$DIS (-0,28%)

$PLTR (+0,16%)

$SRT (+0,78%)

$NXPI (+0%)

$PYPL (-0,08%)

$PEP (+0,19%)

$TER (+2,15%)

$CPRI (+3,64%)

$MRK (+0,19%)

$PFE (-0,75%)

$TTWO (-1,49%)

$EA (-0,19%)

$AMD (-1,53%)

$MDLZ (+0,12%)

$LUMN (-2,64%)

$SMCI (+0,62%)

$7011 (+2,44%)

$6752 (+0,8%)

$6367 (+0%)

$UBSG (+0,03%)

$GSK (-1%)

$UBER (+0,99%)

$ABBV (-0,21%)

$LLY (-1,18%)

$GOOG (+3,65%)

$ELF (+3,54%)

$QCOM (+1,33%)

$SNAP (+2,58%)

$WOLF (-2,76%)

$ARM (-0,93%)

$VOLCAR B (+1,47%)

$6758 (-2,22%)

$SHL (+2,12%)

$SAAB B (-0,74%)

$5401 (-0,52%)

$MAERSK A (+1,53%)

$R3NK (-0,34%)

$BMY (+0,67%)

$BMW (+0,52%)

$EL (+2%)

$ROK (+0,64%)

$PTON (-0,81%)

$KKR (+0,32%)

$LIN (+2,09%)

$RL (+3,3%)

$AGCO (-0,64%)

$RBLX (-3,65%)

$FTNT (-1,83%)

$REDDIT (-0%)

$ILMN (-2,03%)

$WMG (+2,26%)

$IREN (-6,41%)

$MSTR (+1,9%)

$AMZN (+2,51%)

$KOG (+2,62%)

$ORSTED (+1,5%)

$PM (-0,29%)

$WEED (+1%)

Daikin Industries

Price

Discussão sobre 6367

Postos

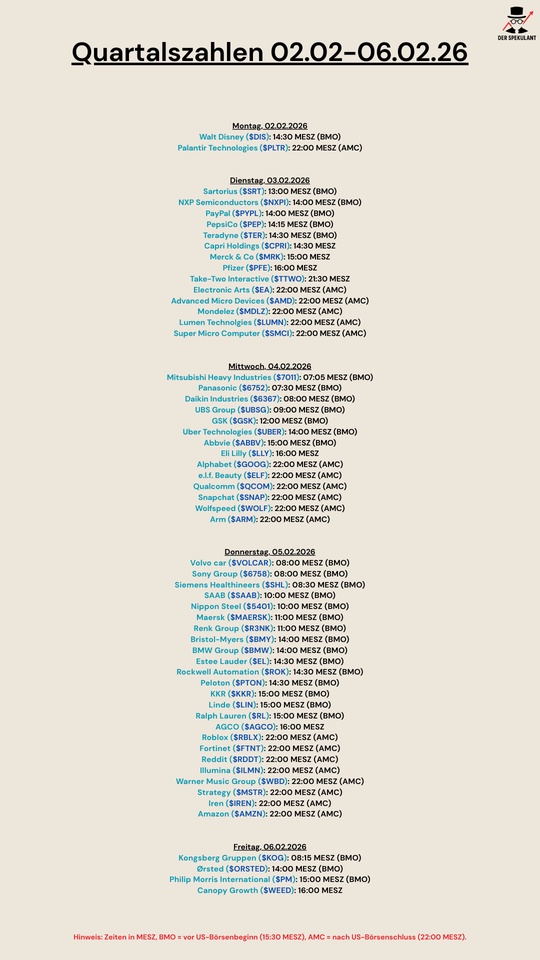

23Quarterly figures 02.02-06.02.26

Interest rate decision Bank of Japan

The BoJ's interest rate decision is due tomorrow. Anyone who remembers August 24 knows that this can also lead to increased volatility here and in the USA.

The consensus among market participants is that key interest rates will be raised from 0.25% to 0.75%. This may sound relaxed against the backdrop of European and US key interest rates, but it could have a direct impact on our portfolio.

- Most of the Japanese companies in our portfolios are heavily dependent on exports ($6367 (+0%)

$8001 (-2,76%)

$SUMICHEM

$8002 (-1,86%) ...). An appreciation of the yen therefore has a direct impact on company results, the outlook and thus possibly on share performance. - For decades, carry trades took place due to the low level of interest rates. In other words, cheap money was borrowed in Japan and invested primarily in US stocks or Bitcoin $BTC (-0,72%) were invested. Due to the lower interest rate spread, many carry trades will no longer be worthwhile and will be settled. This leads to less investable money and can therefore lead to lower prices.

Basically, I believe that the actual interest rate hike is already priced into both prices and carry trades and will therefore only lead to low volatility.

As always, the outlook for the continuation of interest rate policy is much more decisive. If a tighter interest rate policy with several rate hikes is announced next year, I actually expect losses of >10%, especially for Japanese stocks.

I will try to pick up Itochu $8001 (-2,76%) during the day on Friday.

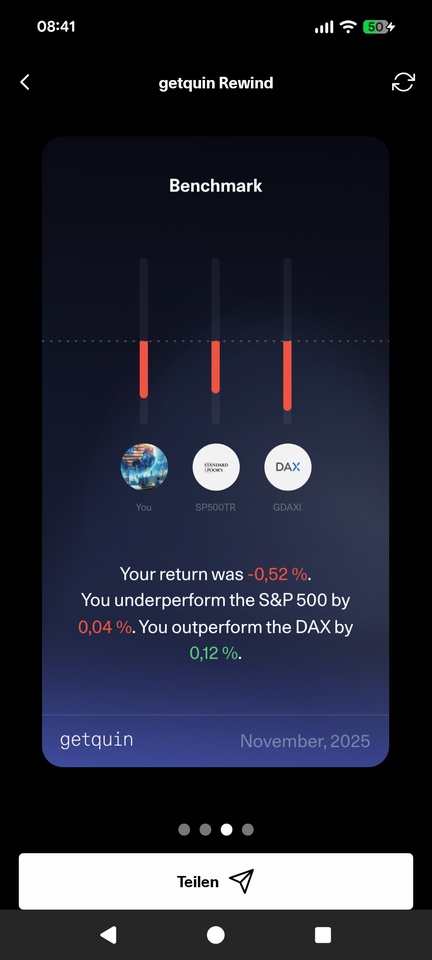

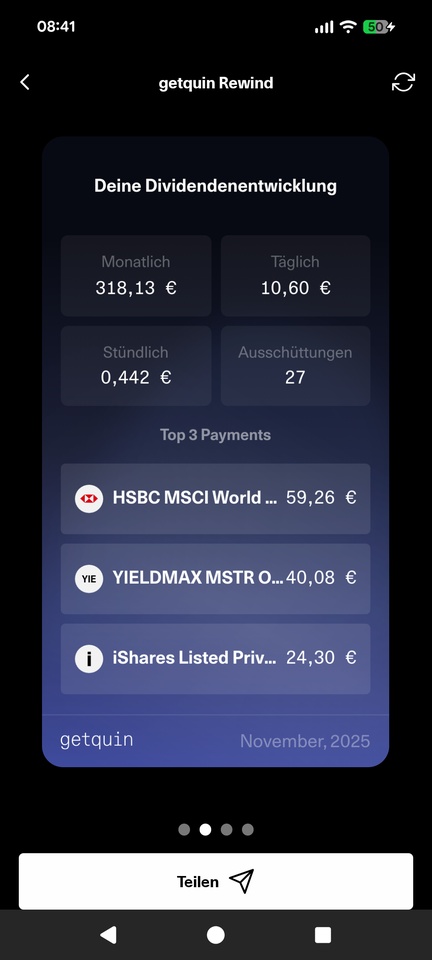

November 2025 Rewind

I remembered it worse :D Bitcoin and assets were tough :)

Top Mover

$CI (-1,76%) +12%

$MPW (+4,57%) +11,6%

$6367 (+0%) +10,1%

$DG (-0,78%) +8,9%

$AVGO (-0,41%) +8,7%

Loosers

$XS3087774306 (+3,06%) -36,3%

$YMST -34,5%

$3350 (+3,5%) -18,7%

$BTC (-0,72%) -17,9%

$HIMS (-0,67%) -17,5%

Allocation by Irish sale

The idea of further diversifying my portfolio had solidified somewhat in recent weeks. $IREN (-6,41%) I left it at my self-imposed partial sell target of EUR 55 and started to build up the first positions on Friday. I am sticking to my target of investing around EUR 5k in each position. $IREN (-6,41%) remains in the portfolio with 500 shares and will (probably) not be touched in the near future. $DEFI (-3,39%) Now also full with 5,500 shares.

19k liquidity left and will still be invested in top-ups + new shares.

Individual shares are now:

$DSFIR (+0,82%) possibly increase

$MUM (-0,58%) possibly increase

$FSLR (+2,98%) Increase if necessary

$NICE Increase if necessary

Does anyone else have an idea for a share, possibly also from the German-speaking region? The Asian region would also be very interesting, although I am looking a little at $1810 (-2,06%) look at.

vg and have a nice WE

Micha

Update: My latest purchases💸

Over the past few days, I have made several share purchases. I have taken the opportunity to diversify my portfolio and selectively add stocks that I consider to be promising in the long term. My focus was on a balanced mix of stable companies and opportunities with growth potential. This allowed me to consistently pursue my investment strategy and further strengthen the basis for the future development of my portfolio.

Energiekontor $EKT (-2,2%) (subsequent purchase)

Novo Nordsik $NOVO B (-2,32%) (subsequent purchase)

LVMH $MC (+4,98%) (subsequent purchase)

Pernod Ricard $RI (+3,49%) (subsequent purchase)

Frosta AG $NLM (+0,84%) (first position)

Adobe $ADBE (-0,23%) (Subsequent purchase)

Nestle $NESN (-0,62%) (Subsequent purchase)

Occidental Petrolium $OXY (+0,48%) (first position)

Sixt Vz $SIX2 (-1,09%) (Subsequent purchase)

Realty Income $O (+1,13%) (Subsequent purchase)

Ping An Insurance (Subsequent purchase)

Volkswagen $VOW3 (+0,64%) (Subsequent purchase)

The Trade Desk $TTD (+0,14%) (subsequent purchase)

Daikin $6367 (+0%) (subsequent purchase)

Danaher $DHR (-0,42%) (subsequent purchase)

Have a great rest of the week!

Let's see what the next few days bring🧐

Investment idea for everyone in the attic

With rising temperatures and increasingly hot summers, demand for air conditioning systems is growing worldwide. Particularly striking: in Germany, production rose by 92% in 2024, while imports reached a record level with a value of almost €1 billion. In growth markets such as India, the boom is only just beginning.

Exciting players in this trend are Carrier Global, Midea Group, $BEAN (+2,27%) - and above all $6367 (+0%).

Why Daikin is my favorite:

- Global market leader in air conditioning systems, strong presence in Asia, Europe and North America.

- Solid growth: Sales have increased steadily over the last three years - most recently around 4.75 trillion. JPY (+8 % YoY).

- Profit development also positive: operating profit +2.4 %, net profit +1.7 %. -> Growth potential!

- Dividend of JPY 330 (~2% yield) with stable payout history.

- Origin from Japan brings geographical diversification to the portfolio, away from classic US and European stocks.

- Valuation in the context of the megatrend: A P/E ratio of 18 seems moderate in view of the expected long-term growth in demand for air conditioning systems - the market is thus pricing in stability, but not yet the full potential of the "cooling boom".

My conclusion: Daikin combines market leadership, stable growth and international diversification - making it the most exciting stock for me to profit from the cooling boom in the long term.

1000% profit-taking and two new additions from Scandinavia

$RKLB (-6,56%)

$9984 (-2,04%)

$CADLR (+1,3%)

$MTRS (-0,95%)

Yesterday I was at Rocket Lab $RKLB (-6,56%) and SoftBank $9984 (-2,04%) took profits, with Rocket Lab even over 1000%to further diversify my portfolio.

The strategy remains the same, namely to invest in future-oriented individual stocks with a lot of upside and stable finances, but the Rocket Lab share in the portfolio is growing and growing, so I have decided to reallocate a little.

Two new stocks from Scandinavia have been added.

1) Cadeler

$CADLR (+1,3%)

Cadeler is a world-leading Danish company specializing in the installation of offshore wind turbines. The offshore wind power market is expected to grow to approx. 70-250 billion dollars by 2035 (depending on estimates). Cadeler is ideally positioned to benefit from this trend. They maintain long-term customer relationships with companies such as Ørsted, Equinor or Siemens Gamesa. The barrier to entry is generally regarded as high (moat).

Turnover (2025e)approx. € 500 million (of which 10-20% is usually recurring)

Profit (2025e)approx. 150 mio €

Order backlog (current)approx. 2.5 billion €

Market capitalization (current)1.6 billion €

P/E ratio (current): approx. 17

P/E ratio 2029 (forecast)approx. 3-4

Cadeler will benefit from the global trend towards decarbonization and political initiatives in this area, and many countries are only just getting started. My AI analysis of the company has shown that we will probably 2035 we are likely to have a profit of around €1.4 billion which, with a P/E ratio of 18.6 (Danish average), this implies a market capitalization of around € 26 billion. would mean. With a more conservative P/E ratio of 12 it would be around 17 billion €. In the first scenario, an investment would therefore be around 16x and in the second scenario 11x in the second scenario. The company therefore fits well into my investment strategy, high potential with comparatively low risk.

2) Munters Group $MTRS (-0,95%) (Edit: sold in the meantime)

The Munters Group is a Swedish company that specializes in air treatment and drying solutionsespecially for air conditioning, dehumidification and industrial air technology - with a focus on data centers, pharmaceuticals, food and industrial plants. The data center business in particular is currently booming. The battery factory business has recently experienced problems due to weak demand, which is also reflected in the share price, but this is only a short-term problem.

The company is a technological leader in the field of dehumidification and energy recovery. They are also ahead of the competition when it comes to sustainability. In addition, they always rely on a very local production structurewhich largely frees them from trade policy risks. Competitors such as Daikin Industries $6367 (+0%) or Carrier $CARR (+1,85%) are more broadly based and less specialized, which is why they do not pose a major threat either. It is also difficult for customers to switch suppliers.

Turnover (2025e)approx. € 1.3 billion (of which 20-30% is usually recurring)

Profit (2025e)approx. 60 million €

Order backlog (current):

Market capitalization (current)2.2 billion €

P/E ratio (current): approx. 31

P/E ratio 2029 (forecast)approx. 10-11

The Munters Group is benefiting from several trends such as the data center boom, electrification and sustainability. This development is only just beginning. My AI analysis has shown that the profit in 2035 will be around € 300 million. in 2035. With a constant P/E ratio, that would correspond to a valuation of € 9.3 billion would correspond. If one assumes a lower P/E ratio of around 20 it would be 6 billion €. So in the first scenario 4x and in the second 2,7x. The Munters Group therefore represents a rather conservative addition in my growth-oriented portfolio. They will definitely perform well, but for the really big multiples you need other stocks.

What do you think of the two new additions? I think it's particularly nice that there are two European companies are 🇪🇺🇪🇺

I have my eye on these 3 stocks

I have already bought one share (a few days ago) and will buy more if there is another setback. One is earmarked for the community portfolio and the other is far too expensive for me, but it's a damn good performer. Take a look at the video 3 Aktien, die JETZT spannend sind: Alibaba, Daikin & Cintas im Check! - YouTube or the report on my financial blog. http://bit.ly/FA_Lounge

$6367 (+0%)

$BABA (+0%)

$CTAS (+1,28%)

Have a great Sunday and looking ahead to tomorrow... stay calm.

Best regards,

Angelo from Finanzen Anders

Annotation:

The majority of the GQ community is really great.

Unfortunately, there are a few "mimimis", "sheriffs", "bored", "envious", etc. who complain that I include links to my respective YouTube video.

It just so happens that my main channel is YouTube. I'm not going to write huge treatises and post them here when I can do the whole thing in short videos.

I would like to offer this link as a service to anyone who is interested:

Everyone else, you are free people, you don't have to get upset, attack me, etc. - block me and enjoy your life.

3 Aktien, die JETZT spannend sind: Alibaba, Daikin & Cintas im Check! - YouTube

Germany is sweating - I'm investing.

While everyone is moaning that the killer temperatures are hitting, I think to myself:

Let the south come to us then. 😎

🏖️ Climate change? Tragic.

🧊 But someone has to supply the air conditioning.

👉 That's why I'm looking at companies like:

- Daikin (JP) $6367 (+0%) - Asian cooling gods

- Carrier Global (USA) $CARR (+1,85%) - Does not only air conditioning, but also cash

- Trane Technologies $TT (+0,74%) - Less well known, but ice cold efficient

And if I'm not in the mood for individual stocks, there are ETFs with the whole smart city/air conditioning eco-mix $CITY (+1,38%) or $RENW (+0,09%) or $INRG (-0,78%)

Maybe that will be my "summer slump play".

Instead of sweating - just profit.

Invest ice-cold instead of taking an ice-cold shower.

#Getquin

#InvestierenMitHumor

#KlimawandelPortfolio

#DeutschlandSchwitzt

#KlimageräteAktien

#BuyTheHeat

#DividendInsteadOfDeo

Títulos em alta

Principais criadores desta semana