This should have been my last purchase in this portfolio for this year; from March onwards, this portfolio will only run with savings plans, financed from the distributions and dividends. Savings are made, $EQQQ (+0,83%) , $WITS (+0,45%) and $IUIT (+0,64%) Let's see what it looks like at the end of the year.

iShares S&P 500 Info Technolg Sctr ETF A

Price

Discussão sobre IUIT

Postos

123Sector rotation

My dears, there will probably be a good shift into conservative values today.

Congratulations to the dividend investors 💐🎂

Is this the fear of investors, who of you are buying now.

Portfolio Review: Thoughts on my Tech, Defense & Banking tilt?

Hi everyone! I’ve been building my portfolio and would love to get some honest opinions on my current allocation and diversification.

My strategy involves a mix of individual stocks and specialized ETFs. To get a better view of my actual risk, I’ve "looked through" my ETFs to see my true underlying exposure.

My Top 10 Holdings (by % weight):

Oracle $ORCL (-5,5%) – (Mix of direct stock + IT ETF)

Engie $ENGI (-0,53%) – (Direct stock)

Amazon $AMZN (+2,51%) – (Direct stock + S&P 500)

NVIDIA $NVDA (+1%) – (Spread across Semiconductor, $IUIT (+0,64%) , and S&P 500 $VUSA (+0,6%) ETFs)

Aegon $AGN (+2,55%) – (Direct stock)

Apple 7. Microsoft 8. Broadcom 9. ASML 10. AMD (because of the etfs)

The Strategy:

I have a significant tilt towards Semiconductors $SMH (+0,6%) and IT, but I try to balance the volatility with a Defense ETF $DFEN (+0,12%) , a European Banks ETF $EXX1 (+1,75%) , and some plays like Engie and Aegon.

I’d love your thoughts on:

Concentration: My top 3 holdings (Oracle, Engie, Amazon) represent a large chunk of the total. Is this too top-heavy, or do you like the conviction?

ETF Overlap: I’ve noticed that companies like NVIDIA and Broadcom appear in three different ETFs I own. Does this "hidden" concentration bother you, or is it just part of betting on winners?

Diversification: I’m currently light on Healthcare and Emerging Markets. Would you stick to this high-conviction tech/defense play or start branching out?

Looking forward to hearing your perspectives! 📈

#investing #portfolio #stocks #etf #tech #defense #getquin #diversification

Shares instead of New Year's Eve fireworks 🧨

The year is drawing to a close and my $O (+1,13%) is at 1k portfolio value. The roadmap for 2026 is to push the existing ETFs. $VWCE (+0,76%)

$IUIT (+0,64%)

$TDIV (+0,23%) $IAPD.

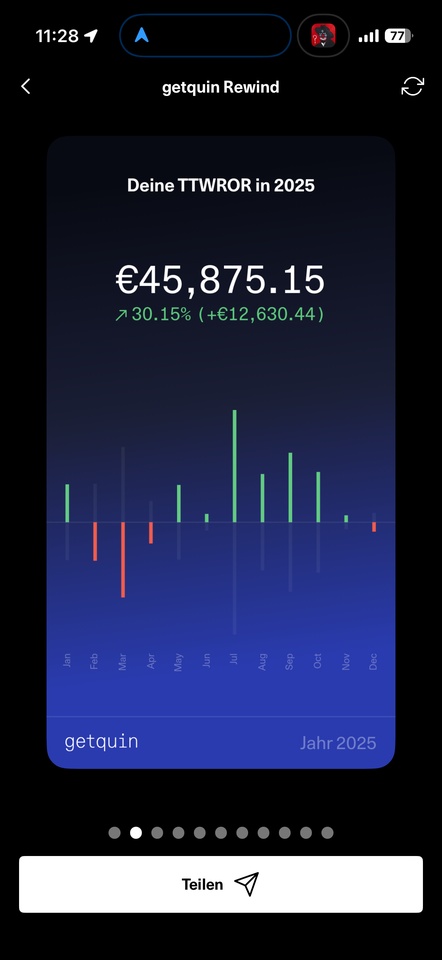

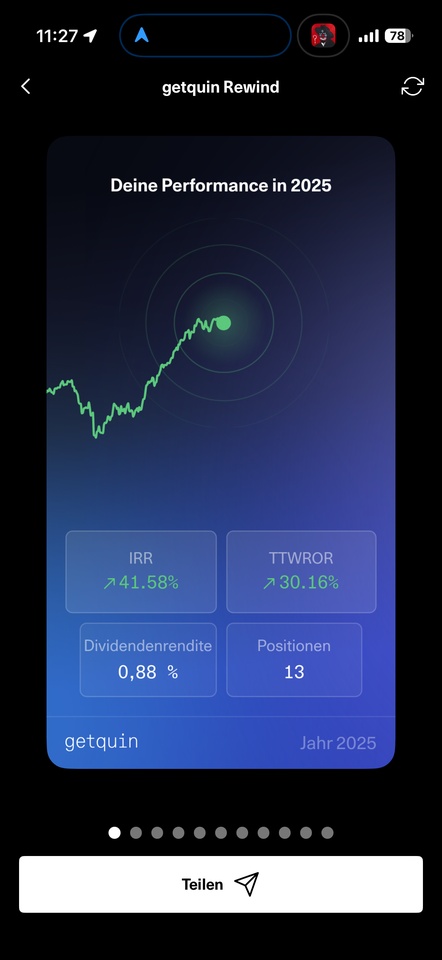

REWIND 2025

The year is coming to an end and for me personally it was the strongest year since I started investing 3 years ago.

There were many very red days, but of course also many very green days. The most important thing for me: no matter what happened, I stuck to my strategy.

My returns were not only generated by my savings plan, but also by making active decisions over the course of the year. I consistently invested several hundred euros a month through my savings plan. Mainly in ETFs such as the $IWDA (+0,57%) and $IUIT (+0,64%), supplemented by individual stocks such as $AAPL (+1,51%)

, $PEP (+0,19%) or also $ASML (+0,76%) .

I also bought additional shares on strong sell-off days. There have been a few of those this year 😅

If you take a look at my portfolio, you can see that I like to invest in large, high-quality companies that have temporarily come under heavy pressure. I deliberately focus on a rebound. Examples of this are $UNH (-0,11%)

, $MC (+4,98%) , $ASML (+0,76%) and $GOOGL (+3,81%) , which were undervalued for me at the time.

This year I also invested in crypto for the first time: bought several $ETH (-1,58%) for around 2k and later sold them completely at around 3.2k. ( A bit of luck definitely played a part in that :D )

All in all, it was an extremely exciting year from which I learned a lot and was able to take a lot with me.

Companies that I currently find interesting and am already invested in are: $ADBE (-0,23%)

, $SBUX (+1,95%) and $UPS (+1,43%)

Latest NAV Update highlights robust sector performance for iShares S&P 500 Information Tech ETF ($IUIT):

For $IUIT (+0,64%)

(iShares S&P 500 Information Tech ETF) investors, BlackRock has disclosed the latest Net Asset Value (NAV) per share as of September 22, 2025, reassuring the fund’s strong core fundamentals amid ongoing tech sector momentum.

Key Update

Latest NAV:

USD: $41.207404

GBP Equivalent: £30.534192

Shares in Issue: 351,656,000

ISIN: IE00B3WJKG14

London Ticker: QDVE ($IUIT (+0,64%))

AUM & Market Growth: The fund has amassed over €12 billion in assets, reflecting high investor confidence in the US tech sector’s medium-long term prospects.

Performance: YTD return is over 22%, with a trailing 12-month gain above 26%, underscoring robust sector leadership and compounding.

Structural Strength: This ETF tracks the S&P 500 Capped 35/20 Information Technology index—offering diversified exposure to blue-chip US technology equities through a low-cost, accumulating, physically replicated vehicle.

With a TER of just 0.15% and a sharp year-to-date rally, $IUIT (+0,64%)

continues to provide an efficient, scalable entry point to the thriving US information technology sector. The recent NAV update underscores transparency, operational strength, and sustained scale, supporting a buy-and-hold thesis for tech-focused portfolios.

Depot of a 20 year old electrician

Today is my 20th birthday and I thought I'd share my portfolio with the GetQuin community.

Last week I passed my final apprenticeship exam as an electrical and building services engineer with a special module in building control technology with an excellent result.

I first got involved with shares and ETFs when I was about 14 years old through various YouTube videos and had already developed a great interest in them. I made my first small investment at the age of 16, which at the time was around €600 in Bitcoin via the Swiss provider Relai (my average purchase price is €23,500)

On my 18th birthday, I opened a securities account with Trade Republic and invested in shares for the first time and immediately set up a savings plan. I continued to save and invest diligently. My savings rate was around €500 per month. I invested in 4 ETFs ($VWCE (+0,76%)

$VHYL (+0,81%)

$IUIT (+0,64%)

$XAIX (+1%) ) and various individual shares.

From time to time I added a bit more crypto to the portfolio, but I didn't buy any more this year as the crypto weighting in the portfolio became too high for me and my focus is more on shares and ETFs.

The gold in my portfolio comes from gifts for my birth and first communion.

As I will be joining the Austrian Red Cross as a civilian servant next week and will then only earn just under €950 per month, the savings rate will be reduced to €200 for the time being and will only be invested in $VWCE (+0,76%) and $XAIX (+1%) saved. When I see how I manage with the money, I will increase or decrease the savings rate accordingly.

I would be very interested to hear what you think of my portfolio and would also be very happy to receive suggestions for improvement.

I think it's good that you want to expand the shares of $VWCE.

Reallocation - need your opinion

Hello everyone,

I am 20 years old, currently have a custody account of around CHF 37,000 with IBKR and save around CHF 600 per month.

My current statement:

- ETFs: $IWDA (+0,57%) (MSCI World), $IUIT (+0,64%) (S&P 500 IT), $IGLN (+1,13%) (Gold)

- Individual stocks: $NVDA (+1%) , $GOOGL (+3,81%) , $BRK.B (+0,06%) $IBKR, $RHM (-0,17%)

Cash: almost nothing

Considering:

- Selling some SWDA and also reducing some gold.

- With the capital freed up, invest more in S&P 500 / Nasdaq or in individual stocks ($MSFT (-0,3%) , $META (+1,59%) , $AMZN (+2,51%) , $NOVO B (-2,32%) ).

- Possibly also $BTC (-0,95%) slightly for more "risk-on".

My thoughts:

- MSCI World is too broad and too heavy in Europe/Japan for me, I see more long term return in the S&P 500.

- Gold is okay for safety, but maybe I don't need 10% at 20 years.

- I want more growth / oomph, I am also prepared to endure short-term fluctuations.

👉 Questions for you:

- Would you cut SWDA and weight S&P 500 / Nasdaq more instead?

- Reduce gold and increase tech or EM instead?

- Is it worth adding to Bitcoin or growth stocks like Novo Nordisk at my age in order to achieve even higher returns in the long term?

- Or would it be better to leave everything as it is and just optimize via the savings rate?

Thank you for your feedback 🚀

If I were you, I would implement a targeted weighting via savings rate and "opportunities"...

Then, as I understand it, you want to keep all positions...

By the way, I find depot 👍

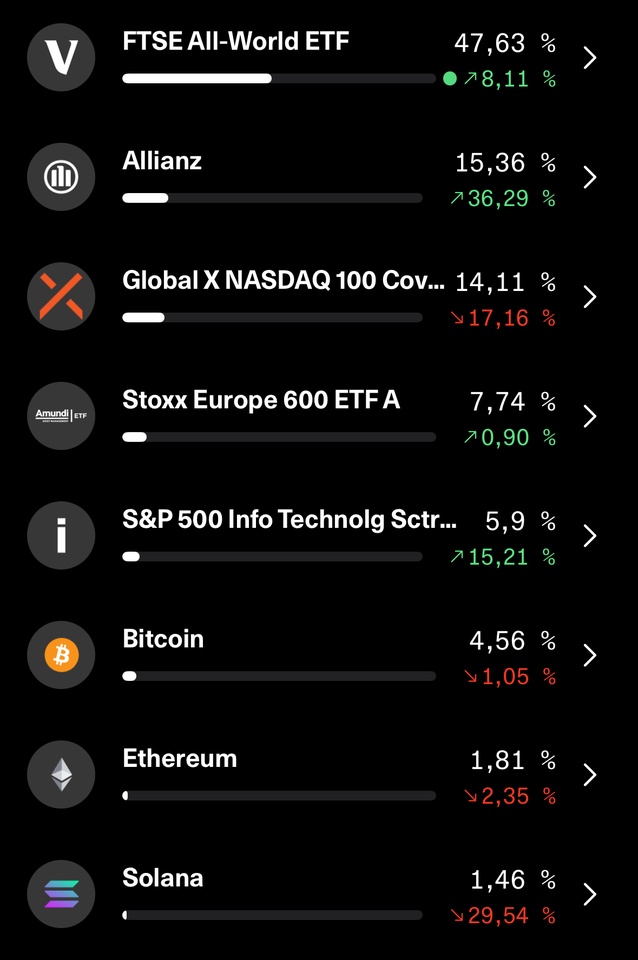

Portfolio structure

Hello everyone,

I am 28 and would like to invest for the long term. My savings rate is around 600€-800€ per month.

Briefly about the current positions:

The $VWRL (+0,63%) position is in the savings plan.

$ALV (+1,65%) The savings plan ran initially and I am currently simply holding the position and not expanding it any further.

$QYLE (+0,77%) was also once in a savings plan. The aim here was to generate cash flow, but I would now rather reallocate in order to get a higher return in the long term.

$MEUD (+0,81%) runs in the savings plan to increase the European share.

$IUIT (+0,64%) I like to buy more when there are setbacks and use it as a yield booster. Also in the savings plan.

$BTC (-0,95%)

$ETH (-1,58%)

$SOL (-2,61%) are partly older. I am considering expanding them.

I would be pleased to hear your ideas and opinions on what you would do - also with regard to regrouping and structuring the savings plans.

Thank you very much for your encouragement!

Also, of course: portfolio volume and investment goals.

Portfolio

I am restructuring my portfolio. My goal is to have a solid foundation that generates significant dividends which i can deploy on available opportunities. I have selected the following scheme.

Dividend generators (75% via buy and hold for 10+ years)

$JEGP (+0,2%) 25%

$TDIV (+0,23%) 15%

$SHEL (-0,01%) 15%

$NN (+2,06%) 10%

$ADC (+1,4%) 10%

Growth ETF (25% depending on trends)

$IUIT (+0,64%) 10%

$XAIX (+1%) 10%

Note that besides the 75% of dividend stocks I have an equal share in loans that generate interest. The profit from both (dividends and interest) are deployed to the above mentioned weighted scheme.

Any thoughts on this or stocks, etf's I missed?

Títulos em alta

Principais criadores desta semana