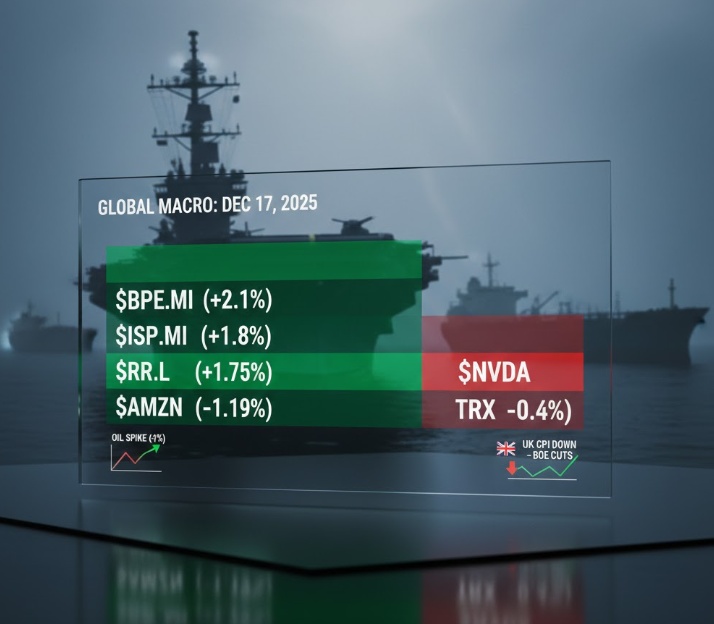

The mid-week session is defined by an aggressive shift from overextended Tech into Financials and Aerospace.

🌍 THE MACRO SHOCK: TRUMP’S VENEZUELA BLOCKADE

The biggest geopolitical mover today is the U.S. naval blockade of sanctioned oil tankers into Venezuela.

The Impact: Crude prices spiked >1% instantly. This is providing a massive tailwind for energy and commodity-linked sectors.

The Shift: This "geopolitical premium" is forcing capital into hard assets. Silver just hit a record high above $66, with Gold following. 🛢️🔥🥈

🇪🇺 EUROPE: INFLATION COLLAPSE & CENTRAL BANK FEVER

EU indices are ripping because UK CPI fell sharper than expected this morning (3.2% vs 3.4% exp).

The Reaction: A shockwave through the bond market. Traders are now pricing in a near-certain Bank of England (BoE) rate cut tomorrow.

The "Trifecta": We are in a "relief rally" ahead of tomorrow’s massive data dump: ECB, BoE, and U.S. CPI. Markets are front-running a Dovish pivot from Lagarde. 🏦📉

🏦 THE ITALIAN BANKING RALLY

$$BPE (-0,13 %) (+2.1%) | $ISP (-1,54 %) (+1.8%) | $UCG (-2,5 %) (+1.7%)

The Driver: Resilience in Net Interest Margins (NIM) as the ECB easing cycle appears slower than feared.

The Catalyst: Massive shareholder distribution. $UCG (-2,5 %) and $ISP (-1,54 %) are acting as "cash machines," using buybacks to floor the price against any macro noise.

⚙️ AEROSPACE & DEFENSE MOMENTUM

$$RR. (+0,07 %) (+1.75%) | $LDO (+1,54 %) (+1.4%) | $RKLB (+2,37 %) (+1.3%)

The Driver: Rolls-Royce ($RR.L) just initiated a new £200M interim buyback starting Jan 2, immediately following their £1B 2025 program.

Context: Institutional accumulation in Defense is at peak levels as a structural hedge against 2026 geopolitical uncertainty.

📦 RETAIL & CLOUD RESILIENCE

$AMZN (-0,03 %) (+1.19%)

The Driver: Wall Street is digesting the delayed Non-Farm Payrolls (64k added, but unemployment at 2021 highs).

The Sentiment: "Bad news is good news." A weakening labor market gives the Fed more ammo to cut. $AMZN (-0,03 %) is catching the bid as BMO Capital hikes PT to $304, citing AWS cloud acceleration. 📊💼

⚠️ SECTOR ROTATION: THE "AI BUBBLE" PAUSE

$NVDA (-0,1 %) (-0.25%) | $BTC (+0,66 %) (~$86.7k) | $TRX (+0,03 %) (-0.4%)

The Analysis: Pure profit-taking. Capital is bleeding out of high-beta Tech and Crypto to fund the rally in "Value" equities (Banks/Industrials).

The Risk: If $NVDA (-0,1 %) loses its 20-day EMA at the US open, expect a broader drag on the Nasdaq. 🏛️➡️💻