Credo Technology

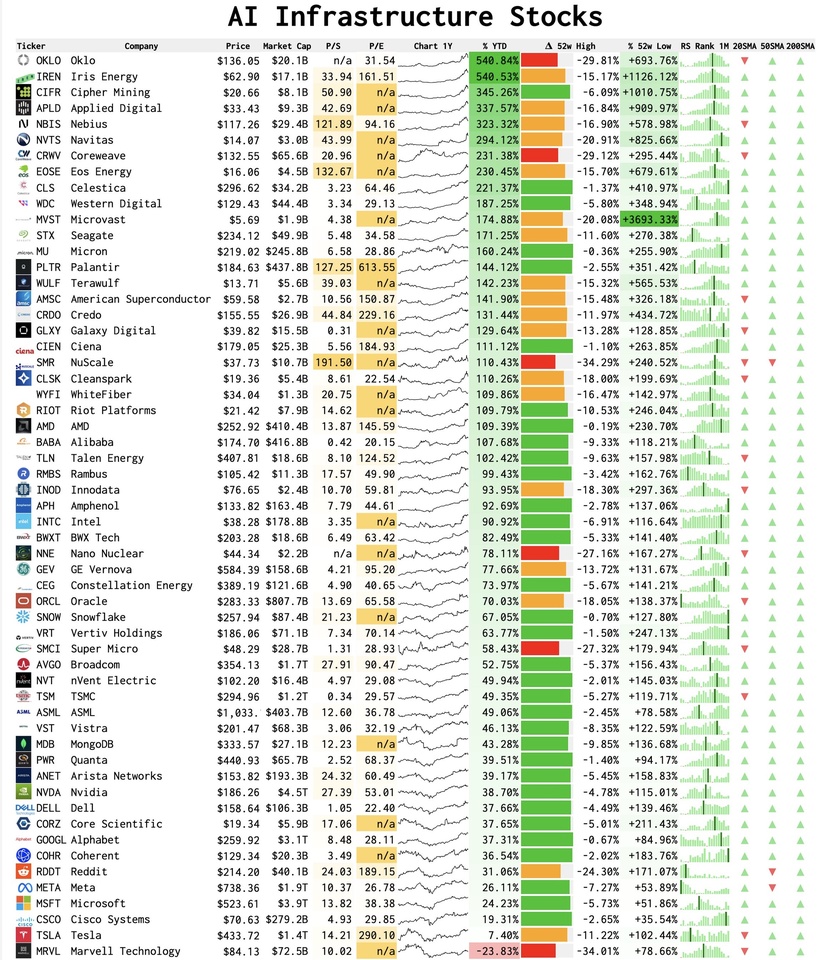

$CRDO was still an insider tip in 2024 with a valuation of around 2 billion $. Today, at the beginning of 2026, the company is valued at over 27 billion $ valued. 🚀

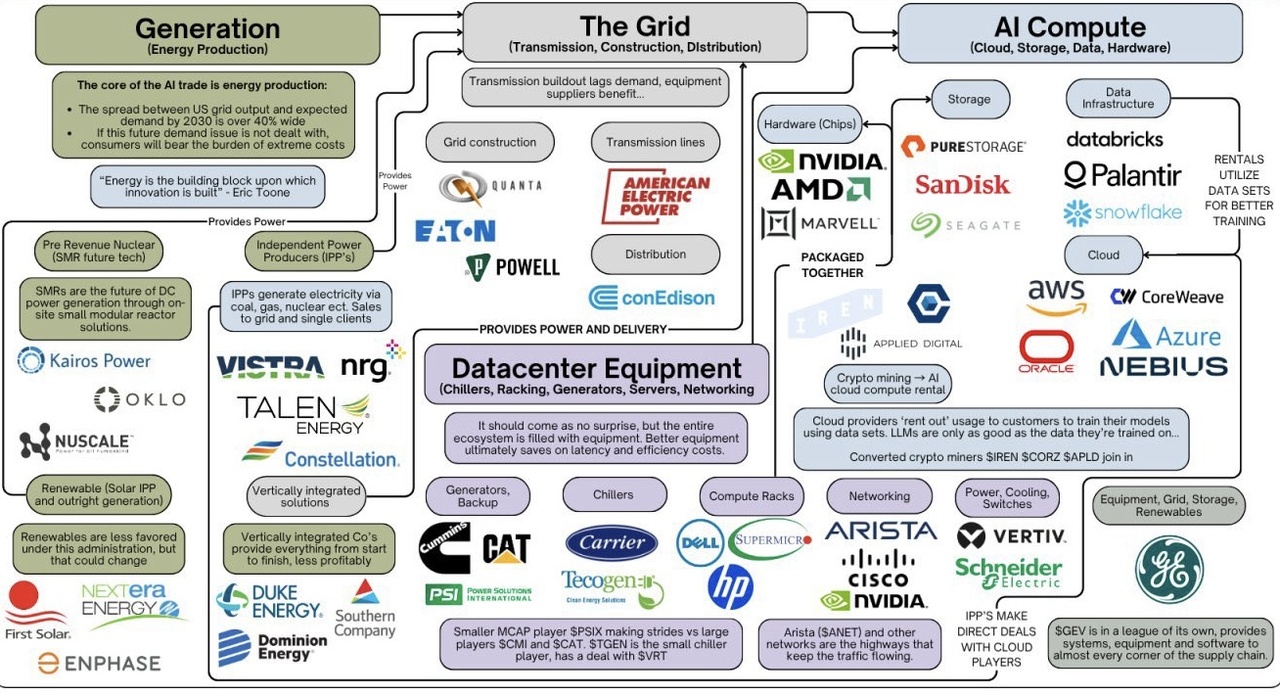

This is because Credo is positioned in exactly the area that is currently most in demand: the infrastructure for AI data centers.

Even without the constant takeover fantasy (rumors about giants such as Broadcom or Marvell persist), I consider Credo to be an extremely exciting growth stock.

Why Credo is so exciting right now:

Credo presents at the Needham Growth Conference On Wednesday, January 14, 2026 at 3:30 pmCEO Bill Brennan will take the stage in New York.

An update on the 1.6T AEC (Active Electrical Cable).

Explosive growth & "Top Pick 2026" Needham has just added Credo to its "Conviction List" and as a Top Pick for 2026 named.

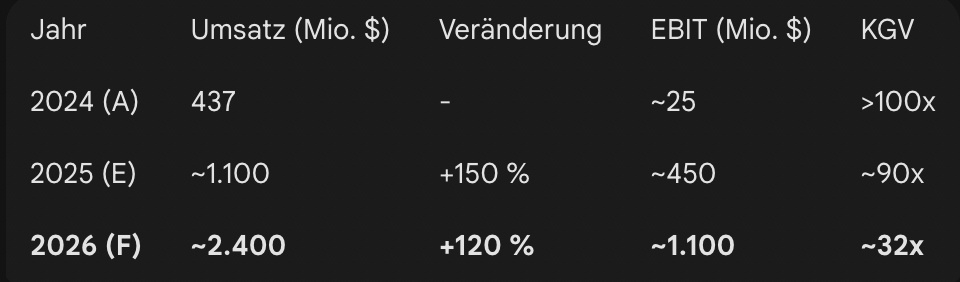

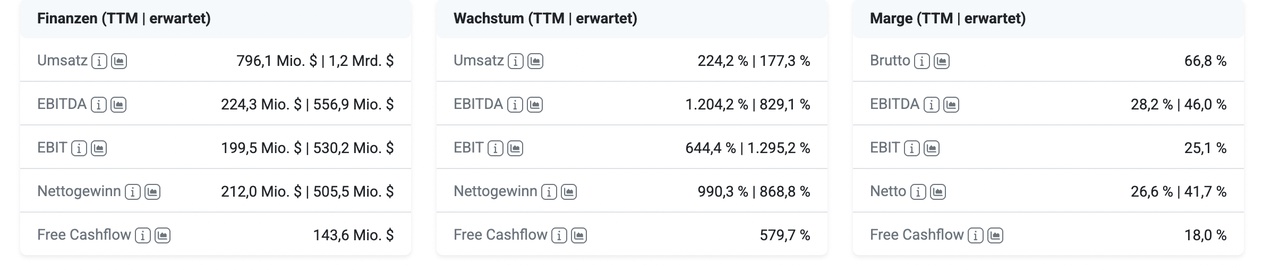

The price target was set at 220 $ (currently approx. 151 $). The figures speak for themselves:

- Jump in sales: In the last quarter, sales grew by 272 % compared to the previous year to 268 million dollars.

- Margin monster: The gross margin is a strong 67,7 %.

- Fantasy: For the 2026 financial year, analysts expect sales growth of over 170 %.

The "shield" against volatility Credo is not just a chip manufacturer, but supplies the "cables and connectors" (AECs) without which Nvidia GPUs could not communicate with each other in the data centers. This makes them less dependent on individual chip cycles and more dependent on the general expansion of the AI infrastructure.

Credo is expensively valued, but is growing into this valuation just fast enough that the PEG ratio (price-earnings-growth ratio) for 2026 is just 0.8 anything below 1.0 is considered a bargain for growth stocks by professionals.