$SZG (-3,59%)

$HYQ (+0,38%)

$ABX (+1,13%)

$BBAI (+4,75%)

$PLUG (+3,18%)

$GPRO (+1,47%)

$TEG (+2,14%)

$1SXP (+0,88%)

$SE (-3,5%)

$ETOR (+0,38%)

$NCH2 (-0,6%)

$TUI1 (-0,24%)

$VWS (-0,26%)

$R3NK (-0,01%)

$EOAN (+2,27%)

$CSCO (+0,37%)

$SLI (+6,02%)

$HFG (-1,78%)

$HTG (+0%)

$HLAG (+2,24%)

$TKA (-5,97%)

$DOU (-1,11%)

$RWE (+1,91%)

$BIRK (-0,79%)

$9618 (+1,13%)

$DE (-1,02%)

$FR (+3,36%)

$NU (+1,81%)

First Majestic

Price

Discussão sobre FR

Postos

10Quartalszahlen 11.08-15.08.2025

Precious metal supercycle? The empire of metals strikes back

YTD return:

🥇 Gold: ≈ +39.1 %

🥈 Silver: ≈ +24.7 %

🥉 Copper: ≈ +20.6 %

⚗️ Palladium: ≈ +34.5 %

💎 Platinum: ≈ +45.4 %

🥇Gold:

📈Chart technicals: The uptrend is running in a clean rising weekly channel.

The all-time high at 3 500 $/oz (22 Apr.) is intact; setbacks to the 50-day EMA (~3 300 $) were absorbed each time.

Primary support zone: 3 200 - 3 100 $ - the previous breakout level. RSI > 60 confirms bullish momentum.

ℹ️Fundamental Driver No. 1: Central bank buying.

In 2025, the official sector is again targeting ≈ 1,000 t - the 4th year in a row of massive purchases, driven by de-dollarization and geopolitical hedging.

🥈Silver:

📈Chart technicals:

Despite +25% YTD, the price is still ~30% below the historic peak of $49. The multi-decade cup-and-handle formation is approaching the neckline at 36 - 37 $; a significant weekly close above it could activate a target above 75 $. Short-term supports: $34.8 (May breakout level) and $32.

ℹ️Fundamental Driver No. 1: Supply deficit.

The World Silver Survey reports a shortfall of 149 Moz in 2024; a further 118 Moz is expected in 2025 - largely due to solar and e-mobility demand, while 70% of production is by-product.

🥉Copper:

📈Chart technicals:

On July 8, the "blue-sky breakout" to 12 526 $/t (5.68 $/lb) took place. Volume spike and weekly RSI > 70 confirm strength. The former top band 10 500 - 10 800 $/t now serves as key support; a retest to ~11 000 $ would be technically sound without breaking the uptrend.

ℹ️Fundamental driver no. 1: Structural scarcity.

UNCTAD warns: By 2030, around 80 new mines and $ 250 bn CapEx would be needed to meet demand from the energy transition, data centers and e-mobility - otherwise the market deficit will persist.

This is where I am currently positioned:

🥇Gold:

🥈Silver:

🥉Copper:

❓Do you see a continuation of the bull market in metals and are you positioned accordingly?

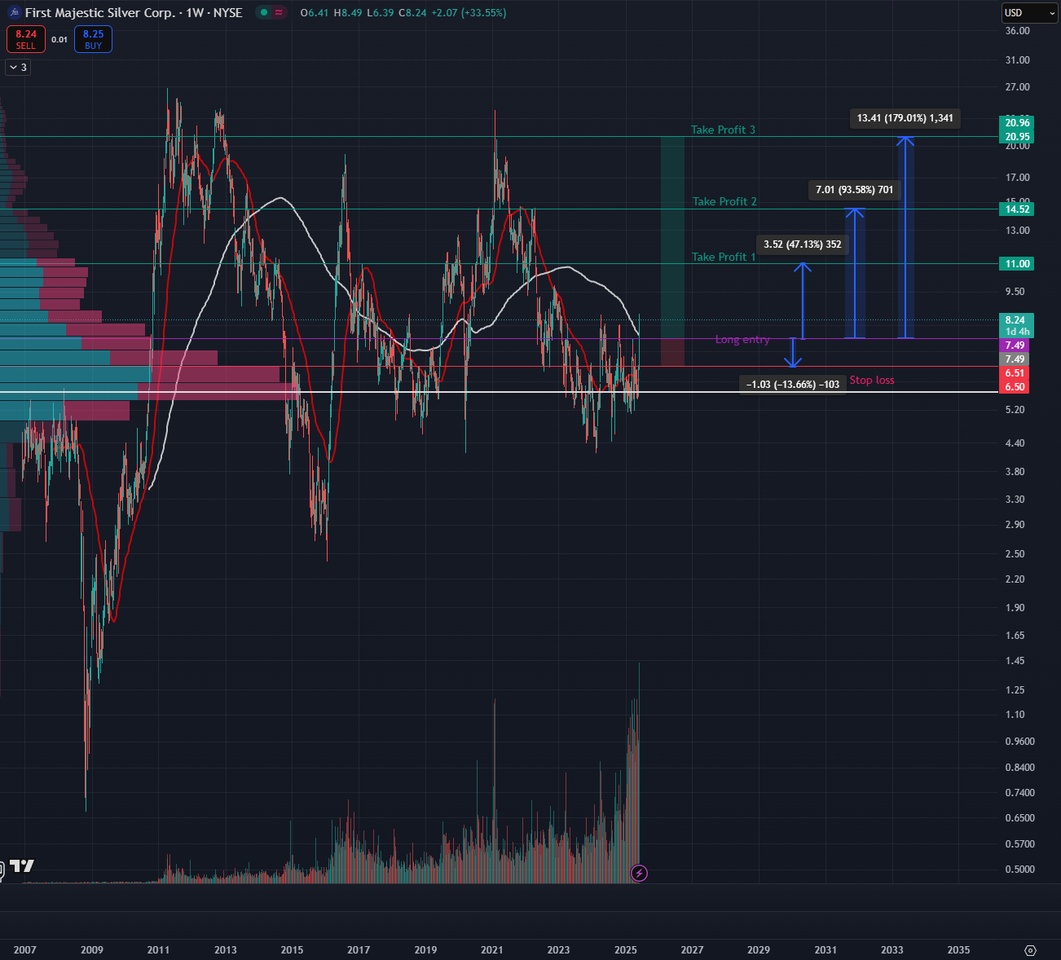

First Majestic Silver Corp - Silver Long Trade Idea

$FR (+3,36%)

broke out above the 200-week SMA today with massive buying volume.

Here is a possible trading idea to bet on a continuation of the silver rally with this mining stock.

This is not investment advice and is merely my personal opinion and trading idea. Everyone must make their own investment decisions and assess the associated risk themselves.

Trading in shares, especially in the commodities sector, can be subject to high fluctuations in value.

👉 Please DYOR (Do Your Own Research)!

🔍 Technical setup:

- Breakout above the 200-week SMA (white line)

- Volume support at a high level

- Horizontal level (~6.50-7.00 USD) was overcome with momentum

- Volume profile shows high interest in this zone → former resistance = potential new support

📈 Trade idea (swing trade on a weekly basis):

🟢 Entry

- Current price (~ USD 8.15) conceivable after breakout, but aggressive.

- Conservative: Wait for a setback to the breakout level ~ USD 7.20-7.50 (pullback to SMA200 or horizontal zone)

🟡 Stop loss

- Below the breakout zone:

- ~6.20-6.50 USDdepending on risk appetite and position size

- Alternatively: below the last weekly lows

🟢 Target zones (take profit)

Short-term (~10.50-11.00 USD): Last swing high range (2022/2023)

Medium/long-term (~13.00-15.00 USD): Consolidation zone from 2021

Bull case (~19.00-21.00 USD): Breakout from multi-year range

⚖️ Risk-reward ratio (CRV)

Example at entry 7.50 USD:

- SL at USD 6.20 (risk: USD 1.30)

- TP1 at USD 11.00 (opportunity: USD 3.50)

- → CRV: approx. 2.7:1

📌 Notes:

- AG is a very volatile silver share, reacts strongly to the silver price.

- Look at the silver future (XAG/USD) - a parallel breakout there increases the validity.

- For speculative trades, always adjust the position size to the risk.

🪙 Gold & silver are just coming to life 🚀

Apart from the current standard reasons "geopolitical uncertainties, expectations of interest rate cuts, weakening US dollar", I can't think of any 🤷♂️

🥈 Silver on course for an all-time high - Is a breakout like gold on the cards?

Since gold broke above its previous high from 2020 at the beginning of 2024, it has been soaring.

Major banks have made massive purchases - a clear indication of growing institutional confidence, but also growing skepticism on the market.

📌Historical perspective: inflation and precious metals

Historically, gold and silver have performed particularly well in times of high inflation. While paper money loses value, precious metals traditionally offer security and value retention.

👉 The historical price ratio between gold and silver is also interesting.

Historically, this ratio has usually fluctuated between 15:1 and 80:1, currently it is in the higher range (approx. 89)which suggests that silver has the potential to catch up in the long term.

🆘Gold & silver in stagflation

In stagflation scenarios - economic stagnation combined with high inflation - precious metals have performed above average in the past.

👉 During the stagflation in the USA in the 1970s, the price of gold exploded from around 35 to around USD 850 per ounce.

Currently, many experts see a possible stagflation emerging again, triggered by high national debt, geopolitical tensions and a fragile economic situation.

This could be a catalyst for further price increases in precious metals.

📈Bull market 2025 and beyond?

Fundamentally, there are many reasons for a continuation of the bull market in gold and silver:

- 🪖 Persistent geopolitical uncertainties

- 🆘 Possible stagflation in the USA and Europe

- 📉 High government debt and expansionary monetary policy

- ☀️ Particularly for silver: strong growth in industrial demand from electronics, solar energy and electromobility

The main arguments against this are possible interest rate cuts or a surprisingly strong economic recovery, which could lure investors back into risk assets.

👇 In the following sections, we will now take a look at the charts.

If you are not familiar with chart technology, it is best to skip straight to the conclusion at the bottom

📌 Gold chart

☕Cup-and-handle formation

A cup-and-handle formation is a bullish (positive) chart pattern that often develops over several years. It resembles a cup with a handle and often signals a long-term trend reversal to the upside.

The formation consists of:

Cup: A long, u-shaped recovery that occurs after a sharp price rise and subsequent correction.

Handle: A shorter correction phase after the recovery before the price finally breaks out and ideally starts a long-term bull market.

👉 From 2011 to 2024, gold formed a clear cup-and-handle formation. (Cup: 2011 to 2020 - Handle: 2020 to 2024)

The most recent breakout from this formation in March 2024 could mark the start of a new long-term bull market.

📌 Silver chart

🧐 It is worth taking a long-term look at silver since 1960:

- Silver reached a spectacular high in 1980

- A new high was only just reached in 2011

📈 Silver is currently approaching this all-time high again.

A long-term cup-and-handle formation can also be seen here:

- Cup: 1980 to 2011

- Handle: 2011 to today (possibly completed soon)

👉 Technically, silver may be on the verge of a possible long-term breakout, which is extremely exciting.

📌 Conclusion

I currently see strong arguments for investing in gold and silver in the fundamental data and the technical charts.

Yesterday (18.03.2025) I increased my silver position in $PHAG (-2,11%) in order to benefit from a potential rally.

I have to say that my investment horizon for gold and silver is very long (20+ years), as I consider precious metals to be the cornerstone of my portfolio.

This is the current composition of my precious metal portfolio:

- GOLD:

$EWG2 (-0,67%) , $IGLN (-1,04%) (3.75% of my portfolio) - SILVER:

$PHAG (-2,11%) (2.40% of my portfolio) - Gold mining ETFs:

$SPGP (+0,27%) , $GDXJ (+6,57%) (1.92% of my portfolio) - Individual shares (very speculative):

$BTO (+6,17%) , $FF (-1,94%) , $FR (+3,36%) (< 1% of my portfolio)

Do you have gold and silver in your portfolio?

If so, what is your weighting?

You might also be interested:

🆘 Crash-Warnsignale & die beste Strategie: Was sagt uns die Vergangenheit?

📈 When in Doubt, Zoom Out – Chart-Tipps für Langfrist-Investoren

06.09.2024

TESLA at the top of the NASDAQ-100 + C3.ai has to cut spending + Further acquisition in the precious metals sector + Major orders from the USA for headlight specialist Hella

TESLA $TSLA (+2,53%) at the top of the NASDAQ-100 - Climbing well above the 50-day line

C3.ai $AI (+3,38%) fell 19% after the AI software company missed estimates for quarterly subscription revenue as companies cut back on spending amid economic uncertainties.

First Majestic $FR (+3,36%) are pleased to announce that they have entered into a definitive merger agreement pursuant to which First Majestic will acquire all of the issued and outstanding common shares of Gatos. Gatos is a leading silver producer with a 70% interest in the Los Gatos joint venture, which owns the producing Cerro Los Gatos underground silver mine in Chihuahua, Mexico.

The headlamp specialist Hella $HLE (+1,03%) has received orders for electronics and lighting projects in the USA worth more than two billion euros. The company, which has been part of the French automotive supplier Forvia since the beginning of 2022, announced that series production for the unspecified US car manufacturer will start in Mexico within two to four years. For comparison: Hella is targeting currency and portfolio-adjusted Group sales of between around 8.1 and 8.6 billion euros in 2024.

Friday: Stock market dates, economic data, quarterly figures

ex-dividend of individual stocks

Bank of America USD 0.26

PepsiCo 1.36 USD

Booking Holdings USD 8.75

Quarterly figures / company dates USA / Asia

/

Quarterly figures / Company dates Europe

10:20 PSI Software Half-year figures

Economic data

- 08:00 DE: Trade balance July Trade balance calendar and seasonally adjusted FORECAST: +20.6 billion euros previously: +20.4 billion euros Exports FORECAST: +0.8% yoy previously: -3.4% yoy Imports FORECAST: +1.1% yoy previously: +0.3% yoy

- 08:00 DE: Production in the manufacturing sector July seasonally adjusted OUTLOOK: -0.2% yoy previous: +1.4% yoy

- 08:45 FR: Industrial production July OUTLOOK: -0.3% yoy previous: +0.8% yoy

- 11:00 EU: GDP (3rd release) 2Q Eurozone FORECAST: +0.3% yoy/+0.6% yoy 2nd release: +0.3% yoy/+0.6% yoy 1st quarter: +0.3% yoy/+0.5% yoy

- 14:30 US: Labor market data August employment ex agriculture PROGNOSE: +161,000 yoy previous: +114,000 yoy Unemployment rate PROGNOSE: 4.2% previous: 4.3% average hourly earnings PROGNOSE: +0.3% yoy/+3.7% yoy previous: +0.2% yoy/+3.6% yoy

In recent days it became quite quiet about the rumors of the acquisition of $1COV (+0%) .

In the meantime I am skeptical whether $ADNOCDIST meanwhile is willing to make a higher offer. Personally, however, I think that rather not.

Why?

Out of personal interest, I got into $BRKM5 (+2,52%) in December. It opened up a solid product portfolio in important niches for industrial production. Worth noting the large market shares in polypropylene, also bio-based, and ethylene crackers in Mexico. My entry price was 3.60€.

A few weeks later $ADNOCDIST with $APO (+0,51%) a takeover offer with a premium of 157% at the then price of 27.60 BRL.

In the meantime, however, this takeover is in the stars, as the two investor groups disagree on the financing.

For this reason, I took profits of about 50% this week and will nevertheless continue to monitor the situation, as it will definitely provide impetus for the Covestro takeover.

I reinvested the liquidated position in First Majestic $FR (+3,36%) , the German SmallCap Pferdewetten.de $EMH (+0,55%) (You wouldn't believe how popular horse racing is.) , and the problematic chemical giant Lanxess $LXS (+1,25%) whose portfolio is now worth more than its market capitalization. This does not even include the tangible assets of the industrial plants and the supply contracts with very well-known customers.

Even if the chemical industry is hard hit at the moment, it remains one of the mainstays of a modern civil society, along with the metal and electrical industries. If the apocalypse does not occur, we will be able to benefit from good earnings and therefore also good dividends in the long term.

Global chemical sell-off?

It was basically predictable that Western chemical producers would now be attractive to heavy "cash holders" in the wake of falling stock markets.

Insiders are predicting a takeover of $1COV (+0%) by $ADNOCDIST assume.

The oil company of the emirate Abu Dhabi already crossed my way on the stock exchange only some time ago.

My speculation at the time was that the takeover of $BRKM5 (+2,52%) . Later, the interest in Braskem was also proven by ADNOC.

A takeover with an offer to Covestro would have real chances from about 60€/share. Therefore, have fun to the gamblers. 👍

However, it remains to be seen how politics will behave. Here, one has clearly maneuvered oneself into a dead end.

But what would the economic consequences be in Germany?

Personally, I actually think that there is a certain tactic behind the decision to buy plastics producers.

With the takeovers of the two groups, a very large part of German plastics production would be under control and, thanks to the domestic group's cheaper oil and gas contracts, it would be able to exert a certain pricing power, which could certainly pose a threat to its competitors. In addition, further capital outflows would be shifted abroad. This is the next potential nail in the coffin for the Leverkusen site. A collective bargaining agreement for current employees would probably cease to apply in a similar way. However, this can only be assessed once a takeover has been negotiated at all, and of course depends on Covestro's integration into the ADNOC Group.

How realistic do you think a takeover of the German chemical giant is? Will further offers to German energy-intensive companies follow?

Títulos em alta

Principais criadores desta semana