Hi there!

First off, I want to introduce myself. I'm a 24-year-old who's spent about two years diving into the world of investing. Though I’m just starting, I’d love to share a bit of my journey with you all.

My Beginnings

I’ve always had a unique approach to life and investments, which often feels different from most people I know. I started working young, driven by a goal to save €10,000. For someone living in Portugal, where building wealth takes time, this felt like a mountain to climb.

Unfortunately, at 18, I fell victim to a scam and lost €5,000 in my first year of trying to invest. It was a harsh lesson. My family thought I was naive for believing I could become wealthy quickly through trading. They’d never ventured into investments, so I was forging a path on my own.

Hitting Rock Bottom

After the scam, I swore off markets altogether. I moved to Spain to try earning more, but the isolation and inability to grow my savings left me depressed. It was during this tough time that my boss introduced me to Bitcoin.

He told me: “Diogo, buy Bitcoin. This could change your life. Don’t spend on cars or houses—invest in this!” At first, I thought he was crazy. Bitcoin was volatile, and I couldn’t imagine risking so much. But his passion stayed with me, and I began paying attention to the market.

Turning Things Around

In 2022, I returned to Portugal, reuniting with family, friends, and a sense of purpose. I found a stable job—not well-paying, but it gave me a foundation to rebuild. Slowly, I started meeting people active in the markets, shifting my mindset, and planning my future more thoughtfully.

I set a goal to save €10,000 again, this time with a clear strategy. By saving at least €200 a month and focusing on long-term growth (like investing in the S&P 500), I envisioned reaching €1 million by the time I turn 40.

Lessons and Progress

By the end of 2023, I came close to my goal, saving €9,500. My biggest win was investing in NVIDIA ($NVDA (+3.71%) ), which gave me a 55% return in less than a year!

In 2024, I made another significant investment—this time in myself. I used some savings to fix my teeth, boosting my confidence. Despite that expense, I managed to grow my investments to €23,000 by year's end.

My Current Strategy

This year, I’m focusing on stocks and crypto that are undervalued but have strong potential for growth. My portfolio includes:

$VOW3 (-3.76%)

$PAH3 (-2.84%)

$NESN (-1.16%)

$VALE (+0%)

$BAYN (-3.37%)

$MAN

$JMT (+0.27%)

$BTI (+0.19%)

$CABO (+6.15%)

$GMAB (+1.85%)

$MAERSK A (+7.75%)

$TMV (-1.95%)

$BMRN (-0.47%)

$EGL

$ABEV (-1.5%)

Cripto:

$ETH (+7.33%)

$DOT (+0.7%)

$FET (+3.23%)

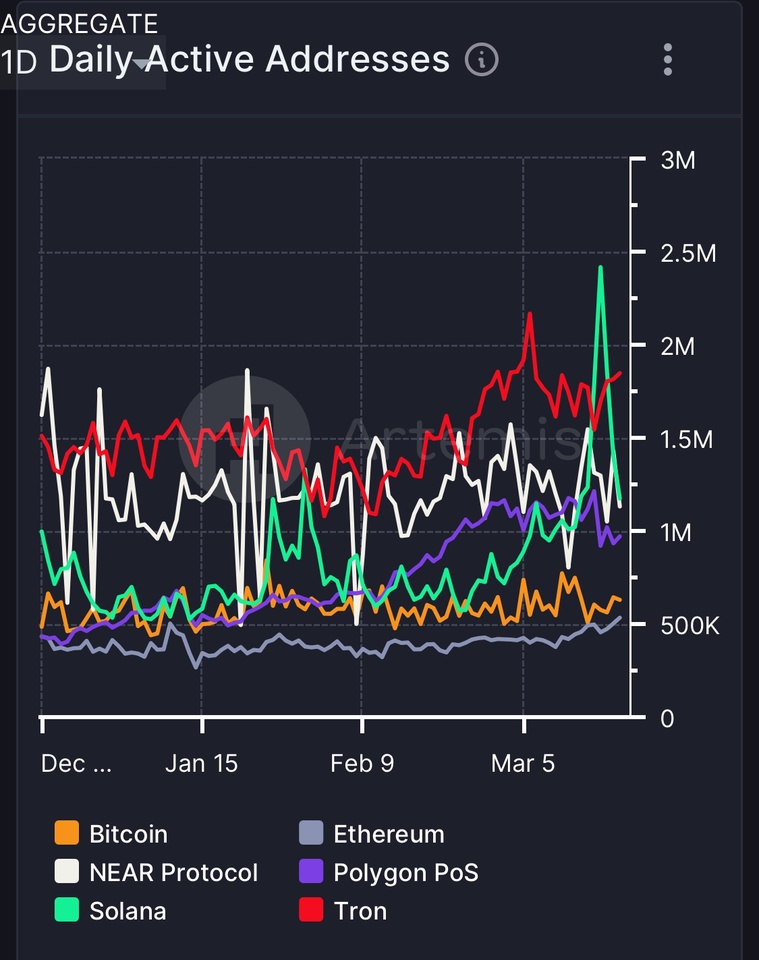

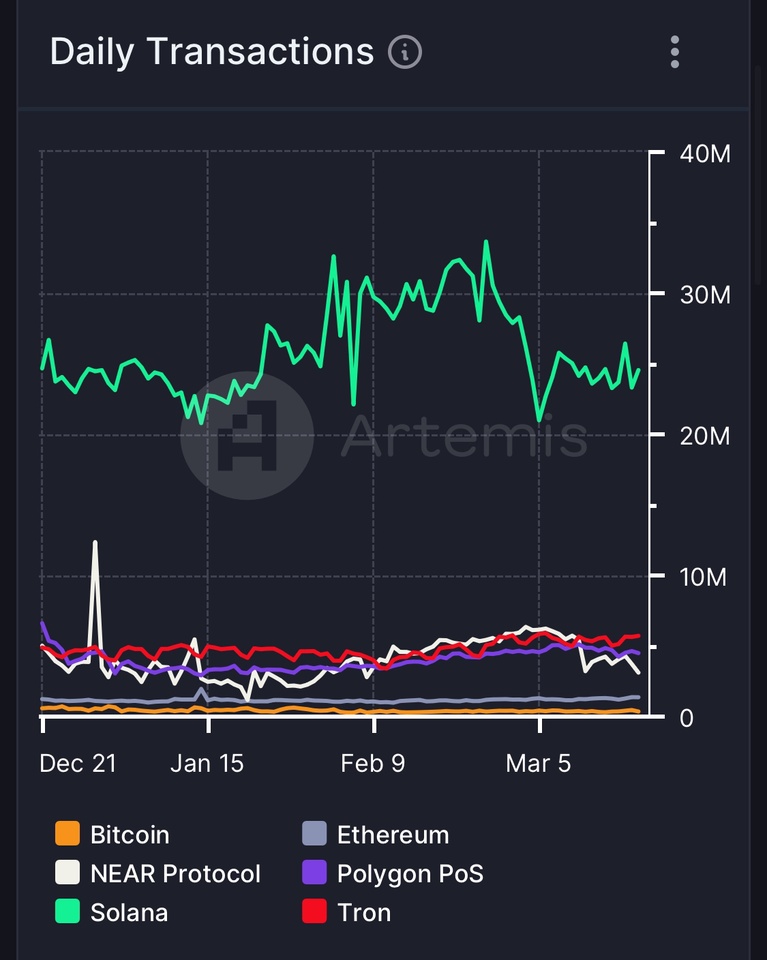

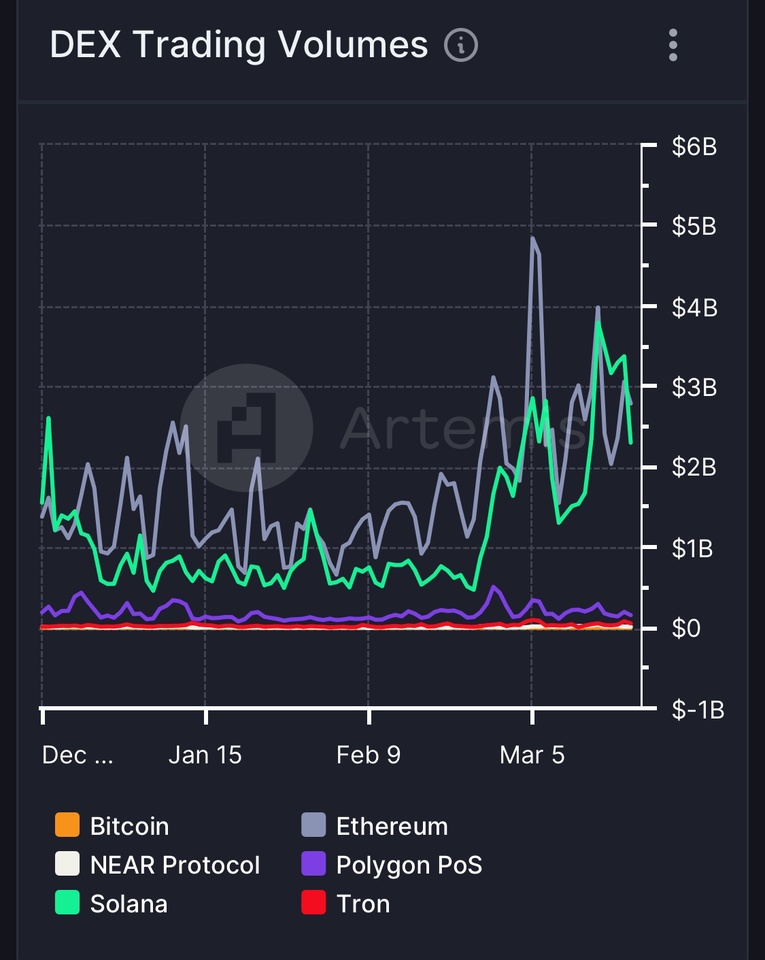

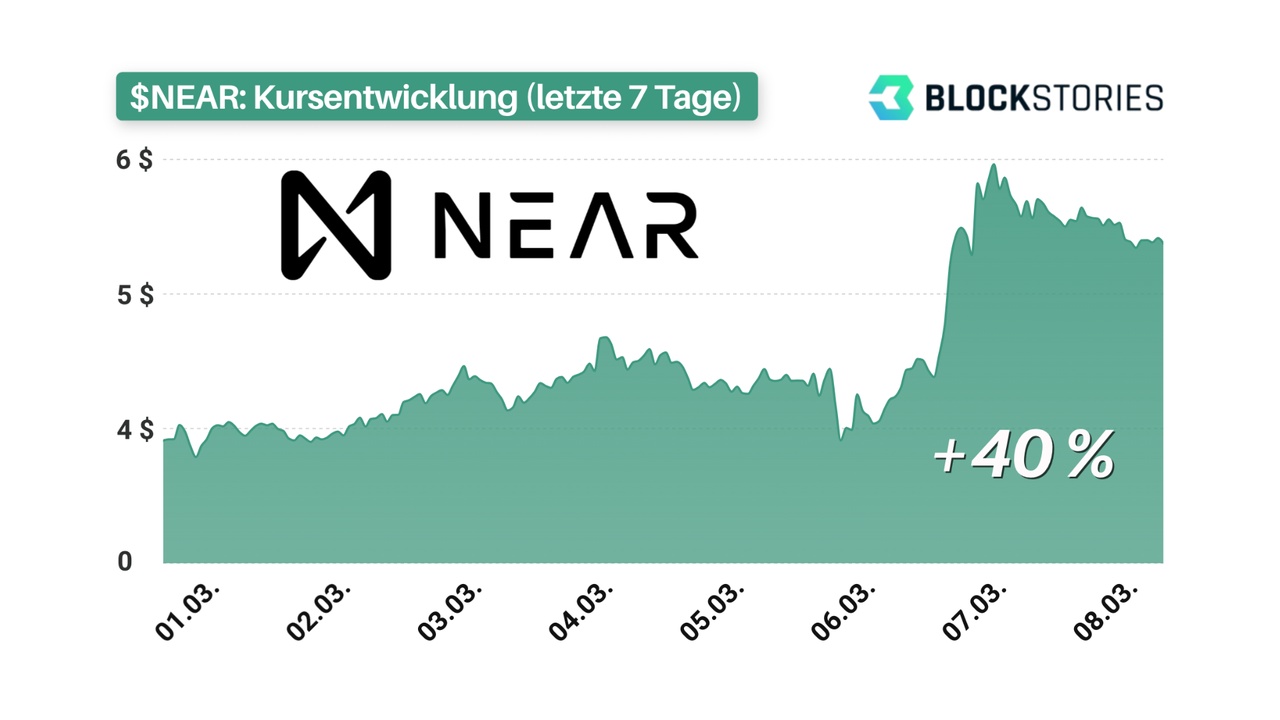

$NEAR (+22.84%)

$TIA.N (+11.18%)

$APTOS

Final Thoughts

My goal is to end this year with €40,000 invested, to be able to get half of it into the real state,It’s ambitious, but I’ve learned that persistence and patience can yield great rewards.

I’ll keep you all updated on my journey. Best of luck to everyone on yours!

Diogo Cordas