Dear getquin community

Having been a silent reader here for a few months now, I would like to briefly introduce myself and my journey so far. Before I do, however, I would like to say a big thank you to everyone who regularly shares very exciting posts here and helps this community to grow. You are not only convincing in terms of content, but also create a really pleasant atmosphere in the forum with your appreciative way of writing.

My Story

Against the background and with the expectation of a substantial inheritance, I have been looking into investment opportunities as a complete newcomer to the stock market since the beginning of 2025. As I wanted to gain some experience first, I started investing my annual savings on a trial basis instead of paying off my mortgage as usual.

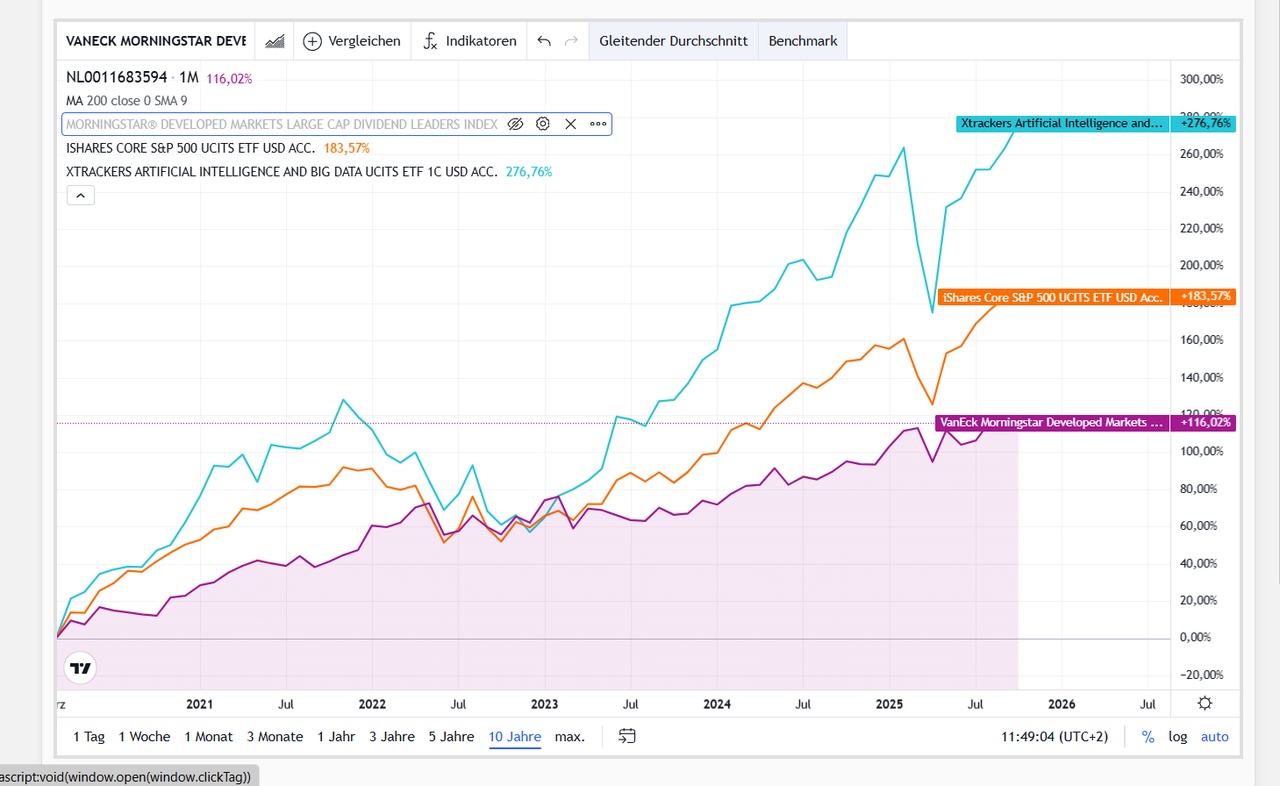

I started with an investment in $SPYI (-0.76%) . As I didn't like the heavy weighting of the USA, in a second step I tried to build up a 35/25/30/10 ETF portfolio with a weighting of the world regions by GDP. The result did not convince me due to the complexity (at times over six ETFs → manual rebalancing effort) on the one hand and the manageable long-term return prospects on the other. In the meantime, I had the idea of investing in slightly better-performing and riskier thematic ETFs such as $SEMI (-2.37%) and $XAIX (-0.07%) but in the end this only led to an even more complex setup.

I then decided to try a buy-and-hold approach based on individual stocks, but was quickly impressed by the return prospects of riskier stocks. So - also influenced by posts here in the forum - I went all-in at the beginning of November with $IREN (-2.7%) at a buy-in of around € 61 at the time. I now know that this impulse is called "FOMO" 🙂. When a sharp correction immediately began, I realized that return also means risk and that timing plays a role when buying individual stocks. Encouraged by posts here in the forum, however, I didn't sell in a panic, but continued to buy during the correction phase until I was able to reduce my buy-in to €45 at the end of December.

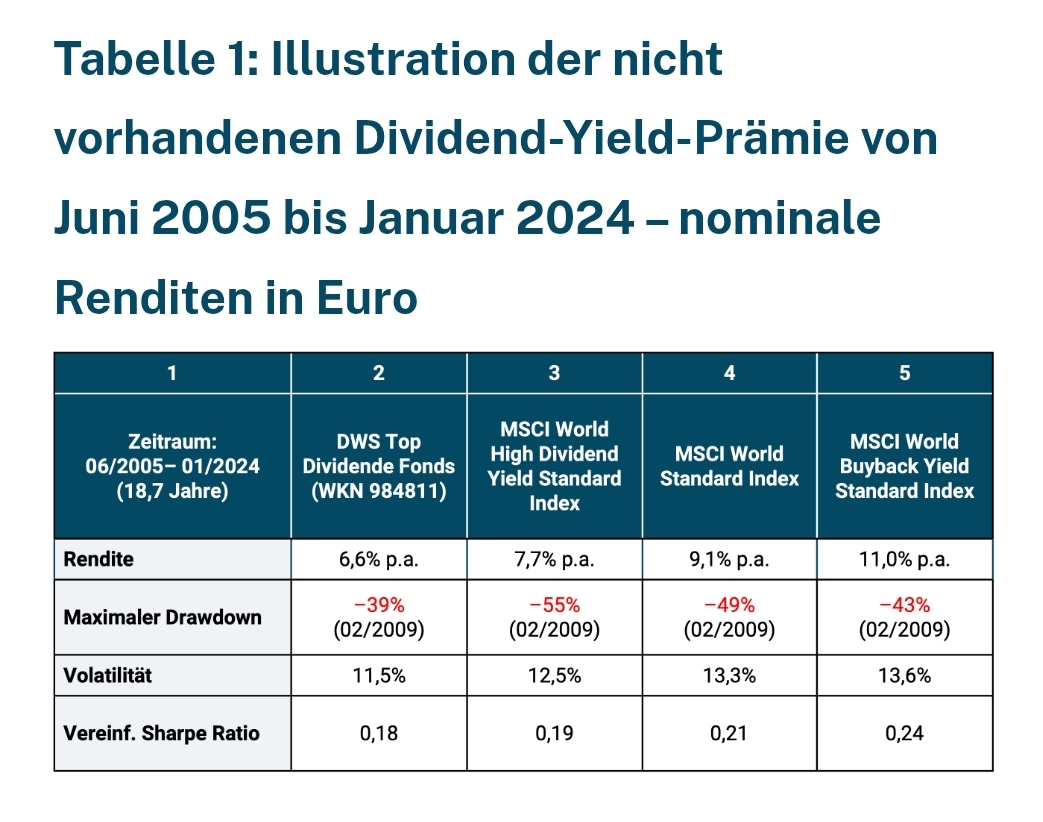

I am now slightly in the green again and the further prospects do not currently motivate me to sell my shares. I am setting myself a price target in the region of the old ATH in order to then reduce the position to a more reasonable size and restructure my portfolio. If I am satisfied with this, I will also invest the larger sum from the inheritance. At the moment, I can imagine a core of $VWCE (-0.71%) , $TDIV (+0.07%) and @Epis 3xGTAA Wikifolio Index as well as a somewhat smaller portion for selected, higher-risk stocks. There are numerous well-founded ideas for the individual stocks here in the forum, for which I would recommend, among others@Multibagger , @Tenbagger2024 , @Iwamoto and @Shiya are very grateful.

It's fun to be here.