While I wandered through Rostock and Schwerin, spent a frugal night and found a moment of peace in Schwerin Cathedral, my depots simply carried on doing their thing. No hectic rush, no manual interventions, no nervous glances at my smartphone. The automation of my reinvestments, savings plans and standing orders is simply worth its weight in gold!

And then, right in that moment of silence in the cathedral, a message demanded my attention. It was the moment when the biggest dividend of the month arrived. A sign from the very top, or timing straight out of a picture book? Back home at the end of the month, a new player became apparent in the portfolio, which advanced into the top 5. But catching up with my strongest stock is still a long way off for the new challenger. Time for a review.

Overall performance

For me, November in general was the same as always: steady and boring. I didn't even really notice that the US budget shutdown had ended. Just as well, because business as usual can continue.

My key performance indicators for my overall portfolio at a glance:

- TTWROR (month under review): +1.40 % (previous month: +1.39 %)

- TTWROR (since inception): +79,75 %

- IZF (month under review): +18.54 % (previous month: +9.65 %)

- IZF (since inception): +11,22 %

- Delta: +1,211.47 €

- Absolute change: +€2,398.46

Performance & volume

$AVGO (+0.56%) remains the heavyweight in the portfolio, but as mentioned in the introduction, there is a new challenger that made significant gains in November and has now moved into the top 5. $GOOGL (-0.21%) pulls past $BAC (+1.09%) . They have just delivered. New Gemini and Nano Banana version. The constant new advances in AI are the clear driver here. But watch out! The question in the future will be who will earn money with AI. Will it be those who have integrated it into their products or those who create the basic prerequisites for its use via data centers and hardware? I am curious.

And even if this competition is super exciting, these values are not in my sights, more on that later in the outlook.

Size of individual stock positions by volume in the overall portfolio:

Share ( %) of total portfolio (and associated portfolio):

$AVGO (+0.56%) 3.57 % (main share portfolio)

$WMT (+0.46%) 1.75 % (main share portfolio)

$GOOGL (-0.21%) 1.56 % (main share portfolio)

$NFLX (+1.67%) 1.60 % (main share portfolio)

$BAC (+1.09%) 1.46 % (main share portfolio)

Smallest individual share positions by volume in the overall portfolio:

Share ( %) of the total portfolio (and associated securities account):

$NOVO B (+1.34%) : 0.45 % (main share portfolio)

$GIS (+0.86%) : 0.56 % (crypto follow-on portfolio)

$BATS (+0.47%) 0.57 % (main share portfolio)

$TGT (+0.56%) 0.57 % (main share portfolio)

$MDLZ (-0.02%) 0.59 % (main share portfolio)

Top-performing individual stocks

Shares with performance since initial purchase ( %) (and the respective portfolio):

$AVGO (+0.56%) : +369 % (main share portfolio)

$NFLX (+1.67%) +120 % (main share portfolio)

$GOOGL (-0.21%) +119 % (main share portfolio)

$WMT (+0.46%) +95 % (main share portfolio)

$OHI (+0.71%) + 90 % (main share portfolio)

Flop performer individual stocks

Shares with performance since initial purchase ( %) (and the respective portfolio):

$TGT (+0.56%) : -35 % (main share portfolio)

$GIS (+0.86%) : -35 % (main share portfolio)

$NKE (-0.76%) -31 % (main share portfolio)

$NOVO B (+1.34%) -29 % (main share portfolio)

$CPB (-1.14%) -26 % (main share portfolio)

Asset allocation

Equities and ETFs currently determine my asset allocation.

ETFs: 41.3 %

Equities: 58.6 %

Crypto: 0.0 %

P2P: less than 0.01 %

Investments and subsequent purchases

I have invested the following amounts in savings plans:

Planned savings plan amount from the fixed net salary: € 1,030

Planned savings plan amount from the fixed net salary, incl. reinvested dividends according to plan size: € 1,140

Savings ratio of the savings plans to the fixed net salary: 49.75

In addition, the following additional investments were made from returns, refunds, cashback, etc. as one-off savings plans/repurchases:

Subsequent purchases/one-off savings plans as cashback annuities from refunds: € 75.00

Subsequent purchases/one-off savings plans as a cashback annuity from bonuses: € 21.98

Subsequent purchases from other surpluses: € 0.00* (additional purchases are only made in December)

Automatically reinvested dividends by the broker: € 2.08 (function is only activated for an old custody account, as I otherwise prefer to control the reinvestment myself)

Unscheduled purchases were made on various securities accounts outside the regular savings plans:

Number of unscheduled purchases: 9

21.98 € for $SPYW (-1.44%)

35.00 € for $SPYW (-1.44%)

40.00 € for $GGRP (+0.81%)

35.00 € for $GGRP (+0.81%)

Passive income from dividends

I received € 113.15 in dividends (€ 82.45 in the same month last year). This corresponds to a change of +37.36 % compared to the same month last year. For a rather weak month, this is a great sum, which I am grateful for and from which I made a small donation in addition to reinvesting, as I did in September and October. Other key figures:

Number of dividend payments: 22

Number of payment days: 10 days

Average dividend per payment: € 5.60

average dividend per payday: € 12.32

The top three payers in the month under review were:

My passive income from dividends (and some interest) mathematically covered 12.59% of my expenses for the month under review. Acceptable for a weak month with medium-high expenses (by my standards).

Crypto performance

As I play by the cycle theory, I got out of crypto completely in October. The share was previously insignificant in my portfolio anyway, but the harvest has nevertheless been reaped. Only the Oracle of Delphi knows whether I am right with my approach. There was more in an earlier getquin post from me, in which I explained my assumptions and strategy in detail.

So there are no key figures to report. Now it's time to learn and understand.

Performance comparison: portfolio vs. benchmarks

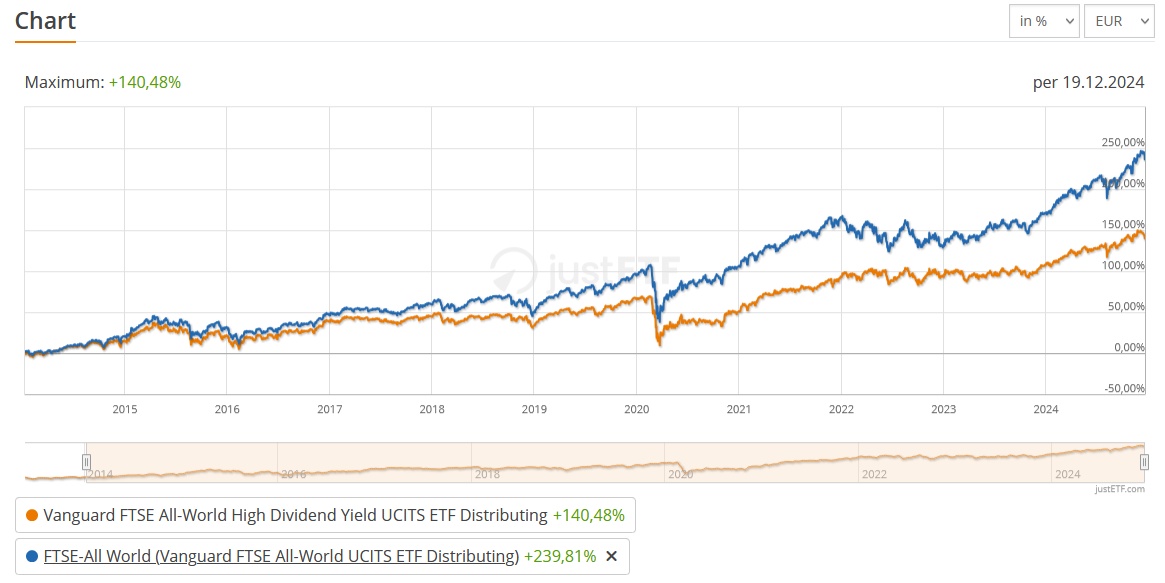

A comparison of my portfolio with two important ETFs shows the TTWROR in the current month (and since the beginning):

My portfolio: +1.40 % (since I started: +79.75 %)

$VWRL (-0.16%) -0.50 % (since my start: 62.52 %)

$VUSA (+1.3%) -0.48 % (since my start: 58.04 %)

Finally performed better than my chosen benchmark ETFs.☺️

Risk figures

Here are my risk figures for the month under review:

Maximum drawdown: YTD: 17.17% (month under review: 2.34%)

Maximum drawdown duration: 702 days since inception (reporting month: 14 days)

Volatility: YTD: 28.15 % (in the month under review: 2.44 %)

Sharpe Ratio: YTD: 0.39 (in the month under review: 7.63)

Semi-volatility: YTD: 20.91 % (in the month under review: 1.75 %)

The maximum drawdown of 702 days since the beginning is a long period 2022-2023 before the year-end rally began at the end of 2023. Otherwise the figures suit me well.

My Sharpe ratio of 0.39 YTD shows that I have achieved a return of 0.39 units above the risk-free rate per unit of risk.

My vola of 28.15% YTD is the direct footprint of the loud roar and then small cave-in of Trump's tariff policy. It has proven itself again: For me as a long-term investor, what counts is simply staying calm and buying the dip when another dip comes.

Outlook

I still have some money left over from my food and drugstore budget, but I won't be (re)investing it until December with the surpluses I hope to have by then. I've chosen a boring REIT that won't be $O, but still pays out monthly dividends and has long been a position in my portfolio. Strictly speaking, I've seen little or no mention of this stock among the financial tycoons recently. You'll see which one in the next review.

The last point will be a little more personal again. Loyal readers of my reviews will know from the August review that this summer I was diagnosed with aortic ectasia of the ascending aorta near the heart as a result of the bicuspid and insufficient aortic valve. An incidental finding that will be treated with the necessary seriousness through close monitoring and an upcoming operation. And precisely because of this, it is no longer the ticking time bomb that it would be if it were still undetected and possibly larger. The knowledge of this and now my own adjustment to day X is gradually changing my way of thinking. Before the discovery, when I was just a patient with a leaky aortic valve who regained a lot after changing my lifestyle for the better, e.g. exercise, I was influenced by the idea that I had a lot of time to implement what was on my mind. Now I know that I want to get a few things done before the day of the procedure and the lengthy recovery. I am now aware of the issue of time in a whole new way. Why am I writing this publicly? Because I want to show that finances are certainly important, but only one piece of the puzzle of life.

So, that's enough writing. With that in mind, have a wonderful Christmas.

Thank you for reading. Stay healthy and happy!

👉 You can also see my review on Instagram from next week (portfolio review from 8.12.25 and budget review from 9.12.25).

📲 In addition to the portfolio and budget review, there are currently three posts a week: @frugalfreisein

!!! Please pay close attention to the spelling of my alias. Unfortunately, there are too many fake and phishing accounts on social media. I have already been "copied" several times.

👉 How was your month at the depot? Do you have any tops and flops to report? Leave your thoughts in the comments!