Is it actually considered a falling knife if cryptos have been falling for what feels like half a year🤔? I don't care, I buy small tranches from time to time. Today some ETH, SOL, XRP and Chainlink. All just small amounts, but better than nothing 😃. Bitcoin makes up 95% of my crypto holdings, but it has to be fun.

Discussão sobre ETH

Postos

1.067What is my real Bitcoin entry price? 🤔

I'm having a discussion with friends and would like to hear what you think.

I currently hold around 0.208 BTC. Some of it was bought over the years, but some of it also came as a gift from family (birthday, Christmas, etc.).

The total amount of money I have invested in Bitcoin is around €5,536.

If I do the simple math:

€5,536 / 0.208 BTC = about €26,600 per BTC.

For me, that honestly feels like my "real" entry price, because that's the money I actually put in myself.

But now comes the point where the discussion started.

I exchanged some altcoins for Bitcoin in November 2024, when the price was already relatively high. As a result, some people say that my average price should actually be much higher, in some cases closer to 70k, because this exchange practically counts as a new purchase.

Others say the same thing:

The Bitcoins I received as a gift shouldn't actually be included in the average because I didn't pay anything for them.

In the end - depending on how you do the math - I end up with completely different "entry prices".

Once around 26k,

sometimes significantly higher due to the trades,

or theoretically even lower if you look at the gifts differently.

So I'll just ask around:

How would you calculate your entry?

- Just your own invested money?

- Include every trade at the price at the time?

- Or are donated coins simply a bonus without an entry price?

I just realized that the "average entry" is much less clear than I always thought.

😂😆😂😆

$BTC (-0,23%)

$ETH (-0,32%)

$SOL (-0,82%)

$XRP (-0,16%)

$PEPE (+0%)

$ADA (-0,08%)

#crypto

Market Update — March 4, 2026: Ripples After Recent Drop

The markets are trying to recover today after heavy volatility earlier in the week, triggered by the ongoing conflict involving the U.S., Israel and Iran. What started as a sharp sell-off in stocks and a surge in oil prices has recently shown signs of stabilisation.

What’s Driving the Swings:

After several days of geopolitical escalation, investors have been on edge. Energy prices spiked as the conflict threatened key shipping routes, inflation fears picked up, and risk-off sentiment drove broad sell-offs in equities in the first part of the week. Recessionary fears and market nerves led to significant selling pressure in major indexes.

Today, however, markets are attempting to bounce back.

• SP 500 and Nasdaq 100 are trading higher as reports emerge that Iran may have approached the U.S. to discuss conflict de-escalation.

• Markets are sensitive to geopolitical headlines — both positive and negative — which is driving this seesaw action.

Some Context

Earlier in the week, the SP 500 and Nasdaq had fallen sharply as the conflict intensified, causing risk-off positioning and boosting demand for safe-haven assets. Oil and gas surged, and broader macro fear caused volatility to jump as investors reassessed inflation and rate expectations.

But the latest reports of possible negotiations and stabilisation efforts have helped stocks claw back some losses — particularly in technology stocks after earlier declines.

What This Means Now

Markets are still in a state of uncertainty, not calm — but short-term buyers have stepped in on dips, reacting to evolving geopolitical news. If conflict concerns ease, there is potential for further recovery. If tensions escalate again, volatility will likely rise and risk assets may slide once more.

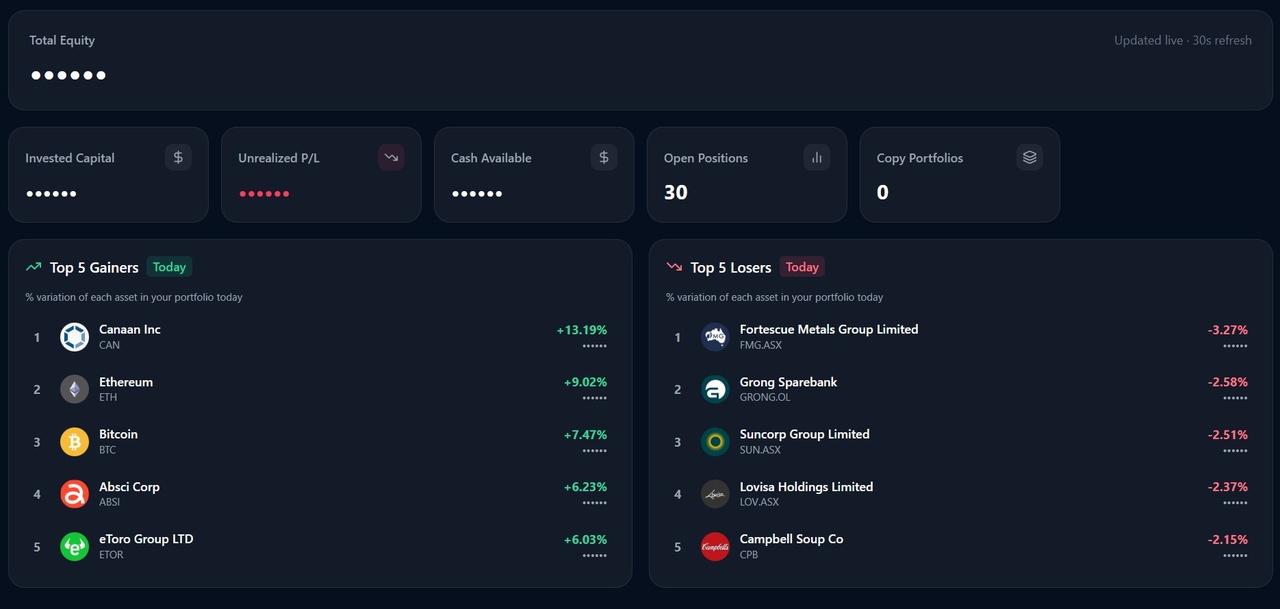

Several positions closed the day in positive territory, contributing to steady portfolio progression. The gains were broad-based and aligned with the current volatility structure the strategy is built around.

No aggressive moves — just disciplined execution, position sizing, and patience paying off.

As always, risk remains controlled and exposure is intentional.

𝗧𝗵𝗶𝘀 𝗶𝘀 𝘁𝗵𝗲 𝗽𝗲𝗿𝗳𝗲𝗰𝘁 𝘁𝗶𝗺𝗲 𝘁𝗼 𝗰𝗼𝗽𝘆 𝗺𝗲 𝗼𝗻 𝗲𝗧𝗼𝗿𝗼—𝗱𝗼𝗻’𝘁 𝗺𝗶𝘀𝘀 𝘁𝗵𝗶𝘀 𝗼𝗽𝗽𝗼𝗿𝘁𝘂𝗻𝗶𝘁𝘆 𝘁𝗼 𝗴𝗿𝗼𝘄 𝗮𝗹𝗼𝗻𝗴𝘀𝗶𝗱𝗲 𝗺𝘆 𝘀𝘁𝗿𝗮𝘁𝗲𝗴𝘆.

😎 𝗗𝗶𝘀𝗰𝗹𝗮𝗶𝗺𝗲𝗿: This is my personal opinion and is for informational purposes only. You should not interpret this information as financial or investment advice

$ETH (-0,32%)

$BTC (-0,23%)

$TSLA (+0,13%)

$AMZN (-0,22%)

$NVDA (+2,01%)

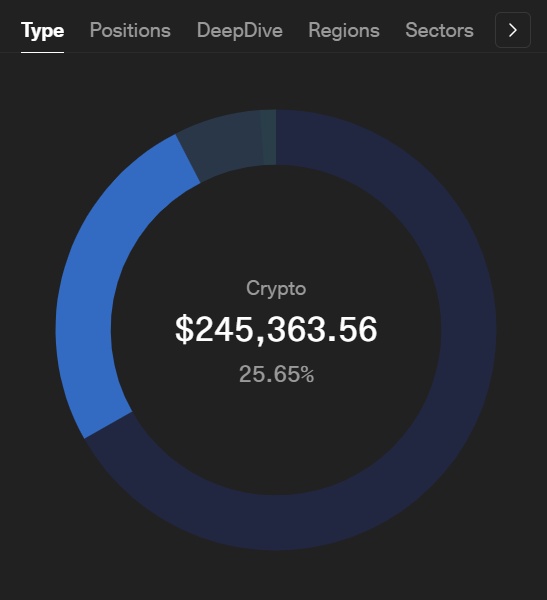

Crypto Allocation

Our crypto allocation is currently ~25%, holding $BTC (-0,23%)

$HYPE (-0,71%)

$ETH (-0,32%)

$GRASS (-1,64%)

$SAHARA (-0,36%) and $SPX (-1,69%) , the aim is to bring it to around 30%, even though we were, at first, exclusively focused on crypto. Any suggestions? 👀

GQ Community - please explain crypto to me

For a long time I looked at the crypto market and saw nothing but a digital casino.

Between the 10,000% "to the moon" pumps and the endless sea of meme coins, it’s hard not to feel like the whole thing is just a giant game of bulls***.

I’ve spent the last few weeks watching YouTube videos and I have to admit that the Bitcoin ecosystem is an absolute masterpiece. Seeing it explained as a decentralized, self-sustaining machine changed my perspective from " bulls*** " to "speculative innovation."

Very good videos:

https://www.youtube.com/watch?v=vclZlAFXpEI

https://www.youtube.com/watch?v=-D3ChoNtlX8

Please recommend more!

My Current Setup (Noob)

I’ve decided to start small. A low allocation just to start playing the game. Currently, I’m running a 90/10 split: (100€ monthly)

- 90% Bitcoin ($BTC (-0,23%)): It’s the king for a reason I guess.

- 10% Binance Coin ($BNB (-0,36%)): Just because of the 25% discount on trading fees on binance and it is too good to ignore.

I’m fully aware I’m still "uneducated" in this space. I love the idea of decentralized tokens, but I’m struggling to understand the utility of other altcoins without them feeling like a roll of the dice.

Is a 90/10 BTC/BNB split too "safe," or is it the smartest way to start?

Are there other "beautiful machines" (actual utility projects) I should look into that are not just hype and noise? Because when I look at $ETH (-0,32%) for example isn't it just Bitcoin but worst?

The 100€ montlhy deposit on binance is all automated but is it the best? I transfer to binance and then it auto converts 25€ each week to btc and bnb. I feel that I am paying more in spread for than I usually pay on spot trading for some reason. Please help

$BTC (-0,23%) , $ETH (-0,32%) , $SOL (-0,82%) , $USDT (+0,05%) , $USDC (+0,11%) , $XRP (-0,16%) , $AVAX (-0,59%) , $BNB (-0,36%) , $ADA (-0,08%) , $SHIB (-0,81%) , $DOT (+0,26%) , $DOGE (-0,33%) , $LUNA (-0,58%) , $ASML (+4,35%) , $NVDA (+2,01%) , $NVO (+3,01%) , $NOVO B (+2,75%) , $V (-0,53%) , $PLTR (-1,04%) , $MSFT (-0,07%) , $NFLX (-0,69%) , $IREN (+4,14%) , $NBIS (+5,83%) , $DAPP (+3,07%) , $CIFR (+3,59%) , $DUOL , $MCD (+0,72%) , $MA (-1,06%) , $MARA (+7,39%) , $SE (-1,89%) , $OSCR (+0,63%) , $UNH (-1,35%) , $CRM (-1,39%) , $NOW (-2,08%)

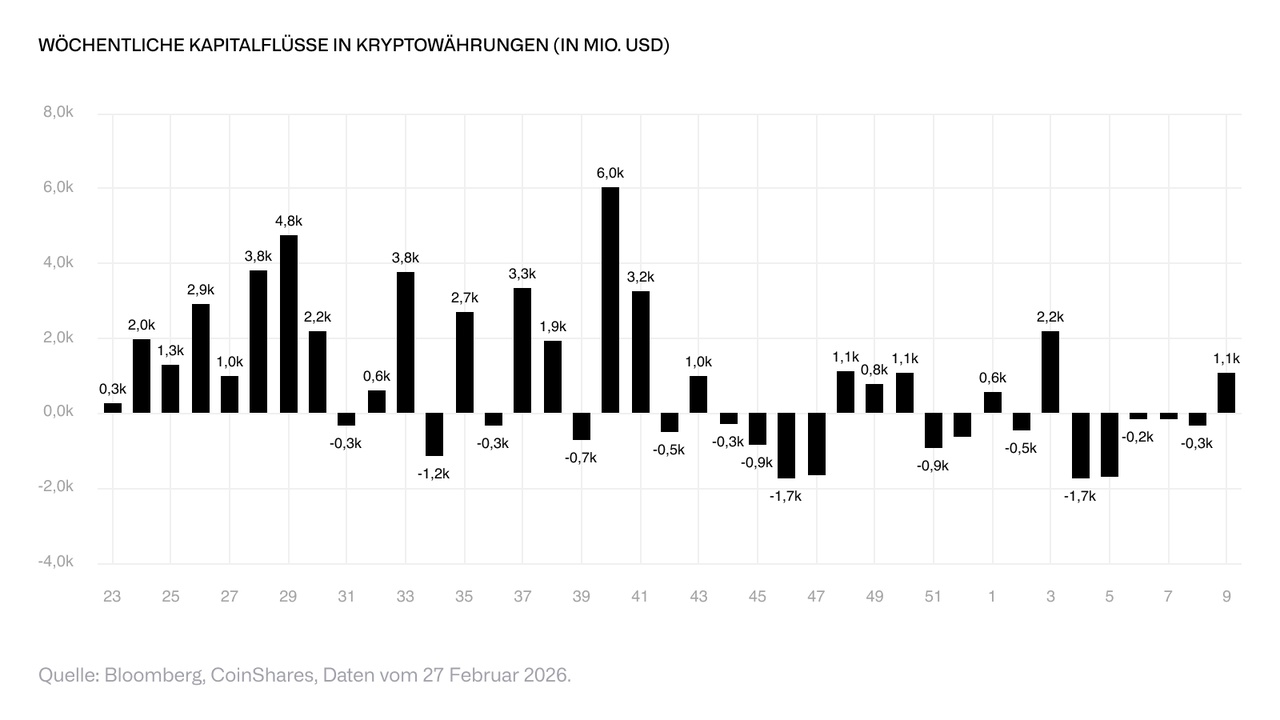

Inflows of one billion US dollars mark shift in sentiment for digital assets

Investment products on digital assets recorded inflows of USD 1 billion last week, ending a five-week period of outflows that totaled USD 4 billion. From a macroeconomic perspective, it is difficult to attribute the change in sentiment to a single trigger. However, the previously weak price performance, the break of important technical support levels and renewed accumulation by large $BTC (-0,23%)-holders are likely to have contributed to the trend reversal. Anecdotally, it can also be observed that recent client discussions are almost exclusively about attractive entry levels and no longer about reducing the allocation to this asset class.

Bitcoin was the main beneficiary, attracting USD 881 million. At the same time, inflows into short Bitcoin products amounting to USD 3.7 million illustrate that opinions continue to diverge. Ethereum also saw inflows totaling USD 117 million - the highest since mid-January. Both $ETH (-0,32%) and #bitcoin are still net negative since the beginning of the year.

$SOL (-0,82%) In contrast, inflows of USD 53.8 million were recorded last week and total USD 156 million since the start of the year. At $LINK (-0,53%) (Chainlink) saw inflows of a moderate USD 3.4 million, while there were no significant outflows.

You can invest in Bitcoin, Ethereum, Solana and Chainlink via the following vehicles:

Crypto market: nerves on edge - but is the bottom approaching?

Digital assets remain in consolidation. $BTC (-0,23%) has been fluctuating between USD 67,000 and 70,000 for weeks, while major market participants continue to sell: an estimated USD 30 billion has flowed out of so-called whales since October 2025. At 64%, their share of exchange deposits is at its highest level since 2015 - a clear supply overhang.

Macroeconomic headwinds also remain: a more restrictive tone from the US Federal Reserve and dampened expectations of interest rate cuts are putting pressure on risk appetite. Spot Bitcoin and $ETH (-0,32%)-ETFs recorded outflows of USD 4.3 billion for five weeks in a row.

And yet: the first signs of a bottom are becoming visible. Bitcoin's relative strength index fell to 16 - historically an extreme value in oversold territory. Leverage ratios have fallen significantly, valuation ratios are normalizing and inflows of around USD 1 billion have returned for the first time this week.

The environment remains fragile in the short term. But structurally, the conditions for the next phase of expansion could slowly emerge. (Text by James Butterfill, CoinShares' Head of Research)

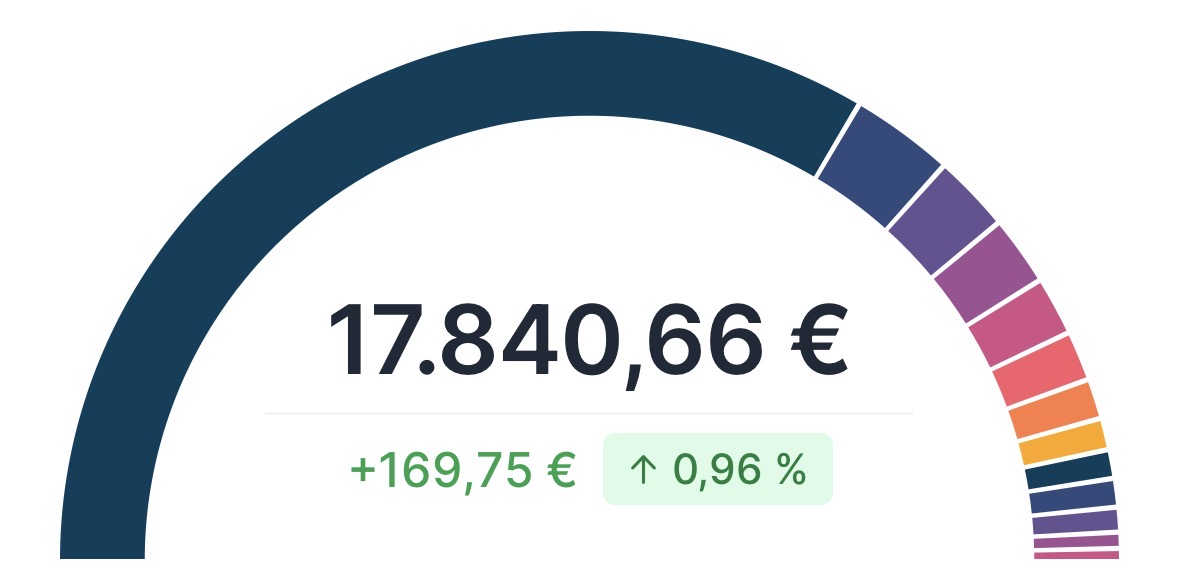

📊Depot development February 2026/ YTD

Before March gets off to a turbulent start tomorrow due to the unrest in the Middle East (my gold will be happy!?), I am enjoying the fact that February just ended so green.

A whole 0.96%📈 positive return was achieved in February.

(According to getquin even 1.6%📈🧐)

_________________________

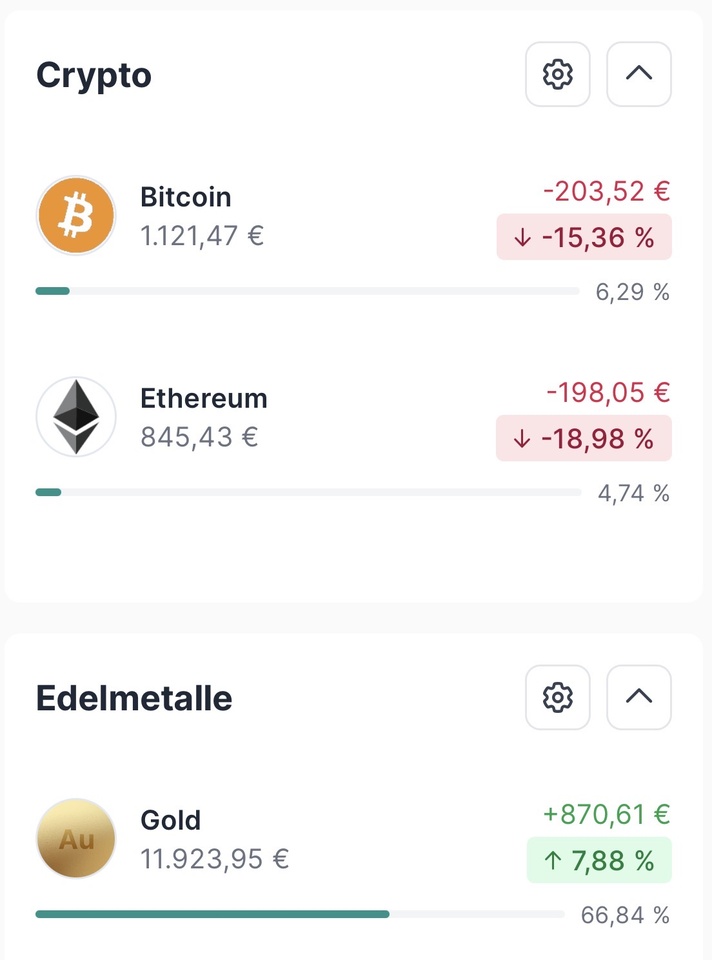

Winners and losers February 2026,

sorted by percentage return

Individual stocks:

$CVX (-1,57%) + 7,5% 📈

$ONDS (-2,44%) + 7,3% 📈

$PNG (+7,57%) + 3,5% 📈

$RBRK (-0,4%) - 1,5% 📉 (added 27.02.)

$LMND (+0%) - 10,8% 📉 (added 24.02.)

$RKLB (+1,66%) - 13,8% 📉

$SOFI (-1,29%) - 22,1% 📉

$IREN (+4,14%) - 26,4 % 📉

Derivatives:

$DE000PF5R6A4 (-5,97%) + 47% 📈 (Has been running since 10.02.2026)

$DE000VH5Y352 (-6,22%) - 27,4% 📉 (Has been running since 02.02.2026)

Crypto:

$BTC (-0,23%) - 15,4% 📉

$ETH (-0,32%) - 18,9% 📉

Precious metals:

$4GLD (-0,83%) + 7,9% 📈

________________________

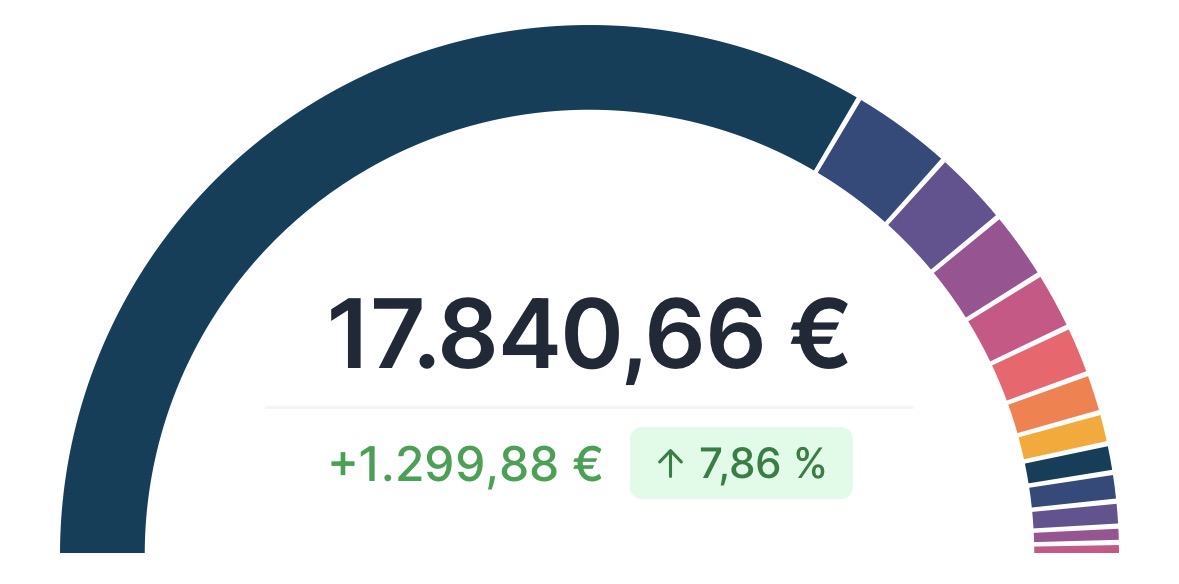

Since the beginning of the year

The year started with just under €15,000.

Annual target: €25,000.

Almost 28% of this has already been achieved. So I'm on the right track.

Positive return of + 7.86% 📈

_________________________

Distribution of assets

What does your February look like?

+ 4

The war in the Middle East has begun! 🚀 🔫

https://www.perplexity.ai/page/bitcoin-plunges-as-us-and-isra-MSfIUjUOQpOKHHKNvhYycg

$BTC (-0,23%) and $ETH (-0,32%) send it down already.

Apart from the financial and economic situation, we hope for the best from a human perspective, although this is virtually impossible in war.

Expect a deep red start to the day on Monday.

Have a nice weekend everyone.

🚀 Ethereum: quantum-safe & faster blockchain + focus on real DeFi standards

Ethereum is planning big changes: The second largest blockchain in the world wants to significantly faster and at the same time quantum secure against future threats - and at the same time, co-founder Vitalik Buterin calls for a new balance in DeFi, moving away from half-hearted projects towards real, secure decentralized financial systems. These are important signals for crypto investors and developers alike.

_________________________

⚡ 1. $ETH (-0,32%)

should become faster and quantum-safe

Ethereum has a long-term four-year roadmap that envisages some fundamental changes:

🚀 Drastically reduce block time

- Ethereum currently needs around 12 seconds per block.

- The goal is to reduce it to up to 2 seconds - for faster transactions and a better user experience.

- This is to be achieved by decoupling slot time and finality.

🧠 Finality in seconds instead of minutes

- The time until a transaction is considered irrevocable (finality) still takes around 16 minutes.

- A range between 6 and 16 seconds - significantly faster than before.

🛡️ Quantum security to protect the future

- Ethereum is planning the use of post-quantum secure cryptographyto protect the blockchain against the threat of future quantum computers.

🧩 Seven forks by 2030

- Over the next four years seven fork upgrades are planned, roughly every six months - including already confirmed steps such as Glamsterdam and Hegotá.

➡️ This technical vision, known as Strawmapis designed not only to make Ethereum faster, but also to increase its security and resilience in the long term.

_________________________

🧠 2 Vitalik Buterin calls for stricter DeFi standards

In addition to the technical roadmap, Vitalik Buterin emphasizes that Decentralized finance (DeFi) must become more mature and secure:

🎯 No support for unsafe projects

- In future, the Ethereum Foundation will only secure, truly decentralized protocols support.

- Projects that have admin keys or centralized control points are considered a risk and will not receive funding.

🚶 The so-called "walkaway test"

- Buterin demands that DeFi protocols continue to functioneven if their developers are no longer around - a sign of true decentralization.

➡️ In this way, Ethereum wants to prevent many so-called DeFi projects from ultimately becoming heavily dependent on centralized components.

_________________________

📊 3. why this is important for investors & developers

💡 Positive implications

- Higher block speed makes Ethereum more attractive for applications and users - and could more usage and demand generated.

- Quantum security addresses a long-term risk that many crypto investors underestimate.

- Stricter DeFi standards could protect the industry from security incidents and loss of trust.

⚠️ Risks & challenges

- Implementation over seven forks and years is complex and technically demanding.

- Transitions to new forms of cryptography can lead to network risks if they are not implemented properly.

- Stricter DeFi criteria could slow down innovations that do not comply with the new standards in the short term.

_________________________

📌 Conclusion

Ethereum is on the verge of a major transformation:

✅ Block times are to drop massively - from 12 s to 2 s.

✅ Transaction finality is to be achieved at the second level.

✅ The blockchain should be quantum-safe become quantum secure.

✅ DeFi ecosystems should meet real decentralized finance standards to comply with them.

_________________________

Sources:

IT Blotwise: Ethereum plant schnellere und quantensichere Blockchain

As a crypto beginner and NoCoiner, I am often irritated by some of the comments from totalitarian Bitcoin advocates.

They often say that you should only invest in $BTC.

However, when I listen to podcasts with experts (e.g. "Alles auf Aktien"), they also speak quite positively about $ETH.

What can I believe, or what are the pros and cons, what are the prospects for both cryptocurrencies, and which can benefit or suffer from which government regulations? ✌🏼