$ADS (+1,95 %) at a 3-year low.

Adidas

Price

Discussion sur ADS

Postes

125adidas with a strong year 2025.

$ADS (+1,95 %) with record sales of € 24.8 billion (+13% adjusted for currency effects), gross margin at 51.6%, operating result +54% to € 2.06 billion. Profit almost +70%. Growth came from all markets and channels - Running and DTC particularly strong.

Dividend proposal +40% to € 2.80 and an additional share buyback of up to € 1 bn.

I built up an initial position yesterday and will buy more today after the share price has fallen by around 5%. For me, the operating momentum remains intact.

PUMA after the recent rises - first all-clear?

After the heavy volatility of recent weeks, the PUMA share is finally showing strength again. The recent price increase is not only technical, but also has a fundamental tailwind.

The entry of Anta Sports as a new major shareholder (~29%) has restored confidence in the market. Even though it has been clearly communicated that no complete takeover is planned, the deal provides stability, imagination and strategic options - exactly what the share has been lacking recently.

From a technical perspective, PUMA was able to break away from the low and recapture important resistance levels. Momentum is clearly positive in the short term, even if the share is likely to remain volatile.

⚠️ What remains important:

PUMA is still in the midst of operational restructuring. The turnaround is not a foregone conclusion, but the market seems to be ready to award advance praise again.

Biggest losers in 2025 (in euros 🐻)📉 Which ones do you see potential in?

-72% The Trade Desk $TTD (+1,63 %)

-72% Fiserv $FI (+0,15 %)

-65% Dogecoin $DOGE (-0,26 %)

-65% Cardano

-61% Gerresheimer

-60% Enphase Energy $ENPH (+1,72 %)

-59% CarMax $KMX (+0,25 %)

-57% Strategy $MSTR (+0,77 %)

-56% Deckers Outdoor

-56% Alexandria Real Estate

-50% Redcare Pharmacy

-50% PUMA $PUM

-50% lululemon

-49% Dow

-49% Novo Nordisk $NOVO B (+1,04 %)

-48% MARA $MARA (+0,3 %)

-48% Molina Healthcare

-47% FactSet

-47% Charter Communications

-47% HelloFresh

-45% Wolters Kluwer

-43% Solana $SOL (-0,81 %)

-43% Cocoa

-42% UnitedHealth $UNH (+0,12 %)

-41% Atlassian

-41% Li Auto

-40% Copart

-40% Meituan

-38% PayPal

-38% Chipotle Mexican Grill

-36% TeamViewer

-35% GameStop $GME (+0,33 %)

-35% Orsted $ORSTED (-0,86 %)

-33% Pernod Ricard $RI (-0,12 %)

-33% Evotec

-33% Symrise

-31% Marvell Technology $MRVL

-30% Comcast

-30% Natural Gas

-30% Kraft Heinz $KHC (-0,35 %)

-30% Adobe $ADBE (+0,25 %)

-29% Salesforce $CRM (+0,7 %)

-28% Nike $NKE (+0,24 %)

-28% Adidas $ADS (+1,95 %)

-27% Sugar

-27% XRP $XRP (-0,16 %)

-26% Stellantis $STLAM (-1,63 %)

-25% JD .com

-24% Procter & Gamble $PG (-0,05 %)

-23% Arm $ARM (+0,29 %)

-22% Ferrari $RACE (+1,03 %)

-22% Porsche AG $P911

-21% Zalando $ZAL (+1,21 %)

-21% NEL ASA $NEL (+2,59 %)

-21% Ethereum $ETH (-0,02 %)

-18% Bitcoin $BTC

-16% Brent Oil

-16% Delivery Hero

-13% Vonovia $VNA

-12% Coinbase $COIN (+0,35 %)

-11% SAP $SAP (+0,8 %)

-7% Amazon $ (+0,61 %)AMZN (+0,61 %)

SHOULD YOU OWN ADIDAS IN 2025 AS A DIVIDEND INVESTOR

YT: https://youtube.com/shorts/pfY20NyX5uA

A few days ago we took a look a $NKE (+0,24 %) , so lets check out if $ADS (+1,95 %) is doing better in form of performance, dividend-stats and outlook.

2025 was a bad year for $ADS (+1,95 %) if you look only at the performance of the stockprice. They had a negative return of 29% over the last 12 months. Other than that, the outlook is not too bad.

BUT the negative dividend-rate of -38% over the last 3 years is nothing you want to see as a dividend investor with a long investment horizon.

Let's see if $ADS (+1,95 %) can turnaround the performance and the dividends in 2026!

What are your thoughts about it?

#investing

#investingjourney

#dividends

#passiveincome

#financialfreedom

#stocks

#adidas

" Breaking News " Star investor was spotted in Germany

$QSR (-0,36 %)

$LULU (+0,38 %)

$ADS (+1,95 %)

$BIRK (+0,58 %)

$ZAL (+1,21 %)

$9983 (+2,56 %)

$US2533932016

Hello my dears,

I have just received the news that the star investor @Simpson has been spotted in the cathedral city with his son Bart.

( attached a few paparazzi shots ).

The on 12.

May 1956 Homer Simpson grew up with his father Abe Simpson, as his mother Mona Simpson had already left the family during his childhood.

There are now rumors that he has relocated to Germany.

Simpson has been spotted in front of branches of several large chain stores. There is already wild speculation online about which company his holding could invest in next.

Because the star investor has proven for years that he can find growth pearls well in advance. More and more small investors are following his strategy.

Interestingly, he was also spotted outside a Foot Locker store.

Foot Locker's global store network comprises around 2,400 locations in 20 countries. US sporting goods retailer Dick's Sporting Goods has confirmed that it will acquire footwear specialist Foot Locker for 2.4 billion US dollars (2.1 billion euros). Could even @Simpson could even get in between.

It remains exciting in the " Ultimate Holding "

+ 5

And Bart probably still has a junior portfolio.

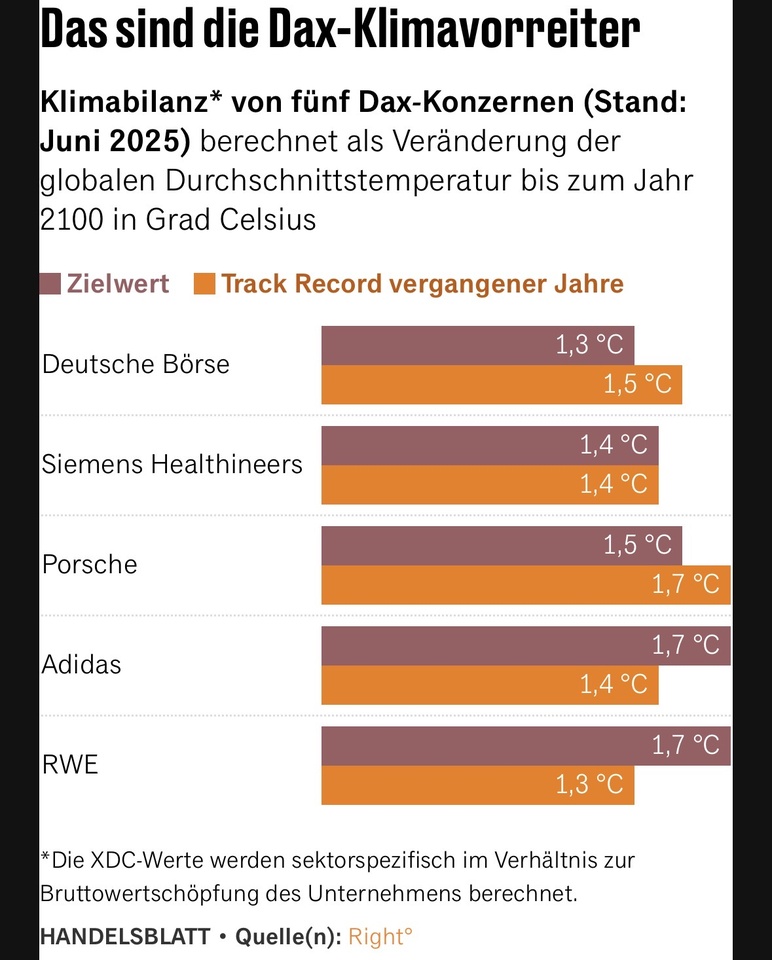

5 companies are climate pioneers in the DAX

The second "What if" report by climate tech company Right° was published on Thursday. Right° compares company data with the goals of the Paris Climate Agreement. Right° sets the limit value at a global warming of 1.7 degrees by 2100.

None of the 34 DAX companies analyzed would be Paris-compatible if no further measures were taken to reduce emissions. However, according to the data, twelve companies have decoupled their value creation from climate-damaging emissions in recent years to such an extent that they are on a Paris-compatible path.

And five of these companies also have a Paris-compatible climate target.

For companies, doing business in line with Paris means decoupling their value creation from climate-damaging emissions.

According to the "What if" report, the climate pioneers RWE $RWESiemens Healthineers $SHL (+0,09 %)Adidas $ADS (+1,95 %)Deutsche Börse $DB1 (+0,23 %) and Porsche, which was relegated from the DAX $P911. Both the climate targets and the track record of these companies are on a Paris-compatible path.

However, there are clear differences between the DAX companies in terms of their track record. Many are a long way off the targets of the Paris Climate Agreement.

Source text (excerpt) & graphic: Handelsblatt, 31.10.25

adidas deep red despite decent profit increase

Brief summary:

adidas posted a jump in profits in Q3 - nevertheless, the share price came under pressure. The final figures confirm the already raised outlook.

🧾 Figures at a glance

- Earnings before taxes (EBT) amounted to € 650 million, around +8% compared to the previous year.

- After taxes, profit from continuing operations amounted to € 482 million (previous year: € 469 million).

- The effect on earnings per share: € 2.57 (previous year: € 2.44).

- Including special effects and charges (e.g. currency-related effects), consolidated profit amounted to € 461 million compared to € 443 million in the previous year.

📉 Why is the adidas share slipping into the red?

Although the figures are solid, the market reacted negatively - reasons for this:

- Burdens from currency and hyperinflation-related effects reduced the financial result.

- In the conference to present the figures, the management stated that US retailers are currently more cautious when placing orders - this caused uncertainty.

- Despite measures to control US tariffs and adjustments to financial management, skepticism remained high.

On the day of publication, the share price fell by more than 5% at times in Xetra trading, most recently by almost 8%.

🔭 Outlook & assessment

- Operating profit for the year as a whole is now forecast at around € 2 billion. The first nine months already cover € 1.89 billion - the company is thus above the old target.

- Currency-adjusted sales are expected to increase by around 9%.

- Excluding the Yeezy brand, adidas expects double-digit sales growth for the adidas brand itself.

💡 Investor tips & thoughts

- The balance sheet shows that adidas is operating strongly and holding its own despite external burdens.

- In the short term, however, sentiment and statements on trading dominate - especially in the USA.

- For medium to long-term investors, the fundamental data could provide a reliable basis.

- Those who are already invested could view setbacks as an opportunity - with caution, as the environment is volatile.

Titres populaires

Meilleurs créateurs cette semaine