$DIS (+0,43 %)

$PLTR (+1,78 %)

$SRT (-0,78 %)

$NXPI (-1,01 %)

$PYPL (-2,52 %)

$PEP (-0,26 %)

$TER (-4,13 %)

$CPRI (+2,68 %)

$MRK (-3,17 %)

$PFE (+0,17 %)

$TTWO (+2,74 %)

$EA (-0,36 %)

$AMD (-2,88 %)

$MDLZ (+0 %)

$LUMN (-1,16 %)

$SMCI (-4,16 %)

$7011 (+2,12 %)

$6752 (-1,35 %)

$6367 (-4,33 %)

$UBSG (+0,61 %)

$GSK (-1,9 %)

$UBER (+2,85 %)

$ABBV (-0,93 %)

$LLY (-0,72 %)

$GOOG (-1,85 %)

$ELF (+1,73 %)

$QCOM (-0,36 %)

$SNAP (+3,03 %)

$WOLF (-0,87 %)

$ARM (-2,84 %)

$VOLCAR B (-0,02 %)

$6758 (+6,02 %)

$SHL (+0,94 %)

$SAAB B (+0,22 %)

$5401 (-2,17 %)

$MAERSK A (+1,33 %)

$R3NK (+0,14 %)

$BMY (-0,71 %)

$BMW (+0,32 %)

$EL (-1,56 %)

$ROK (+2,29 %)

$PTON (-0,29 %)

$KKR (-2,18 %)

$LIN (-0,7 %)

$RL (+0,56 %)

$AGCO (-0,07 %)

$RBLX (+5,24 %)

$FTNT (+1,85 %)

$REDDIT (-0 %)

$ILMN (+4,68 %)

$WMG (+4,13 %)

$IREN (-2,7 %)

$MSTR (-2,02 %)

$AMZN (-1,79 %)

$KOG (-1,43 %)

$ORSTED (-1,7 %)

$PM (-1,43 %)

$WEED (-3,05 %)

Discussion sur REDDIT

Postes

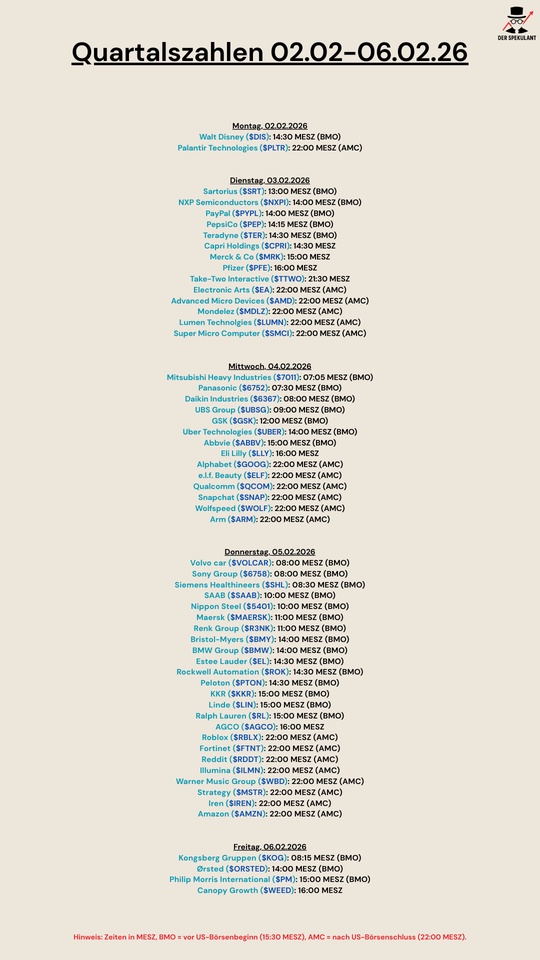

7Quarterly figures 02.02-06.02.26

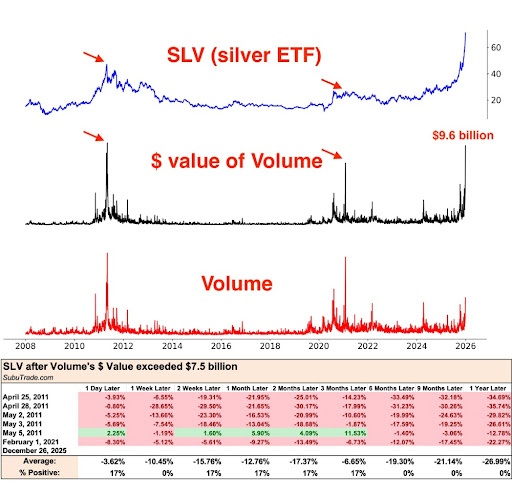

Commodities | Is the silver correction coming?

$SLV (-0,51 %) has now reached the same level as in 2011 and 2021 if you look at the volume, which historically indicates overheating. Statistically, the probability of falling prices over a period of 1-12 months after such a volume peak is almost 100%. The average setback after one year was historically -26.99%.

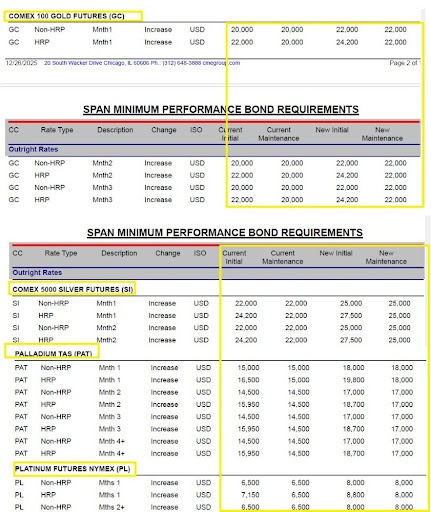

In addition, the CME has carried out margin increases. This was yesterday (26.12) and means that margins for silver futures are being increased, 14% to be exact. This usually leads to deleveraging, traders have to either immediately cash in their highly leveraged positions or sell their positions. Paper money goes!

In short, we are very likely to see a drop in price next week, which does not necessarily mean that silver has ended its bull trend, quite the opposite. If you look at the 2011 silver rally, you will see that the rise to almost 50$ was primarily speculative. Investors fled into metals due to the euro crisis and US debt concerns. The sell-off came when the COMEX raised margins by 30 and forced selling. And 2021 was a short thing when $REDDIT (-0 %) User tried to bring banks to their knees. 2025 looks different. We are currently in the 5th consecutive year of a structural deficit. Around 59% of demand today comes from industry. The solar industry in particular is a huge consumer and is estimated to consume over 195 million ounces in 2025. These buyers will have to buy silver, no matter what the price, to maintain their production. Another sign of a real shortage is the increased rates for leasing silver (7%), which shows that there is hardly any physical silver available in the warehouses. This means short term we are seeing a sell off, but long term I am still bullish!

Quarterly figures 27.10-31.10.25

$KDP (+1,45 %)

$7751 (+1,2 %)

$NXPI (-1,01 %)

$WM (+1,47 %)

$CDNS (-1,22 %)

$BN (+1,23 %)

$SOFI (-2,08 %)

$UNH (+1,11 %)

$AMT (+0,8 %)

$UPS (+2,25 %)

$BNP (+0,32 %)

$NVS (-1,06 %)

$DB1 (+3,27 %)

$MSCI (+2,97 %)

$ENPH (-6,02 %)

$BKNG (+2,19 %)

$LOGN (+2,66 %)

$V (+0,74 %)

$MDLZ (+0 %)

$PYPL (-2,52 %)

$000660

$MBG (+0,09 %)

$BAS (+1,31 %)

$UBSG (+0,61 %)

$SAN (-0,36 %)

$CVS (+2,46 %)

$OTLY (+0 %)

$GSK (-1,9 %)

$ETSY (+3,2 %)

$CAT (-2,23 %)

$KHC (+0,72 %)

$ADYEN (+3,13 %)

$ADS (+2,48 %)

$AIR (+0,71 %)

$SBUX (+0,05 %)

$CMG (+0,72 %)

$META (+0,08 %)

$KLAC (-1,39 %)

$MELI (-1,63 %)

$WOLF (-0,87 %)

$GOOGL (-1,74 %)

$EQIX (-1,19 %)

$MSFT (-1,55 %)

$CVNA (+5,46 %)

$EBAY (+3,09 %)

$005930

$6752 (-1,35 %)

$KOG (-1,43 %)

$VOW3 (+0,72 %)

$GLE (-1,19 %)

$LHA (+2,55 %)

$STLAM (+4,18 %)

$SPGI (+2,45 %)

$MA (+0,96 %)

$PUM (+7,9 %)

$AIXA (+4,21 %)

$FSLR (-4,83 %)

$AAPL (-0,23 %)

$REDDIT (-0 %)

$AMZN (-1,79 %)

$NET (+2,68 %)

$MSTR (-2,02 %)

$GDDY (+5,86 %)

$TWLO (+1,72 %)

$COIN (-2,41 %)

$066570

$CL (+0,91 %)

$ABBV (-0,93 %)

$XOM (-0,25 %)

Insights from the Reddit analyst conference - growth, monetization and the future of the community

I had the opportunity to attend a really exciting analyst conference with Steve Huffman, the co-founder and CEO of Reddit ($REDDIT (-0 %) ), took part.

It was a very insightful conversation where a lot of interesting points about Reddit's strategy, growth and future vision until 2025 came up.

Right at the beginning of the Q&A session, the analyst looked back on the year since the IPO and asked about the key findings, changed priorities and biggest surprises. Huffman was very satisfied with the past year. He recalled that in 2015, the year of its return, Reddit recorded a turnover of just 12 million US dollars with 12 million daily active users (DAU). Last year, however, significant milestones were reached: 100 million DAU, over 1 billion US dollars in revenue and profitability for the first time. Huffman cited the following as the most important findings continuity in strategy and communication as the driving force behind these results.

Another important topic was the user development in the USA . The analyst addressed a slight sequential decline in logged-in DAUs in the US in the last quarter and asked about the reasons and whether this was an exception rather than a permanent trend. Huffman put this into perspective by pointing to the overall strong user growth of 39% in the last year and a growth in logged-in users of over 27% per quarter. per quarter. He explained the decline in logged-in users with fluctuations in traffic from Google due to algorithm changes.

Interestingly, Reddit simultaneously observed an increase in increase in search queries for "Reddit" on Googlesuggesting that internet users are generally interested in Reddit's content. Huffman emphasized that last year, Reddit was the sixth most searched word on Google last year. The current figures for the USA are 48-49 million DAU and 170 million weekly active users (WAU)which underlines the huge potential to convert these weekly users into daily users.

With regard to Google the analyst asked about the development of the relationship, the mutual benefit and the dependence on Google as a traffic source. Huffman emphasized that one of the main differences with other companies with high Google traffic is that Reddit receives much of its traffic directly. He pointed out that revenue growth in the fourth quarter remained strong at over 60%, although there were slight fluctuations in Google traffic. Huffman sees the relationship with Google as fundamentally positiveas Reddit improves Google's search product with its content. He also mentioned the collaboration in the area of AIwhere Google is a customer for Reddit data, while Reddit is a large cloud customer. There is also collaboration on security issues.

Another point was the possible influence of Google AI Overviews on engagement trends. Huffman argued that AI can never replace the human interaction and communitythat makes up Reddit's core product. He sees Google more as a tool that helps users navigate Reddit's vast content inventory. He also emphasized the development of a own AI-supported search product called "Reddit Answers"which is already delivering promising initial results.

With regard to the long-term user growth potential Huffman is very optimistic. He sees Reddit as a universal platform with communities for literally every interest. The goal is to grow from the current 100 million DAU to 1 billion DAU to grow. In the USA alone, with 170 million weekly users, he sees enormous potential to turn these into daily users. He also sees considerable growth potential outside the USA, where Reddit also has around 50 million DAU, and believes it is realistic that the ratio will shift towards 80-95% international users in the long term, similar to other major social media platforms.

The analyst also inquired about the early findings and the further development of Reddit Answers. Huffman described Reddit as more than just a technology product, more like a living organism. He emphasized that in its 20 years, Reddit has become a massive collection of information and discussions that has been difficult for users and the wider internet to access, as Google only indexes a fraction of the Reddit corpus. Reddit Answers was developed as a 90-day prototype to test whether there is real added value here. It allows users to ask subjective questions and then receives an AI-based summary of opinions and discussions from various Reddit communities. The plan is to Reddit Answers will be merged with the traditional search function within the Reddit platform to make the product more accessible and easier to use.

The topic on-platform search was also discussed in detail. Huffman gave a status update and explained the ongoing improvements such as smarter auto-complete, spell check, improved performance and ranking. The goal is to significantly improve traditional search and unify it with Reddit Answers. Huffman emphasized that an improved search appeals to all user groups and could therefore have a significant impact on DAU growth.

The monetization of searchfor example through ads on search results pages, is a long-term goal, but should only be tackled once the product has reached a consistent level of quality. An important growth area is the internationalization. Huffman spoke about the first positive experiences with the use of machine translation of the English-language Reddit corpus into other languages using Large Language Models (LLMs). France was the first country to launch this last year and has seen very strong growth. In general, countries with machine translation are growing 30-40% faster. The long-term goal is for each country to develop independent communities with local content. In selected focus markets Reddit works intensively with local moderators and organizes meet-ups to boost community growth.

The analyst also addressed the strong revenue growth in particular the advertising revenue growth of 60% in the last quarter. Huffman attributed this to the improved effectiveness of the adsbetter targeting and, in particular, progress in the area of performance advertising . Reddit saw a record number of advertisers in the fourth quarter, especially small and medium-sized companies for whom performance is crucial. Huffman still sees years of growth potential by implementing known and proven advertising strategies from other platforms.

A newer ad format is the conversational ads. Huffman confirmed their good performanceas they are placed on the conversation pages that form the heart of Reddit and are often about specific questions, decisions or products. These pages are also frequently reached by users who come via Google. Huffman therefore sees a great opportunity here, to better monetize logged and non-logged usersby displaying more relevant ads based on the page content.

One question from the Reddit community concerned the video experience on the platform given the success of TikTok and Instagram Reels. Huffman emphasized that Reddit is a conversational platform platform that is driven by what users want to talk about and therefore offers different content formats supported. Video is one of the fastest growing formats on Reddit, but differs from other platforms in its focus on the topic ("camera out" vs. "camera in"). Huffman again mentioned Reddit Lite as an experiment to improve the improve the integration of different content formats and to make Reddit equally attractive for text and video.

An important growth driver in the past year was data licensing. Huffman emphasized the immense value of Reddit's nearly 20-year corpus of conversations and mentioned the deals with Google and OpenAI to use the data for training their LLMs. Huffman continued to be open to further data licensing dealswith both large AI companies and smaller providers of social listening or financial services.

The final question from the Reddit community was about the future development of the future development of the product and community over the next 10 years. Huffman summarized the four main priorities summarized: Improving the core product, growing the advertising business, expanding search and internationalization. The long-term goal remains, 1 billion users by improving product quality and converting weekly users into daily users.

To summarize, Steve Huffman has given a very optimistic outlook on the future of Reddit. The milestones achieved in user growth, revenue and profitability in the past year underline the company's successful strategy. Particularly exciting are the developments in the area of search with Reddit Answers and the efforts towards internationalization through machine translation. Progress in the advertising business and the potential of data licensing also point to further growth.

The challenges of monetizing users who are not logged in and the integration of video content are being actively addressed. Overall, Reddit appears to be well positioned to reach its long-term goal of 1 billion users and further expand its position as a unique platform for community and discussion.

I hope you found this summary informative!

Reddit analyst conference recap - Reddit surpasses $1 billion in revenue and plans global expansion

Another exciting analyst conference last week was that of $REDDIT (-0 %) the fourth quarter and full year 2024. The fourth quarter marked the end of a significant year for Reddit. significant yearits first as a publicly traded company. In 2024, Reddit surpassed $1 billion in revenue, broke the 100 million mark in daily active users (DAU) and gained traction in several new countries around the world.

Financially The fourth quarter was the strongest of the year in financial terms, with revenue growth of 71 % compared to the previous year. Of particular note, international growth of 76% exceeded growth in the US for the first time since mid-2023. Adjusted EBITDA reached USD 154 million and GAAP net income USD 71 million. Gross margins increased to 92.6%2 in the fourth quarter. Revenue for the first quarter of 2025 is expected to be between USD 360 million and USD 370 million, which corresponds to year-on-year growth of 48% to 52%.

Operationally The company recorded strong growth in its advertising business, which increased by 60 % year-on-year to USD 395 million in the fourth quarter. This growth was driven by broad strength across all channels, sectors and regions. Of particular note was the 77% year-on-year growth in international advertising revenue, led by the UK and EMEA.

In the area of product development Reddit is focusing on improving the search function on the platform and making it the first port of call for information on Reddit. In the US, the beta version of "Reddit Answers" was launched, an AI-powered search tool that provides curated summaries of community discussions. Reddit has updated its mission to reflect both the creation of a platform for the community and the use of Reddit as a source of knowledge.

In the content licensing business Reddit partnered with Intercontinental Exchange to develop new data and analytics products for the financial industry.

In the subsequent analysts' Q&A session the following topics were discussed:

Reddit Answers: The initial results are promising, especially in terms of the depth of the answers. Reddit plans to integrate Reddit Answers into the general search function.

Google Search: Google's algorithm changes have historically led to fluctuations in traffic, mainly from non-logged-in users in the US. Reddit observed an increase in search queries with the term "Reddit", which indicates that users specifically want to access the platform.

Monetization of search: Reddit is inherently commercial, with many posts relating to products and services. Reddit Answers offers a great opportunity to monetize recommendations as users are searching with a high intent to purchase.

International growth: Reddit sees great potential for international growth as communities are universal. The company relies on machine translation and community work to drive growth in international markets.

Open source AI models: Reddit welcomes open-source AI models and utilizes both commercial and open-source models. The company believes that open source does not jeopardize licensing opportunities, as Reddit sells ongoing access to up-to-date information.

In summary, Reddit has had a strong quarter and a successful first year as a publicly traded company. The company is focused on improving product quality, increasing user growth, monetizing the platform and expanding into new markets.

I hope you enjoyed the summary.

Stay tuned!

Earnings Recap

$LLY (-0,72 %) Eli Lilly Earnings

Revenue: $11.44 billion vs. $12.11 billion expected ❌

Earnings per share: $1.18 adjusted vs. $1.47 expected ❌

Lowering guidance ❌

Stock down -7% pre-market ❌

$GOOGL (-1,74 %) Earnings

Revenue: $88.27 billion vs. $86.30 billion expected ✅

EPS: $2.12 vs $1.84 expected ✅

Stock up +6% pre-market ✅

$V (+0,74 %) Visa Earnings

Revenue: $9.62B vs $9.49B expected ✅

EPS: $2.71 vs $2.58 expected ✅

Stock up +2% pre-market ✅

$AMD (-2,88 %) Earnings

Revenue: $6.82 billion vs. $6.71 billion expected ✅

Earnings per share: 92 cents adjusted vs. 92 cents expected ✅

Guidance falls short. Stock down -8% pre-market ❌

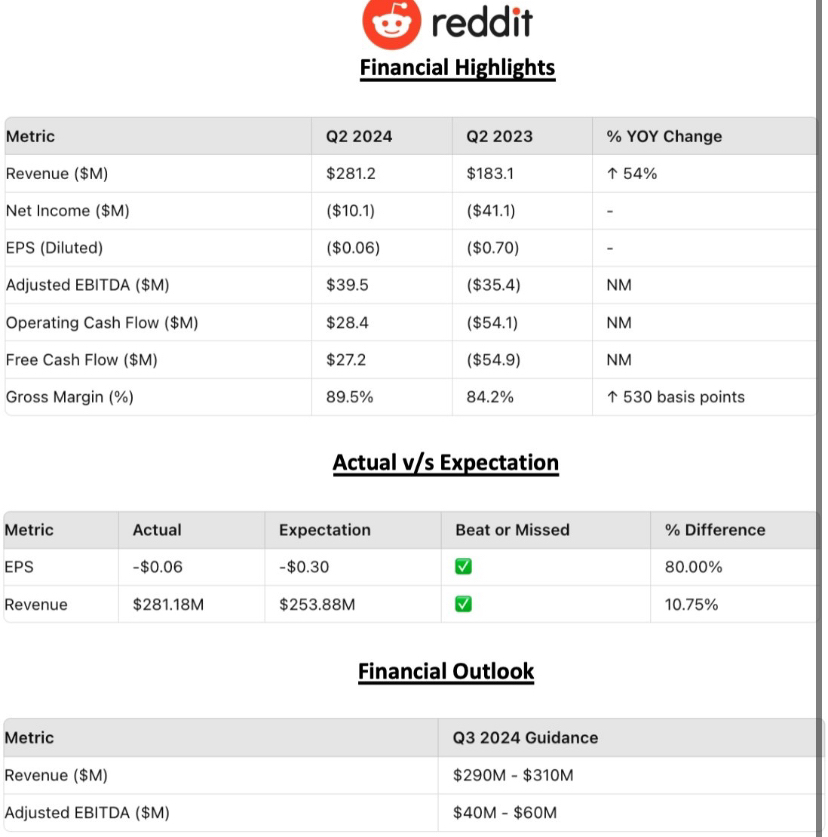

$REDDIT (-0 %) Earnings

Revenue: $348.4 million vs. $312.8 million expected ✅

Earnings per share: 16 cents vs. a loss of 7 cents expected ✅

Stock up 22% pre-market ✅