GFT Technologies

Price

Discussão sobre GFT

Postos

49GFT Technologies

$GFT (-0,73%) is currently at its 52-week low and has been on my watchlist for some time.

What do you think? Is it a good entry point?

I see potential and think it is currently very fairly valued.

@Tenbagger2024 You've been there for quite a long time. What do you think?

Thank you for your answers ❤️

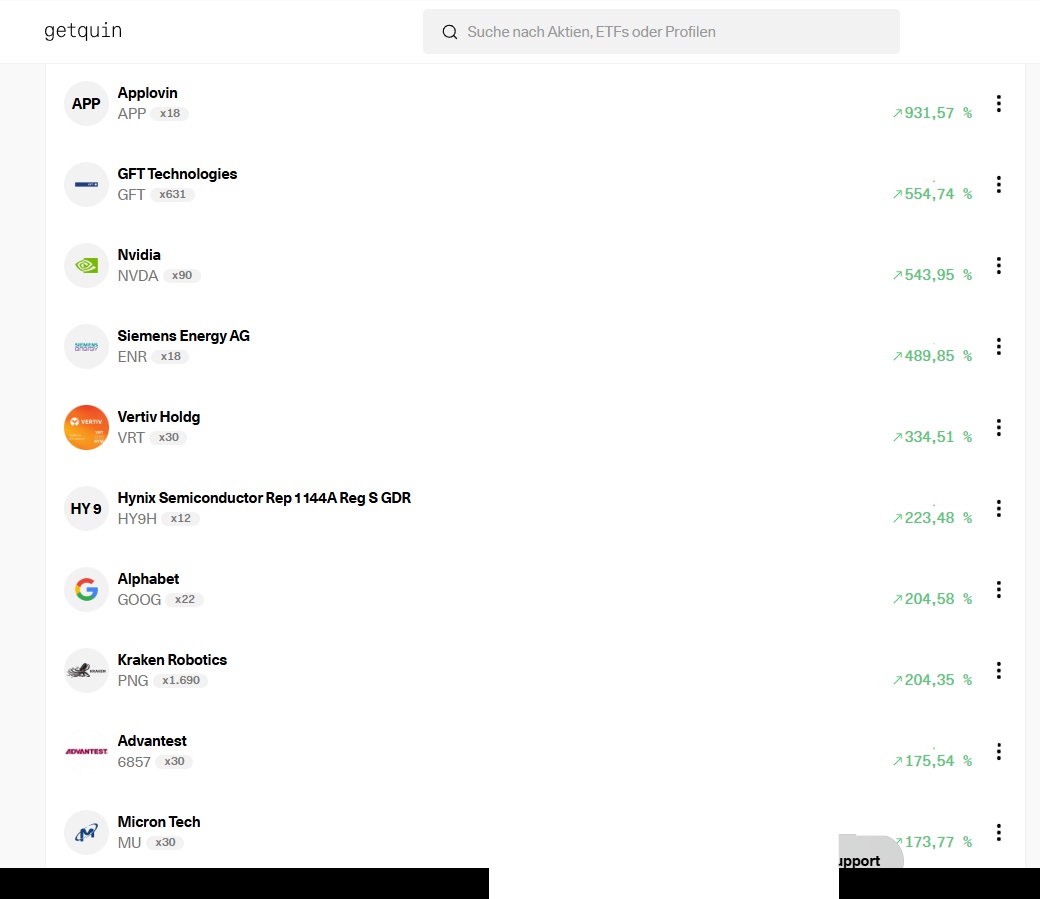

Multibagger Challenge

I lead the way with 8 multibaggers 🙈

$APP (-0,67%)

$NVDA (-0,08%)

$GFT (-0,73%)

$ENR (-0,69%)

$VRT (+0,48%)

$HY9H (+0%)

$GOOGL (-0,3%)

$PNG (-0,69%)

Portfolio update this is how I start 2026

Sooooo it's time for another portfolio update.

Over the last few years, I have noticed that my long therm target of 20% pa is becoming increasingly difficult to achieve as the size of my portfolio increases, because more and more money is flowing into "safe" ETFs. Nevertheless, with my top picks 2025 $RKLB (+0%)

$KSB (-0,89%)

$NU (+0,2%) and $GOOGL (-0,3%) very satisfied. However, all 4 are at ATH or just below, which could make things a bit volatile in the short term. Nevertheless, I assume that all 4 will be higher at the end of the year than they are now.

My aim this year is to increase my exposure to small/mid caps. I already made a start last year, $KSB (-0,89%) has already done quite well, stocks like $P4O (-0,1%)

$GFT (-0,73%)

$SBMO (+1,17%) and $OSIS (+0%) are to be held, but no major additional purchases are planned there for the time being.

The downward positions in Samsung are all part of my 212 trading pies, divided into 3 different pies. Since mid-August, the pies have gained 21.6%. Meanwhile the total value of my 212 investments is 9600€. These are saved monthly with a total of €500 plus one-off payments from time to time.

Apart from that, there are only 2 three-month savings plans with 1.5k each on the $VWRL (-0,09%) and $TDIV (+0,07%)

In addition, there are still around 60k in various orders, but these are all turnaround bets with short-term targets of between 8% and 12%

In the long term, I will keep my eyes and ears open to find new pearls.

GFT Technologies & FICO: Revolutionary alliance for Smart Finance

My dears, I remain invested in both companies.

GFT Technologies and FICO launch a global alliance to empower banks with AI solutions against digital fraud and revolutionize risk management.

GFT Technologies and FICO have launched a global smart finance partnership to help banks fight digital fraud and improve risk management.

The partnership uses AI-based solutions to improve onboarding, risk management and real-time decision-making for banks worldwide.

The first successful projects have been implemented in Asia and Latin America, including real-time analytics for fast decision-making and a demand management system for insurance companies.

The alliance combines GFT's expertise in cloud, data and digital banking with FICO's fraud detection and decision management solutions to provide an integrated platform for banks and FinTechs.

A key element of the partnership is the integration of GFT's GenAI product Wynxx, which automates the software development cycle and enables in-depth data analytics.

GFT has established a Center of Excellence for FICO technologies to train specialized teams and support standardized rollouts across various industries.

Schaeffler uses humanoid robots from Neura Robotics and supplies parts

Automotive supplier Schaeffler manufactures parts for humanoid robots from Neura Robotics. They are also used in production and supply data.

The German automotive and industrial supplier Schaeffler will increasingly supply robot parts to the German robotics company Neura Robotics in the future. Schaeffler announced this on Tuesday. To this end, the two companies have entered into a partnership that also provides for Schaeffler to integrate a "medium four-digit number" of humanoid robots into its own production by 2035.

Together, Schaeffler and Neura Robotics want to develop and manufacture key components for humanoid robots. These include, for example, robot actuators that move the joints of the robots. Schaeffler already has some expertise in the field of planetary actuators, which enable precise rotary movements with high torque. In addition, these actuators are lightweight and robust and therefore designed for continuous operation.

Schaeffler already has robot actuators of various performance classes in its range that can deliver up to 250 Nm of torque. The current humanoid robot 4NE1 from Neura Robotics is equipped with such actuators so that it is also able to lift heavy weights. In the future, Neura Robotics wants Schaeffler to cover its demand for lightweight and powerful actuators.

Neura robots work for Schaeffler

The agreement also provides for Schaeffler to use a larger number of humanoid robots from Neura Robotics in its own production. Neither company has disclosed the exact number. Schaeffler's announcement speaks somewhat cryptically of a mid-four-figure number. Both companies are also keeping a low profile on the costs. According to industry sources, the order value for Neura Robotics is said to be 300 million euros. However, this cannot be substantiated at present.

During the use of the robots in real production environments, application data is collected, which in turn is to be used for AI training of the humanoid robots. The aim is for the robots to develop further by continuously learning specific skills.

GFT and NEURA Robotics enter into strategic partnership to develop pioneering software for physical AI

GFT completes acquisition of SAP specialist Megawork earlier than planned

$GFT (-0,73%) Growth stock with a good dividend yield at a good valuation.

I therefore remain invested and expect the stock to break above the 200-day line soon.

Stuttgart / São Paulo, September 30, 2025 - GFT Technologies has already completed the acquisition of the Brazilian SAP specialist Megawork in September. Closing was originally scheduled for the fourth quarter of 2025.

The acquisition strengthens GFT's market position in the high-margin SAP Cloud ERP segment and expands its portfolio to include highly specialized services in the areas of migration, support and integration. Megawork is one of the leading SAP partners in Brazil, has more than 20 years of experience and serves over 400 clients - a strong foundation for further growth in a dynamic market environment.

Another strategic advantage is the integration of Wynxx, GFT's GenAI product, into Megawork's SAP services. This increases automation, accelerates implementations and shortens the time to value for customers. In addition, the two companies' complementary client portfolios open up significant cross-selling opportunities - enabling GFT to enter new industries such as healthcare, the public sector and utilities.

"This fast closing is a strong signal of our ability to execute our strategy and grow our business with high-margin, high value-added services in partnership with global ISVs such as SAP," said Marco Santos, Global CEO of GFT. "It will enable us to drive the integration forward quickly and provide our clients with an enhanced service offering at an early stage. Given the continued high global demand for SAP services, we see significant potential for further revenue and profitability growth.

The acquisition is part of GFT's growth strategy, which focuses on high-margin, high value-added services.

Use the full potential of AI - for measurable success.

Many AI initiatives remain stuck in pilot mode - held back by incomplete data, unclear use cases and concerns about security, governance and risk. GFT helps companies accelerate AI transformation from start to finish: We consistently align strategies with outcomes, develop modern data platforms and bring AI into practical use with robust engineering and MLOps. We focus on Responsible AI by Design - solutions that are secure, controlled, explainable and ready to scale across the enterprise. Find out how leading banks, insurers and machine builders are successfully putting AI into practice with GFT - and turning their visions into measurable results.

https://www.gft.com/de/de/insights/accelerate-your-ai-transformation

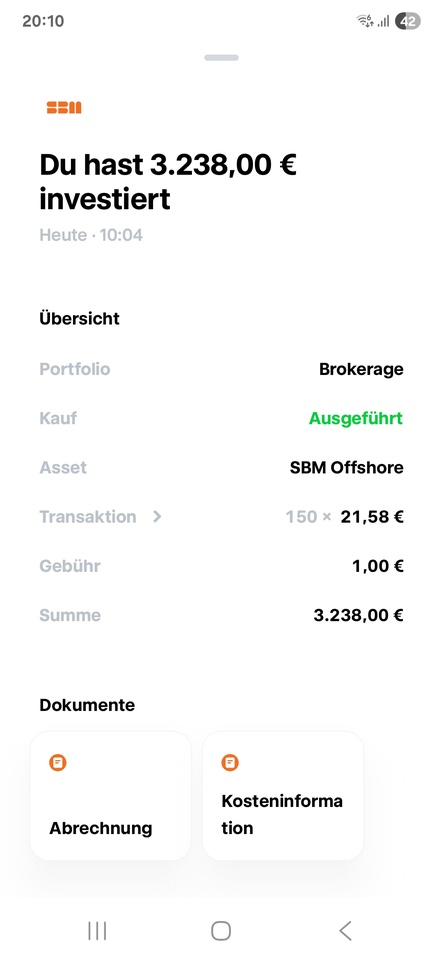

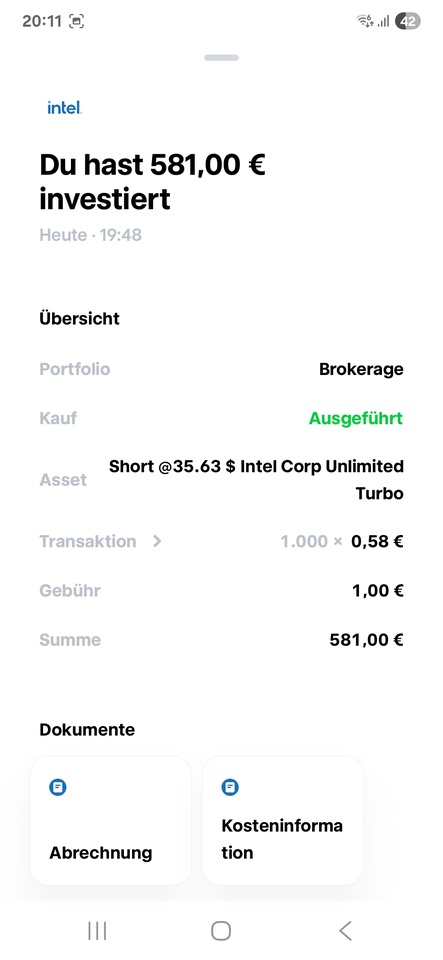

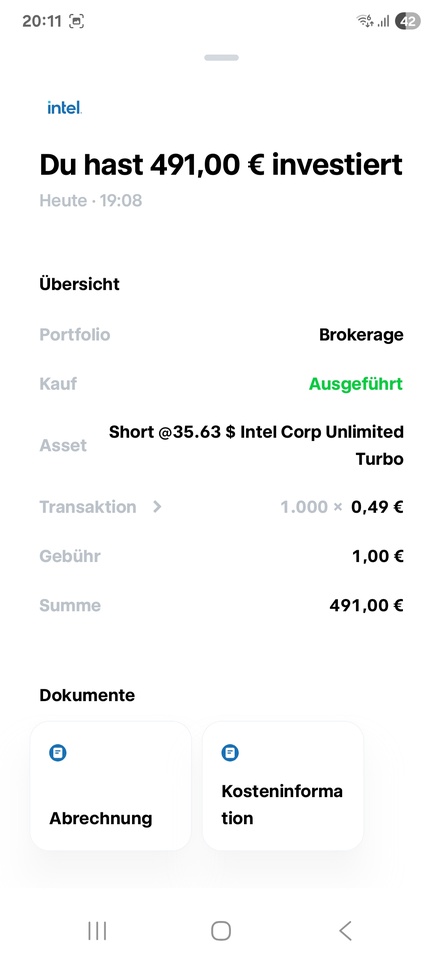

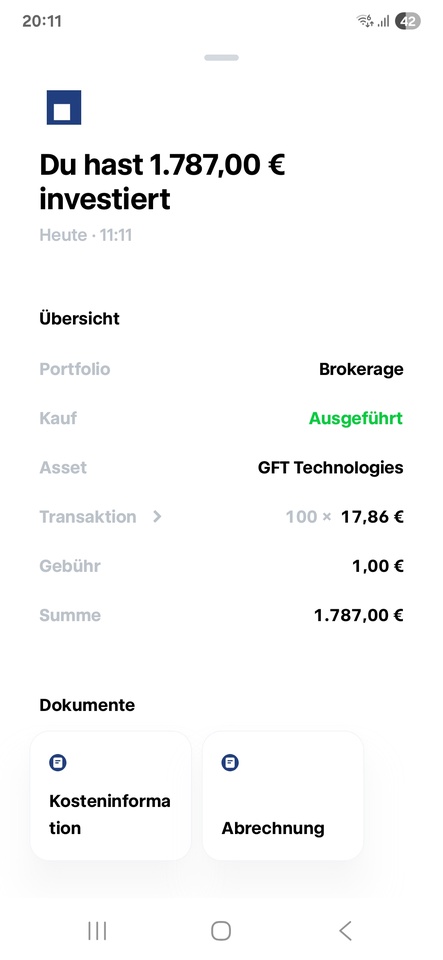

Big shopping day

From buy the dip to short the winner, everything was there again today. Almost 10k were pumped into the market again today. Somehow I can't get my Tr account updated again, so make do with the screenshots

$SBMO (+1,17%)

$GFT (-0,73%)

$AMD (+0,51%)

$INTC (-0,08%)

$3350 (-4,17%)

+ 2

GFT Technologies: Share buyback and award as Digital Banking Leader!

Ladies and gentlemen, I remain invested in this growth stock with a great dividend yield. Because I am now expecting a breakout on the way to the old high.

On September 15, 2025, GFT Technologies SE announced that it had acquired a total of 30,341 shares in the second tranche of its share buyback program. The buyback took place between September 8 and 12, 2025, with the shares being purchased at a volume-weighted average price of EUR 16.4496 per share. The total amount for these transactions amounted to EUR 499,097.72, excluding incidental acquisition costs. Since the start of the buyback program on 15 April 2025, GFT has bought back a total of 652,571 shares. The purchases were carried out via the Frankfurt Stock Exchange (Xetra) by a commissioned bank.

In parallel to the buyback activities, GFT Technologies was recognized as a leader in the SPARK Matrix 2025 for Digital Banking Services in a report by the QKS Group. This award highlights the company's high service quality and innovative strength, particularly in the combination of artificial intelligence (AI) and modern banking solutions. GFT is praised for its customized solutions based on platforms such as Thought Machine and Mambu. These solutions include end-to-end delivery models covering design, configuration, testing and support.

Akhilesh Vundavalli, Principal Analyst at QKS Group, emphasizes that GFT's approach to reshaping digital banking is characterized by a combination of engineering depth and AI-centric methodologies. GFT is helping banks to unlock new revenue streams and improve the customer experience. Marco Santos, CEO of GFT, sees the award as a confirmation of GFT's achievements to date and an incentive for the future, in which GFT aims to continue developing innovative solutions for banking.

The SPARK Matrix 2025 confirms GFT's role as a transformation driver in the financial sector, particularly through the use of AI and modern delivery approaches. With a global presence and extensive regulatory expertise, GFT is well positioned to successfully implement major transformation projects. The combination of technological know-how and high delivery and cost efficiency makes GFT a reliable partner for companies that want to succeed in the digital age.

Overall, GFT Technologies SE's buyback measures and recognition in the SPARK Matrix demonstrate that it is both financially stable and able to offer innovative solutions in the field of digital transformation.

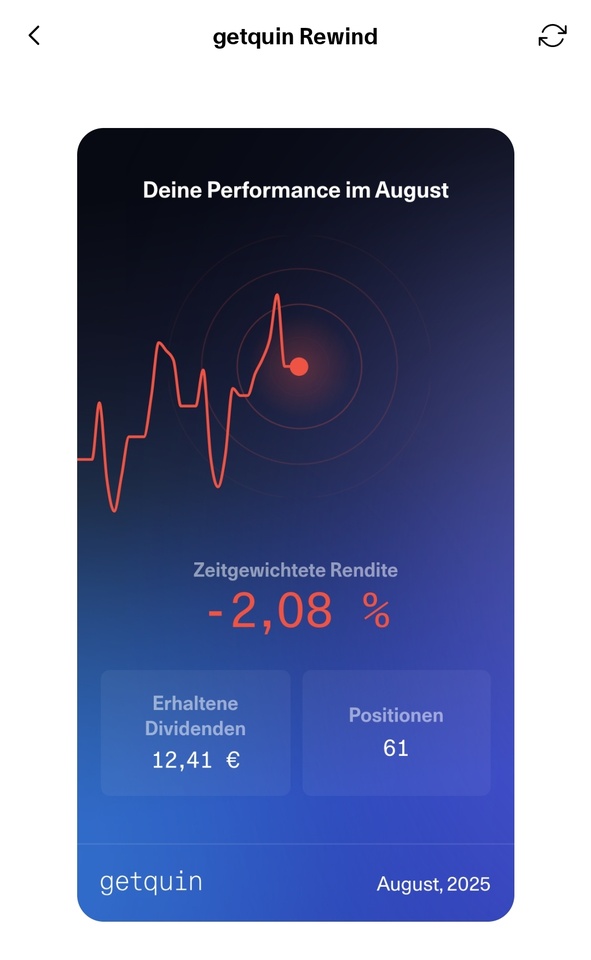

Red August

Hello my dears, @Klein-Anleger1

after the great performance in the previous months

August was unfortunately not so successful.

But September is going well again so far. And so I am YTD with + 5.04 % better than the

NASDAQ 100 + 0.16% World+ 1.14 %.

Reasons for the underperformance in August are earnings at my large position GFT and negative news at Defi Technologie.

The tariffs weighed on Embraer, and the correction in defense weighed on Kitron and AeroVironment.

Vertex's earnings were also the fly in the ointment.

Negative position: (month of August)

Defi Technology - 25.61%. $DEFI (+0,66%)

Innodata - 23.64%. $INOD (+0,13%)

Tokyo Electron - 20.95%. $8035 (-0,21%)

Vertex. - 16,38% $VRTX (-0,16%)

Aixtron. -15,53%. $AIXA (-0,13%)

Transdigm. -15,13%. $TDG (+1,52%)

Vertiv. -14,72%. $VRT (+0,48%)

Coinbase. -13,01%. $COIN (-0,07%)

AeroVironment. -11,91%. $AVAV (+2,14%)

Kitron. -7,79%. $KIT (+0,92%)

Microsoft. -7,64%. $MSFT (+0,24%)

Embraer. -4,75%. $ERJ (+0,33%)

Nvidia. -4,33%. $NVDA (-0,08%)

GFT Technology -3.67%. $GFT (-0,73%)

With so many negative positions, I am glad that I got off lightly due to my positive positions.

Plus positions: (month of August)

Gilat Satellite. +22,14%. $GILT (-1,21%)

Applovin. +18,69%. $APP (-0,67%)

NU Holdings +17.88%. $NU (+0,2%)

SoFi. +12,24%. $SOFI (-0,28%)

Alphabet. +8,95%. $GOOGL (-0,3%)

Fortescue. +8,90%. $FSUGY (+0,82%)

Performed worse than the S&P again. But if I benchmark myself YTD or 1Y with Getquin, I'm about 6% better off 😅

Títulos em alta

Principais criadores desta semana