Dear Community,

In the last analysis, we saw how the nuclear renaissance and SMRs are set to satisfy the huge hunger for electricity of AI data centers. But while the world debates megawatt hours and power grids, the biggest challenge of decarbonization often remains in the shadows: industrial process heat. industrial process heat.

Steelworks, chemical parks and glass factories don't need batteries for laptops - they need constant heat of 500 to over 1,500 degrees Celsius. Until now, there was no alternative to natural gas. But a new generation of "shovel sellers" is preparing to revolutionize this market. Those who bridge the gap between energy generation and thermal storage will find companies that are building system-critical infrastructure for the next 50 years, far removed from the tech hype.

So after water and nuclear power, let's take a look at the "thermodynamic champions" - those companies that store heat, control steam and use the earth as an eternal battery. It is the next logical and still massively underestimated step.

While everyone is talking about electricity, industrial process heat is the "elephant in the room". Industry consumes more energy for heat than for electricity worldwide. A gigantic market is currently emerging here, closing the gap between fluctuating renewables and the constant hunger of factories.

The three pillars of the analysis:

- Thermal batteries (Iron & Brick Storage). Companies are developing systems that use surplus wind or solar power to heat huge blocks of graphite, firebrick or molten salt. These "batteries" then release the energy over days as process steam. Important players here are Rondo Energy (supported by Bill Gates) or listed companies such as Alfa Laval.

- Geothermal energy 2.0 (Next-Gen Geothermal). Thanks to drilling technology from the oil sector, it is now possible to drill deeper and more precisely than ever before (Enhanced Geothermal Systems). The aim is to tap into base load-capable geothermal energy all over the world, not just in volcanic hotspots.

- The interface to the nuclear report (VHTR). The new generation of Very High Temperature Reactors (VHTR) not only produces electricity, but also industrial heat directly. This makes them direct partners for chemical parks such as BASF or Dow. SMRs can not only feed data centers, but also decarbonize entire industrial clusters.

1. the specialists for heat transfer & storage

Alfa Laval ($ALFA (+1.56%)

) is a Swedish veteran and world market leader in heat exchangers. Without this technology, no thermal storage system and no district heating network can function. The company also manufactures separators and filter systems for the process industry.

- Business model: Turnover is generated through plant sales and project-related deliveries. However, recurring revenue from the global service and spare parts network (maintenance, inspection, retrofitting) is particularly lucrative.

- Opportunities & risks: As a technology leader, Alfa Laval is benefiting massively from decarbonization and green hydrogen. However, dependence on global cycles in shipbuilding and the oil industry remains a risk. Price pressure from cheaper competitors and fluctuating raw material costs can put pressure on margins. An important checkpoint is the order intake in the marine sector (CO2 capture).

GEA Group ($G1A (+1.5%)

) has established itself as a specialist for process technology, with a strong focus on the "Heating & Refrigeration" division. They build gigantic industrial heat pumps that make waste heat from factories or data centers usable again.

- Business model: GEA supplies both individual machines and complete production lines for the food and pharmaceutical industries. The after-sales business with high margins stabilizes sales and extends customer relationships through digital optimization tools.

- Opportunities & risks: The model is very defensive and benefits from the stable demand for hygiene and efficiency solutions. One disadvantage is the lower growth rates compared to tech players. In addition, fluctuating incoming orders for major projects can have a short-term negative impact on cash flow. Investors should keep a close eye on the margin development of the heat pump division.

Spirax-Sarco Engineering ($SPX (+1.67%)

) is the British market leader for steam systems. As energy in industry is usually transported via steam, Spirax converts factories worldwide to electric steam generation and highly efficient condensate systems.

- Business model: The company combines product sales (valves, pumps, control technology) with intensive engineering consulting and maintenance contracts. There is a strong focus on aftermarket relationships.

- Opportunities & risks: There is no alternative to steam in sectors such as chemicals or pharmaceuticals, which gives Spirax strong market leadership and pricing power (moat). However, the valuation (P/E ratio) is often very high and there is an exchange rate risk due to the British pound. It must be critically examined whether the integration of new acquisitions in the area of electrical thermal solutions will succeed smoothly.

2. geothermal energy & district heating infrastructure

Ormat Technologies ($ORA (+0.73%)

) is probably the best-known "pure play" for geothermal energy. They build and operate plants that convert geothermal energy into electricity and useful heat. Ormat Technologies is the established market leader in this field.

- Business model: As a vertically integrated provider, Ormat earns money from plant construction, the sale of OEM equipment and long-term power supply agreements (PPAs). The portfolio is currently being expanded to include energy storage and solar hybrid solutions.

- Opportunities & risks: Ormat is a beneficiary of the US Inflation Reduction Act and offers genuine, renewable base load capacity. Risks are inherent in the nature of the business: geothermal energy is capital intensive and there are drilling and permitting risks. An important milestone is the progress made with the "Enhanced Geothermal" pilot projects in cooperation with Google.

Ariston Group ($ARIS (-1.75%)

) produces highly efficient solutions for water and space heating. While many think of private homes, Ariston is increasingly supplying systems for commercial and industrial hot water applications.

- Opportunities & risks: The mandatory refurbishment of old heating systems in Europe is a massive driver. Ariston has a strong brand name and focus on the European continent. The risk lies in the tough competition with Asian giants such as Daikin or Samsung and the dependence on the construction sector, which is suffering from the economic downturn. Gaining market share in commercial hybrid solutions is the decisive factor here.

3. high temperature technology & materials

Vesuvius plc ($VSVS (+0.44%) ) specializes in refractory materials (refractories). These are essential to keep heat at up to 1,500 degrees in storage systems without the system melting.

- Opportunities & risks: As a niche specialist, Vesuvius is indispensable for the new storage infrastructure. However, the biggest risk is the close link to the currently struggling steel industry. Investors should pay attention to how quickly the share of sales outside the traditional metallurgy sector (e.g. new energy storage systems) grows.

SGL Carbon ($SGL (-7.84%)

) supplies specialty graphite, one of the best heat conductors for extreme temperatures, which is required in high-temperature furnaces and chemical processes.

- Business model: SGL operates in the areas of graphite materials and composite materials (carbon fibers). They offer customer-specific solutions, which are often specially coated or refined.

- Opportunities & risks: Graphite is a key material for semiconductor production and the heat management of modern thermal batteries. SGL is considered a turnaround candidate with a strategically important portfolio, but has historically struggled with a volatile share price and high expectations.

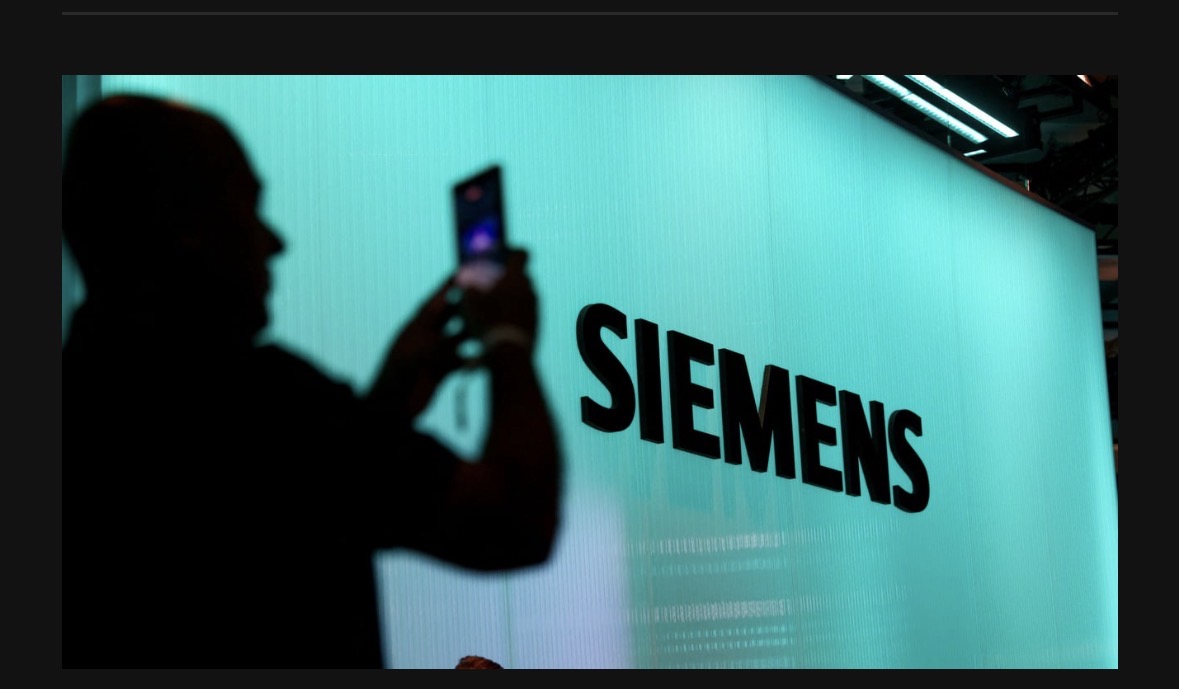

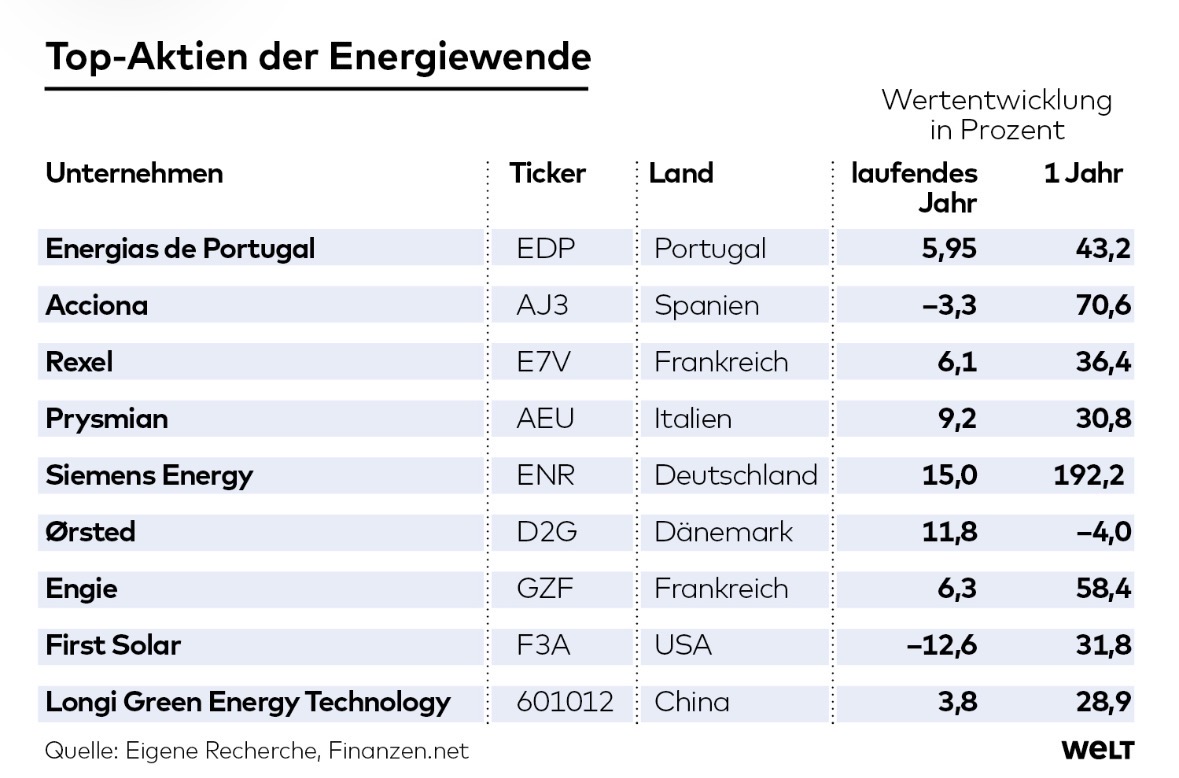

4. the system integrator: Siemens Energy ($ENR (-0.08%)

)

Siemens Energy covers the entire spectrum - from huge thermal energy storage systems based on volcanic rock (ETES) to hydrogen-capable gas turbines.

- Business model: Revenue is generated from plant sales, project engineering and long-term service contracts for grid infrastructure and power plants. Siemens often acts as a general contractor for the decarbonization of entire industrial sites.

- Opportunities & risks: The broad positioning makes the company a beneficiary of the global energy transition. However, the risks lie in the known legacy issues of the wind subsidiary Gamesa as well as in political risks and a complex Group structure. The stabilization of the wind division remains the basic prerequisite for being able to fully assess the potential of the heat assets.

Strategic conclusion

Why is this topic so exciting? There is hardly any "hype" at the moment, which allows for attractive entry prices compared to AI stocks. It is a real ESG magnet as it solves the most difficult problem of the energy transition. It also has a clear infrastructure character: it involves hard assets, patents and long-term industrial contracts - just like the water and nuclear sectors. The industrial heat transition is the missing piece of the puzzle to future-proof an energy portfolio.

How do you assess the situation? Is the industrial heat transition underestimated as a 'sleeping giant' because it receives less media hype than SMRs or e-mobility? And which of these companies do you think has the most convincing business model to benefit from the decarbonization of industry in the long term?

Best regards ✌🏼

Anderlé