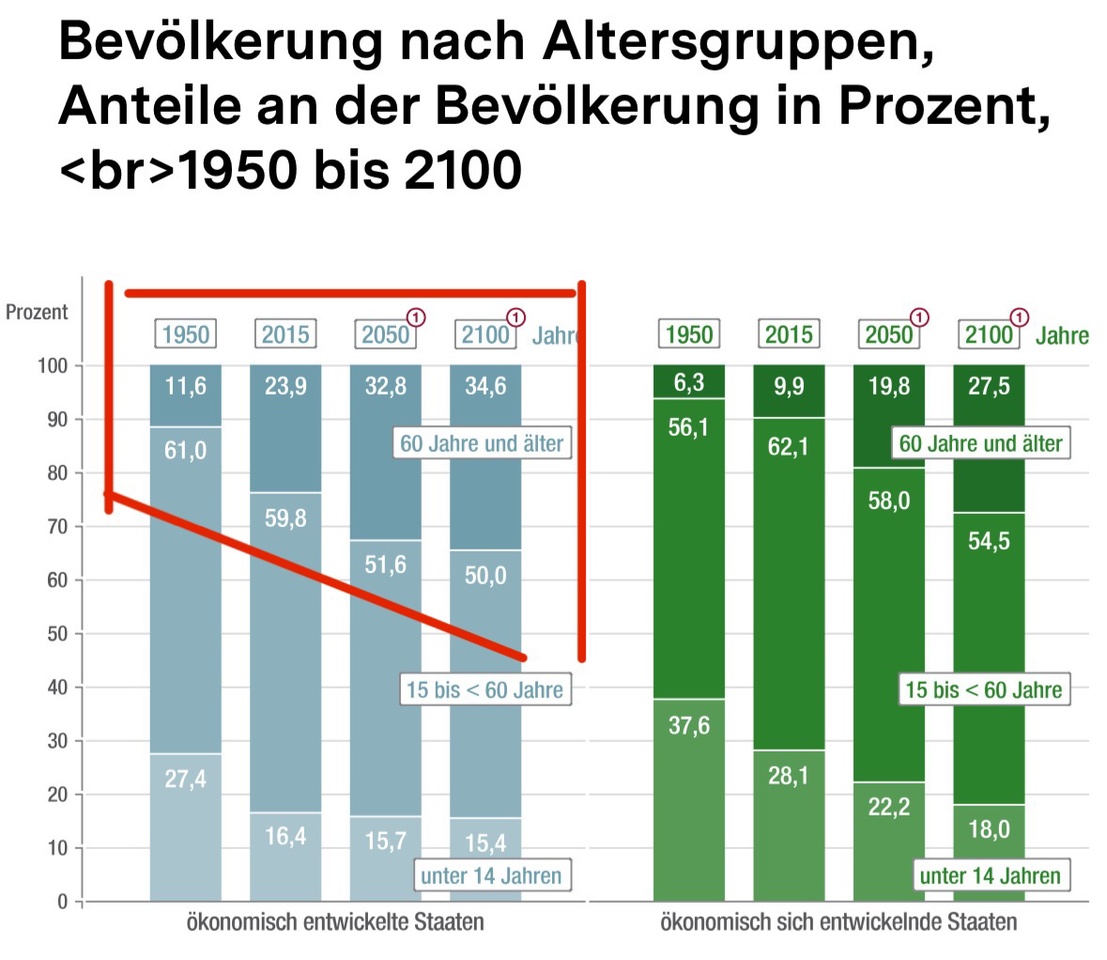

- China recovery as a catalyst: Weak Chinese tourism is weighing on business, but consumer behavior should normalize in the medium term.

- Global demand shift: Luxury is not dependent on "one" country; if one region weakens (e.g. due to US tariffs on European luxury goods), LVMH can expand sales in other markets (e.g. in the Middle East, South East Asia or Europe). In addition, different production locations and logistics strategies can be used to circumvent trade barriers.

- Solid financial position: Despite the decline in profits, cash flow remains strong (€10.5 billion), debt has been reduced and the dividend remains stable at €13.

📉 It may remain bumpy in the short term, but LVMH is a quality company with a strong capacity for innovation, which will remain in demand even in difficult times. I am looking forward to the future plans of the industry leader, which remains on course for success with a strongly growing brand presence. For long-term investors, the "price slide" could therefore be more of an opportunity than a risk. (Of course, my personal opinion does not constitute investment advice or a recommendation to buy or sell. 🙂)

Finally, Bernard Arnault was also optimistic about the future:

"LVMH will continue to focus on creativity, excellence and agility to extend its leadership in the luxury market. Despite global uncertainties, the Group sees further potential for sustainable growth and long-term success."

🎉 Thanks for reading! From here on there are attachments, examples & original slides

_______________

*Exchange rate fluctuations explained (example)

When a company like LVMH sells products in the USA, sales are generated in US dollars (USD). However, since LVMH publishes its financial report in euros (EUR), these sales must be converted into euros.

What happens if the US dollar depreciates against the euro?

1 . Before the devaluation: 1 USD = 0.95 EUR

- A turnover of USD 100 million would correspond to EUR 95 million.

2 . After the devaluation: 1 USD = 0.90 EUR

- The same turnover of USD 100 million now corresponds to EUR 90 million.

➡️ Although LVMH sold exactly the same amount in the USA, sales in euros appear lower.

At the beginning of 2024: 1 USD = 0.9060 EUR.

Low on August 23: 1 USD = 0.8927 EUR.

Increase until December 31: 1 USD = 0.9662 EUR.

_______________

Sources:

[1] LVMH: "Presentation" to " 2024 Annual Results"

https://lvmh-com.cdn.prismic.io/lvmh-com/Z5j825bqstJ998qD_LVMH-2024FullYearresults.pdf

[2] LVMH: "Financial Domcuments"

https://lvmh-com.cdn.prismic.io/lvmh-com/Z5kVBpbqstJ999KR_Financialdocuments-December31%2C2024.pdf

[3] Expected results 2024

https://stock3.com/news/lvmh-aktie-nach-zahlen-deutlich-unter-druck-2-16085679

If you've made it this far, you can still see the original slides from the presentation of my favorite products, or rather those of my wife 😵💫.

$CFR (-0,08 %)

$BRBY (-0,02 %)

$KER (-1,4 %)