$SZG (-0,55%) has been doing absolutely fantastic in my portfolio for a year now. Today the quarterly figures came out, which were rather subdued and continued to point to the difficult economic situation. I took this as an opportunity to take out part of the stake, around 3/4, and let the rest, including the previous profits, continue to run. Of course, I may fall into the trap of selling the positions that are performing well and churning it into the loss-makers, but in this case I don't trust the rapid rise in share prices one hundred percent. Yes, defense, infrastructure and hopefully soon the reconstruction of Ukraine should remain price drivers, but I don't know whether this justifies an annual performance of 180%.

Salzgitter A

Price

Discussão sobre SZG

Postos

16Another annual performance

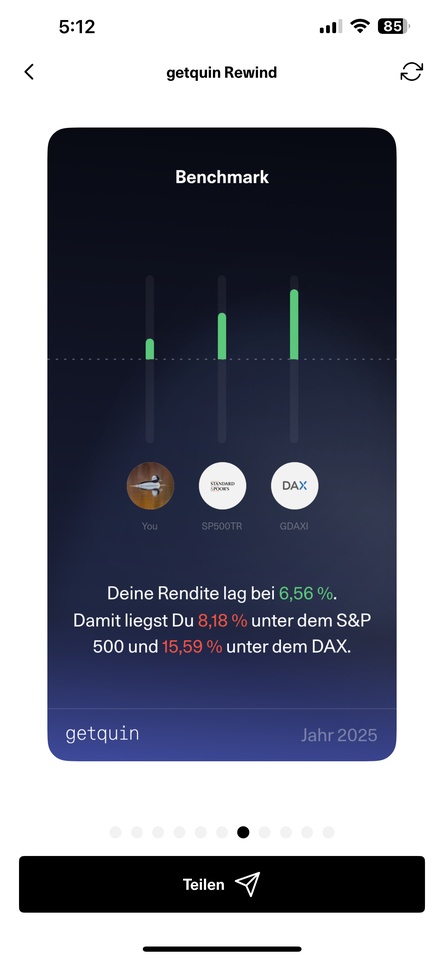

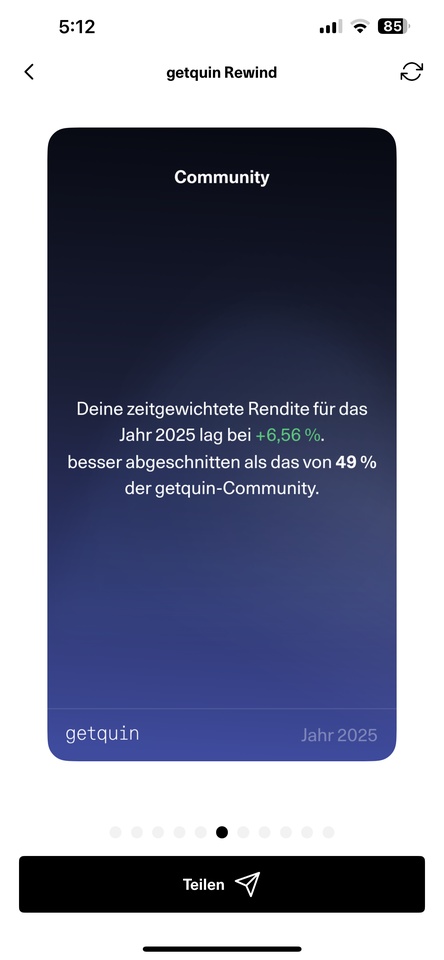

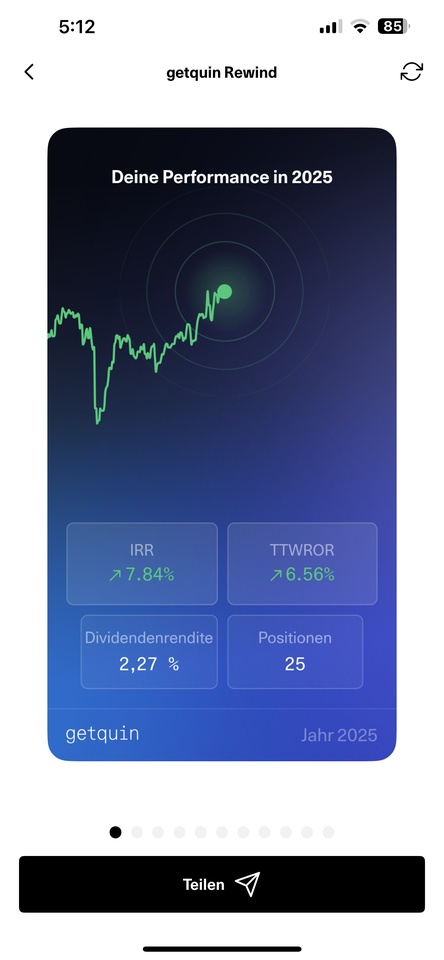

Since it's obviously a trend, I'll join in 😁 Not great in terms of performance, but I don't have to bury myself in shame either. $GOOG (+3,65%) and $SZG (-0,55%) were top performers this year, $WEN (-3,11%) , $AMP (+0,44%) and $CLX (+0,97%) then spoiled my balance sheet again. But all in all, I still achieved what I wanted. If I had to give myself a school grade, it would probably be a 3+, which you forget in 2 weeks 😁.

Quartalszahlen 11.08-15.08.2025

$SZG (-0,55%)

$HYQ (-1,06%)

$ABX (-1,19%)

$BBAI (-6,76%)

$PLUG (-3,07%)

$GPRO (+0%)

$TEG (-1,04%)

$1SXP (+0%)

$SE (+0,41%)

$ETOR (+1,14%)

$NCH2 (-0,32%)

$TUI1 (-1,14%)

$VWS (+0,21%)

$R3NK (-0,34%)

$EOAN (-0,64%)

$CSCO (+1,04%)

$SLI (+1,93%)

$HFG (-1,37%)

$HTG (-0,69%)

$HLAG (+0,9%)

$TKA (+5,16%)

$DOU (+2,68%)

$RWE (+0,8%)

$BIRK (+0,75%)

$9618 (+0,35%)

$DE (+0,58%)

$FR (+11,01%)

$NU (+1,09%)

💥 Trump doubles steel tariffs to 50% - Germany and EU affected! 🇺🇸🔩

It doesn't stop...

Donald Trump has announced that he will increase import tariffs on steel and aluminum from 25% to 50%. This measure will come into force on June 4, 2025 and will also affect imports from Germany and the EU.

🔍 Background:

- Trump justified the tariff increase with the protection of national security and the strengthening of the US steel industry.

- In a speech at US Steel in Pennsylvania, he emphasized that tariffs are his "absolute favorite word".

- The measure affects imports from countries such as Canada, Brazil, Mexico, South Korea and Germany.

📈 Effects:

- Importing steel products into the US is likely to become more difficult with the doubling of tariffs.

- Prices for steel in the USA could rise in the medium term, which could have an impact on the construction and automotive sectors.

- Germany, the leading steel producer within the EU, exported around one million tons of steel to the US in 2023.

🌍 International reactions:

- Canada's Chamber of Commerce criticized the tariff increase as costly for both countries.

- Australia described the move as "unjustified and not the act of a friend".

Proposal for his tombstone:

🪦 Here rests Donald J. Trump

"Tariffs were my favorite word - now I'm paying the last tax." 💸🇺🇸

$TKA (+5,16%)

$SZG (-0,55%)

$MT (+0,91%)

$OUT1V (+0%)

$SSAB A (+0,29%)

16.04.2025

Nvidia: New hurdles for exports to China cost billions + Sartorius starts the year with growth + Salzgitter slumps

Nvidia $NVDA (+1%): New hurdles for exports to China cost billions

- With stricter restrictions on the supply of AI chips to China, the US government is causing semiconductor giant Nvidia losses running into billions.

- According to Nvidia, the company will record a charge of 5.5 billion dollars in connection with inventories and purchase commitments.

- Even under the previous president Joe Biden, the USA created hurdles for the sale of the most modern high-performance chips to China.

- As a result, Nvidia was only able to supply Chinese companies with a slimmed-down and slower version called H20.

- However, even these chip systems are now subject to export restrictions due to the trade policy of Biden's successor Donald Trump, as Nvidia announced.

- The company's chips have become key technology for the booming artificial intelligence business.

- Chinese AI developers cannot ignore them either.

- There has been speculation for some time about a tightening of export restrictions.

- As a result, Chinese companies such as Tiktok owner Bytedance, Alibaba and Tencent ordered H20 chips worth at least 16 billion dollars from Nvidia in the first three months of this year alone, the website "The Information" recently reported.

- This exceeded Nvidia's previous production capacity for this version, according to reports citing informed persons.

Sartorius $SRT (+0,78%)starts the year with growth

- The laboratory and pharmaceutical supplier Sartorius has increased sales and profits in the first quarter.

- The company was therefore confident about the current year and provided a concrete outlook.

- The DAX-listed company announced in Göttingen on Wednesday that sales revenue is set to increase by around 6 percent in 2025.

- The larger Bioprocess division in particular is expected to contribute to this growth.

- Around 29 to 30 percent (previous year: 28.0 percent) of turnover is expected to remain in the Group as adjusted earnings before interest, taxes, depreciation and amortization (EBITDA).

- Possible effects from customs duties are not included in the margin forecast.

- In the first quarter, turnover increased by almost 8% year-on-year to 883 million euros.

- Adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) increased by around 12 percent to 263 million euros.

- The corresponding margin improved from 28.6 percent in the previous year to 29.8 percent.

- The results were therefore better than analysts had expected on average.

- Adjusted net profit rose by a good fifth to just under 85 million euros.

Salzgitter $SZG (-0,55%)plummets - downgrade after takeover called off

- Salzgitter's canceled takeover by a consortium has increased the pressure on the steel manufacturer's shares.

- After the shares had already fallen by 0.8 percent at the beginning of the week, they were down 7.1 percent to just over 22 euros on Tuesday.

- A skeptical analyst commentary by the investment bank Oddo BHF proved to be a burden.

- Salzgitter shares were thus by far the weakest stock in the SDax .

- The second-line index gained a good 1 percent.

- Salzgitter announced on Friday evening that it had ended talks with the bidding companies GP Günter Papenburg and TSR Recycling.

- The steel manufacturer cited "significantly different ideas about the current and future value of the company" as the reason.

- According to earlier information, the consortium had submitted a non-binding offer of around EUR 18.50 per share.

- Analyst Krishan Agarwal from the US bank Citigroup wrote that the offer price was probably a key factor in the break-off.

- There had been greater agreement between the parties regarding the future strategic direction of the steel group.

- Analysts at Oddo downgraded Salzgitter shares to "underperform".

- In this respect, the experts expect the shares to underperform the corresponding benchmark index over the next twelve months.

- Without the takeover hopes, the Salzgitter shares are valued too high, Oddo said.

- This applies even if possible proceeds from the sale of non-core activities are taken into account.

- The slide in the share price on Tuesday further clouded the chart picture.

- The shares slipped below the 50-day average line, which describes the medium-term trend.

- Since the beginning of the year, however, the share price has still risen by almost 40 percent.

Wednesday: Stock market dates, economic data, quarterly figures

Stock exchange trading in Norway shortened

- ex-dividend of individual stocks

- Austrian Post EUR 1.83

- Quarterly figures / company dates USA / Asia

- 13:00 Travelers Cos quarterly figures

- 13:30 Abbott Laboratories quarterly figures

- 16:00 United Airlines quarterly figures

- 22:10 Alcoa quarterly figures

- 22:30 BHP Group Ltd Operation Report 9 months

- Quarterly figures / Company dates Europe

- 00:30 Rio Tinto Q1 sales

- 07:00 Sartorius quarterly figures | Hella Q1 sales

- 07:00 ABN Amro Pre close Announcement 1Q

- 08:00 Heineken Trading Update 1Q

- 09:00 Sartorius PK

- 13:00 Sartorius Analyst Conference

- 14:30 Nestle AGM

- Economic data

08:00 UK: Consumer prices March Forecast: +0.5% yoy/+2.7% yoy Previous: +0.4% yoy/+2.8% yoy Core Forecast: +0.5% yoy/+3.4% yoy Previous: +0.4% yoy/+3.5% yoy

11:00 EU: Consumer Prices March Eurozone PROGNOSE: +0.6% yoy/+2.2% yoy PREVIEW: +0.6% yoy/+2.2% yoy PREVIEW: +0.4% yoy/+2.3% yoy CORE RATE PROGNOSE: +1.0% yoy/+2.4% yoy PREVIEW: +1.0% yoy/+2.4% yoy PREVIEW: +0.5% yoy/+2.6% yoy

14:30 US: Retail Sales March FORECAST: +1.2% yoy previous: +0.2% yoy Retail Sales ex Motor Vehicles FORECAST: +0.3% yoy previous: +0.3% yoy

15:15 US: Industrial Production and Capacity Utilization March Industrial Production PROGNOSE: -0.1% yoy previous: +0.7% yoy Capacity utilization PROGNOSE: 77.9% previous: 78.2%

15:45 CA :Bank of Canada, Monetary Policy Council Overnight Rate Results PROGNOSE: 2.75% previous: 2.75%

16:00 US: Inventories February PROGNOSE: +0.3% yoy previous: +0.3% yoy

Analsyst updates, 06.12.

⬆️⬆️⬆️

- BERNSTEIN raises the price target for SIEMENS from EUR 220 to EUR 227. Outperform. $SIE (+1,82%)

- JPMORGAN raises the target price for SIEMENS ENERGY from EUR 38.70 to EUR 44. Neutral. $ENR (+0,35%)

- JEFFERIES upgrades BMW from Hold to Buy and raises target price from EUR 80 to EUR 85. $BMW (+0,52%)

- ODDO BHF raises the price target for AURUBIS from EUR 70 to EUR 76. Neutral. $NDA (+1,7%)

- UBS raises target price for AUTO1 from EUR 9.80 to EUR 20.50. Buy. $AG1 (+2,62%)

- UBS raises the target price for NORDEA from SEK 144 to SEK 145. Buy. $NDA FI (+1,06%)

- DEUTSCHE BANK RESEARCH raises the price target for FREENET from EUR 34 to EUR 36. Buy. $FNTN (-0,68%)

- DEUTSCHE BANK RESEARCH raises the target price for DS SMITH from GBP 4 to GBP 5.80. Hold. $SMDS

- JPMORGAN raises the price target for THYSSENKRUPP from EUR 3.80 to EUR 4.10. Neutral. $TKA (+5,16%)

- JPMORGAN raises the target price for SALZGITTER from EUR 11.50 to EUR 14.10. Underweight. $SZG (-0,55%)

- JPMORGAN raises the price target for SCHNEIDER ELECTRIC from EUR 270 to EUR 275. Overweight. $SU (+1,12%)

- JPMORGAN raises the price target for KNORR-BREMSE from EUR 88 to EUR 92. Overweight. $KBX (+4,4%)

- MORGAN STANLEY upgrades HANNOVER RÜCK to Overweight. Target price EUR 292. $HNR1 (+1,13%)

- JPMORGAN raises the target price for COMMERZBANK from EUR 18.40 to EUR 19.50. Overweight. $CBK (+1,34%)

⬇️⬇️⬇️

- GOLDMAN lowers the price target for LVMH from EUR 770 to EUR 720. Buy. $MC (+4,98%)

- MORGAN STANLEY downgrades MUNICH RE to Equal-Weight. Target price 523 EUR. $MUV2 (+0,8%)

- JEFFERIES downgrades MERCEDES-BENZ from Buy to Hold and lowers target price from EUR 73 to EUR 60. $MBG (+1,16%)

- ODDO BHF lowers the price target for DELIVERY HERO from EUR 43 to EUR 38. Neutral. $DHER (+0,07%)

- WARBURG RESEARCH lowers the price target for COMPUGROUP from EUR 31 to EUR 24.50. Buy. $COP (+0,7%)

- JPMORGAN lowers the price target for VESTAS from DKK 143 to DKK 123. Neutral. $VWS (+0,21%)

- JPMORGAN lowers the price target for KION from EUR 44 to EUR 43. Overweight. $KGX (+0,5%)

- MORGAN STANLEY downgrades ORSTED to Equal-Weight. Target price DKK 480. $ORSTED (+1,5%)

Earnings this morning 👇🏼

Continental AG Q3 24 Earnings $CONTI

- Sales EU9.83B (est EU9.97B)

- Adj EBIT EU873M (est EU804.4M)

- Adj EBIT Margin 8.9% (est 7.96%)

- Automotive Rev EU4.8B (est EU4.8B)

- Lower FY Sales Outlook To Around EU39.5B To EU42B

Hannover Re $HNR1 (+1,13%) raises its profit outlook for 2024 to EUR 2.3 billion, which leads to a share price increase of 1.4 percent in pre-market trading. The profit target for 2025 is EUR 2.4 billion and is considered conservative by analysts.

Salzgitter

$SZG (-0,55%) confirms the loss of just under 198 million euros in the first nine months and is sticking to its transformation course despite possible takeover plans. The second-largest shareholder GP Günter Papenburg AG is examining an offer for the steel group, while the state of Lower Saxony remains skeptical.

As every Sunday, the most important news from the past week, as well as the dates for the coming week.

Also as a video:

https://youtube.com/shorts/I6Spb2-8GPY?si=EkrAKROkkdawQVwE

Monday:

The mood on the employment market has not been this bad for four years. Companies are hardly hiring any new employees. "The autumn revival on the labor market has largely failed to materialize this year," said Andrea Nahles, head of the Federal Employment Agency.

Tuesday:

$BOSS (+0,57%) HUGO BOSS can make gains in the pre-market, the Q3 figures are convincing. The company was able to increase sales against the market and thus gain further market share. Sales rose by one percent to 1.029 billion euros. Profits, on the other hand, fell slightly to 55 million euros. As a result, the company was able to beat both the sales forecast and the operating profit forecast. The profit was lower than expected.

A purchase offer for $SZG (-0,55%) Salzgitter caused the share price to explode on Tuesday. The family entrepreneur Günter Papenburg probably wants to take over the steel manufacturer.

Wednesday:

Black day for $BMW (+0,52%) BMW, on the one hand Donald Trump became US President, on the other hand bad quarterly figures. In Q3, BMW earned half a billion euros, 84% less than in the same period last year. Sales slumped by 16%. BMW had to recall 1.5 million cars worldwide due to problems with the brake systems.

Bad share price reaction also at $TMV (+0,54%) TeamViewer, although the Group was able to significantly increase its profit. This rose by 49 % on an adjusted basis. Revenue also increased by 7 %. The company is targeting the lower end of the forecast range for revenue for the year as a whole. The EBITDA forecast was even raised. RBC leaves the target price at 18 euros after the figures. Why the share fell by more than 10% remains a mystery to us.

https://www.4investors.de/nachrichten/dgap-meldung.php?sektion=dgap&ID=145568

That was it for the traffic lights. It had become apparent. The decisive factor was Lindner's paper calling for a change in economic policy

Thursday:

The FED cut the key interest rate again by 25 basis points. This had been expected. The US economy would grow solidly and the inflation rate would fall towards 2%.

The Bank of England also cut interest rates by 25 basis points on Thursday. The prime rate there is still at 4.75%.

https://www.bbc.com/news/live/c3rxp879j3xt

Most important dates in the coming week:

Monday: 11:00 ZEW Economic Sentiment (DE)

Tuesday: 14:30 Inflation data (USA)

Thursday: 14:30 Producer prices (USA)

What other important dates can you think of?

Analyst updates, 05.11.

⬆️⬆️⬆️

- ODDO BHF raises the price target for BIONTECH from USD 110 to USD 130. Outperform. $BNTX (-0,32%)

- BARCLAYS raises the price target for AIRBUS from EUR 161 to EUR 165. Overweight. $AIR (+0,87%)

- CITIGROUP raises the price target for SCOUT24 from EUR 91 to EUR 94.50. Buy. $G24 (+1,36%)

- WARBURG RESEARCH raises the price target for REDCARE PHARMACY from EUR 174 to EUR 176. Buy. $RDC (-2,18%)

- DEUTSCHE BANK RESEARCH raises the price target for RYANAIR from EUR 17 to EUR 17.50. Hold. $RYA (-0,75%)

- BERNSTEIN rates EBAY from Market-Perform to Outperform. Target price USD 70. $EBAY (+3,98%)

- ODDO BHF raises the price target for SALZGITTER from EUR 14 to EUR 15.50. Underperform. $SZG (-0,55%)

- BARCLAYS raises the target price for COMMERZBANK from EUR 16 to EUR 17. Equal-Weight. $CBK (+1,34%)

- BARCLAYS raises the target price for MTU from EUR 295 to EUR 340. Equal-Weight. $MTX (+1,02%)

- MORGAN STANLEY rates LUFTHANSA to Equal-Weight. Target price EUR 7. $LHA (+0,06%)

- BERENBERG raises the price target for DEUTSCHE KONSUM REIT from EUR 3.50 to EUR 5. Hold.

⬇️⬇️⬇️

- GOLDMAN lowers the price target for MERCEDES-BENZ from EUR 65 to EUR 63. Buy. $MBG (+1,16%)

- UBS lowers target price for 1&1 from EUR 21.60 to EUR 21. Buy.

- WARBURG RESEARCH lowers the price target for GFT TECHNOLOGIES from EUR 40 to EUR 37.50. Buy. $GFT (+1,44%)

- HAUCK AUFHÄUSER IB lowers the price target for ECKERT & ZIEGLER from EUR 63.50 to EUR 55. Buy. $EUZ (+0,97%)

- BARCLAYS lowers the price target for BNP PARIBAS from EUR 90 to EUR 85. Overweight. $BNP (+1,18%)

- BERENBERG downgrades SCHNEIDER ELECTRIC from Buy to Hold and lowers price target from EUR 261 to EUR 255. $SU (+1,12%)

- BERENBERG lowers the price target for BEFESA from EUR 41 to EUR 31. Buy. $BFSA (+0,97%)

Salzgitter Aktiengesellschaft | $SZG (-0,55%) : Possible voluntary public takeover offer to the shareholders of Salzgitter AG

The company has not yet been informed of the possible amount of the offer price.

Títulos em alta

Principais criadores desta semana