The TACO Effect — Live Demo This Week (Jan 19–22, 2026)

TACO stands for "Trump Always Chickens Out" — market shorthand for a recurring pattern where aggressive policy announcements trigger sharp selloffs, followed by swift reversals when threats get diluted or postponed. Traders who recognize the cycle start fading the headline risk and buying the dip.

This week delivered a textbook case, compressed into four trading days.

Monday (Jan 19): Risk-off on tariff escalation

President Trump announced staged tariffs on eight European nations (Denmark, Norway, Sweden, France, Germany, Netherlands, Finland, UK) — 10% from Feb 1, scaling to 25% by June 1 absent bilateral deals. The reaction was immediate: STOXX 600 dropped 1.2%, S&P 500 and Nasdaq futures fell over 1.2% in overnight trading (US cash markets closed for MLK Day). Safe-haven flows pushed gold and silver to fresh highs.

Tuesday (Jan 20): Sell America pressures accelerate

When Wall Street reopened, the drawdown deepened into a broad global risk-off session. Dow closed down 1.76%, S&P 500 fell 2.06%, Nasdaq dropped 2.39% — the steepest single-day decline since October 10. STOXX 600 gave back another 0.7%. The episode reignited "Sell America" positioning across equities, Treasuries, and the dollar.

Wednesday (Jan 21): The walk-back and reversal

Markets pivoted hard when Trump announced a framework for Greenland discussions and confirmed Feb 1 tariffs would not be imposed. The rally was sharp and coordinated: Dow +1.21%, S&P 500 +1.16%, Nasdaq +1.18%.

Thursday (Jan 22): European relief rally follows through

European markets extended gains as tariff threats were formally dropped and Trump ruled out military action on Greenland. STOXX 600 rallied 1.2%. Volatility compressed modestly, though strategists noted the headline-driven whipsaw keeps uncertainty elevated and positioning defensive.

Why this reinforces my Sell America stance

Yes, the TACO pattern creates dip-buying opportunities — but the volatility itself is exhausting. Each cycle demands constant monitoring, rapid position adjustments, and tolerance for headline-driven drawdowns that can hit hard before the reversal materializes. Frankly, I'm tired of the noise.

This week's whipsaw underscores the cost of overconcentration in US assets tethered to unpredictable policy signals. My allocation has been shifting toward reduced USD exposure, lower sensitivity to Washington-driven volatility, and higher weights in Europe-focused strategies — particularly EUR-denominated funds and European small-cap exposure. Beyond geopolitics, the structural backdrop matters: US fiscal trajectories still point to sustained large deficits, which adds another layer of risk to a US-heavy portfolio.

The TACO trade might work for those willing to stay glued to the tape, but the mental bandwidth it requires isn't sustainable. This is my personal positioning logic, not advice — but I'd rather build around stability than keep chasing reversals.

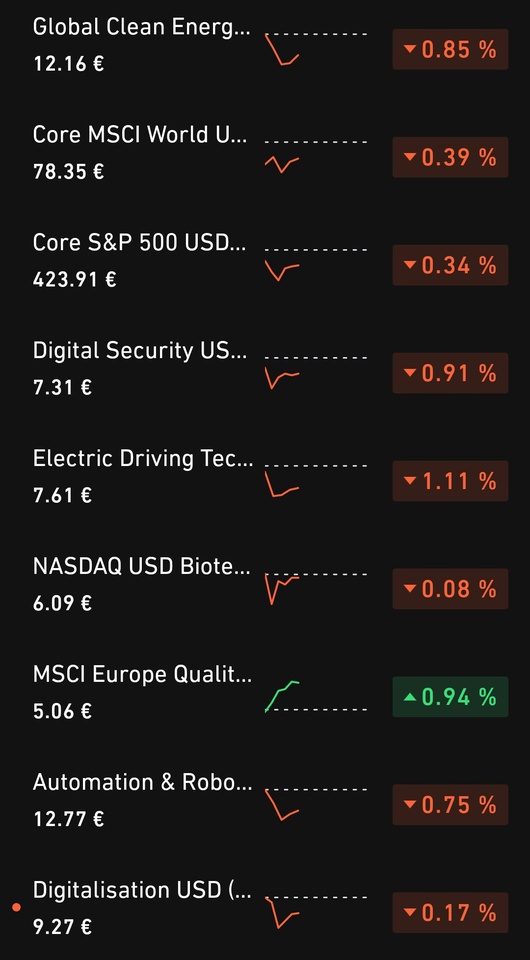

I'm buying for balancing my portfolio to beta<1 and i picked up these ETF and european small caps :

Any advice?